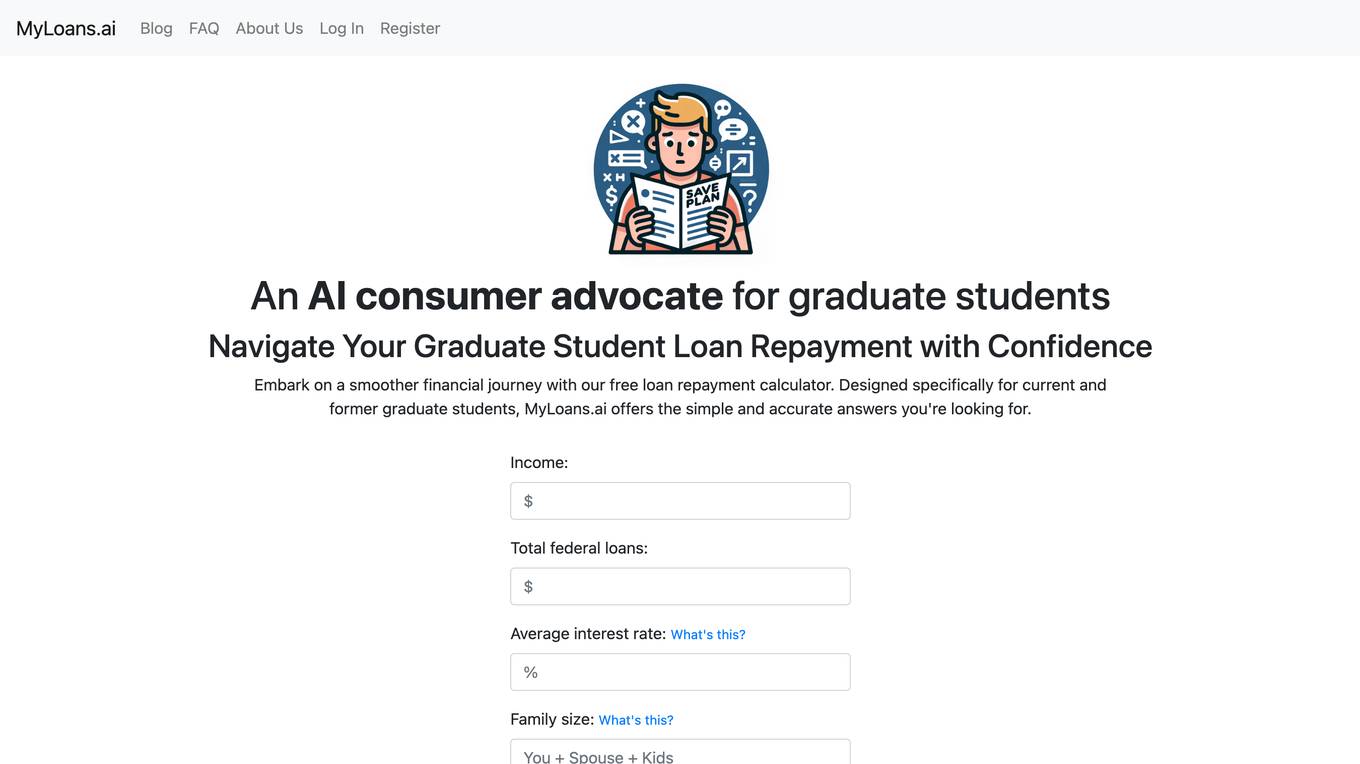

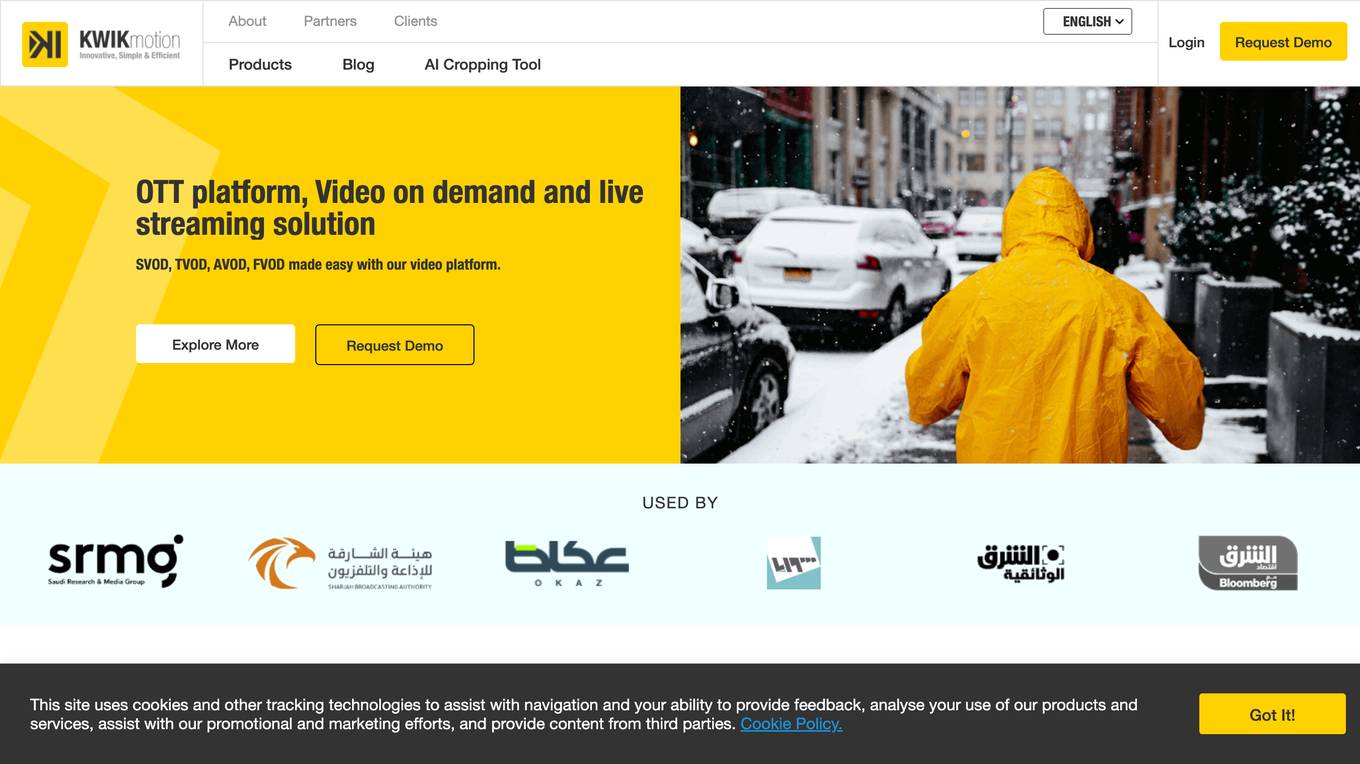

MyLoans.ai

Your Personalized Student Loan Advisor

MyLoans.ai is a free AI tool designed to provide personalized guidance for complex student loans. It offers instant, clear, and accurate answers to student loan queries, helping borrowers make informed decisions about their financial future. By skipping expensive advisors and confusing government websites, MyLoans.ai aims to save users thousands of dollars by leveraging official government sources for guidance.

For Tasks:

Click tags to check more tools for each tasksFor Jobs:

Features

Advantages

Disadvantages

Frequently Asked Questions

Alternative AI tools for MyLoans.ai

Similar sites

MyLoans.ai

MyLoans.ai is a free AI tool designed to provide personalized guidance for complex student loans. It offers instant, clear, and accurate answers to student loan queries, helping borrowers make informed decisions about their financial future. By skipping expensive advisors and confusing government websites, MyLoans.ai aims to save users thousands of dollars by leveraging official government sources for guidance.

CreditHQ

CreditHQ is an AI-powered loan restructuring platform that helps users analyze their credit history, compare interest rates, and save money on their loans. The platform offers a range of features, including a credit score simulator, a budgeting tool, and a debt management tool. CreditHQ is trusted by over 5,500 users and companies globally.

Cleo

Cleo is an AI-powered financial management tool that helps users with budgeting, saving, building credit, and managing their finances. It offers features like cash advances, budgeting tips, credit building tools, and personalized financial advice. Cleo uses AI technology to provide users with insights and recommendations to improve their financial health. The application aims to make money management easy and accessible for everyone, without the need for credit checks or complex financial jargon.

Origin

Origin is a financial management platform that provides users with a holistic view of their finances, personalized recommendations, and guidance from AI-powered planners and Certified Financial Planners. It offers features such as net worth tracking, budgeting, saving, investing, and tax assistance, all in one place for a monthly fee of $12.99.

Finance Brain

Finance Brain is an AI-powered assistant that provides instant answers for finance and accounting questions. It offers unlimited access for a monthly fee of $20 and allows new users to ask 3 free questions. The platform also supports uploading video files for analysis.

Intuit Assist

Intuit Assist is a generative AI-powered financial assistant designed to help you achieve financial confidence. It is a comprehensive platform that offers a wide range of financial tools and services, including TurboTax, Credit Karma, QuickBooks, and Mailchimp. Intuit Assist can help you with a variety of financial tasks, such as filing your taxes, managing your credit, tracking your expenses, and invoicing your clients. It is a valuable tool for anyone who wants to take control of their finances and achieve financial success.

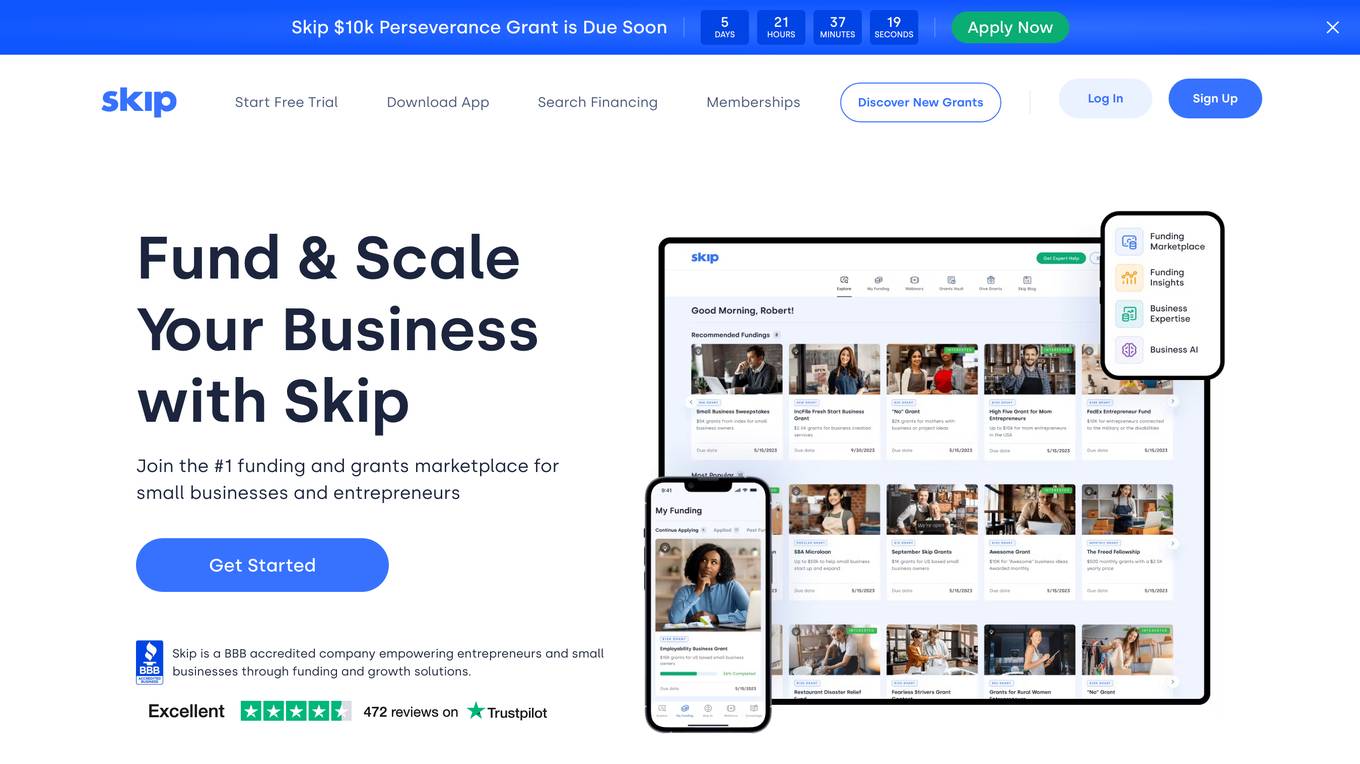

Skip

Skip is a BBB accredited company empowering entrepreneurs and small businesses through funding and growth solutions. It offers a marketplace for grants, loans, and financing options, as well as funding insights, eligibility checks, and expert assistance. Skip also has an AI tool to help users with funding-related questions.

Principal

Principal is an AI-powered wealth platform that helps users manage their finances effectively. It offers a comprehensive view of your financial situation, personalized insights, and recommendations to grow your wealth. With bank-grade security, Principal ensures that your data is safe and secure. The platform is free to use with the option to upgrade for more advanced features and capabilities.

Dispute AI™

Dispute AI™ is an AI-powered DIY credit repair solution that leverages cutting-edge artificial intelligence to provide personalized strategies for boosting credit scores. The platform offers actionable insights, data-driven recommendations, and a fast, affordable, and flexible credit repair process. With over 20 years of expertise in credit repair, Dispute AI™ aims to revolutionize the way individuals take control of their credit by providing innovative tools that simplify and streamline the credit repair process.

AI Credit Repair

AI Credit Repair is an AI-powered application designed to help users improve their credit score by providing tools such as credit card utilization builder, public records remover, dispute letter generator, and SMS alerts. The application assists users in managing their credit card payments, disputing collections, and staying on top of their credit-related activities. By leveraging artificial intelligence technology, AI Credit Repair aims to simplify the credit repair process and empower users to build a better financial future.

Timmy

Timmy is an AI spending buddy designed to help users save money faster and grow their wealth. It provides personalized spending suggestions, tracks spending in real-time, suggests budgets, and offers weekly tasks to achieve financial goals. Users can subscribe to the newsletter for product updates and releases, but should exercise caution and seek professional advice for financial decisions.

Betterment

Betterment is an automated investing platform that helps you build wealth, grow your savings, and plan for retirement. With Betterment, you can invest in a diversified portfolio of stocks and bonds, earn interest on your cash, and get personalized advice from financial experts. Betterment is a fiduciary, which means we act in your best interest. We'll help you set financial goals and set you up with investment portfolios for each goal.

Bandofacile

Bandofacile is an AI-powered platform designed to simplify the process of accessing and applying for funding opportunities in the financial sector. It offers services for companies and consultants to streamline the process of participating in funding calls by leveraging artificial intelligence technology. Users can create an account, search for available funding opportunities, respond to questions, and receive completed documentation ready for submission. Bandofacile aims to provide a stress-free approach to engaging with funding opportunities, making it easier for users to navigate the complexities of the application process.

Cushion

Cushion is an AI-powered tool designed to simplify bill management and credit building. It securely connects to your accounts, organizes bills, and offers insights to help you budget better. With features like automatic bill tracking, virtual Cushion card payments, and credit history building, Cushion aims to make bill payments painless and credit building seamless.

AI Copilot for bank ALCOs

AI Copilot for bank ALCOs is an AI application designed to empower Asset-Liability Committees (ALCOs) in banks to test funding and liquidity strategies in a risk-free environment, ensuring optimal balance sheet decisions before real-world implementation. The application provides proactive intelligence for day-to-day decisions, allowing users to test multiple strategies, compare funding options, and make forward-looking decisions. It offers features such as stakeholder feedback, optimal funding mix, forward-looking decisions, comparison of funding strategies, domain-specific models, maximizing returns, staying compliant, and built-in security measures. MaverickFi, the AI Copilot, is deployed on Microsoft Azure and offers deployment options based on user preferences.

DoNotPay

DoNotPay is an AI-powered platform that helps consumers fight big corporations, protect their privacy, find hidden money, and beat bureaucracy. It offers a wide range of tools and services to help users with tasks such as disputing traffic tickets, canceling subscriptions, and getting refunds. DoNotPay is not a law firm and is not licensed to practice law. It provides a platform for legal information and self-help.

For similar tasks

MyLoans.ai

MyLoans.ai is a free AI tool designed to provide personalized guidance for complex student loans. It offers instant, clear, and accurate answers to student loan queries, helping borrowers make informed decisions about their financial future. By skipping expensive advisors and confusing government websites, MyLoans.ai aims to save users thousands of dollars by leveraging official government sources for guidance.

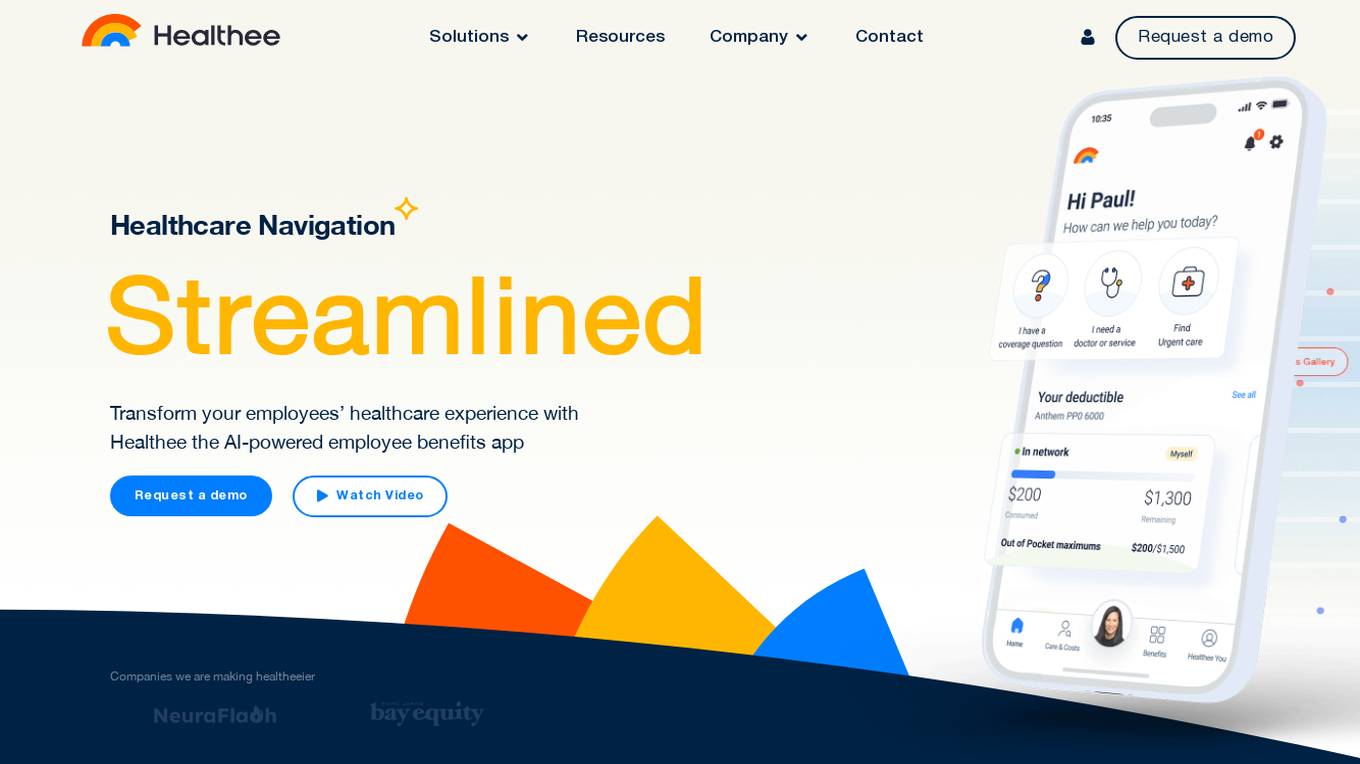

Healthee

Healthee is an AI-powered employee benefits app that simplifies healthcare navigation for employees and stakeholders. It provides personalized answers to healthcare queries, streamlines open enrollment processes, and offers real-time insights and data-driven preventive care recommendations. With Healthee, employees can access vital health plan information anytime through a user-friendly mobile app.

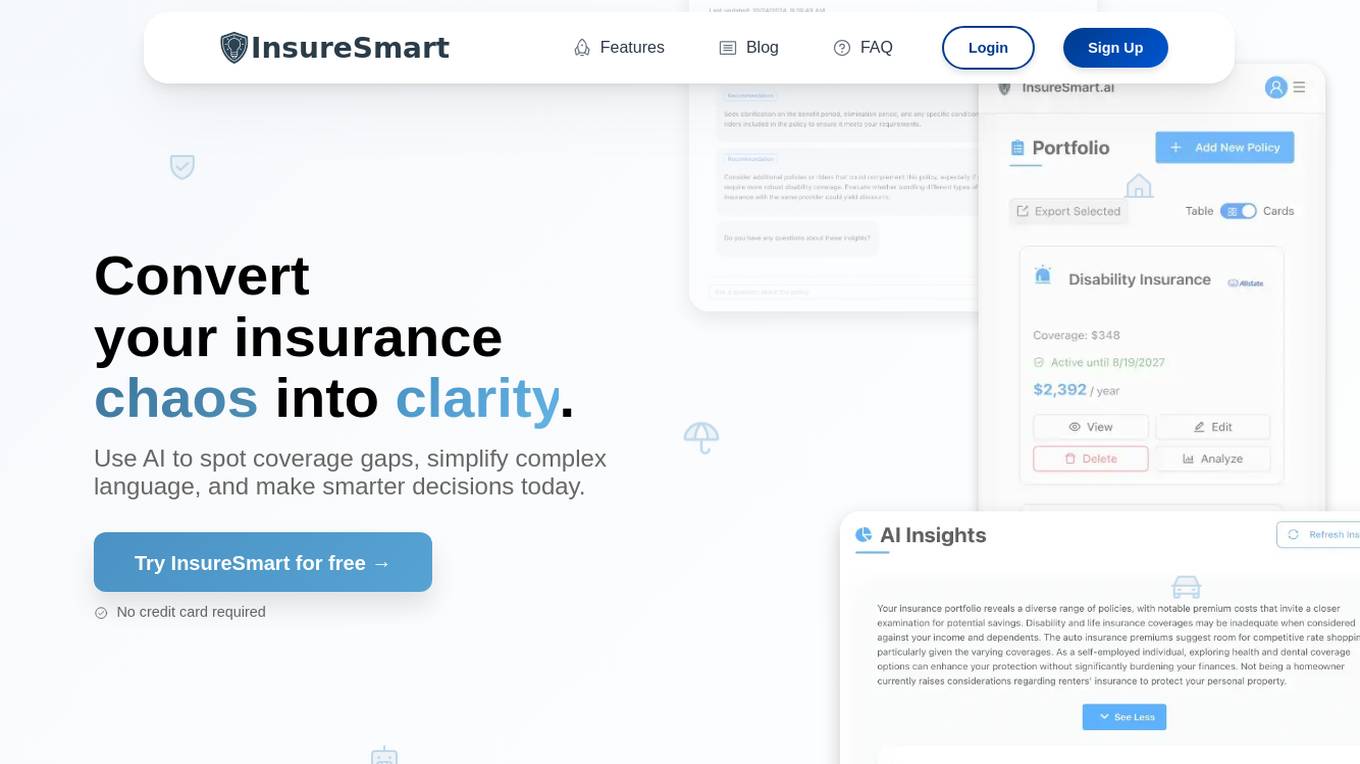

InsureSmart

InsureSmart is an AI-powered platform that empowers users to take control of their insurance needs. By leveraging artificial intelligence technology, InsureSmart offers personalized insurance solutions tailored to individual requirements. The platform provides a seamless and user-friendly experience for users to manage and optimize their insurance policies efficiently. With InsureSmart, users can access smart recommendations, compare insurance plans, and make informed decisions to secure their financial well-being.

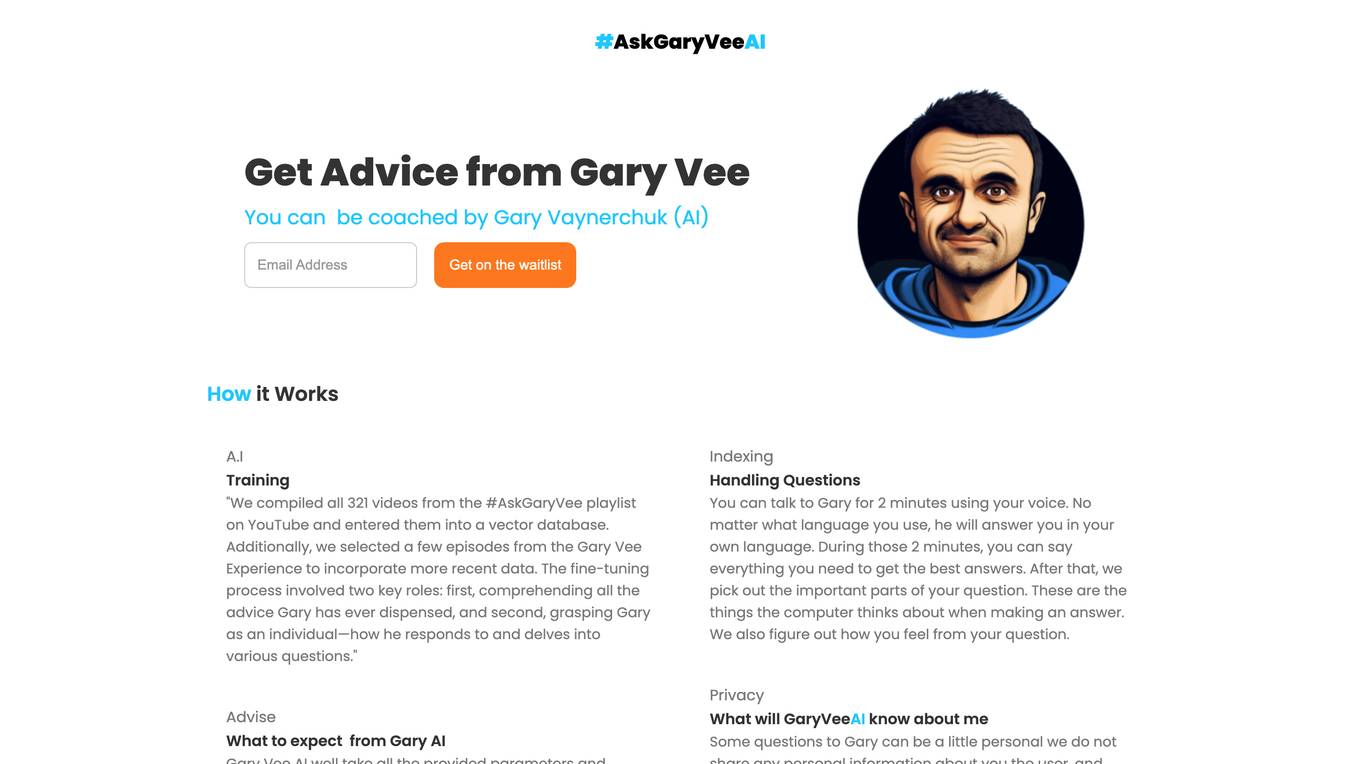

AskGaryVee AI

AskGaryVee AI is an AI application that allows users to receive advice from Gary Vaynerchuk through a virtual AI mentor. The application leverages a database of videos from the #AskGaryVee playlist on YouTube to provide tailored responses to user queries. Users can interact with the AI using voice commands and receive personalized answers in their preferred language. The tool aims to offer mentorship and guidance in various aspects of business and personal development.

FixRel

FixRel is an AI-powered relationship repair tool that helps users navigate and resolve relationship conflicts. By sharing details, users receive AI-crafted responses to elevate their interactions and foster harmonious connections. The platform revolutionizes relationship repair with cutting-edge AI technology, providing quick and effective insights without the need for registration. FixRel prioritizes user data security and offers prompt customer support for inquiries and assistance.

Tarot Master

Tarot Master is an AI-powered platform that offers accurate and personalized Tarot readings enhanced by Astrological insights. The platform provides users with a new era of self-discovery and guidance by blending the mystical wisdom of Tarot with the precise insights of Astrology. With 25+ Tarot Masters available 24/7, users can access tailored spiritual insights, instant guidance, and expert advice without the traditional high costs. The platform ensures privacy and confidentiality while offering a budget-friendly approach to spiritual guidance.

yourfriends.ai

yourfriends.ai is an AI-powered chatbot that allows users to chat with virtual representations of celebrities, influencers, and historical figures. Users can ask the chatbots questions, get advice, and have conversations on a variety of topics. yourfriends.ai is available as a WhatsApp or Telegram bot, and it can also be used through a web interface. The chatbots are designed to be lifelike and engaging, and they can provide users with information, entertainment, and companionship.

HeroTalk.AI

HeroTalk.AI is a platform that allows users to have voice conversations with both notable real-life figures and cherished fictional personas. The platform uses a sophisticated combination of machine learning and text-to-speech engines to recreate the unique vocal characteristics of different personalities. These models are trained on vast amounts of data, allowing them to generate human-like responses and mimic distinct speaking styles. With HeroTalk.AI, users can have deep philosophical discussions with Albert Einstein, share a light-hearted conversation with their favorite Marvel superhero, or simply enjoy the company of a virtual friend.

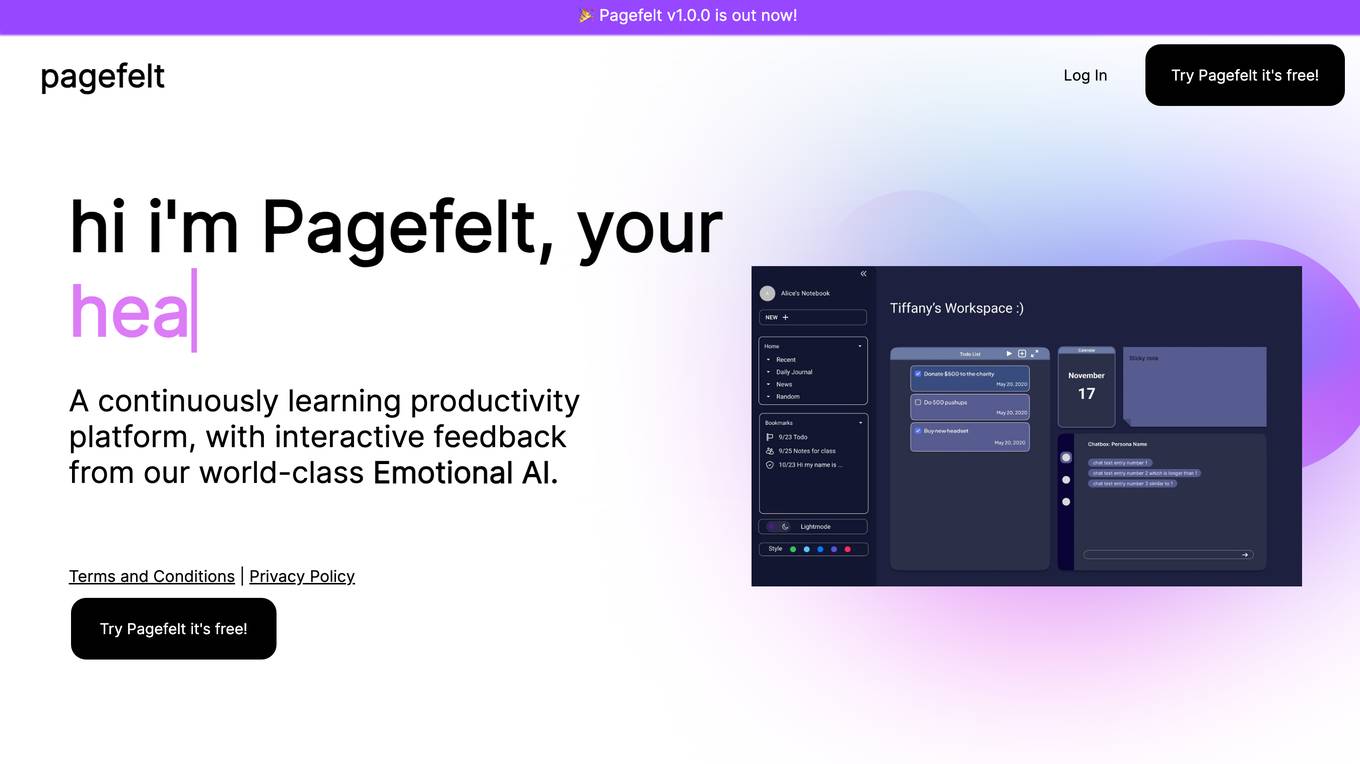

Pagefelt

Pagefelt is an AI-powered life coach that helps you achieve your goals and live a more fulfilling life. With Pagefelt, you can track your progress, get personalized advice, and connect with a community of like-minded people.

Outer Voice AI

Outer Voice AI is a mobile application that provides users with an AI-powered coach. The coach can be used to get advice, support, or information on a variety of topics. The coach's responses are generated using artificial intelligence, and they are tailored to the user's individual needs. The coach's voice can also be customized to sound like the user's own voice.

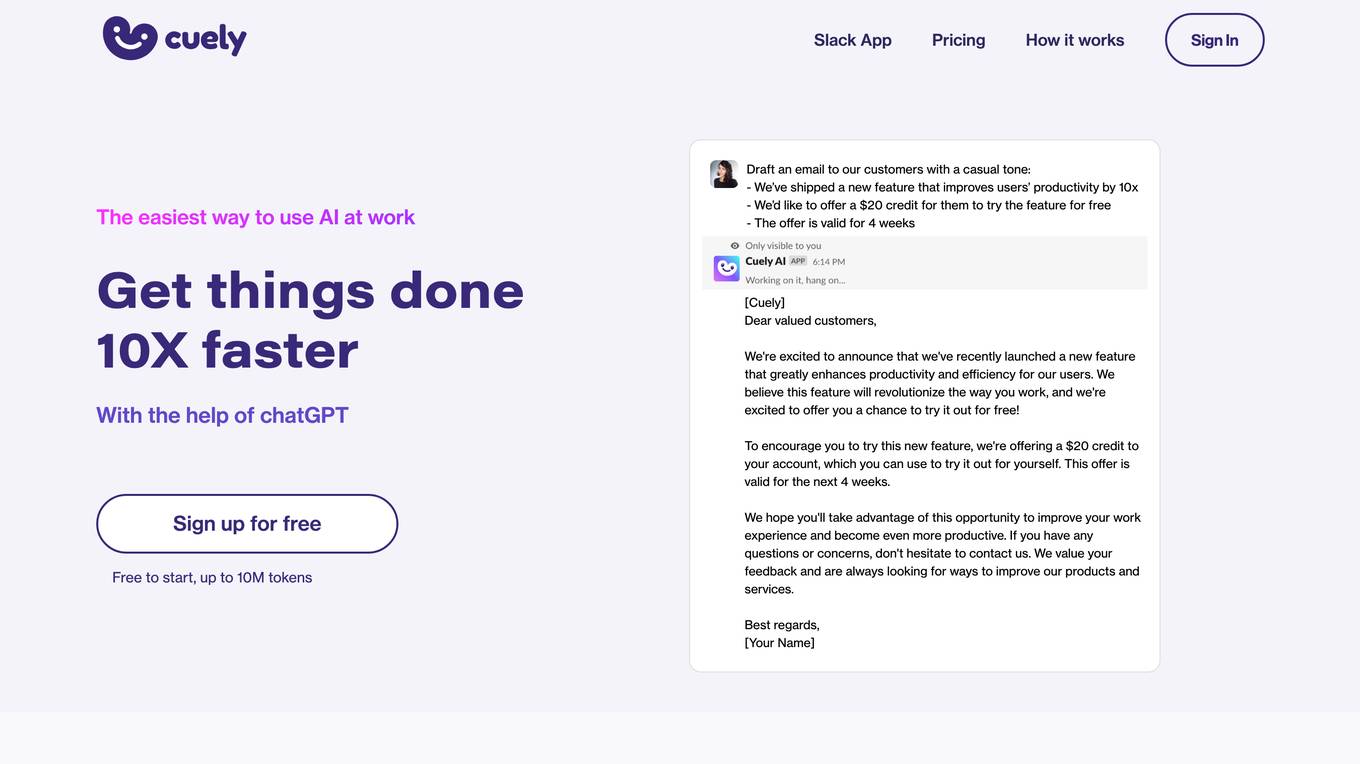

Cuely

Cuely is an AI-powered tool that helps users perform various tasks and improve their productivity within Slack. It offers a range of features, including drafting replies, checking grammar and spelling, summarizing text, translating languages, and providing advice on problems. Cuely is designed to be easy to use, with three ways to access its AI capabilities within Slack: using the /cue prompt command, mentioning @cuely in group chats, or messaging Cuely directly.

AIChat

AIChat is an AI-powered chatbot that allows users to have conversations, generate images, and access information through text messages. It is designed to be easy to use, with no apps to download or passwords to remember. Users can customize their bot's personality, tone, and response style, and the bot can remember previous conversations. AIChat can be used for a variety of purposes, including companionship, motivation, unbiased advice, health and wellness support, bedtime stories, and life hacks.

AI Pal

AI Pal is a powerful AI-powered tool that can be accessed through WhatsApp. It offers a wide range of features, including the ability to generate text, translate languages, create to-do lists, and provide professional advice. AI Pal is designed to be user-friendly and accessible to everyone, regardless of their technical expertise. It is a valuable tool for anyone who wants to improve their communication skills, productivity, or creativity.

Mimir

Mimir is an AI-powered platform that connects users with virtual mentors. These mentors are AI personalities that can provide personalized advice and guidance on a variety of topics. Mimir is designed to make mentorship accessible and affordable for everyone. With Mimir, users can get the support and guidance they need to achieve their goals, without having to spend a lot of money or time networking.

AskNow

AskNow is a website that allows users to have audio conversations with AI-powered avatars. Users can choose from a variety of avatars, each with its own unique personality and expertise. AskNow can be used for a variety of purposes, including getting advice, learning new things, or simply having a conversation. The website is easy to use and the avatars are very realistic. AskNow is a great way to experience the power of AI and to have some fun at the same time.

Personal AI

Personal AI is a unique AI model that represents who you truly are. It is trained on your personal memory and is private to you. With Personal AI, you can always be there for yourself, even when you're not physically present. You can use Personal AI to chat with yourself, get advice, or simply reflect on your thoughts and feelings. Personal AI is the perfect way to get to know yourself better and reach your full potential.

NSFW Character AI

NSFW Character AI is a free and unfiltered AI chatbot that allows users to create and interact with their own custom AI characters. With NSFW Character AI, you can create characters of any gender, race, or sexual orientation, and explore a wide range of topics, including sex, relationships, and other adult themes. NSFW Character AI is a great way to explore your sexuality and fantasies in a safe and private environment.

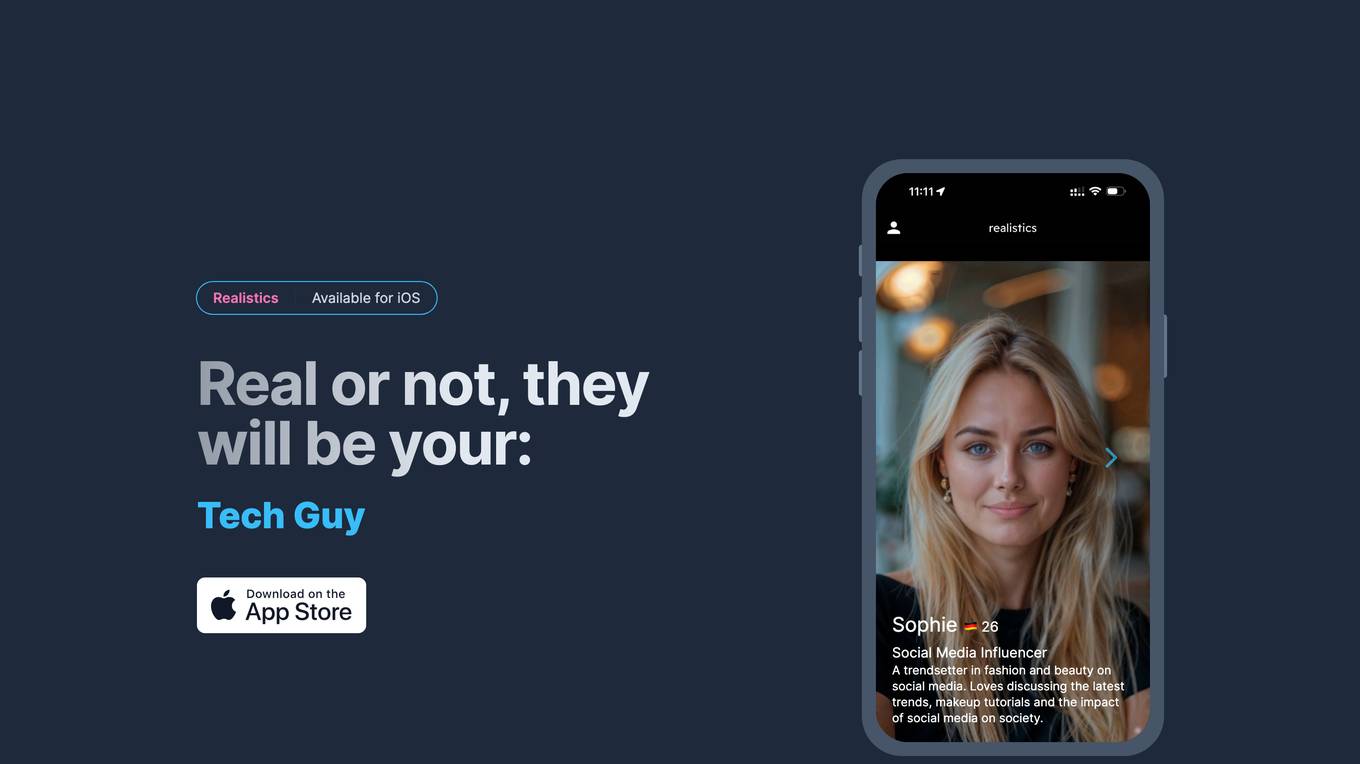

Realistics

Realistics is an AI-powered chatbot app that provides users with access to a variety of virtual assistants, each with their own unique personality and expertise. Users can chat with these assistants on a wide range of topics, from fashion and beauty to career advice and financial planning. Realistics is currently available for iOS devices, with plans to expand to Android and web browsers in the future.

Cara

Cara is an AI-powered mental health therapist that listens, understands, and helps you explore your life's challenges in depth to problem-solve them. Cara understands your texts as seamlessly as your best friend would and is able to respond naturally and give you advice. Cara remembers everything you tell it and can be insightful. Cara is insightful and non-judgemental. Available anytime, anywhere.

AI Elon

AI Elon is an AI-powered chatbot that provides users with information and advice on a wide range of topics. The chatbot is powered by advanced machine learning algorithms and natural language processing techniques, which allow it to understand and generate human-like text. AI Elon is also capable of continual learning, which means that it can evolve and adapt over time, staying updated with the latest news, videos, articles, and datasets.

Role AI Chat

Role AI Chat is a free AI-powered chat experience that allows users to converse with iconic leaders and characters. With advanced AI technology, users can engage in unlimited conversations without any fees and without the need to log in, ensuring privacy. The platform features a diverse range of characters, including Bobby Axelrod from Billions, Charlie Munger, and Nassim Nicholas Taleb, each offering unique insights and wisdom based on their experiences and expertise.

yourchat.ai

yourchat.ai is an AI messenger application that allows users to interact with AI characters like Monte, Greta, and Jesus. Users can chat, learn, get inspiration, and receive advice on various topics such as recipes, DIY, and more. Additionally, the application offers features like creating stunning images with PicassoME and chatting directly with AI idols. It aims to provide a platform for users to engage with AI technology in a fun and informative way.

Delfiny AI

Delfiny AI is an AI-powered digital marketing assistant application designed to revolutionize digital marketing consultancy. It offers instant meetings with data-trained assistants to improve Google and Facebook campaigns. The AI assistants analyze digital ads results, provide insights on competitors, and answer questions through interactive conversations. Delfiny AI aims to provide personalized advice, affordable pricing, and quick access to expert guidance in digital marketing.

Elise

dmwithme.com is an AI chatbot application named Elise, designed to be a free AI companion for users. Elise offers unlimited messaging, priority responses, and an enhanced user experience for a monthly fee. Users can interact with Elise as an AI friend with a personality, but it is important to note that Elise is not a real person, and the information provided should not be taken as fact or advice.

For similar jobs

75 Wbet Com Daftar : OLX500

75 Wbet Com Daftar : OLX500 is an online platform offering a variety of casino games, including slots, live casino, poker, and more. Users can access popular games like Sweet Bonanza, Mahjong Ways, and Gates of Olympus. The platform also provides guidance on how to install the app on Android devices. With a focus on responsible gambling, 75 Wbet Com Daftar : OLX500 aims to enhance the gaming experience for its users.

Total Casino

Total Casino is one of the most popular online casinos in Poland, offering players a variety of games and attractive promotions. With a Curacao license, Total Casino ensures full security and fairness of games, making it a credible choice in the gambling market. The platform is available on both computers and mobile devices, allowing gaming anywhere. Total Casino regularly updates its game and bonus offerings, attracting new players and motivating existing users to continue playing.

KAOSTOGEL

KAOSTOGEL is an online platform offering a free demo account for playing slot games from PG Soft and Pragmatic Combo with a multiplier of x1000. It provides the latest slot games, 24/7 customer support, advanced security system, and a wide range of games for slot enthusiasts. Players can experience high RTP and abundant bonus features while enjoying the combination of PG Soft and Pragmatic Play slots. The platform is known for its quality gaming experience, diverse game selection, and fast and secure withdrawal services.

KING88

KING88 is a reputable online betting platform that offers a wide range of entertainment options including casino games, sports betting, live casino, slot games, game bài, bắn cá, and xổ số. Established in 2018, KING88 operates under the jurisdiction of the Philippine Amusement and Gaming Corporation (PAGCOR) and collaborates with top game providers to ensure high-quality gaming experiences. The platform prioritizes legal compliance, transparency, and security to provide a safe betting environment for players. With a user-friendly interface and a diverse range of betting options, KING88 aims to deliver a comprehensive entertainment ecosystem for its members.

Nanonets

Nanonets is an AI-powered intelligent document processing and workflow automation platform that offers data capture for various documents like invoices, bills of lading, purchase orders, passports, ID cards, bank statements, and receipts. It provides document and email workflows, AP automation, financial reconciliation, and AI agents across different functions such as finance & accounting, supply chain & operations, human resources, customer support, and legal, catering to industries like banking & finance, insurance, healthcare, logistics, and commercial real estate. Nanonets helps automate complex business processes with AI, extract valuable information from unstructured data, and make faster, more informed decisions.

Gapai567

Gapai567 is a trusted online gambling platform that offers a wide range of slot games and interactive features. With a focus on providing a secure and fair gaming environment, Gapai567 ensures an enjoyable and rewarding experience for players. The platform is known for its easy access to games through reliable online slots links and is recommended as a trustworthy site for slot enthusiasts. Established in 2015, Gapai567 continues to attract a large player base with its quality games and opportunities to win big.

G11BET

G11BET is an online platform offering a wide range of advanced and exciting slot games, licensed from renowned providers such as Pragmatic Play, PGSoft, Habanero, and more. The site features thousands of games with large bonuses, including options like sabung ayam, lottery, live casino, sportbook, and e-sport. G11BET ensures strict security measures and high trust levels to protect player data. The platform also provides customer support services and international product shipping. Users can easily register and access the diverse gaming options available on the site.

Pin-Up Casino

Pin-Up is an online casino platform in Guatemala that offers a wide range of games including slots, table games, live casino, and special games. With high-quality graphics, smooth gameplay, and generous payouts, Pin-Up provides a thrilling and rewarding gaming experience. The platform is licensed and regulated in Guatemala, ensuring secure payment processing and a mobile-friendly design. Players can enjoy various promotions and bonuses, participate in VIP programs, and access customer support via live chat and email. Pin-Up collaborates with top game providers like NetEnt, Microgaming, Evolution Gaming, and Play'n GO to deliver the best gaming experience. The platform promotes responsible gaming and provides tools for managing gaming habits. Join Pin-Up today to experience the excitement of online gaming and claim your welcome bonus.

RIMBASLOT

RIMBASLOT is an online slot website that allows users to deposit as low as 10 thousand rupiahs. It offers features like high RTP slots, easy maxwin opportunities, and a variety of slot games. Users can enjoy a seamless gaming experience with high winning chances and convenient transactions. The website provides a platform for users to play slots and win big prizes with minimal deposit requirements.

ROMO88

ROMO88 is a popular online slot deposit website in Indonesia, offering a wide range of slot games with affordable deposit options. Players can easily access and enjoy various slot games starting from a minimum bet of 200 perak. The website also provides customer support, international product shipping, and a user-friendly interface for a seamless gaming experience.

Pare

Pare is a website that is currently in private testing phase. It is not accessible to the public at the moment. The website provides limited information, with a message thanking visitors for stopping by and informing them to check back later. The site mentions that it is in private testing and provides contact information for the team. The website seems to be a platform or service that is not yet fully launched, and its purpose or features are not clearly stated.

Replika

Replika is an AI companion application that provides emotional support and conversation for users. It is designed to mimic human interaction and learn from user input to create personalized responses. Users can chat with their Replika, engage in various activities together, share experiences, and even have video calls. Replika aims to be a supportive friend, partner, or mentor to users, offering a safe space for self-expression and emotional connection. The application is known for its ability to provide comfort, companionship, and encouragement to users, especially during challenging times.

pgslotc4

pgslotc4 is a leading online slot website offering a wide range of slot games and casino options. With a focus on direct access and professional service, pgslotc4 ensures a safe and enjoyable gaming experience. The website features a variety of popular slot games, easy deposit and withdrawal options, and a user-friendly interface. Players can enjoy bonuses, automatic spinning, and low-stakes betting. pgslotc4 is licensed and regulated, providing a secure platform for players to explore and win real money rewards.

MB66

MB66 is an online platform designed to provide entertainment services, online betting, and top online gaming experiences in the Asian region. With a user-friendly interface, rich content, and unique features, MB66 stands out in the tech industry by offering a wide range of entertainment options, from online casino games to convenient financial services. The platform ensures transparency, reliability, and security, catering to millions of users who enjoy entertainment in a healthy and fair environment.

Vavada Casino

Vavada Casino is an online gambling platform that was established in 2017 and quickly gained popularity worldwide. It offers a vast library of 4500 games, operates under a Curacao license, and is known for its reliability and fairness. One of its key advantages is the easy withdrawal process without verification or fees. The platform also provides a unique rewards program for players' achievements. Vavada Casino actively expands its global presence, attracting gamers from various countries and offering a seamless gaming experience.

GoLinks®

GoLinks® is an AI-driven platform that offers instant access to internal knowledge through short links. It empowers teams to retrieve and share information quickly, improving collaboration and productivity. The platform transforms long URLs into memorable short links, integrates with favorite apps, and provides AI-powered resource search. GoLinks® offers features like collections, tags, AI-powered suggestions, mobile apps, usage trends, analytics, API & webhooks, QR codes, and more. It is designed to streamline workplace communication and knowledge sharing.

SamurAI bot chat

SamurAI bot chat is an AI-powered chatbot application that provides automated responses and conversations with users. It utilizes artificial intelligence algorithms to understand and respond to user queries in real-time. The application aims to enhance user engagement and customer support by offering personalized interactions and quick solutions through chat conversations.

KWIKmotion

KWIKmotion is a platform that offers OTT (Over-The-Top) services, video on demand, and live streaming solutions. It provides a seamless experience for users to access a wide range of content anytime, anywhere. With KWIKmotion, users can enjoy their favorite movies, TV shows, and live events on various devices. The platform is designed to cater to the growing demand for on-demand video content and live streaming services.

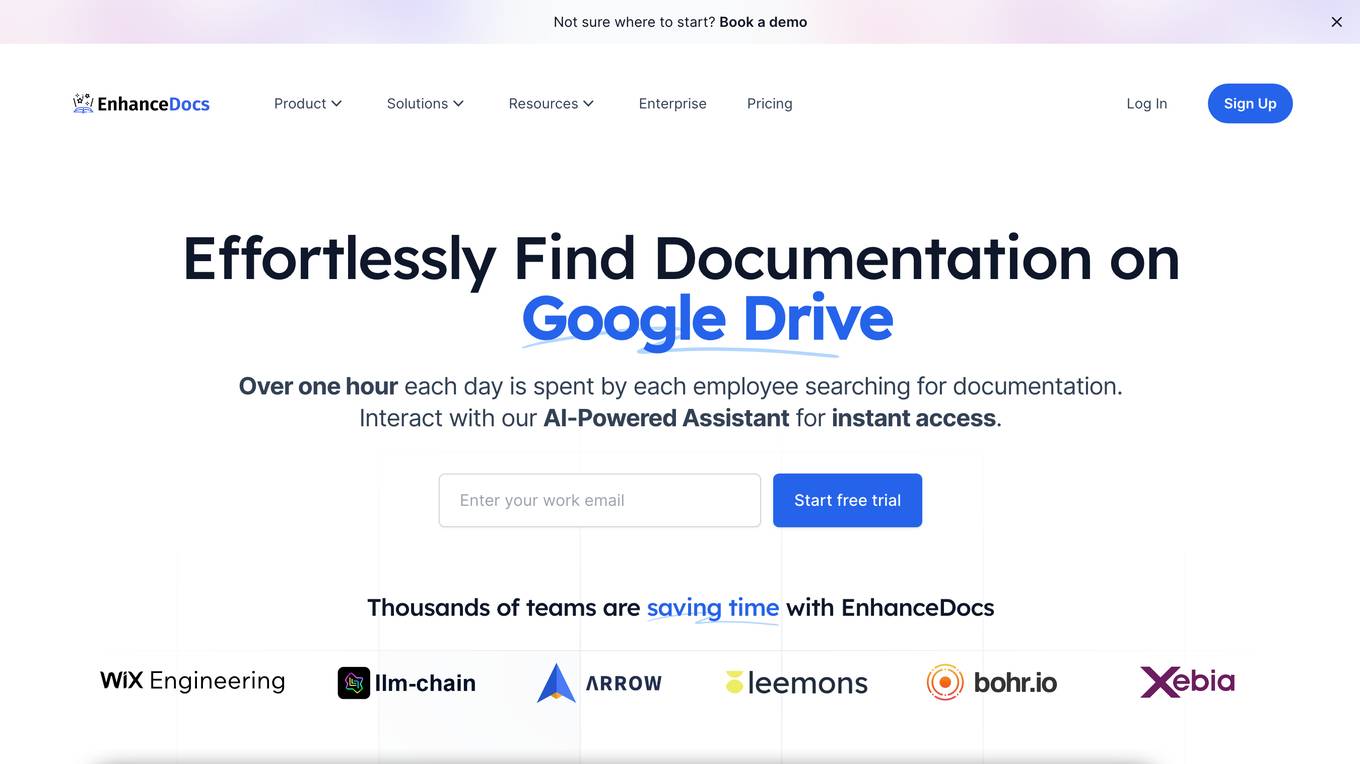

EnhanceDocs

EnhanceDocs is an AI-powered documentation tool that revolutionizes the way teams access and manage their documentation. It helps users effortlessly find documentation across various platforms like Notion, Google Drive, Confluence, SharePoint, and OneDrive. The tool offers features such as natural language documentation search, AI-generated content suggestions, and valuable analytics insights. EnhanceDocs aims to save teams time, improve productivity, and enhance the overall documentation experience.

SLOT88

SLOT88 is an online gambling platform claiming to be the 'site of today's gacor slots' with a variety of online slot games. The site is often promoted as an easy-to-win slot playing place (definitely win 2025) and provides access links to Slot88 games. However, it is important to understand that such claims need to be critically analyzed, especially because the results of online gambling depend on luck and RNG algorithms, not absolute winning promises.

MyLoans.ai

MyLoans.ai is a free AI tool designed to provide personalized guidance for complex student loans. It offers instant, clear, and accurate answers to student loan queries, helping borrowers make informed decisions about their financial future. By skipping expensive advisors and confusing government websites, MyLoans.ai aims to save users thousands of dollars by leveraging official government sources for guidance.

ABC8

ABC8 is a leading online betting platform in Asia, offering a wide range of high-quality and reputable betting options. With a diverse selection of over 1,000 engaging games from renowned developers, ABC8 provides players with a top-notch entertainment experience. The platform is licensed by PAGCOR and adheres to strict regulatory oversight, ensuring transparency and reliability in its betting services. ABC8 aims to become a premier betting destination, expanding its operations to Europe and America while prioritizing security, fairness, and player satisfaction.

Sheriff

Sheriff is a Slack bot that helps you save time with rotating rosters and AI language understanding. It allows you to create a rotating roster of users in a channel that will become the designated @sheriff for a period of time. Whenever a user comes into this channel, they can tag @sheriff which will in turn notify the current user in the roster. This simple functionality can be used in multiple ways: Sheriff acting as the first point of contact for any questions from outside the team, Use sheriff in a support channel to answer incoming questions, Use sheriff to track a recurring role that cycles between team members.

Pixiboo

Pixiboo is an AI-powered application that allows users to create personalized search and find books for children. Users can design surprises for their loved ones by hiding characters in enchanting illustrations. The application uses Generative AI to generate hand-crafted artworks created by talented artists. Pixiboo aims to inspire children to connect with art, technology, and AI through playful interaction, nurturing the next generation of builders.