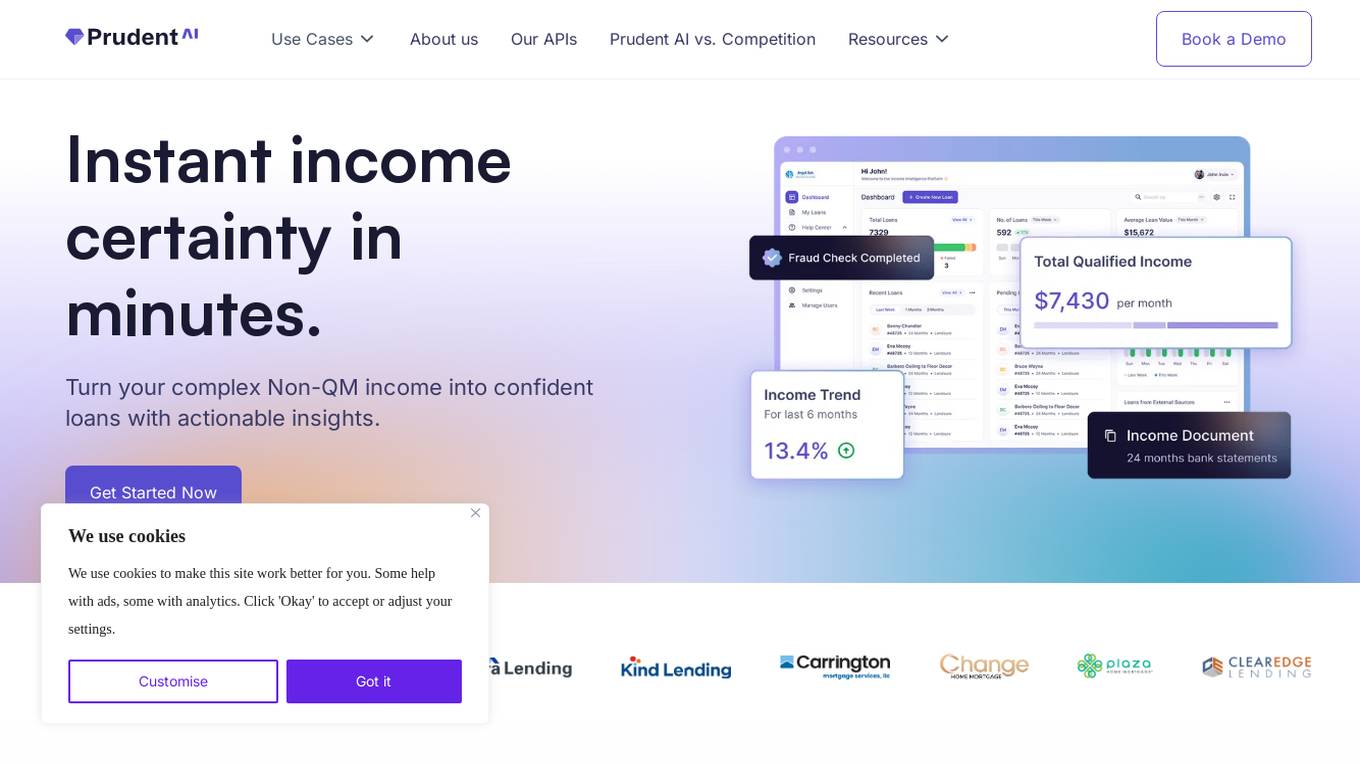

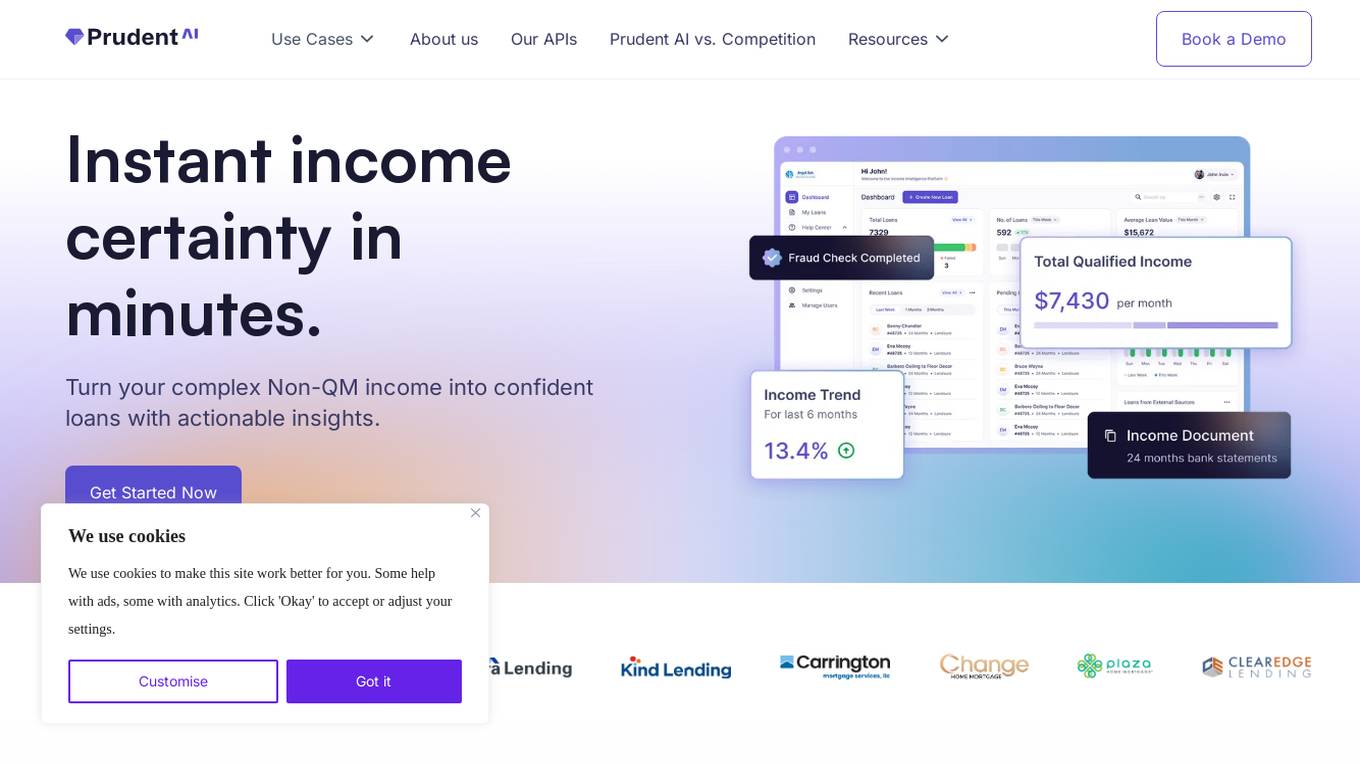

Prudent AI

Empowering Lenders with AI-driven Income Intelligence

Prudent AI is an AI-powered Income Intelligence Platform designed for lenders, offering fast data extraction, proactive fraud prevention, and in-depth insights on borrower income. The platform simplifies complex income calculations, streamlines the lending process, and enables lenders to make confident loan decisions quickly. Prudent AI is trusted by various lending institutions and has been proven to increase productivity, save time, and improve submission accuracy.

For Tasks:

Click tags to check more tools for each tasksFor Jobs:

Features

Advantages

Disadvantages

Frequently Asked Questions

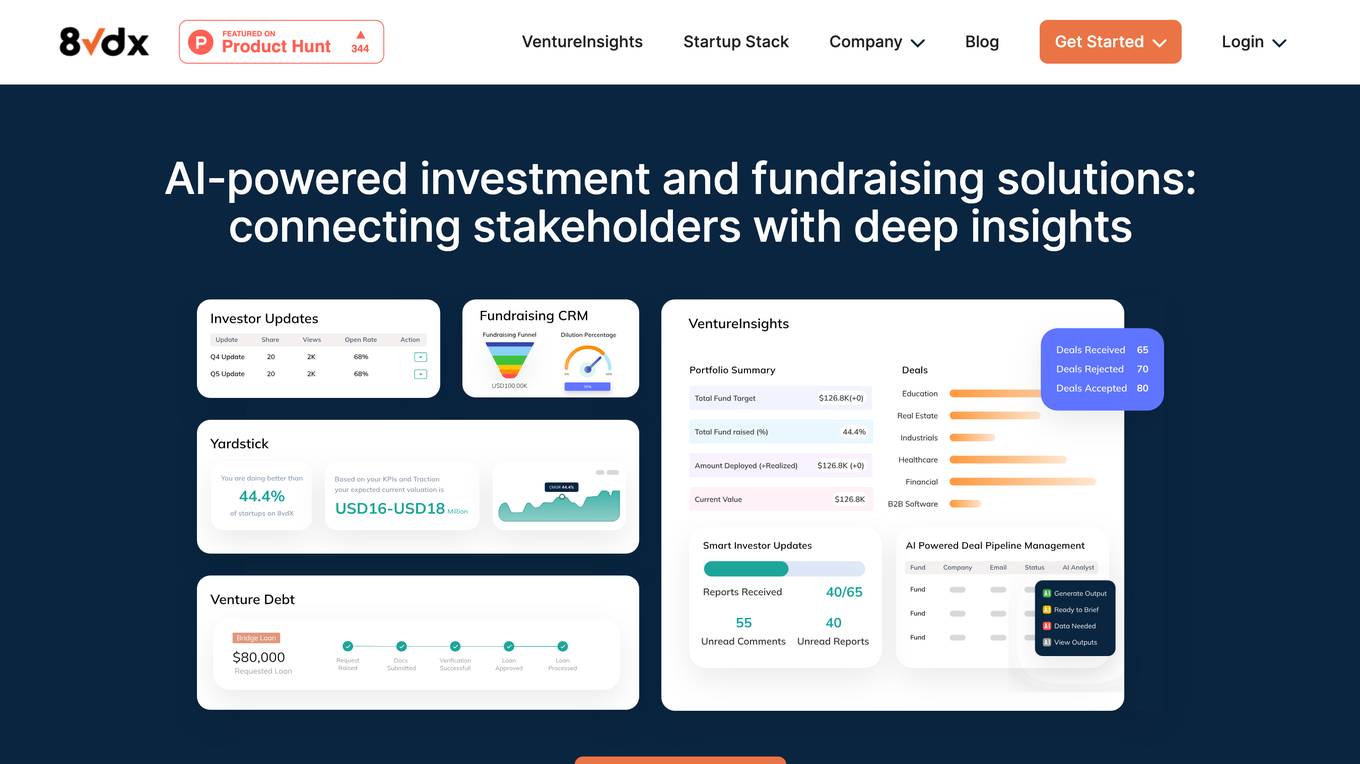

Alternative AI tools for Prudent AI

Similar sites

Prudent AI

Prudent AI is an AI-powered Income Intelligence Platform designed for lenders, offering fast data extraction, proactive fraud prevention, and in-depth insights on borrower income. The platform simplifies complex income calculations, streamlines the lending process, and enables lenders to make confident loan decisions quickly. Prudent AI is trusted by various lending institutions and has been proven to increase productivity, save time, and improve submission accuracy.

Clerkie

Clerkie is a powerful debt repayment and optimization platform that offers a full-service automation solution powered by machine learning and human expertise. It helps lenders, both big and small, to manage and optimize their loan portfolios efficiently. With features like smart payment experience, AI-driven repayment strategies, real-time reporting, and easy integration, Clerkie ensures a seamless and secure experience for lenders and borrowers alike.

Zest AI

Zest AI is an AI-driven credit underwriting software that offers a complete solution for AI-driven lending. It enables users to build custom machine learning risk models, adopt model assessment and regulatory compliance, and operate performance management and model monitoring. Zest AI helps increase approvals, manage risk, control loss, drive operational efficiency, automate credit decisioning, and improve borrower experience while ensuring fair lending practices. The software is designed to provide powerful AI for better lending outcomes by accelerating loan growth and expanding credit access through accurate risk prediction and faster credit decisions.

Zest AI

Zest AI is an AI-driven credit underwriting software that offers a complete solution for AI-driven lending. It enables users to build custom machine learning risk models, adopt model assessment and regulatory compliance, and operate performance management and model monitoring. Zest AI helps increase approvals, manage risk, control loss, drive operational efficiency, automate credit decisioning, and improve borrower experience while ensuring fair lending practices. The software is designed to provide fair and transparent credit for everyone, making lending more accessible and inclusive.

Scienaptic Systems

Scienaptic Systems is an AI-powered Credit Decisioning Platform that revolutionizes the lending industry by automating credit underwriting processes, leveraging alternate data points, and offering self-learning models for instant credit decisions. The platform helps lenders identify creditworthy borrowers, streamline customer experience, and ensure fair lending practices through explainable AI models. Scienaptic's suite of AI-enabled technologies enables lenders to say 'Yes' to more borrowers at lower risk, providing a 360-degree risk assessment before approving applications. The platform integrates seamlessly with existing lending ecosystems, ensuring disruption-free deployment and better risk predictions through a single API call.

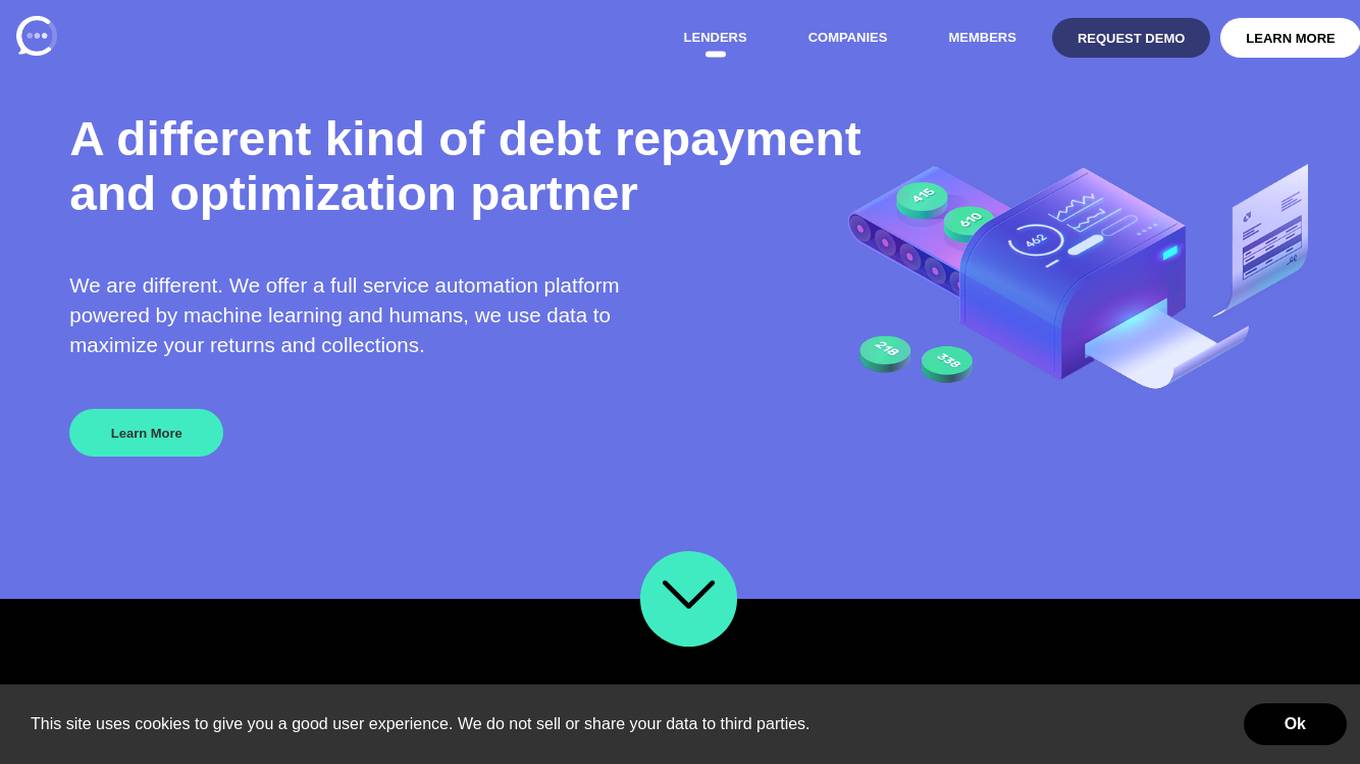

Casca

Casca is a revolutionary AI-native Loan Origination System that helps banks and non-bank lenders automate 90% of manual effort in business loan origination. By leveraging AI technology, Casca enables financial institutions to process loans 10x faster, achieve 3x higher conversion rates, and save significant time for loan officers. With features like AI Loan Assistant, digital application processing, KYB checks automation, and document analysis, Casca transforms the loan origination process into a seamless and efficient experience for both lenders and borrowers.

VantedgeAI

VantedgeAI is an AI application that offers fine-tuned AI models for credit funds, revolutionizing credit investing workflows with faster, smarter, and cost-effective solutions. The application transforms manual processes into scalable, automated workflows tailored for Private Credit and Hedge Funds. VantedgeAI is trusted by market leaders in the industry, providing unique AI-driven insights to maintain a competitive advantage and ensure data security and privacy through SOC 2 compliance. The application offers advanced AI solutions for credit investing, including automated investment memo generation, data extraction for Excel models, portfolio monitoring, loan reconciliation, smart bond screening, real-time data querying with AI bots, and more.

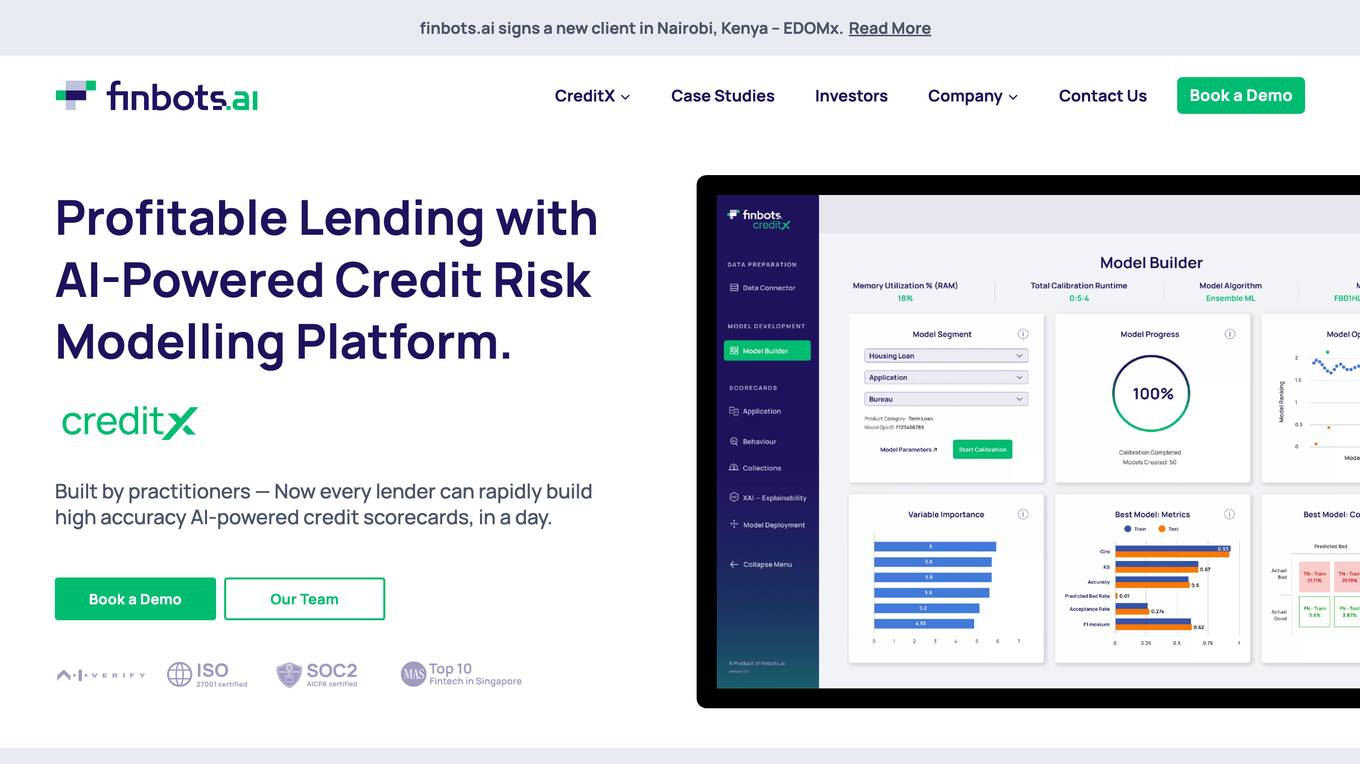

Finbots.ai

Finbots.ai is a trusted AI credit risk platform that offers AI credit scoring to boost lending profits and reduce non-performing loans. The platform provides the highest accuracy in the market, allowing users to build scorecards in a day without the need for coding. It helps in making instant decisions, increasing revenue, reducing risk, and improving operational efficiency. Finbots.ai is utilized by various financial institutions to enhance credit risk management, improve profitability, and drive down the cost of risk through AI-enabled models.

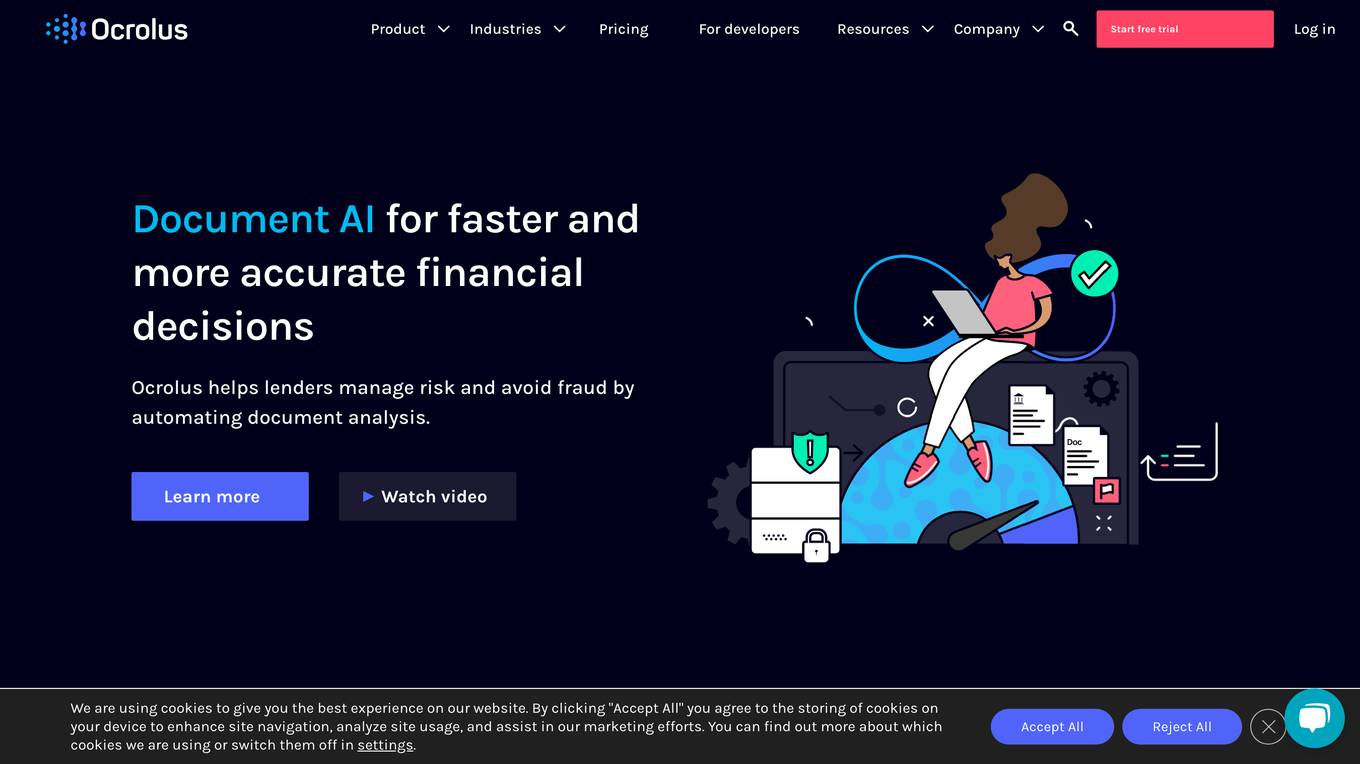

Ocrolus

Ocrolus is an intelligent document automation software that leverages AI-driven document processing automation with Human-in-the-Loop. It offers capabilities such as classifying, capturing, detecting, and analyzing documents, with use cases in cash flow, income, address, employment, and identity verification. Ocrolus caters to various industries like small business lending, mortgage, consumer finance, and multifamily housing. The platform provides resources for developers, including guides on income verification, fraud detection, and business process automation. Users can explore the API to build innovative customer experiences and make faster and more accurate financial decisions.

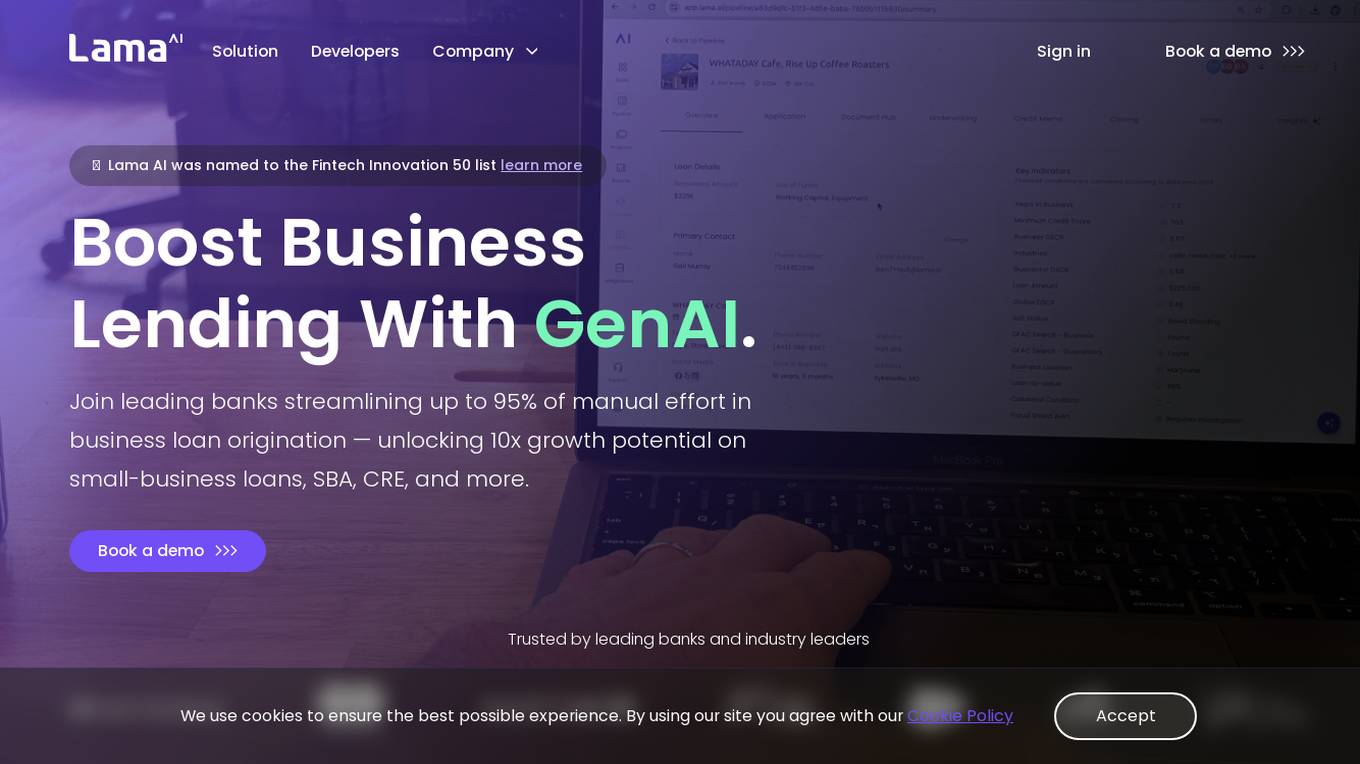

Lama AI

Lama AI is an AI-powered platform designed to revolutionize business lending processes for banks and financial institutions. It offers advanced features, rapid configurability, and exceptional support to streamline loan origination, underwriting, and decision-making. By leveraging the power of AI, Lama AI enables banks to boost business growth potential, improve profitability, and enhance customer experience through contextual onboarding, decisioning workspace, expanded credit access, and pre-qualified applications. The platform also provides white-labeled solutions, API-first integration, high configurability, built-in AI models, and access to a network of bank lenders, all while ensuring bank-grade security and compliance standards.

FairPlay

FairPlay is a Fairness-as-a-Service solution designed for financial institutions, offering AI-powered tools to assess automated decisioning models quickly. It helps in increasing fairness and profits by optimizing marketing, underwriting, and pricing strategies. The application provides features such as Fairness Optimizer, Second Look, Customer Composition, Redline Status, and Proxy Detection. FairPlay enables users to identify and overcome tradeoffs between performance and disparity, assess geographic fairness, de-bias proxies for protected classes, and tune models to reduce disparities without increasing risk. It offers advantages like increased compliance, speed, and readiness through automation, higher approval rates with no increase in risk, and rigorous Fair Lending analysis for sponsor banks and regulators. However, some disadvantages include the need for data integration, potential bias in AI algorithms, and the requirement for technical expertise to interpret results.

Convr

Convr is an AI-driven underwriting analysis platform that helps commercial P&C insurance organizations transform their underwriting operations. It provides a modularized AI underwriting and intelligent document automation workbench that enriches and expedites the commercial insurance new business and renewal submission flow with underwriting insights, business classification, and risk scoring. Convr's mission is to solve the last big problem of commercial insurance while improving profitability and increasing efficiency.

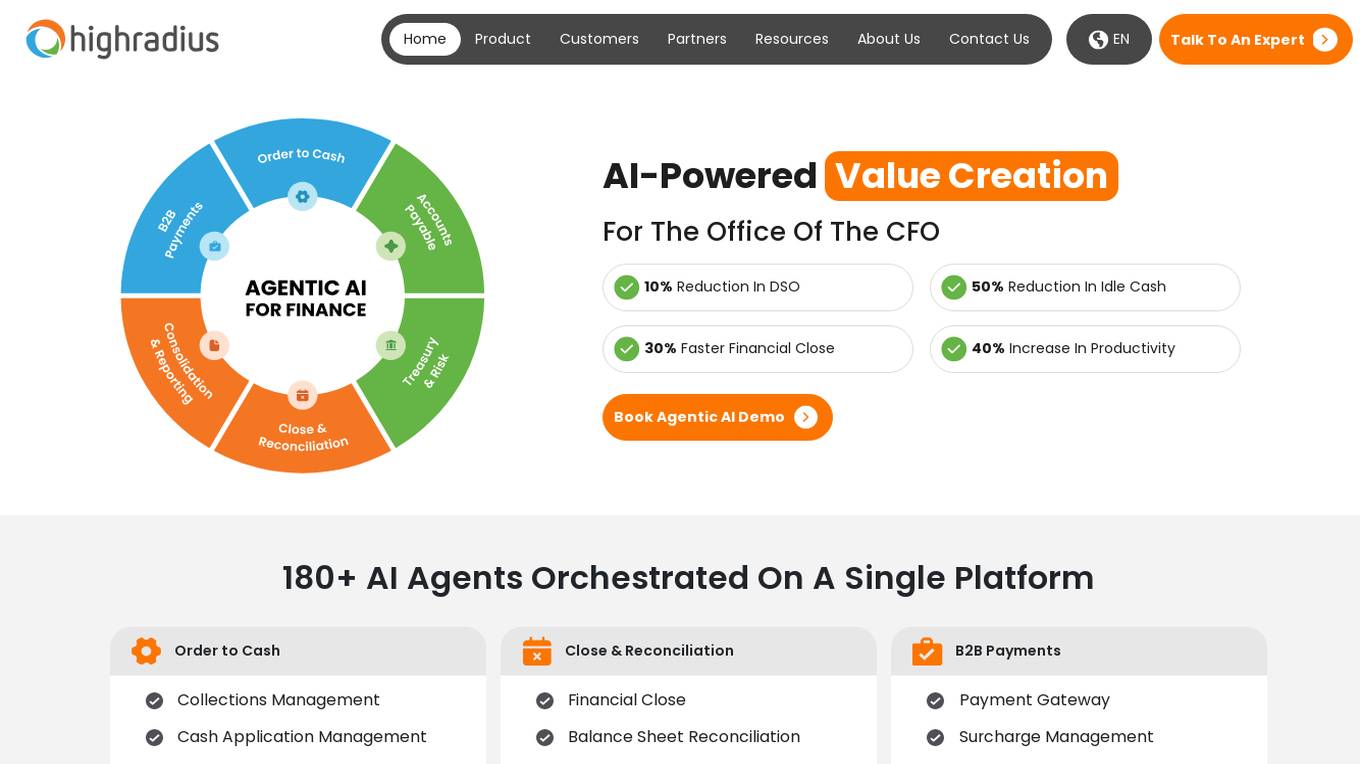

HighRadius

HighRadius is an AI-powered platform that offers Autonomous Finance solutions for Order to Cash (O2C), Treasury, and Record-to-Report (R2R) processes. It provides a single platform for various financial functions such as Accounts Payable, B2B Payments, Cash Management, and Financial Reporting. HighRadius leverages Generative AI and a No-Code AI Platform to automate data analysis and streamline financial operations for the Office of the CFO. The platform aims to enhance productivity, reduce manual work, and improve financial decision-making through advanced AI capabilities.

Convr

Convr is a modularized AI underwriting and intelligent document automation workbench that enriches and expedites the commercial insurance new business and renewal submission flow with underwriting insights, business classification and risk scoring. As a trusted technology partner and advisor with deep industry expertise, we help insurance organizations transform their underwriting operations through our AI-driven digital underwriting analysis platform.

Capchair

Capchair is a personal finance application that leverages AI technology to provide users with a seamless and efficient way to manage their finances. The app offers instant analysis, on-demand insights, and a comprehensive view of all financial data. Users can set budgets, goals, and connect their accounts to track their financial progress. Capchair prioritizes security by implementing bank-level security measures to safeguard users' financial information.

ficc.ai

ficc.ai is an AI application that revolutionizes municipal bond pricing by providing real-time, accurate AI technology for informed decisions, portfolio optimization, and compliance. The platform offers a user-friendly web app, direct API access, and integration with existing software or vendors. ficc.ai uses cutting-edge AI models developed in-house by market experts and scientists to deliver highly accurate bond prices based on trade size, ensuring valuable output for trading decisions, investment allocations, and compliance oversight.

For similar tasks

Prudent AI

Prudent AI is an AI-powered Income Intelligence Platform designed for lenders, offering fast data extraction, proactive fraud prevention, and in-depth insights on borrower income. The platform simplifies complex income calculations, streamlines the lending process, and enables lenders to make confident loan decisions quickly. Prudent AI is trusted by various lending institutions and has been proven to increase productivity, save time, and improve submission accuracy.

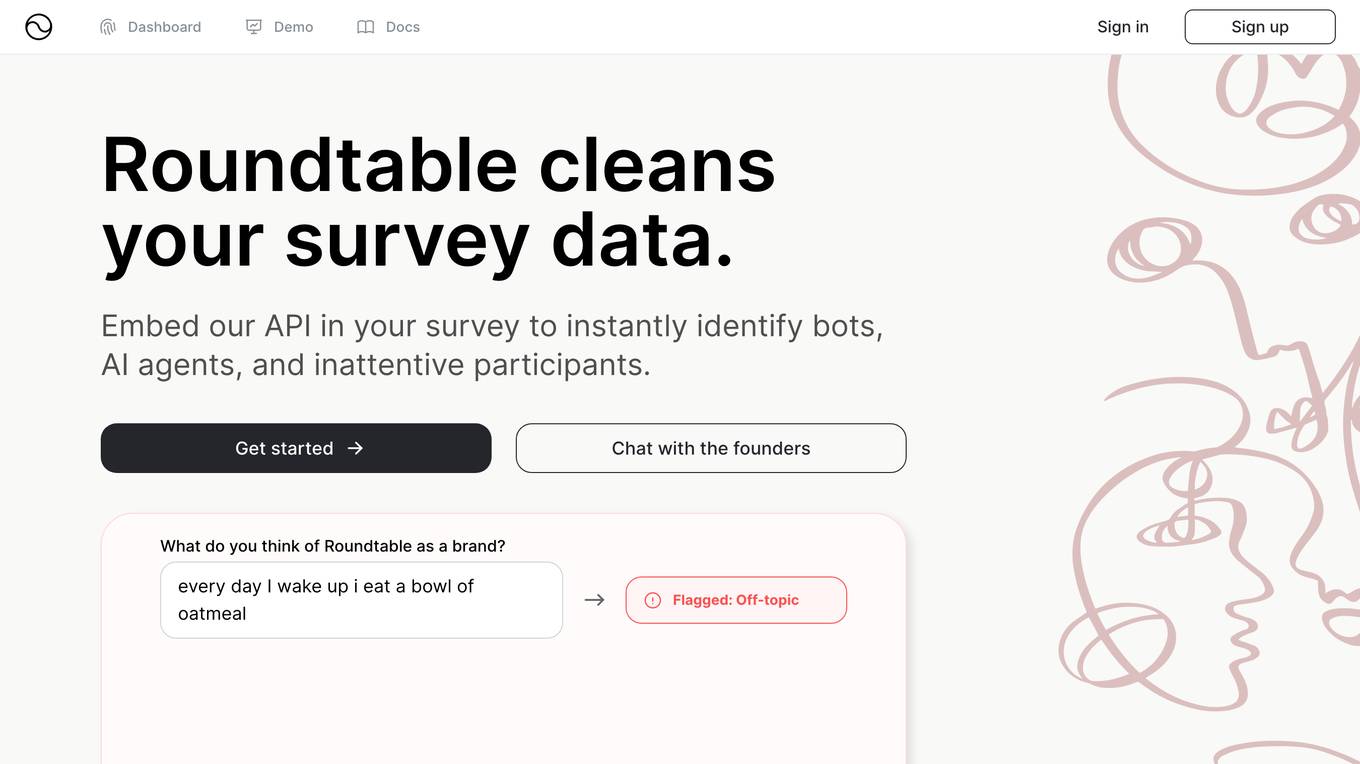

Roundtable

Roundtable is a human-in-the-loop AI application designed to improve market research data quality by detecting and stopping bots and fraud in real-time. It uses behavioral biometrics to analyze user interactions, identify AI-generated responses, and ensure data integrity. The application offers seamless security, effortless integration, privacy-preserving design, and explainable results for transparent decision-making. Trusted by global platforms, Roundtable helps businesses maintain trust in their data and make informed decisions.

Greip

Greip is an AI-powered fraud prevention tool that offers a range of services to detect and prevent fraudulent activities in payments, validate card and IBAN details, detect profanity in text, identify VPN/proxy connections, provide IP location intelligence, and more. It combines AI-driven transaction analysis with advanced technology to safeguard financial security and enhance data integrity. Greip's services are trusted by businesses worldwide for secure and reliable protection against fraud.

Fraud.net

Fraud.net is an AI-powered fraud detection and prevention platform designed for enterprises. It offers a comprehensive and customizable solution to manage and prevent financial fraud and risks. The platform utilizes AI and machine learning technologies to provide real-time monitoring, analytics, and reporting, helping businesses in various industries to combat fraud effectively. Fraud.net's solutions are trusted by CEOs, directors, technology and security officers, fraud managers, and analysts to ensure trust and beat fraud at every step of the customer lifecycle.

Shaped

Shaped is a cloud-based platform that provides APIs and tools for building and deploying ranking systems. It offers a variety of features to help developers quickly and easily create and manage ranking models, including a multi-connector SQL interface, a real-time feature store, and a library of pre-built models. Shaped is designed to be scalable, cost-efficient, and easy to use, making it a great option for businesses of all sizes.

Onfido

Onfido is a digital identity verification provider that helps businesses verify the identities of their customers online. It offers a range of products and services, including document verification, biometric verification, data verification, and fraud detection. Onfido's solutions are used by businesses in a variety of industries, including financial services, gaming, healthcare, and retail.

DataVisor

DataVisor is a modern, end-to-end fraud and risk SaaS platform powered by AI and advanced machine learning for financial institutions and large organizations. It helps businesses combat various fraud and financial crimes in real time. DataVisor's platform provides comprehensive fraud detection and prevention capabilities, including account onboarding, application fraud, ATO prevention, card fraud, check fraud, FinCrime and AML, and ACH and wire fraud detection. The platform is designed to adapt to new fraud incidents immediately with real-time data signal orchestration and end-to-end workflow automation, minimizing fraud losses and maximizing fraud detection coverage.

Gradient AI

Gradient AI is a leading provider of artificial intelligence solutions for the insurance industry. Their solutions improve loss ratios and profitability by predicting underwriting and claims risks with greater accuracy, as well as reducing quote turnaround times and claim expenses through intelligent automation.

Beyond Limits

Beyond Limits is an industrial-grade, hybrid artificial intelligence company built for the most demanding sectors. Beyond traditional AI, Beyond Limits’ unique Hybrid AI technology combines numeric techniques like machine learning with knowledge-based reasoning to produce actionable intelligence.

MindCommerce

MindCommerce is a leading provider of AI-powered solutions for the retail industry. Our mission is to help retailers unlock the power of AI to improve their customer experience, increase sales, and reduce costs. We offer a range of AI-powered solutions, including personalized recommendations, automated customer service, and fraud detection.

DataVisor

DataVisor is a modern, end-to-end fraud and risk SaaS platform powered by AI and advanced machine learning for financial institutions and large organizations. It provides a comprehensive suite of capabilities to combat a variety of fraud and financial crimes in real time. DataVisor's hyper-scalable, modern architecture allows you to leverage transaction logs, user profiles, dark web and other identity signals with real-time analytics to enrich and deliver high quality detection in less than 100-300ms. The platform is optimized to scale to support the largest enterprises with ultra-low latency. DataVisor enables early detection and adaptive response to new and evolving fraud attacks combining rules, machine learning, customizable workflows, device and behavior signals in an all-in-one platform for complete protection. Leading with an Unsupervised approach, DataVisor is the only proven, production-ready solution that can proactively stop fraud attacks before they result in financial loss.

Redflag AI

Redflag AI is a leading provider of content and brand protection solutions. Our AI-powered platform helps businesses protect their brands from fraud, abuse, and counterfeiting. We offer a range of services to help businesses protect their online presence, including brand monitoring, content moderation, and fraud detection.

Vizly

Vizly is an AI-powered data analysis tool that empowers users to make the most of their data. It allows users to chat with their data, visualize insights, and perform complex analysis. Vizly supports various file formats like CSV, Excel, and JSON, making it versatile for different data sources. The tool is free to use for up to 10 messages per month and offers a student discount of 50%. Vizly is suitable for individuals, students, academics, and organizations looking to gain actionable insights from their data.

Fusemachines

Fusemachines is an AI company that offers AI products and solutions to democratize AI. Their AI Studio platform provides various AI engines for different use cases, such as GenAI Engines for predictive analytics and Fraud Detection, Forecast AI for demand forecasting, and more. The company aims to empower enterprises with tailored AI solutions and seamless integration of tools to enhance value across specific industries like Retail, Healthcare, Technology, Banking & Insurance, and Media & Entertainment.

Brighterion AI

Brighterion AI, a Mastercard company, offers advanced AI solutions for financial institutions, merchants, and healthcare providers. With over 20 years of experience, Brighterion has revolutionized AI by providing market-ready models that enhance customer experience, reduce financial fraud, and mitigate risks. Their solutions are enriched with Mastercard's global network intelligence, ensuring scalability and powerful personalization. Brighterion's AI applications cater to acquirers, PSPs, issuers, and healthcare providers, offering custom AI solutions for transaction fraud monitoring, merchant monitoring, AML & compliance, and healthcare fraud detection. The company has received several prestigious awards for its excellence in AI and financial security.

FacePlugin

FacePlugin is an ID verification and Biometric Authentication solution provider that utilizes advanced face recognition, face liveness detection, and ID document recognition technologies. The platform offers solutions for eKYC and ID verification needs, with features such as instant face recognition, enhanced face anti-spoofing technology, and robust identity document verification. FacePlugin aims to secure and streamline the authentication process for various industries and use cases, providing proprietary solutions, top-notch quality, and competitive pricing.

Unit21

Unit21 is a customizable no-code platform designed for risk and compliance operations. It empowers organizations to combat financial crime by providing end-to-end lifecycle risk analysis, fraud prevention, case management, and real-time monitoring solutions. The platform offers features such as AI Copilot for alert prioritization, Ask Your Data for data analysis, Watchlist & Sanctions for ongoing screening, and more. Unit21 focuses on fraud prevention and AML compliance, simplifying operations and accelerating investigations to respond to financial threats effectively and efficiently.

Quantifind

Quantifind is an AI-powered financial crimes automation platform that specializes in Anti-Money Laundering (AML) and Know Your Customer (KYC) solutions. It offers end-to-end automation impact, best-in-class accuracy, and powerful APIs and applications for risk screening, investigations, and compliance in the financial services and public sector industries. Quantifind's Graphyte platform leverages AI and external data to streamline AML-KYC processes, providing comprehensive data coverage, dynamic risk typologies, and seamless integrations with case management systems.

VisionLabs

VisionLabs is a leading provider of facial recognition technology that enhances digital identity experiences. Their Artificial Intelligence and Machine Learning technology, based on neural network algorithms, ensures a safer and more secure world, enabling seamless navigation in the digital realm. With applications in over 60 countries across various industries, VisionLabs aims to facilitate better and safer interactions through facial recognition technology.

hCaptcha Enterprise

hCaptcha Enterprise is a comprehensive AI-powered security platform designed to detect and deter human and automated threats, including bot detection, fraud protection, and account defense. It offers highly accurate bot detection, fraud protection without false positives, and account takeover detection. The platform also provides privacy-preserving abuse detection with zero personally identifiable information (PII) required. hCaptcha Enterprise is trusted by category leaders in various industries worldwide, offering universal support, comprehensive security, and compliance with global privacy standards like GDPR, CCPA, and HIPAA.

CARCO

CARCO is an advanced Mobile AI Fraud Prevention application designed to protect insurance carriers and consumers by identifying and preventing risk events and fraudulent activities. The application streamlines the inspection process through integrated AI and fraud alert validation technology, providing a back-office solution that is easily integrated into mobile platforms, cost-effective, and fraud-detecting. CARCO also offers NMVTIS, a premier system in the U.S. that requires reporting of vehicle title data. With over 50 million transactions completed to date, CARCO has a proven track record in fraud prevention and risk mitigation for the insurance industry.

QeDatalab

QeDatalab is a leading data science consulting and AI company offering a wide range of services such as software consulting, generative AI consulting, artificial intelligence services, cloud enablement & automation, AI-driven mobile app development, IoT & IIoT data consulting, digital services, AI product development, MLOps consulting, and more. The company specializes in providing AI-powered solutions for industries like healthcare, manufacturing, retail, and education, helping businesses leverage data for informed strategic decision-making and accurate predictions. QeDatalab's team of experts offers end-to-end services, customized solutions, and a trusted partnership to ensure client success.

Intuition Machines

Intuition Machines is a leading provider of Privacy-Preserving AI/ML platforms and research solutions. They offer products and services that cater to category leaders worldwide, focusing on AI/ML research, security, and risk analysis. Their innovative solutions help enterprises prepare for the future by leveraging AI for a wide range of problems. With a strong emphasis on privacy and security, Intuition Machines is at the forefront of developing cutting-edge AI technologies.

Subex

Subex is a Telecom AI company that enables Connected Experiences for CFOs, CTOs, and CMOs. With over 25 years of experience, Subex helps Communications Service Providers (CSPs) worldwide maximize revenues and profitability by leveraging AI to create connected experiences in business ecosystems. The company offers AI solutions, including Business Assurance, Fraud and Security management, Network Analytics, Enterprise Cybersecurity, Enterprise Billing, and more. Subex is trusted by over 75% of the world's top 50 telcos and provides a range of industry-leading solutions to enhance operational efficiency and effectiveness.

For similar jobs

Casca

Casca is a revolutionary AI-native Loan Origination System that helps banks and non-bank lenders automate 90% of manual effort in business loan origination. By leveraging AI technology, Casca enables financial institutions to process loans 10x faster, achieve 3x higher conversion rates, and save significant time for loan officers. With features like AI Loan Assistant, digital application processing, KYB checks automation, and document analysis, Casca transforms the loan origination process into a seamless and efficient experience for both lenders and borrowers.

Zest AI

Zest AI is an AI-driven credit underwriting software that offers a complete solution for AI-driven lending. It enables users to build custom machine learning risk models, adopt model assessment and regulatory compliance, and operate performance management and model monitoring. Zest AI helps increase approvals, manage risk, control loss, drive operational efficiency, automate credit decisioning, and improve borrower experience while ensuring fair lending practices. The software is designed to provide fair and transparent credit for everyone, making lending more accessible and inclusive.

Scienaptic Systems

Scienaptic Systems is an AI-powered Credit Decisioning Platform that revolutionizes the lending industry by automating credit underwriting processes, leveraging alternate data points, and offering self-learning models for instant credit decisions. The platform helps lenders identify creditworthy borrowers, streamline customer experience, and ensure fair lending practices through explainable AI models. Scienaptic's suite of AI-enabled technologies enables lenders to say 'Yes' to more borrowers at lower risk, providing a 360-degree risk assessment before approving applications. The platform integrates seamlessly with existing lending ecosystems, ensuring disruption-free deployment and better risk predictions through a single API call.

Underwrite.ai

Underwrite.ai is a platform that leverages advances in artificial intelligence and machine learning to provide lenders with nonlinear, dynamic models of credit risk. By analyzing thousands of data points from credit bureau sources, the application accurately models credit risk for consumers and small businesses, outperforming traditional approaches. Underwrite.ai offers a unique underwriting methodology that focuses on outcomes such as profitability and customer lifetime value, allowing organizations to enhance their lending performance without the need for capital investment or lengthy build times. The platform's models are continuously learning and adapting to market changes in real-time, providing explainable decisions in milliseconds.

Zest AI

Zest AI is an AI-driven credit underwriting software that offers a complete solution for AI-driven lending. It enables users to build custom machine learning risk models, adopt model assessment and regulatory compliance, and operate performance management and model monitoring. Zest AI helps increase approvals, manage risk, control loss, drive operational efficiency, automate credit decisioning, and improve borrower experience while ensuring fair lending practices. The software is designed to provide powerful AI for better lending outcomes by accelerating loan growth and expanding credit access through accurate risk prediction and faster credit decisions.

FinFloh

FinFloh is an AI-powered Accounts Receivable Software that automates the accounts receivable process effortlessly with features like credit decisioning, collections, cash application, invoice verification, and dispute resolution. It enhances collections efficiency, reduces decision-making time, and improves cash flows for B2B finance teams worldwide. The software integrates with ERP/CRM systems, offers predictive analytics, and AI-driven credit scoring to optimize accounts receivable management. FinFloh ensures secure data handling and seamless communication between finance, sales, and customer support teams, ultimately leading to increased cash flow and reduced DSO.

Prudent AI

Prudent AI is an AI-powered Income Intelligence Platform designed for lenders, offering fast data extraction, proactive fraud prevention, and in-depth insights on borrower income. The platform simplifies complex income calculations, streamlines the lending process, and enables lenders to make confident loan decisions quickly. Prudent AI is trusted by various lending institutions and has been proven to increase productivity, save time, and improve submission accuracy.

Formula Wizard

Formula Wizard is an AI-powered software designed to assist users in writing Excel, Airtable, and Notion formulas effortlessly. By leveraging artificial intelligence, the application automates the process of formula creation, allowing users to save time and focus on more critical tasks. With features like automating tedious tasks, unlocking insights from data, and customizing templates, Formula Wizard streamlines the formula-writing process for various spreadsheet applications.

Eilla

Eilla is an AI-native M&A advisory platform designed for small and medium businesses (SMBs) looking to sell their companies. By combining top-tier M&A advisors with advanced AI algorithms, Eilla aims to deliver faster and higher-value outcomes for its clients. The platform automates manual tasks, surfaces hidden buyers, drives valuation, and creates competitive tension to push offers higher. Eilla provides expert advisory services, market intelligence, and a frictionless preparation process to make the selling experience efficient and effective. With decades of expertise backed by technology, Eilla has executed transactions worth over $100 billion and is trusted by numerous funds and banks.

StockGPT

StockGPT is an AI-powered financial research assistant that provides knowledge of earnings releases, financial reports, and fundamental information for S&P 500 and Nasdaq companies. It offers features like AI search, customizable filters, up-to-date data, and industry research to help users analyze companies and markets more efficiently.

ChatBTC

ChatBTC is an AI tool designed to help users learn about bitcoin technology and history. It provides AI responses to questions related to bitcoin technology, such as approaches to mitigating fee sniping, the benefits of SegWit, and the differences between PTLCs and HTLCs. The tool features AI bots representing various bitcoin experts who provide insights and explanations on different aspects of bitcoin technology. ChatBTC aims to educate users through AI-generated content sourced from reputable sources like the bitcoin-dev mailing list and Bitcoin StackExchange.

Questflow

Questflow is an AI agent economy platform that enables users to automate tasks, turn user feedback into action, and build AI agent teams for various workflows. It offers a developer platform to design and deploy AI swarms, empowering teams and innovators worldwide. Questflow aims to create a multi-agent economy on-chain, connecting AI agents to all apps and allowing users to customize AI agent-powered applications. With features like autonomous task completion, on-chain incentives for builders, and tokenization of AI agents, Questflow provides a composable solution for orchestrating AI agents to work together seamlessly.

Susterra

Susterra is an advanced analytics platform for Public Finance stakeholders, aiming to catalyze urban development by providing powerful insights. The platform integrates leading practices from academia, utilizes public data for creating relevant insights, and leverages technology innovations like ML and AI. Susterra offers solutions such as TerraScore, TerraVision, TerraView, and Impact IQ, enabling evaluation of public benefit programs in various sectors. The platform also provides data visualization tools and is powered by Google Cloud, offering state-of-the-art analytics for smart decision-making in the Municipal Bond Market and Smart Cities development.

Receiptor AI

Receiptor AI is an automated bookkeeping tool that leverages AI technology to streamline the process of managing receipts and expenses. The application finds and extracts data from receipts past and present, auto-categorizes expenses, and syncs with accounting software like Xero and QuickBooks. With features like smart categorization, audit-ready reports, retroactive extraction, and real-time processing, Receiptor AI aims to save time, money, and reduce stress for businesses of all sizes. The tool is designed to work with receipts in any language, making it ideal for international businesses. Receiptor AI offers a 14-day free trial and has processed millions of emails, receipts, and invoices, freeing up hours of manual work for users.

ResumeBoostAI

ResumeBoostAI is a free AI resume builder that helps job seekers create professional resumes and cover letters quickly and efficiently. With AI-powered features like resume summary generator, bullet point generator, cover letter generator, and ATS-friendly templates, users can save time and land their dream jobs. The platform offers privacy-first services, PDF format downloads, resume parsing, and compatibility with Applicant Tracking Systems (ATS). ResumeBoostAI is trusted by top professionals and loved by over 22,000 job seekers for its intuitive interface and time-saving capabilities.

AiTax

AiTax is an AI-based tax-preparation software that leverages Artificial Intelligence and Machine Learning to help individuals and entrepreneurs prepare and file their taxes accurately and efficiently. The software eliminates the risk of human error, ensures the lowest possible tax amount, prioritizes data security, and offers free audit and legal defense support. AiTax aims to simplify the tax-filing process, maximize potential refunds, and minimize the chances of an audit, providing users with a reliable and secure solution for their tax needs.

Chatsheet

Chatsheet is an AI-powered spreadsheet platform that leverages artificial intelligence to enhance data analysis and decision-making processes. It offers advanced features such as predictive analytics, natural language processing, and automated insights generation. With Chatsheet, users can easily manipulate and visualize data, collaborate in real-time, and derive valuable insights from complex datasets. The platform is designed to streamline workflows, improve productivity, and empower users with actionable intelligence.

Bandofacile

Bandofacile is an AI-powered platform designed to simplify the process of accessing and applying for funding opportunities in the financial sector. It offers services for companies and consultants to streamline the process of participating in funding calls by leveraging artificial intelligence technology. Users can create an account, search for available funding opportunities, respond to questions, and receive completed documentation ready for submission. Bandofacile aims to provide a stress-free approach to engaging with funding opportunities, making it easier for users to navigate the complexities of the application process.

Dispute AI™

Dispute AI™ is an AI-powered DIY credit repair solution that leverages cutting-edge artificial intelligence to provide personalized strategies for boosting credit scores. The platform offers actionable insights, data-driven recommendations, and a fast, affordable, and flexible credit repair process. With over 20 years of expertise in credit repair, Dispute AI™ aims to revolutionize the way individuals take control of their credit by providing innovative tools that simplify and streamline the credit repair process.

Pin-Up Casino

Pin-Up is an online casino platform in Guatemala that offers a wide range of games including slots, table games, live casino, and special games. With high-quality graphics, smooth gameplay, and generous payouts, Pin-Up provides a thrilling and rewarding gaming experience. The platform is licensed and regulated in Guatemala, ensuring secure payment processing and a mobile-friendly design. Players can enjoy various promotions and bonuses, participate in VIP programs, and access customer support via live chat and email. Pin-Up collaborates with top game providers like NetEnt, Microgaming, Evolution Gaming, and Play'n GO to deliver the best gaming experience. The platform promotes responsible gaming and provides tools for managing gaming habits. Join Pin-Up today to experience the excitement of online gaming and claim your welcome bonus.

ChatCSV

ChatCSV is your personal data analyst that allows you to interact with your spreadsheets in a conversational manner. Simply upload a CSV file and start asking questions to get insights through visualizations. It is designed to assist users across various industries such as retail, finance, banking, marketing, and more, making data analysis more accessible and intuitive.

Stocknews AI

Stocknews AI is an AI-powered platform that curates and provides the best stock news from over 100 sources. It leverages artificial intelligence to analyze and pick the most relevant and impactful stock news for investors. The platform aims to help users stay informed about the latest market trends, investment opportunities, and stock movements. Stocknews AI offers a comprehensive and efficient way to access valuable stock-related information, making it a valuable tool for both novice and experienced investors.

Novel

Novel is a platform designed for professional profiles and career management. It offers users the ability to create and manage their professional profiles, connect with other professionals, and explore career opportunities. The platform aims to provide a comprehensive solution for individuals looking to enhance their professional presence and advance their careers.

Taxly

Taxly is a user-friendly online platform designed to automate the process of UAE corporate tax filing for small and medium enterprises (SMEs), free zone entities, and accountants. The application simplifies tax compliance by allowing users to upload their financial data and receive FTA-ready tax returns. Taxly provides real-time tax insights, instant tax projections, and built-in compliance assistance to help users navigate the complexities of UAE tax regulations. With a focus on simplicity and efficiency, Taxly aims to streamline the tax filing process for businesses in the UAE.