Best AI tools for< Loan Officer >

Infographic

19 - AI tool Sites

Dispute AI™

Dispute AI™ is an AI-powered DIY credit repair solution that revolutionizes the way individuals take control of their credit. With over 20 years of expertise in credit repair and financial empowerment, Dispute AI™ delivers personalized strategies backed by cutting-edge artificial intelligence to simplify and streamline the credit repair process. The platform offers tailored AI-driven tactics to challenge and resolve inaccurate credit report items effectively, providing actionable, data-driven recommendations to improve credit scores. Users can handle credit repair on their terms, anytime, anywhere, without the need to hire expensive credit repair companies. Dispute AI™ aims to make credit improvement accessible, efficient, and impactful, empowering individuals to achieve financial freedom.

Ocrolus

Ocrolus is an intelligent document automation software that leverages AI-driven document processing automation with Human-in-the-Loop. It offers capabilities such as classifying, capturing, detecting, and analyzing documents, with use cases in cash flow, income, address, employment, and identity verification. Ocrolus caters to various industries like small business lending, mortgage, consumer finance, and multifamily housing. The platform provides resources for developers, including guides on income verification, fraud detection, and business process automation. Users can explore the API to build innovative customer experiences and make faster and more accurate financial decisions.

MyLoans.ai

MyLoans.ai is a free AI tool designed to provide personalized guidance for complex student loans. It offers instant, clear, and accurate answers to student loan queries, helping borrowers make informed decisions about their financial future. By skipping expensive advisors and confusing government websites, MyLoans.ai aims to save users thousands of dollars by leveraging official government sources for guidance.

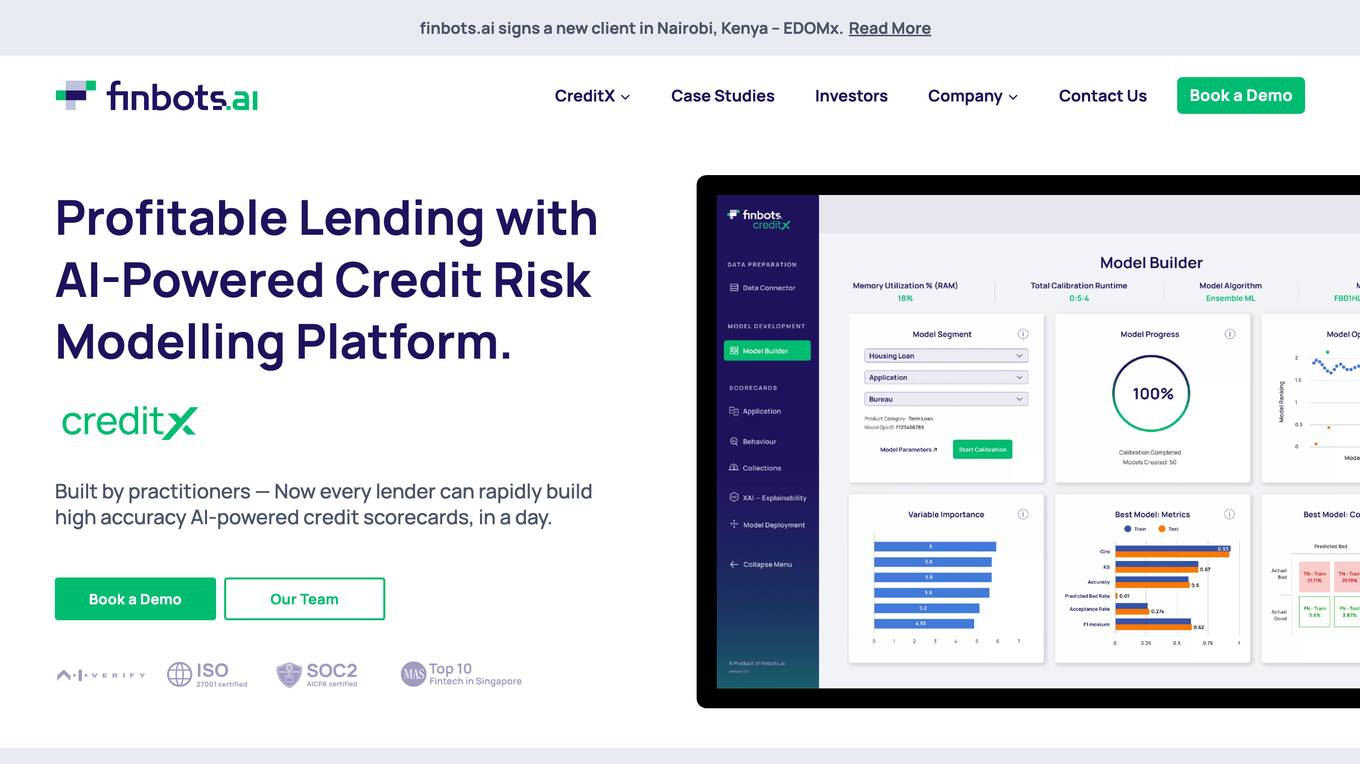

Finbots.ai

Finbots.ai is a trusted AI credit risk platform that offers AI credit scoring to boost lending profits and reduce non-performing loans. The platform provides the highest accuracy in the market, allowing users to build scorecards in a day without the need for coding. It helps in making instant decisions, increasing revenue, reducing risk, and improving operational efficiency. Finbots.ai is utilized by various financial institutions to enhance credit risk management, improve profitability, and drive down the cost of risk through AI-enabled models.

Casca

Casca is a revolutionary AI-native Loan Origination System that helps banks and non-bank lenders automate 90% of manual effort in business loan origination. By leveraging AI technology, Casca enables financial institutions to process loans 10x faster, achieve 3x higher conversion rates, and save significant time for loan officers. With features like AI Loan Assistant, digital application processing, KYB checks automation, and document analysis, Casca transforms the loan origination process into a seamless and efficient experience for both lenders and borrowers.

CreditHQ

CreditHQ is an AI-powered loan restructuring platform that helps users analyze their credit history, compare interest rates, and save money on their loans. The platform offers a range of features, including a credit score simulator, a budgeting tool, and a debt management tool. CreditHQ is trusted by over 5,500 users and companies globally.

Skip

Skip is a BBB accredited company empowering entrepreneurs and small businesses through funding and growth solutions. It offers a marketplace for grants, loans, and financing options, as well as funding insights, eligibility checks, and expert assistance. Skip also has an AI tool to help users with funding-related questions.

Silverwork Solutions

Silverwork Solutions is a fintech company that provides AI-powered mortgage automation solutions. Its Digital Workforce Solutions are role-based autonomous bots that integrate seamlessly into loan manufacturing processes, from application to post-closing. These bots utilize AI to make predictions and decisions, enhancing the loan processing experience. Silverwork's solutions empower lenders to realize the full potential of automation and transform their operations, allowing them to focus on higher-value activities while the bots handle repetitive tasks.

Kasisto

Kasisto is a conversational AI platform that provides financial institutions with the ability to create personalized, automated, and engaging digital experiences for their customers and employees. Kasisto's platform is infused with unmatched financial literacy and augments your workforce with remarkably competent digital bankers who facilitate accurate, human-like conversations and empower your teams with “in-the-moment” financial knowledge.

Zest AI

Zest AI is an AI-driven credit underwriting software that offers a complete solution for AI-driven lending. It enables users to build custom machine learning risk models, adopt model assessment and regulatory compliance, and operate performance management and model monitoring. Zest AI helps increase approvals, manage risk, control loss, drive operational efficiency, automate credit decisioning, and improve borrower experience while ensuring fair lending practices. The software is designed to provide fair and transparent credit for everyone, making lending more accessible and inclusive.

Clerkie

Clerkie is a powerful debt repayment and optimization platform that offers a full-service automation solution powered by machine learning and human expertise. It helps lenders, both big and small, to manage and optimize their loan portfolios efficiently. With features like smart payment experience, AI-driven repayment strategies, real-time reporting, and easy integration, Clerkie ensures a seamless and secure experience for lenders and borrowers alike.

SmartDispute.ai

SmartDispute.ai is an AI-powered credit repair application that helps users improve their credit scores by leveraging artificial intelligence technology. The application offers a patented Smart Dispute System™ technology that identifies and helps remove negative accounts from credit reports, making it one of the most effective credit repair systems available. Users can easily repair their own credit with the help of SmartDispute.ai's automated processes and fact-based dispute method. The application provides users with a simple and clearly explained process, allowing them to track their progress and see significant improvements in their credit scores over time.

FairPlay

FairPlay is a Fairness-as-a-Service solution designed for financial institutions, offering AI-powered tools to assess automated decisioning models quickly. It helps in increasing fairness and profits by optimizing marketing, underwriting, and pricing strategies. The application provides features such as Fairness Optimizer, Second Look, Customer Composition, Redline Status, and Proxy Detection. FairPlay enables users to identify and overcome tradeoffs between performance and disparity, assess geographic fairness, de-bias proxies for protected classes, and tune models to reduce disparities without increasing risk. It offers advantages like increased compliance, speed, and readiness through automation, higher approval rates with no increase in risk, and rigorous Fair Lending analysis for sponsor banks and regulators. However, some disadvantages include the need for data integration, potential bias in AI algorithms, and the requirement for technical expertise to interpret results.

Scienaptic Systems

Scienaptic Systems is an AI-powered Credit Decisioning Platform that revolutionizes the lending industry by automating credit underwriting processes, leveraging alternate data points, and offering self-learning models for instant credit decisions. The platform helps lenders identify creditworthy borrowers, streamline customer experience, and ensure fair lending practices through explainable AI models. Scienaptic's suite of AI-enabled technologies enables lenders to say 'Yes' to more borrowers at lower risk, providing a 360-degree risk assessment before approving applications. The platform integrates seamlessly with existing lending ecosystems, ensuring disruption-free deployment and better risk predictions through a single API call.

Underwrite.ai

Underwrite.ai is a platform that leverages advances in artificial intelligence and machine learning to provide lenders with nonlinear, dynamic models of credit risk. By analyzing thousands of data points from credit bureau sources, the application accurately models credit risk for consumers and small businesses, outperforming traditional approaches. Underwrite.ai offers a unique underwriting methodology that focuses on outcomes such as profitability and customer lifetime value, allowing organizations to enhance their lending performance without the need for capital investment or lengthy build times. The platform's models are continuously learning and adapting to market changes in real-time, providing explainable decisions in milliseconds.

Zest AI

Zest AI is an AI-driven credit underwriting software that offers a complete solution for AI-driven lending. It enables users to build custom machine learning risk models, adopt model assessment and regulatory compliance, and operate performance management and model monitoring. Zest AI helps increase approvals, manage risk, control loss, drive operational efficiency, automate credit decisioning, and improve borrower experience while ensuring fair lending practices. The software is designed to provide powerful AI for better lending outcomes by accelerating loan growth and expanding credit access through accurate risk prediction and faster credit decisions.

AI Credit Repair

AI Credit Repair is an AI-powered application designed to help users improve their credit score by providing tools such as credit card utilization builder, public records remover, dispute letter generator, and SMS alerts. The application assists users in managing their credit card payments, disputing collections, and staying on top of their credit-related activities. By leveraging artificial intelligence technology, AI Credit Repair aims to simplify the credit repair process and empower users to build a better financial future.

Likely.AI

Likely.AI is an AI-powered platform designed for the real estate industry, offering innovative solutions to enhance database management, marketing content creation, and predictive analytics. The platform utilizes advanced AI models to predict likely sellers, update contact information, and trigger automated notifications, ensuring real estate professionals stay ahead of the competition. With features like contact enrichment, predictive modeling, 24/7 contact monitoring, and AI-driven marketing content generation, Likely.AI revolutionizes how real estate businesses operate and engage with their clients. The platform aims to streamline workflows, improve lead generation, and maximize ROI for users in the residential real estate sector.

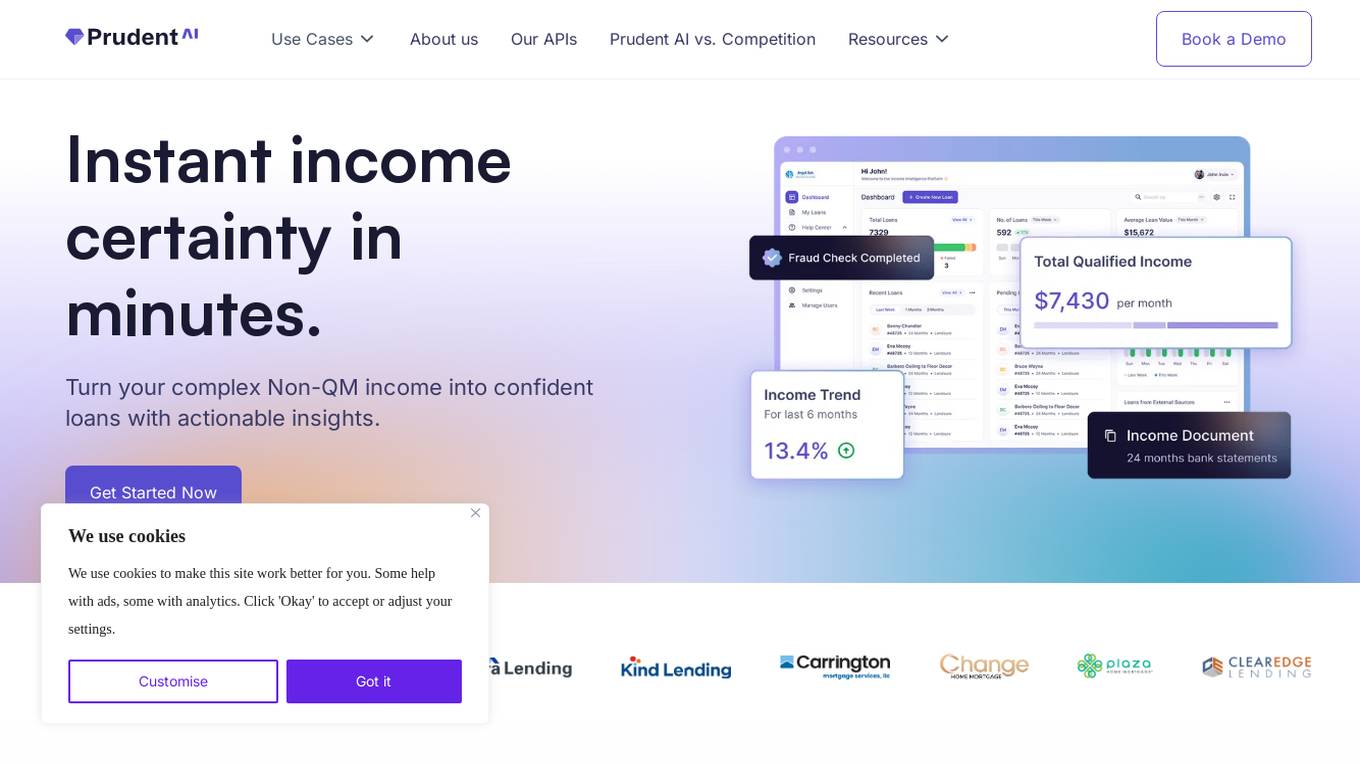

Prudent AI

Prudent AI is an AI-powered Income Intelligence Platform designed for lenders, offering fast data extraction, proactive fraud prevention, and in-depth insights on borrower income. The platform simplifies complex income calculations, streamlines the lending process, and enables lenders to make confident loan decisions quickly. Prudent AI is trusted by various lending institutions and has been proven to increase productivity, save time, and improve submission accuracy.

0 - Open Source Tools

46 - OpenAI Gpts

CREDIT411

Providing information on consumer credit laws, regulations and resources. Because when it comes to credit, what you don't know CAN hurt you.

Loan Management Software

Loan management software expertise. Get the most powerful loan origination and loan servicing software on the market.

Solvo

Buying something new? Let me show you how much it will *really* cost you over time. What is it, and how much are you paying?

Debt Management Advisor

Advises on debt management strategies to improve financial stability.

Debt Dodger

Avoid Debt Accumulation with Credit Card Interest Insights. Find out how much interest you will pay before you make that purchase with your credit card.

Top Loan Apps Expert

An AI tool offering expert advice on financial products, focusing on Top Loan Apps, best lending apps, fast cash advance apps, online loan apps, instant loan apps, and emergency loan apps. This tool provides insights, comparisons, and guidance for users seeking quick and reliable loan solutions.

SBA Loan Advisor

Using public SBA data to help you find the best fit lender for your small business

Mobile Home Mortgage Calculator

Get the most up to date information about mortgages for a mobile home

Pay Later

Explains 'buy now, pay later' and recommends providers in a financial, informative tone.

Credit Card Companion

Balanced guidance on credit cards for young people, with a mix of formal and casual tones

Credit Score Check

Guides on checking and monitoring credit scores, with a financial and informative tone.

Personal Loan

Discusses personal loans, payment methods, and financial options informatively.

Fast Loan

Discusses fast loans, application processes, and financial considerations informatively.

Finance Guide

Multilingual advisor on microfinance, focusing on clarity and educational content.

Credit Card Advisor

Expert on credit cards, offering advice on choosing and using them wisely.

Credit Analyst

Analyzes financial data to assess creditworthiness, aiding in lending decisions and solutions.

GPT Loans Analyzer

An economic advisor for loan feasibility, market analysis, and investment advice.

Compound Interest Calc

Your go-to tool for Compound Interest (CI) Calculation and Learning.

Chief Bank Examiner Assistant

Hello I'm Chief Bank Examiner Assistant! What would you like help with today?