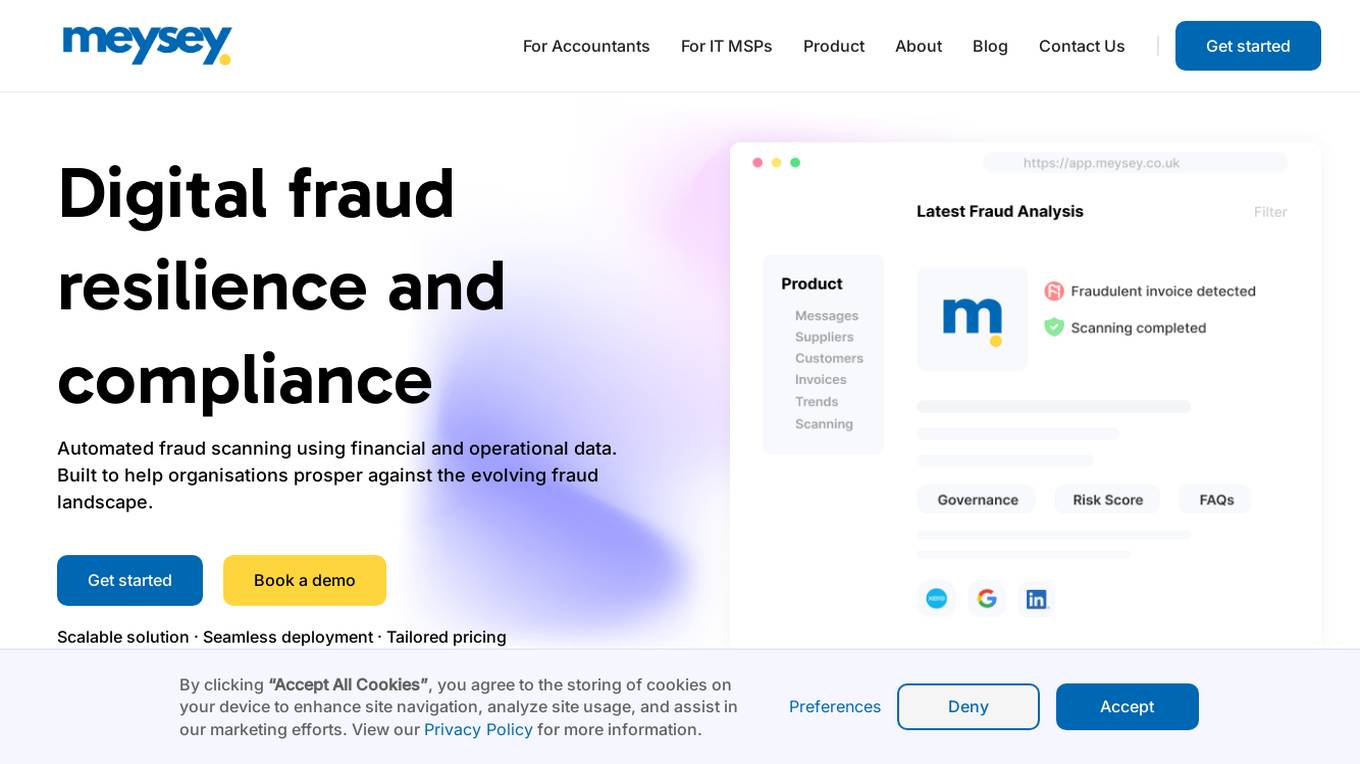

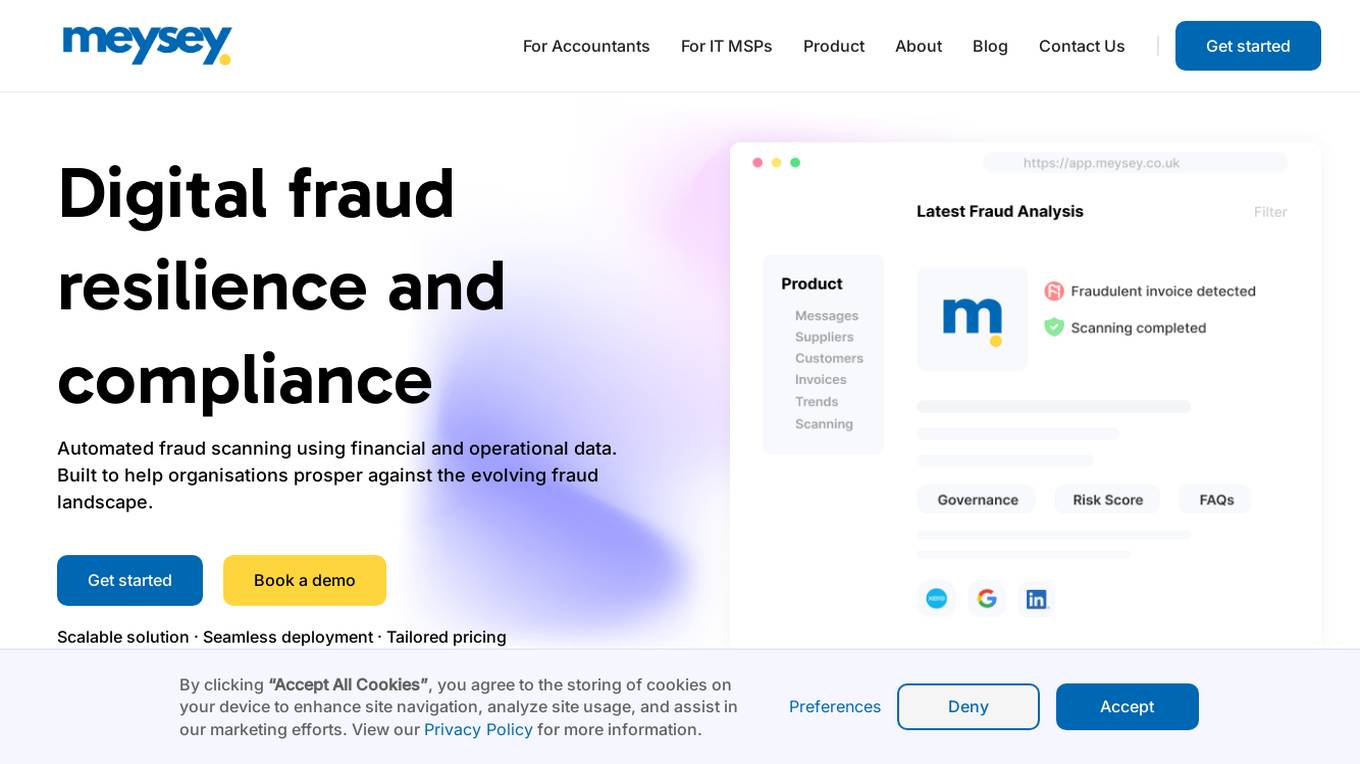

Meysey

Empowering organizations against fraud

Meysey is an AI fraud protection application designed for accountants and IT managed service providers. It offers automated fraud scanning using financial and operational data to help organizations prosper against the evolving fraud landscape. Meysey provides scalable solutions with seamless deployment and tailored pricing, enabling users to gain visibility of bribery and corruption risk, identify conflicts of interest, baseline financial patterns, and comply with fraud legislation. The application integrates with finance and business operations tools to analyze data across the commercial landscape, providing actionable insights to enhance business resilience and reduce fraud risk.

For Tasks:

Click tags to check more tools for each tasksFor Jobs:

Features

Advantages

Disadvantages

Frequently Asked Questions

Alternative AI tools for Meysey

Similar sites

Meysey

Meysey is an AI fraud protection application designed for accountants and IT managed service providers. It offers automated fraud scanning using financial and operational data to help organizations prosper against the evolving fraud landscape. Meysey provides scalable solutions with seamless deployment and tailored pricing, enabling users to gain visibility of bribery and corruption risk, identify conflicts of interest, baseline financial patterns, and comply with fraud legislation. The application integrates with finance and business operations tools to analyze data across the commercial landscape, providing actionable insights to enhance business resilience and reduce fraud risk.

SymphonyAI NetReveal Financial Services

SymphonyAI NetReveal Financial Services is an AI-powered platform that offers solutions for financial crime prevention in various industries such as banking, insurance, financial markets, and private banking. The platform utilizes predictive and generative AI applications to enhance efficiency, reduce fraud, streamline compliance, and maximize output. SymphonyAI provides a fundamentally different approach to AI by combining high-value AI capabilities with industry-leading predictive and generative AI technologies. The platform offers a range of solutions including transaction monitoring, customer due diligence, payment fraud detection, and enterprise investigation management. SymphonyAI aims to revolutionize financial crime prevention by leveraging AI to detect suspicious activity, expedite investigations, and improve compliance operations.

DataVisor

DataVisor is a modern, end-to-end fraud and risk SaaS platform powered by AI and advanced machine learning for financial institutions and large organizations. It helps businesses combat various fraud and financial crimes in real time. DataVisor's platform provides comprehensive fraud detection and prevention capabilities, including account onboarding, application fraud, ATO prevention, card fraud, check fraud, FinCrime and AML, and ACH and wire fraud detection. The platform is designed to adapt to new fraud incidents immediately with real-time data signal orchestration and end-to-end workflow automation, minimizing fraud losses and maximizing fraud detection coverage.

FOCAL

FOCAL is an AI-driven platform designed for AML compliance and anti-fraud purposes. It offers solutions for verification, customer due diligence, fraud prevention, and financial insights. The platform leverages AI technology to streamline onboarding processes, enhance trust through advanced customer screening, and detect and prevent fraud using advanced AI algorithms. FOCAL is tailored to meet industry-specific needs, provides seamless integration with existing systems, and offers localized expertise with global standards for regulatory compliance.

Unit21

Unit21 is a customizable no-code platform designed for risk and compliance operations. It empowers organizations to combat financial crime by providing end-to-end lifecycle risk analysis, fraud prevention, case management, and real-time monitoring solutions. The platform offers features such as AI Copilot for alert prioritization, Ask Your Data for data analysis, Watchlist & Sanctions for ongoing screening, and more. Unit21 focuses on fraud prevention and AML compliance, simplifying operations and accelerating investigations to respond to financial threats effectively and efficiently.

iSEM.ai

iSEM.ai is an end-to-end AI-powered AML and Fraud Detection solution that empowers users to identify risks, investigate anomalies, and streamline reporting. The platform combines human intelligence with machine technology to adapt, reduce risks, and enhance efficiency in combating financial crimes. iSEM.ai offers tailored solutions to manage client data, onboard monitoring, client profile management, watchlist monitoring, transaction monitoring, transaction screening, and fraud monitoring. The application is designed to help businesses comply with regulations, detect suspicious activities, and ensure seamless protection at every step.

Fraud.net

Fraud.net is an AI-powered fraud detection and prevention platform designed for enterprises. It offers a comprehensive and customizable solution to manage and prevent financial fraud and risks. The platform utilizes AI and machine learning technologies to provide real-time monitoring, analytics, and reporting, helping businesses in various industries to combat fraud effectively. Fraud.net's solutions are trusted by CEOs, directors, technology and security officers, fraud managers, and analysts to ensure trust and beat fraud at every step of the customer lifecycle.

Flagright Solutions

Flagright Solutions is an AI-native AML Compliance & Risk Management platform that offers real-time transaction monitoring, automated case management, AI forensics for screening, customer risk assessment, and sanctions screening. Trusted by financial institutions worldwide, Flagright's platform streamlines compliance workflows, reduces manual tasks, and enhances fraud detection accuracy. The platform provides end-to-end solutions for financial crime compliance, empowering operational teams to collaborate effectively and make reliable decisions. With advanced AI algorithms and real-time processing, Flagright ensures instant detection of suspicious activities, reducing false positives and enhancing risk detection capabilities.

Feedzai

Feedzai is an AI-native Fraud & Financial Crime Prevention Platform that uses purpose-built AI to stop fraud and lower compliance costs. The platform covers the entire financial crime lifecycle, from account opening to fraud prevention to AML compliance. It applies behavioral analytics to detect and prevent fraud, reduces AML compliance costs, and empowers customers to stop scams before they happen. Feedzai is trusted by global financial leaders and helps protect billions of consumers worldwide while enabling better customer experiences.

Jumio

Jumio is a leading digital identity verification platform that offers AI-driven services to verify the identities of new and existing users, assess risk, and help meet compliance mandates. With over 1 billion transactions processed, Jumio provides cutting-edge AI and ML models to detect fraud and maintain trust throughout the customer lifecycle. The platform offers solutions for identity verification, predictive fraud insights, dynamic user experiences, and risk scoring, trusted by global brands across various industries.

Napier AI

Napier AI is an AI-powered Anti-Money Laundering platform designed to combat evolving threats in the financial industry. It offers a suite of intelligent compliance products that aim to transform organizations' attitudes towards compliance by focusing on efficiency and outcomes. The platform integrates multiple compliance solutions into one master dashboard, provides flexible deployment options, and offers AI-enhanced insights to empower compliance teams to make faster and more accurate decisions. Napier AI is trusted by leading data providers and financial organizations worldwide for its innovative approach to financial crime compliance.

Socure

Socure is a revolutionary digital identity verification and fraud prevention platform that leverages advanced AI/ML technology to provide the most accurate and comprehensive identity verification and fraud prediction solutions. The platform offers a wide range of features including graph-defined identity verification, fraud risk assessment, compliance solutions, account intelligence, decisioning analytics, and reporting. Socure's ID+ platform integrates real-time intelligence from billions of predictions and outcomes to deliver maximum accuracy and eliminate the need for disparate products. With up to 98% auto-approvals across all demographics, Socure helps organizations prevent fraud, streamline compliance, and onboard good customers efficiently.

NICE Actimize

NICE Actimize is an AI-driven platform that offers solutions for combatting financial crime, including Anti-Money Laundering (AML), Enterprise Fraud Management, Financial Markets Compliance, Investigation and Case Management, and Data Intelligence. The platform utilizes AI and machine learning to optimize efficacy, accuracy, and regulatory compliance coverage in the fight against financial crime.

Relyance AI

Relyance AI is a platform that offers 360 Data Governance and Trust solutions. It helps businesses safeguard against fines and reputation damage while enhancing customer trust to drive business growth. The platform provides visibility into enterprise-wide data processing, ensuring compliance with regulatory and customer obligations. Relyance AI uses AI-powered risk insights to proactively identify and address risks, offering a unified trust and governance infrastructure. It offers features such as data inventory and mapping, automated assessments, security posture management, and vendor risk management. The platform is designed to streamline data governance processes, reduce costs, and improve operational efficiency.

Sift

Sift is an AI-powered fraud decisioning platform that helps businesses prevent fraud, secure digital trust, and enhance customer experiences. Leveraging AI technology, Sift offers solutions for various industries and roles, such as fraud prevention, compliance, IT operations, and cybersecurity. The platform enables users to make accurate and real-time fraud decisions, automate fraud prevention processes, and scale operations efficiently. Sift is trusted by over 700 global brands to protect transactions, reduce risk, and drive revenue growth.

Sardine

Sardine is an AI-powered platform for fraud prevention and compliance. It offers a comprehensive suite of products to help banks, retailers, and fintechs detect fraud patterns, prevent money laundering, and stop sophisticated scams. Sardine combines deep device intelligence, behavior biometrics, and identity signals to provide a precise risk score for every customer interaction. The platform also features machine learning models, a rules engine, network graph analysis, anomaly detection, and generative AI capabilities to fight modern threats. Sardine helps reduce fraud rates, decrease false positives, and streamline risk operations with its fully integrated solutions.

For similar tasks

Potato.trade

Potato.trade was a service that has been closed down as the company evolved into an AI Finance solutions company called Telescope. The website is no longer active, and users are encouraged to explore the new direction in AI-powered financial solutions at telescope.co.

Receipt OCR API

Receipt OCR API by ReceiptUp is an advanced tool that leverages OCR and AI technology to extract structured data from receipt and invoice images. The API offers high accuracy and multilingual support, making it ideal for businesses worldwide to streamline financial operations. With features like multilingual support, high accuracy, support for multiple formats, accounting downloads, and affordability, Receipt OCR API is a powerful tool for efficient receipt management and data extraction.

Quill AI

Quill is an AI-powered SEC filing platform that allows users to extract key information from filings, answer questions about public investor materials, access historical financial data, and receive real-time SEC filings and earnings call transcripts. The platform leverages financially-tuned AI to provide accurate and up-to-date information, making it a valuable tool for analysts and professionals in the finance industry.

FinChat.io

FinChat.io is a comprehensive AI-powered stock research platform that provides institutional-quality data and insights to investors. With FinChat.io, you can access accurate financial data on over 100,000 global public companies, as well as company revenue and profit segments, KPIs, analyst estimates, price targets, and ratings. FinChat.io also utilizes cutting-edge AI to build summaries, models, and visualizations, making it easy to understand complex financial data. Additionally, FinChat.io offers a customizable terminal, allowing you to track what matters most to you and auto-save your research. With FinChat.io, you can work faster than ever and make better investment decisions.

Novus Writer

Novus Writer is a customizable, on-premise AI and LLM solution designed to enhance efficiency in various business functions, including sales, finance, customer support, and more. It offers a range of features such as plagiarism detection, long-form generation, proofreading, fact checking, and custom AI agents. Novus Writer is trusted by enterprises for its streamlined processes, advanced data analysis capabilities, and compliance with industry standards.

Fama.one

Fama.one is an AI-powered platform that helps businesses automate their financial processes. It uses machine learning to analyze financial data and identify patterns, which can then be used to automate tasks such as invoice processing, expense management, and financial reporting. Fama.one also provides businesses with insights into their financial performance, which can help them make better decisions.

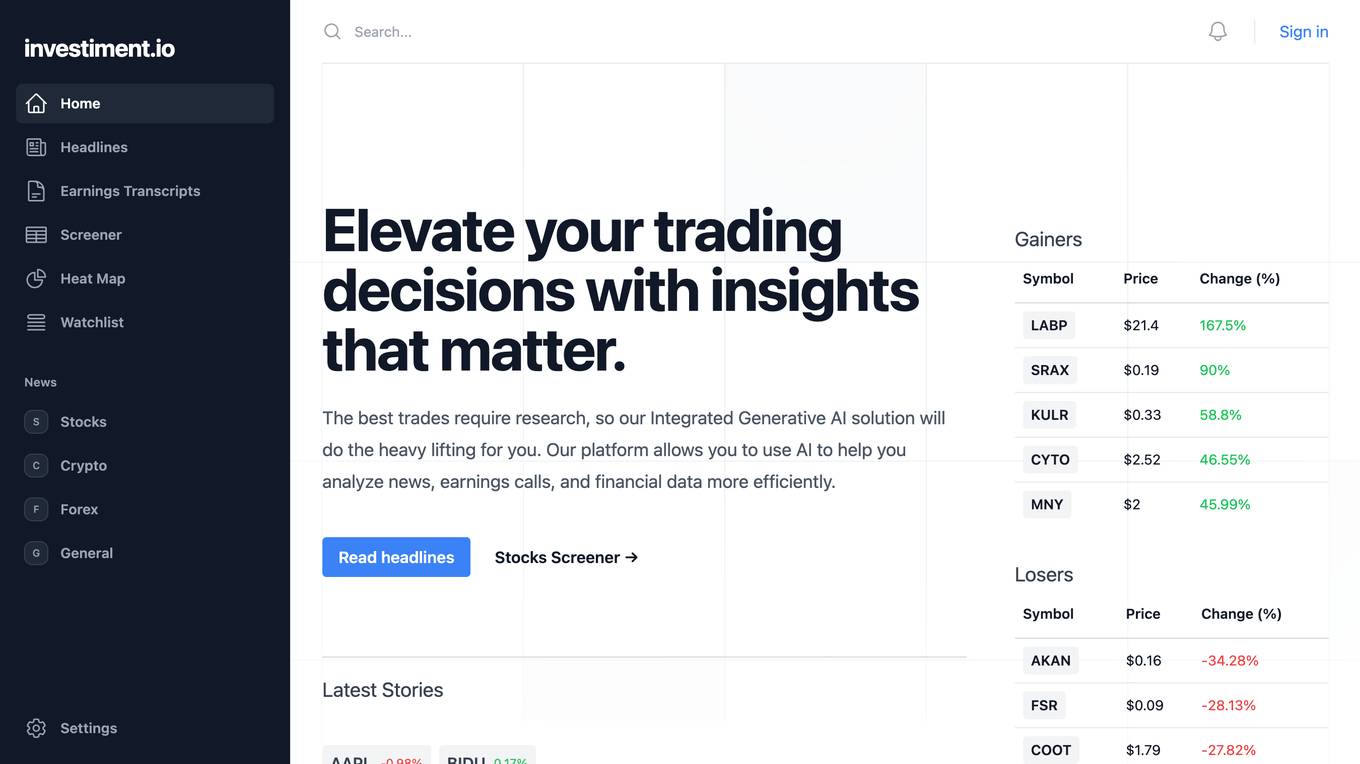

Investiment.io

Investiment.io is a financial news and data platform that uses AI to help investors make better decisions. The platform provides access to real-time news, earnings transcripts, and financial data, as well as AI-powered insights and analysis. Investiment.io is designed to help investors of all levels, from beginners to experienced professionals.

Castello.ai

Castello.ai is a financial analysis tool that uses artificial intelligence to help businesses make better decisions. It provides users with real-time insights into their financial data, helping them to identify trends, risks, and opportunities. Castello.ai is designed to be easy to use, even for those with no financial background.

PrometAI

PrometAI is an AI-powered business plan generator that helps entrepreneurs and businesses create comprehensive and professional business plans. It offers a range of features and tools to guide users through each step of the planning process, including strategy development, financial analysis, and valuation. PrometAI's platform is designed to simplify and streamline the business planning process, making it accessible to users of all levels of experience.

CityFALCON

CityFALCON is a financial and business due diligence platform that provides a range of solutions for the needs of a wide audience, including retail investors, retail traders, daily business news readers, brokers, students, professors, academia, wealth managers, financial advisors, P2P crowdfunding, VC, PE, institutional investors, treasury, consultancy, legal, accounting, central banks, and regulatory agencies. The platform offers a variety of features and content, including a CityFALCON Score, watchlists, similar stories, grouping news on charts, key headlines, sentiment content translation, content news premium publications, insider transactions, official company filings, investor relations, ESG content, and languages.

Thomson Reuters

Thomson Reuters is a leading provider of business information services. The company provides a wide range of products and services to professionals in the legal, tax, accounting, and risk management industries. Thomson Reuters' products and services include news and information, research and analysis, software and technology, and education and training. The company has a global presence with operations in over 100 countries.

Datafitai

Datafitai is a community platform for ChatGPT prompting, where users can find and share top-rated prompts for various topics such as marketing, coding, finance, writing, gaming, and art. The platform aims to improve the accuracy of ChatGPT responses by providing high-quality prompts. Users can explore, share, and contribute to a wide range of prompts to enhance their ChatGPT experience.

Baselinemag

Baselinemag is an AI tool that provides news and insights on software, business, finance, and project management. It covers a wide range of topics related to technology and business, offering valuable information to professionals and enthusiasts in the industry.

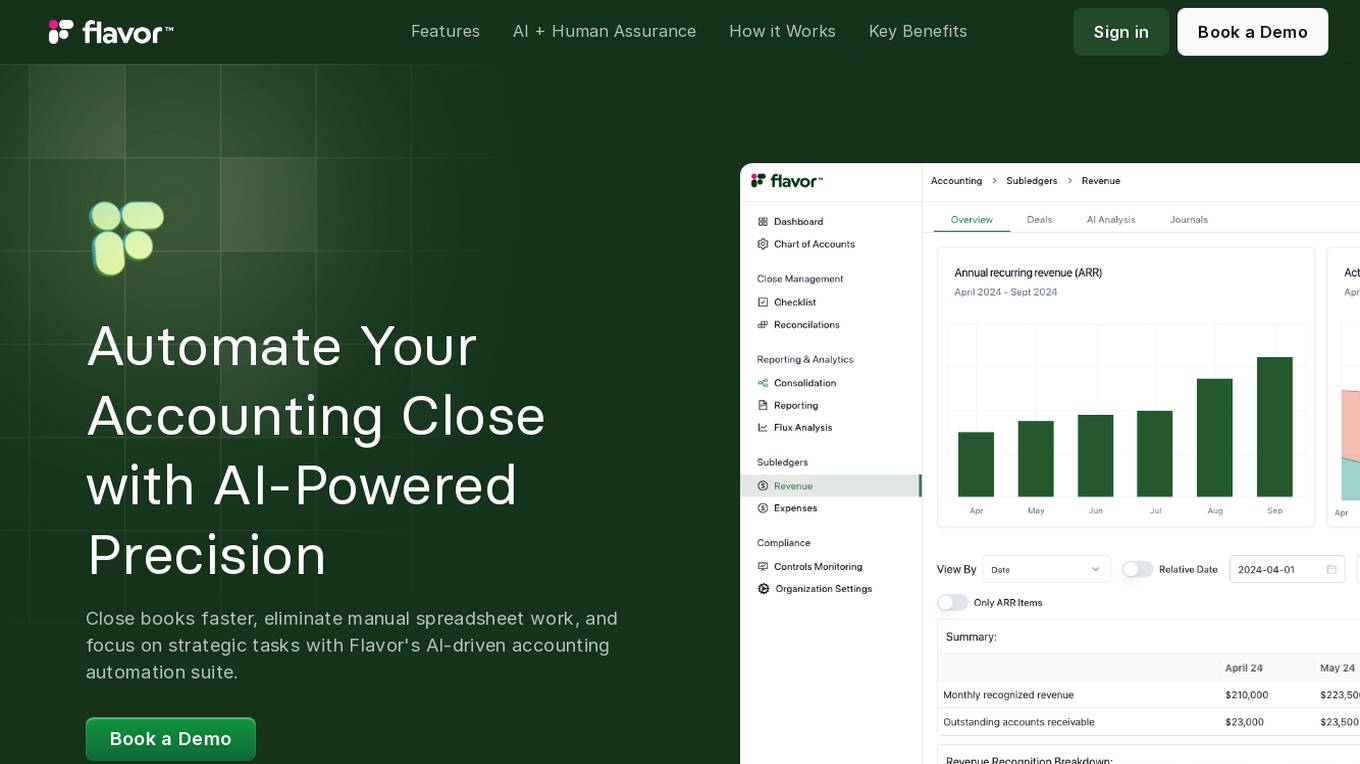

Flavor

Flavor is an AI-powered accounting automation tool that revolutionizes the month-end close process. It automates tasks such as book closure management, general ledger reconciliations, consolidation & reporting, financial analysis, and accruals management. Flavor combines AI technology with human validation to ensure accurate, compliant, and audit-ready financial records. The tool offers customizable checklists, real-time insights, and dynamic reports for faster decision-making. With Flavor, users can reduce manual workload, eliminate errors, and focus on strategic growth initiatives.

Monexa

Monexa is a professional-grade financial analysis platform that offers institutional-grade market insights, news, and data analysis in one powerful platform. It provides comprehensive market analysis, AI-powered insights, rich data visualizations, research and analysis tools, advanced screener, rich financial history, automated SWOT analysis, comprehensive reports, interactive performance analytics, institutional investment tracking, company intelligence, dividend analysis, earnings call analysis, portfolio analytics, strategy explorer, real-time market intelligence, and more. Monexa is designed to help users make data-driven investment decisions with a comprehensive suite of analytical capabilities.

COUNT

COUNT is a modern accounting software designed for ambitious businesses, offering automation of bookkeeping and providing actionable insights to help businesses grow. The platform equips users with tools for invoicing, bill management, employee task streamlining, and automated workflows powered by AI. COUNT aims to help businesses operate smarter, scale faster, and stay ahead of the competition by simplifying financial tasks and providing real-time insights.

Meysey

Meysey is an AI fraud protection application designed for accountants and IT managed service providers. It offers automated fraud scanning using financial and operational data to help organizations prosper against the evolving fraud landscape. Meysey provides scalable solutions with seamless deployment and tailored pricing, enabling users to gain visibility of bribery and corruption risk, identify conflicts of interest, baseline financial patterns, and comply with fraud legislation. The application integrates with finance and business operations tools to analyze data across the commercial landscape, providing actionable insights to enhance business resilience and reduce fraud risk.

Accountancy Age

Accountancy Age is an AI-powered platform that offers cutting-edge accounting solutions and insights for businesses. It provides a wide range of resources, news articles, and rankings related to accounting firms, audit, consulting, tax, and business recovery. With a focus on AI and cloud-centric strategies, Accountancy Age helps businesses navigate complex financial landscapes and regulatory environments. The platform aims to redefine accounting practices by leveraging advanced technologies to enhance efficiency and accuracy in financial management.

AI Agents for SMBs

The website is an AI tool designed to assist Small and Medium Businesses (SMBs) in various aspects of their operations. It utilizes AI agents to provide intelligent solutions and support to SMBs, helping them streamline processes, make data-driven decisions, and enhance overall efficiency. The tool aims to empower SMBs with advanced technology typically available to larger enterprises, enabling them to compete effectively in the market.

Levelup Intelligence

Levelup Intelligence is an advanced financial reporting tool designed for SMB portfolios. It provides a comprehensive dashboard to view and analyze financial data, offering real-time insights and customizable KPIs. The tool integrates with major accounting platforms, such as Quickbooks and Xero, to streamline data organization and analysis. With AI-powered standardization, Levelup ensures financial transparency and accuracy, making it a valuable resource for accounting firms and financial institutions.

Sardine

Sardine is an AI-powered platform for fraud prevention and compliance. It offers a comprehensive suite of products to help banks, retailers, and fintechs detect fraud patterns, prevent money laundering, and stop sophisticated scams. Sardine combines deep device intelligence, behavior biometrics, and identity signals to provide a precise risk score for every customer interaction. The platform also features machine learning models, a rules engine, network graph analysis, anomaly detection, and generative AI capabilities to fight modern threats. Sardine helps reduce fraud rates, decrease false positives, and streamline risk operations with its fully integrated solutions.

Arya.ai

Arya.ai is an AI tool designed for Banks, Insurers, and Financial Services to deploy safe, responsible, and auditable AI applications. It offers a range of AI Apps, ML Observability Tools, and a Decisioning Platform. Arya.ai provides curated APIs, ML explainability, monitoring, and audit capabilities. The platform includes task-specific AI models for autonomous underwriting, claims processing, fraud monitoring, and more. Arya.ai aims to facilitate the rapid deployment and scaling of AI applications while ensuring institution-wide adoption of responsible AI practices.

Pascal

Pascal is an AI-powered risk-based KYC & AML screening and monitoring platform that offers users the ability to assess findings faster and more accurately than other compliance tools. It utilizes AI, machine learning, and Natural Language Processing to analyze open-source and client-specific data, interpret adverse media in multiple languages, simplify onboarding processes, provide continuous monitoring, reduce false positives, and enhance compliance decision-making.

InteliConvo®

InteliConvo® is a state-of-the-art AI-powered speech analytics and automation platform that enables businesses to process and analyze recorded customer conversations. It provides valuable insights into customer buying patterns, intents, sentiments, and feedback, which can be utilized to automate workflows, improve team performance, accelerate sales, enhance debt collections, boost customer experience, and ensure compliance. The platform offers features like multilingual support, flexible deployment options, hot lead identification, debt default prediction, brand building insights, and compliance monitoring.

For similar jobs

Tango

Tango is a comprehensive platform designed to automate and streamline contract management, billing, and payment processes for small and medium professional services practices and consultancies. It offers clear scope definition, transparent contracts, automated billing, and easy payment options to help businesses save time, reduce administrative tasks, and improve client relationships. With features like self-service contracts, key term highlighting, automated invoicing, and multiple payment methods, Tango aims to simplify the entire workflow from client engagement to payment collection. Trusted by over 600 practices, studios, and agencies, Tango is a trusted solution for businesses looking to enhance efficiency and profitability.

Receiptor AI

Receiptor AI is an automated bookkeeping tool that leverages artificial intelligence to streamline the process of managing receipts and invoices. It finds, extracts, categorizes, and syncs data from various sources like emails, WhatsApp, and manual uploads to accounting software such as Xero and QuickBooks. The tool aims to save time, money, and reduce stress by automating tedious bookkeeping tasks, making financial records always complete and audit-ready. With features like automatic extraction, retroactive email analysis, real-time expense analytics, and smart AI categorization, Receiptor AI offers a novel approach to accounting that simplifies the workflow for individuals, businesses, and accountants.

AITax

AITax.com is a website that appears to be related to tax services, but due to a privacy error, the connection is not secure. The site seems to have an expired security certificate, which may pose a risk to users' information security. The site prompts users to proceed at their own risk, indicating potential security vulnerabilities.

Taxly

Taxly is a user-friendly online platform designed to automate UAE corporate tax filing for small and medium-sized enterprises (SMEs), free zone entities, and accountants. It simplifies the tax compliance process by allowing users to upload their financial data and receive FTA-ready tax returns. With real-time tax insights, built-in compliance assistance, and instant tax projections, Taxly aims to make tax filing smart, simple, and stress-free for businesses in the UAE.

Ramp

Ramp is a comprehensive platform offering Spend Management, Corporate Cards, and Accounts Payable Solutions. It provides easy-to-use corporate cards, bill payments, accounting, and more in one place. With features like Ramp Intelligence, Corporate Cards, Expense Management, Accounts Payable, Travel solutions, and Procurement tools, Ramp aims to streamline finance operations for businesses of all sizes. The platform is designed to save time and money for finance teams by automating processes and providing efficient solutions.

Humanlike

Humanlike is an AI-powered AP/AR tool that helps businesses cut AP/AR costs by 80%. It is a better alternative to outsourcing accounts payable and receivable, using human-like AI to process invoices more efficiently and accurately than traditional methods. The tool is built by fintech veterans from Stripe and Modern Treasury, offering a risk-free trial period and SOC 2 compliance. Humanlike enables businesses to scale sub-linearly, grow without increasing headcount, and reduce reliance on outsourcing. It boasts 24/7 availability, a 4-week implementation time, and an average cost reduction of 80% by shortening cycle time, automating exception handling, and reducing AP/AR processing costs.

wallet.AI

wallet.AI is an AI application that provides smart machines to inform users about their financial behavior and help them make better daily financial decisions. Founded in San Francisco in 2012, wallet.AI builds intelligent engines that analyze millions of pieces of data to offer personalized insights and recommendations to users. The application aims to empower individuals to manage their finances more effectively by leveraging artificial intelligence technology.

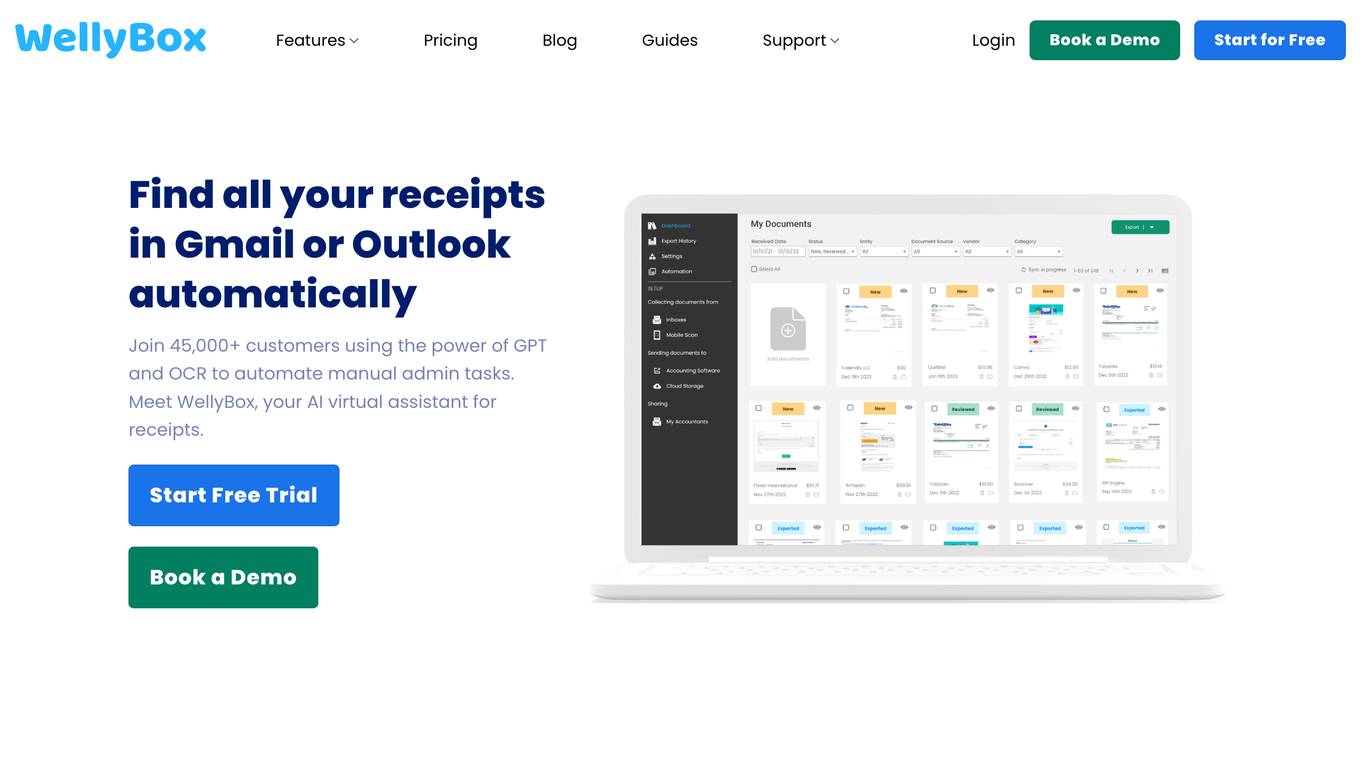

WellyBox

WellyBox is an AI-powered platform designed to help individuals and businesses organize receipts and invoices efficiently. With advanced AI technology, WellyBox automates the collection, analysis, and integration of financial documents from various sources, streamlining the process of managing expenses and improving overall financial operations. The platform offers features such as receipt scanning, automatic data extraction, integration with accounting software, and secure storage of receipts. WellyBox is a comprehensive solution for businesses looking to simplify their receipt management and enhance productivity.

Finance Brain

Finance Brain is an AI-powered assistant that provides instant answers for finance and accounting questions. It offers unlimited access for a monthly fee of $20 and allows new users to ask 3 free questions. The platform also supports uploading video files for analysis.

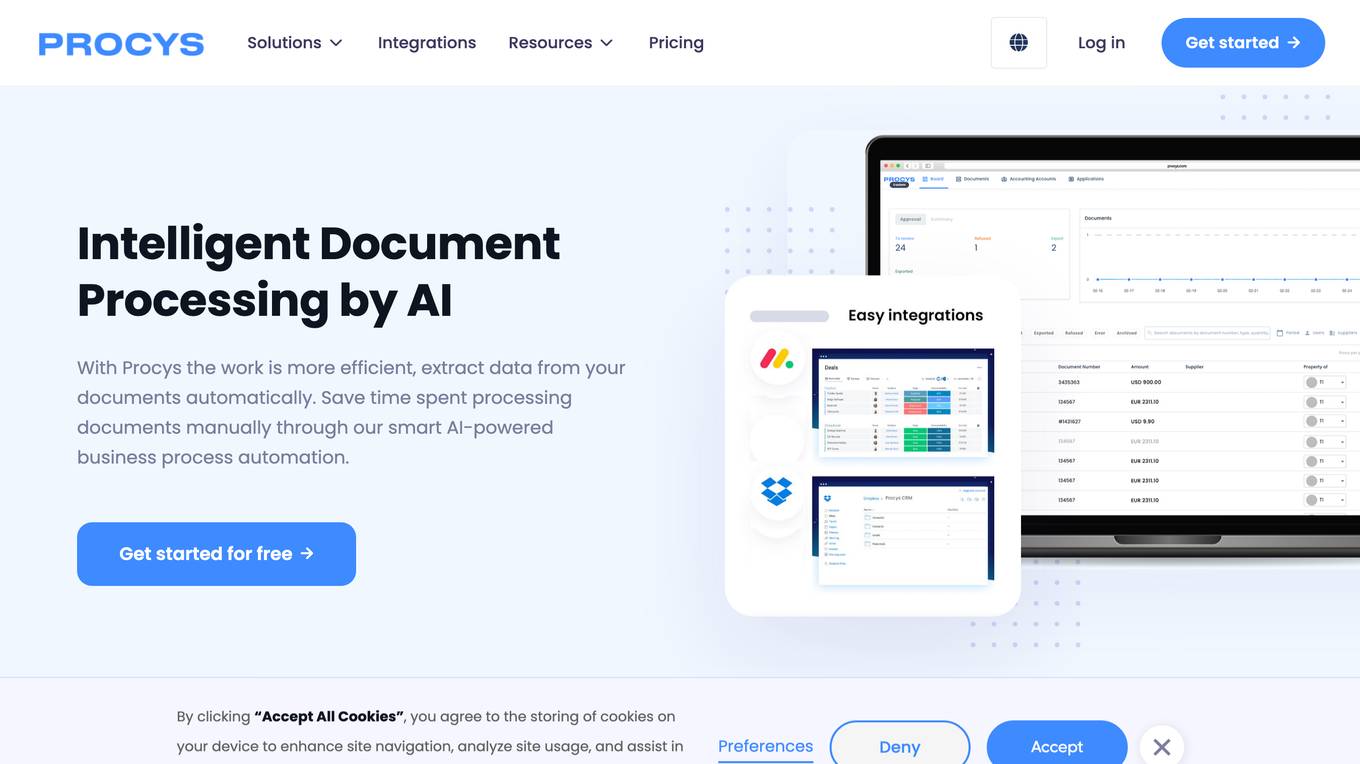

Procys

Procys is a document processing platform powered by AI solutions. It offers a self-learning engine for document processing, seamless integration with over 260 apps, OCR API powered by AI for optical character recognition, customized data extraction capabilities, and AI autosplit feature for automatic document splitting. Procys caters to various industries such as accounting firms, travel & hospitality, and restaurants, providing solutions for invoice OCR, purchase order OCR, ID card OCR, and receipt OCR. The platform aims to automate and streamline document workflows, saving time, reducing errors, and ensuring compliance for businesses.

Potato.trade

Potato.trade was a service that has been closed down as the company evolved into an AI Finance solutions company called Telescope. The website is no longer active, and users are encouraged to explore the new direction in AI-powered financial solutions at telescope.co.

AI Bank Statement Converter

The AI Bank Statement Converter is an industry-leading tool designed for accountants and bookkeepers to extract data from financial documents using artificial intelligence technology. It offers features such as automated data extraction, integration with accounting software, enhanced security, streamlined workflow, and multi-format conversion capabilities. The tool revolutionizes financial document processing by providing high-precision data extraction, tailored for accounting businesses, and ensuring data security through bank-level encryption. It also offers Intelligent Document Processing (IDP) using AI and machine learning techniques to process structured, semi-structured, and unstructured documents.

SplitMyExpenses

SplitMyExpenses is an AI-powered application designed to simplify shared expenses with friends. It allows users to create groups, split bills effortlessly, track debts, and settle up using integrated payment apps. The app offers modern design, AI receipt itemization, friend data powered by payment apps, and beautiful spending charts to help users manage their expenses efficiently. With over 150 supported currencies and secure handling of data, SplitMyExpenses revolutionizes the age-old problem of bill splitting, providing users with a stress-free experience.

Receipt OCR API

Receipt OCR API by ReceiptUp is an advanced tool that leverages OCR and AI technology to extract structured data from receipt and invoice images. The API offers high accuracy and multilingual support, making it ideal for businesses worldwide to streamline financial operations. With features like multilingual support, high accuracy, support for multiple formats, accounting downloads, and affordability, Receipt OCR API is a powerful tool for efficient receipt management and data extraction.

Bitskout

Bitskout is an AI Front Office platform designed for CPAs and professional services firms to enhance productivity and efficiency. It helps in managing client requests, customer onboarding, and information intake, allowing firms to double their bandwidth without the need for additional headcount. The platform leverages AI technology to streamline workflows, reduce manual tasks, and improve client interactions, ultimately leading to increased profitability and client satisfaction.

CanTax.ai

CanTax.ai is an AI-powered platform offering instant tax help for Canadians. It provides personalized tax advice tailored to individual financial needs, ensuring privacy and security with industry-leading encryption protocols. The platform's artificial intelligence is proficiently trained on federal and provincial tax legislation, offering comprehensive knowledge and 24/7 availability. CanTax aims to simplify the tax filing process and empower Canadians with expert-level tax guidance.

Truewind

Truewind is a next-generation AI-powered accounting solution that brings generative AI to automate accounting tasks for accounting firms, startups, and SMBs. It offers end-to-end services, core AI platform, and month-end close powered by AI. Truewind helps accountants close their books faster, provides AI-powered bookkeeping services, and offers CFO services for strategic scaling. The platform ensures enterprise-grade data security and privacy, and integrates with various accounting systems. Truewind is SOC 2 certified and adheres to strict data privacy policies.

Respaid

Respaid is a B2B collections tool that focuses on respectful and efficient debt recovery. It utilizes AI-powered precision messaging to optimize communication with debtors, resulting in a 50% collection rate and 30x faster performance than traditional methods. The tool offers features such as direct payments, database cleaning, and insights into why customers aren't paying. Respaid aims to protect your brand reputation while helping you recover unpaid invoices in a respectful manner.

Expense Sorted

Expense Sorted is an AI-powered tool designed to automate the categorization of expenses, eliminating the manual effort required every month. By integrating with Google Sheets, users can streamline their workflow and benefit from accurate transaction identification. The tool offers customizable categories to suit personal or business needs, ensuring a seamless user experience.

Airparser

Airparser is an AI-powered email and document parser tool that revolutionizes data extraction by utilizing the GPT parser engine. It allows users to automate the extraction of structured data from various sources such as emails, PDFs, documents, and handwritten texts. With features like automatic extraction, export to multiple platforms, and support for multiple languages, Airparser simplifies data extraction processes for individuals and businesses. The tool ensures data security and offers seamless integration with other applications through APIs and webhooks.

SparkReceipt

SparkReceipt is an AI-powered receipt scanner, expense tracker, and document manager application that streamlines pre-accounting tasks by reducing manual data entry up to 95%. It allows users to scan receipts, invoices, and bank statements, track expenses and income with AI-powered scanning and automatic categorization. The application works in any language and supports 150 currencies. SparkReceipt offers features like automatic data extraction (OCR), forwarding e-receipts from email, managing finances across borders, separating business and personal expenses, real-time profit/loss monitoring, and lightning-fast expense tracking.

ChatNRA

ChatNRA is an innovative platform dedicated to assisting non-US residents in various aspects of launching and managing a US company. Their comprehensive suite of services is designed to streamline the process of establishing a US business presence and navigating the complexities of the American market. They offer services such as LLC and INC formation, tax filing, annual compliance, bookkeeping, and beneficial ownership information. ChatNRA aims to simplify the process for individuals looking to start and manage a US-based business, providing expert guidance and support throughout the journey.

Monarch Money

Monarch Money is an all-in-one money management platform that helps you track your finances, collaborate with your partner or financial advisor, and achieve your financial goals. It offers a variety of features, including budgeting, investment tracking, transaction categorization, and financial planning. Monarch Money is available on the web, iOS, and Android.

Booke AI

Booke AI is an AI-driven bookkeeping software that automates tasks, reduces errors, and improves communication. It uses AI to categorize transactions, extract data from invoices and receipts, and provide expert reconciliation assistance. Booke AI integrates with Xero, QuickBooks, and Zoho Books, and offers a user-friendly client portal for seamless collaboration. With Booke AI, businesses can save time, reduce stress, and improve the accuracy of their bookkeeping.