Scienaptic Systems

More Approvals. Lower Risk. Instant Decisions.

Scienaptic Systems is an AI-powered Credit Decisioning Platform that revolutionizes the lending industry by automating credit underwriting processes, leveraging alternate data points, and offering self-learning models for instant credit decisions. The platform helps lenders identify creditworthy borrowers, streamline customer experience, and ensure fair lending practices through explainable AI models. Scienaptic's suite of AI-enabled technologies enables lenders to say 'Yes' to more borrowers at lower risk, providing a 360-degree risk assessment before approving applications. The platform integrates seamlessly with existing lending ecosystems, ensuring disruption-free deployment and better risk predictions through a single API call.

For Tasks:

Click tags to check more tools for each tasksFor Jobs:

Features

Advantages

Disadvantages

Frequently Asked Questions

Alternative AI tools for Scienaptic Systems

Similar sites

Scienaptic Systems

Scienaptic Systems is an AI-powered Credit Decisioning Platform that revolutionizes the lending industry by automating credit underwriting processes, leveraging alternate data points, and offering self-learning models for instant credit decisions. The platform helps lenders identify creditworthy borrowers, streamline customer experience, and ensure fair lending practices through explainable AI models. Scienaptic's suite of AI-enabled technologies enables lenders to say 'Yes' to more borrowers at lower risk, providing a 360-degree risk assessment before approving applications. The platform integrates seamlessly with existing lending ecosystems, ensuring disruption-free deployment and better risk predictions through a single API call.

Zest AI

Zest AI is an AI-driven credit underwriting software that offers a complete solution for AI-driven lending. It enables users to build custom machine learning risk models, adopt model assessment and regulatory compliance, and operate performance management and model monitoring. Zest AI helps increase approvals, manage risk, control loss, drive operational efficiency, automate credit decisioning, and improve borrower experience while ensuring fair lending practices. The software is designed to provide powerful AI for better lending outcomes by accelerating loan growth and expanding credit access through accurate risk prediction and faster credit decisions.

Zest AI

Zest AI is an AI-driven credit underwriting software that offers a complete solution for AI-driven lending. It enables users to build custom machine learning risk models, adopt model assessment and regulatory compliance, and operate performance management and model monitoring. Zest AI helps increase approvals, manage risk, control loss, drive operational efficiency, automate credit decisioning, and improve borrower experience while ensuring fair lending practices. The software is designed to provide fair and transparent credit for everyone, making lending more accessible and inclusive.

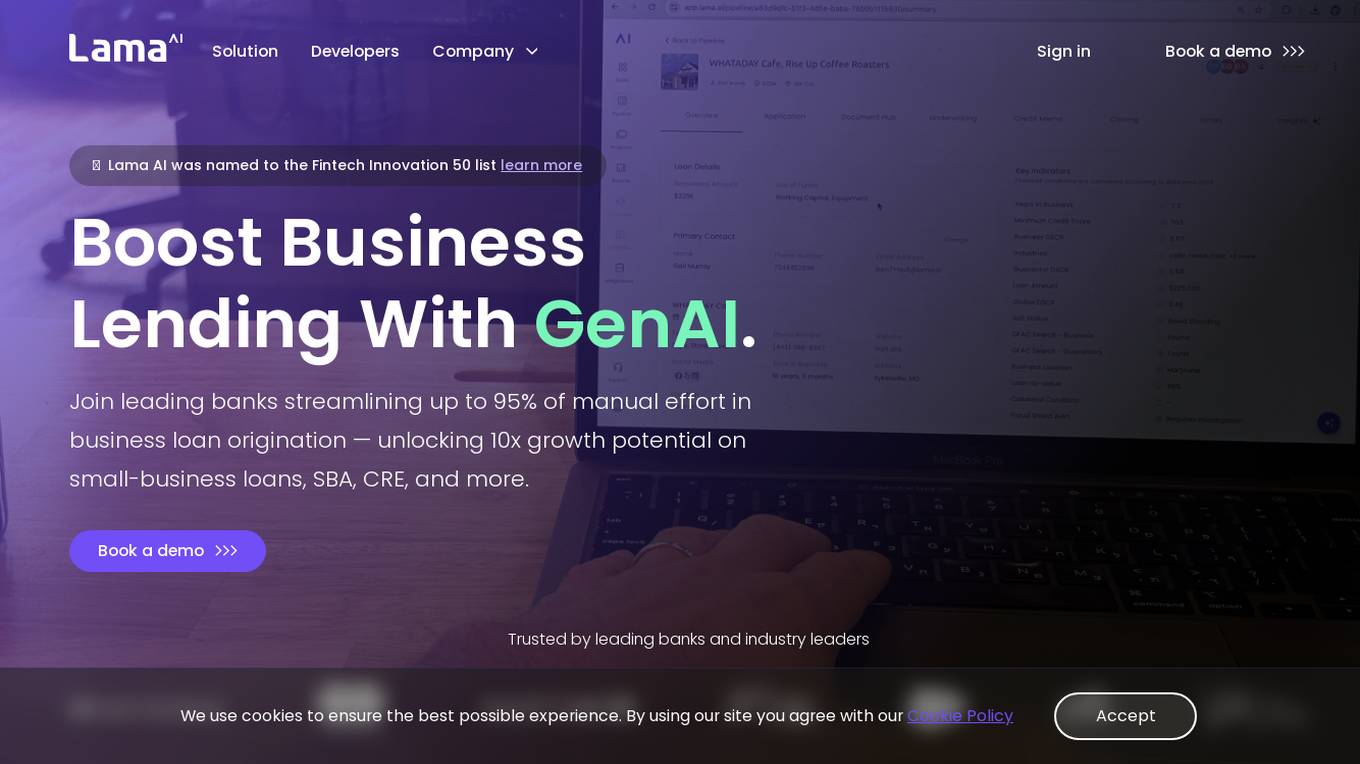

Lama AI

Lama AI is an AI-powered platform designed to revolutionize business lending processes for banks and financial institutions. It offers advanced features, rapid configurability, and exceptional support to streamline loan origination, underwriting, and decision-making. By leveraging the power of AI, Lama AI enables banks to boost business growth potential, improve profitability, and enhance customer experience through contextual onboarding, decisioning workspace, expanded credit access, and pre-qualified applications. The platform also provides white-labeled solutions, API-first integration, high configurability, built-in AI models, and access to a network of bank lenders, all while ensuring bank-grade security and compliance standards.

Clerkie

Clerkie is a powerful debt repayment and optimization platform that offers a full-service automation solution powered by machine learning and human expertise. It helps lenders, both big and small, to manage and optimize their loan portfolios efficiently. With features like smart payment experience, AI-driven repayment strategies, real-time reporting, and easy integration, Clerkie ensures a seamless and secure experience for lenders and borrowers alike.

VantedgeAI

VantedgeAI is an AI application that offers fine-tuned AI models for credit funds, revolutionizing credit investing workflows with faster, smarter, and cost-effective solutions. The application transforms manual processes into scalable, automated workflows tailored for Private Credit and Hedge Funds. VantedgeAI is trusted by market leaders in the industry, providing unique AI-driven insights to maintain a competitive advantage and ensure data security and privacy through SOC 2 compliance. The application offers advanced AI solutions for credit investing, including automated investment memo generation, data extraction for Excel models, portfolio monitoring, loan reconciliation, smart bond screening, real-time data querying with AI bots, and more.

Dispute AI™

Dispute AI™ is an AI-powered DIY credit repair solution that leverages cutting-edge artificial intelligence to provide personalized strategies for boosting credit scores. The platform offers actionable insights, data-driven recommendations, and a fast, affordable, and flexible credit repair process. With over 20 years of expertise in credit repair, Dispute AI™ aims to revolutionize the way individuals take control of their credit by providing innovative tools that simplify and streamline the credit repair process.

Federato

Federato is an AI-powered platform that integrates Google Cloud's AI capabilities to provide new AI underwriting solutions for the insurance industry. It aims to revolutionize underwriting processes by leveraging AI technology to enhance risk assessment, portfolio management, and decision-making. Federato's RiskOps platform empowers underwriters with powerful insights, real-time risk selection guidance, and unified underwriting workflows, enabling them to make more informed decisions and improve operational efficiency.

Silverwork Solutions

Silverwork Solutions is a fintech company that provides AI-powered mortgage automation solutions. Its Digital Workforce Solutions are role-based autonomous bots that integrate seamlessly into loan manufacturing processes, from application to post-closing. These bots utilize AI to make predictions and decisions, enhancing the loan processing experience. Silverwork's solutions empower lenders to realize the full potential of automation and transform their operations, allowing them to focus on higher-value activities while the bots handle repetitive tasks.

FlowX.AI

FlowX.AI is a Multi-Agent AI Platform designed for Banking and Insurance Modernization. It offers a cutting-edge AI-native agentic platform for building and deploying AI agents and mission-critical AI-enabled systems in highly regulated industries. The platform enables businesses to build the next generation of banking and insurance systems in weeks, not years, by providing faster development, time to market, and reduced maintenance and implementation costs.

Perfios

Perfios is an AI-powered FinTech software company that offers digital solutions for various industries such as banking, insurance, fintech, payments, e-commerce, legal, gaming, and more. Their platform provides end-to-end solutions for digital onboarding, underwriting, risk assessment, fraud detection, and customer engagement. Perfios leverages AI and machine learning technologies to streamline processes, enhance operational efficiency, and improve decision-making in financial services. With a wide range of products and features, Perfios aims to transform the way businesses experience technology and make data-driven decisions.

Cape.ai

Cape.ai is an agentic AI platform designed for financial operations, offering AI-powered automation to enhance reach, insight, and efficiency in daily operations for financial firms. The platform is built on real-world customer use cases, providing tangible business ROI by integrating structured and unstructured data sources, automating complex manual processes, and offering context-aware insights. Users have control over their data and processes, with customizable workflows and human-in-the-loop capabilities. Cape.ai enables flexible implementation of agentic and deterministic automation, with seamless integrations for various financial workflows and direct access to leading financial data providers. The platform empowers users to create powerful AI agents without technical barriers, unlocking real business value with speed and confidence.

AI Copilot for bank ALCOs

AI Copilot for bank ALCOs is an AI application designed to empower Asset-Liability Committees (ALCOs) in banks to test funding and liquidity strategies in a risk-free environment, ensuring optimal balance sheet decisions before real-world implementation. The application provides proactive intelligence for day-to-day decisions, allowing users to test multiple strategies, compare funding options, and make forward-looking decisions. It offers features such as stakeholder feedback, optimal funding mix, forward-looking decisions, comparison of funding strategies, domain-specific models, maximizing returns, staying compliant, and built-in security measures. MaverickFi, the AI Copilot, is deployed on Microsoft Azure and offers deployment options based on user preferences.

Convr

Convr is a modularized AI underwriting and intelligent document automation workbench that enriches and expedites the commercial insurance new business and renewal submission flow with underwriting insights, business classification and risk scoring. As a trusted technology partner and advisor with deep industry expertise, we help insurance organizations transform their underwriting operations through our AI-driven digital underwriting analysis platform.

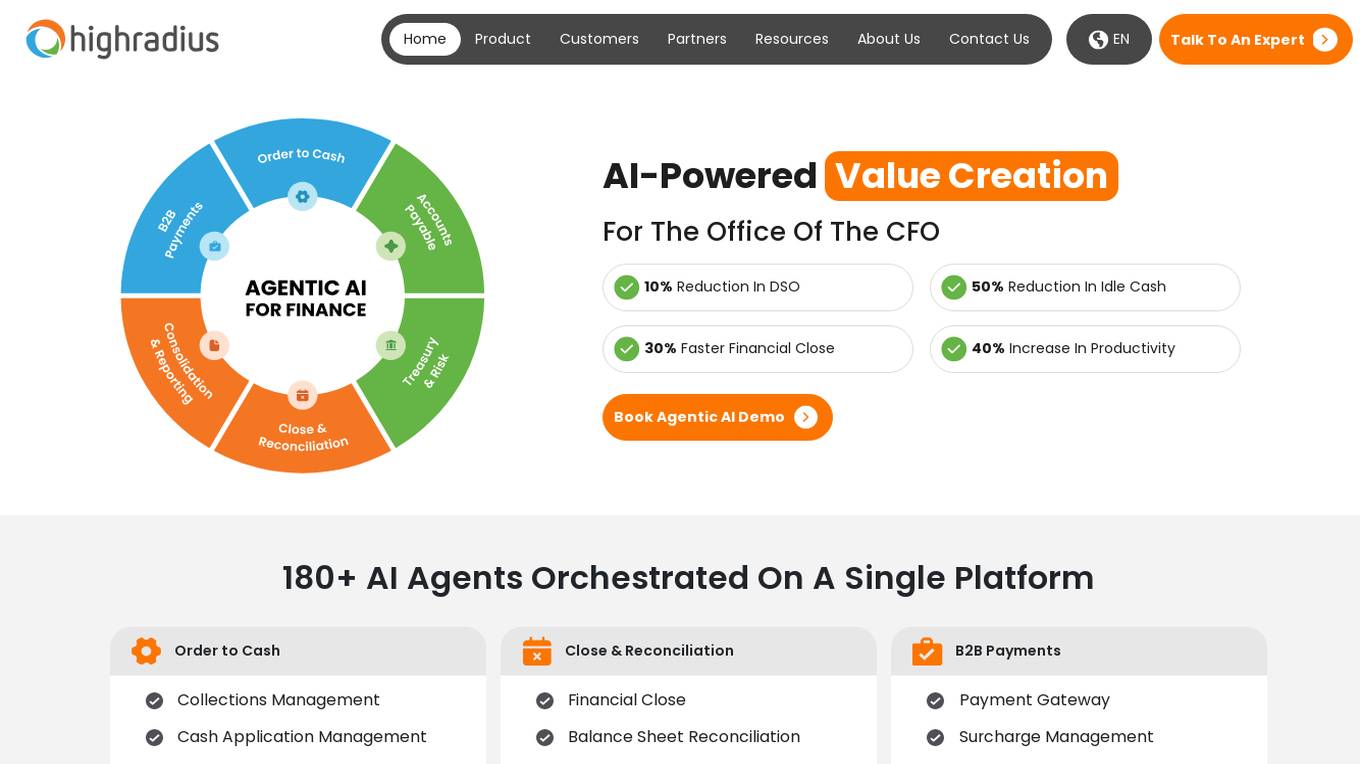

HighRadius

HighRadius is an AI-powered platform that offers Autonomous Finance solutions for Order to Cash (O2C), Treasury, and Record-to-Report (R2R) processes. It provides a single platform for various financial functions such as Accounts Payable, B2B Payments, Cash Management, and Financial Reporting. HighRadius leverages Generative AI and a No-Code AI Platform to automate data analysis and streamline financial operations for the Office of the CFO. The platform aims to enhance productivity, reduce manual work, and improve financial decision-making through advanced AI capabilities.

Convr

Convr is an AI-driven underwriting analysis platform that helps commercial P&C insurance organizations transform their underwriting operations. It provides a modularized AI underwriting and intelligent document automation workbench that enriches and expedites the commercial insurance new business and renewal submission flow with underwriting insights, business classification, and risk scoring. Convr's mission is to solve the last big problem of commercial insurance while improving profitability and increasing efficiency.

For similar tasks

Zest AI

Zest AI is an AI-driven credit underwriting software that offers a complete solution for AI-driven lending. It enables users to build custom machine learning risk models, adopt model assessment and regulatory compliance, and operate performance management and model monitoring. Zest AI helps increase approvals, manage risk, control loss, drive operational efficiency, automate credit decisioning, and improve borrower experience while ensuring fair lending practices. The software is designed to provide fair and transparent credit for everyone, making lending more accessible and inclusive.

Scienaptic Systems

Scienaptic Systems is an AI-powered Credit Decisioning Platform that revolutionizes the lending industry by automating credit underwriting processes, leveraging alternate data points, and offering self-learning models for instant credit decisions. The platform helps lenders identify creditworthy borrowers, streamline customer experience, and ensure fair lending practices through explainable AI models. Scienaptic's suite of AI-enabled technologies enables lenders to say 'Yes' to more borrowers at lower risk, providing a 360-degree risk assessment before approving applications. The platform integrates seamlessly with existing lending ecosystems, ensuring disruption-free deployment and better risk predictions through a single API call.

Zest AI

Zest AI is an AI-driven credit underwriting software that offers a complete solution for AI-driven lending. It enables users to build custom machine learning risk models, adopt model assessment and regulatory compliance, and operate performance management and model monitoring. Zest AI helps increase approvals, manage risk, control loss, drive operational efficiency, automate credit decisioning, and improve borrower experience while ensuring fair lending practices. The software is designed to provide powerful AI for better lending outcomes by accelerating loan growth and expanding credit access through accurate risk prediction and faster credit decisions.

Leadster

Leadster is an AI-powered marketing chatbot designed to increase lead generation by engaging and qualifying leads automatically. It offers interactive chatbot features to personalize visitor interactions, qualify leads 24/7, and distribute leads intelligently. Leadster integrates with various systems, tracks campaign performance, and optimizes lead conversion. The tool is user-friendly, requires no programming knowledge, and provides over 2000 integration possibilities. Leadster is a leader in conversational marketing in Brazil, validated by over 2000 companies. It helps businesses generate more qualified leads, optimize sales processes, and improve lead quality.

Allego Conversation Intelligence

Allego Conversation Intelligence is an AI-powered platform that helps revenue teams enhance performance and revenue by analyzing sales conversations. The platform enables users to capture, review, coach, and share valuable insights from conversations with customers. It leverages AI-driven analysis to reveal successful outcomes and provides data-driven performance coaching to improve sales performance. Allego Conversation Intelligence allows users to search, filter, and leverage call intelligence to uncover key moments that impact revenue. Trusted by top companies, the platform offers integrations with existing systems and resources for modern sales teams.

For similar jobs

Casca

Casca is a revolutionary AI-native Loan Origination System that helps banks and non-bank lenders automate 90% of manual effort in business loan origination. By leveraging AI technology, Casca enables financial institutions to process loans 10x faster, achieve 3x higher conversion rates, and save significant time for loan officers. With features like AI Loan Assistant, digital application processing, KYB checks automation, and document analysis, Casca transforms the loan origination process into a seamless and efficient experience for both lenders and borrowers.

Zest AI

Zest AI is an AI-driven credit underwriting software that offers a complete solution for AI-driven lending. It enables users to build custom machine learning risk models, adopt model assessment and regulatory compliance, and operate performance management and model monitoring. Zest AI helps increase approvals, manage risk, control loss, drive operational efficiency, automate credit decisioning, and improve borrower experience while ensuring fair lending practices. The software is designed to provide fair and transparent credit for everyone, making lending more accessible and inclusive.

Scienaptic Systems

Scienaptic Systems is an AI-powered Credit Decisioning Platform that revolutionizes the lending industry by automating credit underwriting processes, leveraging alternate data points, and offering self-learning models for instant credit decisions. The platform helps lenders identify creditworthy borrowers, streamline customer experience, and ensure fair lending practices through explainable AI models. Scienaptic's suite of AI-enabled technologies enables lenders to say 'Yes' to more borrowers at lower risk, providing a 360-degree risk assessment before approving applications. The platform integrates seamlessly with existing lending ecosystems, ensuring disruption-free deployment and better risk predictions through a single API call.

Underwrite.ai

Underwrite.ai is a platform that leverages advances in artificial intelligence and machine learning to provide lenders with nonlinear, dynamic models of credit risk. By analyzing thousands of data points from credit bureau sources, the application accurately models credit risk for consumers and small businesses, outperforming traditional approaches. Underwrite.ai offers a unique underwriting methodology that focuses on outcomes such as profitability and customer lifetime value, allowing organizations to enhance their lending performance without the need for capital investment or lengthy build times. The platform's models are continuously learning and adapting to market changes in real-time, providing explainable decisions in milliseconds.

Zest AI

Zest AI is an AI-driven credit underwriting software that offers a complete solution for AI-driven lending. It enables users to build custom machine learning risk models, adopt model assessment and regulatory compliance, and operate performance management and model monitoring. Zest AI helps increase approvals, manage risk, control loss, drive operational efficiency, automate credit decisioning, and improve borrower experience while ensuring fair lending practices. The software is designed to provide powerful AI for better lending outcomes by accelerating loan growth and expanding credit access through accurate risk prediction and faster credit decisions.

FinFloh

FinFloh is an AI-powered Accounts Receivable Software that automates the accounts receivable process effortlessly with features like credit decisioning, collections, cash application, invoice verification, and dispute resolution. It enhances collections efficiency, reduces decision-making time, and improves cash flows for B2B finance teams worldwide. The software integrates with ERP/CRM systems, offers predictive analytics, and AI-driven credit scoring to optimize accounts receivable management. FinFloh ensures secure data handling and seamless communication between finance, sales, and customer support teams, ultimately leading to increased cash flow and reduced DSO.

Prudent AI

Prudent AI is an AI-powered Income Intelligence Platform designed for lenders, offering fast data extraction, proactive fraud prevention, and in-depth insights on borrower income. The platform simplifies complex income calculations, streamlines the lending process, and enables lenders to make confident loan decisions quickly. Prudent AI is trusted by various lending institutions and has been proven to increase productivity, save time, and improve submission accuracy.

Rationale

Rationale is a cutting-edge decision-making AI tool that leverages the power of the latest GPT technology and in-context learning. It is designed to assist users in making informed decisions by providing valuable insights and recommendations based on the data provided. With its advanced algorithms and machine learning capabilities, Rationale aims to streamline the decision-making process and enhance overall efficiency.

CHAI AI

CHAI AI is a leading conversational AI platform that focuses on building AI solutions for quant traders. The platform has secured significant funding rounds to expand its computational capabilities and talent acquisition. CHAI AI offers a range of models and techniques, such as reinforcement learning with human feedback, model blending, and direct preference optimization, to enhance user engagement and retention. The platform aims to provide users with the ability to create their own ChatAIs and offers custom GPU orchestration for efficient inference. With a strong focus on user feedback and recognition, CHAI AI continues to innovate and improve its AI models to meet the demands of a growing user base.

Cambrian Copilot

Cambrian Copilot is an AI tool designed for researchers and engineers to stay up-to-date with the latest machine learning research. With the ability to search over 240,000 ML papers, the tool helps users discover new research, understand complex details, and automate literature reviews. It simplifies the process of keeping track of the rapid developments in the field of machine learning.

Nexus

Nexus is a Business-led Enterprise AI Platform that empowers business teams to transform their workflows into autonomous agents in a matter of days. It offers a secure, reliable, and flexible solution that enables enterprises to deploy 100x faster without involving engineering teams. Nexus provides adaptive intelligence, dynamic planning, continuous learning, and technology-agnostic intelligent automation. It allows for universal deployment, works with existing tools, and grows with businesses without increasing headcount.

Mnemonic AI

Mnemonic AI is an end-to-end marketing intelligence platform that helps businesses unify their data, understand their customers, and automate their growth. It connects disparate data sources to build AI-powered customer insights and streamline marketing processes. The platform offers features such as connecting marketing and sales apps, generating AI insights, and automating growth through BI-grade reports. Mnemonic AI is trusted by forward-thinking marketing teams to transform marketing intelligence and drive confident decisions.

Functime

Functime is an AI tool specializing in time-series machine learning at scale. It offers a comprehensive set of features and functions to assist users in forecasting and analyzing time-series data efficiently. With its user-friendly interface and detailed documentation, Functime is designed to cater to both beginners and experienced users in the field of machine learning. The tool provides scoring, ranking, and plotting functions to evaluate forecasts, along with an AI copilot feature for in-depth analysis of trends, seasonality, and causal factors. Functime also offers an API reference for seamless integration with other applications.

Promptmakr

Promptmakr is an AI-powered platform that facilitates the buying and selling of AI prompts. It serves as a marketplace where users can discover, purchase, and sell prompts to enhance their AI projects. With a user-friendly interface and robust features, Promptmakr streamlines the process of accessing high-quality prompts for various applications, from chatbots to image recognition systems. The platform ensures secure transactions and fosters a community of AI enthusiasts and professionals.

StockGPT

StockGPT is an AI-powered financial research assistant that provides knowledge of earnings releases, financial reports, and fundamental information for S&P 500 and Nasdaq companies. It offers features like AI search, customizable filters, up-to-date data, and industry research to help users analyze companies and markets more efficiently.

DiscuroAI

DiscuroAI is an all-in-one platform designed for developers to easily build, test, and consume complex AI workflows. Users can define their workflows in a user-friendly interface and execute them with a single API call. The platform integrates with GPT-3, DALLE-2, and other OpenAI models, allowing users to chain prompts together in powerful ways and extract output in JSON format via API. DiscuroAI enables users to build and test complex self-transforming AI workflows and datasets, execute workflows with one API call, and monitor AI usage across workflows.

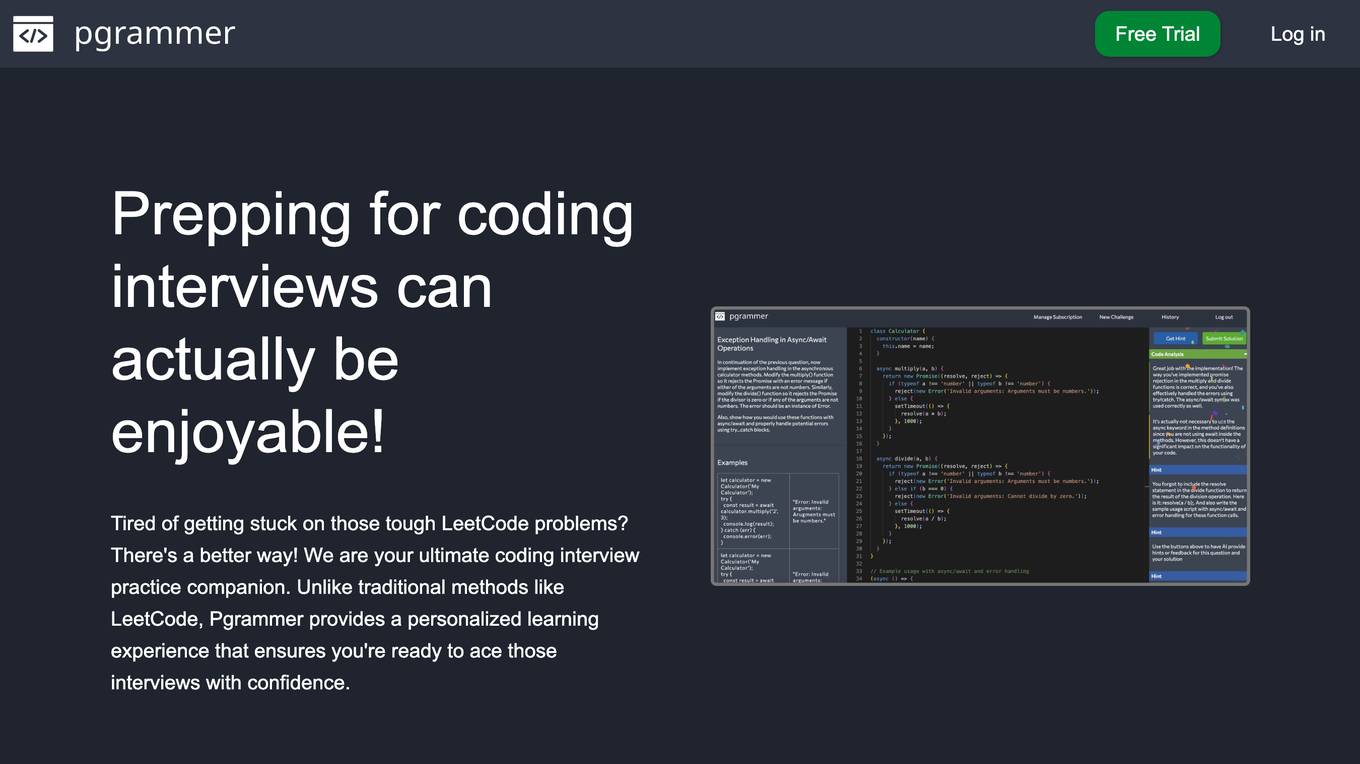

Pgrammer

Pgrammer is an AI-powered platform designed to help users practice coding interview questions with hints and personalized learning experiences. Unlike traditional methods like LeetCode, Pgrammer offers a diverse set of questions for over 20 programming languages, real-time hints, and solution analysis to improve coding skills and knowledge. The platform uses AI, specifically GPT-4, to determine question difficulty levels and provide feedback on code submissions. Pgrammer aims to make coding interview preparation enjoyable and effective for both beginners and seasoned professionals.

Google Colab Copilot

Google Colab Copilot is an AI tool that integrates the GitHub Copilot functionality into Google Colab, allowing users to easily generate code suggestions and improve their coding workflow. By following a simple setup guide, users can start using the tool to enhance their coding experience and boost productivity. With features like code generation, auto-completion, and real-time suggestions, Google Colab Copilot is a valuable tool for developers looking to streamline their coding process.

Lobe

Lobe is a free easy-to-use tool for Mac and PC that helps you train machine learning models and ship them to any platform you choose. It provides a user-friendly interface for training machine learning models without requiring extensive coding knowledge. Lobe supports various tasks related to machine learning, such as creating image-based datasets, working with Python toolsets, and deploying models on different platforms.

GitHub Buoyant

GitHub Buoyant is an AI-powered marine data aggregator tool that fetches marine conditions from NOAA via various free APIs. It provides wave conditions, wind data, tide levels, and water temperature for coastal areas in the US. The tool offers a comprehensive marine report with detailed information on waves, wind, tides, water temperature, and weather forecasts. It includes a library for developers to integrate marine data into their own code and covers US mainland coastal waters, Great Lakes, Hawaii, Alaska, Puerto Rico, USVI, and Guam. The tool handles NOAA's data quirks and provides insights into the technical aspects of data processing and validation.

Digicurator Agency

Digicurator Agency is an AI automation partner that specializes in building custom automation solutions and training teams for long-term success. They provide end-to-end services, from discovery and strategy to solution design and development, deployment, and empowerment. Their mission is to transform businesses through custom solutions and expert education, empowering clients to master automation for lasting success. The agency offers full-service solutions that employ AI-driven strategies to propel businesses to new heights.

Weaviate

Weaviate is an AI tool designed to empower AI builders to design, build, and ship complete AI experiences. It provides a foundation for search, retrieval augmented generation, and agentic AI. Weaviate offers production-ready AI applications, faster deployment, and seamless model integration. With billion-scale architecture and enterprise-ready deployment options, Weaviate helps AI builders scale seamlessly and meet enterprise requirements. The platform offers AI-first features under one roof, enabling users to write less custom code and build AI apps efficiently.

Microsoft Azure

Microsoft Azure is a cloud computing service that offers a wide range of products and solutions for businesses and developers. It provides services such as databases, analytics, compute, containers, hybrid cloud, AI, application development, and more. Azure aims to help organizations innovate, modernize, and scale their operations by leveraging the power of the cloud. With a focus on flexibility, performance, and security, Azure is designed to support a variety of workloads and use cases across different industries.

Qualifyed

Qualifyed is an AI predictive audiences and lead scoring platform designed to help businesses optimize their advertising efforts by targeting people with the highest probability to become customers. The platform uses machine learning to continuously inspect and score leads, providing a model of targetable individuals with a high probability of conversion. Qualifyed aims to decrease customer acquisition costs, increase online conversions, and enhance the efficiency of offline sales teams. By leveraging data and AI technology, Qualifyed offers a solution to reach ideal customers effectively and automatically.