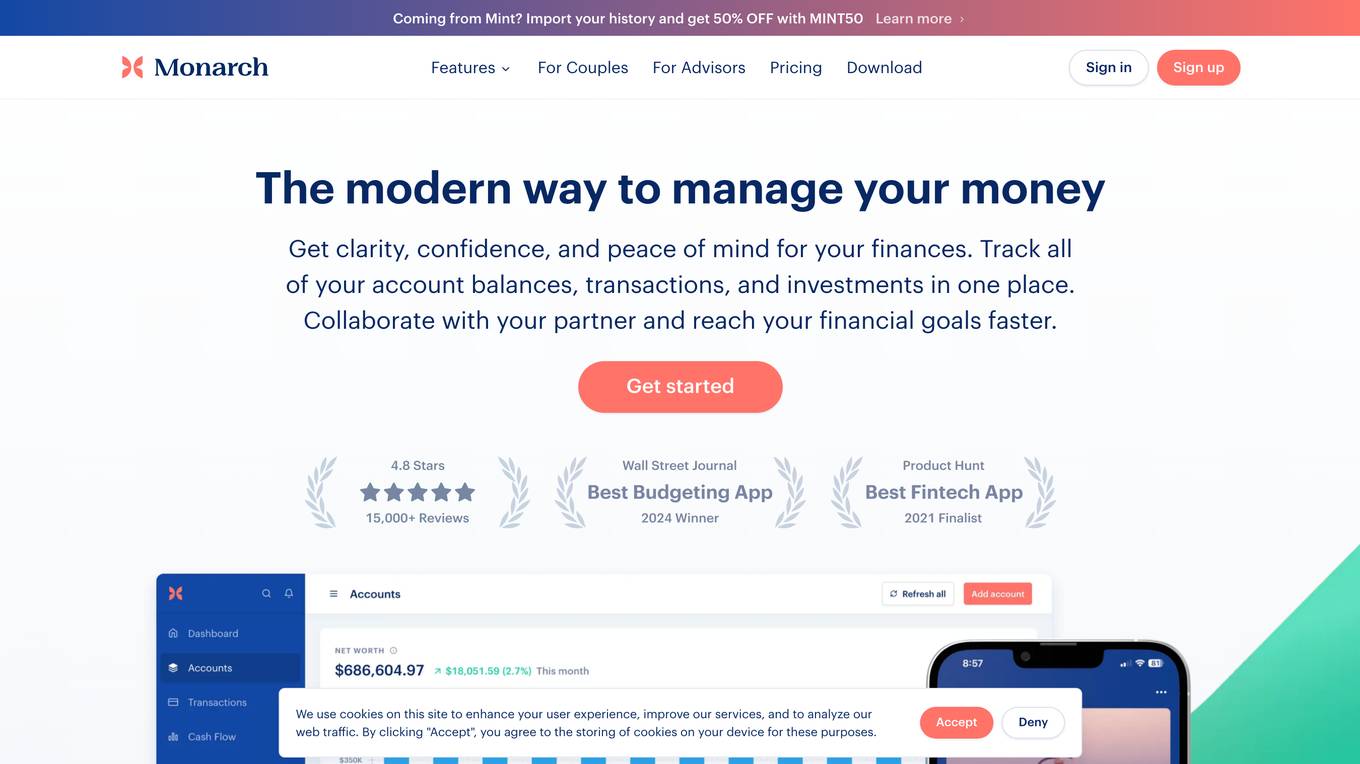

Monarch Money

The modern way to manage your money

Monarch Money is an all-in-one money management platform that helps you track your finances, collaborate with your partner or financial advisor, and achieve your financial goals. It offers a variety of features, including budgeting, investment tracking, transaction categorization, and financial planning. Monarch Money is available on the web, iOS, and Android.

For Tasks:

Click tags to check more tools for each tasksFor Jobs:

Features

Advantages

Disadvantages

Frequently Asked Questions

Alternative AI tools for Monarch Money

Similar sites

Monarch Money

Monarch Money is an all-in-one money management platform that helps you track your finances, collaborate with your partner or financial advisor, and achieve your financial goals. It offers a variety of features, including budgeting, investment tracking, transaction categorization, and financial planning. Monarch Money is available on the web, iOS, and Android.

Origin

Origin is a financial management platform that provides users with a holistic view of their finances, personalized recommendations, and guidance from AI-powered planners and Certified Financial Planners. It offers features such as net worth tracking, budgeting, saving, investing, and tax assistance, all in one place for a monthly fee of $12.99.

Principal

Principal is an AI-powered wealth platform that helps users manage their finances effectively. It offers a comprehensive view of your financial situation, personalized insights, and recommendations to grow your wealth. With bank-grade security, Principal ensures that your data is safe and secure. The platform is free to use with the option to upgrade for more advanced features and capabilities.

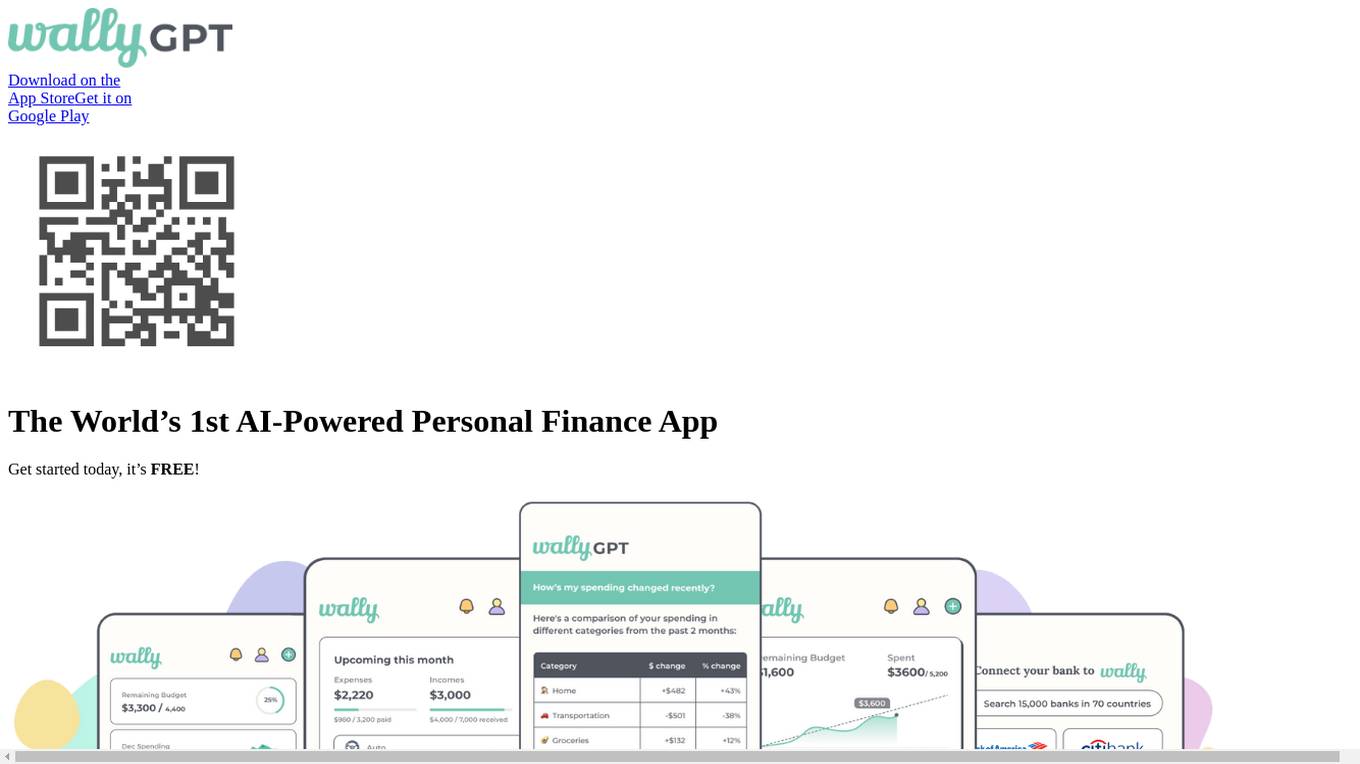

Wally

Wally is the world's first AI-powered personal finance app. It helps you track your spending, create budgets, and plan for the future. Wally is available on iOS and Android devices.

Cleo

Cleo is an AI-powered financial management tool that helps users with budgeting, saving, building credit, and managing their finances. It offers features like cash advances, budgeting tips, credit building tools, and personalized financial advice. Cleo uses AI technology to provide users with insights and recommendations to improve their financial health. The application aims to make money management easy and accessible for everyone, without the need for credit checks or complex financial jargon.

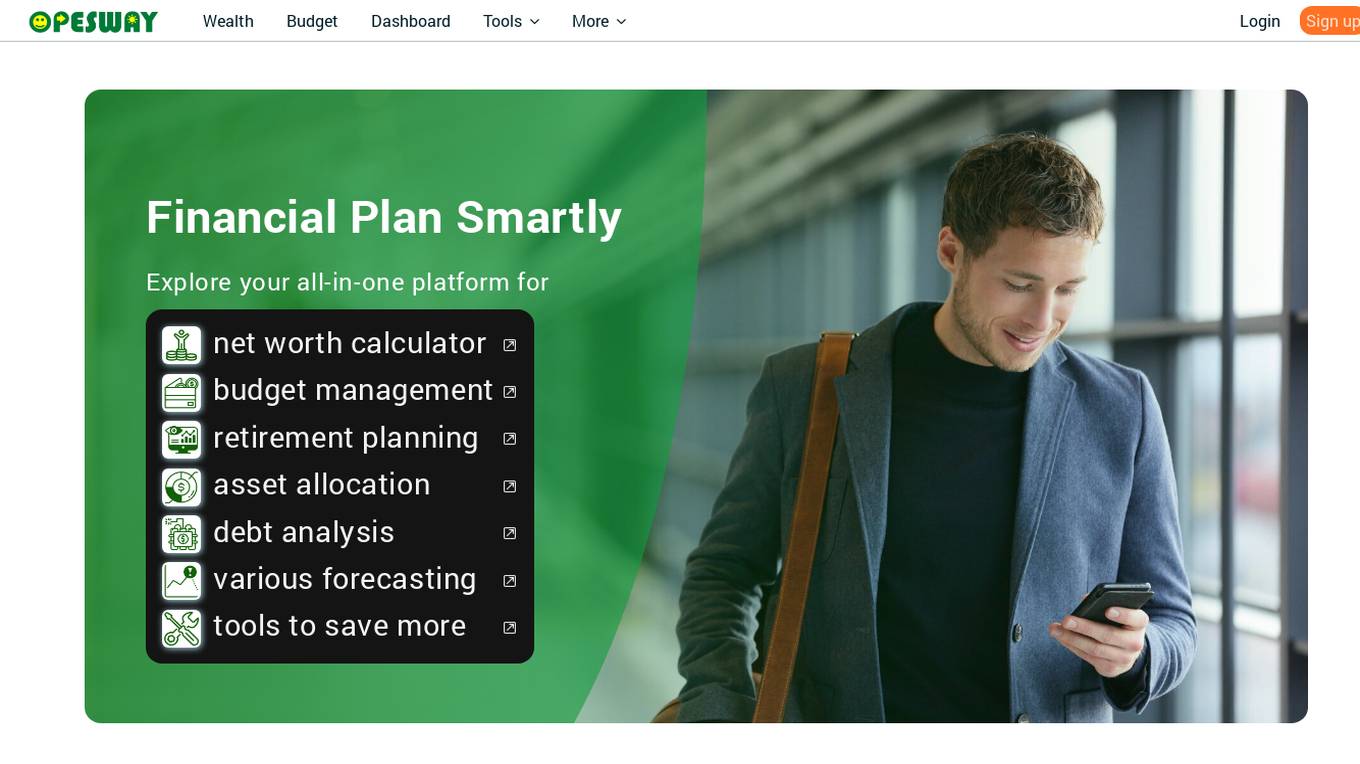

Opesway

Opesway is an AI-powered financial planning platform that offers a comprehensive solution to help users achieve financial freedom and manage their wealth effectively. The platform provides tools for retirement planning, investment assessment, budget management, debt analysis, and various forecasting tools. Opesway uses AI technology to simplify financial management, make budgeting and investment decisions, and provide personalized insights. Users can connect to financial institutions, import spending data, customize budgets, forecast retirement, and compare financial plans. The platform also features a personalized AI chatbot powered by OpenAI's ChatGPT model.

Tendi

Tendi is an AI-powered personal financial advisor designed to make advanced, personalized financial guidance accessible to everyone. It helps users set financial goals, plan, budget, reduce debt, build savings, invest wisely, and ultimately retire. Tendi analyzes spending, saving, and investing behaviors to provide actionable insights and personalized money strategies. The platform aims to bridge the wealth gap by empowering users to navigate their financial journey with confidence.

WeFIRE

WeFIRE is an AI-empowered personal finance copilot that offers personalized financial services 24/7. It helps users gain insights into their financial status, balance spending and earning, prioritize tasks, establish a sustainable mindset for wealth, and track progress towards financial independence. The platform provides personalized solutions based on financial data, comprehensive cashflow overviews, timely alerts, progress tracking tools, educational resources, and top-notch security measures.

Betterment

Betterment is an automated investing platform that helps you build wealth, grow your savings, and plan for retirement. With Betterment, you can invest in a diversified portfolio of stocks and bonds, earn interest on your cash, and get personalized advice from financial experts. Betterment is a fiduciary, which means we act in your best interest. We'll help you set financial goals and set you up with investment portfolios for each goal.

Capchair

Capchair is a personal finance application that leverages AI technology to provide users with a seamless and efficient way to manage their finances. The app offers instant analysis, on-demand insights, and a comprehensive view of all financial data. Users can set budgets, goals, and connect their accounts to track their financial progress. Capchair prioritizes security by implementing bank-level security measures to safeguard users' financial information.

Zevrio Capiture

Zevrio Capiture is an automated investing and cash management platform that offers personalized, effortless investing and savings solutions. It provides users with the ability to customize their investment portfolios, automate savings, optimize performance, and lower taxes. The platform also offers a Cash account with regulated banking partners for everyday cash management, bill payments, ATM withdrawals, and quick investments. Zevrio Capiture aims to make wealth management easy and accessible for users, connecting all their accounts in one app to help them achieve their financial goals.

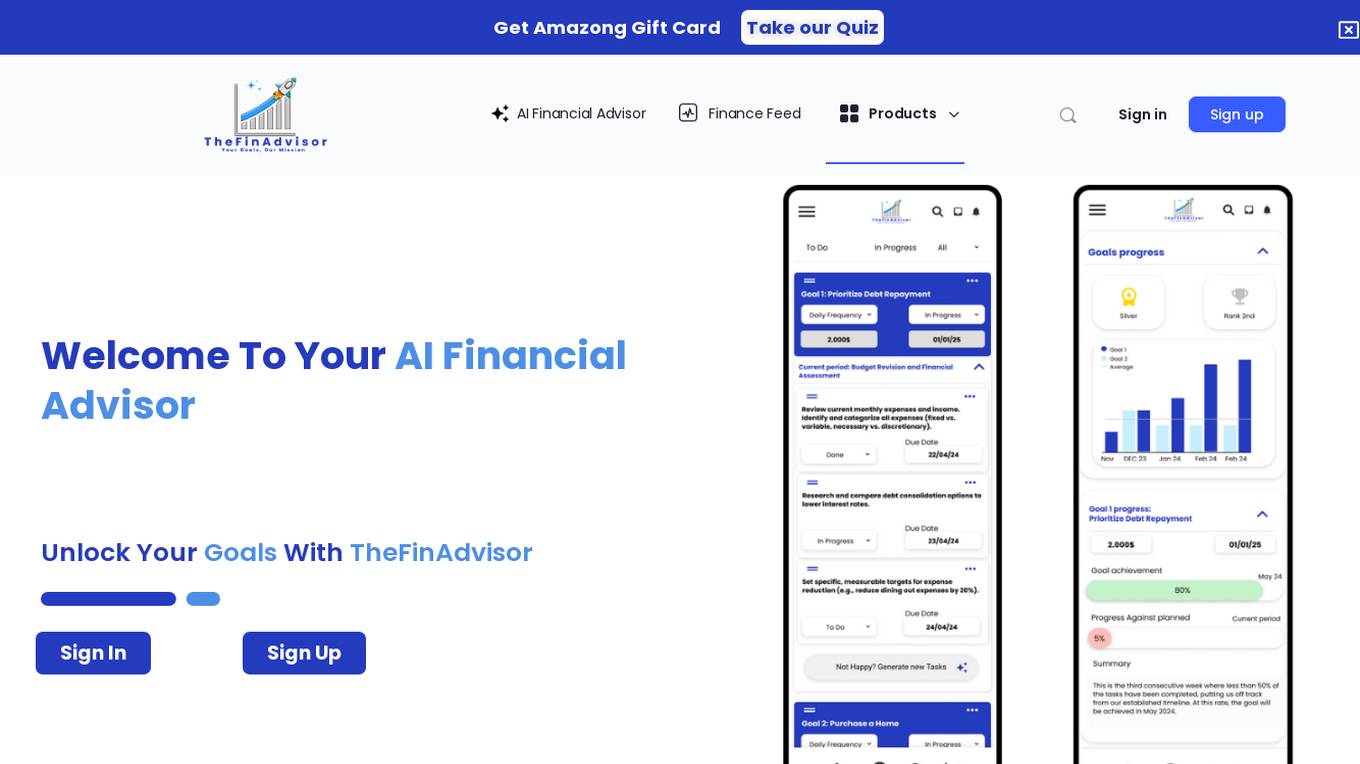

TheFinAdvisor

TheFinAdvisor.com is an AI financial advisor platform that offers personalized investment strategies and expert guidance tailored to individual financial goals. Users can receive assistance in managing student loans, credit cards, debt restructuring, home purchases, car/truck acquisitions, house market investments, early retirement planning, world travel, and business building. The platform also provides insights on financial topics, encourages user questions, and facilitates community connections with financial experts. Additionally, users can explore various financial services, share reviews, and monetize content as financial influencers.

MyInvestment-AI

MyInvestment-AI is an AI-powered personal investment platform that offers tailored investment plans to help users achieve their financial goals. By leveraging advanced algorithms, the platform analyzes users' financial data, goals, and risk tolerance to craft personalized investment strategies. With a user-friendly interface and detailed investment breakdown, MyInvestment-AI simplifies the investment process, providing cost-saving and time-saving benefits. The platform ensures data security and confidentiality, offering a fast, personalized, and data-driven approach to investment planning.

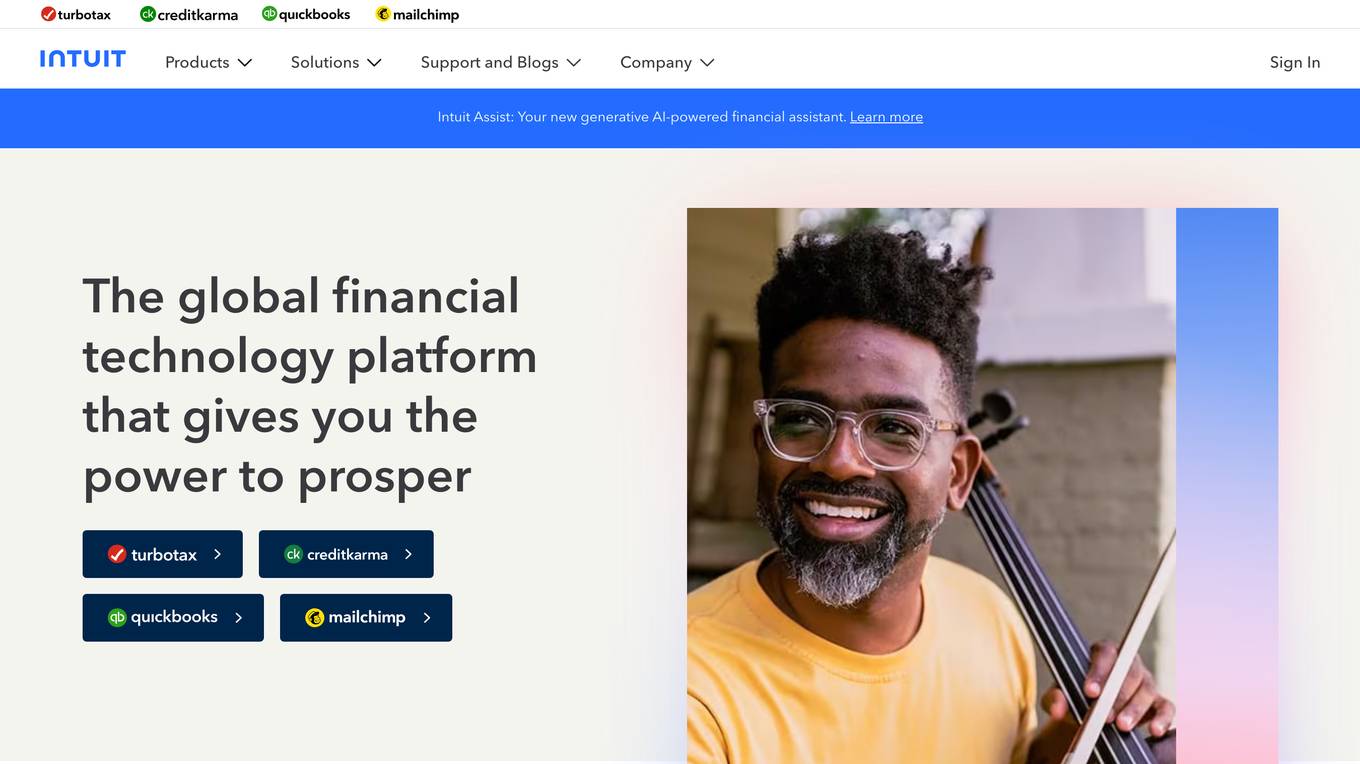

Intuit Assist

Intuit Assist is a generative AI-powered financial assistant designed to help you achieve financial confidence. It is a comprehensive platform that offers a wide range of financial tools and services, including TurboTax, Credit Karma, QuickBooks, and Mailchimp. Intuit Assist can help you with a variety of financial tasks, such as filing your taxes, managing your credit, tracking your expenses, and invoicing your clients. It is a valuable tool for anyone who wants to take control of their finances and achieve financial success.

Pluto.fi

Pluto.fi is an AI investing application that provides users with research, insights, and trading capabilities in one platform. It offers personalized AI assistance for making informed investment decisions, analyzing real-time market data, and optimizing investment portfolios. With access to over 40 data sources, Pluto ensures users stay informed and empowered to make prompt decisions. The application is trusted by individuals taking control of their finances and offers features like scheduled prompts, portfolio optimization, attachments & charts, and syncing of financial accounts.

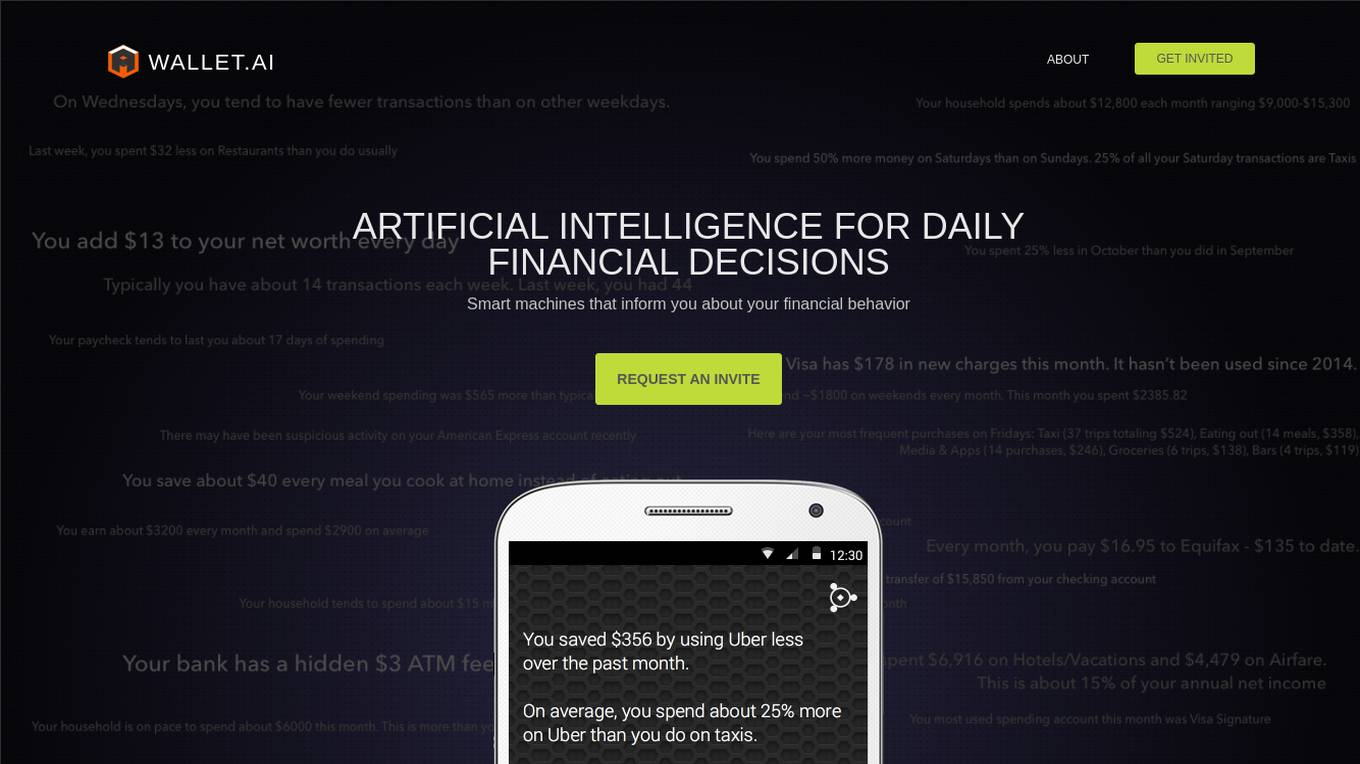

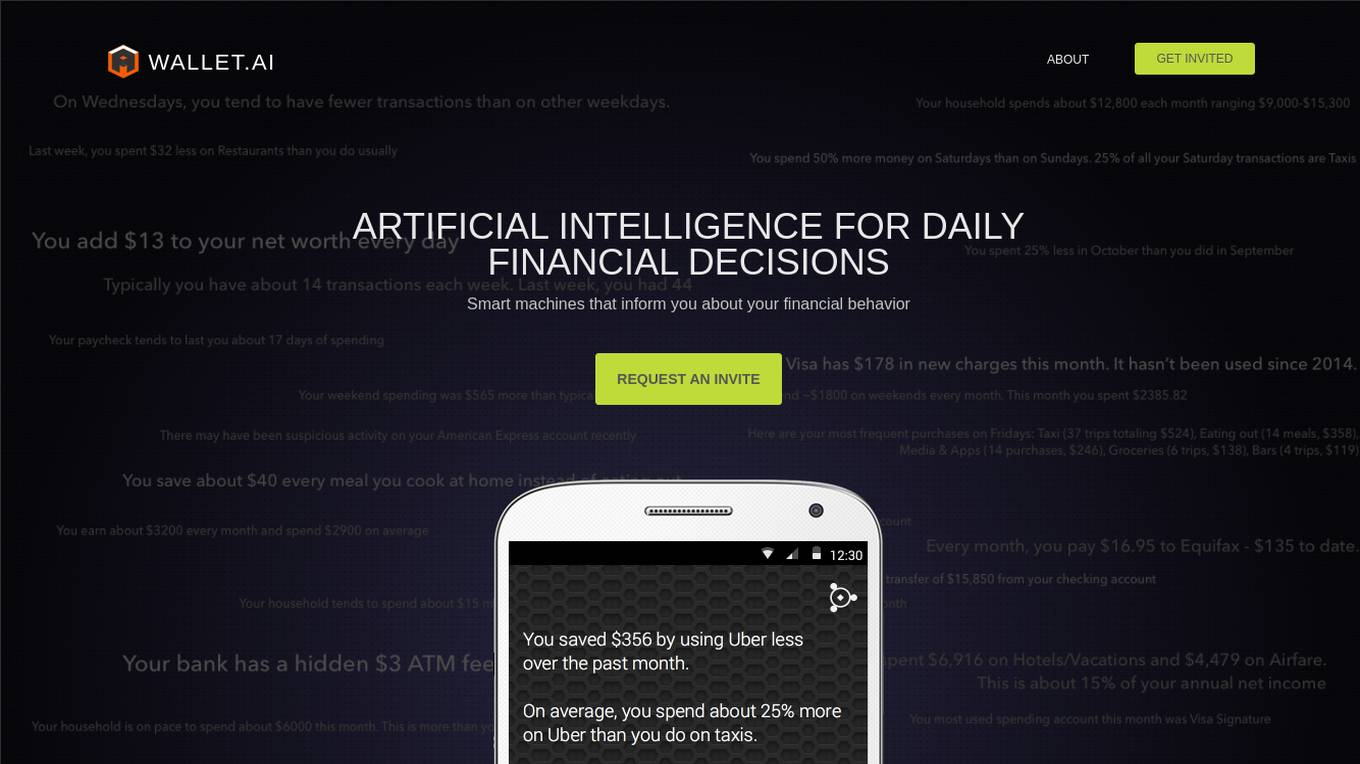

wallet.AI

wallet.AI is an AI application that provides smart machines to inform users about their financial behavior. Founded in San Francisco in 2012, wallet.AI builds intelligent engines that analyze millions of pieces of data to help users make better daily financial decisions. The application aims to assist people in making informed financial choices by leveraging artificial intelligence technology.

For similar tasks

Monarch Money

Monarch Money is an all-in-one money management platform that helps you track your finances, collaborate with your partner or financial advisor, and achieve your financial goals. It offers a variety of features, including budgeting, investment tracking, transaction categorization, and financial planning. Monarch Money is available on the web, iOS, and Android.

Forescribe AI

Forescribe AI is a spend management platform that uses artificial intelligence (AI) to help businesses streamline their spending and fuel growth. The platform provides real-time visibility into spending, automates invoice processing, and identifies opportunities for cost savings. Forescribe AI is designed to help businesses of all sizes improve their financial performance.

Origin

Origin is a financial management platform that provides users with a holistic view of their finances, personalized recommendations, and guidance from AI-powered planners and Certified Financial Planners. It offers features such as net worth tracking, budgeting, saving, investing, and tax assistance, all in one place for a monthly fee of $12.99.

wallet.AI

wallet.AI is an AI application that provides smart machines to inform users about their financial behavior. Founded in San Francisco in 2012, wallet.AI builds intelligent engines that analyze millions of pieces of data to help users make better daily financial decisions. The application aims to assist people in making informed financial choices by leveraging artificial intelligence technology.

Finance Brain

Finance Brain is an AI-powered assistant that provides instant answers for finance and accounting questions. It offers unlimited access for a monthly fee of $20 and allows new users to ask 3 free questions. The platform also supports uploading video files for analysis.

STRATxAI

STRATxAI is an AI-powered quantitative investment platform that offers custom AI model portfolios tailored to clients' investment philosophy, risk tolerance, and objectives. The platform harnesses machine learning to deliver data-driven insights for security analysis, portfolio construction, and management. Powered by the proprietary investment engine Alana, STRATxAI processes over 8 billion financial data points daily to uncover hidden alpha beyond traditional methods. Clients benefit from smarter decision-making, better risk-adjusted returns, optimized portfolio management, and savings on resources. The platform is designed to enhance investment decisions for forward-thinking investors by leveraging AI technology.

Potato.trade

Potato.trade was a service that has been closed down as the company evolved into an AI Finance solutions company called Telescope. The website is no longer active, and users are encouraged to explore the new direction in AI-powered financial solutions at telescope.co.

KGiSL

KGiSL is a BFSI-centric multiproduct enterprise software company focused on insurance, capital markets, and wealth management segments, delivering AI and ML-driven products for a transformative edge. The company offers a wide range of solutions for various industries, including digital transformation, automation, analytics, and IT infrastructure management. KGiSL aims to empower its clients through innovative technologies such as Machine Learning, Artificial Intelligence, Analytics, and Cloud services to enhance productivity and deliver exceptional customer experiences.

Pluto.fi

Pluto.fi is an AI investing application that provides users with research, insights, and trading capabilities in one platform. It offers personalized AI assistance for making informed investment decisions, analyzing real-time market data, and optimizing investment portfolios. With access to over 40 data sources, Pluto ensures users stay informed and empowered to make prompt decisions. The application is trusted by individuals taking control of their finances and offers features like scheduled prompts, portfolio optimization, attachments & charts, and syncing of financial accounts.

Wally

Wally is the world's first AI-powered personal finance app. It helps you track your spending, create budgets, and plan for the future. Wally is available on iOS and Android devices.

Ailtra AI Crypto Bot

Ailtra's AI Crypto Bot is a revolutionary trading tool that leverages artificial intelligence to maximize profits and minimize losses in the cryptocurrency market. With its advanced algorithms, smart fund management, and risk-free trading experience, Ailtra empowers traders of all levels to achieve consistent profitability. The AI Crypto Bot's 13 levels of holding capacity and intelligent trading strategies ensure that your investments are in capable hands, guiding you through the complexities of the crypto market.

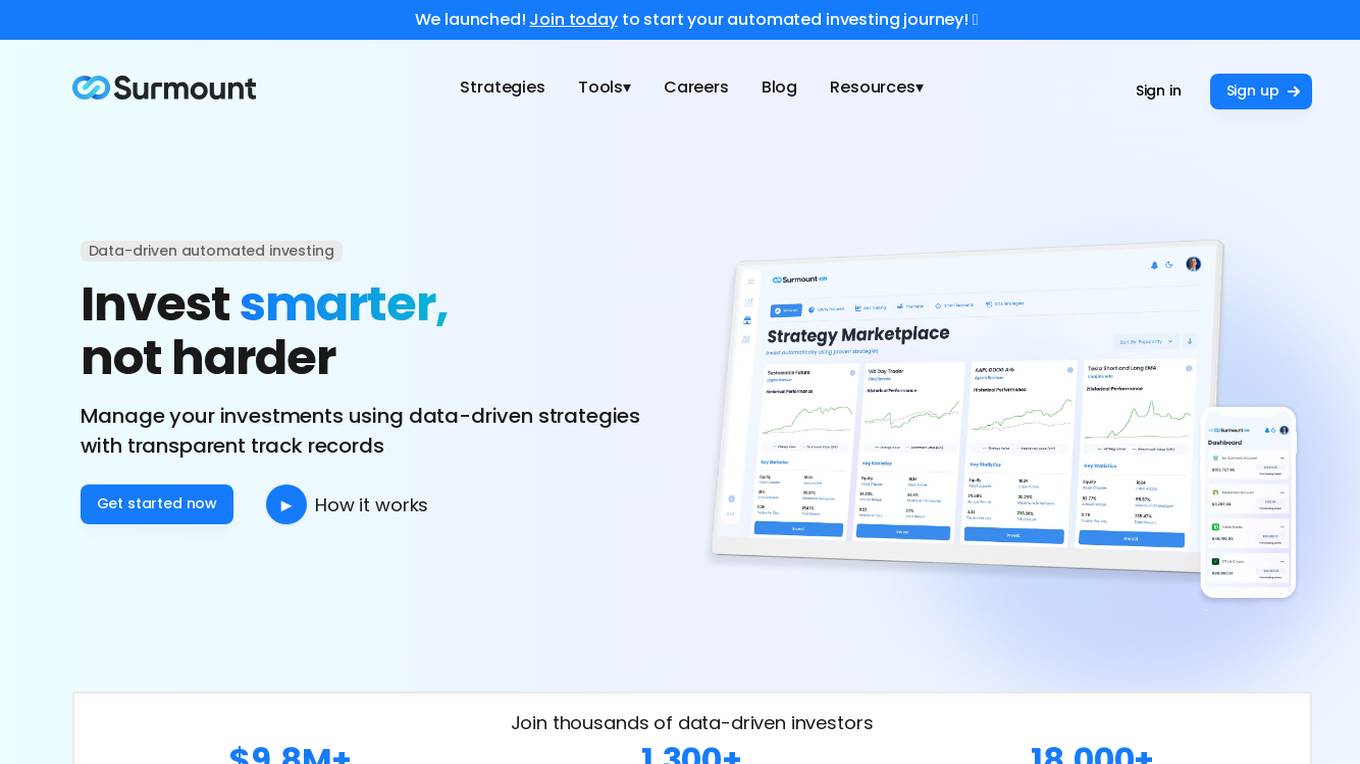

Surmount AI

Surmount AI is an automated investing platform designed to make investing accessible to everyone. It utilizes advanced algorithms to provide users with personalized investment strategies based on their financial goals and risk tolerance. With Surmount AI, users can easily create and manage their investment portfolios, track performance, and receive real-time insights to make informed decisions. The platform aims to democratize investing by removing barriers to entry and empowering individuals to grow their wealth through intelligent automation.

Bhavv

Bhavv is India's first and most powerful AI platform for Nifty and Bank Nifty Options buying. The platform offers automated trade management, personalized risk management, integrated stop loss, and a user-friendly interface. Bhavv's AI algorithms continuously analyze market data to create and manage a diversified trading portfolio tailored to individual goals and risk tolerance. The platform aims to revolutionize trading by simplifying the process and making it more accessible and enjoyable for traders.

Financial Planning

The Financial Planning website is a comprehensive platform that offers insights and resources on various aspects of financial planning, including tax investing, wealth management, estate planning, retirement planning, practice management, regulation and compliance, technology, industry news, and opinion pieces. The site covers a wide range of topics relevant to financial advisors and professionals in the wealth management industry. It also features articles on emerging trends, investment strategies, industry updates, and expert opinions to help readers stay informed and make informed decisions.

Streetbeat

Streetbeat is an innovative investment platform that simplifies and automates investing activities. It serves as a solution for navigating the complexity of financial markets and deriving actionable insights. Streetbeat offers AI Agents for businesses to automate tasks and enhance client services, while individuals can access an AI-powered financial advisor to manage investments. The platform aims to make investing more accessible and efficient for users.

AskJimmy

AskJimmy is a platform for AI agents focused on finance and trading. It offers exposure to a diverse range of strategies managed by top-notch AI Agents. The platform allows users to compose autonomous agents and trading strategies with extreme customization. It aims to create a decentralized multi-strategy collaborative hedge-fund powered by AI agents. AskJimmy is designed to aggregate non-correlated autonomous agent strategies into a diversified subnet, shaping the future of multi-strategies decentralized hedge-fund.

Jobs Originalis

Jobs Originalis is an Intelligent Composable OS designed for the Private Capital Markets. It aims to help users save time and focus on the creative aspects of their work. The platform offers a range of tools and features to streamline processes and enhance productivity in the private capital market sector.

RockFlow

RockFlow is an AI-powered fintech platform that simplifies investing by offering AI-first trading experiences. The platform, powered by Bobby AI, allows users to build AI portfolios, execute trades, manage portfolios, and receive real-time trading opportunities. With features like Copy Trading, simplified options trading, and access to a wide range of investment products, RockFlow aims to empower users to make informed investment decisions effortlessly. The platform also prioritizes customer service and security, ensuring a safe and reliable trading environment for users.

wallet.AI

wallet.AI is an AI application that provides smart machines to inform users about their financial behavior and help them make better daily financial decisions. Founded in San Francisco in 2012, wallet.AI builds intelligent engines that analyze millions of pieces of data to offer personalized insights and recommendations to users. The application aims to empower individuals to manage their finances more effectively by leveraging artificial intelligence technology.

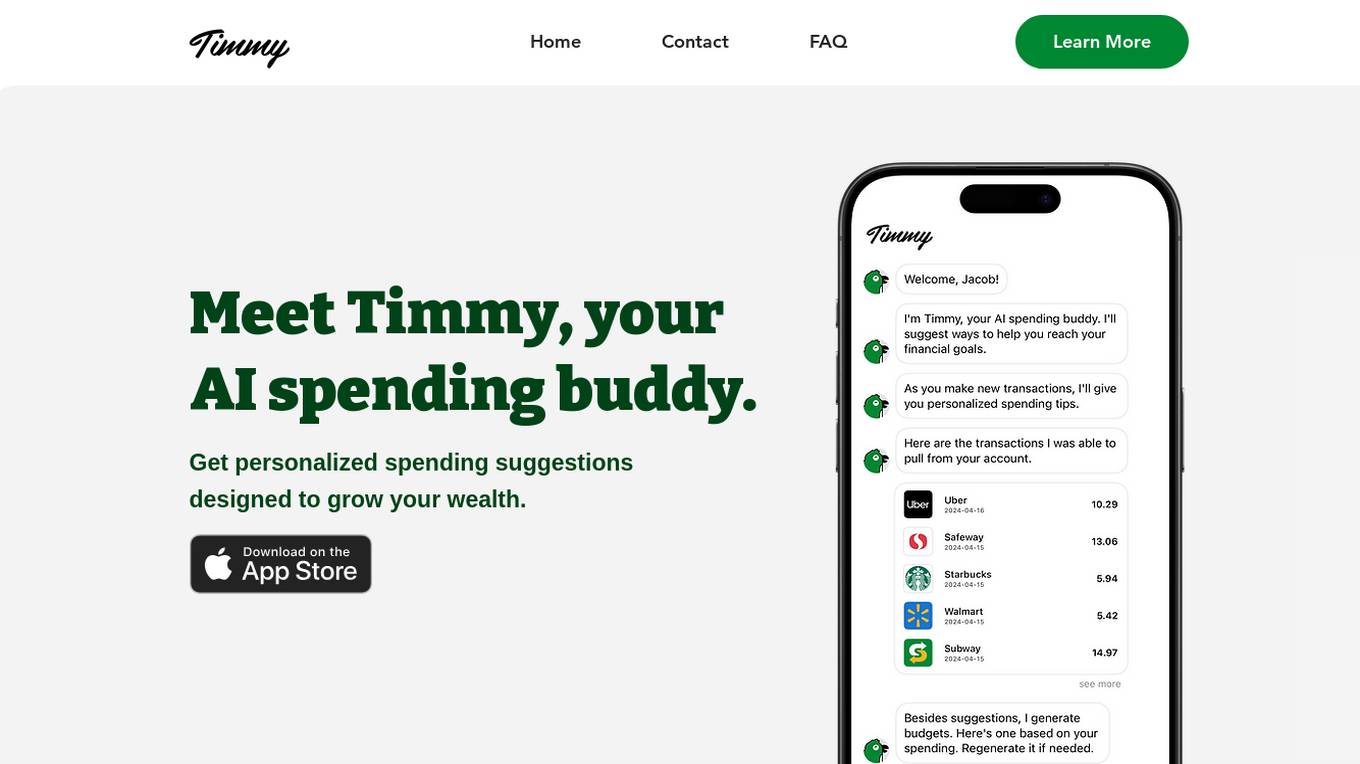

Timmy

Timmy is an AI spending buddy designed to help users save money faster and grow their wealth. It provides personalized spending suggestions, tracks spending in real-time, suggests budgets, and offers weekly tasks to achieve financial goals. Users can subscribe to the newsletter for product updates and releases, but should exercise caution and seek professional advice for financial decisions.

For similar jobs

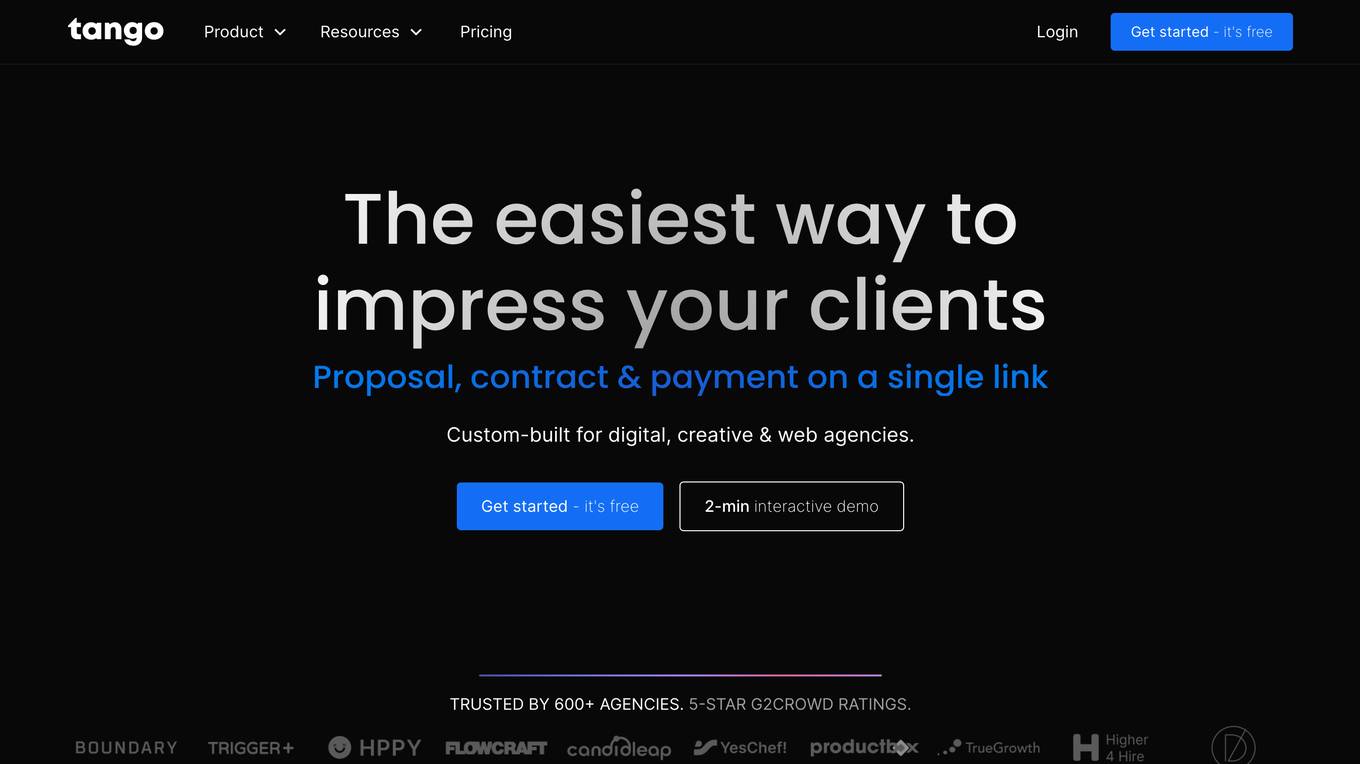

Tango

Tango is a comprehensive platform designed to automate and streamline contract management, billing, and payment processes for small and medium professional services practices and consultancies. It offers clear scope definition, transparent contracts, automated billing, and easy payment options to help businesses save time, reduce administrative tasks, and improve client relationships. With features like self-service contracts, key term highlighting, automated invoicing, and multiple payment methods, Tango aims to simplify the entire workflow from client engagement to payment collection. Trusted by over 600 practices, studios, and agencies, Tango is a trusted solution for businesses looking to enhance efficiency and profitability.

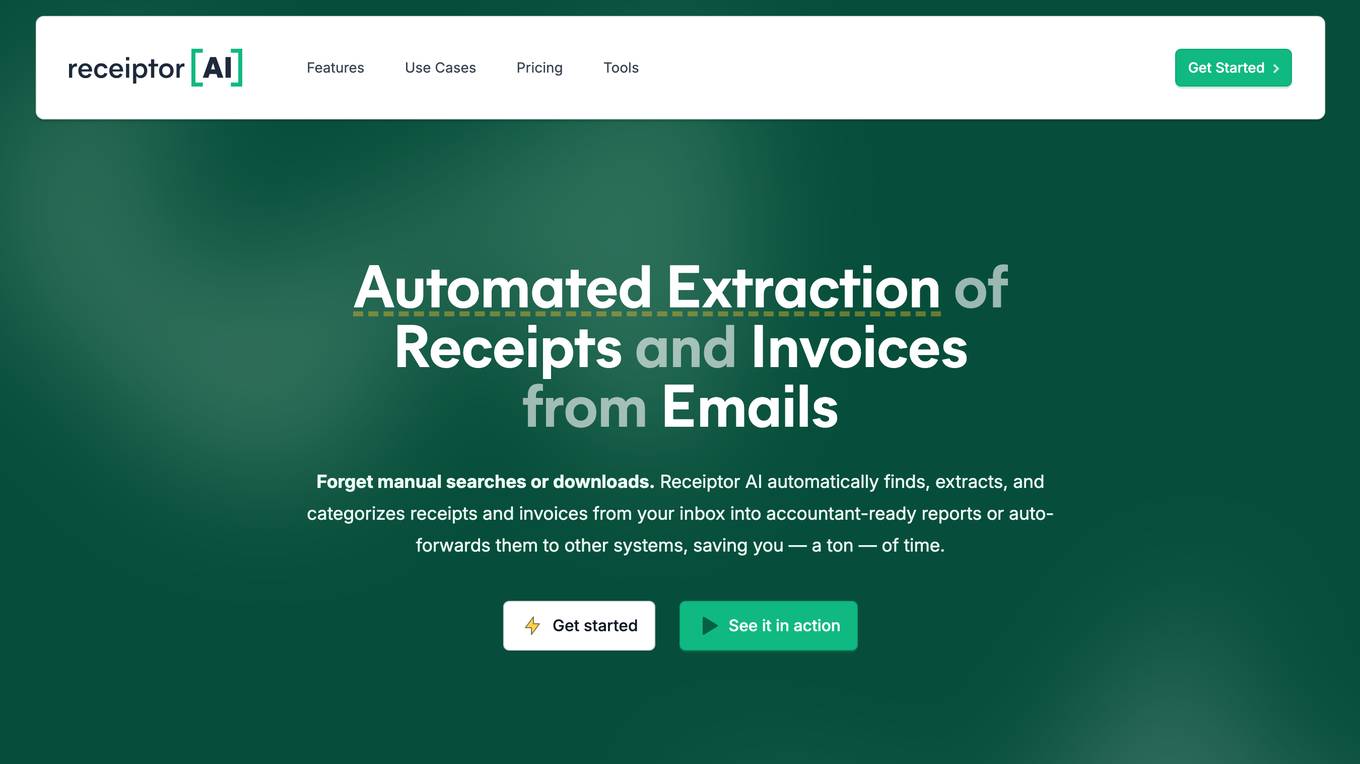

Receiptor AI

Receiptor AI is an automated bookkeeping tool that leverages artificial intelligence to streamline the process of managing receipts and invoices. It finds, extracts, categorizes, and syncs data from various sources like emails, WhatsApp, and manual uploads to accounting software such as Xero and QuickBooks. The tool aims to save time, money, and reduce stress by automating tedious bookkeeping tasks, making financial records always complete and audit-ready. With features like automatic extraction, retroactive email analysis, real-time expense analytics, and smart AI categorization, Receiptor AI offers a novel approach to accounting that simplifies the workflow for individuals, businesses, and accountants.

AITax

AITax.com is a website that appears to be related to tax services, but due to a privacy error, the connection is not secure. The site seems to have an expired security certificate, which may pose a risk to users' information security. The site prompts users to proceed at their own risk, indicating potential security vulnerabilities.

Taxly

Taxly is a user-friendly online platform designed to automate the process of UAE corporate tax filing for small and medium enterprises (SMEs), free zone entities, and accountants. The application simplifies tax compliance by allowing users to upload their financial data and receive FTA-ready tax returns. Taxly provides real-time tax insights, instant tax projections, and built-in compliance assistance to help users navigate the complexities of UAE tax regulations. With a focus on simplicity and efficiency, Taxly aims to streamline the tax filing process for businesses in the UAE.

Itemery

Itemery is an Office Inventory Software designed for small and medium businesses, offering an AI-based Inventory Management Solution. It allows users to easily manage and control their property inventory using AI technology. With features like integration with Excel and Google Threads, importing existing property databases, AI item recognition through the mobile app, and easy inventory tracking, Itemery simplifies the process of asset management for companies of all sizes. The application offers different subscription plans catering to varying needs and budgets, making it a versatile solution for businesses looking to streamline their inventory processes.

Ramp

Ramp is a comprehensive financial management platform that offers Spend Management, Corporate Cards, and Accounts Payable Solutions. It provides easy-to-use corporate cards, bill payments, accounting, and more, all in one place. With Ramp, finance teams can save time and money by streamlining processes and automating tasks. The platform is designed to make finance teams faster and happier, with features like expense management, travel control, accounts payable processing, and accounting automation. Ramp is trusted by over 40,000 finance teams worldwide to save millions of hours and improve efficiency in financial operations.

Kintsugi Vertex

Kintsugi Vertex is an AI-powered sales tax automation tool designed to help companies globally in monitoring, filing, and optimizing sales tax. It automates compliance in three simple steps: connecting and monitoring billing, payment, and HR systems; registering and collecting the right tax with precise rules; and remitting and filing taxes seamlessly. The tool eliminates manual tax calculations, compliance headaches, and unexpected fees, making tax reporting and filing a breeze. It offers white glove support and accurate Nexus tracking to ensure compliance without the complexity of tax requirements. Kintsugi Vertex is trusted by leading businesses worldwide for its end-to-end tax compliance solutions.

Humanlike

Humanlike is an AI-powered AP/AR tool that helps businesses cut AP/AR costs by 80%. It offers a better alternative to outsourcing accounts payable and receivable by using human-like AI to process invoices efficiently and accurately. Developed by fintech veterans from Stripe and Modern Treasury, Humanlike streamlines cashflow management processes, allowing businesses to scale sub-linearly and grow without increasing headcount. The tool provides a risk-free trial period, is SOC 2 compliant, and boasts features such as 24/7 availability, 4-week implementation time, and an average cost reduction of 80%. With Humanlike, businesses can shorten cycle time, automate exception handling, and significantly reduce AP/AR processing costs.

wallet.AI

wallet.AI is an AI application that provides smart machines to inform users about their financial behavior and help them make better daily financial decisions. Founded in San Francisco in 2012, wallet.AI builds intelligent engines that analyze millions of pieces of data to offer personalized insights and recommendations to users. The application aims to empower individuals to manage their finances more effectively by leveraging artificial intelligence technology.

WellyBox

WellyBox is an AI-powered platform designed to help individuals and businesses organize receipts and invoices efficiently. With advanced AI technology, WellyBox automates the collection, analysis, and integration of financial documents from various sources, streamlining the process of managing expenses and improving overall financial operations. The platform offers features such as receipt scanning, automatic data extraction, integration with accounting software, and secure storage of receipts. WellyBox is a comprehensive solution for businesses looking to simplify their receipt management and enhance productivity.

Finance Brain

Finance Brain is an AI-powered assistant that provides instant answers for finance and accounting questions. It offers unlimited access for a monthly fee of $20 and allows new users to ask 3 free questions. The platform also supports uploading video files for analysis.

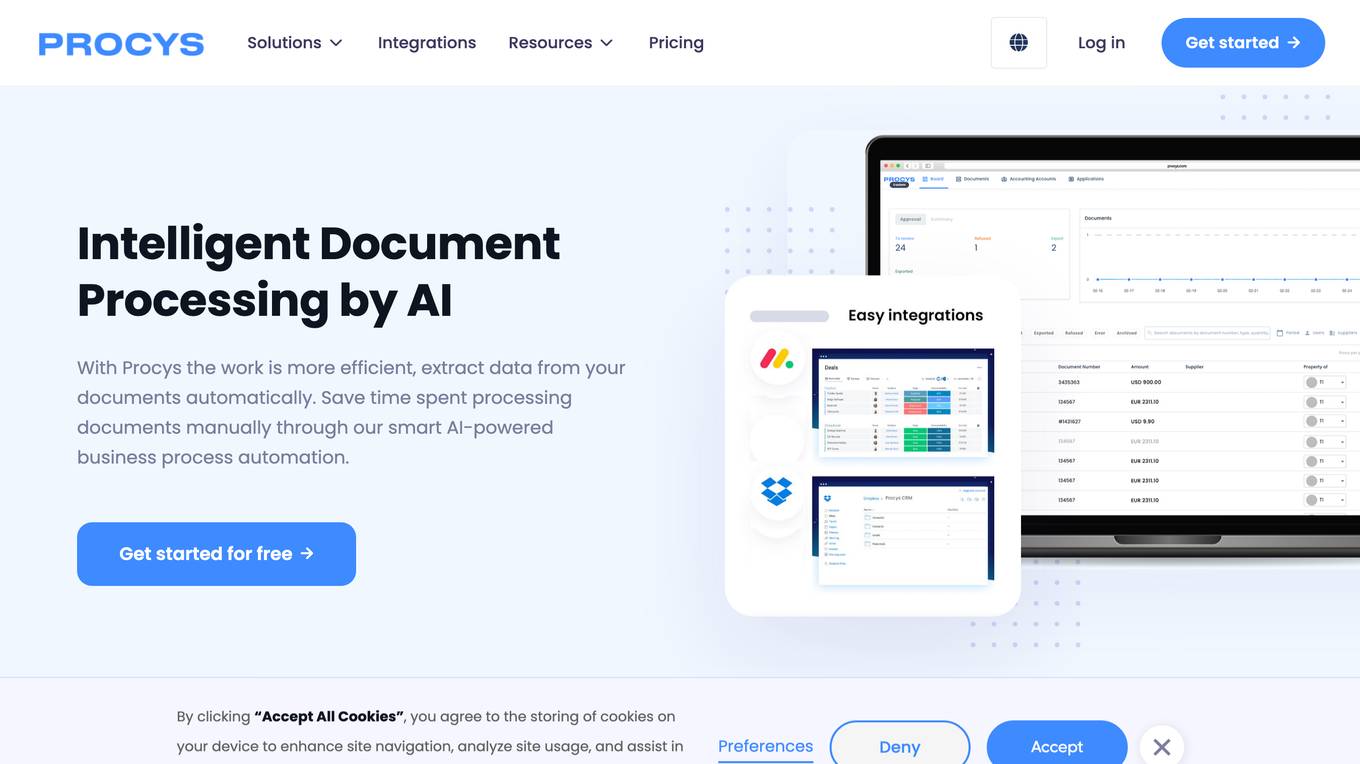

Procys

Procys is a document processing platform powered by AI solutions. It offers a self-learning engine for document processing, seamless integration with over 260 apps, OCR API powered by AI for optical character recognition, customized data extraction capabilities, and AI autosplit feature for automatic document splitting. Procys caters to various industries such as accounting firms, travel & hospitality, and restaurants, providing solutions for invoice OCR, purchase order OCR, ID card OCR, and receipt OCR. The platform aims to automate and streamline document workflows, saving time, reducing errors, and ensuring compliance for businesses.

Potato.trade

Potato.trade was a service that has been closed down as the company evolved into an AI Finance solutions company called Telescope. The website is no longer active, and users are encouraged to explore the new direction in AI-powered financial solutions at telescope.co.

AI Bank Statement Converter

The AI Bank Statement Converter is an industry-leading tool designed for accountants and bookkeepers to extract data from financial documents using artificial intelligence technology. It offers features such as automated data extraction, integration with accounting software, enhanced security, streamlined workflow, and multi-format conversion capabilities. The tool revolutionizes financial document processing by providing high-precision data extraction, tailored for accounting businesses, and ensuring data security through bank-level encryption. It also offers Intelligent Document Processing (IDP) using AI and machine learning techniques to process structured, semi-structured, and unstructured documents.

SplitMyExpenses

SplitMyExpenses is an AI-powered application designed to simplify shared expenses with friends. It allows users to create groups, split bills effortlessly, track debts, and settle up using integrated payment apps. The app offers modern design, AI receipt itemization, friend data powered by payment apps, and beautiful spending charts to help users manage their expenses efficiently. With over 150 supported currencies and secure handling of data, SplitMyExpenses revolutionizes the age-old problem of bill splitting, providing users with a stress-free experience.

Receipt OCR API

Receipt OCR API by ReceiptUp is an advanced tool that leverages OCR and AI technology to extract structured data from receipt and invoice images. The API offers high accuracy and multilingual support, making it ideal for businesses worldwide to streamline financial operations. With features like multilingual support, high accuracy, support for multiple formats, accounting downloads, and affordability, Receipt OCR API is a powerful tool for efficient receipt management and data extraction.

Bitskout

Bitskout is an AI Front Office platform designed for CPAs and professional services firms to enhance productivity and efficiency. It helps in managing client requests, customer onboarding, and information intake, allowing firms to double their bandwidth without the need for additional headcount. The platform leverages AI technology to streamline workflows, reduce manual tasks, and improve client interactions, ultimately leading to increased profitability and client satisfaction.

CanTax.ai

CanTax.ai is an AI-powered platform offering instant tax help for Canadians. It provides personalized tax advice tailored to individual financial needs, ensuring privacy and security with industry-leading encryption protocols. The platform's artificial intelligence is proficiently trained on federal and provincial tax legislation, offering comprehensive knowledge and 24/7 availability. CanTax aims to simplify the tax filing process and empower Canadians with expert-level tax guidance.

Truewind

Truewind is a next-generation AI-powered accounting solution that brings generative AI to automate accounting tasks for accounting firms, startups, and SMBs. It offers end-to-end services, core AI platform, and month-end close powered by AI. Truewind helps accountants close their books faster, provides AI-powered bookkeeping services, and offers CFO services for strategic scaling. The platform ensures enterprise-grade data security and privacy, and integrates with various accounting systems. Truewind is SOC 2 certified and adheres to strict data privacy policies.

Respaid

Respaid is a B2B collections tool that focuses on respectful and efficient debt recovery. It utilizes AI-powered precision messaging to optimize communication with debtors, resulting in a 50% collection rate and 30x faster performance than traditional methods. The tool offers features such as direct payments, database cleaning, and insights into why customers aren't paying. Respaid aims to protect your brand reputation while helping you recover unpaid invoices in a respectful manner.

Expense Sorted

Expense Sorted is an AI-powered tool designed to automate the categorization of expenses, eliminating the manual effort required every month. By integrating with Google Sheets, users can streamline their workflow and benefit from accurate transaction identification. The tool offers customizable categories to suit personal or business needs, ensuring a seamless user experience.

Airparser

Airparser is an AI-powered email and document parser tool that revolutionizes data extraction by utilizing the GPT parser engine. It allows users to automate the extraction of structured data from various sources such as emails, PDFs, documents, and handwritten texts. With features like automatic extraction, export to multiple platforms, and support for multiple languages, Airparser simplifies data extraction processes for individuals and businesses. The tool ensures data security and offers seamless integration with other applications through APIs and webhooks.

SparkReceipt

SparkReceipt is an AI-powered receipt scanner, expense tracker, and document manager application that streamlines pre-accounting tasks by reducing manual data entry up to 95%. It allows users to scan receipts, invoices, and bank statements, track expenses and income with AI-powered scanning and automatic categorization. The application works in any language and supports 150 currencies. SparkReceipt offers features like automatic data extraction (OCR), forwarding e-receipts from email, managing finances across borders, separating business and personal expenses, real-time profit/loss monitoring, and lightning-fast expense tracking.

ChatNRA

ChatNRA is an innovative platform dedicated to assisting non-US residents in various aspects of launching and managing a US company. Their comprehensive suite of services is designed to streamline the process of establishing a US business presence and navigating the complexities of the American market. They offer services such as LLC and INC formation, tax filing, annual compliance, bookkeeping, and beneficial ownership information. ChatNRA aims to simplify the process for individuals looking to start and manage a US-based business, providing expert guidance and support throughout the journey.