Dispute AI™

Revolutionizing Credit Repair with AI-Powered Solutions

Dispute AI™ is an AI-powered DIY credit repair solution that revolutionizes the way individuals take control of their credit. With over 20 years of expertise in credit repair and financial empowerment, Dispute AI™ delivers personalized strategies backed by cutting-edge artificial intelligence to simplify and streamline the credit repair process. The platform offers tailored AI-driven tactics to challenge and resolve inaccurate credit report items effectively, providing actionable, data-driven recommendations to improve credit scores. Users can handle credit repair on their terms, anytime, anywhere, without the need to hire expensive credit repair companies. Dispute AI™ aims to make credit improvement accessible, efficient, and impactful, empowering individuals to achieve financial freedom.

For Tasks:

Click tags to check more tools for each tasksFor Jobs:

Features

Advantages

Disadvantages

Frequently Asked Questions

Alternative AI tools for Dispute AI™

Similar sites

Dispute AI™

Dispute AI™ is an AI-powered DIY credit repair solution that revolutionizes the way individuals take control of their credit. With over 20 years of expertise in credit repair and financial empowerment, Dispute AI™ delivers personalized strategies backed by cutting-edge artificial intelligence to simplify and streamline the credit repair process. The platform offers tailored AI-driven tactics to challenge and resolve inaccurate credit report items effectively, providing actionable, data-driven recommendations to improve credit scores. Users can handle credit repair on their terms, anytime, anywhere, without the need to hire expensive credit repair companies. Dispute AI™ aims to make credit improvement accessible, efficient, and impactful, empowering individuals to achieve financial freedom.

SmartDispute.ai

SmartDispute.ai is an AI-powered credit repair application that helps users improve their credit scores by leveraging artificial intelligence technology. The application offers a patented Smart Dispute System™ technology that identifies and helps remove negative accounts from credit reports, making it one of the most effective credit repair systems available. Users can easily repair their own credit with the help of SmartDispute.ai's automated processes and fact-based dispute method. The application provides users with a simple and clearly explained process, allowing them to track their progress and see significant improvements in their credit scores over time.

Cleo

Cleo is an AI-powered financial management tool that helps users with budgeting, saving, building credit, and managing their finances. It offers features like cash advances, budgeting tips, credit building tools, and personalized financial advice. Cleo uses AI technology to provide users with insights and recommendations to improve their financial health. The application aims to make money management easy and accessible for everyone, without the need for credit checks or complex financial jargon.

CreditHQ

CreditHQ is an AI-powered loan restructuring platform that helps users analyze their credit history, compare interest rates, and save money on their loans. The platform offers a range of features, including a credit score simulator, a budgeting tool, and a debt management tool. CreditHQ is trusted by over 5,500 users and companies globally.

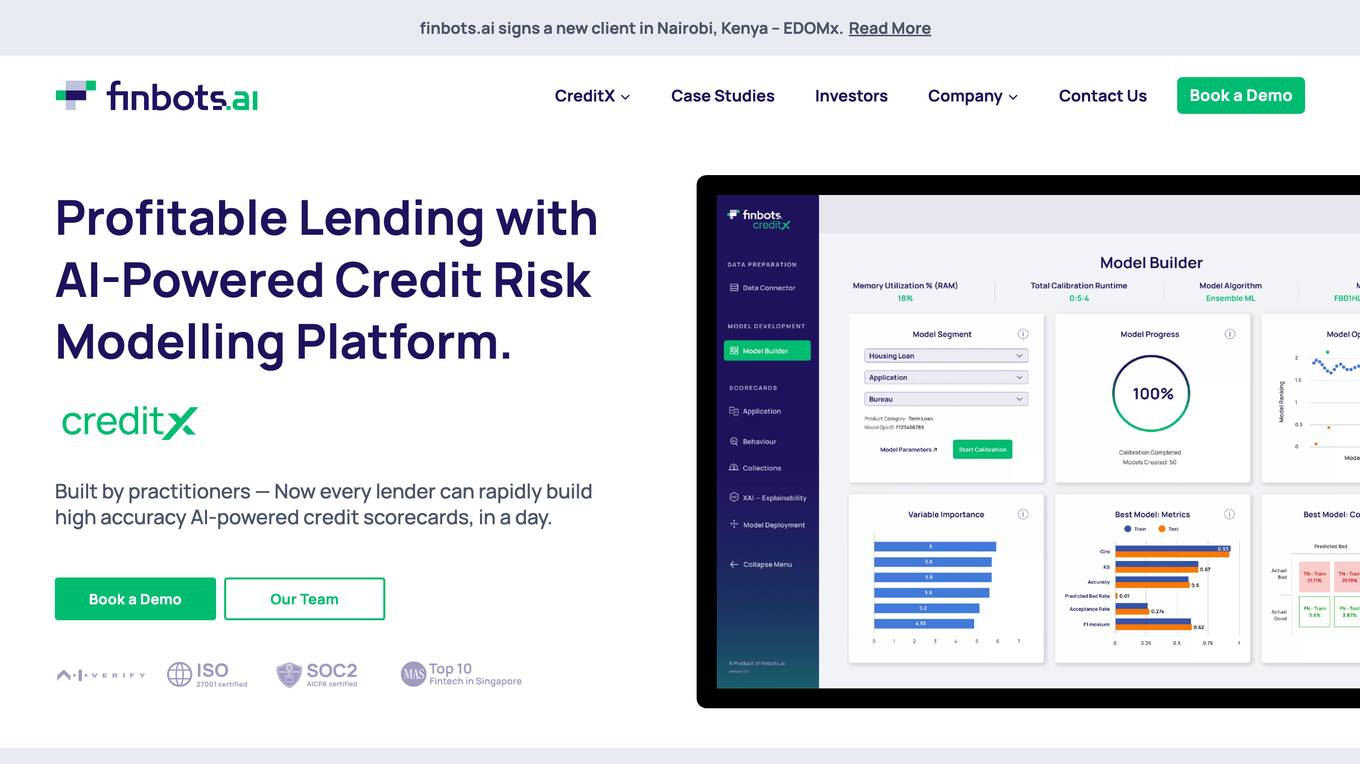

Finbots.ai

Finbots.ai is a trusted AI credit risk platform that offers AI credit scoring to boost lending profits and reduce non-performing loans. The platform provides the highest accuracy in the market, allowing users to build scorecards in a day without the need for coding. It helps in making instant decisions, increasing revenue, reducing risk, and improving operational efficiency. Finbots.ai is utilized by various financial institutions to enhance credit risk management, improve profitability, and drive down the cost of risk through AI-enabled models.

Zest AI

Zest AI is an AI-driven credit underwriting software that offers a complete solution for AI-driven lending. It enables users to build custom machine learning risk models, adopt model assessment and regulatory compliance, and operate performance management and model monitoring. Zest AI helps increase approvals, manage risk, control loss, drive operational efficiency, automate credit decisioning, and improve borrower experience while ensuring fair lending practices. The software is designed to provide fair and transparent credit for everyone, making lending more accessible and inclusive.

Intuit Assist

Intuit Assist is a generative AI-powered financial assistant designed to help you achieve financial confidence. It is a comprehensive platform that offers a wide range of financial tools and services, including TurboTax, Credit Karma, QuickBooks, and Mailchimp. Intuit Assist can help you with a variety of financial tasks, such as filing your taxes, managing your credit, tracking your expenses, and invoicing your clients. It is a valuable tool for anyone who wants to take control of their finances and achieve financial success.

Zest AI

Zest AI is an AI-driven credit underwriting software that offers a complete solution for AI-driven lending. It enables users to build custom machine learning risk models, adopt model assessment and regulatory compliance, and operate performance management and model monitoring. Zest AI helps increase approvals, manage risk, control loss, drive operational efficiency, automate credit decisioning, and improve borrower experience while ensuring fair lending practices. The software is designed to provide powerful AI for better lending outcomes by accelerating loan growth and expanding credit access through accurate risk prediction and faster credit decisions.

Boast

Boast is an AI-driven platform that simplifies the process of claiming R&D tax credits for companies in Canada and the US. By combining technical expertise with AI technology, Boast helps businesses maximize their returns by identifying and claiming eligible innovation funding opportunities. The platform offers complete transparency and control, ensuring that users are well-informed at every step of the claim process. Boast has successfully helped over 1000 companies across North America to secure higher R&D tax credit claims with less effort and peace of mind.

wallet.AI

wallet.AI is an AI application that provides smart machines to inform users about their financial behavior and help them make better daily financial decisions. Founded in San Francisco in 2012, wallet.AI builds intelligent engines that analyze millions of pieces of data to offer personalized insights and recommendations to users. The application aims to empower individuals to manage their finances more effectively by leveraging artificial intelligence technology.

InsureSmart

InsureSmart is an AI-powered platform that empowers users to take control of their insurance needs. By leveraging artificial intelligence technology, InsureSmart offers personalized insurance solutions tailored to individual requirements. The platform provides a seamless and user-friendly experience for users to manage and optimize their insurance policies efficiently. With InsureSmart, users can access smart recommendations, compare insurance plans, and make informed decisions to secure their financial well-being.

Capchair

Capchair is a personal finance application that leverages AI technology to provide users with a seamless and efficient way to manage their finances. The app offers instant analysis, on-demand insights, and a comprehensive view of all financial data. Users can set budgets, goals, and connect their accounts to track their financial progress. Capchair prioritizes security by implementing bank-level security measures to safeguard users' financial information.

wallet.AI

wallet.AI is an AI application that provides smart machines to inform users about their financial behavior. Founded in San Francisco in 2012, wallet.AI builds intelligent engines that analyze millions of pieces of data to help users make better daily financial decisions. The application aims to assist people in making informed financial choices by leveraging artificial intelligence technology.

Principal

Principal is an AI-powered wealth platform that helps users manage their finances effectively. It offers a comprehensive view of your financial situation, personalized insights, and recommendations to grow your wealth. With bank-grade security, Principal ensures that your data is safe and secure. The platform is free to use with the option to upgrade for more advanced features and capabilities.

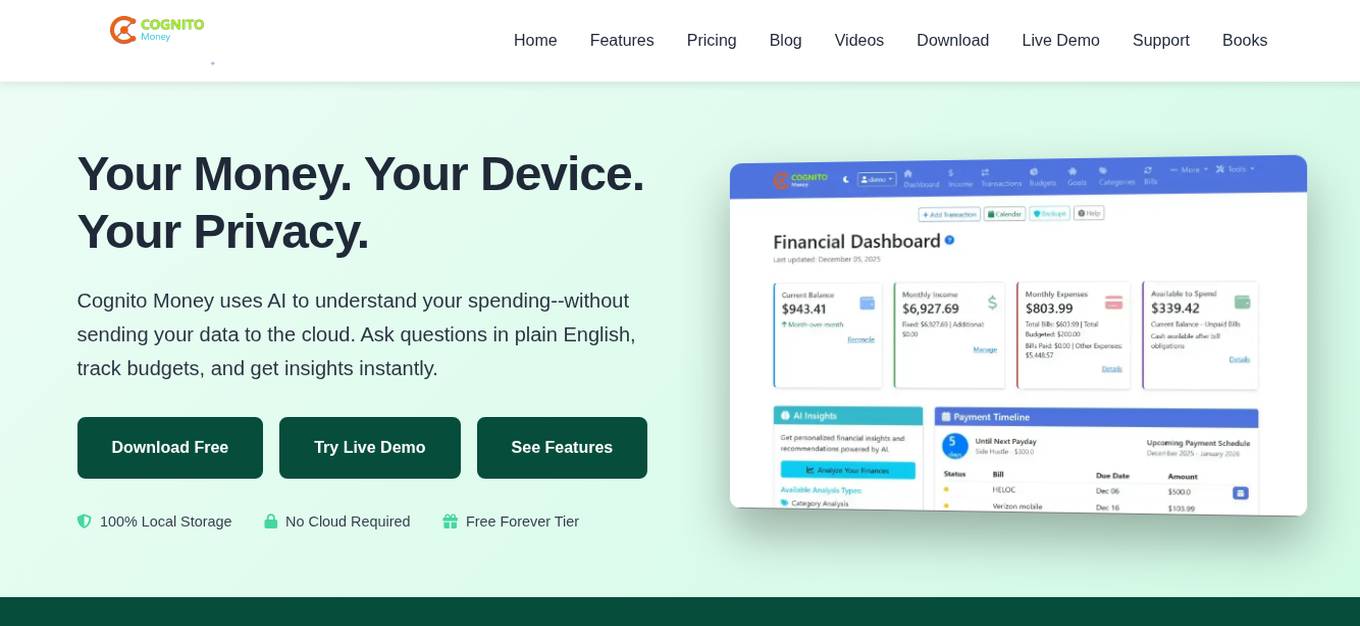

Cognito Money

Cognito Money is an AI-powered personal finance application that helps users manage their finances with privacy in mind. It uses AI to understand spending habits without sending data to the cloud. Users can ask questions in plain English, track budgets, and receive instant insights. The application offers features such as 100% local storage, instant answers, private and local data handling, visual budgets, financial health tracking, and transaction management.

Lama AI

Lama AI is an AI-powered platform designed to revolutionize business lending processes for banks and financial institutions. It offers advanced features, rapid configurability, and exceptional support to streamline loan origination, underwriting, and decision-making. By leveraging the power of AI, Lama AI enables banks to boost business growth potential, improve profitability, and enhance customer experience through contextual onboarding, decisioning workspace, expanded credit access, and pre-qualified applications. The platform also provides white-labeled solutions, API-first integration, high configurability, built-in AI models, and access to a network of bank lenders, all while ensuring bank-grade security and compliance standards.

For similar tasks

Dispute AI™

Dispute AI™ is an AI-powered DIY credit repair solution that revolutionizes the way individuals take control of their credit. With over 20 years of expertise in credit repair and financial empowerment, Dispute AI™ delivers personalized strategies backed by cutting-edge artificial intelligence to simplify and streamline the credit repair process. The platform offers tailored AI-driven tactics to challenge and resolve inaccurate credit report items effectively, providing actionable, data-driven recommendations to improve credit scores. Users can handle credit repair on their terms, anytime, anywhere, without the need to hire expensive credit repair companies. Dispute AI™ aims to make credit improvement accessible, efficient, and impactful, empowering individuals to achieve financial freedom.

SmartDispute.ai

SmartDispute.ai is an AI-powered credit repair application that helps users improve their credit scores by leveraging artificial intelligence technology. The application offers a patented Smart Dispute System™ technology that identifies and helps remove negative accounts from credit reports, making it one of the most effective credit repair systems available. Users can easily repair their own credit with the help of SmartDispute.ai's automated processes and fact-based dispute method. The application provides users with a simple and clearly explained process, allowing them to track their progress and see significant improvements in their credit scores over time.

For similar jobs

Dispute AI™

Dispute AI™ is an AI-powered DIY credit repair solution that revolutionizes the way individuals take control of their credit. With over 20 years of expertise in credit repair and financial empowerment, Dispute AI™ delivers personalized strategies backed by cutting-edge artificial intelligence to simplify and streamline the credit repair process. The platform offers tailored AI-driven tactics to challenge and resolve inaccurate credit report items effectively, providing actionable, data-driven recommendations to improve credit scores. Users can handle credit repair on their terms, anytime, anywhere, without the need to hire expensive credit repair companies. Dispute AI™ aims to make credit improvement accessible, efficient, and impactful, empowering individuals to achieve financial freedom.

Skeptical Tom

Skeptical Tom is an AI tool designed to help users control their impulsive shopping habits. The AI Cat feature provides personalized guidance to curb impulsive buys, offering wise whispers to guide users' wallets. Users can reach out to the team at [email protected] for any issues or queries.

Monarch Money

Monarch Money is an all-in-one money management platform that helps you track your finances, collaborate with your partner or financial advisor, and achieve your financial goals. It offers a variety of features, including budgeting, investment tracking, transaction categorization, and financial planning. Monarch Money is available on the web, iOS, and Android.

Origin

Origin is a financial management platform that provides users with a holistic view of their finances, personalized recommendations, and guidance from AI-powered planners and Certified Financial Planners. It offers features such as net worth tracking, budgeting, saving, investing, and tax assistance, all in one place for a monthly fee of $12.99.

Wally

Wally is the world's first AI-powered personal finance app. It helps you track your spending, create budgets, and plan for the future. Wally is available on iOS and Android devices.

Datarails

Datarails is a financial planning and analysis platform for Excel users. It automates data consolidation, reporting, and planning while enabling finance teams to continue using their spreadsheets and financial models. With Datarails, finance teams can save time on repetitive tasks and focus on strategic insights that drive business growth.

TripBudget

TripBudget is an AI-powered travel cost prediction tool that helps users plan and budget for their trips. It uses machine learning algorithms to analyze historical travel data and provide accurate estimates of travel expenses. TripBudget is designed to make travel planning easier and more affordable for everyone.

Capchair

Capchair is a personal finance application that leverages AI technology to provide users with a seamless and efficient way to manage their finances. The app offers instant analysis, on-demand insights, and a comprehensive view of all financial data. Users can set budgets, goals, and connect their accounts to track their financial progress. Capchair prioritizes security by implementing bank-level security measures to safeguard users' financial information.

CreditHQ

CreditHQ is an AI-powered loan restructuring platform that helps users analyze their credit history, compare interest rates, and save money on their loans. The platform offers a range of features, including a credit score simulator, a budgeting tool, and a debt management tool. CreditHQ is trusted by over 5,500 users and companies globally.

Cushion

Cushion is an AI-powered tool designed to simplify bill management and credit building. It securely connects to your accounts, organizes bills, and offers insights to help you budget better. With features like automatic bill tracking, virtual Cushion card payments, and credit history building, Cushion aims to make bill payments painless and credit building seamless.

Cleo

Cleo is an AI-powered financial management tool that helps users with budgeting, saving, building credit, and managing their finances. It offers features like cash advances, budgeting tips, credit building tools, and personalized financial advice. Cleo uses AI technology to provide users with insights and recommendations to improve their financial health. The application aims to make money management easy and accessible for everyone, without the need for credit checks or complex financial jargon.

SmartDispute.ai

SmartDispute.ai is an AI-powered credit repair application that helps users improve their credit scores by leveraging artificial intelligence technology. The application offers a patented Smart Dispute System™ technology that identifies and helps remove negative accounts from credit reports, making it one of the most effective credit repair systems available. Users can easily repair their own credit with the help of SmartDispute.ai's automated processes and fact-based dispute method. The application provides users with a simple and clearly explained process, allowing them to track their progress and see significant improvements in their credit scores over time.

AI Credit Repair

AI Credit Repair is an AI-powered application designed to help users improve their credit score by providing tools such as credit card utilization builder, public records remover, dispute letter generator, and SMS alerts. The application assists users in managing their credit card payments, disputing collections, and staying on top of their credit-related activities. By leveraging artificial intelligence technology, AI Credit Repair aims to simplify the credit repair process and empower users to build a better financial future.

Formula Wizard

Formula Wizard is an AI-powered software designed to assist users in writing Excel, Airtable, and Notion formulas effortlessly. By leveraging artificial intelligence, the application automates the process of formula creation, allowing users to save time and focus on more critical tasks. With features like automating tedious tasks, unlocking insights from data, and customizing templates, Formula Wizard streamlines the formula-writing process for various spreadsheet applications.

Eilla

Eilla is an AI-native M&A advisory platform designed for small and medium businesses (SMBs) looking to sell their companies. By combining top-tier M&A advisors with advanced AI algorithms, Eilla aims to deliver faster and higher-value outcomes for its clients. The platform automates manual tasks, surfaces hidden buyers, drives valuation, and creates competitive tension to push offers higher. Eilla provides expert advisory services, market intelligence, and a frictionless preparation process to make the selling experience efficient and effective. With decades of expertise backed by technology, Eilla has executed transactions worth over $100 billion and is trusted by numerous funds and banks.

StockGPT

StockGPT is an AI-powered financial research assistant that provides knowledge of earnings releases, financial reports, and fundamental information for S&P 500 and Nasdaq companies. It offers features like AI search, customizable filters, up-to-date data, and industry research to help users analyze companies and markets more efficiently.

ChatBTC

ChatBTC is an AI tool designed to help users learn about bitcoin technology and history. It provides AI responses to questions related to bitcoin technology, such as approaches to mitigating fee sniping, the benefits of SegWit, and the differences between PTLCs and HTLCs. The tool features AI bots representing various bitcoin experts who provide insights and explanations on different aspects of bitcoin technology. ChatBTC aims to educate users through AI-generated content sourced from reputable sources like the bitcoin-dev mailing list and Bitcoin StackExchange.

Capsolver

Capsolver is an AI-powered application that offers fast and seamless automatic captcha solving services. It provides solutions for various types of captchas, including reCAPTCHA, Geetest, ImageToText, Cloudflare, and more. Capsolver ensures easy integration with multiple language support and ready-to-use code examples, making it effortless to implement in web projects. The application caters to a wide range of industries, such as web testing, social media, market research, SEO, online shopping, online gaming, and financial services. Capsolver is known for its reliability, flexibility, and customization options, making it a preferred choice for enterprises seeking efficient captcha solving solutions.

Kupiks

Kupiks is a platform that provides access to alternative data for prediction markets. Users can join the waitlist to get early access to real-time alternative data signals from various sources. The platform offers powerful analytics tools for data-driven decision-making and instant alerts for tracking market shifts. Kupiks aims to help users make better predictions by leveraging alternative data.

Susterra

Susterra is an advanced analytics platform for Public Finance stakeholders, aiming to catalyze urban development by providing powerful insights. The platform integrates leading practices from academia, utilizes public data growth, and leverages technology and innovation, including ML and AI. Susterra offers solutions like TerraScore, TerraVision, TerraView, and Impact IQ, enabling sophisticated evaluation of public benefit programs across various sectors like Utilities, Education, Healthcare, and more. The platform also specializes in data visualization tools and is powered by Google Cloud.

Receiptor AI

Receiptor AI is an automated bookkeeping tool that leverages artificial intelligence to streamline the process of managing receipts and invoices. It finds, extracts, categorizes, and syncs data from various sources like emails, WhatsApp, and manual uploads to accounting software such as Xero and QuickBooks. The tool aims to save time, money, and reduce stress by automating tedious bookkeeping tasks, making financial records always complete and audit-ready. With features like automatic extraction, retroactive email analysis, real-time expense analytics, and smart AI categorization, Receiptor AI offers a novel approach to accounting that simplifies the workflow for individuals, businesses, and accountants.

Nanonets

Nanonets is an AI-powered intelligent document processing and workflow automation platform that helps businesses extract valuable information from unstructured data, automate repetitive tasks, and make faster, more informed decisions. The platform offers solutions for various industries and functions, such as finance & accounting, supply chain & operations, human resources, customer support, and legal. Nanonets' AI agents and no-code platform enable businesses to streamline complex processes and achieve measurable ROI in a short period. With a focus on automation, Nanonets empowers users to optimize workflows, reduce manual effort, and enhance efficiency across different use cases.

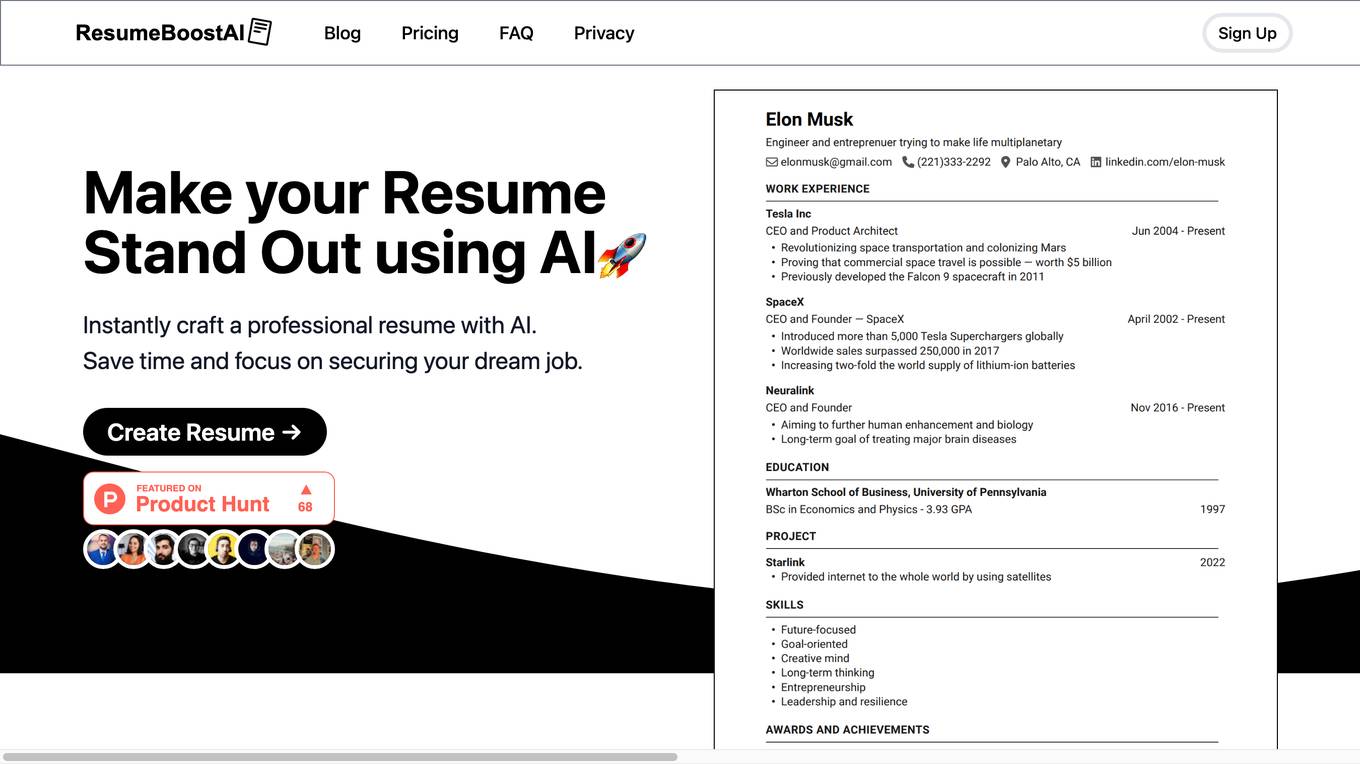

ResumeBoostAI

ResumeBoostAI is a free AI resume builder that helps job seekers create professional resumes and cover letters online. The platform offers a suite of innovative AI tools to streamline the job application process, save time, and increase the chances of landing a dream job. With features like resume parsing, bullet point generation, cover letter customization, and ATS-friendly templates, ResumeBoostAI aims to revolutionize the way resumes are created and optimized for job applications.

AITax

AITax.com is a website that appears to be related to tax services, but due to a privacy error, the connection is not secure. The site seems to have an expired security certificate, which may pose a risk to users' information security. The site prompts users to proceed at their own risk, indicating potential security vulnerabilities.