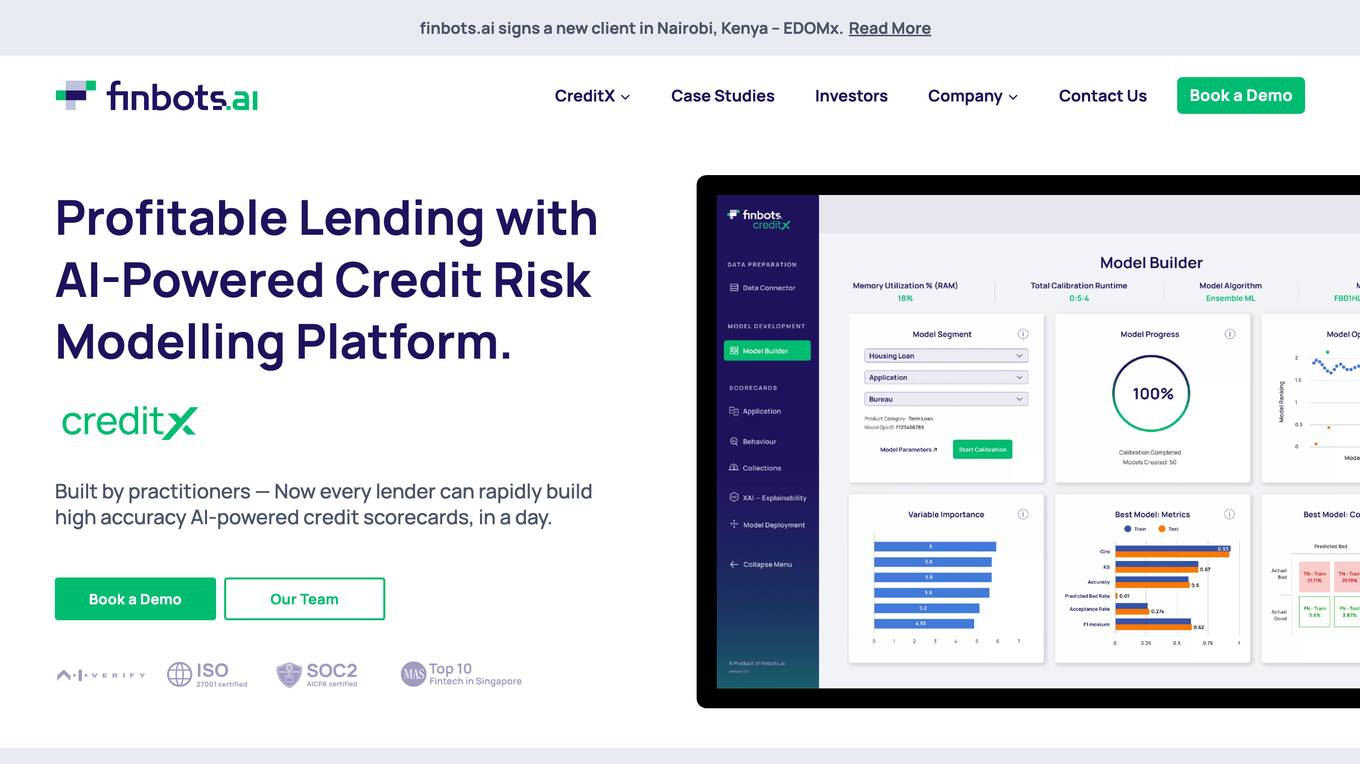

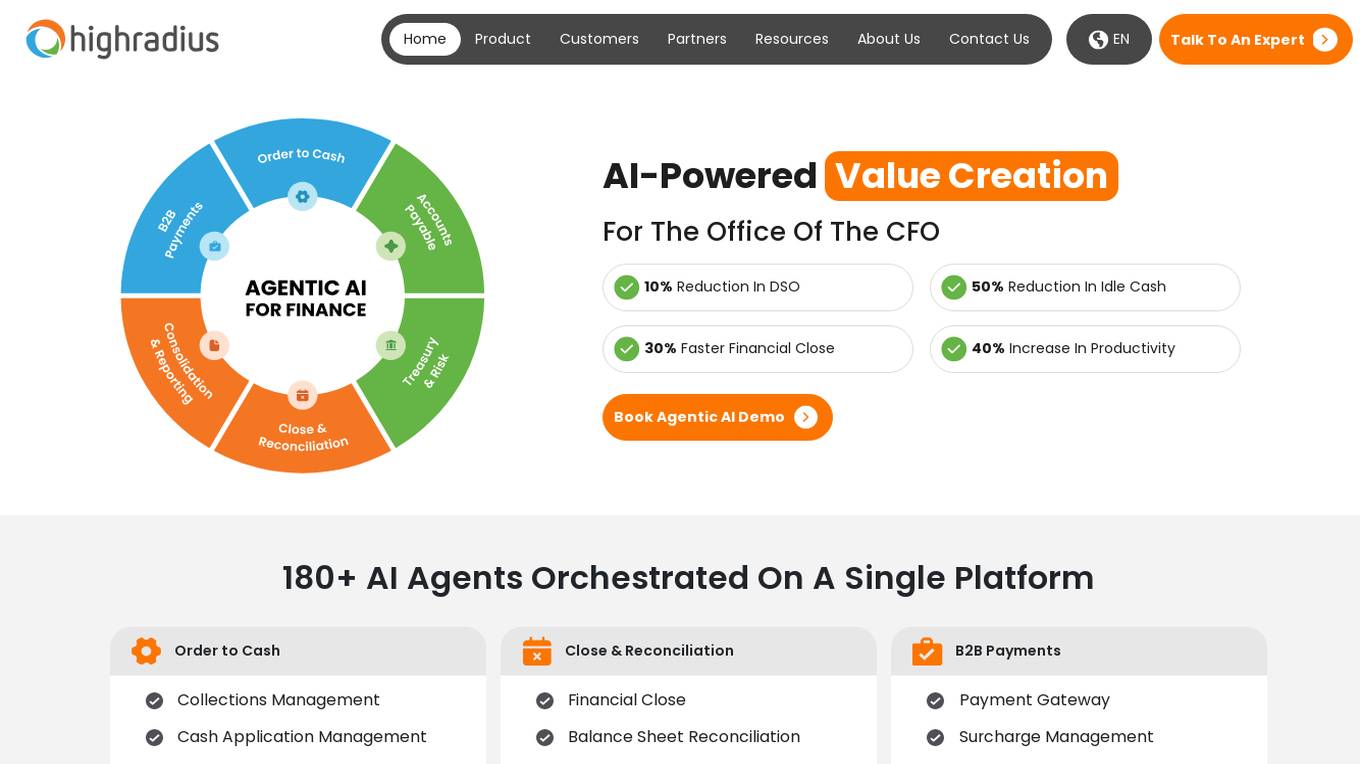

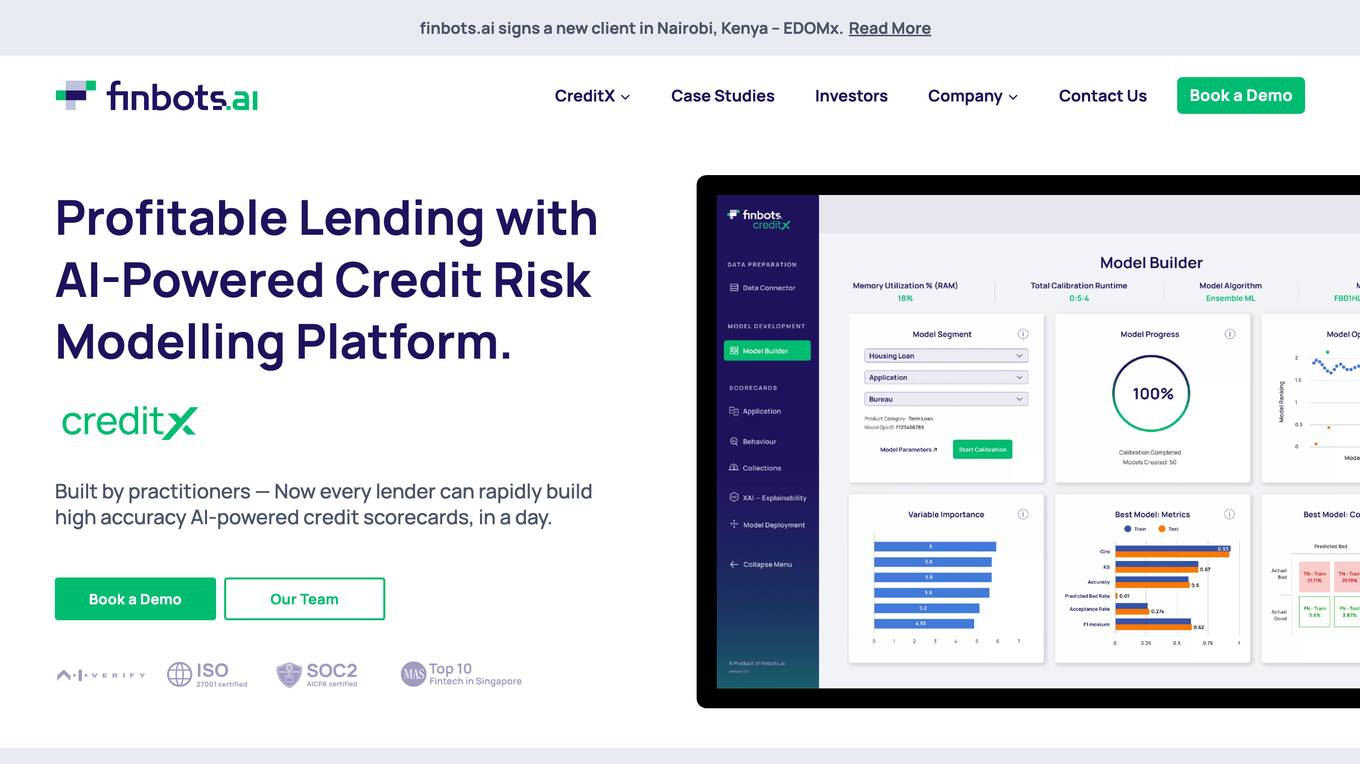

Finbots.ai

Boosting lending profits with AI credit scoring

Finbots.ai is a trusted AI credit risk platform that offers AI credit scoring to boost lending profits and reduce non-performing loans. The platform provides the highest accuracy in the market, allowing users to build scorecards in a day without the need for coding. It helps in making instant decisions, increasing revenue, reducing risk, and improving operational efficiency. Finbots.ai is utilized by various financial institutions to enhance credit risk management, improve profitability, and drive down the cost of risk through AI-enabled models.

For Tasks:

Click tags to check more tools for each tasksFor Jobs:

Features

Advantages

Disadvantages

Frequently Asked Questions

Alternative AI tools for Finbots.ai

Similar sites

Finbots.ai

Finbots.ai is a trusted AI credit risk platform that offers AI credit scoring to boost lending profits and reduce non-performing loans. The platform provides the highest accuracy in the market, allowing users to build scorecards in a day without the need for coding. It helps in making instant decisions, increasing revenue, reducing risk, and improving operational efficiency. Finbots.ai is utilized by various financial institutions to enhance credit risk management, improve profitability, and drive down the cost of risk through AI-enabled models.

Zest AI

Zest AI is an AI-driven credit underwriting software that offers a complete solution for AI-driven lending. It enables users to build custom machine learning risk models, adopt model assessment and regulatory compliance, and operate performance management and model monitoring. Zest AI helps increase approvals, manage risk, control loss, drive operational efficiency, automate credit decisioning, and improve borrower experience while ensuring fair lending practices. The software is designed to provide powerful AI for better lending outcomes by accelerating loan growth and expanding credit access through accurate risk prediction and faster credit decisions.

Zest AI

Zest AI is an AI-driven credit underwriting software that offers a complete solution for AI-driven lending. It enables users to build custom machine learning risk models, adopt model assessment and regulatory compliance, and operate performance management and model monitoring. Zest AI helps increase approvals, manage risk, control loss, drive operational efficiency, automate credit decisioning, and improve borrower experience while ensuring fair lending practices. The software is designed to provide fair and transparent credit for everyone, making lending more accessible and inclusive.

Scienaptic Systems

Scienaptic Systems is an AI-powered Credit Decisioning Platform that revolutionizes the lending industry by automating credit underwriting processes, leveraging alternate data points, and offering self-learning models for instant credit decisions. The platform helps lenders identify creditworthy borrowers, streamline customer experience, and ensure fair lending practices through explainable AI models. Scienaptic's suite of AI-enabled technologies enables lenders to say 'Yes' to more borrowers at lower risk, providing a 360-degree risk assessment before approving applications. The platform integrates seamlessly with existing lending ecosystems, ensuring disruption-free deployment and better risk predictions through a single API call.

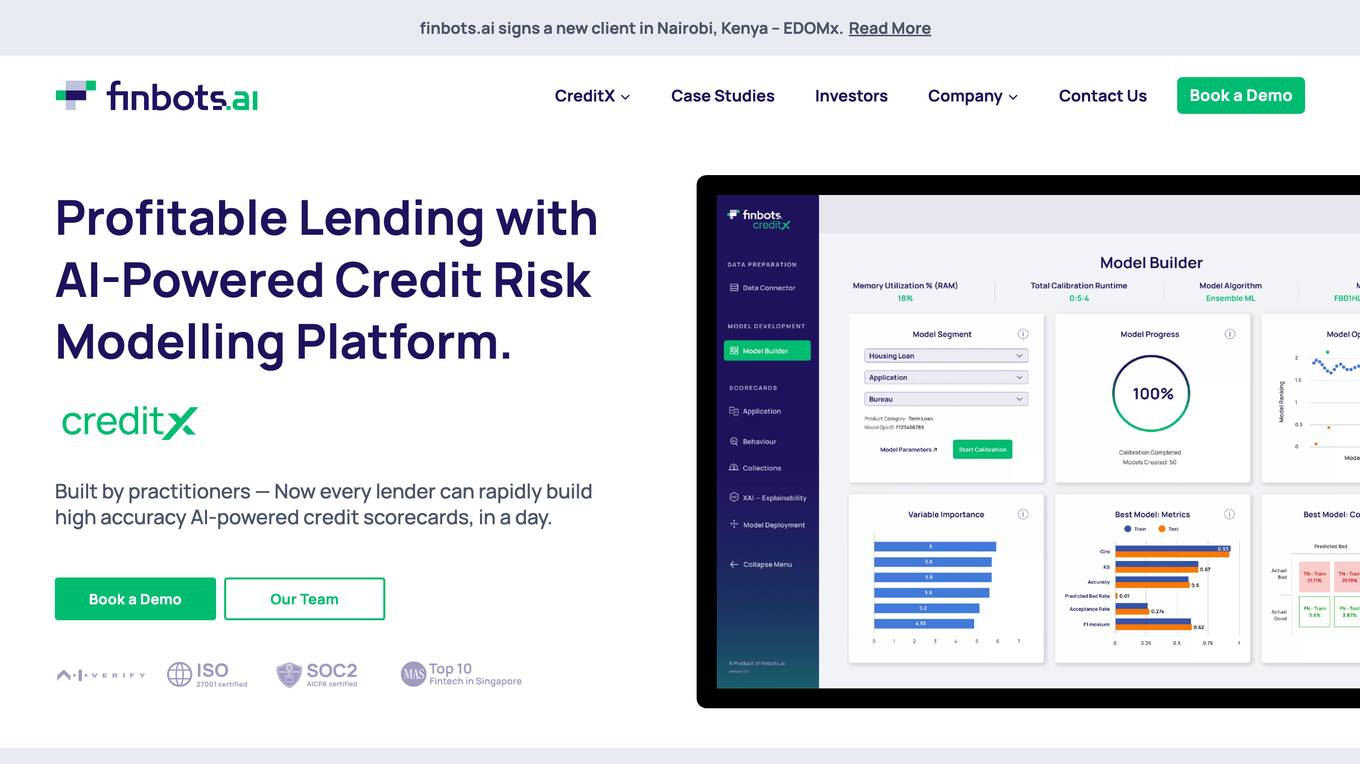

FairPlay

FairPlay is a Fairness-as-a-Service solution designed for financial institutions, offering AI-powered tools to assess automated decisioning models quickly. It helps in increasing fairness and profits by optimizing marketing, underwriting, and pricing strategies. The application provides features such as Fairness Optimizer, Second Look, Customer Composition, Redline Status, and Proxy Detection. FairPlay enables users to identify and overcome tradeoffs between performance and disparity, assess geographic fairness, de-bias proxies for protected classes, and tune models to reduce disparities without increasing risk. It offers advantages like increased compliance, speed, and readiness through automation, higher approval rates with no increase in risk, and rigorous Fair Lending analysis for sponsor banks and regulators. However, some disadvantages include the need for data integration, potential bias in AI algorithms, and the requirement for technical expertise to interpret results.

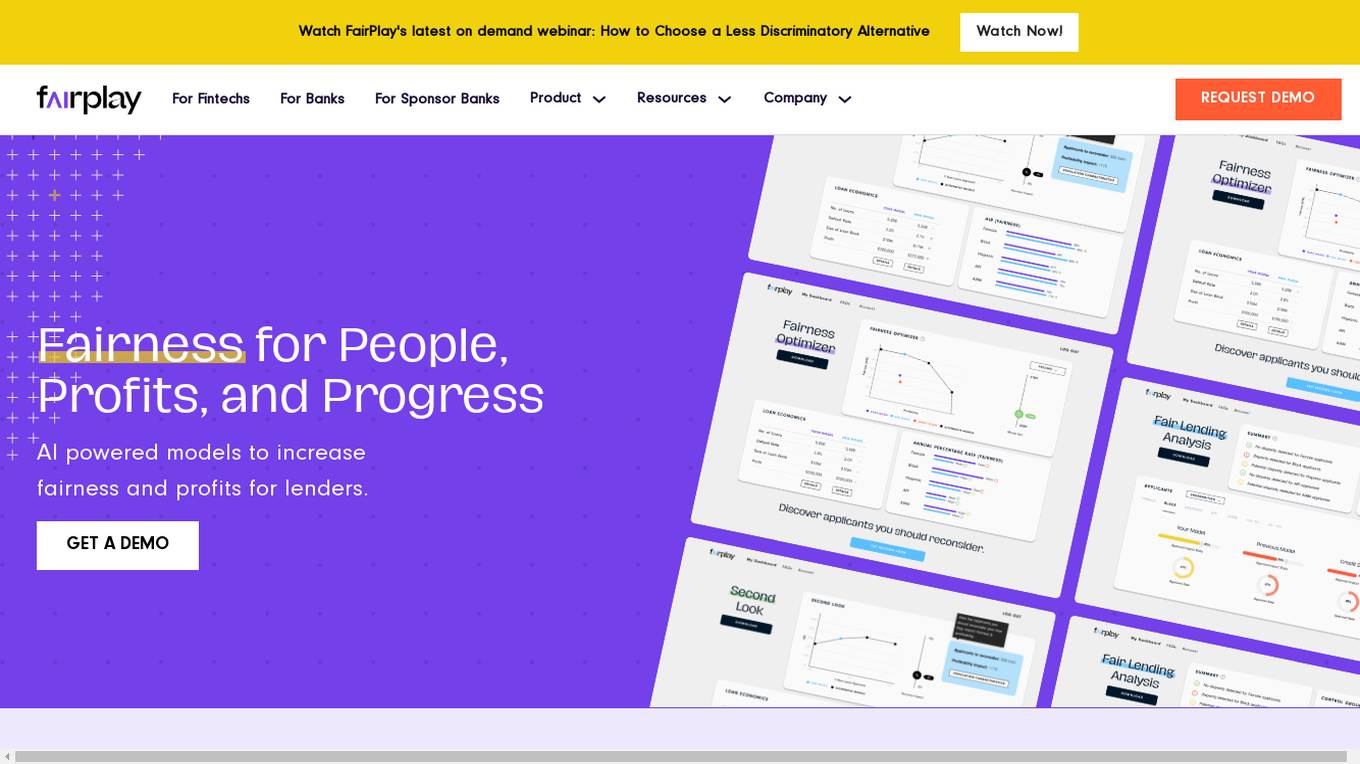

Prudent AI

Prudent AI is an AI-powered Income Intelligence Platform designed for lenders, offering fast data extraction, proactive fraud prevention, and in-depth insights on borrower income. The platform simplifies complex income calculations, streamlines the lending process, and enables lenders to make confident loan decisions quickly. Prudent AI is trusted by various lending institutions and has been proven to increase productivity, save time, and improve submission accuracy.

Dispute AI™

Dispute AI™ is an AI-powered DIY credit repair solution that leverages cutting-edge artificial intelligence to provide personalized strategies for boosting credit scores. The platform offers actionable insights, data-driven recommendations, and a fast, affordable, and flexible credit repair process. With over 20 years of expertise in credit repair, Dispute AI™ aims to revolutionize the way individuals take control of their credit by providing innovative tools that simplify and streamline the credit repair process.

Lama AI

Lama AI is an AI-powered platform designed to revolutionize business lending processes for banks and financial institutions. It offers advanced features, rapid configurability, and exceptional support to streamline loan origination, underwriting, and decision-making. By leveraging the power of AI, Lama AI enables banks to boost business growth potential, improve profitability, and enhance customer experience through contextual onboarding, decisioning workspace, expanded credit access, and pre-qualified applications. The platform also provides white-labeled solutions, API-first integration, high configurability, built-in AI models, and access to a network of bank lenders, all while ensuring bank-grade security and compliance standards.

Forescribe AI

Forescribe AI is a spend management platform that uses artificial intelligence (AI) to help businesses streamline their spending and fuel growth. The platform provides real-time visibility into spending, automates invoice processing, and identifies opportunities for cost savings. Forescribe AI is designed to help businesses of all sizes improve their financial performance.

AI Copilot for bank ALCOs

AI Copilot for bank ALCOs is an AI application designed to empower Asset-Liability Committees (ALCOs) in banks to test funding and liquidity strategies in a risk-free environment, ensuring optimal balance sheet decisions before real-world implementation. The application provides proactive intelligence for day-to-day decisions, allowing users to test multiple strategies, compare funding options, and make forward-looking decisions. It offers features such as stakeholder feedback, optimal funding mix, forward-looking decisions, comparison of funding strategies, domain-specific models, maximizing returns, staying compliant, and built-in security measures. MaverickFi, the AI Copilot, is deployed on Microsoft Azure and offers deployment options based on user preferences.

VantedgeAI

VantedgeAI is an AI application that offers fine-tuned AI models for credit funds, revolutionizing credit investing workflows with faster, smarter, and cost-effective solutions. The application transforms manual processes into scalable, automated workflows tailored for Private Credit and Hedge Funds. VantedgeAI is trusted by market leaders in the industry, providing unique AI-driven insights to maintain a competitive advantage and ensure data security and privacy through SOC 2 compliance. The application offers advanced AI solutions for credit investing, including automated investment memo generation, data extraction for Excel models, portfolio monitoring, loan reconciliation, smart bond screening, real-time data querying with AI bots, and more.

VUW.ai

VUW.ai is a unique virtual underwriting platform that offers end-to-end digital trading solutions for specialty insurance lines. The platform leverages machine learning to improve risk selection, reduce volatility, increase consistency, and enhance profitability and underwriting controls while lowering operating costs. VUW.ai aims to revolutionize the insurance market by providing a cost-effective and tech-based underwriting solution that caters to brokers and capacity providers. The platform also offers services in Property, Casualty, and Marine Cargo business, with plans to expand into other classes like Livestock, Fine Art, and Political Violence.

FlowX.AI

FlowX.AI is a Multi-Agent AI Platform designed for Banking and Insurance Modernization. It offers a cutting-edge AI-native agentic platform for building and deploying AI agents and mission-critical AI-enabled systems in highly regulated industries. The platform enables businesses to build the next generation of banking and insurance systems in weeks, not years, by providing faster development, time to market, and reduced maintenance and implementation costs.

CreditHQ

CreditHQ is an AI-powered loan restructuring platform that helps users analyze their credit history, compare interest rates, and save money on their loans. The platform offers a range of features, including a credit score simulator, a budgeting tool, and a debt management tool. CreditHQ is trusted by over 5,500 users and companies globally.

Clerkie

Clerkie is a powerful debt repayment and optimization platform that offers a full-service automation solution powered by machine learning and human expertise. It helps lenders, both big and small, to manage and optimize their loan portfolios efficiently. With features like smart payment experience, AI-driven repayment strategies, real-time reporting, and easy integration, Clerkie ensures a seamless and secure experience for lenders and borrowers alike.

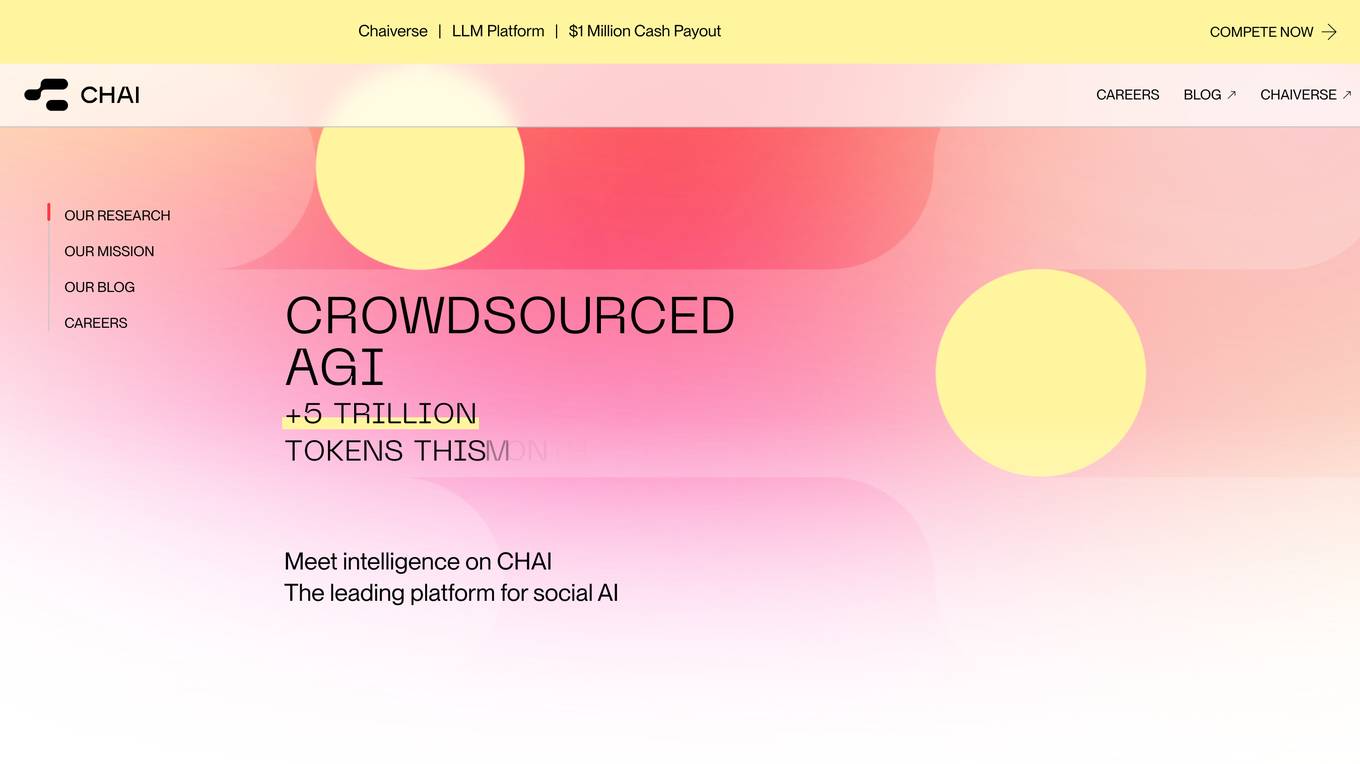

HighRadius

HighRadius is an AI-powered platform that offers Autonomous Finance solutions for Order to Cash (O2C), Treasury, and Record-to-Report (R2R) processes. It provides a single platform for various financial functions such as Accounts Payable, B2B Payments, Cash Management, and Financial Reporting. HighRadius leverages Generative AI and a No-Code AI Platform to automate data analysis and streamline financial operations for the Office of the CFO. The platform aims to enhance productivity, reduce manual work, and improve financial decision-making through advanced AI capabilities.

For similar tasks

Finbots.ai

Finbots.ai is a trusted AI credit risk platform that offers AI credit scoring to boost lending profits and reduce non-performing loans. The platform provides the highest accuracy in the market, allowing users to build scorecards in a day without the need for coding. It helps in making instant decisions, increasing revenue, reducing risk, and improving operational efficiency. Finbots.ai is utilized by various financial institutions to enhance credit risk management, improve profitability, and drive down the cost of risk through AI-enabled models.

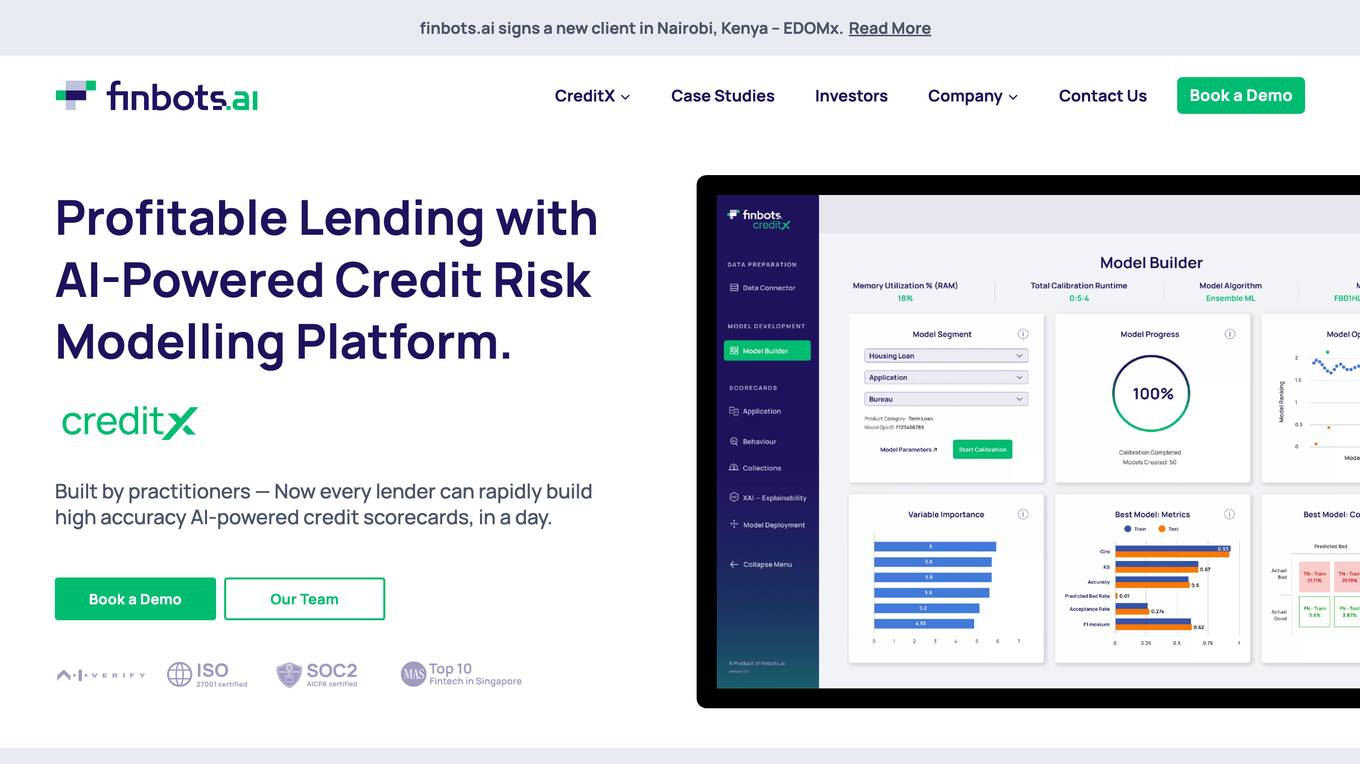

CyanArrow

CyanArrow is an AI-first help desk application designed for solopreneurs to supercharge their customer service with AI chatbots and ticketing system. The application aims to address the challenges faced by solopreneurs in providing 24/7 customer support, leading to service gaps and unhappy customers. CyanArrow offers features such as 24/7 quality support, instant FAQ responses, time and resource savings, efficiency boost, and ticket volume reduction. The application helps businesses enhance customer support, save time, and ultimately boost profits by leveraging AI technology.

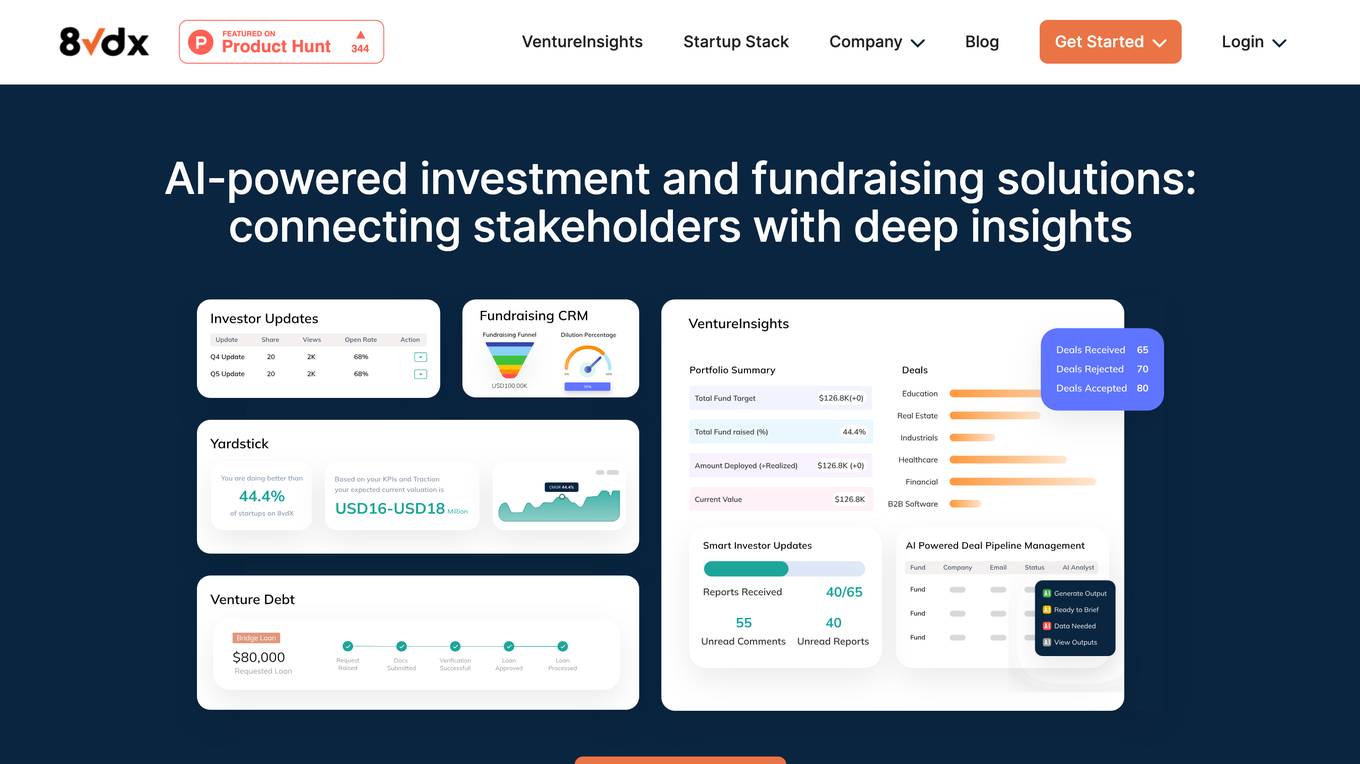

CHAI AI

CHAI AI is a leading conversational AI platform that focuses on building AI solutions for quant traders. The platform has secured significant funding rounds to expand its computational capabilities and talent acquisition. CHAI AI offers a range of models and techniques, such as reinforcement learning with human feedback, model blending, and direct preference optimization, to enhance user engagement and retention. The platform aims to provide users with the ability to create their own ChatAIs and offers custom GPU orchestration for efficient inference. With a strong focus on user feedback and recognition, CHAI AI continues to innovate and improve its AI models to meet the demands of a growing user base.

SkyDeck AI

SkyDeck AI is a secure business-first AI productivity platform that offers solutions for teams and individuals. It provides a Generative AI Workspace for every team, enabling collaboration, customization, and automation of AI workflows. The platform prioritizes data security, team collaboration, and customization options, allowing users to deploy AI models and agents safely and securely. SkyDeck AI aims to enhance team productivity, education, entrepreneurship, and partnership through AI-powered assistance and real-time education.

Cerebium

Cerebium is a serverless AI infrastructure platform that allows teams to build, test, and deploy AI applications quickly and efficiently. With a focus on speed, performance, and cost optimization, Cerebium offers a range of features and tools to simplify the development and deployment of AI projects. The platform ensures high reliability, security, and compliance while providing real-time logging, cost tracking, and observability tools. Cerebium also offers GPU variety and effortless autoscaling to meet the diverse needs of developers and businesses.

Freeplay

Freeplay is a tool that helps product teams experiment, test, monitor, and optimize AI features for customers. It provides a single pane of glass for the entire team, lightweight developer SDKs for Python, Node, and Java, and deployment options to meet compliance needs. Freeplay also offers best practices for the entire AI development lifecycle.

Invicta AI

Invicta AI is a provider of artificial intelligence solutions for the enterprise. The company's flagship product is a platform that enables businesses to build and deploy AI models without the need for specialized expertise. Invicta AI's platform provides a range of tools and services to help businesses with every step of the AI development process, from data preparation and model training to deployment and monitoring.

Cradl AI

Cradl AI is a no-code AI-powered document workflow automation tool that helps organizations automate document-related tasks, such as data extraction, processing, and validation. It uses AI to automatically extract data from complex document layouts, regardless of layout or language. Cradl AI also integrates with other no-code tools, making it easy to build and deploy custom AI models.

LabLab.ai

LabLab.ai is an online community and platform for artificial intelligence (AI) enthusiasts, developers, and innovators. The platform hosts AI hackathons, provides access to state-of-the-art AI technologies, and offers educational resources on AI. LabLab.ai aims to foster collaboration and innovation in the AI field and to make AI accessible to everyone.

Codenull.ai

Codenull.ai is a no-code AI platform that allows users to build and train AI models without writing any code. The platform provides a variety of pre-built AI models that can be used for a variety of tasks, including portfolio optimization, fraud detection, and customer acquisition. Codenull.ai also provides a user-friendly interface that makes it easy to train and deploy AI models.

Mirage

Mirage is a custom AI platform that builds custom LLMs to accelerate productivity. It is backed by Sequoia and offers a variety of features, including the ability to create custom AI models, train models on your own data, and deploy models to the cloud or on-premises.

SandboxAQ

SandboxAQ is a company that leverages the compound effects of AI and Quantum technologies (AQ) to solve hard challenges impacting society. Their AQ technologies include crypto-agile security, quantum sensing, and quantum simulation & optimization for global organizations. With their solutions, they can bring you into the quantum era and provide a competitive advantage, even before scalable and fault-tolerant quantum computers become widely available.

Evoke AI

Evoke AI is a cloud-based AI platform that provides a suite of tools for building and deploying AI models. The platform includes a drag-and-drop interface for creating models, a library of pre-trained models, and a set of tools for managing and deploying models. Evoke AI is designed to make AI accessible to businesses of all sizes, and it is used by a variety of organizations, including Fortune 500 companies and startups.

Appen

Appen is a leading provider of high-quality data for training AI models. The company's end-to-end platform, flexible services, and deep expertise ensure the delivery of high-quality, diverse data that is crucial for building foundation models and enterprise-ready AI applications. Appen has been providing high-quality datasets that power the world's leading AI models for decades. The company's services enable it to prepare data at scale, meeting the demands of even the most ambitious AI projects. Appen also provides enterprises with software to collect, curate, fine-tune, and monitor traditionally human-driven tasks, creating massive efficiencies through a trustworthy, traceable process.

Radicalbit

Radicalbit is an MLOps and AI Observability platform that helps businesses deploy, serve, observe, and explain their AI models. It provides a range of features to help data teams maintain full control over the entire data lifecycle, including real-time data exploration, outlier and drift detection, and model monitoring in production. Radicalbit can be seamlessly integrated into any ML stack, whether SaaS or on-prem, and can be used to run AI applications in minutes.

Mo Ai Jobs

Mo Ai Jobs is a job board for artificial intelligence (AI) professionals. It lists jobs in machine learning, engineering, research, data science, and other AI-related fields. The site is designed to help AI professionals find jobs at next-generation AI companies. Mo Ai Jobs is a valuable resource for anyone looking for a job in the AI industry.

Domino Data Lab

Domino Data Lab is an enterprise AI platform that enables data scientists and IT leaders to build, deploy, and manage AI models at scale. It provides a unified platform for accessing data, tools, compute, models, and projects across any environment. Domino also fosters collaboration, establishes best practices, and tracks models in production to accelerate and scale AI while ensuring governance and reducing costs.

Duckietown

Duckietown is a platform for delivering cutting-edge robotics and AI learning experiences. It offers teaching resources to instructors, hands-on activities to learners, an accessible research platform to researchers, and a state-of-the-art ecosystem for professional training. Duckietown's mission is to make robotics and AI education state-of-the-art, hands-on, and accessible to all.

KZHU.ai

KZHU.ai is an online learning platform that offers a variety of courses in artificial intelligence, machine learning, data science, and other related fields. The platform is designed for both beginners and experienced professionals who want to learn more about AI and its applications.

John McCarthy's Website

This website is dedicated to the life and work of Professor John McCarthy, a legendary computer scientist and the father of Artificial Intelligence. It includes his social commentary, acknowledgements of his outstanding contributions and impact, and a collection of his work. Visitors are encouraged to share their comments, suggestions, stories, photographs, and videos on John and his work.

BentoML

BentoML is a framework for building reliable, scalable, and cost-efficient AI applications. It provides everything needed for model serving, application packaging, and production deployment.

BentoML

BentoML is a platform for software engineers to build, ship, and scale AI products. It provides a unified AI application framework that makes it easy to manage and version models, create service APIs, and build and run AI applications anywhere. BentoML is used by over 1000 organizations and has a global community of over 3000 members.

DataRobot

DataRobot is a leading provider of AI cloud platforms. It offers a range of AI tools and services to help businesses build, deploy, and manage AI models. DataRobot's platform is designed to make AI accessible to businesses of all sizes, regardless of their level of AI expertise. DataRobot's platform includes a variety of features to help businesses build and deploy AI models, including: * A drag-and-drop interface that makes it easy to build AI models, even for users with no coding experience. * A library of pre-built AI models that can be used to solve common business problems. * A set of tools to help businesses monitor and manage their AI models. * A team of AI experts who can provide support and guidance to businesses using the platform.

Denvr DataWorks AI Cloud

Denvr DataWorks AI Cloud is a cloud-based AI platform that provides end-to-end AI solutions for businesses. It offers a range of features including high-performance GPUs, scalable infrastructure, ultra-efficient workflows, and cost efficiency. Denvr DataWorks is an NVIDIA Elite Partner for Compute, and its platform is used by leading AI companies to develop and deploy innovative AI solutions.

For similar jobs

VantedgeAI

VantedgeAI is an AI application that offers fine-tuned AI models for credit funds, revolutionizing credit investing workflows with faster, smarter, and cost-effective solutions. The application transforms manual processes into scalable, automated workflows tailored for Private Credit and Hedge Funds. VantedgeAI is trusted by market leaders in the industry, providing unique AI-driven insights to maintain a competitive advantage and ensure data security and privacy through SOC 2 compliance. The application offers advanced AI solutions for credit investing, including automated investment memo generation, data extraction for Excel models, portfolio monitoring, loan reconciliation, smart bond screening, real-time data querying with AI bots, and more.

Finbots.ai

Finbots.ai is a trusted AI credit risk platform that offers AI credit scoring to boost lending profits and reduce non-performing loans. The platform provides the highest accuracy in the market, allowing users to build scorecards in a day without the need for coding. It helps in making instant decisions, increasing revenue, reducing risk, and improving operational efficiency. Finbots.ai is utilized by various financial institutions to enhance credit risk management, improve profitability, and drive down the cost of risk through AI-enabled models.

Rationale

Rationale is a cutting-edge decision-making AI tool that leverages the power of the latest GPT technology and in-context learning. It is designed to assist users in making informed decisions by providing valuable insights and recommendations based on the data provided. With its advanced algorithms and machine learning capabilities, Rationale aims to streamline the decision-making process and enhance overall efficiency.

CHAI AI

CHAI AI is a leading conversational AI platform that focuses on building AI solutions for quant traders. The platform has secured significant funding rounds to expand its computational capabilities and talent acquisition. CHAI AI offers a range of models and techniques, such as reinforcement learning with human feedback, model blending, and direct preference optimization, to enhance user engagement and retention. The platform aims to provide users with the ability to create their own ChatAIs and offers custom GPU orchestration for efficient inference. With a strong focus on user feedback and recognition, CHAI AI continues to innovate and improve its AI models to meet the demands of a growing user base.

Cambrian Copilot

Cambrian Copilot is an AI tool designed for researchers and engineers to stay up-to-date with the latest machine learning research. With the ability to search over 240,000 ML papers, the tool helps users discover new research, understand complex details, and automate literature reviews. It simplifies the process of keeping track of the rapid developments in the field of machine learning.

Nexus

Nexus is a Business-led Enterprise AI Platform that empowers business teams to transform their workflows into autonomous agents in a matter of days. It offers a secure, reliable, and flexible solution that enables enterprises to deploy 100x faster without involving engineering teams. Nexus provides adaptive intelligence, dynamic planning, continuous learning, and technology-agnostic intelligent automation. It allows for universal deployment, works with existing tools, and grows with businesses without increasing headcount.

Mnemonic AI

Mnemonic AI is an end-to-end marketing intelligence platform that helps businesses unify their data, understand their customers, and automate their growth. It connects disparate data sources to build AI-powered customer insights and streamline marketing processes. The platform offers features such as connecting marketing and sales apps, generating AI insights, and automating growth through BI-grade reports. Mnemonic AI is trusted by forward-thinking marketing teams to transform marketing intelligence and drive confident decisions.

Functime

Functime is an AI tool specializing in time-series machine learning at scale. It offers a comprehensive set of features and functions to assist users in forecasting and analyzing time-series data efficiently. With its user-friendly interface and detailed documentation, Functime is designed to cater to both beginners and experienced users in the field of machine learning. The tool provides scoring, ranking, and plotting functions to evaluate forecasts, along with an AI copilot feature for in-depth analysis of trends, seasonality, and causal factors. Functime also offers an API reference for seamless integration with other applications.

Promptmakr

Promptmakr is an AI-powered platform that facilitates the buying and selling of AI prompts. It serves as a marketplace where users can discover, purchase, and sell prompts to enhance their AI projects. With a user-friendly interface and robust features, Promptmakr streamlines the process of accessing high-quality prompts for various applications, from chatbots to image recognition systems. The platform ensures secure transactions and fosters a community of AI enthusiasts and professionals.

StockGPT

StockGPT is an AI-powered financial research assistant that provides knowledge of earnings releases, financial reports, and fundamental information for S&P 500 and Nasdaq companies. It offers features like AI search, customizable filters, up-to-date data, and industry research to help users analyze companies and markets more efficiently.

DiscuroAI

DiscuroAI is an all-in-one platform designed for developers to easily build, test, and consume complex AI workflows. Users can define their workflows in a user-friendly interface and execute them with a single API call. The platform integrates with GPT-3, DALLE-2, and other OpenAI models, allowing users to chain prompts together in powerful ways and extract output in JSON format via API. DiscuroAI enables users to build and test complex self-transforming AI workflows and datasets, execute workflows with one API call, and monitor AI usage across workflows.

Pgrammer

Pgrammer is an AI-powered platform designed to help users practice coding interview questions with hints and personalized learning experiences. Unlike traditional methods like LeetCode, Pgrammer offers a diverse set of questions for over 20 programming languages, real-time hints, and solution analysis to improve coding skills and knowledge. The platform uses AI, specifically GPT-4, to determine question difficulty levels and provide feedback on code submissions. Pgrammer aims to make coding interview preparation enjoyable and effective for both beginners and seasoned professionals.

Google Colab Copilot

Google Colab Copilot is an AI tool that integrates the GitHub Copilot functionality into Google Colab, allowing users to easily generate code suggestions and improve their coding workflow. By following a simple setup guide, users can start using the tool to enhance their coding experience and boost productivity. With features like code generation, auto-completion, and real-time suggestions, Google Colab Copilot is a valuable tool for developers looking to streamline their coding process.

Lobe

Lobe is a free easy-to-use tool for Mac and PC that helps you train machine learning models and ship them to any platform you choose. It provides a user-friendly interface for training machine learning models without requiring extensive coding knowledge. Lobe supports various tasks related to machine learning, such as creating image-based datasets, working with Python toolsets, and deploying models on different platforms.

GitHub Buoyant

GitHub Buoyant is an AI-powered marine data aggregator tool that fetches marine conditions from NOAA via various free APIs. It provides wave conditions, wind data, tide levels, and water temperature for coastal areas in the US. The tool offers a comprehensive marine report with detailed information on waves, wind, tides, water temperature, and weather forecasts. It includes a library for developers to integrate marine data into their own code and covers US mainland coastal waters, Great Lakes, Hawaii, Alaska, Puerto Rico, USVI, and Guam. The tool handles NOAA's data quirks and provides insights into the technical aspects of data processing and validation.

Weaviate

Weaviate is an AI-native database that developers love. It offers a feature-rich vector database trusted by AI innovators, empowering AI-native builders to create AI-powered search, retrieval augmented generation, and agentic AI applications. Weaviate simplifies the process of building production-ready AI applications by providing seamless model integration, pre-built database agents, and language-agnostic SDKs for easy development. With billion-scale architecture and enterprise-ready deployment options, Weaviate enables developers to scale seamlessly, deploy anywhere, and meet enterprise requirements. The platform is designed to help AI builders write less custom code, optimize costs, and build AI-native apps faster.

Microsoft Azure

Microsoft Azure is a cloud computing service that offers a wide range of products and solutions for businesses and developers. It provides tools for AI, machine learning, databases, analytics, compute, containers, hybrid cloud, and more. Azure enables users to build, deploy, and scale AI-powered applications and agents faster, with a focus on data security and flexibility. The platform offers a pay-as-you-go model and a free trial period of up to 30 days, with no upfront commitment required. Azure aims to empower businesses to innovate and modernize their applications and infrastructure in a secure and scalable environment.

Questflow

Questflow is an AI agent economy platform that enables users to automate tasks, turn user feedback into action, and build AI agent teams for various workflows. It offers a developer platform to design and deploy AI swarms, empowering teams and innovators worldwide. Questflow aims to create a multi-agent economy on-chain, connecting AI agents to all apps and allowing users to customize AI agent-powered applications. With features like autonomous task completion, on-chain incentives for builders, and tokenization of AI agents, Questflow provides a composable solution for orchestrating AI agents to work together seamlessly.

Qualifyed

Qualifyed is an AI predictive audiences and lead scoring platform designed to help businesses optimize their advertising efforts by targeting people with the highest probability to become customers. The platform uses industry-leading machine learning systems to continuously inspect and score leads, ultimately decreasing customer acquisition costs, increasing online conversions, and improving sales team efficiency. Qualifyed offers a streamlined process of data ingestion, machine learning modeling, advertising optimization, and media execution to reach ideal customers effectively.

Chessvision.ai

Chessvision.ai is an AI-powered eBook reader designed to enhance the study of chess eBooks. It utilizes Artificial Intelligence and Computer Vision to make chess books interactive, allowing users to analyze positions, add comments, search online databases, watch YouTube videos, and analyze with an engine. The application has gained popularity among chess players of all levels for its innovative approach to studying and improving chess skills.

Vectara

Vectara is a conversational search demo application that provides users with the ability to interact with a search engine using natural language. The application allows users to ask questions and receive relevant search results in a conversational manner. Vectara leverages AI technology to understand user queries and provide accurate responses, making the search process more intuitive and user-friendly.

Susterra

Susterra is an advanced analytics platform for Public Finance stakeholders, aiming to catalyze urban development by providing powerful insights. The platform integrates leading practices from academia, utilizes public data for creating relevant insights, and leverages technology innovations like ML and AI. Susterra offers solutions such as TerraScore, TerraVision, TerraView, and Impact IQ, enabling evaluation of public benefit programs in various sectors. The platform also provides data visualization tools and is powered by Google Cloud, offering state-of-the-art analytics for smart decision-making in the Municipal Bond Market and Smart Cities development.

![Collective[i] Screenshot](/screenshots/collectivei.com.jpg)

Collective[i]

Collective[i] is an AI-powered platform that helps businesses optimize their operations by leveraging data and AI technology. The platform offers solutions for sales forecasting, data cleansing, insights generation, and community building. Collective[i] focuses on revenue optimization, productivity improvement, and growth through AI-driven decision-making processes. The platform is designed to provide enterprise-level security and privacy to ensure the confidentiality and integrity of business information.

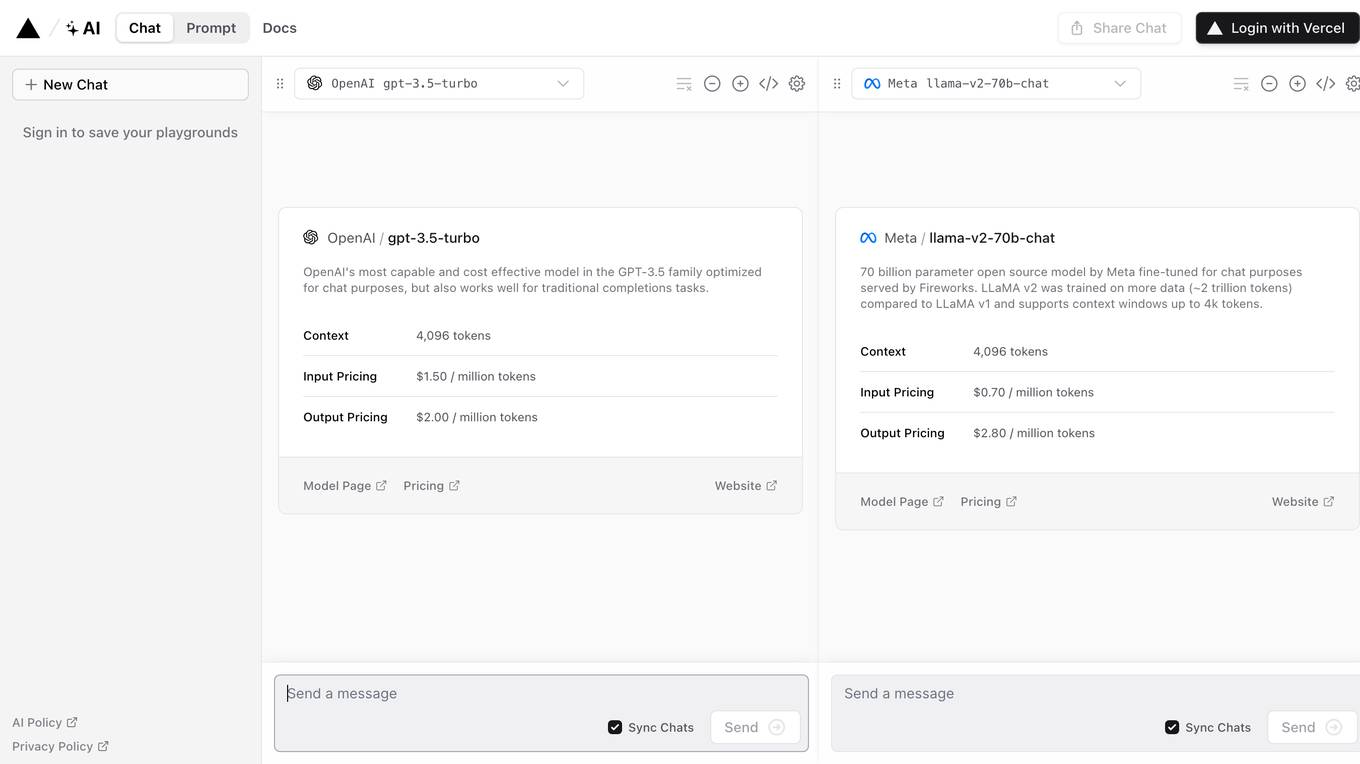

AI SDK

The AI SDK is a free open-source library designed to empower developers to build AI-powered products. Developed by the creators of Next.js, it offers a unified Provider API that allows users to easily switch between AI providers by changing a single line of code. With features like generative UI, framework-agnostic compatibility, and streaming AI responses, the AI SDK simplifies the process of integrating AI capabilities into applications. Trusted by prominent builders like OpenAI and Hugging Face, the AI SDK has received praise for its ease of use, speed of development, and comprehensive documentation.