Best AI tools for< Manage Loans >

20 - AI tool Sites

Clerkie

Clerkie is a powerful debt repayment and optimization platform that offers a full-service automation solution powered by machine learning and human expertise. It helps lenders, both big and small, to manage and optimize their loan portfolios efficiently. With features like smart payment experience, AI-driven repayment strategies, real-time reporting, and easy integration, Clerkie ensures a seamless and secure experience for lenders and borrowers alike.

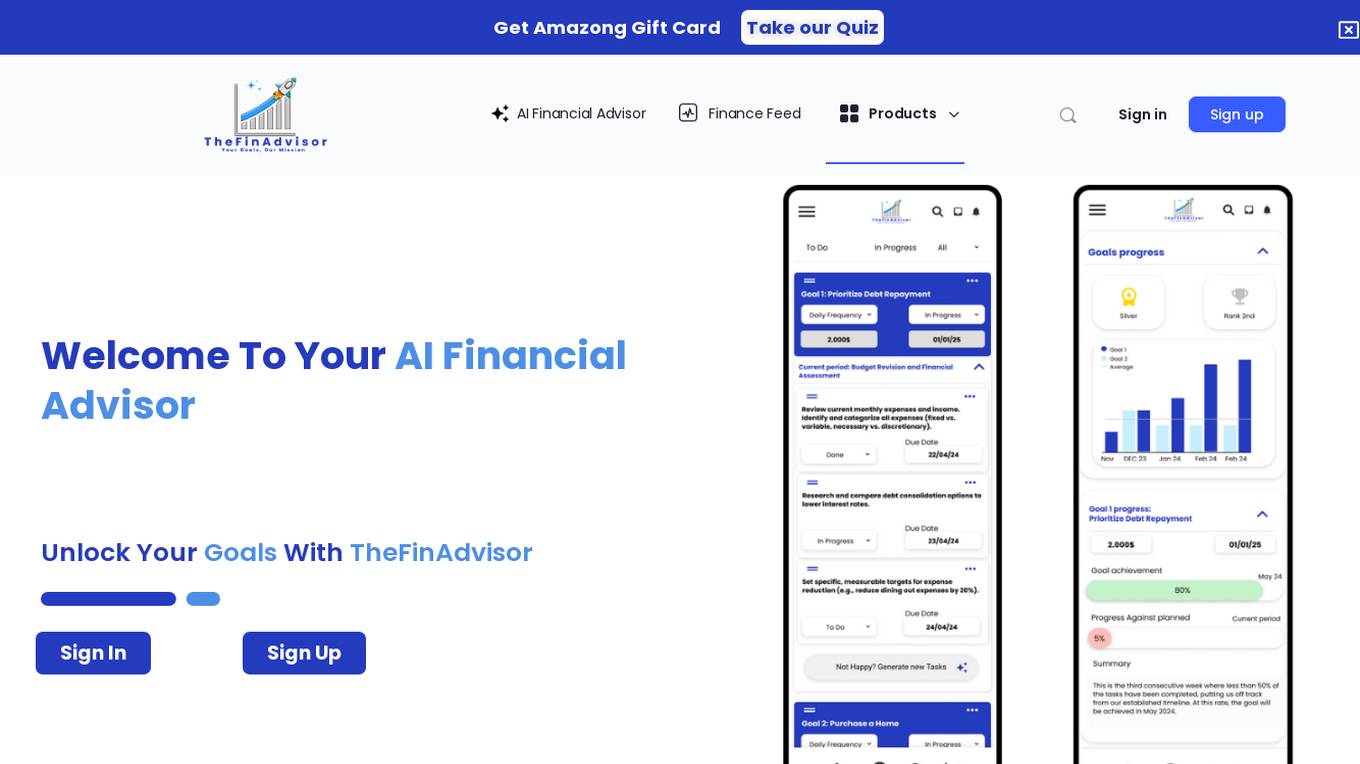

TheFinAdvisor

TheFinAdvisor.com is an AI financial advisor platform that offers personalized investment strategies and expert guidance tailored to individual financial goals. Users can receive assistance in managing student loans, credit cards, debt restructuring, home purchases, car/truck acquisitions, house market investments, early retirement planning, world travel, and business building. The platform also provides insights on financial topics, encourages user questions, and facilitates community connections with financial experts. Additionally, users can explore various financial services, share reviews, and monetize content as financial influencers.

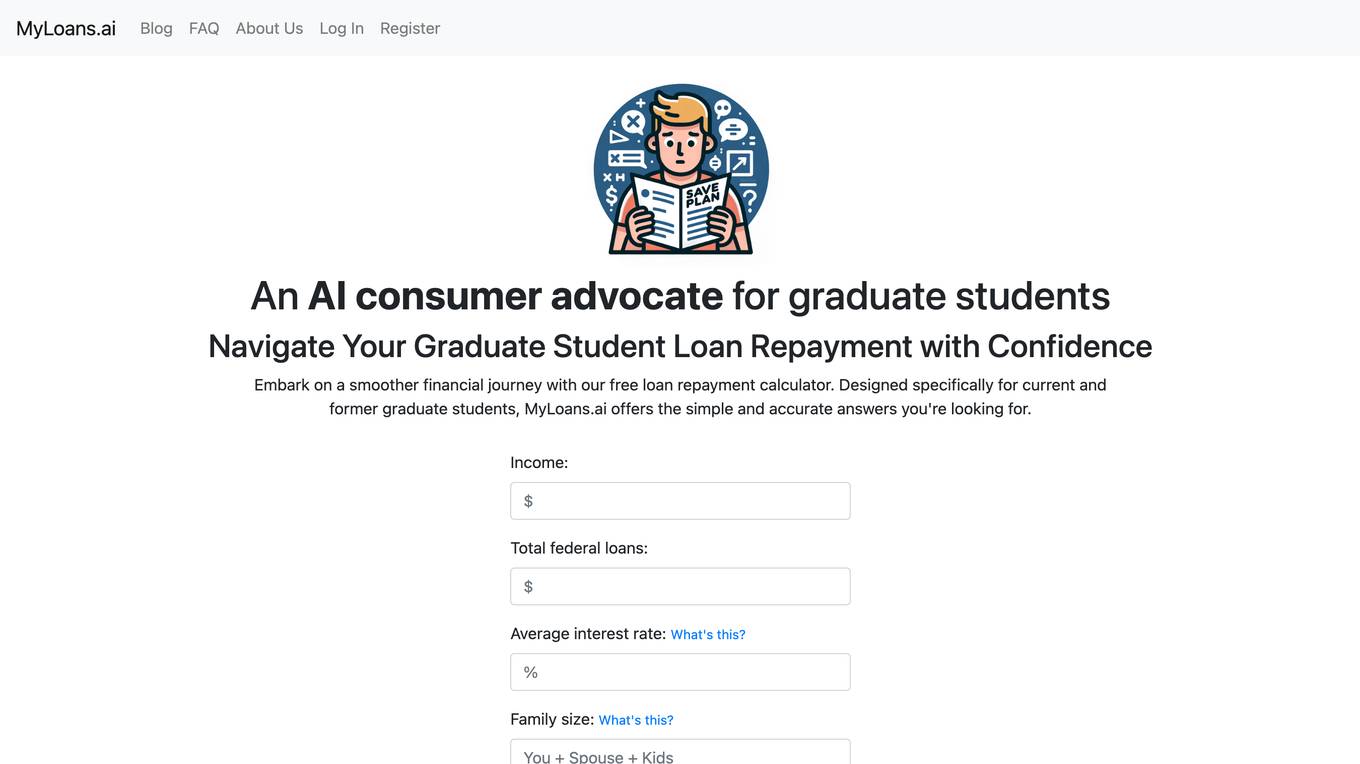

MyLoans.ai

MyLoans.ai is a free AI tool designed to provide personalized guidance for complex student loans. It offers instant, clear, and accurate answers to student loan queries, helping borrowers make informed decisions about their financial future. By skipping expensive advisors and confusing government websites, MyLoans.ai aims to save users thousands of dollars by leveraging official government sources for guidance.

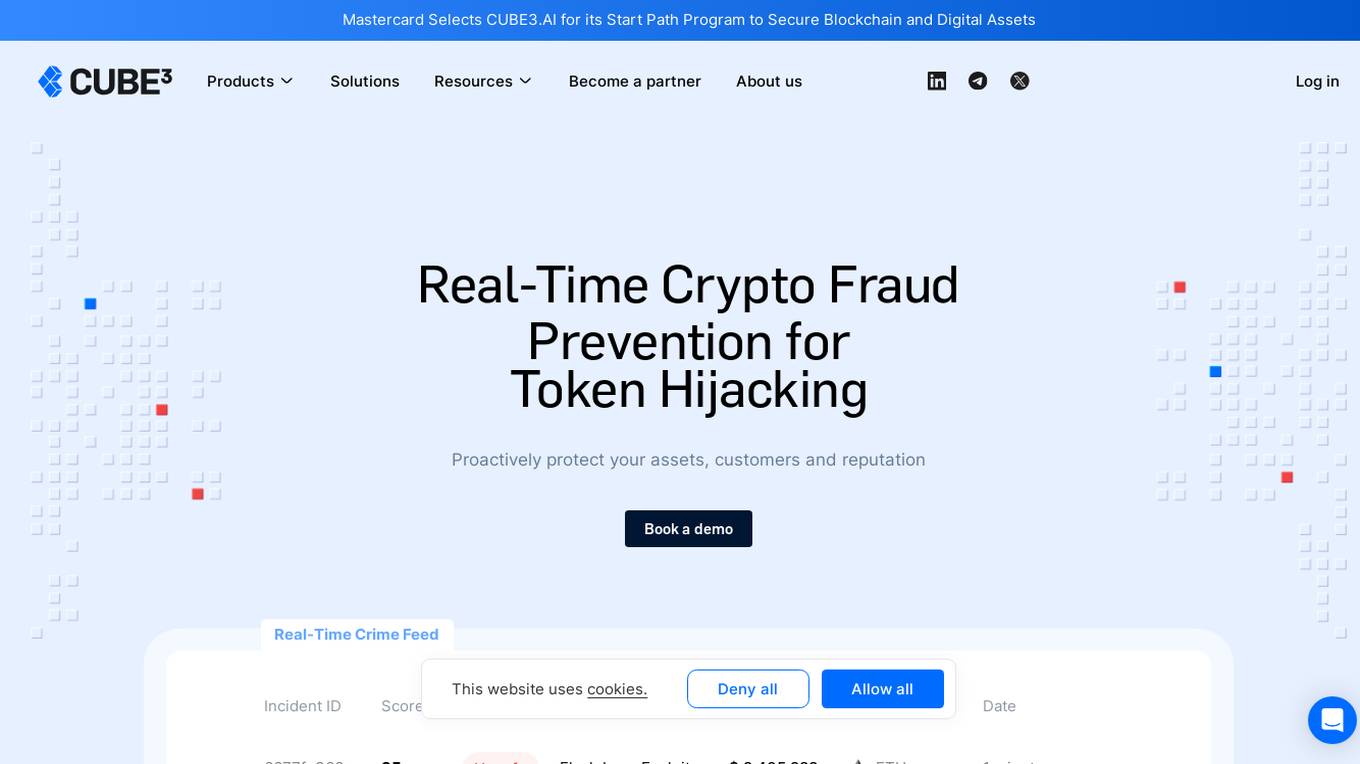

CUBE3.AI

CUBE3.AI is a real-time crypto fraud prevention tool that utilizes AI technology to identify and prevent various types of fraudulent activities in the blockchain ecosystem. It offers features such as risk assessment, real-time transaction security, automated protection, instant alerts, and seamless compliance management. The tool helps users protect their assets, customers, and reputation by proactively detecting and blocking fraud in real-time.

VantedgeAI

VantedgeAI is an AI application that offers fine-tuned AI models for credit funds, revolutionizing credit investing workflows with faster, smarter, and cost-effective solutions. The application transforms manual processes into scalable, automated workflows tailored for Private Credit and Hedge Funds. VantedgeAI is trusted by market leaders in the industry, providing unique AI-driven insights to maintain a competitive advantage and ensure data security and privacy through SOC 2 compliance. The application offers advanced AI solutions for credit investing, including automated investment memo generation, data extraction for Excel models, portfolio monitoring, loan reconciliation, smart bond screening, real-time data querying with AI bots, and more.

AI Credit Repair

AI Credit Repair is an AI-powered application designed to help users improve their credit score by providing tools such as credit card utilization builder, public records remover, dispute letter generator, and SMS alerts. The application assists users in managing their credit card payments, disputing collections, and staying on top of their credit-related activities. By leveraging artificial intelligence technology, AI Credit Repair aims to simplify the credit repair process and empower users to build a better financial future.

Parade

Parade is a capacity management platform designed for freight brokerages and 3PLs to streamline operations, automate bookings, and improve margins. The platform leverages advanced AI to optimize pricing, bidding, and carrier management, helping users book more loads efficiently. Parade integrates seamlessly with existing tech stacks, offering precise pricing, optimized bidding, and enhanced shipper connectivity. The platform boasts a range of features and benefits aimed at increasing efficiency, reducing costs, and boosting margins for freight businesses.

Zest AI

Zest AI is an AI-driven credit underwriting software that offers a complete solution for AI-driven lending. It enables users to build custom machine learning risk models, adopt model assessment and regulatory compliance, and operate performance management and model monitoring. Zest AI helps increase approvals, manage risk, control loss, drive operational efficiency, automate credit decisioning, and improve borrower experience while ensuring fair lending practices. The software is designed to provide powerful AI for better lending outcomes by accelerating loan growth and expanding credit access through accurate risk prediction and faster credit decisions.

Zest AI

Zest AI is an AI-driven credit underwriting software that offers a complete solution for AI-driven lending. It enables users to build custom machine learning risk models, adopt model assessment and regulatory compliance, and operate performance management and model monitoring. Zest AI helps increase approvals, manage risk, control loss, drive operational efficiency, automate credit decisioning, and improve borrower experience while ensuring fair lending practices. The software is designed to provide fair and transparent credit for everyone, making lending more accessible and inclusive.

Kasisto

Kasisto is a conversational AI platform that provides financial institutions with the ability to create personalized, automated, and engaging digital experiences for their customers and employees. Kasisto's platform is infused with unmatched financial literacy and augments your workforce with remarkably competent digital bankers who facilitate accurate, human-like conversations and empower your teams with “in-the-moment” financial knowledge.

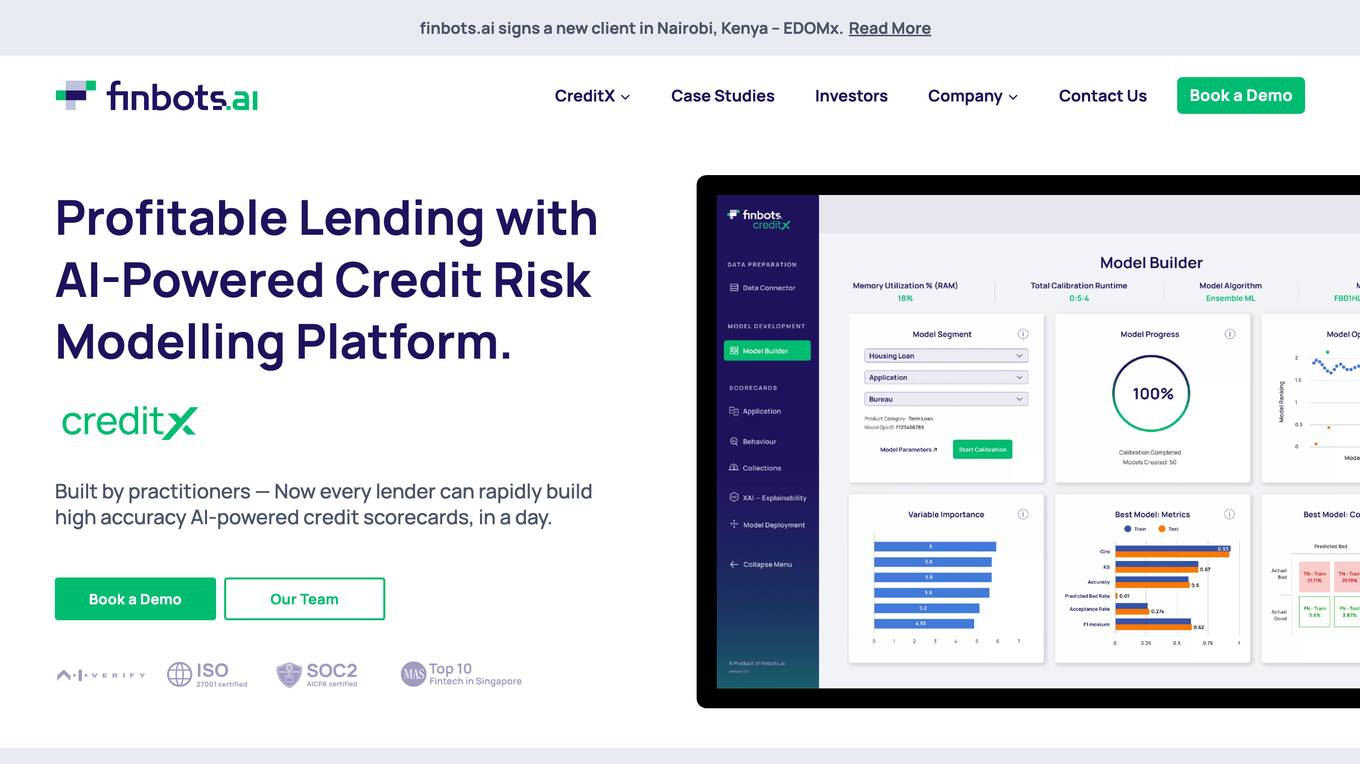

Finbots.ai

Finbots.ai is a trusted AI credit risk platform that offers AI credit scoring to boost lending profits and reduce non-performing loans. The platform provides the highest accuracy in the market, allowing users to build scorecards in a day without the need for coding. It helps in making instant decisions, increasing revenue, reducing risk, and improving operational efficiency. Finbots.ai is utilized by various financial institutions to enhance credit risk management, improve profitability, and drive down the cost of risk through AI-enabled models.

Casca

Casca is a revolutionary AI-native Loan Origination System that helps banks and non-bank lenders automate 90% of manual effort in business loan origination. By leveraging AI technology, Casca enables financial institutions to process loans 10x faster, achieve 3x higher conversion rates, and save significant time for loan officers. With features like AI Loan Assistant, digital application processing, KYB checks automation, and document analysis, Casca transforms the loan origination process into a seamless and efficient experience for both lenders and borrowers.

Scienaptic Systems

Scienaptic Systems is an AI-powered Credit Decisioning Platform that revolutionizes the lending industry by automating credit underwriting processes, leveraging alternate data points, and offering self-learning models for instant credit decisions. The platform helps lenders identify creditworthy borrowers, streamline customer experience, and ensure fair lending practices through explainable AI models. Scienaptic's suite of AI-enabled technologies enables lenders to say 'Yes' to more borrowers at lower risk, providing a 360-degree risk assessment before approving applications. The platform integrates seamlessly with existing lending ecosystems, ensuring disruption-free deployment and better risk predictions through a single API call.

Ocrolus

Ocrolus is an intelligent document automation software that leverages AI-driven document processing automation with Human-in-the-Loop. It offers capabilities such as classifying, capturing, detecting, and analyzing documents, with use cases in cash flow, income, address, employment, and identity verification. Ocrolus caters to various industries like small business lending, mortgage, consumer finance, and multifamily housing. The platform provides resources for developers, including guides on income verification, fraud detection, and business process automation. Users can explore the API to build innovative customer experiences and make faster and more accurate financial decisions.

Underwrite.ai

Underwrite.ai is a platform that leverages advances in artificial intelligence and machine learning to provide lenders with nonlinear, dynamic models of credit risk. By analyzing thousands of data points from credit bureau sources, the application accurately models credit risk for consumers and small businesses, outperforming traditional approaches. Underwrite.ai offers a unique underwriting methodology that focuses on outcomes such as profitability and customer lifetime value, allowing organizations to enhance their lending performance without the need for capital investment or lengthy build times. The platform's models are continuously learning and adapting to market changes in real-time, providing explainable decisions in milliseconds.

Cape.ai

Cape.ai is an agentic AI platform designed for financial operations, offering AI-powered automation to enhance reach, insight, and efficiency in daily operations for financial firms. The platform is built on real-world customer use cases, providing tangible business ROI by integrating structured and unstructured data sources, automating complex manual processes, and offering context-aware insights. Users have control over their data and processes, with customizable workflows and human-in-the-loop capabilities. Cape.ai enables flexible implementation of agentic and deterministic automation, with seamless integrations for various financial workflows and direct access to leading financial data providers. The platform empowers users to create powerful AI agents without technical barriers, unlocking real business value with speed and confidence.

Hey Bubba!

Hey Bubba! is an AI voice dispatcher application designed to assist truck drivers in finding, negotiating, and booking freight loads efficiently. The app operates 24x7, utilizing AI technology to maximize earnings by securing high-paying loads. With voice commands and AI auto-pilot features, Hey Bubba! streamlines the load search, negotiation, and booking process, ultimately reducing downtime and increasing revenue for owner-operators and small fleets.

Hey Bubba!

Hey Bubba! is an AI voice dispatcher application designed to help truck drivers find, negotiate, and book loads efficiently using voice commands and AI technology. The app operates 24x7, allowing drivers to focus on the road while Bubba works to secure high-paying loads. With features like AI dispatch, best load recommendations, auto-pilot voice technology, and hassle-free load booking, Hey Bubba! aims to streamline the freight booking process for owner-operators and small fleets.

Houmify

Houmify.com is an AI-powered property companion that offers personalized real estate solutions. The platform uses artificial intelligence to guide users in accessing the best services related to selling a home, buying a home, loan & refinance, and home maintenance. Users can interact with the AI Agent to get expert advice and recommendations tailored to their specific needs and preferences. The website also provides informative posts and articles on real estate topics to help users make informed decisions. With a focus on user experience and convenience, Houmify aims to simplify the real estate process and empower individuals in their property transactions.

Kolank AI

Kolank AI is a freight broker automation software powered by AI that handles carrier communication, load tracking, and dispatch management. It automates routine tasks like check calls, status updates, and document processing, allowing your team to focus on booking more loads and building relationships. The platform offers multi-channel communication, 24/7 coverage, and seamless integration with existing TMS systems. Designed for brokerages of all sizes, Kolank AI aims to amplify your operations by providing intelligent automation and support for critical decision-making.

0 - Open Source AI Tools

20 - OpenAI Gpts

Loan Management Software

Loan management software expertise. Get the most powerful loan origination and loan servicing software on the market.

Personal Loan

Discusses personal loans, payment methods, and financial options informatively.

Fast Loan

Discusses fast loans, application processes, and financial considerations informatively.

Debt Management Advisor

Advises on debt management strategies to improve financial stability.

Pay Later

Explains 'buy now, pay later' and recommends providers in a financial, informative tone.

Finance Guide

Multilingual advisor on microfinance, focusing on clarity and educational content.

Debt Dodger

Avoid Debt Accumulation with Credit Card Interest Insights. Find out how much interest you will pay before you make that purchase with your credit card.

Credit Card Companion

Balanced guidance on credit cards for young people, with a mix of formal and casual tones