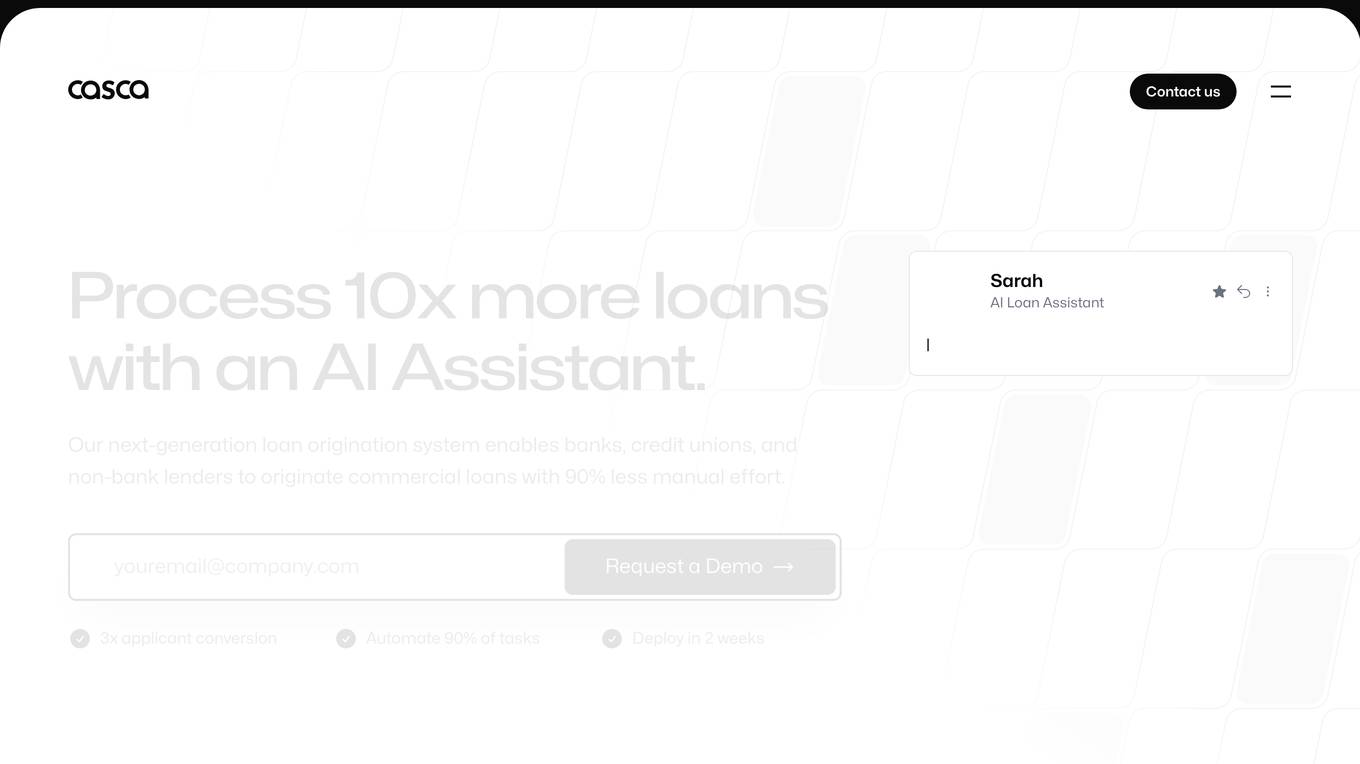

Casca

Make banking magical

Casca is a revolutionary AI-native Loan Origination System that helps banks and non-bank lenders automate 90% of manual effort in business loan origination. By leveraging AI technology, Casca enables financial institutions to process loans 10x faster, achieve 3x higher conversion rates, and save significant time for loan officers. With features like AI Loan Assistant, digital application processing, KYB checks automation, and document analysis, Casca transforms the loan origination process into a seamless and efficient experience for both lenders and borrowers.

For Tasks:

Click tags to check more tools for each tasksFor Jobs:

Features

Advantages

Disadvantages

Frequently Asked Questions

Alternative AI tools for Casca

Similar sites

Casca

Casca is a revolutionary AI-native Loan Origination System that helps banks and non-bank lenders automate 90% of manual effort in business loan origination. By leveraging AI technology, Casca enables financial institutions to process loans 10x faster, achieve 3x higher conversion rates, and save significant time for loan officers. With features like AI Loan Assistant, digital application processing, KYB checks automation, and document analysis, Casca transforms the loan origination process into a seamless and efficient experience for both lenders and borrowers.

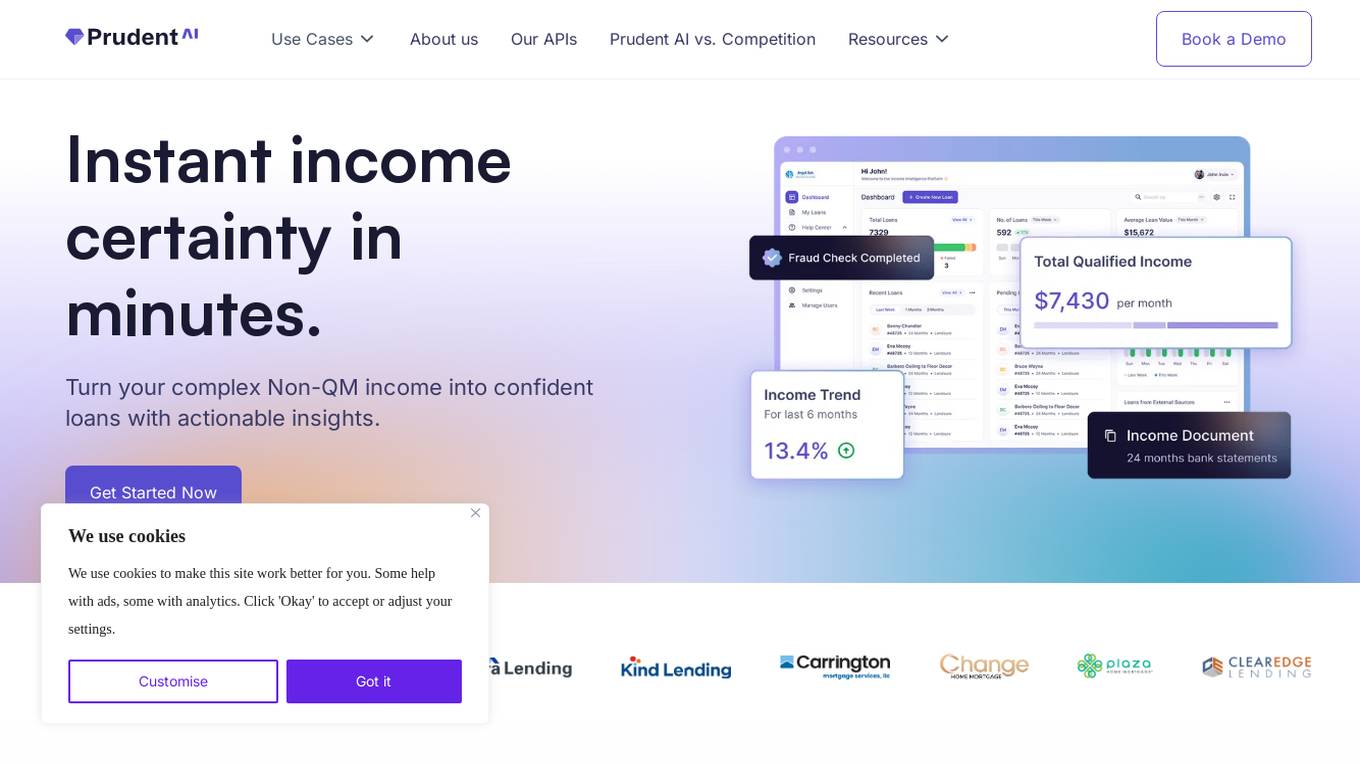

Prudent AI

Prudent AI is an AI-powered Income Intelligence Platform designed for lenders, offering fast data extraction, proactive fraud prevention, and in-depth insights on borrower income. The platform simplifies complex income calculations, streamlines the lending process, and enables lenders to make confident loan decisions quickly. Prudent AI is trusted by various lending institutions and has been proven to increase productivity, save time, and improve submission accuracy.

Clerkie

Clerkie is a powerful debt repayment and optimization platform that offers a full-service automation solution powered by machine learning and human expertise. It helps lenders, both big and small, to manage and optimize their loan portfolios efficiently. With features like smart payment experience, AI-driven repayment strategies, real-time reporting, and easy integration, Clerkie ensures a seamless and secure experience for lenders and borrowers alike.

Scienaptic Systems

Scienaptic Systems is an AI-powered Credit Decisioning Platform that revolutionizes the lending industry by automating credit underwriting processes, leveraging alternate data points, and offering self-learning models for instant credit decisions. The platform helps lenders identify creditworthy borrowers, streamline customer experience, and ensure fair lending practices through explainable AI models. Scienaptic's suite of AI-enabled technologies enables lenders to say 'Yes' to more borrowers at lower risk, providing a 360-degree risk assessment before approving applications. The platform integrates seamlessly with existing lending ecosystems, ensuring disruption-free deployment and better risk predictions through a single API call.

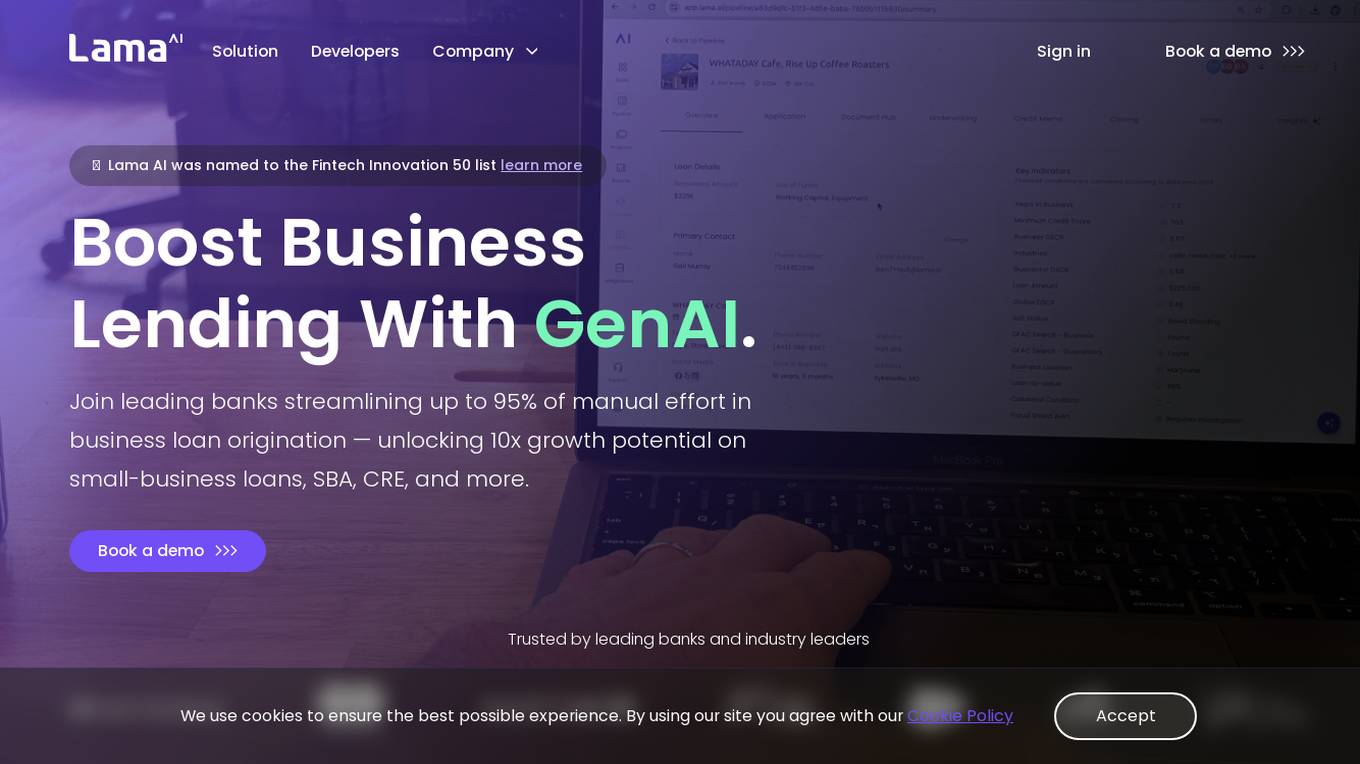

Lama AI

Lama AI is an AI-powered platform designed to revolutionize business lending processes for banks and financial institutions. It offers advanced features, rapid configurability, and exceptional support to streamline loan origination, underwriting, and decision-making. By leveraging the power of AI, Lama AI enables banks to boost business growth potential, improve profitability, and enhance customer experience through contextual onboarding, decisioning workspace, expanded credit access, and pre-qualified applications. The platform also provides white-labeled solutions, API-first integration, high configurability, built-in AI models, and access to a network of bank lenders, all while ensuring bank-grade security and compliance standards.

Zest AI

Zest AI is an AI-driven credit underwriting software that offers a complete solution for AI-driven lending. It enables users to build custom machine learning risk models, adopt model assessment and regulatory compliance, and operate performance management and model monitoring. Zest AI helps increase approvals, manage risk, control loss, drive operational efficiency, automate credit decisioning, and improve borrower experience while ensuring fair lending practices. The software is designed to provide powerful AI for better lending outcomes by accelerating loan growth and expanding credit access through accurate risk prediction and faster credit decisions.

Zest AI

Zest AI is an AI-driven credit underwriting software that offers a complete solution for AI-driven lending. It enables users to build custom machine learning risk models, adopt model assessment and regulatory compliance, and operate performance management and model monitoring. Zest AI helps increase approvals, manage risk, control loss, drive operational efficiency, automate credit decisioning, and improve borrower experience while ensuring fair lending practices. The software is designed to provide fair and transparent credit for everyone, making lending more accessible and inclusive.

VantedgeAI

VantedgeAI is an AI application that offers fine-tuned AI models for credit funds, revolutionizing credit investing workflows with faster, smarter, and cost-effective solutions. The application transforms manual processes into scalable, automated workflows tailored for Private Credit and Hedge Funds. VantedgeAI is trusted by market leaders in the industry, providing unique AI-driven insights to maintain a competitive advantage and ensure data security and privacy through SOC 2 compliance. The application offers advanced AI solutions for credit investing, including automated investment memo generation, data extraction for Excel models, portfolio monitoring, loan reconciliation, smart bond screening, real-time data querying with AI bots, and more.

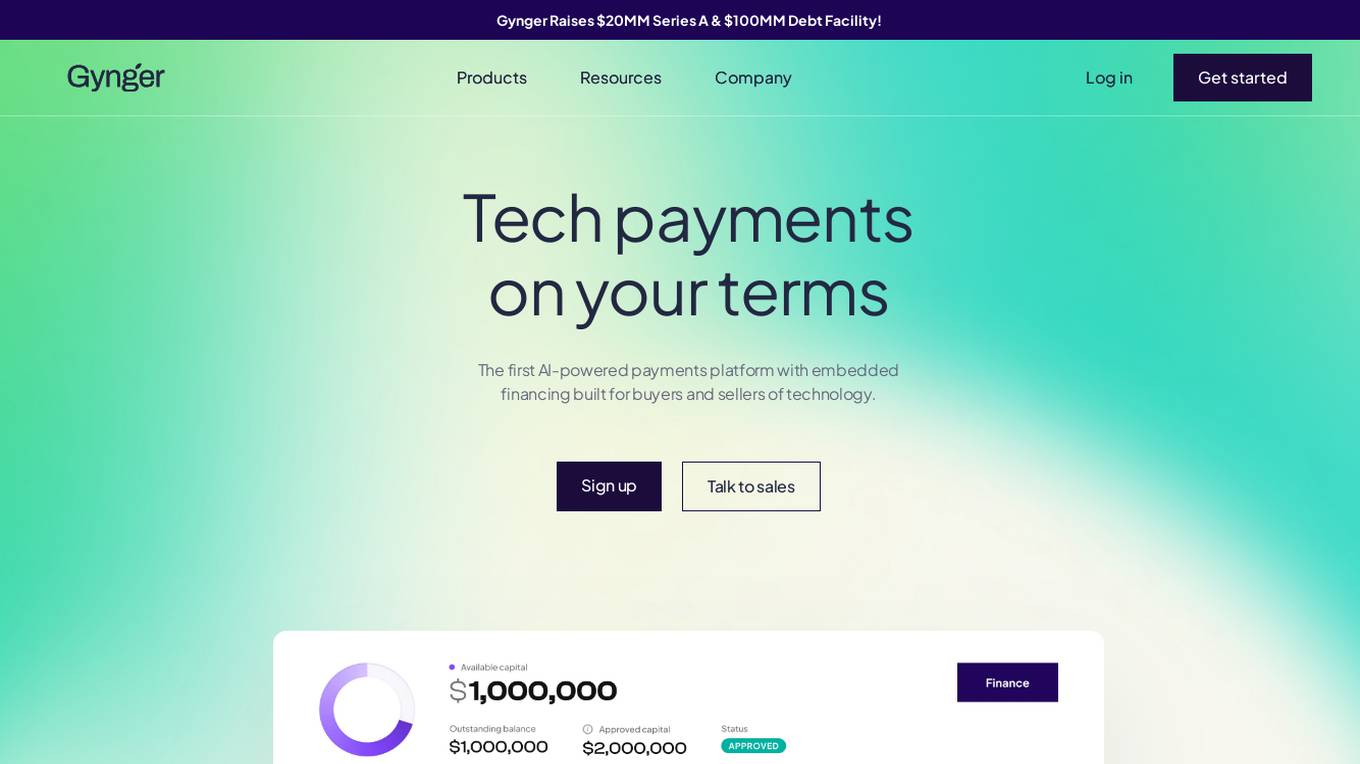

Gynger

Gynger is an AI-powered payments platform with embedded financing designed for buyers and sellers of technology. It provides a line of credit and debt financing to help businesses pay their software and technology bills upfront while paying back later. Gynger simplifies the procurement process, improves cash flow, and offers flexible payment plans for tech expenses.

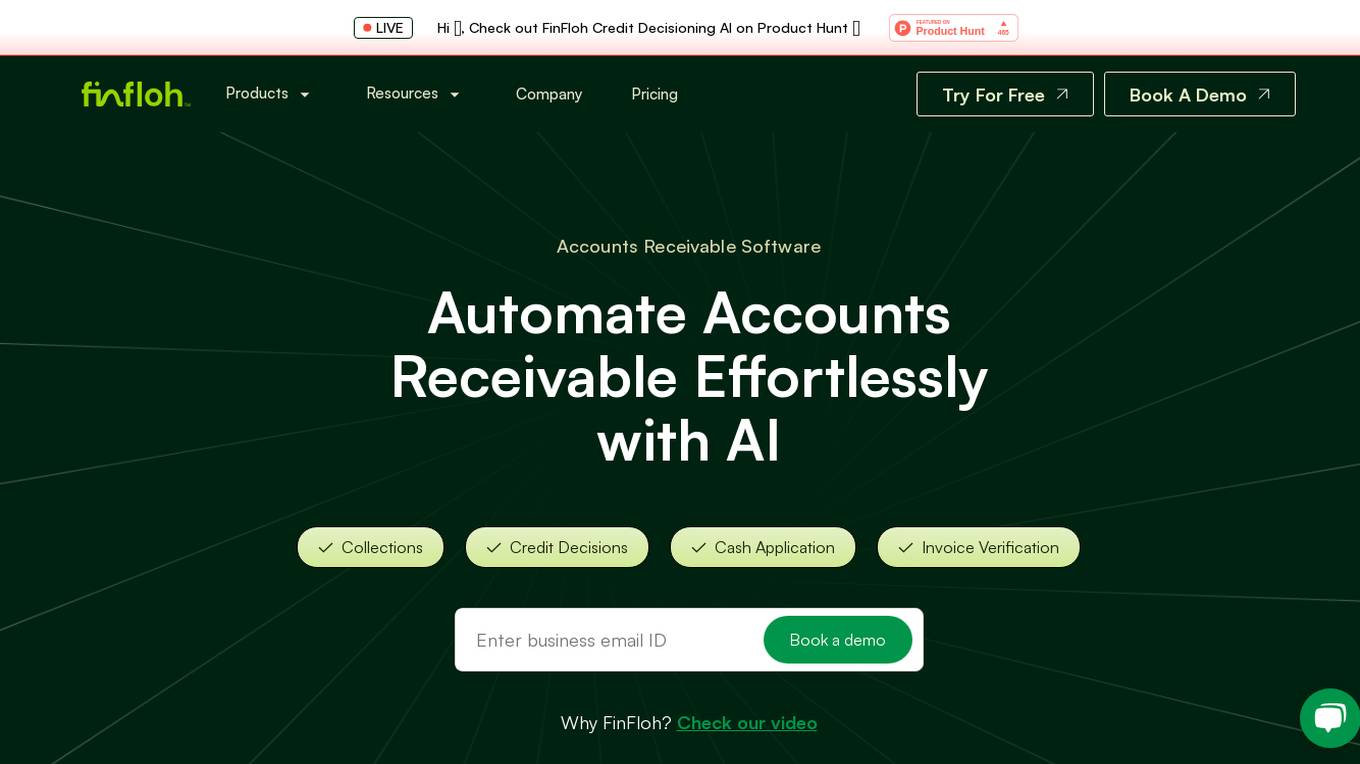

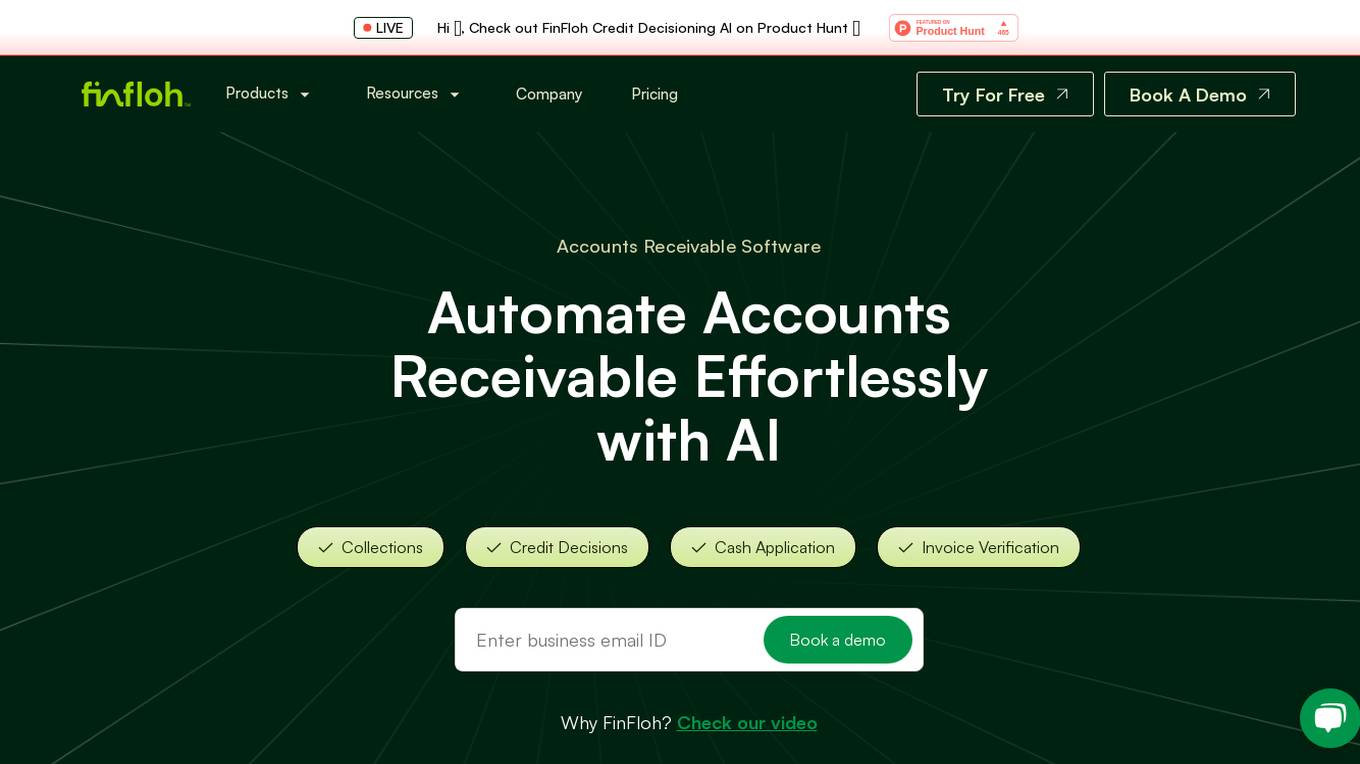

FinFloh

FinFloh is an AI-powered Accounts Receivable Software that automates the accounts receivable process effortlessly with features like credit decisioning, collections, cash application, invoice verification, and dispute resolution. It enhances collections efficiency, reduces decision-making time, and improves cash flows for B2B finance teams worldwide. The software integrates with ERP/CRM systems, offers predictive analytics, and AI-driven credit scoring to optimize accounts receivable management. FinFloh ensures secure data handling and seamless communication between finance, sales, and customer support teams, ultimately leading to increased cash flow and reduced DSO.

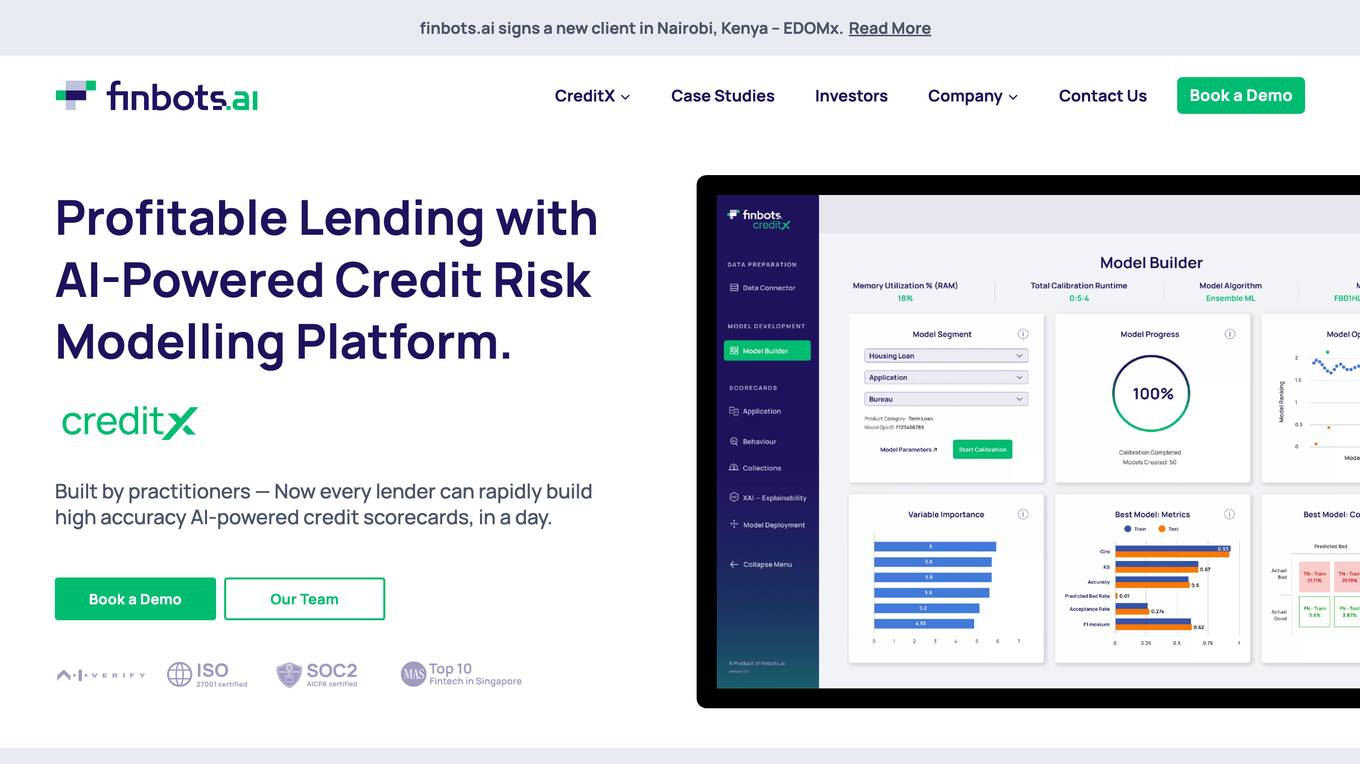

Finbots.ai

Finbots.ai is a trusted AI credit risk platform that offers AI credit scoring to boost lending profits and reduce non-performing loans. The platform provides the highest accuracy in the market, allowing users to build scorecards in a day without the need for coding. It helps in making instant decisions, increasing revenue, reducing risk, and improving operational efficiency. Finbots.ai is utilized by various financial institutions to enhance credit risk management, improve profitability, and drive down the cost of risk through AI-enabled models.

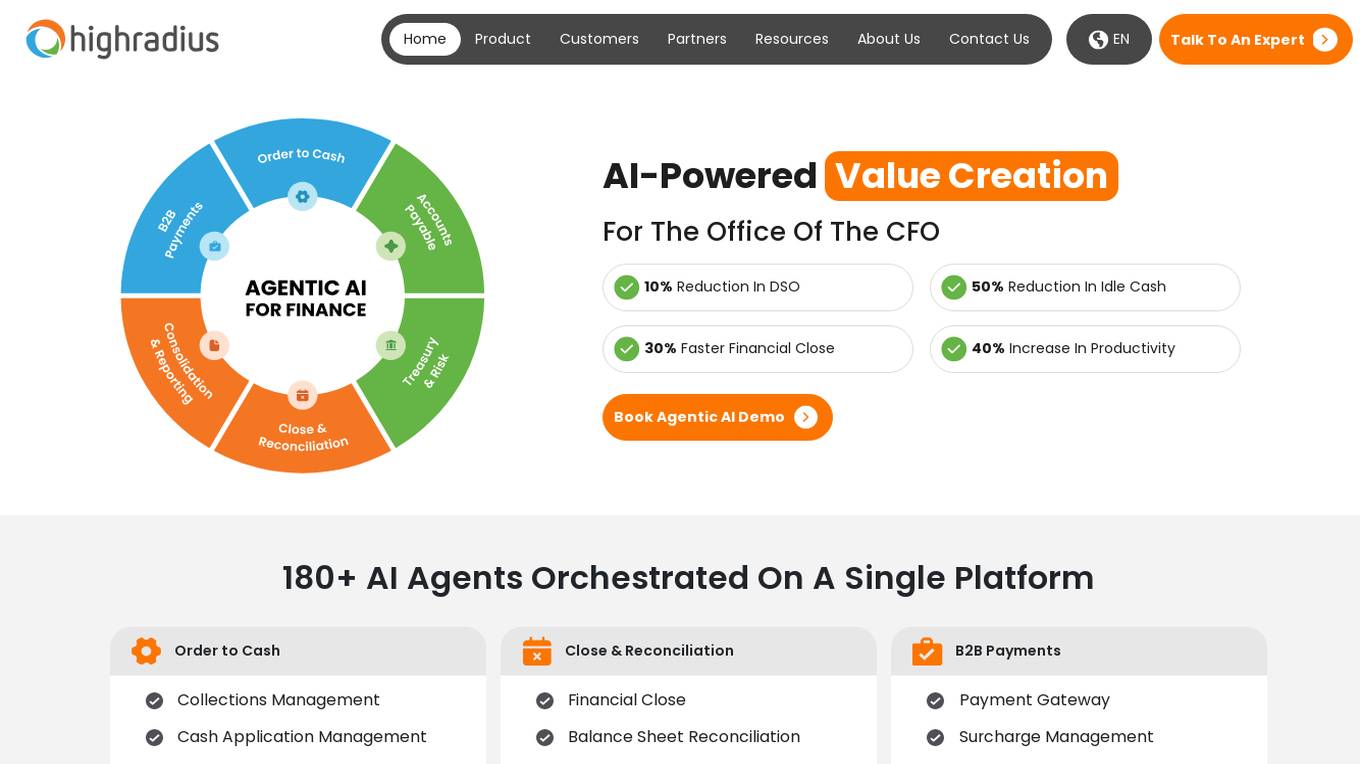

HighRadius

HighRadius is an AI-powered platform that offers Autonomous Finance solutions for Order to Cash (O2C), Treasury, and Record-to-Report (R2R) processes. It provides a single platform for various financial functions such as Accounts Payable, B2B Payments, Cash Management, and Financial Reporting. HighRadius leverages Generative AI and a No-Code AI Platform to automate data analysis and streamline financial operations for the Office of the CFO. The platform aims to enhance productivity, reduce manual work, and improve financial decision-making through advanced AI capabilities.

Ocrolus

Ocrolus is an intelligent document automation software that leverages AI-driven document processing automation with Human-in-the-Loop. It offers capabilities such as classifying, capturing, detecting, and analyzing documents, with use cases in cash flow, income, address, employment, and identity verification. Ocrolus caters to various industries like small business lending, mortgage, consumer finance, and multifamily housing. The platform provides resources for developers, including guides on income verification, fraud detection, and business process automation. Users can explore the API to build innovative customer experiences and make faster and more accurate financial decisions.

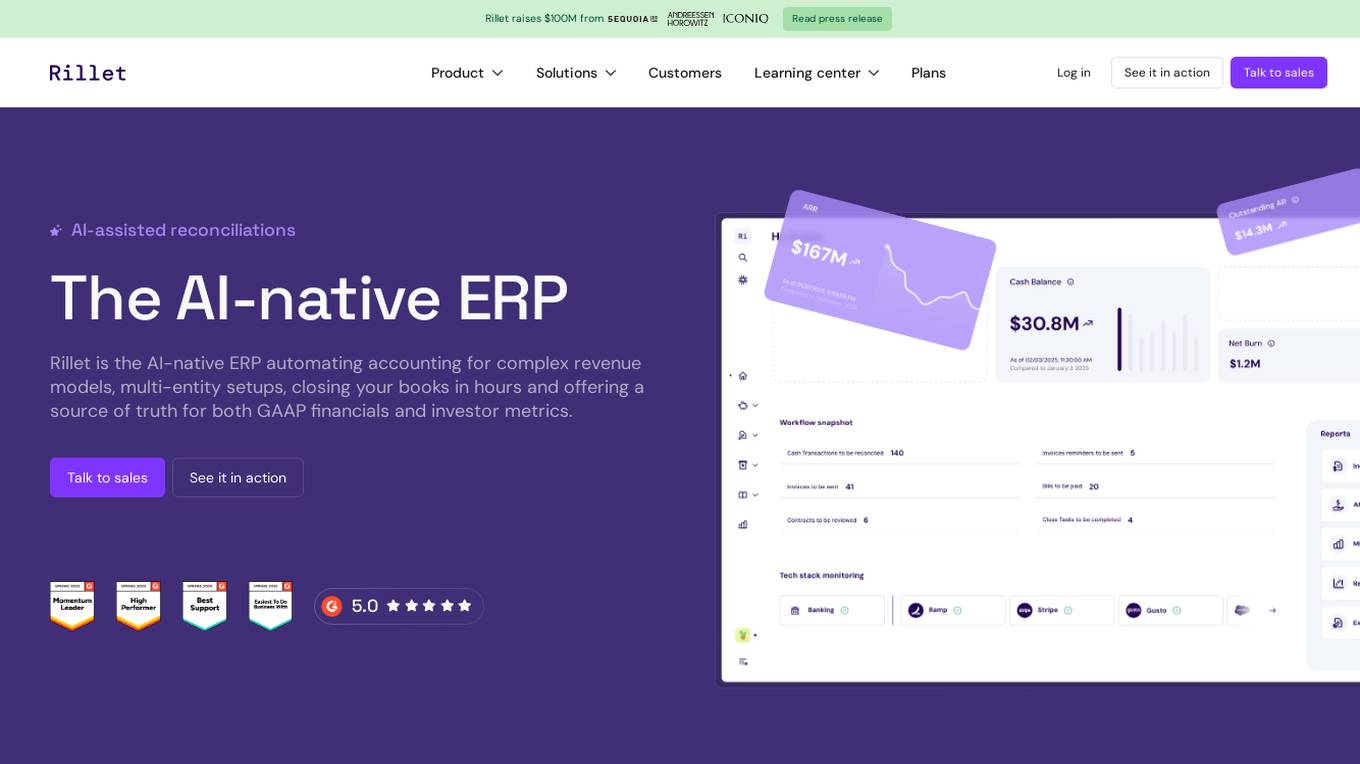

Rillet

Rillet is an AI-native ERP application that automates accounting processes for complex revenue models, multi-entity setups, and monthly book closings. It offers features such as automated general ledger, accounts receivable, accounts payable, bank reconciliation, and flexible GAAP reporting. Rillet is designed to provide a source of truth for both GAAP financials and investor metrics, with advanced functionalities like multi-entity consolidation and AI-powered accounting. The application caters to various industries and company sizes, offering tailored solutions for businesses to streamline financial operations and improve efficiency.

AppZen

AppZen is an AI-powered application designed for modern finance teams to streamline accounts payable processes, automate invoice and expense auditing, and improve compliance. It offers features such as Autonomous AP for invoice automation, Expense Audit for T&E spend management, and Card Audit for analyzing card spend. AppZen's AI learns and understands business practices, ensures compliance, and integrates with existing systems easily. The application helps prevent duplicate spend, fraud, and FCPA violations, making it a valuable tool for finance professionals.

cc:Monet

cc:Monet is an AI Finance Assistant designed to streamline financial operations for businesses. It automates invoice processing, employee claim submissions, and provides actionable insights to help make smarter business decisions. With advanced AI technology, cc:Monet offers features like AI-powered invoice recognition, streamlined employee claim processing, intelligent AI assistance, and actionable business insights. The application simplifies finance workflows, saves time and costs, and transforms financial management for businesses of all sizes.

For similar tasks

Casca

Casca is a revolutionary AI-native Loan Origination System that helps banks and non-bank lenders automate 90% of manual effort in business loan origination. By leveraging AI technology, Casca enables financial institutions to process loans 10x faster, achieve 3x higher conversion rates, and save significant time for loan officers. With features like AI Loan Assistant, digital application processing, KYB checks automation, and document analysis, Casca transforms the loan origination process into a seamless and efficient experience for both lenders and borrowers.

Likely.AI

Likely.AI is an AI-powered platform designed for the real estate industry, offering innovative solutions to enhance database management, marketing content creation, and predictive analytics. The platform utilizes advanced AI models to predict likely sellers, update contact information, and trigger automated notifications, ensuring real estate professionals stay ahead of the competition. With features like contact enrichment, predictive modeling, 24/7 contact monitoring, and AI-driven marketing content generation, Likely.AI revolutionizes how real estate businesses operate and engage with their clients. The platform aims to streamline workflows, improve lead generation, and maximize ROI for users in the residential real estate sector.

Yess

Yess is an AI Sales Engagement Platform designed to empower sales teams by facilitating collaborative outreach efforts with the help of AI technology. It enables seamless orchestration of outreach from internal experts, executives, and peers to drive pipeline growth. Yess leverages AI to match prospects with the most suitable team members, streamline approval workflows, and enhance multi-channel sequences for efficient engagement. The platform aims to address the challenges of low response rates, underutilization of non-SDRs, and non-scalable pipeline collaboration motions in sales processes.

For similar jobs

Casca

Casca is a revolutionary AI-native Loan Origination System that helps banks and non-bank lenders automate 90% of manual effort in business loan origination. By leveraging AI technology, Casca enables financial institutions to process loans 10x faster, achieve 3x higher conversion rates, and save significant time for loan officers. With features like AI Loan Assistant, digital application processing, KYB checks automation, and document analysis, Casca transforms the loan origination process into a seamless and efficient experience for both lenders and borrowers.

AI Credit Repair

AI Credit Repair is an AI-powered application designed to help users improve their credit score by providing tools such as credit card utilization builder, public records remover, dispute letter generator, and SMS alerts. The application assists users in managing their credit card payments, disputing collections, and staying on top of their credit-related activities. By leveraging artificial intelligence technology, AI Credit Repair aims to simplify the credit repair process and empower users to build a better financial future.

Zest AI

Zest AI is an AI-driven credit underwriting software that offers a complete solution for AI-driven lending. It enables users to build custom machine learning risk models, adopt model assessment and regulatory compliance, and operate performance management and model monitoring. Zest AI helps increase approvals, manage risk, control loss, drive operational efficiency, automate credit decisioning, and improve borrower experience while ensuring fair lending practices. The software is designed to provide fair and transparent credit for everyone, making lending more accessible and inclusive.

Scienaptic Systems

Scienaptic Systems is an AI-powered Credit Decisioning Platform that revolutionizes the lending industry by automating credit underwriting processes, leveraging alternate data points, and offering self-learning models for instant credit decisions. The platform helps lenders identify creditworthy borrowers, streamline customer experience, and ensure fair lending practices through explainable AI models. Scienaptic's suite of AI-enabled technologies enables lenders to say 'Yes' to more borrowers at lower risk, providing a 360-degree risk assessment before approving applications. The platform integrates seamlessly with existing lending ecosystems, ensuring disruption-free deployment and better risk predictions through a single API call.

Underwrite.ai

Underwrite.ai is a platform that leverages advances in artificial intelligence and machine learning to provide lenders with nonlinear, dynamic models of credit risk. By analyzing thousands of data points from credit bureau sources, the application accurately models credit risk for consumers and small businesses, outperforming traditional approaches. Underwrite.ai offers a unique underwriting methodology that focuses on outcomes such as profitability and customer lifetime value, allowing organizations to enhance their lending performance without the need for capital investment or lengthy build times. The platform's models are continuously learning and adapting to market changes in real-time, providing explainable decisions in milliseconds.

Zest AI

Zest AI is an AI-driven credit underwriting software that offers a complete solution for AI-driven lending. It enables users to build custom machine learning risk models, adopt model assessment and regulatory compliance, and operate performance management and model monitoring. Zest AI helps increase approvals, manage risk, control loss, drive operational efficiency, automate credit decisioning, and improve borrower experience while ensuring fair lending practices. The software is designed to provide powerful AI for better lending outcomes by accelerating loan growth and expanding credit access through accurate risk prediction and faster credit decisions.

FinFloh

FinFloh is an AI-powered Accounts Receivable Software that automates the accounts receivable process effortlessly with features like credit decisioning, collections, cash application, invoice verification, and dispute resolution. It enhances collections efficiency, reduces decision-making time, and improves cash flows for B2B finance teams worldwide. The software integrates with ERP/CRM systems, offers predictive analytics, and AI-driven credit scoring to optimize accounts receivable management. FinFloh ensures secure data handling and seamless communication between finance, sales, and customer support teams, ultimately leading to increased cash flow and reduced DSO.

Prudent AI

Prudent AI is an AI-powered Income Intelligence Platform designed for lenders, offering fast data extraction, proactive fraud prevention, and in-depth insights on borrower income. The platform simplifies complex income calculations, streamlines the lending process, and enables lenders to make confident loan decisions quickly. Prudent AI is trusted by various lending institutions and has been proven to increase productivity, save time, and improve submission accuracy.

Rationale

Rationale is a cutting-edge decision-making AI tool that leverages the power of the latest GPT technology and in-context learning. It is designed to assist users in making informed decisions by providing valuable insights and recommendations based on the data provided. With its advanced algorithms and machine learning capabilities, Rationale aims to streamline the decision-making process and enhance overall efficiency.

Thirdai

Thirdai.com is an AI-powered platform that offers a range of tools and applications to enhance productivity and decision-making. The platform leverages advanced algorithms and machine learning to provide insights and solutions across various domains such as finance, marketing, and healthcare. Users can access a suite of AI tools to analyze data, automate tasks, and optimize processes. With a user-friendly interface and robust features, Thirdai.com is a valuable resource for individuals and businesses seeking to leverage AI technology for improved outcomes.

Dispute AI™

Dispute AI™ is an AI-powered DIY credit repair solution that leverages cutting-edge artificial intelligence to provide personalized strategies for boosting credit scores. The platform offers actionable insights, data-driven recommendations, and a fast, affordable, and flexible credit repair process. With over 20 years of expertise in credit repair, Dispute AI™ aims to revolutionize the way individuals take control of their credit by providing innovative tools that simplify and streamline the credit repair process.

b-cube.ai

b-cube.ai is an AI application that provides services related to crypto-assets. The platform is currently impacted by the EU's MiCA regulation, leading to a halt in new registrations and a planned cessation of operations. Existing users can access unstaking services until the platform shuts down. The company is considering operating under a new regulatory framework outside the EU. b-cube.ai s.r.l holds the rights to the platform from 2022 to 2025.

AngelList

AngelList is a platform that provides tools for investors and innovators to grow their venture funds. It offers solutions for venture funds, SPVs, scout funds, and digital subscriptions, along with full service fund management. With over half of top-tier VC deals running through the platform, AngelList plays a crucial role in fueling innovation and bridging gaps in the VC market.

Scope Ai Platform

The website is an AI tool called Scope Ai Platform that provides property, owner, investor, and lender intelligence. It offers nationwide coverage, predictive scoring, and tailored insights to help users find opportunities, connect with the right people, and make faster decisions in various markets. The platform combines massive data coverage with advanced predictive modeling to deliver actionable intelligence for business growth. It caters to industries such as insurance, retail, investment, luxury goods, and more, offering solutions for unique data challenges. The platform is compliance-ready, built on public and licensed non-credit data without credit bureau information or live tracking.

Investor Hunter

The website investor-hunter.com seems to be inaccessible, showing an 'Access Denied' message. It appears that the user does not have permission to access the content on the server. The error message references a specific server code, indicating a technical issue preventing access to the GoDaddy website for sale. The website may be related to domain investing or hunting for investment opportunities, but without access, the exact nature of the site remains unknown.

Collie.ai

Collie.ai is an AI-powered tool designed to assist users in various tasks. It offers a wide range of features and advantages to streamline workflows and improve productivity. The tool is known for its user-friendly interface and efficient performance. Collie.ai is suitable for individuals and businesses looking to leverage AI technology for enhanced decision-making and task automation.

Mudrex

Mudrex is a cryptocurrency investment platform that provides users with tools and resources to make informed investment decisions. The platform offers a variety of features, including price predictions, investment guides, and how-to's. Mudrex also has a team of experts who provide support and guidance to users.

PeerAI

PeerAI is an advanced AI tool that leverages cutting-edge artificial intelligence technology to provide users with personalized insights and recommendations. The platform utilizes machine learning algorithms to analyze data and generate actionable suggestions across various domains, including business, marketing, finance, and more. PeerAI empowers users to make informed decisions, optimize strategies, and enhance performance through data-driven intelligence.

MyLoans.ai

MyLoans.ai is a free AI tool designed to provide personalized guidance for complex student loans. It offers instant, clear, and accurate answers to student loan queries, helping borrowers make informed decisions about their financial future. By skipping expensive advisors and confusing government websites, MyLoans.ai aims to save users thousands of dollars by leveraging official government sources for guidance.

AI VC

AI VC was a project that is no longer active. It was likely an AI tool or application related to venture capital. The project may have involved using artificial intelligence to analyze investment opportunities, predict market trends, or provide insights for venture capitalists. Unfortunately, the project is no longer operational, but it may have offered valuable resources and information for individuals interested in the intersection of AI and venture capital.

Langdock

Langdock is an all-in-one AI platform designed for companies to roll out AI to all employees and enable developers to build custom AI workflows. It offers powerful AI chat, use-case-specific assistants, AI workplace search, and API for building and running agents. Langdock provides model-agnostic, privacy-first, scalable, and measurable features, with expert support assistants for various tasks. The platform is enterprise trusted, with a focus on security and compliance. It is hosted in Europe and offers a 7-day free trial for users to get started.

Skeptical Tom

Skeptical Tom is an AI tool designed to help users control their impulsive shopping habits. The AI Cat feature provides personalized guidance to curb impulsive buys, offering wise whispers to guide users' wallets. Users can reach out to the team at [email protected] for any issues or queries.

Numeno

Numeno is an AI tool that allows users to personalize every customer touchpoint without the need for data. It enables businesses to tailor product recommendations, content, gaming experiences, educational content, financial services, and marketing campaigns based on real-time user interactions. Numeno's dead-simple API simplifies the process of personalizing user experiences by creating rich models of user behavior and preferences over time.

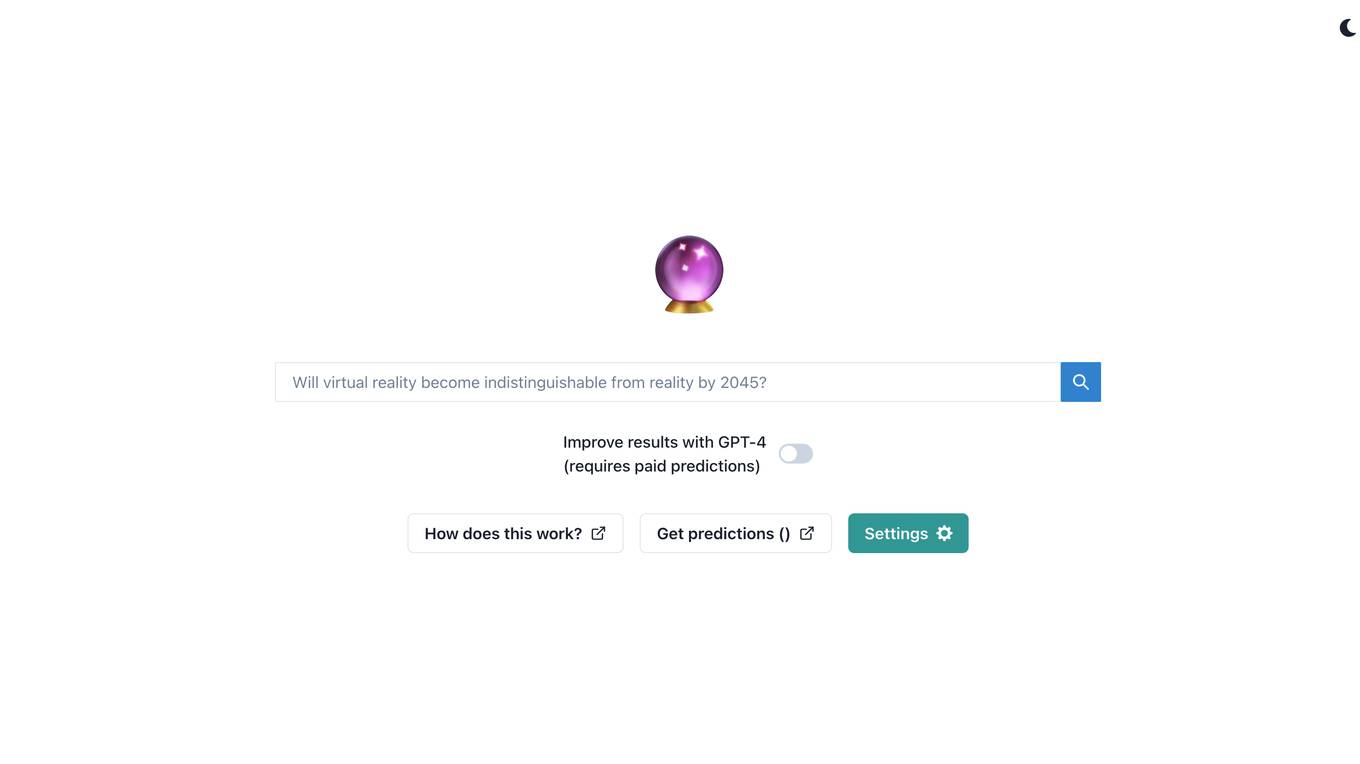

FutureGPT

FutureGPT is an AI tool that leverages the power of GPT-4 to provide advanced predictive capabilities. Users can enhance their results by utilizing this tool, which offers paid predictions. By enabling JavaScript, users can access the app and explore its features to receive accurate and insightful predictions for various purposes. FutureGPT aims to streamline decision-making processes and optimize outcomes through cutting-edge AI technology.