Zest AI

Powerful AI for Better Lending

Zest AI is an AI-driven credit underwriting software that offers a complete solution for AI-driven lending. It enables users to build custom machine learning risk models, adopt model assessment and regulatory compliance, and operate performance management and model monitoring. Zest AI helps increase approvals, manage risk, control loss, drive operational efficiency, automate credit decisioning, and improve borrower experience while ensuring fair lending practices. The software is designed to provide fair and transparent credit for everyone, making lending more accessible and inclusive.

For Tasks:

Click tags to check more tools for each tasksFor Jobs:

Features

Advantages

Disadvantages

Frequently Asked Questions

Alternative AI tools for Zest AI

Similar sites

Zest AI

Zest AI is an AI-driven credit underwriting software that offers a complete solution for AI-driven lending. It enables users to build custom machine learning risk models, adopt model assessment and regulatory compliance, and operate performance management and model monitoring. Zest AI helps increase approvals, manage risk, control loss, drive operational efficiency, automate credit decisioning, and improve borrower experience while ensuring fair lending practices. The software is designed to provide fair and transparent credit for everyone, making lending more accessible and inclusive.

Zest AI

Zest AI is an AI-driven credit underwriting software that offers a complete solution for AI-driven lending. It enables users to build custom machine learning risk models, adopt model assessment and regulatory compliance, and operate performance management and model monitoring. Zest AI helps increase approvals, manage risk, control loss, drive operational efficiency, automate credit decisioning, and improve borrower experience while ensuring fair lending practices. The software is designed to provide powerful AI for better lending outcomes by accelerating loan growth and expanding credit access through accurate risk prediction and faster credit decisions.

Scienaptic Systems

Scienaptic Systems is an AI-powered Credit Decisioning Platform that revolutionizes the lending industry by automating credit underwriting processes, leveraging alternate data points, and offering self-learning models for instant credit decisions. The platform helps lenders identify creditworthy borrowers, streamline customer experience, and ensure fair lending practices through explainable AI models. Scienaptic's suite of AI-enabled technologies enables lenders to say 'Yes' to more borrowers at lower risk, providing a 360-degree risk assessment before approving applications. The platform integrates seamlessly with existing lending ecosystems, ensuring disruption-free deployment and better risk predictions through a single API call.

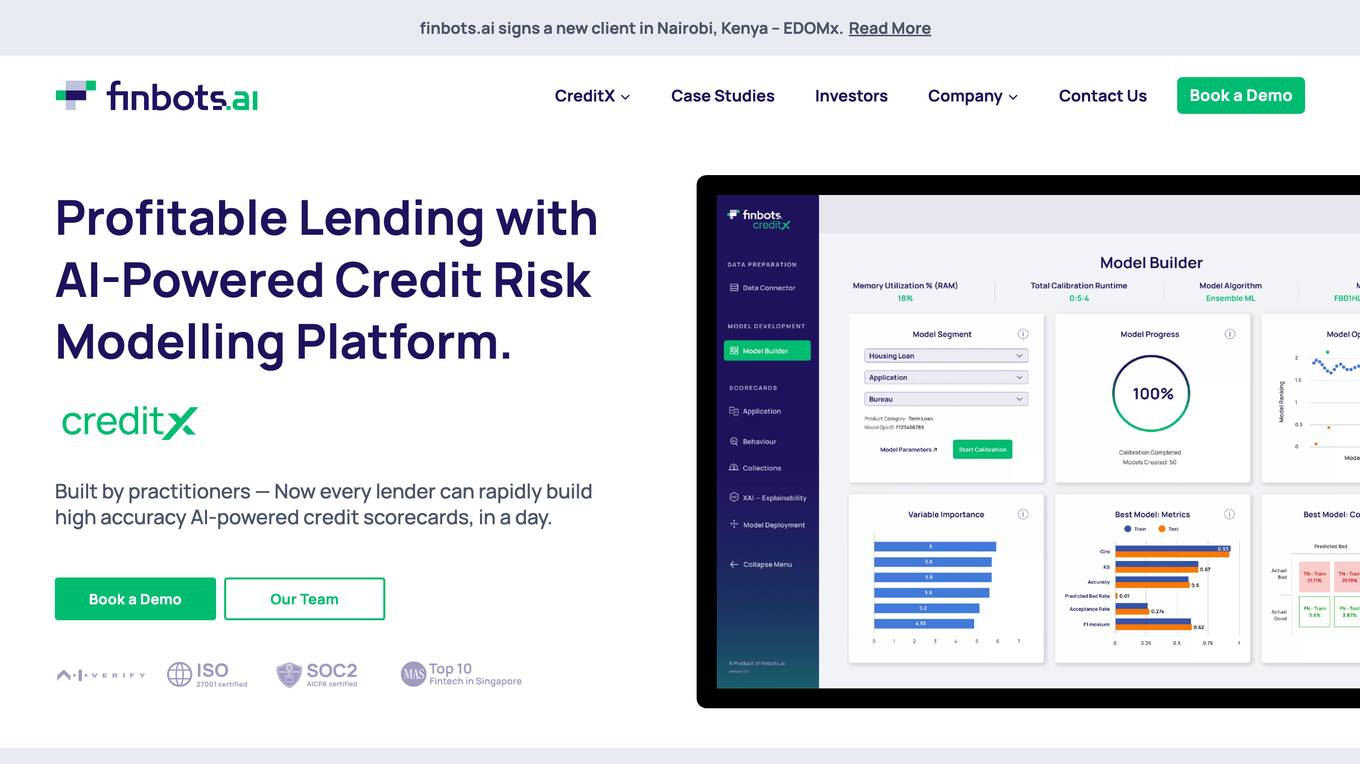

Finbots.ai

Finbots.ai is a trusted AI credit risk platform that offers AI credit scoring to boost lending profits and reduce non-performing loans. The platform provides the highest accuracy in the market, allowing users to build scorecards in a day without the need for coding. It helps in making instant decisions, increasing revenue, reducing risk, and improving operational efficiency. Finbots.ai is utilized by various financial institutions to enhance credit risk management, improve profitability, and drive down the cost of risk through AI-enabled models.

Clerkie

Clerkie is a powerful debt repayment and optimization platform that offers a full-service automation solution powered by machine learning and human expertise. It helps lenders, both big and small, to manage and optimize their loan portfolios efficiently. With features like smart payment experience, AI-driven repayment strategies, real-time reporting, and easy integration, Clerkie ensures a seamless and secure experience for lenders and borrowers alike.

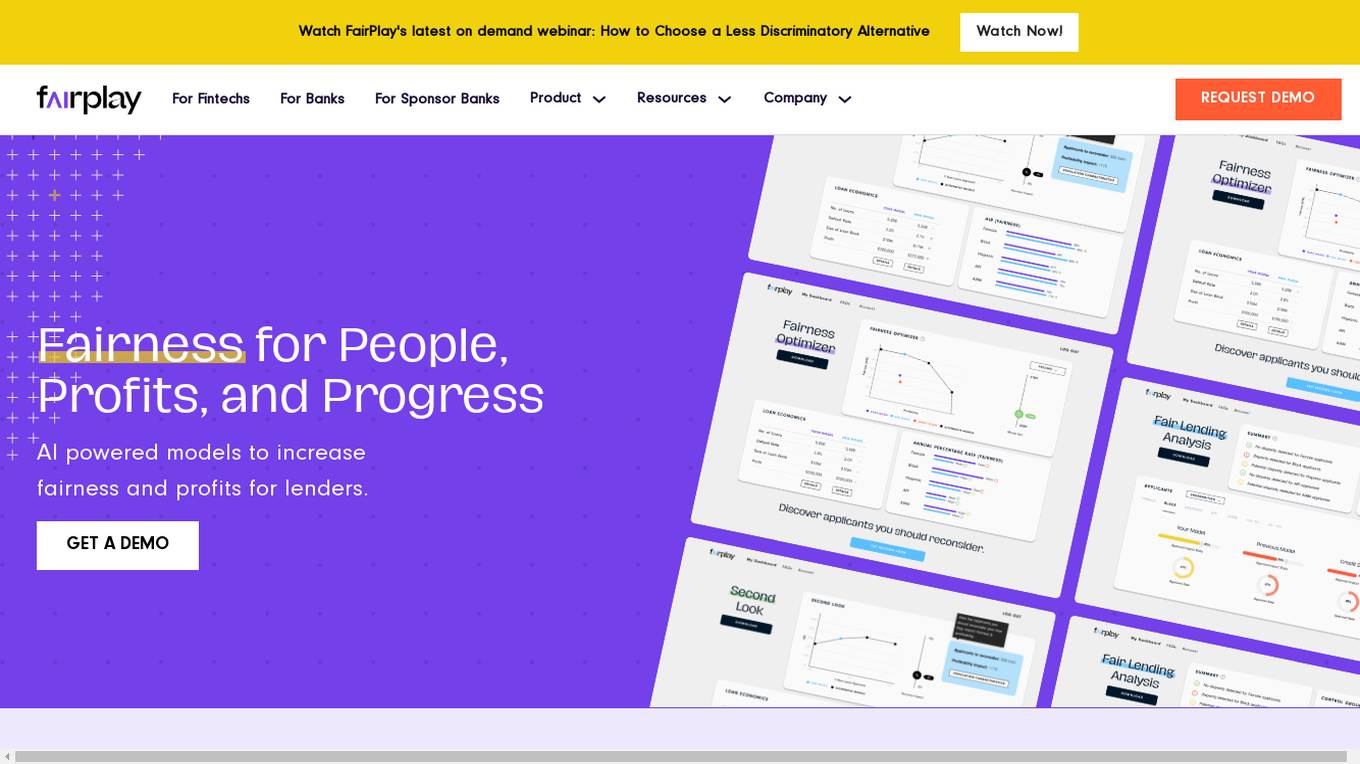

FairPlay

FairPlay is a Fairness-as-a-Service solution designed for financial institutions, offering AI-powered tools to assess automated decisioning models quickly. It helps in increasing fairness and profits by optimizing marketing, underwriting, and pricing strategies. The application provides features such as Fairness Optimizer, Second Look, Customer Composition, Redline Status, and Proxy Detection. FairPlay enables users to identify and overcome tradeoffs between performance and disparity, assess geographic fairness, de-bias proxies for protected classes, and tune models to reduce disparities without increasing risk. It offers advantages like increased compliance, speed, and readiness through automation, higher approval rates with no increase in risk, and rigorous Fair Lending analysis for sponsor banks and regulators. However, some disadvantages include the need for data integration, potential bias in AI algorithms, and the requirement for technical expertise to interpret results.

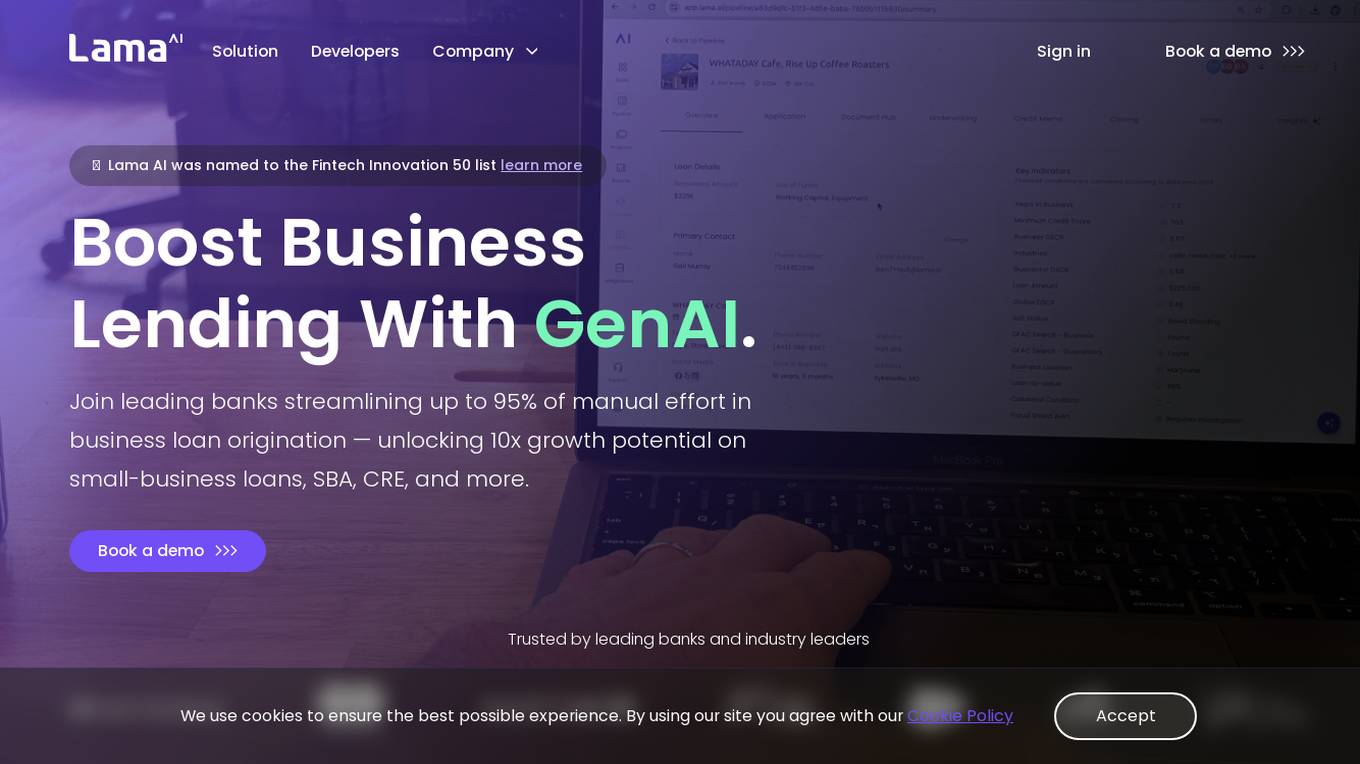

Lama AI

Lama AI is an AI-powered platform designed to revolutionize business lending processes for banks and financial institutions. It offers advanced features, rapid configurability, and exceptional support to streamline loan origination, underwriting, and decision-making. By leveraging the power of AI, Lama AI enables banks to boost business growth potential, improve profitability, and enhance customer experience through contextual onboarding, decisioning workspace, expanded credit access, and pre-qualified applications. The platform also provides white-labeled solutions, API-first integration, high configurability, built-in AI models, and access to a network of bank lenders, all while ensuring bank-grade security and compliance standards.

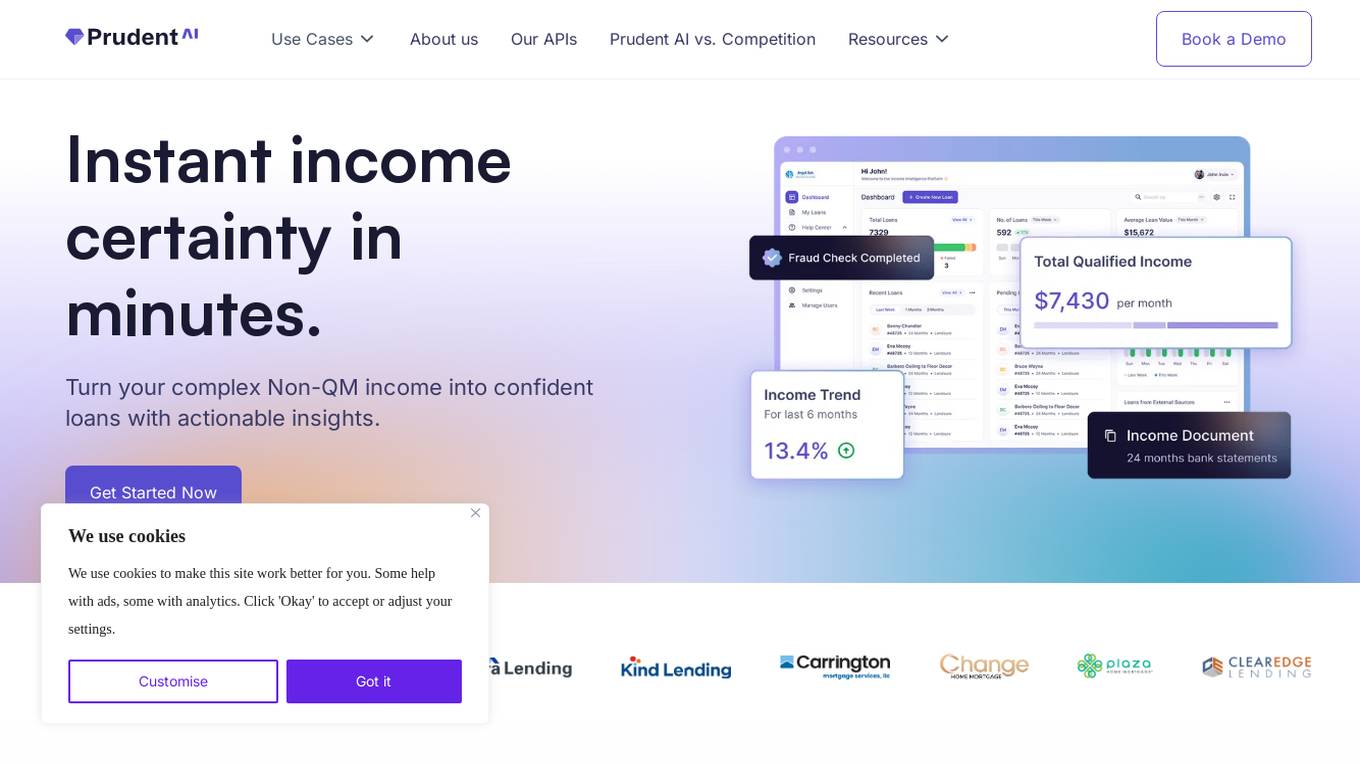

Prudent AI

Prudent AI is an AI-powered Income Intelligence Platform designed for lenders, offering fast data extraction, proactive fraud prevention, and in-depth insights on borrower income. The platform simplifies complex income calculations, streamlines the lending process, and enables lenders to make confident loan decisions quickly. Prudent AI is trusted by various lending institutions and has been proven to increase productivity, save time, and improve submission accuracy.

VantedgeAI

VantedgeAI is an AI application that offers fine-tuned AI models for credit funds, revolutionizing credit investing workflows with faster, smarter, and cost-effective solutions. The application transforms manual processes into scalable, automated workflows tailored for Private Credit and Hedge Funds. VantedgeAI is trusted by market leaders in the industry, providing unique AI-driven insights to maintain a competitive advantage and ensure data security and privacy through SOC 2 compliance. The application offers advanced AI solutions for credit investing, including automated investment memo generation, data extraction for Excel models, portfolio monitoring, loan reconciliation, smart bond screening, real-time data querying with AI bots, and more.

FlowX.AI

FlowX.AI is a Multi-Agent AI Platform designed for Banking and Insurance Modernization. It offers a cutting-edge AI-native agentic platform for building and deploying AI agents and mission-critical AI-enabled systems in highly regulated industries. The platform enables businesses to build the next generation of banking and insurance systems in weeks, not years, by providing faster development, time to market, and reduced maintenance and implementation costs.

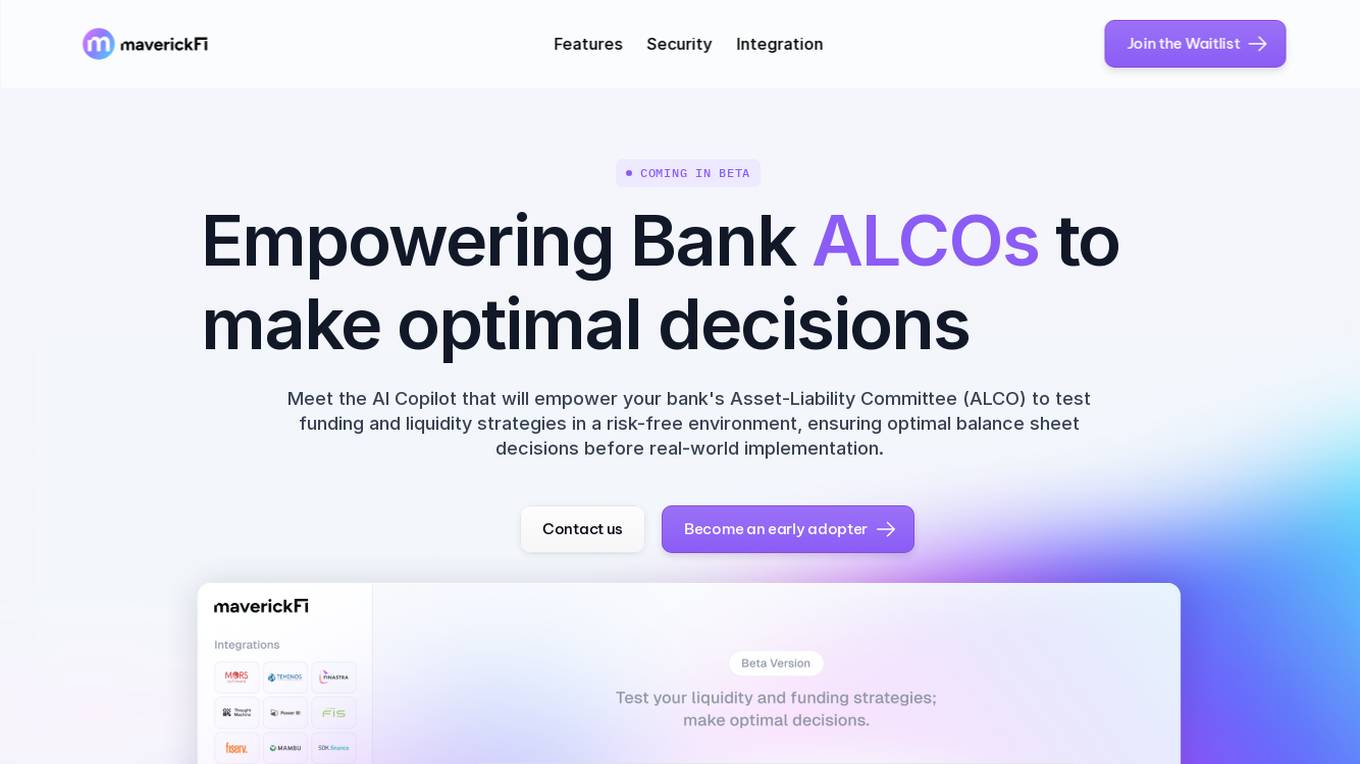

AI Copilot for bank ALCOs

AI Copilot for bank ALCOs is an AI application designed to empower Asset-Liability Committees (ALCOs) in banks to test funding and liquidity strategies in a risk-free environment, ensuring optimal balance sheet decisions before real-world implementation. The application provides proactive intelligence for day-to-day decisions, allowing users to test multiple strategies, compare funding options, and make forward-looking decisions. It offers features such as stakeholder feedback, optimal funding mix, forward-looking decisions, comparison of funding strategies, domain-specific models, maximizing returns, staying compliant, and built-in security measures. MaverickFi, the AI Copilot, is deployed on Microsoft Azure and offers deployment options based on user preferences.

Convr

Convr is an AI-driven underwriting analysis platform that helps commercial P&C insurance organizations transform their underwriting operations. It provides a modularized AI underwriting and intelligent document automation workbench that enriches and expedites the commercial insurance new business and renewal submission flow with underwriting insights, business classification, and risk scoring. Convr's mission is to solve the last big problem of commercial insurance while improving profitability and increasing efficiency.

Federato

Federato is an AI-powered platform that integrates Google Cloud's AI capabilities to provide new AI underwriting solutions for the insurance industry. It aims to revolutionize underwriting processes by leveraging AI technology to enhance risk assessment, portfolio management, and decision-making. Federato's RiskOps platform empowers underwriters with powerful insights, real-time risk selection guidance, and unified underwriting workflows, enabling them to make more informed decisions and improve operational efficiency.

Perfios

Perfios is an AI-powered FinTech software company that offers digital solutions for various industries such as banking, insurance, fintech, payments, e-commerce, legal, gaming, and more. Their platform provides end-to-end solutions for digital onboarding, underwriting, risk assessment, fraud detection, and customer engagement. Perfios leverages AI and machine learning technologies to streamline processes, enhance operational efficiency, and improve decision-making in financial services. With a wide range of products and features, Perfios aims to transform the way businesses experience technology and make data-driven decisions.

Convr

Convr is a modularized AI underwriting and intelligent document automation workbench that enriches and expedites the commercial insurance new business and renewal submission flow with underwriting insights, business classification and risk scoring. As a trusted technology partner and advisor with deep industry expertise, we help insurance organizations transform their underwriting operations through our AI-driven digital underwriting analysis platform.

Arya.ai

Arya.ai is an AI tool designed for Banks, Insurers, and Financial Services to deploy safe, responsible, and auditable AI applications. It offers a range of AI Apps, ML Observability Tools, and a Decisioning Platform. Arya.ai provides curated APIs, ML explainability, monitoring, and audit capabilities. The platform includes task-specific AI models for autonomous underwriting, claims processing, fraud monitoring, and more. Arya.ai aims to facilitate the rapid deployment and scaling of AI applications while ensuring institution-wide adoption of responsible AI practices.

For similar tasks

Zest AI

Zest AI is an AI-driven credit underwriting software that offers a complete solution for AI-driven lending. It enables users to build custom machine learning risk models, adopt model assessment and regulatory compliance, and operate performance management and model monitoring. Zest AI helps increase approvals, manage risk, control loss, drive operational efficiency, automate credit decisioning, and improve borrower experience while ensuring fair lending practices. The software is designed to provide fair and transparent credit for everyone, making lending more accessible and inclusive.

Scienaptic Systems

Scienaptic Systems is an AI-powered Credit Decisioning Platform that revolutionizes the lending industry by automating credit underwriting processes, leveraging alternate data points, and offering self-learning models for instant credit decisions. The platform helps lenders identify creditworthy borrowers, streamline customer experience, and ensure fair lending practices through explainable AI models. Scienaptic's suite of AI-enabled technologies enables lenders to say 'Yes' to more borrowers at lower risk, providing a 360-degree risk assessment before approving applications. The platform integrates seamlessly with existing lending ecosystems, ensuring disruption-free deployment and better risk predictions through a single API call.

Zest AI

Zest AI is an AI-driven credit underwriting software that offers a complete solution for AI-driven lending. It enables users to build custom machine learning risk models, adopt model assessment and regulatory compliance, and operate performance management and model monitoring. Zest AI helps increase approvals, manage risk, control loss, drive operational efficiency, automate credit decisioning, and improve borrower experience while ensuring fair lending practices. The software is designed to provide powerful AI for better lending outcomes by accelerating loan growth and expanding credit access through accurate risk prediction and faster credit decisions.

OpenSpace

OpenSpace is a reality capture and construction site capture platform that provides a complete visual record of projects powered by AI. It offers fast and easy site documentation, automating site capture, simplifying documentation, and delivering flexible progress tracking. OpenSpace uses Spatial AI technology to deliver products that are the fastest and easiest in the industry, allowing builders to document projects, answer questions quickly, and solve problems through images.

Pontus

Pontus is an AI tool that enables users to build AI models with trust, manage risk, and ensure compliance effortlessly. It offers features like smart anonymization, rapid audit, and liability reduction, along with privacy-enhancing technology. Pontus allows for on-premise deployment, role-based access controls, and toxicity checking to prevent inappropriate content. The application is designed to work seamlessly with common LLM providers, making it a valuable asset for industries like healthcare, finance, and research.

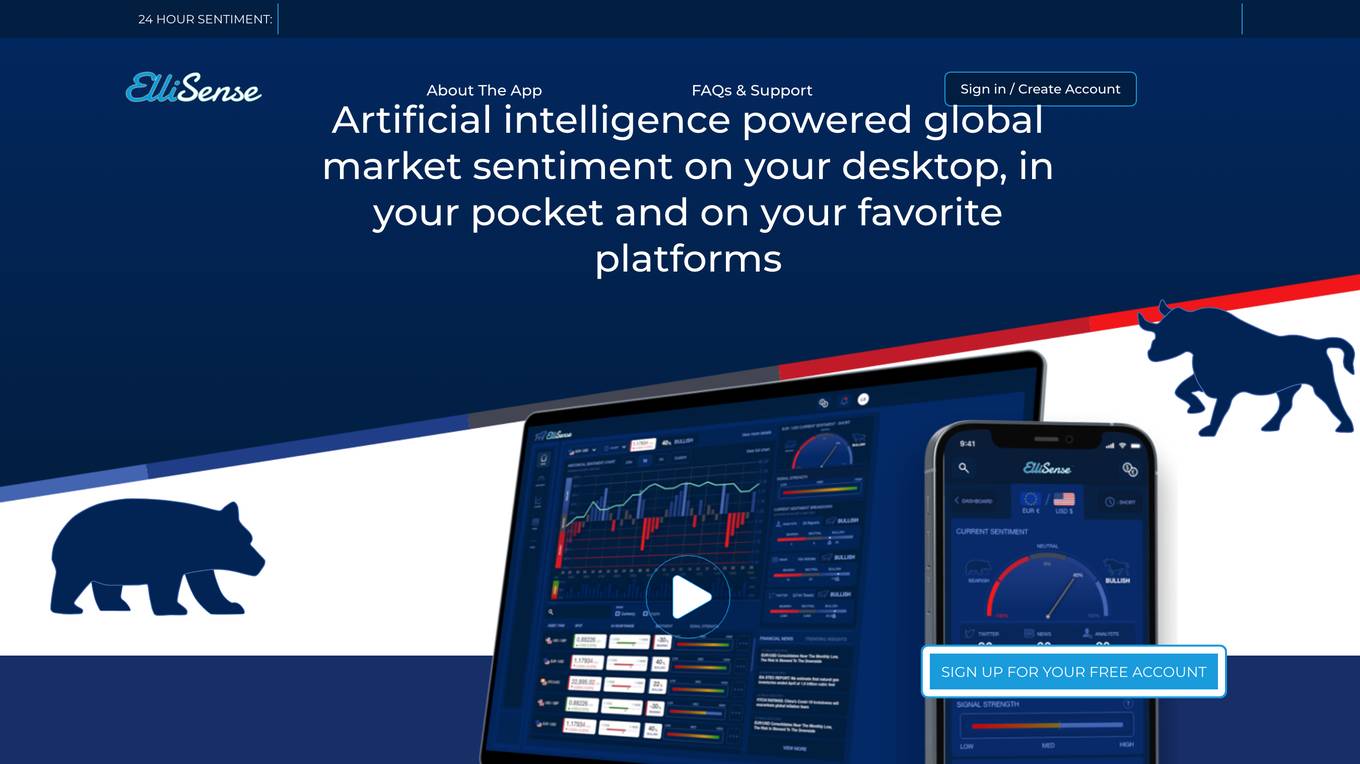

ElliSense

ElliSense is an AI-powered global market sentiment analysis tool that provides real-time insights into the sentiment of various financial assets, including stocks, cryptocurrencies, and forex currencies. It analyzes thousands of data points per second from various sources, including social media, news outlets, and industry analysts, to provide accurate and up-to-date market sentiment. The tool is designed to help traders and investors make informed decisions by providing clear and easy-to-understand market insights.

Dark Pools

Dark Pools is a leading provider of AI-powered solutions for the financial industry. Our mission is to empower our clients with the tools and insights they need to make better decisions, improve their performance, and stay ahead of the competition. We offer a range of products and services that leverage AI to automate tasks, optimize workflows, and generate actionable insights. Our solutions are used by a wide range of financial institutions, including hedge funds, asset managers, and banks.

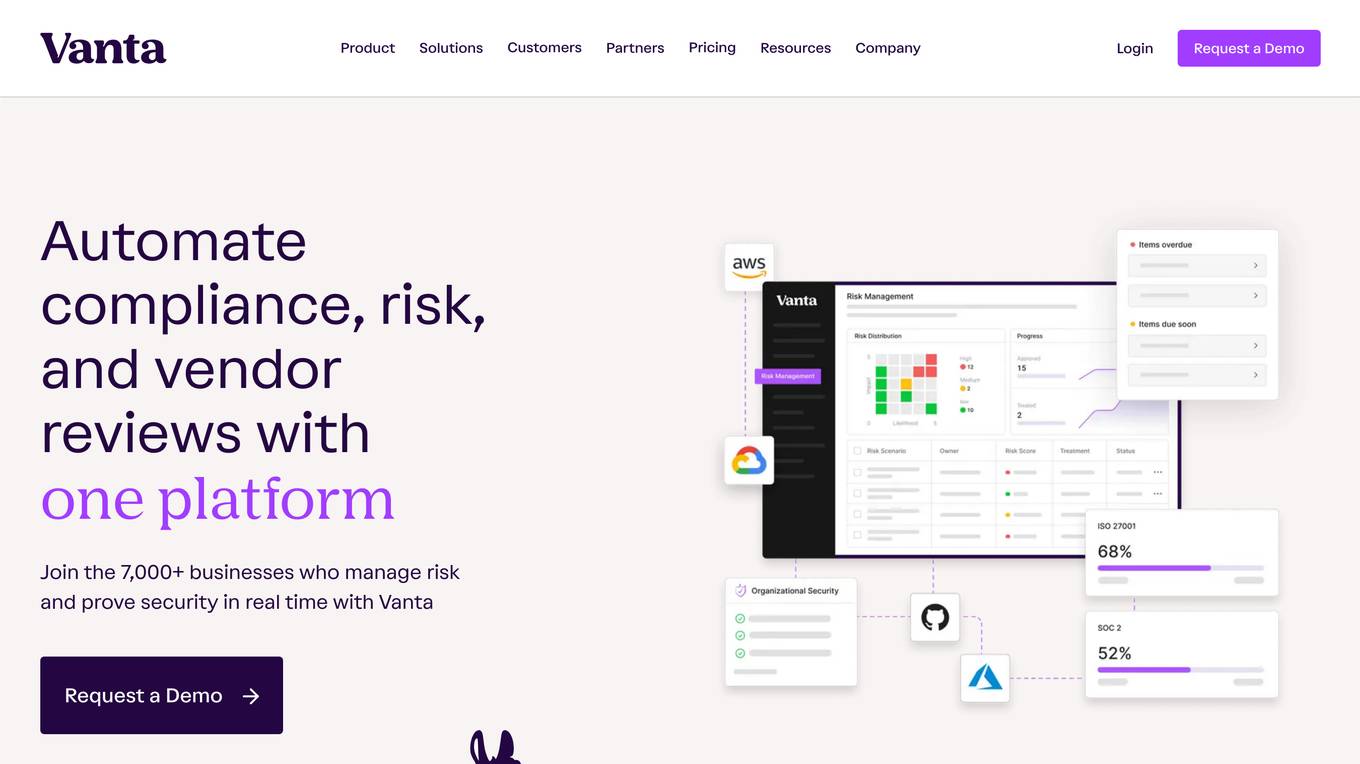

Vanta

Vanta is a trust management platform that helps businesses automate compliance, streamline security reviews, and build trust with customers. It offers a range of features to help businesses manage risk and prove security in real time, including: * **Compliance automation:** Vanta automates up to 90% of the work for security and privacy frameworks, making it easy for businesses to achieve and maintain compliance. * **Real-time monitoring:** Vanta provides real-time visibility into the state of a business's security posture, with hourly tests and alerts for any issues. * **Holistic risk visibility:** Vanta offers a single view across key risk surfaces in a business, including employees, assets, and vendors, to help businesses identify and mitigate risks. * **Efficient audits:** Vanta streamlines the audit process, making it easier for businesses to prepare for and complete audits. * **Integrations:** Vanta integrates with a range of tools and platforms to help businesses automate security and compliance tasks.

DataVisor

DataVisor is a modern, end-to-end fraud and risk SaaS platform powered by AI and advanced machine learning for financial institutions and large organizations. It helps businesses combat various fraud and financial crimes in real time. DataVisor's platform provides comprehensive fraud detection and prevention capabilities, including account onboarding, application fraud, ATO prevention, card fraud, check fraud, FinCrime and AML, and ACH and wire fraud detection. The platform is designed to adapt to new fraud incidents immediately with real-time data signal orchestration and end-to-end workflow automation, minimizing fraud losses and maximizing fraud detection coverage.

SurferPips

SurferPips is a best-in-class trading robot for forex that provides unmatched AI precision and wealth growth. It is designed to be the ultimate all-in-one trading success tool, offering a range of features such as fully automated trading, customizable risk, and access to ready-to-use strategies. SurferPips is trusted by over 500 successful traders and entrepreneurs and has been recognized as the #1 bot performer of the year.

BigShort

BigShort is a real-time stock charting platform designed for day traders and swing traders. It offers a variety of features to help traders make informed decisions, including SmartFlow, which visualizes real-time covert Smart Money activity, and OptionFlow, which shows option blocks, sweeps, and splits in real-time. BigShort also provides backtested and forward-tested leading indicators, as well as live data for all NYSE and Nasdaq tickers.

TradeBX

TradeBX is an AI-powered trading platform that provides advanced AI algorithms, an inbuilt training course, and a user-friendly interface. Its AI algorithms analyze vast amounts of data in real-time to identify profitable opportunities and execute trades with precision. The platform also offers a training course to help users leverage the bot's advanced features and strategies. With 24/7 trading and a user-friendly interface, TradeBX empowers traders of all levels to achieve their financial goals.

Thomson Reuters

Thomson Reuters is a leading provider of business information services. The company provides a wide range of products and services to professionals in the legal, tax, accounting, and risk management industries. Thomson Reuters' products and services include news and information, research and analysis, software and technology, and education and training. The company has a global presence with operations in over 100 countries.

DataVisor

DataVisor is a modern, end-to-end fraud and risk SaaS platform powered by AI and advanced machine learning for financial institutions and large organizations. It provides a comprehensive suite of capabilities to combat a variety of fraud and financial crimes in real time. DataVisor's hyper-scalable, modern architecture allows you to leverage transaction logs, user profiles, dark web and other identity signals with real-time analytics to enrich and deliver high quality detection in less than 100-300ms. The platform is optimized to scale to support the largest enterprises with ultra-low latency. DataVisor enables early detection and adaptive response to new and evolving fraud attacks combining rules, machine learning, customizable workflows, device and behavior signals in an all-in-one platform for complete protection. Leading with an Unsupervised approach, DataVisor is the only proven, production-ready solution that can proactively stop fraud attacks before they result in financial loss.

World Summit AI

World Summit AI is the most important summit for the development of strategies on AI, spotlighting worldwide applications, risks, benefits, and opportunities. It gathers global AI ecosystem stakeholders to set the global AI agenda in Amsterdam every October. The summit covers groundbreaking stories of AI in action, deep-dive tech talks, moonshots, responsible AI, and more, focusing on human-AI convergence, innovation in action, startups, scale-ups, and unicorns, and the impact of AI on economy, employment, and equity. It addresses responsible AI, governance, cybersecurity, privacy, and risk management, aiming to deploy AI for good and create a brighter world. The summit features leading innovators, policymakers, and social change makers harnessing AI for good, exploring AI with a conscience, and accelerating AI adoption. It also highlights generative AI and limitless potential for collaboration between man and machine to enhance the human experience.

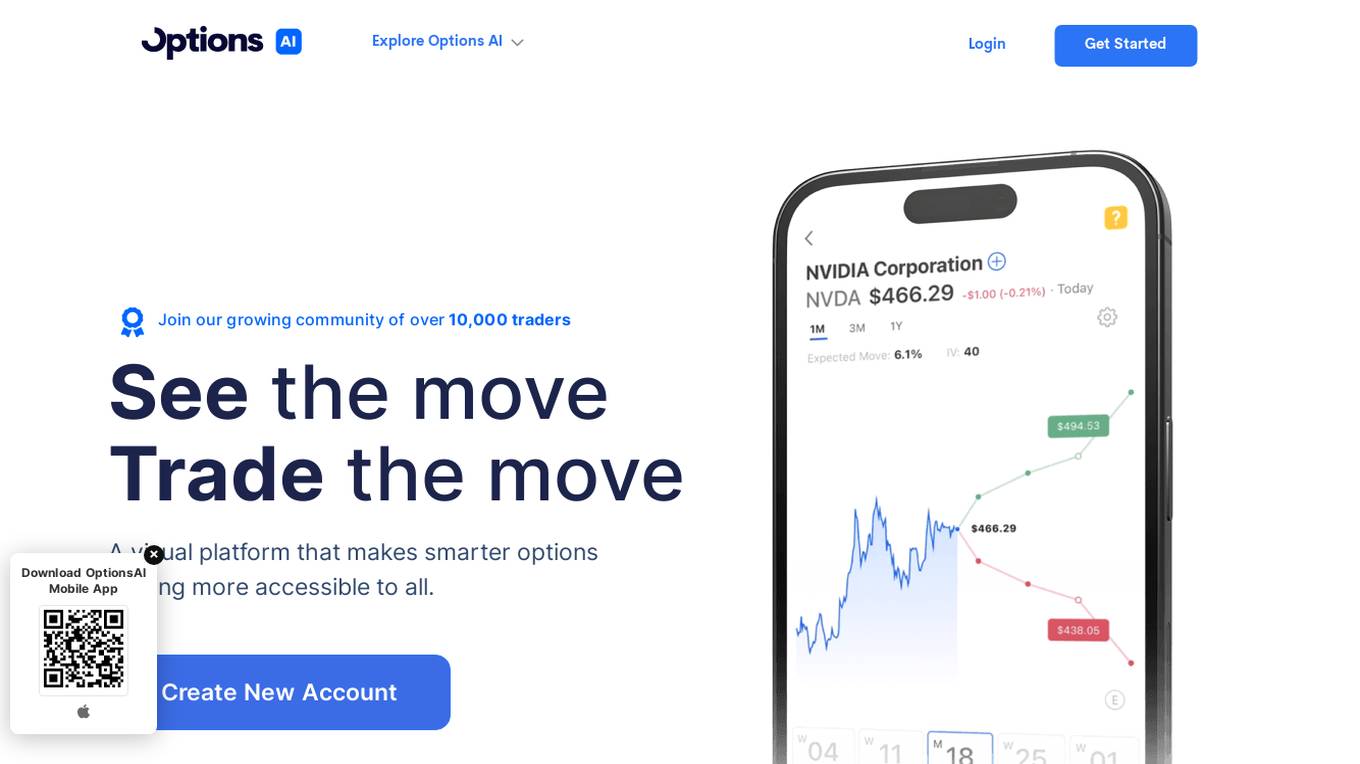

Options AI

Options AI is a revolutionary visual platform for options trading, ETFs, and stock trading. It offers a user-friendly interface that simplifies complex options strategies, making them more accessible to everyday traders. With a team of experienced options experts, Options AI aims to empower traders with advanced trading tools and strategies. The platform provides real-time trade chart zones, industry-leading options experts, and a variety of resources to enhance trading knowledge and skills. Options AI is designed to help traders make smarter trading decisions and navigate the options market with confidence.

Datasparq

Datasparq is a specialist AI & data firm that designs, builds, and runs high-impact AI & data solutions. They help businesses at every stage of their AI journey, from value discovery to managing AI solutions. Datasparq combines data science, data engineering, product thinking, and design to deliver valuable, operational AI solutions quickly. Their focus is on creating AI tools that drive business improvements, efficiency, and effectiveness through data platforms, analytics, and machine learning.

Conformity

Conformity is an AI-powered platform designed to simplify compliance processes for businesses. It offers expert advice on compliance, personalized templates, and immediate responses to compliance questions. With CompliBot at its core, Conformity ensures businesses meet regulatory requirements effortlessly. The platform covers a wide range of compliance frameworks such as SOC 2, HIPAA, GDPR, and more, providing comprehensive support to users.

Quadrature

Quadrature is an AI-powered automated trading business founded by programmers in 2010. The company utilizes sophisticated data and powerful technology to trade securities globally based on predictions made by statistical models. Their long-term vision is to trade all liquid electronically tradeable asset classes across all horizons to generate consistent, significant returns on their proprietary capital. Quadrature Climate Foundation (QCF) was established in 2019 as an independent foundation dedicated to addressing climate change through science-led philanthropy and high-impact solutions.

Capital Companion

Capital Companion is an AI-powered trading and investing platform designed to provide users with a competitive edge in the markets. The platform offers a range of features including 24/7 AI assistant support, intelligent trading recommendations, risk analysis tools, real-time stock analytics, market sentiment analysis, and pattern recognition for technical analysis. By leveraging artificial intelligence, Capital Companion aims to help traders make well-informed decisions and protect their investments in a dynamic market environment.

NICE Actimize

NICE Actimize is an AI-driven platform that offers solutions for combatting financial crime, including Anti-Money Laundering (AML), Enterprise Fraud Management, Financial Markets Compliance, Investigation and Case Management, and Data Intelligence. The platform utilizes AI and machine learning to optimize efficacy, accuracy, and regulatory compliance coverage in the fight against financial crime.

Legit

Legit is an Application Security Posture Management (ASPM) platform that helps organizations manage and mitigate application security risks from code to cloud. It offers features such as Secrets Detection & Prevention, Continuous Compliance, Software Supply Chain Security, and AI Security Posture Management. Legit provides a unified view of AppSec risk, deep context to prioritize issues, and proactive remediation to prevent future risks. It automates security processes, collaborates with DevOps teams, and ensures continuous compliance. Legit is trusted by Fortune 500 companies like Kraft-Heinz for securing the modern software factory.

Feedzai

Feedzai is an AI-native Fraud & Financial Crime Prevention Platform that uses purpose-built AI to stop fraud and lower compliance costs. The platform covers the entire financial crime lifecycle, from account opening to fraud prevention to AML compliance. It applies behavioral analytics to detect and prevent fraud, reduces AML compliance costs, and empowers customers to stop scams before they happen. Feedzai is trusted by global financial leaders and helps protect billions of consumers worldwide while enabling better customer experiences.

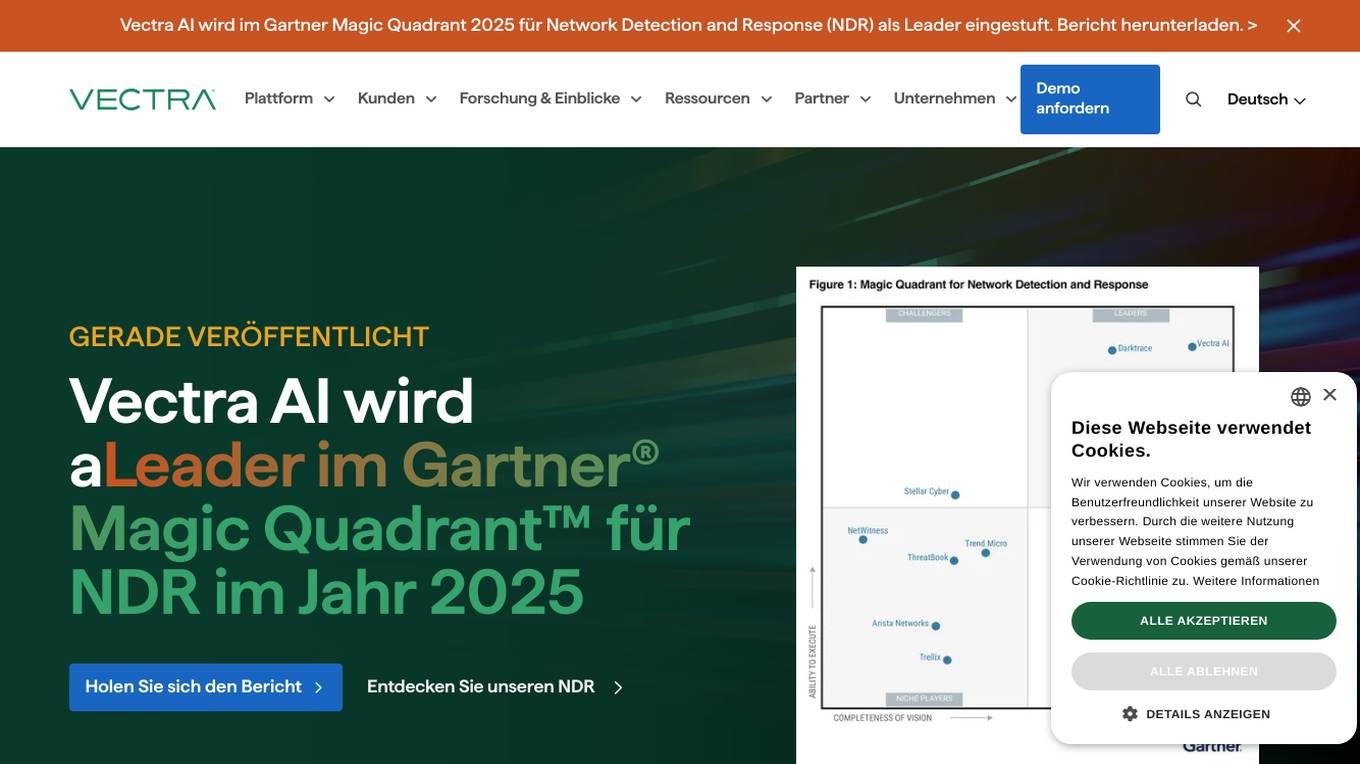

Vectra AI

Vectra AI is a leading cybersecurity AI application that stops attacks that others cannot. It is recognized in the Gartner Magic Quadrant 2025 for Network Detection and Response (NDR) as a leader. Vectra AI's platform protects modern networks from advanced threats by providing real-time attack signal intelligence and AI-driven detections. It equips security analysts with the information needed to quickly stop attacks across various security application scenarios. The application covers a wide range of security areas such as SOC modernization, SIEM optimization, IDS replacement, EDR extension, cloud resilience, and more.

For similar jobs

XenonStack

XenonStack is an AI application that offers a reasoning foundry for agentic enterprises. It provides unified reasoning foundation enabling seamless orchestration, analytics, infrastructure, and trust across intelligent ecosystems. The platform includes various AI tools such as Akira AI for reasoning and agent orchestration, ElixirData for agentic analytics intelligence, NexaStack for agentic infrastructure automation, MetaSecure for trust, compliance, and defense, and Neural AI for agentic intelligence & autonomous innovation. It also offers pre-built autonomous agents for domain-specific intelligence, seamless integrations, and governed enterprise deployment.

BlockSurvey

BlockSurvey is an AI-powered survey assistant that offers a comprehensive platform for creating, analyzing, and optimizing surveys with advanced AI capabilities. It prioritizes user data privacy and security, providing end-to-end encryption and compliance with industry standards. The platform features AI survey creation, analysis, thematic analysis, sentiment analysis, adaptive questioning, and sample responses generation. It also offers features like data encoding, survey optimization, secure surveys, anonymous surveys, and customization options. BlockSurvey caters to various industries and functions, ensuring privacy-first surveys with zero knowledge and decentralized survey capabilities.

Maigon

Maigon is a state-of-the-art AI application designed for contract review. It offers efficiency in closing deals fast by providing AI-driven contract review tools that screen agreements, answer legal questions, and offer guidance for finalizing contracts in record time. Maigon integrates the latest deep learning technology and supports various contract types based on customer demand. The platform also collaborates with OpenAI's GPT-4 to enhance compliance review experience for clients. With features like quick start, always up-to-date solutions, custom playbook, unmatched speed, and on-premise availability, Maigon is trusted by industry leaders to automate legal document review processes and make legal work more resource-efficient.

Peslac AI

Peslac AI is an intelligent document processing and data extraction tool that offers efficient document processing, custom workflows, secure digital signatures, and advanced AI technology for extracting and analyzing data from various document types. It streamlines document-heavy workflows, automates form processing, and provides actionable insights through data visualization. Peslac serves industries like insurance, finance, healthcare, legal, and others by automating claims processing, compliance documentation, patient records processing, legal forms, and more. The platform offers innovative AI models, seamless integration, and scalable cloud infrastructure to enhance operational efficiency and accuracy.

My Voice AI

My Voice AI is an advanced voice identity security infrastructure that provides privacy-preserving, real-time voice authentication and deepfake protection. It is designed to reduce fraud, impersonation, and identity risk in voice-based interactions by offering speaker verification, anti-spoofing, and deepfake detection capabilities. The platform operates as a voice identity layer integrated into existing infrastructure, offering enterprise-grade latency, privacy-first architecture, and deterministic behavior suitable for audits. My Voice AI is purpose-built for regulated environments, such as financial institutions, critical services, and governments, where identity assurance is crucial to mitigate operational risks.

b-cube.ai

b-cube.ai is an AI application that provides services related to crypto-assets. The platform is currently impacted by the EU's MiCA regulation, leading to a halt in new registrations and a planned cessation of operations. Existing users can access unstaking services until the platform shuts down. The company is considering operating under a new regulatory framework outside the EU. b-cube.ai s.r.l holds the rights to the platform from 2022 to 2025.

Robin Legal AI

Robin is a Legal AI platform that offers AI-powered contract software services for enterprises. It provides instant insights from documents, reviews, analyzes, and finalizes contracts quickly, and allows for searchable conversations with AI. The platform features advanced search capabilities, smart alerts, and a structured workspace for legal teams. Robin is compliant with GDPR, ISO27001, and SOC2, ensuring high standards of privacy and security.

Parsepolicy

Parsepolicy is an AI-powered tool that aims to make privacy policies more understandable for users. By utilizing advanced parsing technology, the tool simplifies legal terms, jargon, and complexities in privacy policies, breaking them down into easy-to-understand language. Users can generate a unique URL by entering their email address and paying with Stripe, receiving a simplified, human-readable privacy policy within minutes. The tool helps users gain insights into how their data is handled, understand their rights, and make informed decisions to protect their privacy online. Privacy and data security are top priorities, with cutting-edge encryption and secure protocols in place to ensure the confidentiality of personal information. Currently, the website is at the MVP stage.

Base64.ai

Base64.ai is an AI-powered document intelligence platform that offers a comprehensive solution for document processing and data extraction. It leverages advanced AI technology to automate business decisions, improve efficiency, accuracy, and digital transformation. Base64.ai provides features such as GenAI models, Semantic AI, Custom Model Builder, Question & Answer capabilities, and Large Action Models to streamline document processing. The platform supports over 50 file formats and offers integrations with scanners, RPA platforms, and third-party software.

Biscuits.ai

Biscuits.ai is an AI-powered cookie policy generator that helps website owners create customized cookie policies for their websites. By simply entering the URL of the website, the tool automatically detects the cookies used and generates a comprehensive policy. This tool simplifies the process of ensuring compliance with privacy regulations and provides users with a hassle-free solution for managing their website's cookie policy.

Wunderschild

Schwarzthal Tech's Wunderschild is an AI-driven platform for financial crime intelligence that revolutionizes compliance and investigation techniques. It provides intelligence solutions based on network assessment, data linkage, flow aggregation, and machine learning. The platform offers expertise and insights on strategic risks related to Politically Exposed Persons, Serious Organised Crime, Terrorism Financing, and more. With features like Compliance, Investigation, Know Your Network, Media Scan, Document Drill, and Transaction Monitoring, Wunderschild empowers users to enhance compliance functions, conduct deep dives into complex transnational crime cases, and detect suspicious activities. The platform is trusted by global companies and offers advanced OCR, multilingual support, and key information extraction capabilities.

Bemi

Bemi is an Automatic Audit Trail tool designed for PostgreSQL databases. It allows users to track data changes reliably without the need for complex engineering or costly infrastructure. Bemi offers seamless setup, contextualized data tracking, secure data storage, and trusted integrations with hosting partners. It is a robust and reliable solution for audit & compliance, observability & troubleshooting, data recovery, and building activity feeds. Bemi is trusted by top tech companies for its efficiency and ease of use.

Valossa

Valossa is an AI tool that offers Video Analysis AI services, including Video-to-Text, Search, Captions, Clips, and more. It provides solutions for generating video transcripts, captions, and logging, enabling brand-safe contextual advertising, automatically clipping promo videos, identifying sensitive content for compliance, and analyzing video moods and sentiment. Valossa's AI understands video like a human does, offering advanced video automation tools for various industries.

Kintsugi Vertex

Kintsugi Vertex is an AI-powered sales tax automation tool designed to help companies globally in monitoring, filing, and optimizing sales tax. It automates compliance in three simple steps: connecting and monitoring billing, payment, and HR systems; registering and collecting the right tax with precise rules; and remitting and filing taxes seamlessly. The tool eliminates manual tax calculations, compliance headaches, and unexpected fees, making tax reporting and filing a breeze. It offers white glove support and accurate Nexus tracking to ensure compliance without the complexity of tax requirements. Kintsugi Vertex is trusted by leading businesses worldwide for its end-to-end tax compliance solutions.

DryRun Security

DryRun Security is an AI-driven application security tool that provides Contextual Security Analysis to detect and prevent logic flaws, authorization gaps, IDOR, and other code risks. It offers features like code insights, natural language code policies, and customizable notifications and reporting. The tool benefits CISOs, security leaders, and developers by enhancing code security, streamlining compliance, increasing developer engagement, and providing real-time feedback. DryRun Security supports various languages and frameworks and integrates with GitHub and Slack for seamless collaboration.

Cape.ai

Cape.ai is an agentic AI platform designed for financial operations, offering AI-powered automation to enhance reach, insight, and efficiency in daily operations for financial firms. The platform is built on real-world customer use cases, providing tangible business ROI by integrating structured and unstructured data sources, automating complex manual processes, and offering context-aware insights. Users have control over their data and processes, with customizable workflows and human-in-the-loop capabilities. Cape.ai enables flexible implementation of agentic and deterministic automation, with seamless integrations for various financial workflows and direct access to leading financial data providers. The platform empowers users to create powerful AI agents without technical barriers, unlocking real business value with speed and confidence.

Evervault

Evervault is a flexible payments security platform that provides maximum protection with minimum compliance burden. It allows users to easily tokenize cards, optimize margins, comply with PCI standards, avoid gateway lock-in, and set up card issuing programs. Evervault is trusted by global leaders for securing sensitive payment data and offers features like PCI compliance, payments optimization, card issuing, network tokens, key management, and more. The platform enables users to accelerate card product launches, build complex card sharing workflows, optimize payment performance, and run highly sensitive payment operations. Evervault's unique encryption model ensures data security, reduced risk of data breach, improved performance, and maximum resiliency. It offers agile payments infrastructure, customizable UI components, cross-platform support, and effortless scalability, making it a developer-friendly solution for securing payment data.

Checkr

Checkr is an AI-powered platform that offers employee background screening services for companies. It provides a range of background check services including criminal background checks, employment verification, driving record checks, drug testing, and more. Checkr aims to streamline the hiring process by delivering fast and accurate reports to help organizations make confident decisions while reducing compliance risks.

Compliance.sh

Compliance.sh is a website that provides services related to compliance and privacy. It offers tools and resources to help individuals and businesses ensure they are following regulations and protecting sensitive information. The platform covers a wide range of compliance topics and provides guidance on best practices to maintain trust and security. Users can access information in multiple languages and receive technical support for any inquiries.

.Attorney

The website '.Attorney' is a comprehensive search directory platform that provides resources across various industries and topics. It offers legal advice, law resources, business management, entrepreneurship, education, and professional development information. The platform helps users stay informed about breaking news events and their legal implications, guiding attorneys and clients in rapidly changing situations. '.Attorney' emphasizes the importance of media literacy skills, clear communication protocols, and legal preparedness in responding to breaking news effectively.

Telescope

Telescope is an AI-powered platform for finance that offers a range of solutions for trading, investing, portfolio insights, signal detection, content conversion, compliance, and more. It combines frontier language models with safety and compliance features to provide trustworthy AI intelligence for financial institutions. The platform enables users to personalize solutions, enhance engagement, scale portfolio strategies, and embed AI recommendations in various financial activities.

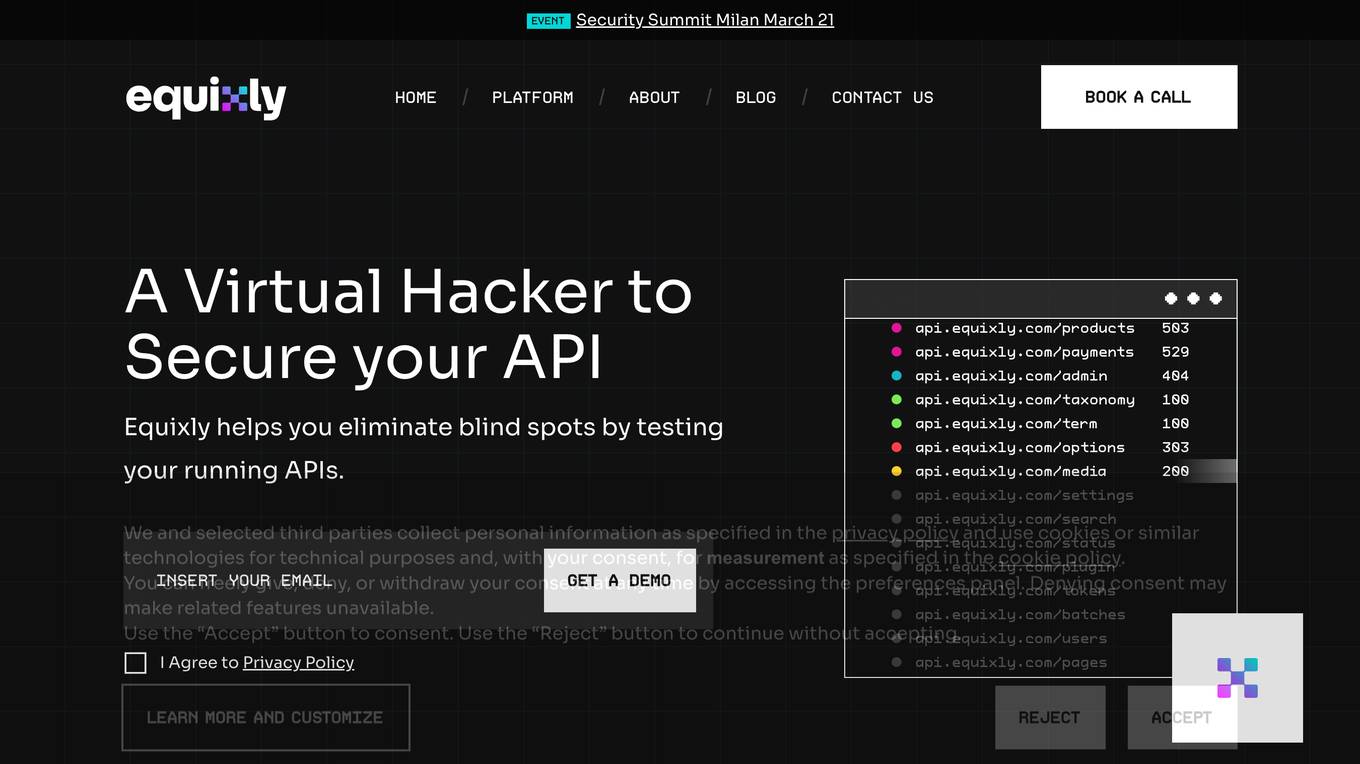

Equixly

Equixly is an AI-powered application designed to help users secure their APIs by identifying vulnerabilities and weaknesses through continuous security testing. The platform offers features such as scalable API PenTesting, attack simulation, mapping of attack surfaces, compliance simplification, and data exposure minimization. Equixly aims to streamline the process of identifying and fixing API security risks, ultimately enabling users to release secure code faster and reduce their attack surface.

Hotseat AI

Hotseat AI is a legal research assistant that allows users to search through a collection of legal documents to find expert-level quotes matching their queries in seconds. It offers semantic search capabilities, metadata extraction, and the ability to search over public and private documents. The tool is currently in private beta with a focus on EU regulations related to tech, fintech, banking, and financial services.

Revisor

Revisor is a neural network-based software package designed for monitoring compliance with electoral procedures and counting the number of actual voters. It utilizes AI-enabled monitoring to provide fast, reliable, and cost-effective election observation missions with high precision in voter counting. The system is trainable and can work with different types of voting procedures and electoral systems in any country. Revisor operates based on video recordings, allowing immediate results after an election or even months and years later.