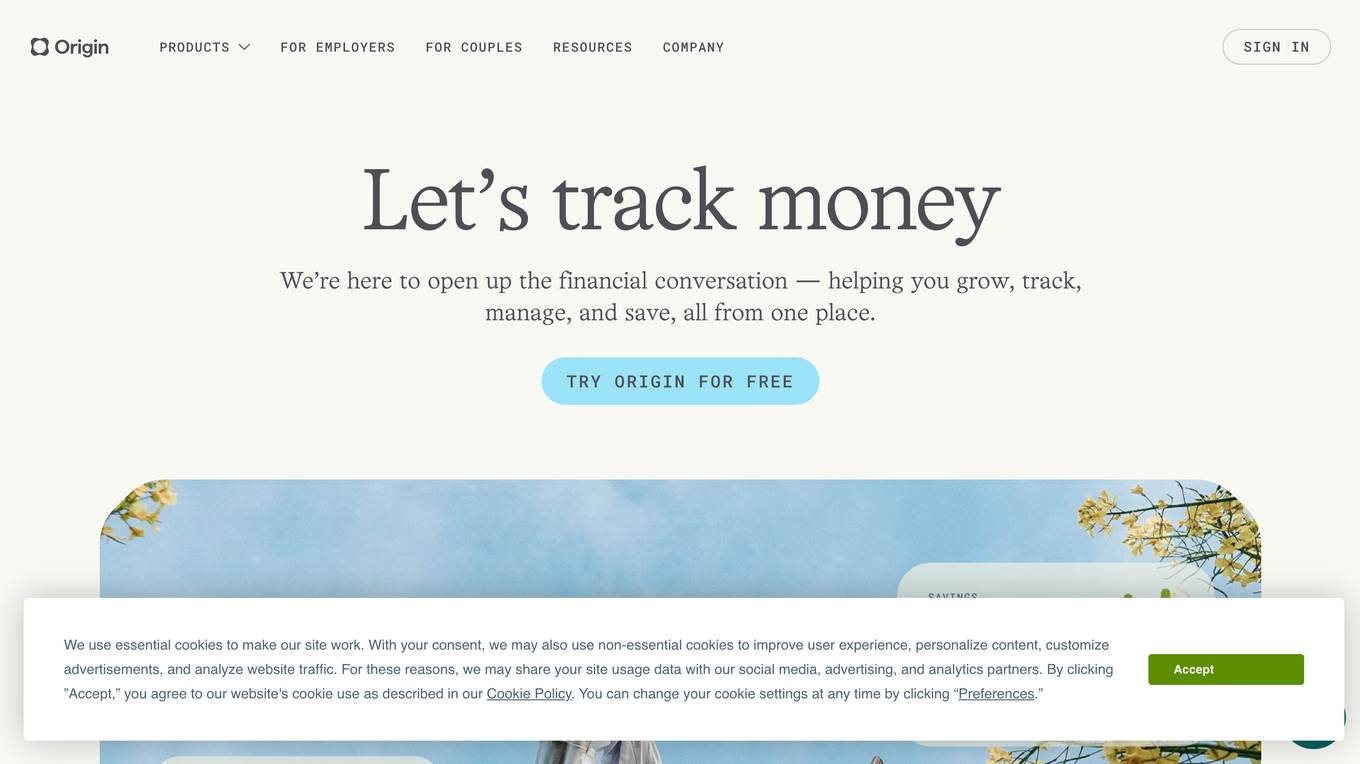

Origin

Let's talk money

Origin is a financial management platform that provides users with a holistic view of their finances, personalized recommendations, and guidance from AI-powered planners and Certified Financial Planners. It offers features such as net worth tracking, budgeting, saving, investing, and tax assistance, all in one place for a monthly fee of $12.99.

For Tasks:

Click tags to check more tools for each tasksFor Jobs:

Features

Advantages

Disadvantages

Frequently Asked Questions

Alternative AI tools for Origin

Similar sites

Origin

Origin is a financial management platform that provides users with a holistic view of their finances, personalized recommendations, and guidance from AI-powered planners and Certified Financial Planners. It offers features such as net worth tracking, budgeting, saving, investing, and tax assistance, all in one place for a monthly fee of $12.99.

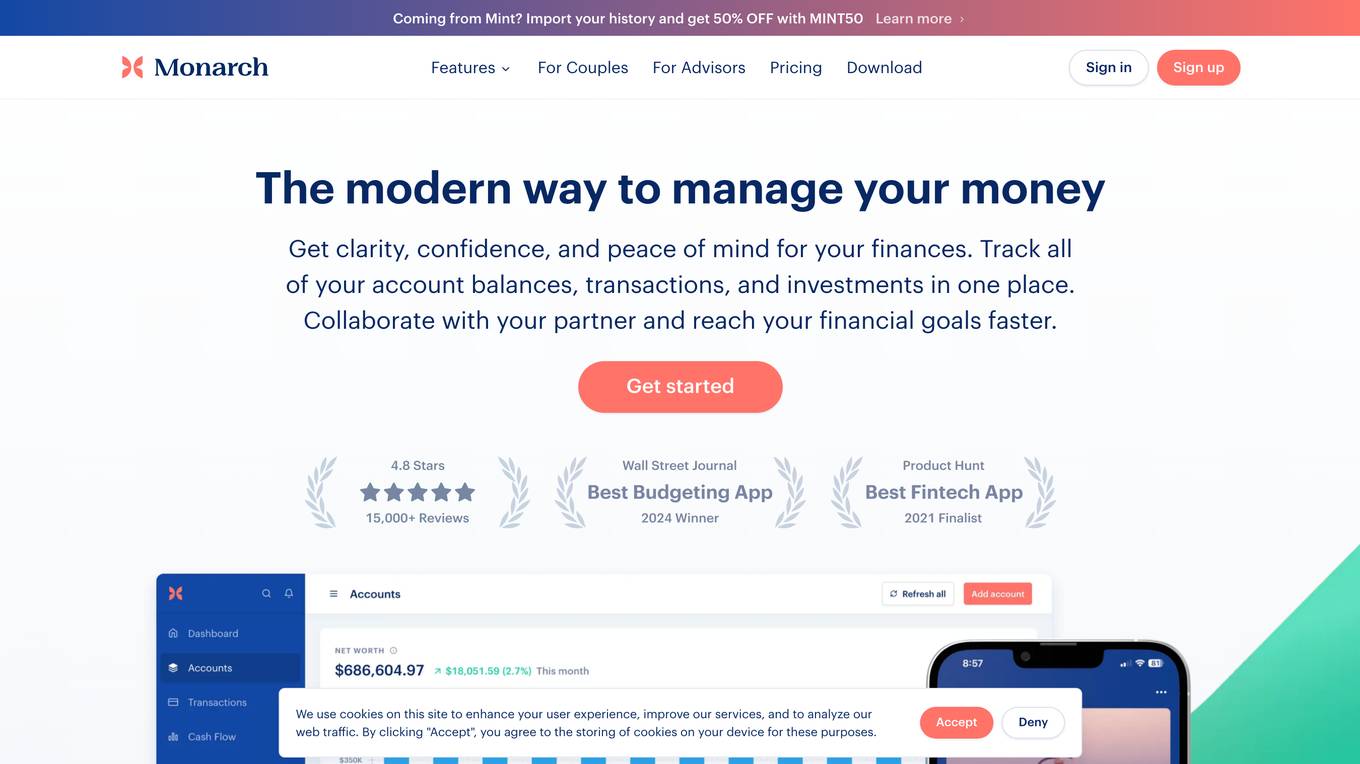

Monarch Money

Monarch Money is an all-in-one money management platform that helps you track your finances, collaborate with your partner or financial advisor, and achieve your financial goals. It offers a variety of features, including budgeting, investment tracking, transaction categorization, and financial planning. Monarch Money is available on the web, iOS, and Android.

Cleo

Cleo is an AI-powered financial management tool that helps users with budgeting, saving, building credit, and managing their finances. It offers features like cash advances, budgeting tips, credit building tools, and personalized financial advice. Cleo uses AI technology to provide users with insights and recommendations to improve their financial health. The application aims to make money management easy and accessible for everyone, without the need for credit checks or complex financial jargon.

Principal

Principal is an AI-powered wealth platform that helps users manage their finances effectively. It offers a comprehensive view of your financial situation, personalized insights, and recommendations to grow your wealth. With bank-grade security, Principal ensures that your data is safe and secure. The platform is free to use with the option to upgrade for more advanced features and capabilities.

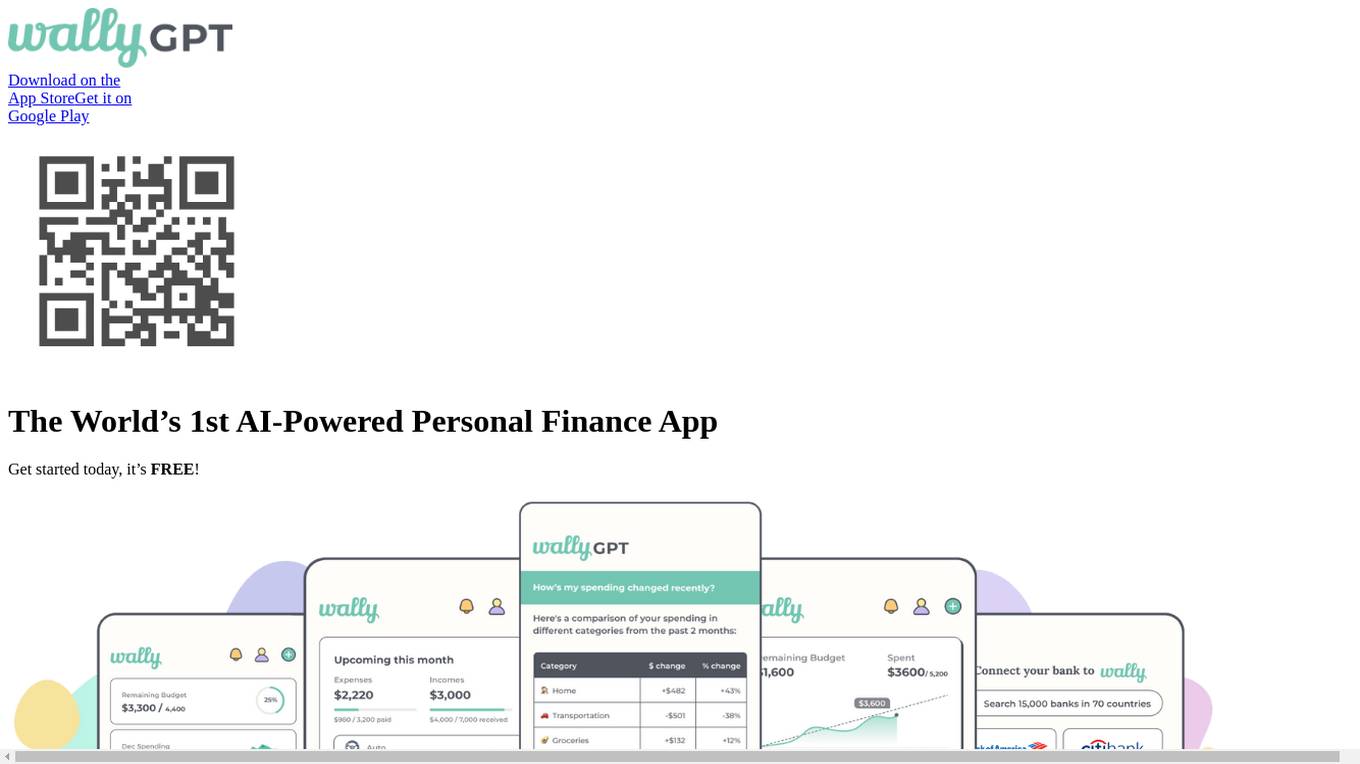

Wally

Wally is the world's first AI-powered personal finance app. It helps you track your spending, create budgets, and plan for the future. Wally is available on iOS and Android devices.

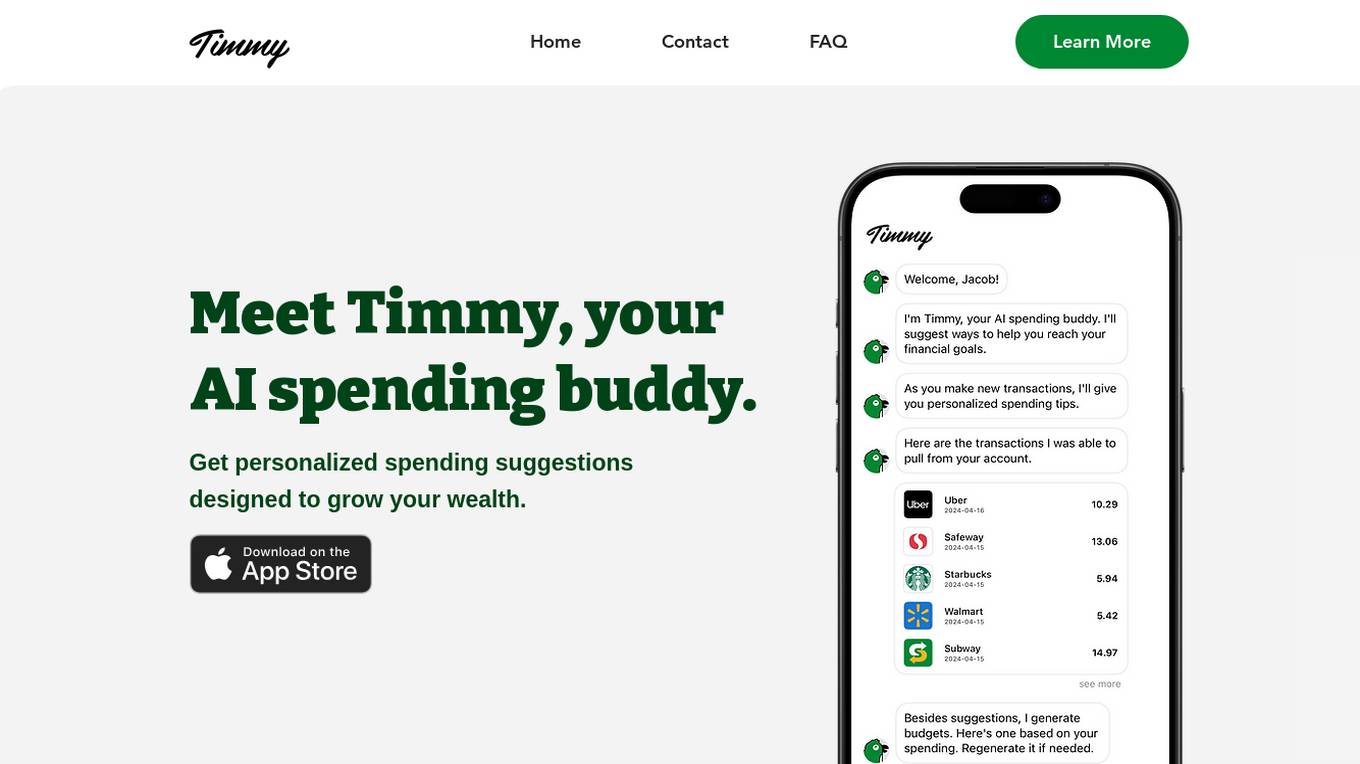

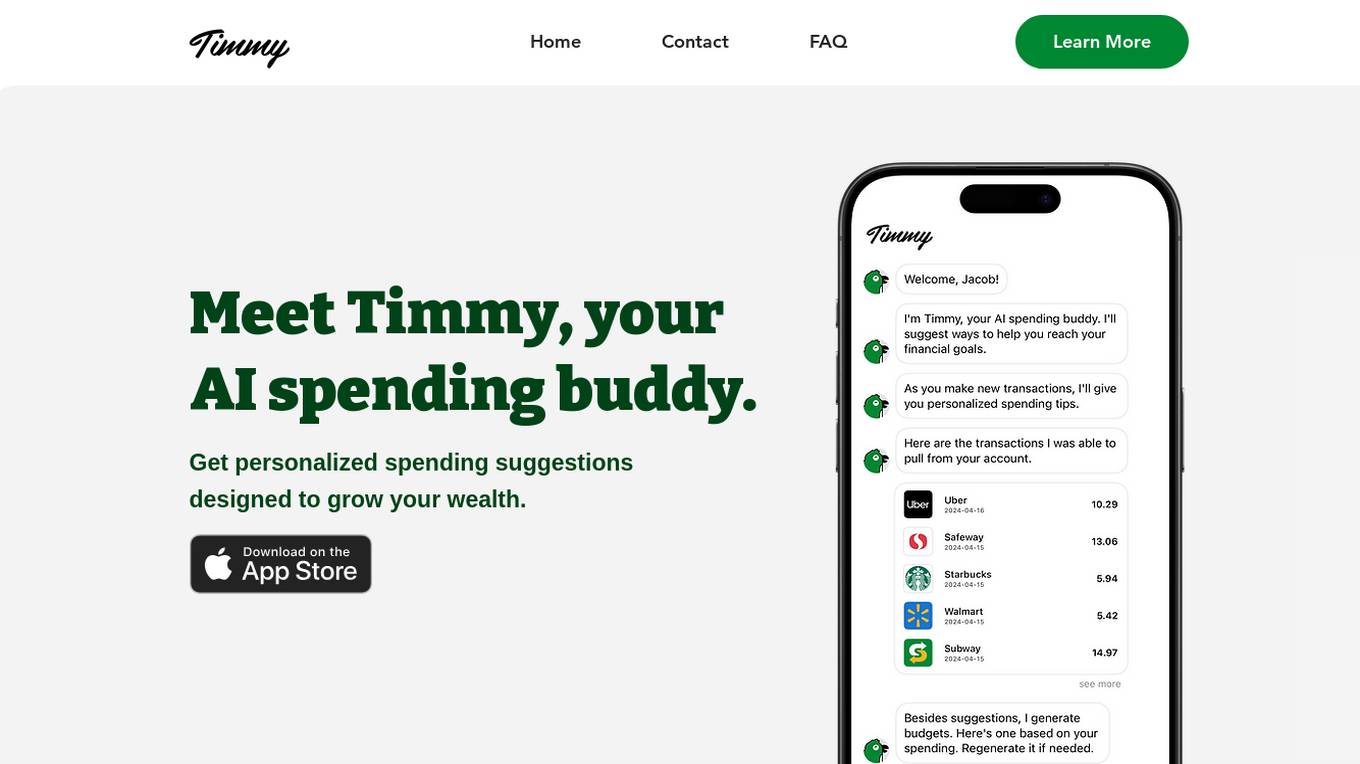

Timmy

Timmy is an AI spending buddy designed to help users save money faster and grow their wealth. It provides personalized spending suggestions, tracks spending in real-time, suggests budgets, and offers weekly tasks to achieve financial goals. Users can subscribe to the newsletter for product updates and releases, but should exercise caution and seek professional advice for financial decisions.

Tendi

Tendi is an AI-powered personal financial advisor designed to make advanced, personalized financial guidance accessible to everyone. It helps users set financial goals, plan, budget, reduce debt, build savings, invest wisely, and ultimately retire. Tendi analyzes spending, saving, and investing behaviors to provide actionable insights and personalized money strategies. The platform aims to bridge the wealth gap by empowering users to navigate their financial journey with confidence.

MyInvestment-AI

MyInvestment-AI is an AI-powered personal investment platform that offers tailored investment plans to help users achieve their financial goals. By leveraging advanced algorithms, the platform analyzes users' financial data, goals, and risk tolerance to craft personalized investment strategies. With a user-friendly interface and detailed investment breakdown, MyInvestment-AI simplifies the investment process, providing cost-saving and time-saving benefits. The platform ensures data security and confidentiality, offering a fast, personalized, and data-driven approach to investment planning.

TheFinAdvisor

TheFinAdvisor.com is an AI financial advisor platform that offers personalized investment strategies and expert guidance tailored to individual financial goals. Users can receive assistance in managing student loans, credit cards, debt restructuring, home purchases, car/truck acquisitions, house market investments, early retirement planning, world travel, and business building. The platform also provides insights on financial topics, encourages user questions, and facilitates community connections with financial experts. Additionally, users can explore various financial services, share reviews, and monetize content as financial influencers.

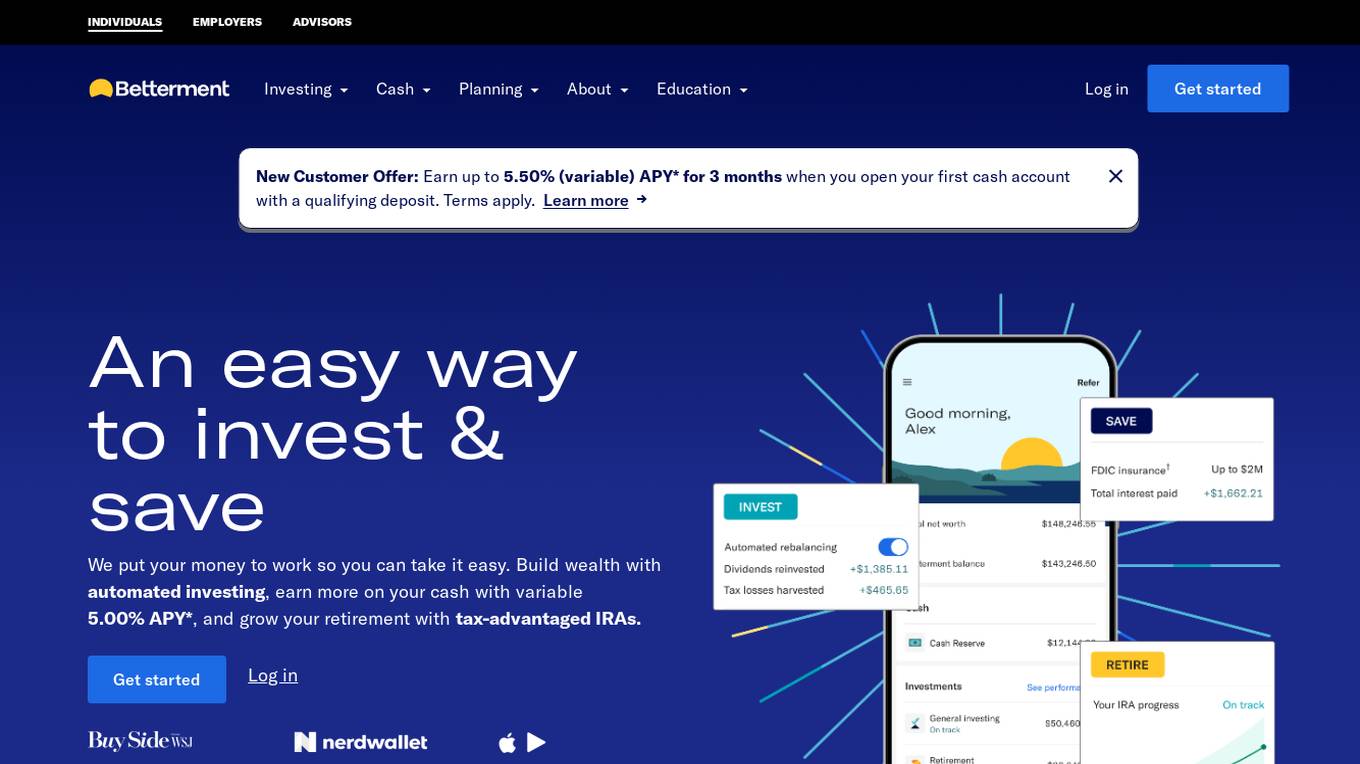

Betterment

Betterment is an automated investing platform that helps you build wealth, grow your savings, and plan for retirement. With Betterment, you can invest in a diversified portfolio of stocks and bonds, earn interest on your cash, and get personalized advice from financial experts. Betterment is a fiduciary, which means we act in your best interest. We'll help you set financial goals and set you up with investment portfolios for each goal.

Capchair

Capchair is a personal finance application that leverages AI technology to provide users with a seamless and efficient way to manage their finances. The app offers instant analysis, on-demand insights, and a comprehensive view of all financial data. Users can set budgets, goals, and connect their accounts to track their financial progress. Capchair prioritizes security by implementing bank-level security measures to safeguard users' financial information.

Intuit Assist

Intuit Assist is a generative AI-powered financial assistant designed to help you achieve financial confidence. It is a comprehensive platform that offers a wide range of financial tools and services, including TurboTax, Credit Karma, QuickBooks, and Mailchimp. Intuit Assist can help you with a variety of financial tasks, such as filing your taxes, managing your credit, tracking your expenses, and invoicing your clients. It is a valuable tool for anyone who wants to take control of their finances and achieve financial success.

Finance Brain

Finance Brain is an AI-powered assistant that provides instant answers for finance and accounting questions. It offers unlimited access for a monthly fee of $20 and allows new users to ask 3 free questions. The platform also supports uploading video files for analysis.

Zevrio Capiture

Zevrio Capiture is an automated investing and cash management platform that offers personalized, effortless investing and savings solutions. It provides users with the ability to customize their investment portfolios, automate savings, optimize performance, and lower taxes. The platform also offers a Cash account with regulated banking partners for everyday cash management, bill payments, ATM withdrawals, and quick investments. Zevrio Capiture aims to make wealth management easy and accessible for users, connecting all their accounts in one app to help them achieve their financial goals.

Reconcile

Reconcile is a finance app designed specifically for multipreneurs, individuals with multiple businesses or income streams. It automates bookkeeping, connects users with tax professionals, and provides financial insights to help users focus on growth. Reconcile's AI assistant tracks expenses, maximizes write-offs, and provides personalized recommendations to help users make more profitable decisions.

Ramp

Ramp is a comprehensive financial management platform that offers Spend Management, Corporate Cards, and Accounts Payable Solutions. It provides easy-to-use corporate cards, bill payments, accounting, and more, all in one place. With Ramp, finance teams can save time and money by streamlining processes and automating tasks. The platform is designed to make finance teams faster and happier, with features like expense management, travel control, accounts payable processing, and accounting automation. Ramp is trusted by over 40,000 finance teams worldwide to save millions of hours and improve efficiency in financial operations.

For similar tasks

Monarch Money

Monarch Money is an all-in-one money management platform that helps you track your finances, collaborate with your partner or financial advisor, and achieve your financial goals. It offers a variety of features, including budgeting, investment tracking, transaction categorization, and financial planning. Monarch Money is available on the web, iOS, and Android.

Forescribe AI

Forescribe AI is a spend management platform that uses artificial intelligence (AI) to help businesses streamline their spending and fuel growth. The platform provides real-time visibility into spending, automates invoice processing, and identifies opportunities for cost savings. Forescribe AI is designed to help businesses of all sizes improve their financial performance.

Origin

Origin is a financial management platform that provides users with a holistic view of their finances, personalized recommendations, and guidance from AI-powered planners and Certified Financial Planners. It offers features such as net worth tracking, budgeting, saving, investing, and tax assistance, all in one place for a monthly fee of $12.99.

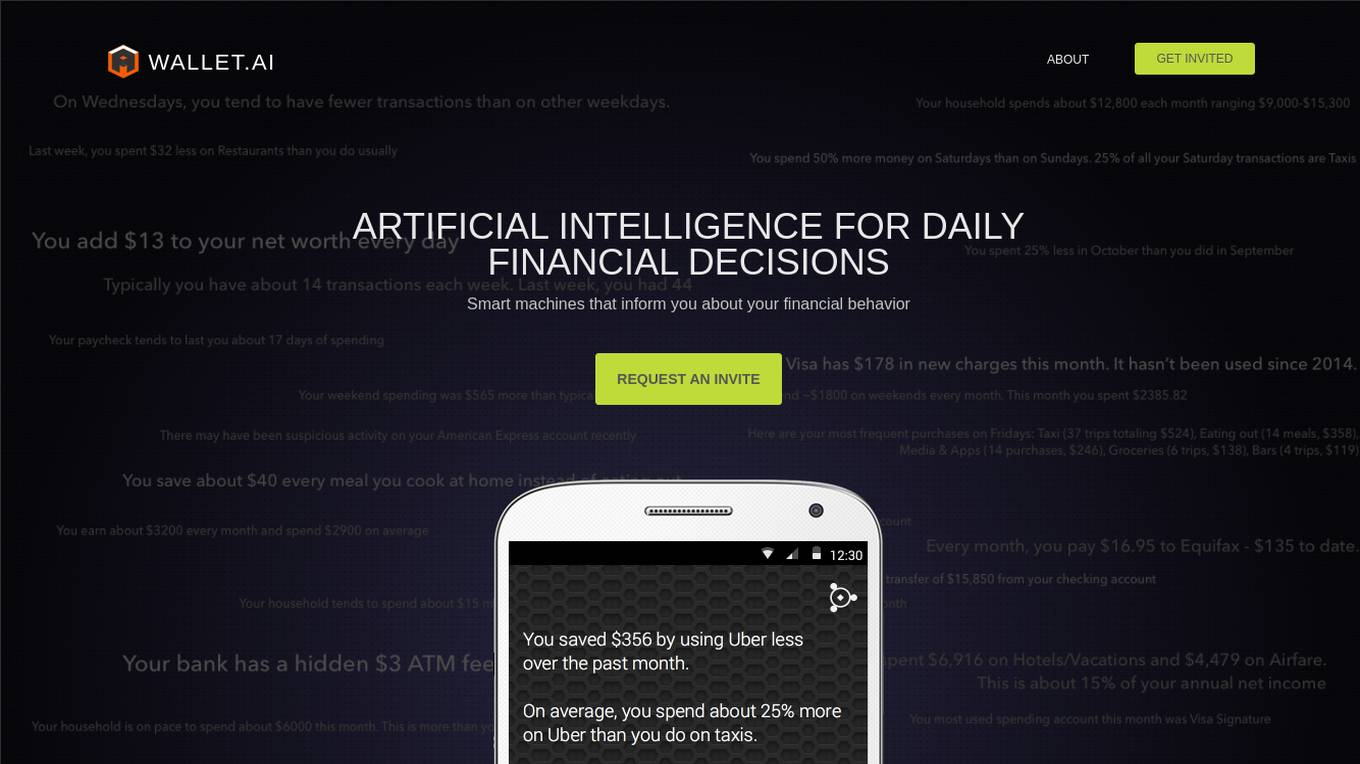

wallet.AI

wallet.AI is an AI application that provides smart machines to inform users about their financial behavior. Founded in San Francisco in 2012, wallet.AI builds intelligent engines that analyze millions of pieces of data to help users make better daily financial decisions. The application aims to assist people in making informed financial choices by leveraging artificial intelligence technology.

Finance Brain

Finance Brain is an AI-powered assistant that provides instant answers for finance and accounting questions. It offers unlimited access for a monthly fee of $20 and allows new users to ask 3 free questions. The platform also supports uploading video files for analysis.

Intuit Assist

Intuit Assist is a generative AI-powered financial assistant designed to help you achieve financial confidence. It is a comprehensive platform that offers a wide range of financial tools and services, including TurboTax, Credit Karma, QuickBooks, and Mailchimp. Intuit Assist can help you with a variety of financial tasks, such as filing your taxes, managing your credit, tracking your expenses, and invoicing your clients. It is a valuable tool for anyone who wants to take control of their finances and achieve financial success.

Realistics

Realistics is an AI-powered chatbot app that provides users with access to a variety of virtual assistants, each with their own unique personality and expertise. Users can chat with these assistants on a wide range of topics, from fashion and beauty to career advice and financial planning. Realistics is currently available for iOS devices, with plans to expand to Android and web browsers in the future.

Cleo

Cleo is an AI-powered financial management tool that helps users with budgeting, saving, building credit, and managing their finances. It offers features like cash advances, budgeting tips, credit building tools, and personalized financial advice. Cleo uses AI technology to provide users with insights and recommendations to improve their financial health. The application aims to make money management easy and accessible for everyone, without the need for credit checks or complex financial jargon.

Betterment

Betterment is an automated investing platform that helps you build wealth, grow your savings, and plan for retirement. With Betterment, you can invest in a diversified portfolio of stocks and bonds, earn interest on your cash, and get personalized advice from financial experts. Betterment is a fiduciary, which means we act in your best interest. We'll help you set financial goals and set you up with investment portfolios for each goal.

wallet.AI

wallet.AI is an AI application that provides smart machines to inform users about their financial behavior and help them make better daily financial decisions. Founded in San Francisco in 2012, wallet.AI builds intelligent engines that analyze millions of pieces of data to offer personalized insights and recommendations to users. The application aims to empower individuals to manage their finances more effectively by leveraging artificial intelligence technology.

Wally

Wally is the world's first AI-powered personal finance app. It helps you track your spending, create budgets, and plan for the future. Wally is available on iOS and Android devices.

Timmy

Timmy is an AI spending buddy designed to help users save money faster and grow their wealth. It provides personalized spending suggestions, tracks spending in real-time, suggests budgets, and offers weekly tasks to achieve financial goals. Users can subscribe to the newsletter for product updates and releases, but should exercise caution and seek professional advice for financial decisions.

For similar jobs

Dispute AI™

Dispute AI™ is an AI-powered DIY credit repair solution that revolutionizes the way individuals take control of their credit. With over 20 years of expertise in credit repair and financial empowerment, Dispute AI™ delivers personalized strategies backed by cutting-edge artificial intelligence to simplify and streamline the credit repair process. The platform offers tailored AI-driven tactics to challenge and resolve inaccurate credit report items effectively, providing actionable, data-driven recommendations to improve credit scores. Users can handle credit repair on their terms, anytime, anywhere, without the need to hire expensive credit repair companies. Dispute AI™ aims to make credit improvement accessible, efficient, and impactful, empowering individuals to achieve financial freedom.

Skeptical Tom

Skeptical Tom is an AI tool designed to help users control their impulsive shopping habits. The AI Cat feature provides personalized guidance to curb impulsive buys, offering wise whispers to guide users' wallets. Users can reach out to the team at [email protected] for any issues or queries.

Monarch Money

Monarch Money is an all-in-one money management platform that helps you track your finances, collaborate with your partner or financial advisor, and achieve your financial goals. It offers a variety of features, including budgeting, investment tracking, transaction categorization, and financial planning. Monarch Money is available on the web, iOS, and Android.

Origin

Origin is a financial management platform that provides users with a holistic view of their finances, personalized recommendations, and guidance from AI-powered planners and Certified Financial Planners. It offers features such as net worth tracking, budgeting, saving, investing, and tax assistance, all in one place for a monthly fee of $12.99.

Wally

Wally is the world's first AI-powered personal finance app. It helps you track your spending, create budgets, and plan for the future. Wally is available on iOS and Android devices.

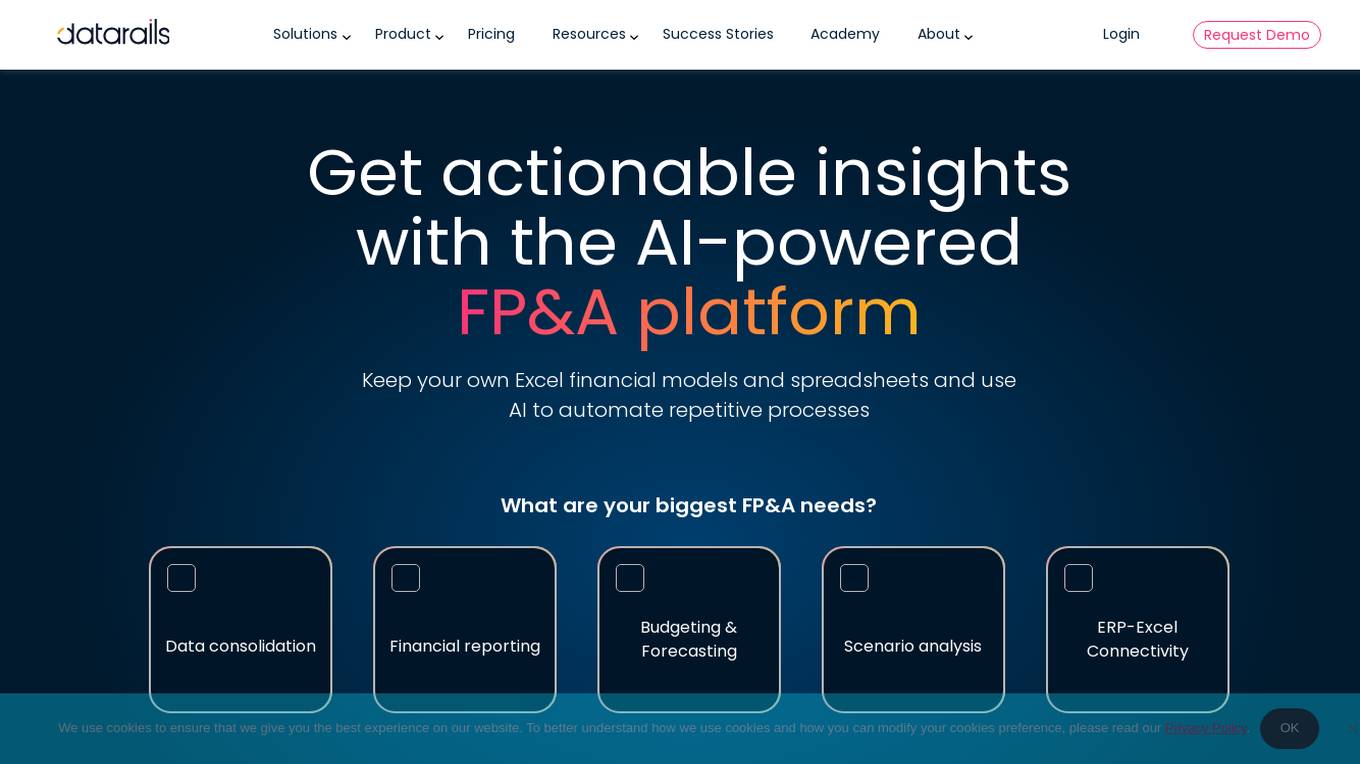

Datarails

Datarails is a financial planning and analysis platform for Excel users. It automates data consolidation, reporting, and planning while enabling finance teams to continue using their spreadsheets and financial models. With Datarails, finance teams can save time on repetitive tasks and focus on strategic insights that drive business growth.

TripBudget

TripBudget is an AI-powered travel cost prediction tool that helps users plan and budget for their trips. It uses machine learning algorithms to analyze historical travel data and provide accurate estimates of travel expenses. TripBudget is designed to make travel planning easier and more affordable for everyone.

Capchair

Capchair is a personal finance application that leverages AI technology to provide users with a seamless and efficient way to manage their finances. The app offers instant analysis, on-demand insights, and a comprehensive view of all financial data. Users can set budgets, goals, and connect their accounts to track their financial progress. Capchair prioritizes security by implementing bank-level security measures to safeguard users' financial information.

Rationale

Rationale is a cutting-edge decision-making AI tool that leverages the power of the latest GPT technology and in-context learning. It is designed to assist users in making informed decisions by providing valuable insights and recommendations based on the data provided. With its advanced algorithms and machine learning capabilities, Rationale aims to streamline the decision-making process and enhance overall efficiency.

AngelList

AngelList is a platform that provides tools for investors and innovators to grow their venture funds. It offers solutions for venture funds, SPVs, scout funds, and digital subscriptions, along with full service fund management. With over half of top-tier VC deals running through the platform, AngelList plays a crucial role in fueling innovation and bridging gaps in the VC market.

Scope Ai Platform

The website is an AI tool called Scope Ai Platform that provides property, owner, investor, and lender intelligence. It offers nationwide coverage, predictive scoring, and tailored insights to help users find opportunities, connect with the right people, and make faster decisions in various markets. The platform combines massive data coverage with advanced predictive modeling to deliver actionable intelligence for business growth. It caters to industries such as insurance, retail, investment, luxury goods, and more, offering solutions for unique data challenges. The platform is compliance-ready, built on public and licensed non-credit data without credit bureau information or live tracking.

Investor Hunter

The website investor-hunter.com seems to be inaccessible, showing an 'Access Denied' message. It appears that the user does not have permission to access the content on the server. The error message references a specific server code, indicating a technical issue preventing access to the GoDaddy website for sale. The website may be related to domain investing or hunting for investment opportunities, but without access, the exact nature of the site remains unknown.

Collie.ai

Collie.ai is an AI-powered tool designed to assist users in various tasks. It offers a wide range of features and advantages to streamline workflows and improve productivity. The tool is known for its user-friendly interface and efficient performance. Collie.ai is suitable for individuals and businesses looking to leverage AI technology for enhanced decision-making and task automation.

Mudrex

Mudrex is a cryptocurrency investment platform that provides users with tools and resources to make informed investment decisions. The platform offers a variety of features, including price predictions, investment guides, and how-to's. Mudrex also has a team of experts who provide support and guidance to users.

PeerAI

PeerAI is an advanced AI tool that leverages cutting-edge artificial intelligence technology to provide users with personalized insights and recommendations. The platform utilizes machine learning algorithms to analyze data and generate actionable suggestions across various domains, including business, marketing, finance, and more. PeerAI empowers users to make informed decisions, optimize strategies, and enhance performance through data-driven intelligence.

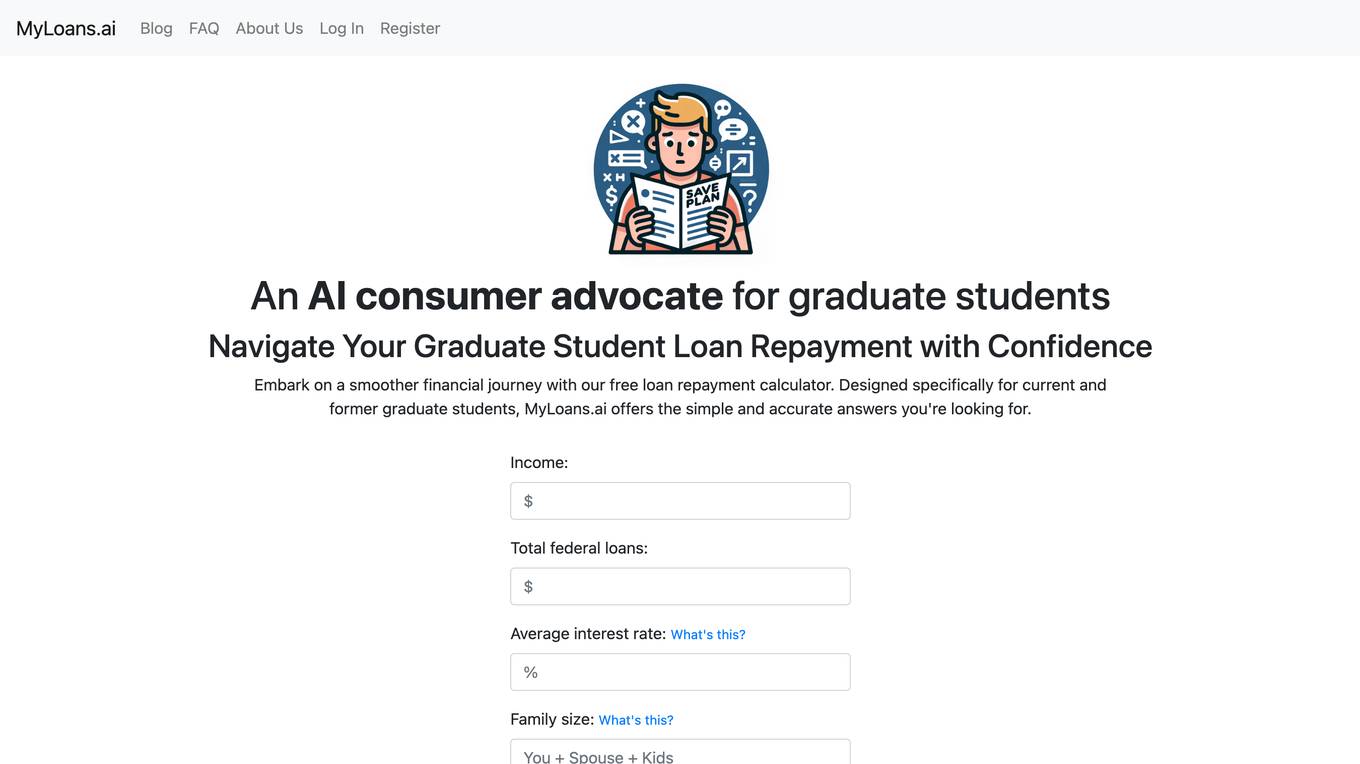

MyLoans.ai

MyLoans.ai is a free AI tool designed to provide personalized guidance for complex student loans. It offers instant, clear, and accurate answers to student loan queries, helping borrowers make informed decisions about their financial future. By skipping expensive advisors and confusing government websites, MyLoans.ai aims to save users thousands of dollars by leveraging official government sources for guidance.

AI VC

AI VC was a project that is no longer active. It was likely an AI tool or application related to venture capital. The project may have involved using artificial intelligence to analyze investment opportunities, predict market trends, or provide insights for venture capitalists. Unfortunately, the project is no longer operational, but it may have offered valuable resources and information for individuals interested in the intersection of AI and venture capital.

Langdock

Langdock is an all-in-one AI platform designed for companies to roll out AI to all employees and enable developers to build custom AI workflows. It offers powerful AI chat, use-case-specific assistants, AI workplace search, and API for building and running agents. Langdock provides model-agnostic, privacy-first, scalable, and measurable features, with expert support assistants for various tasks. The platform is enterprise trusted, with a focus on security and compliance. It is hosted in Europe and offers a 7-day free trial for users to get started.

Numeno

Numeno is an AI tool that allows users to personalize every customer touchpoint without the need for data. It enables businesses to tailor product recommendations, content, gaming experiences, educational content, financial services, and marketing campaigns based on real-time user interactions. Numeno's dead-simple API simplifies the process of personalizing user experiences by creating rich models of user behavior and preferences over time.

FutureGPT

FutureGPT is an AI tool that leverages the power of GPT-4 to provide advanced predictive capabilities. Users can enhance their results by utilizing this tool, which offers paid predictions. By enabling JavaScript, users can access the app and explore its features to receive accurate and insightful predictions for various purposes. FutureGPT aims to streamline decision-making processes and optimize outcomes through cutting-edge AI technology.

Casca

Casca is a revolutionary AI-native Loan Origination System that helps banks and non-bank lenders automate 90% of manual effort in business loan origination. By leveraging AI technology, Casca enables financial institutions to process loans 10x faster, achieve 3x higher conversion rates, and save significant time for loan officers. With features like AI Loan Assistant, digital application processing, KYB checks automation, and document analysis, Casca transforms the loan origination process into a seamless and efficient experience for both lenders and borrowers.

Price Prediction AI Robo Advisor

The website is an AI tool called Price Prediction AI Robo Advisor, developed by Regulus Technologies. It provides cryptocurrency trading predictions and news updates. Users can access the platform in multiple languages and find information about various cryptocurrencies. The tool offers price predictions for popular cryptocurrencies like Bitcoin, Ethereum, and Ripple, along with customer support and company details.

CreditHQ

CreditHQ is an AI-powered loan restructuring platform that helps users analyze their credit history, compare interest rates, and save money on their loans. The platform offers a range of features, including a credit score simulator, a budgeting tool, and a debt management tool. CreditHQ is trusted by over 5,500 users and companies globally.

CanTax.ai

CanTax.ai is an AI-powered platform offering instant tax help for Canadians. It provides personalized tax advice tailored to individual financial needs, ensuring privacy and security with industry-leading encryption protocols. The platform's artificial intelligence is proficiently trained on federal and provincial tax legislation, offering comprehensive knowledge and 24/7 availability. CanTax aims to simplify the tax filing process and empower Canadians with expert-level tax guidance.