Underwrite.ai

Empowering lenders with AI-driven credit risk modeling

Underwrite.ai is a platform that leverages advances in artificial intelligence and machine learning to provide lenders with nonlinear, dynamic models of credit risk. By analyzing thousands of data points from credit bureau sources, the application accurately models credit risk for consumers and small businesses, outperforming traditional approaches. Underwrite.ai offers a unique underwriting methodology that focuses on outcomes such as profitability and customer lifetime value, allowing organizations to enhance their lending performance without the need for capital investment or lengthy build times. The platform's models are continuously learning and adapting to market changes in real-time, providing explainable decisions in milliseconds.

For Tasks:

Click tags to check more tools for each tasksFor Jobs:

Features

- Nonlinear and dynamic credit risk modeling

- Analysis of thousands of data points for accurate risk assessment

- Continuous learning and adaptation of models

- Real-time decision-making in milliseconds

- Explainable models for transparency and ethical lending practices

Advantages

- Outperforms traditional underwriting models

- Enhances lending performance and profitability

- Provides explainable decisions for transparency

- Adapts to market changes in real-time

- Empowers lenders with AI-driven credit risk assessment

Disadvantages

- May require technical expertise to fully utilize the platform

- Dependence on data accuracy and quality for optimal results

- Potential regulatory challenges in certain jurisdictions

Frequently Asked Questions

-

Q:How does Underwrite.ai differ from traditional underwriting models?

A:Underwrite.ai analyzes thousands of data points and focuses on outcomes like profitability and customer lifetime value, outperforming traditional approaches. -

Q:Is the platform suitable for small businesses as well?

A:Yes, Underwrite.ai offers credit risk modeling for both consumers and small businesses. -

Q:Can Underwrite.ai adapt to market changes?

A:Yes, the platform's models are continuously learning and adapting to real-time market changes.

Alternative AI tools for Underwrite.ai

Similar sites

Underwrite.ai

Underwrite.ai is a platform that leverages advances in artificial intelligence and machine learning to provide lenders with nonlinear, dynamic models of credit risk. By analyzing thousands of data points from credit bureau sources, the application accurately models credit risk for consumers and small businesses, outperforming traditional approaches. Underwrite.ai offers a unique underwriting methodology that focuses on outcomes such as profitability and customer lifetime value, allowing organizations to enhance their lending performance without the need for capital investment or lengthy build times. The platform's models are continuously learning and adapting to market changes in real-time, providing explainable decisions in milliseconds.

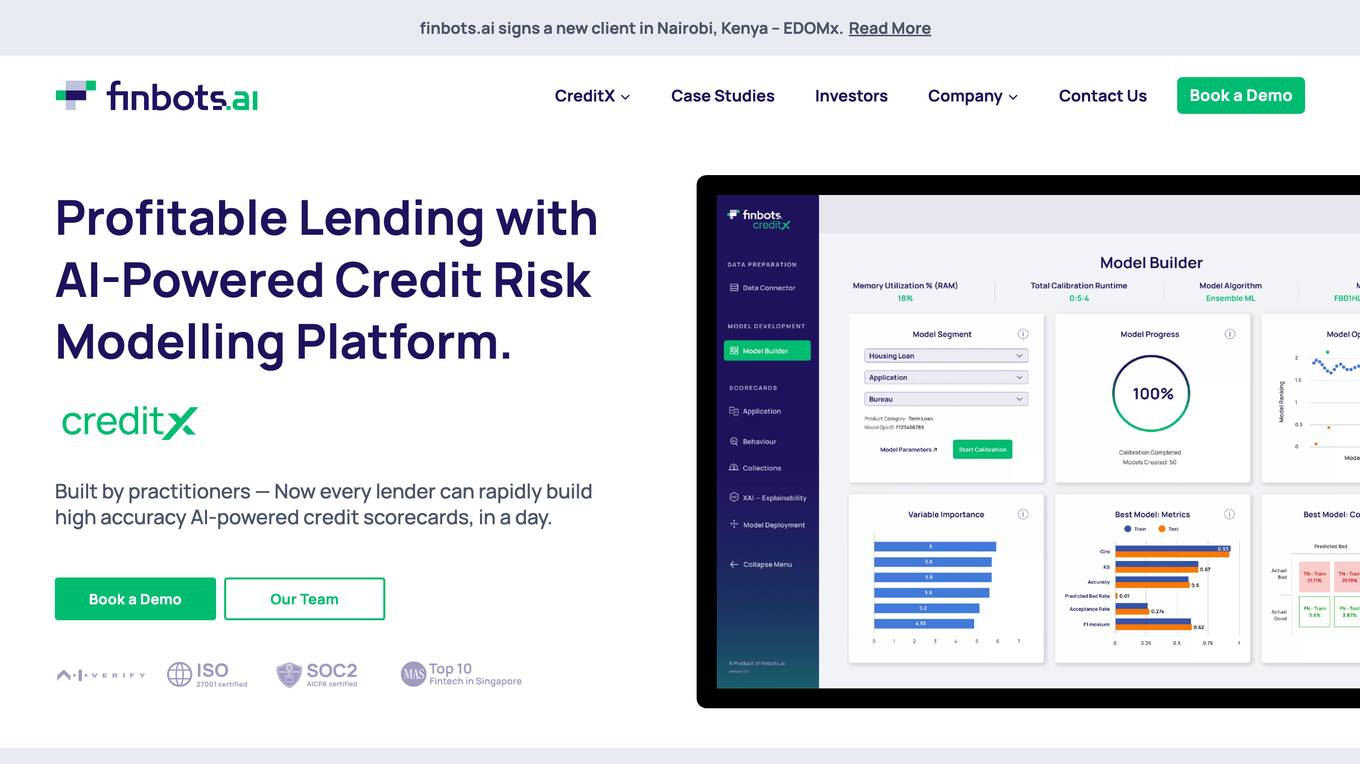

Finbots.ai

Finbots.ai is a trusted AI credit risk platform that offers AI credit scoring to boost lending profits and reduce non-performing loans. The platform provides the highest accuracy in the market, allowing users to build scorecards in a day without the need for coding. It helps in making instant decisions, increasing revenue, reducing risk, and improving operational efficiency. Finbots.ai is utilized by various financial institutions to enhance credit risk management, improve profitability, and drive down the cost of risk through AI-enabled models.

Scienaptic Systems

Scienaptic Systems is an AI-powered Credit Decisioning Platform that revolutionizes the lending industry by automating credit underwriting processes, leveraging alternate data points, and offering self-learning models for instant credit decisions. The platform helps lenders identify creditworthy borrowers, streamline customer experience, and ensure fair lending practices through explainable AI models. Scienaptic's suite of AI-enabled technologies enables lenders to say 'Yes' to more borrowers at lower risk, providing a 360-degree risk assessment before approving applications. The platform integrates seamlessly with existing lending ecosystems, ensuring disruption-free deployment and better risk predictions through a single API call.

Cape.ai

Cape.ai is an agentic AI platform designed for financial operations, offering AI-powered automation to enhance reach, insight, and efficiency in daily operations for financial firms. The platform is built on real-world customer use cases, providing tangible business ROI by integrating structured and unstructured data sources, automating complex manual processes, and offering context-aware insights. Users have control over their data and processes, with customizable workflows and human-in-the-loop capabilities. Cape.ai enables flexible implementation of agentic and deterministic automation, with seamless integrations for various financial workflows and direct access to leading financial data providers. The platform empowers users to create powerful AI agents without technical barriers, unlocking real business value with speed and confidence.

Simudyne

Simudyne is an enterprise simulation software powered by AI technology. It allows large financial institutions to simulate various future scenarios efficiently and measure their impact in a safe virtual environment. The software offers solutions for environment, social and governance issues, market execution, financial crime analytics, and risk management. Simudyne's technology is secure, distributable, and Cloudera certified, providing a robust library of code for specialized functions. The platform also utilizes agent-based modeling to bridge the gap between theoretical and real-world scenarios in the financial services sector.

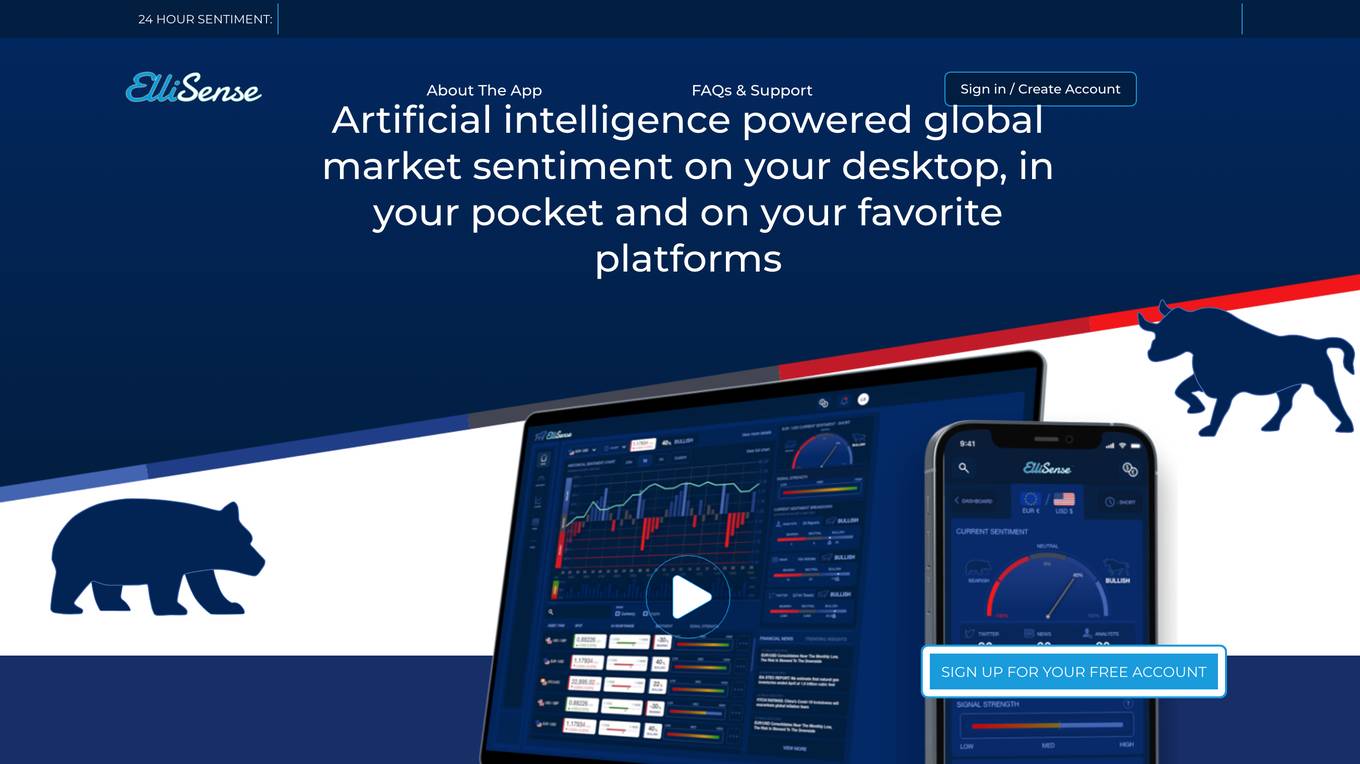

ElliSense

ElliSense is an AI-powered global market sentiment analysis tool that provides real-time insights into the sentiment of various financial assets, including stocks, cryptocurrencies, and forex currencies. It analyzes thousands of data points per second from various sources, including social media, news outlets, and industry analysts, to provide accurate and up-to-date market sentiment. The tool is designed to help traders and investors make informed decisions by providing clear and easy-to-understand market insights.

DataSnack

DataSnack is a real-time, AI-driven due diligence platform that helps you make better decisions faster. With DataSnack, you can access a wealth of data and insights on companies, industries, and markets, all in one place. Our AI-powered platform analyzes data from a variety of sources, including news, social media, and financial filings, to provide you with the most up-to-date and relevant information. With DataSnack, you can:

Convr

Convr is an AI-driven underwriting analysis platform that helps commercial P&C insurance organizations transform their underwriting operations. It provides a modularized AI underwriting and intelligent document automation workbench that enriches and expedites the commercial insurance new business and renewal submission flow with underwriting insights, business classification, and risk scoring. Convr's mission is to solve the last big problem of commercial insurance while improving profitability and increasing efficiency.

Avanzai

Avanzai is a workflow automation tool tailored for financial services, offering AI-driven solutions to streamline processes and enhance decision-making. The platform enables funds to leverage custom data for generating valuable insights, from market trend analysis to risk assessment. With a focus on simplifying complex financial workflows, Avanzai empowers users to explore, visualize, and analyze data efficiently, without the need for extensive setup. Through open-source demos and customizable data integrations, institutions can harness the power of AI to optimize macro analysis, instrument screening, risk analytics, and factor modeling.

Ocrolus

Ocrolus is an intelligent document automation software that leverages AI-driven document processing automation with Human-in-the-Loop. It offers capabilities such as classifying, capturing, detecting, and analyzing documents, with use cases in cash flow, income, address, employment, and identity verification. Ocrolus caters to various industries like small business lending, mortgage, consumer finance, and multifamily housing. The platform provides resources for developers, including guides on income verification, fraud detection, and business process automation. Users can explore the API to build innovative customer experiences and make faster and more accurate financial decisions.

Dataminr

Dataminr is a leading provider of real-time event and risk detection. Its AI platform processes billions of public data units daily to deliver real-time alerts on high-impact events and emerging risks. Dataminr's products are used by businesses, public sector organizations, and newsrooms to plan for and respond to crises, manage risks, and stay informed about the latest events.

Kira Systems

Kira Systems is a machine learning contract search, review, and analysis software that helps businesses identify, extract, and analyze content in their contracts and documents. It uses patented machine learning technology to extract concepts and data points with high efficiency and accuracy. Kira also has built-in intelligence that streamlines the contract review process with out-of-the-box smart fields. Businesses can also create their own smart fields to find specific data points using Kira's no-code machine learning tool. Kira's adaptive workflows allow businesses to organize, track, and export results. Kira has a partner ecosystem that allows businesses to transform how teams work with their contracts.

Scope Ai Platform

The website is an AI tool called Scope Ai Platform that provides property, owner, investor, and lender intelligence. It offers nationwide coverage, predictive scoring, and tailored insights to help users find opportunities, connect with the right people, and make faster decisions in various markets. The platform combines massive data coverage with advanced predictive modeling to deliver actionable intelligence for business growth. It caters to industries such as insurance, retail, investment, luxury goods, and more, offering solutions for unique data challenges. The platform is compliance-ready, built on public and licensed non-credit data without credit bureau information or live tracking.

SentimentWatch

SentimentWatch is an AI-powered tool that enables users to effortlessly monitor the latest financial sentiment in news articles. By leveraging artificial intelligence technology, SentimentWatch analyzes articles in real-time to provide users with valuable insights into the overall sentiment surrounding various companies and topics in the financial sector. Users can easily track sentiment scores, dates, pros, and cons of analyzed articles, allowing them to stay informed and make data-driven decisions in the fast-paced world of finance.

Dark Pools

Dark Pools is a leading provider of AI-powered solutions for the financial industry. Our mission is to empower our clients with the tools and insights they need to make better decisions, improve their performance, and stay ahead of the competition. We offer a range of products and services that leverage AI to automate tasks, optimize workflows, and generate actionable insights. Our solutions are used by a wide range of financial institutions, including hedge funds, asset managers, and banks.

AlphaWatch

The website offers a precision workflow tool for enterprises in the finance industry, combining AI technology with human oversight to empower financial decisions. It provides features such as accurate search citations, multilingual models, and complex human-in-loop automation. The tool integrates seamlessly with existing platforms, offers time savings, and self-improving models. It is backed by innovative generative AI solutions and neural search capabilities, with a focus on transforming data processes and decision-making in finance.

For similar tasks

Underwrite.ai

Underwrite.ai is a platform that leverages advances in artificial intelligence and machine learning to provide lenders with nonlinear, dynamic models of credit risk. By analyzing thousands of data points from credit bureau sources, the application accurately models credit risk for consumers and small businesses, outperforming traditional approaches. Underwrite.ai offers a unique underwriting methodology that focuses on outcomes such as profitability and customer lifetime value, allowing organizations to enhance their lending performance without the need for capital investment or lengthy build times. The platform's models are continuously learning and adapting to market changes in real-time, providing explainable decisions in milliseconds.

Quantifind

Quantifind is an AI-powered financial crimes automation platform that specializes in Anti-Money Laundering (AML) and Know Your Customer (KYC) solutions. It offers end-to-end automation impact, best-in-class accuracy, and powerful APIs and applications for risk screening, investigations, and compliance in the financial services and public sector industries. Quantifind's Graphyte platform leverages AI and external data to streamline AML-KYC processes, providing comprehensive data coverage, dynamic risk typologies, and seamless integrations with case management systems.

Emotion Logic

Emotion Logic Ltd is an AI-powered emotion intelligence application that redefines how businesses understand emotions by analyzing genuine vocal biomarkers beyond words and sentiment analysis. The technology detects stress, confidence, honesty levels, and intent in voice, while AI provides context and insights to help organizations make fair, data-driven, and human-centric decisions. Emotion Logic offers voice-based data for deeper insights and better outcomes, creating optimal experiences for clients and employees across various industries.

Lightfield

Lightfield is an AI-powered CRM application that offers a new approach to managing customer relationships. It creates a comprehensive customer memory by capturing and storing every interaction, from meetings to emails and support tickets. The AI algorithms analyze patterns and automate workflows to enhance productivity and focus on building meaningful customer relationships. Users can ask natural language questions to uncover insights and make data-driven decisions. Lightfield aims to streamline the CRM process and provide grounded answers to complex questions.

Aspect

Aspect is a human-level AI notes application designed to streamline the interview process by recording, transcribing, highlighting, and summarizing interviews. It allows users to focus on candidates by automating note-taking and providing data-driven insights. The platform seamlessly integrates with Applicant Tracking Systems (ATS) and offers features like Q&A, summary creation, and analytics to enhance hiring efficiency and reduce bias. Aspect is trusted by leading organizations worldwide and is praised for its user-friendly interface and helpful customer support.

STRATxAI

STRATxAI is an AI-powered quantitative investment platform that offers custom AI model portfolios tailored to clients' investment philosophy, risk tolerance, and objectives. The platform harnesses machine learning to deliver data-driven insights for security analysis, portfolio construction, and management. Powered by the proprietary investment engine Alana, STRATxAI processes over 8 billion financial data points daily to uncover hidden alpha beyond traditional methods. Clients benefit from smarter decision-making, better risk-adjusted returns, optimized portfolio management, and savings on resources. The platform is designed to enhance investment decisions for forward-thinking investors by leveraging AI technology.

PeerAI

PeerAI is an advanced AI tool that leverages cutting-edge artificial intelligence technology to provide users with personalized insights and recommendations. The platform utilizes machine learning algorithms to analyze data and generate actionable suggestions across various domains, including business, marketing, finance, and more. PeerAI empowers users to make informed decisions, optimize strategies, and enhance performance through data-driven intelligence.

UpTeam.ai

The website offers a platform to chat with a team of AI agents specially trained to provide expert advice in various fields such as business, science, legal, and education. Users can interact with over 100 intelligent and knowledgeable AI models, including experts in contract negotiation, data analysis, human resources, financial analysis, software development, and more. The AI agents are designed to help users write better, solve problems, and receive expert guidance. The platform has been updated to GPT-4, providing advanced conversational capabilities and assistance across a wide range of domains.

Varolio

Varolio is an AI-powered Communication OS that aims to enhance communication efficiency and productivity in organizations. It leverages context-aware communication to provide actionable insights, reduce miscommunications, and capture missed opportunities. Varolio integrates with existing email platforms like Gmail and Outlook, offering AI-driven functionalities without the need for server changes. The platform prioritizes privacy and security, offering enterprise-grade solutions with encryption, on-premise support, and compliance with GDPR & CCPA.

Ever Efficient AI

Ever Efficient AI is an advanced AI development platform that offers customized solutions to streamline business processes and drive growth. The platform leverages historical data to trigger innovation, optimize efficiency, automate tasks, and enhance decision-making. With a focus on AI automation, the tool aims to revolutionize business operations by combining human intelligence with artificial intelligence for extraordinary results.

Checkmyidea-IA

Checkmyidea-IA is an AI-powered tool that helps entrepreneurs and businesses evaluate their business ideas before launching them. It uses a variety of factors, such as customer interest, uniqueness, initial product development, and launch strategy, to provide users with a comprehensive review of their idea's potential for success. Checkmyidea-IA can help users save time, increase their chances of success, reduce risk, and improve their decision-making.

Abacus.AI

Abacus.AI is the world's first AI platform where AI, not humans, build Applied AI agents and systems at scale. Using generative AI and other novel neural net techniques, AI can build LLM apps, gen AI agents, and predictive applied AI systems at scale.

One Connect Solution

One Connect Solution is a data integration and analytics platform that helps organizations make smarter decisions. It offers a variety of features, including data transformation, auto machine learning, and semantic analytics. With One Connect Solution, organizations can improve their efficiency, productivity, and decision-making.

AppSumo

AppSumo is a website that offers deals on software and digital products. It features a variety of software tools for different purposes, including AI-powered tools. The website provides detailed descriptions of each product, along with user reviews and ratings. AppSumo also offers a subscription service that gives users access to exclusive deals and discounts.

Maya

Maya is an AI-powered data robot that provides personalized answers and insights for enterprise data research. It combines multiple data sources and tools into one, automates tasks, offers smart suggestions, and saves time. Maya understands the specific insights required for each workflow and provides justification for implementation. It can access data from various sources, including internal integrations and external sources, and can translate queries in up to 14 languages. Maya is constantly learning and improving through advanced machine learning and regular updates with new data. It prioritizes data privacy and security, following industry-standard protocols to keep customer data safe.

Dystr

Dystr is an AI-powered analysis tool that helps businesses make better decisions. It uses machine learning and natural language processing to analyze data and identify trends and patterns. Dystr can be used to analyze a variety of data sources, including text, images, and videos. It can also be used to analyze data from social media, customer surveys, and other sources.

Skillfusion

Skillfusion is an AI marketplace that connects businesses with AI solutions. It provides a platform for businesses to discover, evaluate, and purchase AI solutions from a variety of vendors. Skillfusion also offers a range of services to help businesses implement and manage AI solutions.

VKTR

VKTR is an online platform that provides resources and insights on the topic of artificial intelligence (AI) in the workplace. It offers articles, case studies, and other content to help users understand how AI is being used in various industries and roles, and how they can leverage AI to improve their own work.

OECD Observatory of Public Sector Innovation

The OECD Observatory of Public Sector Innovation (OPSI) is a website that provides resources and tools to help governments and public servants explore new possibilities for innovation. OPSI's work areas include European Commission Collaboration, Anticipatory Innovation, Cross-Border Government Innovation, Behavioural Insights, Innovative Capacity, Innovation Trends, Innovation Portfolios, Mission-Oriented Innovation, Innovation Management, and Systems Approaches. OPSI also has a number of resources available, including a Toolkit Navigator, Case Study Library, Portfolio Exploration Tool, and Anticipatory Innovation Resource (AIR).

McKinsey & Company

McKinsey & Company is a global management consulting firm that provides a wide range of services to help businesses improve their performance. The company's website provides information on its services, insights, and thought leadership on a variety of topics, including artificial intelligence (AI). McKinsey & Company has a strong focus on AI and has developed a number of tools and resources to help businesses adopt and implement AI technologies. The company's website includes a section on AI that provides information on the latest AI trends, case studies, and white papers.

ListenUp!

ListenUp! is an AI-powered discovery tool designed for busy product teams to streamline the process of collecting and analyzing user feedback. The application automatically centralizes user feedback, orders it, and scales the process with AI technology. It helps product teams understand their users better, make informed decisions, and deliver more value efficiently. ListenUp! offers features such as automated feedback capture, real-time pattern suggestions, and transcribing user interviews with multiple speakers. The tool aims to enhance user understanding, improve product development, and boost team performance.

Surveyed.live

Surveyed.live is an AI-powered video survey platform that allows businesses to collect feedback and insights from customers through customizable survey templates. The platform offers features such as video surveys, AI touch response, comprehensible dashboard, Chrome extension, actionable insights, integration, predefined library, appealing survey creation, customer experience statistics, and more. Surveyed.live helps businesses enhance customer satisfaction, improve decision-making, and drive business growth by leveraging AI technology for video reviews and surveys. The platform caters to various industries including hospitality, healthcare, education, customer service, delivery services, and more, providing a versatile solution for optimizing customer relationships and improving overall business performance.

11:59

11:59 is an AI-powered business and digital transformation consulting service that aims to accelerate your transformation journey by leveraging GenAI and cloud technology. They work with you to build tailored solutions that reduce costs, enhance decision-making, and elevate your competitive edge. With expertise in applied AI, innovation lab, and transformation services, 11:59 helps businesses of all sizes to stay ahead of the curve in today's rapidly evolving technology landscape.

Shieldbase

Shieldbase is an AI-powered enterprise search tool designed to provide secure and efficient search capabilities for businesses. It utilizes advanced artificial intelligence algorithms to index and retrieve information from various data sources within an organization, ensuring quick and accurate search results. With a focus on security, Shieldbase offers encryption and access control features to protect sensitive data. The platform is user-friendly and customizable, making it easy for businesses to implement and integrate into their existing systems. Shieldbase enhances productivity by enabling employees to quickly find the information they need, ultimately improving decision-making processes and overall operational efficiency.

For similar jobs

Casca

Casca is a revolutionary AI-native Loan Origination System that helps banks and non-bank lenders automate 90% of manual effort in business loan origination. By leveraging AI technology, Casca enables financial institutions to process loans 10x faster, achieve 3x higher conversion rates, and save significant time for loan officers. With features like AI Loan Assistant, digital application processing, KYB checks automation, and document analysis, Casca transforms the loan origination process into a seamless and efficient experience for both lenders and borrowers.

Zest AI

Zest AI is an AI-driven credit underwriting software that offers a complete solution for AI-driven lending. It enables users to build custom machine learning risk models, adopt model assessment and regulatory compliance, and operate performance management and model monitoring. Zest AI helps increase approvals, manage risk, control loss, drive operational efficiency, automate credit decisioning, and improve borrower experience while ensuring fair lending practices. The software is designed to provide fair and transparent credit for everyone, making lending more accessible and inclusive.

Scienaptic Systems

Scienaptic Systems is an AI-powered Credit Decisioning Platform that revolutionizes the lending industry by automating credit underwriting processes, leveraging alternate data points, and offering self-learning models for instant credit decisions. The platform helps lenders identify creditworthy borrowers, streamline customer experience, and ensure fair lending practices through explainable AI models. Scienaptic's suite of AI-enabled technologies enables lenders to say 'Yes' to more borrowers at lower risk, providing a 360-degree risk assessment before approving applications. The platform integrates seamlessly with existing lending ecosystems, ensuring disruption-free deployment and better risk predictions through a single API call.

Underwrite.ai

Underwrite.ai is a platform that leverages advances in artificial intelligence and machine learning to provide lenders with nonlinear, dynamic models of credit risk. By analyzing thousands of data points from credit bureau sources, the application accurately models credit risk for consumers and small businesses, outperforming traditional approaches. Underwrite.ai offers a unique underwriting methodology that focuses on outcomes such as profitability and customer lifetime value, allowing organizations to enhance their lending performance without the need for capital investment or lengthy build times. The platform's models are continuously learning and adapting to market changes in real-time, providing explainable decisions in milliseconds.

Zest AI

Zest AI is an AI-driven credit underwriting software that offers a complete solution for AI-driven lending. It enables users to build custom machine learning risk models, adopt model assessment and regulatory compliance, and operate performance management and model monitoring. Zest AI helps increase approvals, manage risk, control loss, drive operational efficiency, automate credit decisioning, and improve borrower experience while ensuring fair lending practices. The software is designed to provide powerful AI for better lending outcomes by accelerating loan growth and expanding credit access through accurate risk prediction and faster credit decisions.

FinFloh

FinFloh is an AI-powered Accounts Receivable Software that automates the accounts receivable process effortlessly with features like credit decisioning, collections, cash application, invoice verification, and dispute resolution. It enhances collections efficiency, reduces decision-making time, and improves cash flows for B2B finance teams worldwide. The software integrates with ERP/CRM systems, offers predictive analytics, and AI-driven credit scoring to optimize accounts receivable management. FinFloh ensures secure data handling and seamless communication between finance, sales, and customer support teams, ultimately leading to increased cash flow and reduced DSO.

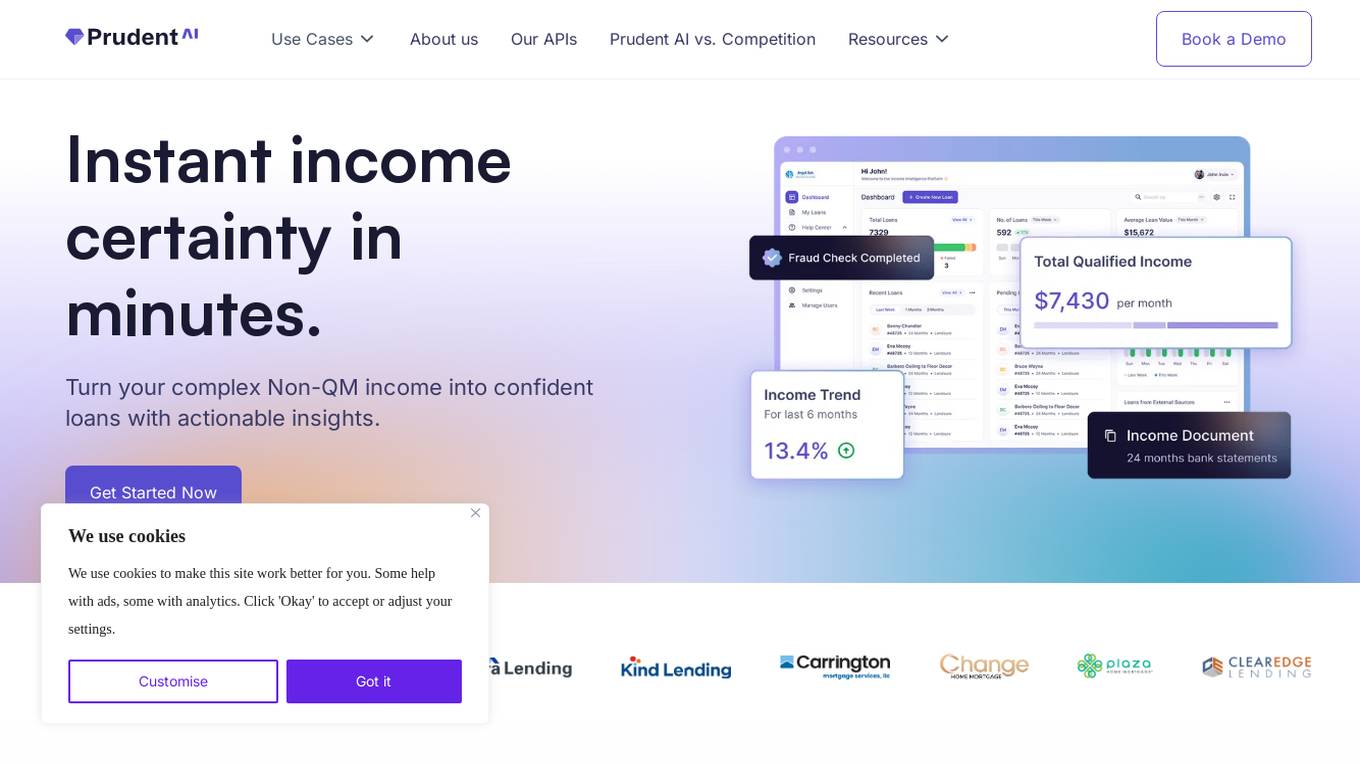

Prudent AI

Prudent AI is an AI-powered Income Intelligence Platform designed for lenders, offering fast data extraction, proactive fraud prevention, and in-depth insights on borrower income. The platform simplifies complex income calculations, streamlines the lending process, and enables lenders to make confident loan decisions quickly. Prudent AI is trusted by various lending institutions and has been proven to increase productivity, save time, and improve submission accuracy.

Rationale

Rationale is a cutting-edge decision-making tool powered by advanced AI technology, including the latest GPT model and in-context learning capabilities. It leverages artificial intelligence to provide users with valuable insights and recommendations for making informed decisions across various domains.

Mnemonic AI

Mnemonic AI is an advanced Customer Intelligence tool that offers AI Personas and Digital Twin of the Customer. It helps organizations improve their understanding of individuals by creating data-driven buyer personas and virtual customers. The tool analyzes OCEAN Big Five Personality Traits and Schwartz Universal Values to tailor messages and marketing strategies. Mnemonic AI automates the process of creating personas and updating customer data, providing deep insights for informed decision-making.

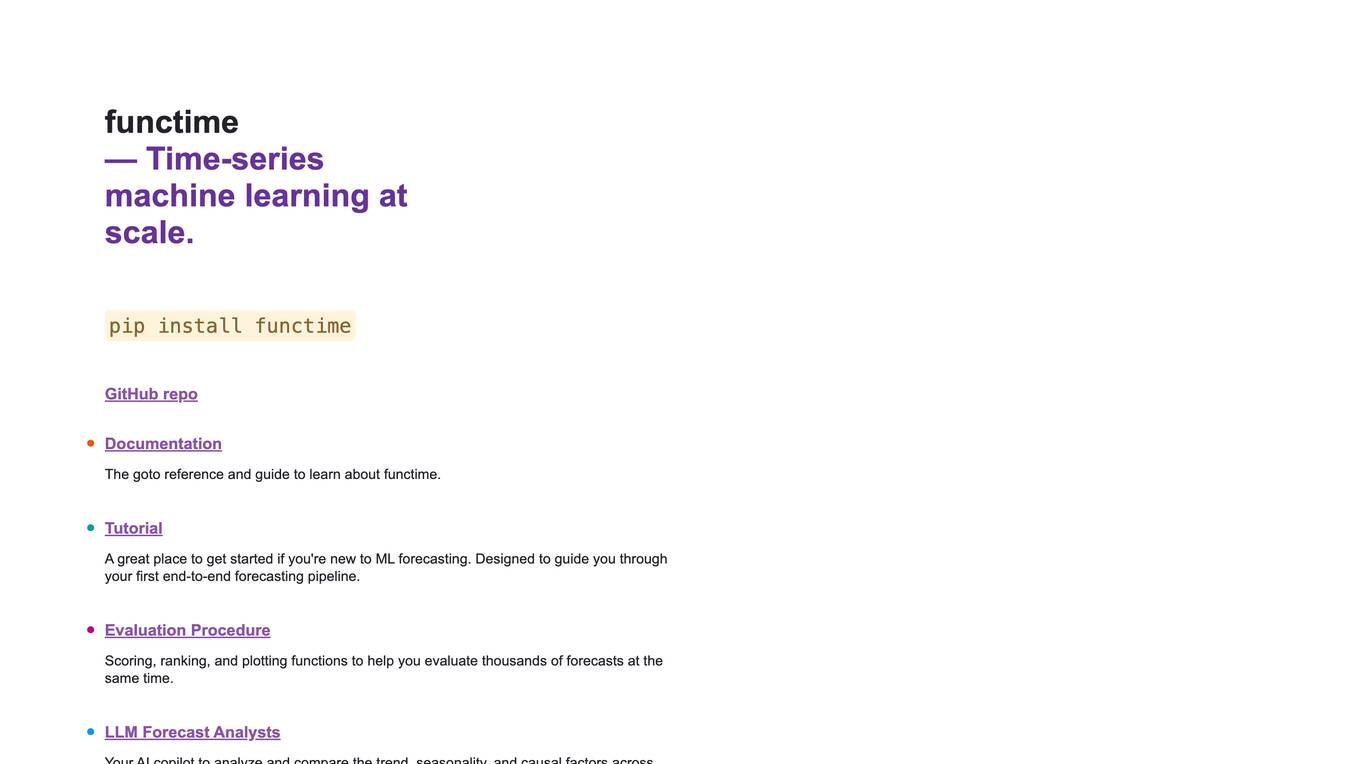

functime

functime is a time-series machine learning tool designed to perform forecasting at scale. It provides functions for scoring, ranking, and plotting thousands of forecasts simultaneously. With a focus on guiding users through their first end-to-end forecasting pipeline, functime serves as an AI copilot to analyze trends, seasonality, and causal factors in forecasts. The tool offers a comprehensive API reference and documentation, making it a valuable resource for both beginners and experienced analysts.

Kolank

Kolank is an AI platform offering a unified API with agent interoperability, automatic model selection, and cost optimization. It enables AI agents to communicate and collaborate efficiently, providing access to a wide range of AI models for text, image, and video processing. With features like load balancing, fallbacks, and performance metrics, Kolank simplifies AI model integration and usage, making it a comprehensive solution for various AI tasks.

Promptmakr

Promptmakr is a platform designed for buying and selling AI prompts. It serves as a marketplace where users can find and offer AI prompts for various purposes. The platform aims to connect individuals and businesses looking for AI prompts with those who create and sell them. With a user-friendly interface, Promptmakr simplifies the process of discovering, purchasing, and selling AI prompts, making it a convenient solution for both buyers and sellers in the AI industry.

StockGPT

StockGPT is an AI-powered financial research assistant that provides knowledge of earnings releases, financial reports, and fundamental information for S&P 500 and Nasdaq companies. It offers features like AI-powered search, customizable filters, up-to-date data, and industry research to help users analyze companies and markets more efficiently.

XenonStack

XenonStack is an AI application that offers a comprehensive suite of tools and services for building and managing Agentic Systems. The platform provides solutions for data management, analytics, AI transformation, and decision-making processes. With features like AI-enabled catalogs, industrial automation, and agent orchestration, XenonStack aims to empower enterprises to reimagine their business workflows and drive efficiency and agility through intelligent AI agents.

Unlearn.ai

Unlearn.ai is an AI-driven platform that specializes in streamlining clinical trials through the use of AI-generated digital twins of patients. By leveraging digital twin technology and disease-specific ML models, Unlearn.ai enables researchers to design and run more efficient and impactful clinical trials across various therapeutic areas. The platform offers solutions to accelerate trial timelines, facilitate faster decision-making, and optimize trial design, ultimately enhancing trial efficiency, insights, and impact.

Discuro

Discuro is an all-in-one platform designed for developers to easily build, test, and consume complex AI workflows. It integrates with GPT-3, DALLE-2, and older OpenAI models, allowing users to chain prompts together in powerful ways. With Discuro, users can define their workflows in an easy-to-use UI and execute them with a single API call. The platform enables users to build and test complex self-transforming AI workflows and data sets, monitor AI usage, and generate completions efficiently.

Google Colab Copilot

Google Colab Copilot is an AI tool that integrates the GitHub Copilot functionality into Google Colab, allowing users to easily generate code suggestions and improve their coding workflow. By following a simple setup guide, users can start using the tool to enhance their coding experience and boost productivity. With features like code generation, auto-completion, and real-time suggestions, Google Colab Copilot is a valuable tool for developers looking to streamline their coding process.

Zomory

Zomory is an AI-powered knowledge search tool that allows users to search their Notion workspace with lightning-fast speed. It offers natural language understanding, Slack integration, conversational interface, page search, and enterprise security. Zomory is designed to provide users with instant access to the information they need, even if they are unsure of the exact keywords. It aims to revolutionize the way users search for knowledge within their workspace by combining AI technology with user-friendly features.

Lobe

Lobe is a free and easy-to-use machine learning tool for Mac and PC that helps users train machine learning models and deploy them to any platform. It offers a range of features such as creating image-based datasets, managing and comparing prompts, automating workflows, and collaborating outside of code. Lobe provides a user-friendly interface for individuals and teams to leverage AI technology without extensive coding knowledge.

Aitodata

Aitodata.com is an AI tool designed to provide advanced data analysis solutions. The platform offers a wide range of features to help users analyze and interpret data more effectively. With a user-friendly interface, Aitodata.com aims to simplify the process of data analysis for individuals and businesses alike. The tool is known for its accuracy, efficiency, and reliability in handling complex data sets.

Sushidata Analytics

Sushidata Analytics is an AI-powered platform that helps companies gain a competitive edge by unifying and automating critical competitive and marketing operations data. It offers fully automated analysis of data, identifies key trends and advocates, and provides actionable insights to marketing teams. The platform assists in monitoring competition, turning customer feedback into actionable strategies, and enhancing customer experience. Sushidata prioritizes data security and offers integrations with various tools for seamless data collection and analysis.

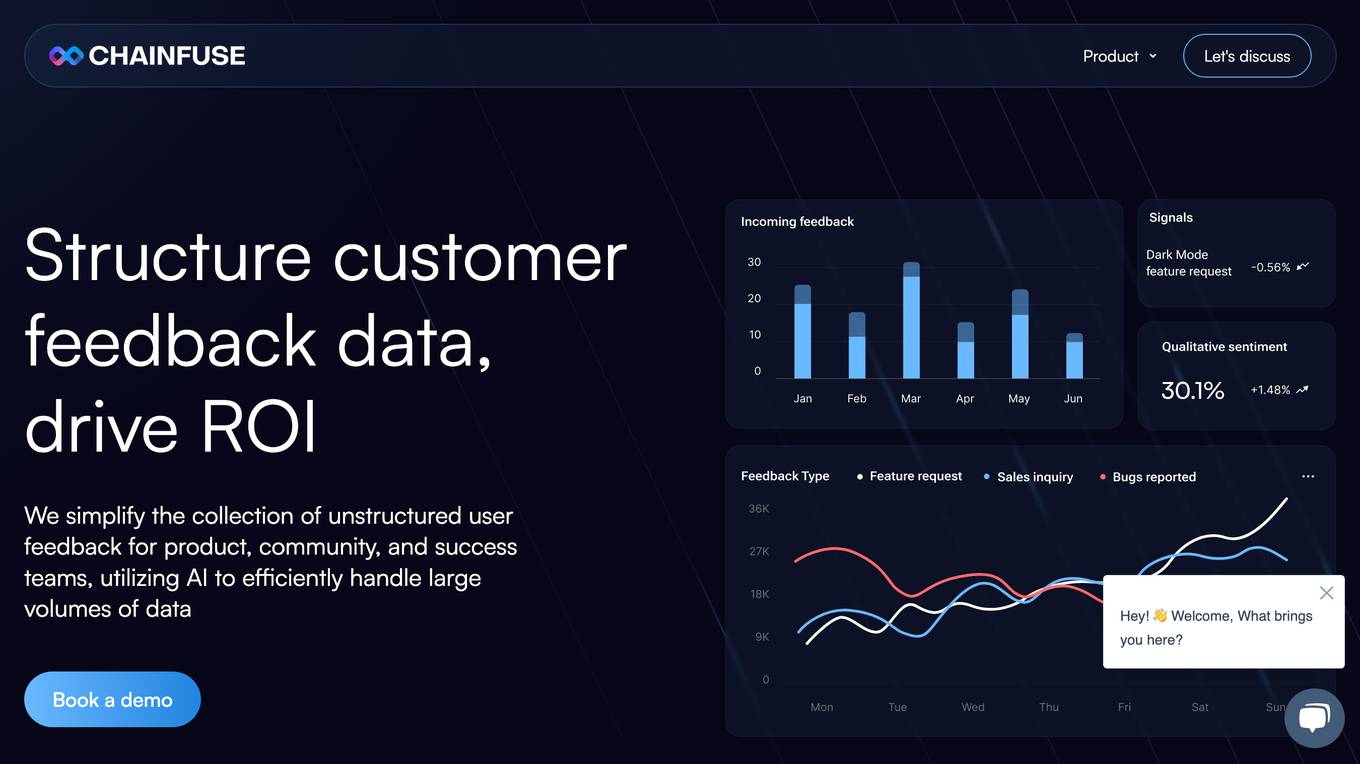

GPT-4 Consulting

GPT-4 Consulting is an AI tool that provides business advice and software consultation services. Users can book consultations to get advice on leveraging AI for their businesses. The tool uses advanced AI technology to generate personalized advice based on the user's input.

Weaviate

Weaviate is an AI-native database that developers love. It offers a feature-rich vector database trusted by AI innovators, empowering AI-native builders to create AI-powered search, retrieval augmented generation, and agentic AI applications. Weaviate simplifies the process of building production-ready AI applications by providing seamless model integration, pre-built database agents, and language-agnostic SDKs for easy development. With billion-scale architecture and enterprise-ready deployment options, Weaviate enables developers to scale seamlessly, deploy anywhere, and meet enterprise requirements. The platform is designed to help AI builders write less custom code, optimize costs, and build AI-native apps faster.

Microsoft Azure

Microsoft Azure is a cloud computing service that offers a wide range of products and solutions for businesses and developers. It provides tools for AI, machine learning, databases, analytics, compute, containers, hybrid cloud, and more. Azure enables users to build, deploy, and scale AI-powered applications and agents faster, with a focus on data security and flexibility. The platform offers a pay-as-you-go model and a free trial period of up to 30 days, with no upfront commitment required. Azure aims to empower businesses to innovate and modernize their applications and infrastructure in a secure and scalable environment.