Gynger

Tech payments on your terms

Gynger is an AI-powered payments platform with embedded financing designed for buyers and sellers of technology. It provides a line of credit and debt financing to help businesses pay their software and technology bills upfront while paying back later. Gynger simplifies the procurement process, improves cash flow, and offers flexible payment plans for tech expenses.

For Tasks:

Click tags to check more tools for each tasksFor Jobs:

Features

- Seamless sign up in five minutes

- Access credit the next business day

- Flexible payment plans for each tech expense

- Founder-friendly unsecured financing

- Manage all tech expenses from one dashboard

Advantages

- Save money by paying technology bills upfront

- Improve cash flow by spreading out payments

- Consolidate software expenses into a single dashboard

- Quick approval process with funding next business day

- No personal credit checks or founder guarantees

Disadvantages

- Flat fee charged on total loan amount

- Limited to commercial debt in the form of closed-end loans

- May not suit businesses with specific financing needs

Frequently Asked Questions

-

Q:What is Gynger?

A:Gynger is a software and infrastructure financing platform for businesses. -

Q:What are the benefits of Gynger for Buyers?

A:Gynger helps businesses save money, improve cash flow, and streamline software expenses. -

Q:How secure is my data with Gynger?

A:Data is encrypted and securely stored using Google Cloud Platform and industry-leading tools. -

Q:What type of financing does Gynger provide?

A:Gynger provides commercial debt in the form of closed-end loans with fixed fees. -

Q:Who can use Gynger for Buyers?

A:Any company that buys software or infrastructure can use Gynger.

Alternative AI tools for Gynger

Similar sites

Gynger

Gynger is an AI-powered payments platform with embedded financing designed for buyers and sellers of technology. It provides a line of credit and debt financing to help businesses pay their software and technology bills upfront while paying back later. Gynger simplifies the procurement process, improves cash flow, and offers flexible payment plans for tech expenses.

Nuvio

Nuvio is an AI-powered financial management application that acts as a personal CFO for startups and small businesses. It provides insights, predictions, and real-time financial analytics to help users manage income, expenses, and cash flow efficiently. Nuvio simplifies complex financial calculations, offers ready-made charts for key metrics analysis, and enables users to track all bank accounts on a single dashboard. The application also allows users to predict future cash flow, customize finance reports, and benefit from dedicated customer support and bank-level security measures.

Zevrio Capiture

Zevrio Capiture is an automated investing and cash management platform that offers personalized, effortless investing and savings solutions. It provides users with the ability to customize their investment portfolios, automate savings, optimize performance, and lower taxes. The platform also offers a Cash account with regulated banking partners for everyday cash management, bill payments, ATM withdrawals, and quick investments. Zevrio Capiture aims to make wealth management easy and accessible for users, connecting all their accounts in one app to help them achieve their financial goals.

Cleo

Cleo is an AI-powered financial management tool that helps users with budgeting, saving, building credit, and managing their finances. It offers features like cash advances, budgeting tips, credit building tools, and personalized financial advice. Cleo uses AI technology to provide users with insights and recommendations to improve their financial health. The application aims to make money management easy and accessible for everyone, without the need for credit checks or complex financial jargon.

Scienaptic Systems

Scienaptic Systems is an AI-powered Credit Decisioning Platform that revolutionizes the lending industry by automating credit underwriting processes, leveraging alternate data points, and offering self-learning models for instant credit decisions. The platform helps lenders identify creditworthy borrowers, streamline customer experience, and ensure fair lending practices through explainable AI models. Scienaptic's suite of AI-enabled technologies enables lenders to say 'Yes' to more borrowers at lower risk, providing a 360-degree risk assessment before approving applications. The platform integrates seamlessly with existing lending ecosystems, ensuring disruption-free deployment and better risk predictions through a single API call.

Vent AI

Vent AI is a smart financial assistant application designed to automate income and expense tracking, as well as reconcile transactions for businesses. It simplifies the process of managing business finances, allowing users to focus on business growth. With features like automated logging of income and expenses, clear financial reports, and the ability to forward receipts for processing, Vent AI aims to streamline financial management for small businesses and entrepreneurs.

Lemon Squeezy

Lemon Squeezy is an all-in-one platform designed for software companies to handle payments, subscriptions, global tax compliance, fraud prevention, and more. It offers features like global tax compliance, borderless SaaS payments, instant payment methods, local currency support, AI fraud prevention, and failed payment recovery. The platform also provides tools for ecommerce, marketing, reporting, and developer integration. Lemon Squeezy aims to simplify running a software business by offering a comprehensive solution for various business needs.

PortfolioGPT

PortfolioGPT is an AI-powered platform that enables users to generate smart investment portfolios in seconds. It leverages OpenAI's advanced algorithms to automatically create personalized portfolios based on user input, including risk tolerance, investment amount, and financial goals. With features like personalized risk profiling, instant portfolio suggestions, and simple user input, PortfolioGPT aims to simplify the investment process for both novice and experienced investors. The platform offers subscription plans for users to access unlimited queries per day and receive tailored investment recommendations.

Opesway

Opesway is an AI-powered financial planning platform that offers a comprehensive solution to help users achieve financial freedom and manage their wealth effectively. The platform provides tools for retirement planning, investment assessment, budget management, debt analysis, and various forecasting tools. Opesway uses AI technology to simplify financial management, make budgeting and investment decisions, and provide personalized insights. Users can connect to financial institutions, import spending data, customize budgets, forecast retirement, and compare financial plans. The platform also features a personalized AI chatbot powered by OpenAI's ChatGPT model.

Glean.ai

Glean.ai is an AI-powered software designed to enhance accounts payable (AP) processes, making them faster, easier, and smarter. It offers a range of features to streamline AP tasks, including automated data extraction, GL coding, bill approvals and payments, accruals, prepaid amortizations, and more. Glean.ai also provides valuable insights into spending patterns, helping businesses identify areas of overspending and uncover opportunities for cost savings. With its user-friendly interface and robust data benchmarking capabilities, Glean.ai empowers accounting and FP&A teams to collaborate seamlessly, plan effectively, and make informed decisions regarding vendor spend.

Principal

Principal is an AI-powered wealth platform that helps users manage their finances effectively. It offers a comprehensive view of your financial situation, personalized insights, and recommendations to grow your wealth. With bank-grade security, Principal ensures that your data is safe and secure. The platform is free to use with the option to upgrade for more advanced features and capabilities.

Zest AI

Zest AI is an AI-driven credit underwriting software that offers a complete solution for AI-driven lending. It enables users to build custom machine learning risk models, adopt model assessment and regulatory compliance, and operate performance management and model monitoring. Zest AI helps increase approvals, manage risk, control loss, drive operational efficiency, automate credit decisioning, and improve borrower experience while ensuring fair lending practices. The software is designed to provide fair and transparent credit for everyone, making lending more accessible and inclusive.

Cushion

Cushion is an AI-powered tool designed to simplify bill management and credit building. It securely connects to your accounts, organizes bills, and offers insights to help you budget better. With features like automatic bill tracking, virtual Cushion card payments, and credit history building, Cushion aims to make bill payments painless and credit building seamless.

Streetbeat

Streetbeat is an innovative investment platform that simplifies and automates investing activities. It serves as a solution for navigating the complexity of financial markets and deriving actionable insights. Streetbeat offers AI Agents for businesses to automate tasks and enhance client services, while individuals can access an AI-powered financial advisor to manage investments. The platform aims to make investing more accessible and efficient for users.

Capchair

Capchair is a personal finance application that leverages AI technology to provide users with a seamless and efficient way to manage their finances. The app offers instant analysis, on-demand insights, and a comprehensive view of all financial data. Users can set budgets, goals, and connect their accounts to track their financial progress. Capchair prioritizes security by implementing bank-level security measures to safeguard users' financial information.

AppZen

AppZen is an AI-powered application designed for modern finance teams to streamline accounts payable processes, automate invoice and expense auditing, and improve compliance. It offers features such as Autonomous AP for invoice automation, Expense Audit for T&E spend management, and Card Audit for analyzing card spend. AppZen's AI learns and understands business practices, ensures compliance, and integrates with existing systems easily. The application helps prevent duplicate spend, fraud, and FCPA violations, making it a valuable tool for finance professionals.

For similar tasks

Gynger

Gynger is an AI-powered payments platform with embedded financing designed for buyers and sellers of technology. It provides a line of credit and debt financing to help businesses pay their software and technology bills upfront while paying back later. Gynger simplifies the procurement process, improves cash flow, and offers flexible payment plans for tech expenses.

ThroughPut AI

ThroughPut AI is a supply chain decision intelligence and analytics platform designed for outcome-driven supply chain decision-makers. It provides accurate demand forecasting, capacity planning, logistics management, and financial insights to drive business results. ThroughPut AI offers a single source of truth for supply chain professionals, enabling them to make faster, better, and confident decisions. The platform helps unlock efficiency, profitability, and growth in day-to-day operations by providing intelligent data-driven recommendations.

Paro

Paro is a professional business finance and accounting solutions platform that matches businesses and accounting firms with skilled finance experts. It offers a wide range of services including accounting, bookkeeping, financial planning, budgeting, business analysis, data visualization, strategic advisory, growth strategy consulting, startup and fundraising consulting, transaction advisory, tax and compliance services, AI consulting services, and more. Paro aims to help businesses optimize faster by providing expert solutions to bridge gaps in finance and accounting operations. The platform also offers staff augmentation services, talent acquisition, and custom solutions to enhance operational efficiency and maximize ROI.

Serina Invoice Automation Software

Serina is an AI-powered Invoice Automation Software designed to streamline the invoice processing workflow for accounts payable teams. By leveraging advanced technologies such as machine learning and artificial intelligence, Serina automates data capture, validation, and workflow management, saving time and reducing errors in the invoicing process. The software offers features such as data entry automation, payment processing integration, invoice generation and management, machine learning-driven enhancements, workflow automation, reporting and analytics. Serina is suitable for small businesses, scaling organizations, and large enterprises looking to improve efficiency and accuracy in their financial processes.

Tango

Tango is a comprehensive platform designed to automate and streamline contract management, billing, and payment processes for small and medium professional services practices and consultancies. It offers clear scope definition, transparent contracts, automated billing, and easy payment options to help businesses save time, reduce administrative tasks, and improve client relationships. With features like self-service contracts, key term highlighting, automated invoicing, and multiple payment methods, Tango aims to simplify the entire workflow from client engagement to payment collection. Trusted by over 600 practices, studios, and agencies, Tango is a trusted solution for businesses looking to enhance efficiency and profitability.

NotedSource

NotedSource is a global research and innovation platform that connects users to a network of research experts. The platform utilizes AI to scout, vet, and manage collaboration projects efficiently. Users can post requests to evaluate experts, startups, and technologies, streamline contract drafting, simplify payments, and access a single project management platform. NotedSource also offers learning and development solutions, executive education, and strategy and innovation services.

Mesha

Mesha is an AI-powered accounts receivable software solution that automates invoice follow-up processes. It offers powerful tools to streamline billing, automate payments, and enhance client communication. Mesha's AI capabilities, led by Marcus, help businesses save time, improve cash flow, and boost productivity. With features like client response tracking, automated email reminders, and white-label client portals, Mesha simplifies invoicing tasks and enhances the overall client experience.

For similar jobs

Tango

Tango is a comprehensive platform designed to automate and streamline contract management, billing, and payment processes for small and medium professional services practices and consultancies. It offers clear scope definition, transparent contracts, automated billing, and easy payment options to help businesses save time, reduce administrative tasks, and improve client relationships. With features like self-service contracts, key term highlighting, automated invoicing, and multiple payment methods, Tango aims to simplify the entire workflow from client engagement to payment collection. Trusted by over 600 practices, studios, and agencies, Tango is a trusted solution for businesses looking to enhance efficiency and profitability.

Receiptor AI

Receiptor AI is an automated bookkeeping tool that leverages AI technology to streamline the process of managing receipts and expenses. The application finds and extracts data from receipts past and present, auto-categorizes expenses, and syncs with accounting software like Xero and QuickBooks. With features like smart categorization, audit-ready reports, retroactive extraction, and real-time processing, Receiptor AI aims to save time, money, and reduce stress for businesses of all sizes. The tool is designed to work with receipts in any language, making it ideal for international businesses. Receiptor AI offers a 14-day free trial and has processed millions of emails, receipts, and invoices, freeing up hours of manual work for users.

Nanonets

Nanonets is an AI-powered intelligent document processing and workflow automation platform that offers data capture for various documents like invoices, bills of lading, purchase orders, passports, ID cards, bank statements, and receipts. It provides document and email workflows, AP automation, financial reconciliation, and AI agents across different functions such as finance & accounting, supply chain & operations, human resources, customer support, and legal, catering to industries like banking & finance, insurance, healthcare, logistics, and commercial real estate. Nanonets helps automate complex business processes with AI, extract valuable information from unstructured data, and make faster, more informed decisions.

Jon AI

Jon AI is an AI tool designed for invoicing and document management. It provides users with a seamless experience in creating and managing invoices, as well as organizing and storing important documents. With its advanced AI capabilities, Jon AI streamlines the invoicing process, reduces errors, and enhances productivity for businesses of all sizes. Whether you are a freelancer, small business owner, or a large corporation, Jon AI offers a user-friendly platform to simplify your invoicing and document management tasks.

AiTax

AiTax is an AI-based tax-preparation software that leverages Artificial Intelligence and Machine Learning to help individuals and entrepreneurs prepare and file their taxes accurately and efficiently. The software eliminates the risk of human error, ensures the lowest possible tax amount, prioritizes data security, and offers free audit and legal defense support. AiTax aims to simplify the tax-filing process, maximize potential refunds, and minimize the chances of an audit, providing users with a reliable and secure solution for their tax needs.

Taxly

Taxly is a user-friendly online platform designed to automate the process of UAE corporate tax filing for small and medium enterprises (SMEs), free zone entities, and accountants. The application simplifies tax compliance by allowing users to upload their financial data and receive FTA-ready tax returns. Taxly provides real-time tax insights, instant tax projections, and built-in compliance assistance to help users navigate the complexities of UAE tax regulations. With a focus on simplicity and efficiency, Taxly aims to streamline the tax filing process for businesses in the UAE.

Itemery

Itemery is an Office Inventory Software designed for small and medium businesses, offering an AI-based Inventory Management Solution. It allows users to easily manage and control their property inventory using AI technology. With features like integration with Excel and Google Threads, importing existing property databases, AI item recognition through the mobile app, and easy inventory tracking, Itemery simplifies the process of asset management for companies of all sizes. The application offers different subscription plans catering to varying needs and budgets, making it a versatile solution for businesses looking to streamline their inventory processes.

Ramp

Ramp is a comprehensive financial management platform that offers Spend Management, Corporate Cards, and Accounts Payable Solutions. It provides easy-to-use corporate cards, bill payments, accounting, and more, all in one place. With Ramp, finance teams can save time and money by streamlining processes and automating tasks. The platform is designed to make finance teams faster and happier, with features like expense management, travel control, accounts payable processing, and accounting automation. Ramp is trusted by over 40,000 finance teams worldwide to save millions of hours and improve efficiency in financial operations.

Kintsugi Vertex

Kintsugi Vertex is an AI-powered sales tax automation tool designed to help companies globally in monitoring, filing, and optimizing sales tax. It automates compliance in three simple steps: connecting and monitoring billing, payment, and HR systems; registering and collecting the right tax with precise rules; and remitting and filing taxes seamlessly. The tool eliminates manual tax calculations, compliance headaches, and unexpected fees, making tax reporting and filing a breeze. It offers white glove support and accurate Nexus tracking to ensure compliance without the complexity of tax requirements. Kintsugi Vertex is trusted by leading businesses worldwide for its end-to-end tax compliance solutions.

Humanlike

Humanlike is an AI-powered AP/AR tool that helps businesses cut AP/AR costs by 80%. It offers a better alternative to outsourcing accounts payable and receivable by using human-like AI to process invoices efficiently and accurately. Developed by fintech veterans from Stripe and Modern Treasury, Humanlike streamlines cashflow management processes, allowing businesses to scale sub-linearly and grow without increasing headcount. The tool provides a risk-free trial period, is SOC 2 compliant, and boasts features such as 24/7 availability, 4-week implementation time, and an average cost reduction of 80%. With Humanlike, businesses can shorten cycle time, automate exception handling, and significantly reduce AP/AR processing costs.

wallet.AI

wallet.AI is an AI application that provides smart machines to inform users about their financial behavior and help them make better daily financial decisions. Founded in San Francisco in 2012, wallet.AI builds intelligent engines that analyze millions of pieces of data to offer personalized insights and recommendations to users. The application aims to empower individuals to manage their finances more effectively by leveraging artificial intelligence technology.

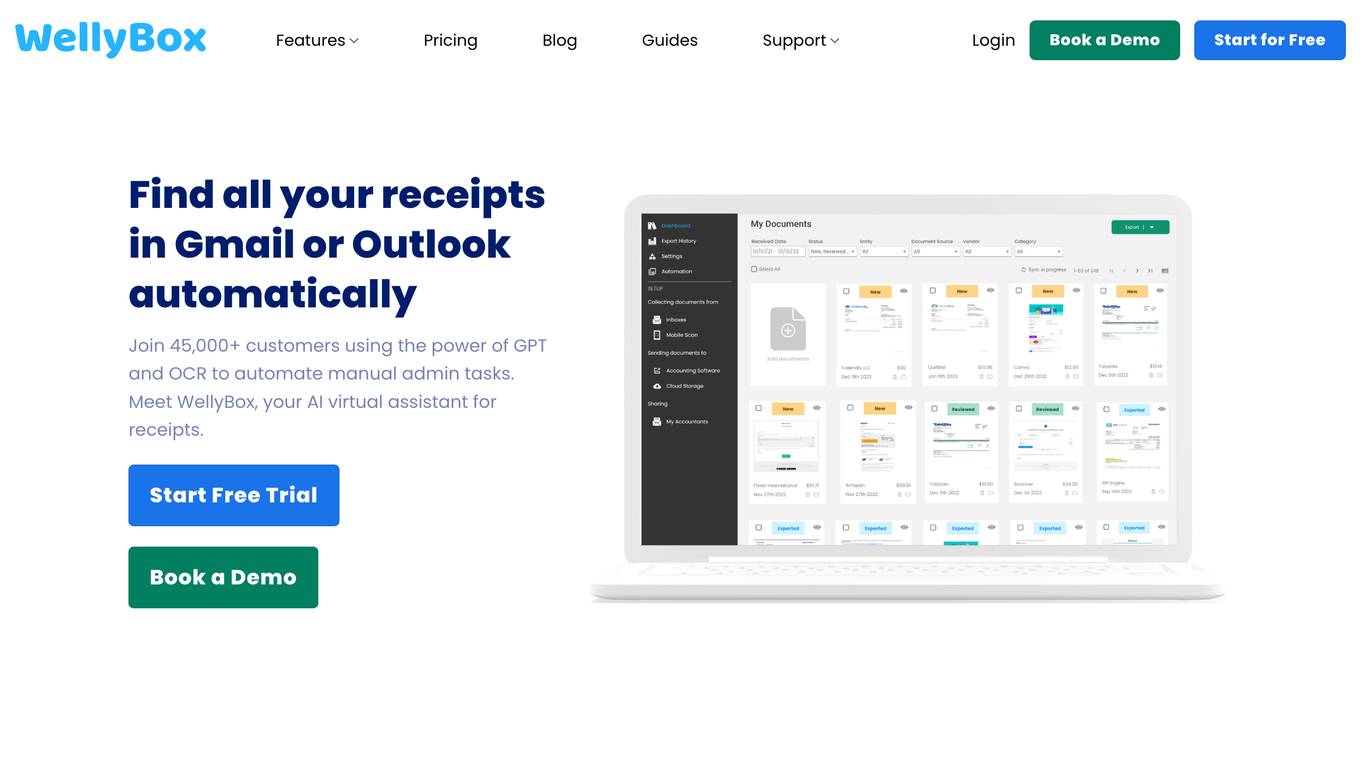

WellyBox

WellyBox is an AI-powered platform designed to help individuals and businesses organize receipts and invoices efficiently. With advanced AI technology, WellyBox automates the collection, analysis, and integration of financial documents from various sources, streamlining the process of managing expenses and improving overall financial operations. The platform offers features such as receipt scanning, automatic data extraction, integration with accounting software, and secure storage of receipts. WellyBox is a comprehensive solution for businesses looking to simplify their receipt management and enhance productivity.

Finance Brain

Finance Brain is an AI-powered assistant that provides instant answers for finance and accounting questions. It offers unlimited access for a monthly fee of $20 and allows new users to ask 3 free questions. The platform also supports uploading video files for analysis.

Procys

Procys is a document processing platform powered by AI solutions. It offers a self-learning engine for document processing, seamless integration with over 260 apps, OCR API powered by AI for optical character recognition, customized data extraction capabilities, and AI autosplit feature for automatic document splitting. Procys caters to various industries such as accounting firms, travel & hospitality, and restaurants, providing solutions for invoice OCR, purchase order OCR, ID card OCR, and receipt OCR. The platform aims to automate and streamline document workflows, saving time, reducing errors, and ensuring compliance for businesses.

Potato.trade

Potato.trade was a service that has been closed down as the company evolved into an AI Finance solutions company called Telescope. The website is no longer active, and users are encouraged to explore the new direction in AI-powered financial solutions at telescope.co.

AI Bank Statement Converter

The AI Bank Statement Converter is an industry-leading tool designed for accountants and bookkeepers to extract data from financial documents using artificial intelligence technology. It offers features such as automated data extraction, integration with accounting software, enhanced security, streamlined workflow, and multi-format conversion capabilities. The tool revolutionizes financial document processing by providing high-precision data extraction, tailored for accounting businesses, and ensuring data security through bank-level encryption. It also offers Intelligent Document Processing (IDP) using AI and machine learning techniques to process structured, semi-structured, and unstructured documents.

SplitMyExpenses

SplitMyExpenses is an AI-powered application designed to simplify shared expenses with friends. It allows users to create groups, split bills effortlessly, track debts, and settle up using integrated payment apps. The app offers modern design, AI receipt itemization, friend data powered by payment apps, and beautiful spending charts to help users manage their expenses efficiently. With over 150 supported currencies and secure handling of data, SplitMyExpenses revolutionizes the age-old problem of bill splitting, providing users with a stress-free experience.

Receipt OCR API

Receipt OCR API by ReceiptUp is an advanced tool that leverages OCR and AI technology to extract structured data from receipt and invoice images. The API offers high accuracy and multilingual support, making it ideal for businesses worldwide to streamline financial operations. With features like multilingual support, high accuracy, support for multiple formats, accounting downloads, and affordability, Receipt OCR API is a powerful tool for efficient receipt management and data extraction.

Bitskout

Bitskout is an AI Front Office platform designed for CPAs and professional services firms to enhance productivity and efficiency. It helps in managing client requests, customer onboarding, and information intake, allowing firms to double their bandwidth without the need for additional headcount. The platform leverages AI technology to streamline workflows, reduce manual tasks, and improve client interactions, ultimately leading to increased profitability and client satisfaction.

CanTax.ai

CanTax.ai is an AI-powered platform offering instant tax help for Canadians. It provides personalized tax advice tailored to individual financial needs, ensuring privacy and security with industry-leading encryption protocols. The platform's artificial intelligence is proficiently trained on federal and provincial tax legislation, offering comprehensive knowledge and 24/7 availability. CanTax aims to simplify the tax filing process and empower Canadians with expert-level tax guidance.

Truewind

Truewind is a next-generation AI-powered accounting solution that brings generative AI to automate accounting tasks for accounting firms, startups, and SMBs. It offers end-to-end services, core AI platform, and month-end close powered by AI. Truewind helps accountants close their books faster, provides AI-powered bookkeeping services, and offers CFO services for strategic scaling. The platform ensures enterprise-grade data security and privacy, and integrates with various accounting systems. Truewind is SOC 2 certified and adheres to strict data privacy policies.

Respaid

Respaid is a B2B collections tool that focuses on respectful and efficient debt recovery. It utilizes AI-powered precision messaging to optimize communication with debtors, resulting in a 50% collection rate and 30x faster performance than traditional methods. The tool offers features such as direct payments, database cleaning, and insights into why customers aren't paying. Respaid aims to protect your brand reputation while helping you recover unpaid invoices in a respectful manner.

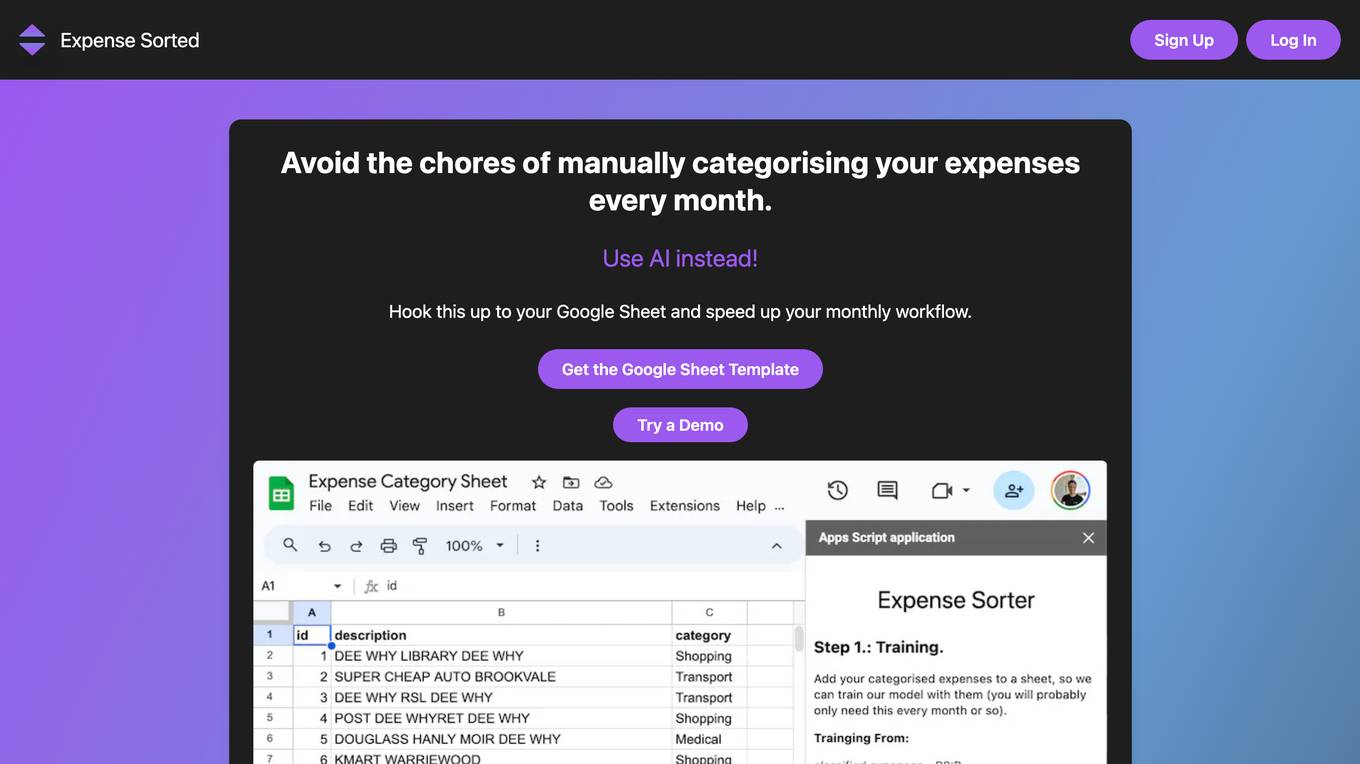

Expense Sorted

Expense Sorted is an AI-powered tool designed to automate the categorization of expenses, eliminating the manual effort required every month. By integrating with Google Sheets, users can streamline their workflow and benefit from accurate transaction identification. The tool offers customizable categories to suit personal or business needs, ensuring a seamless user experience.

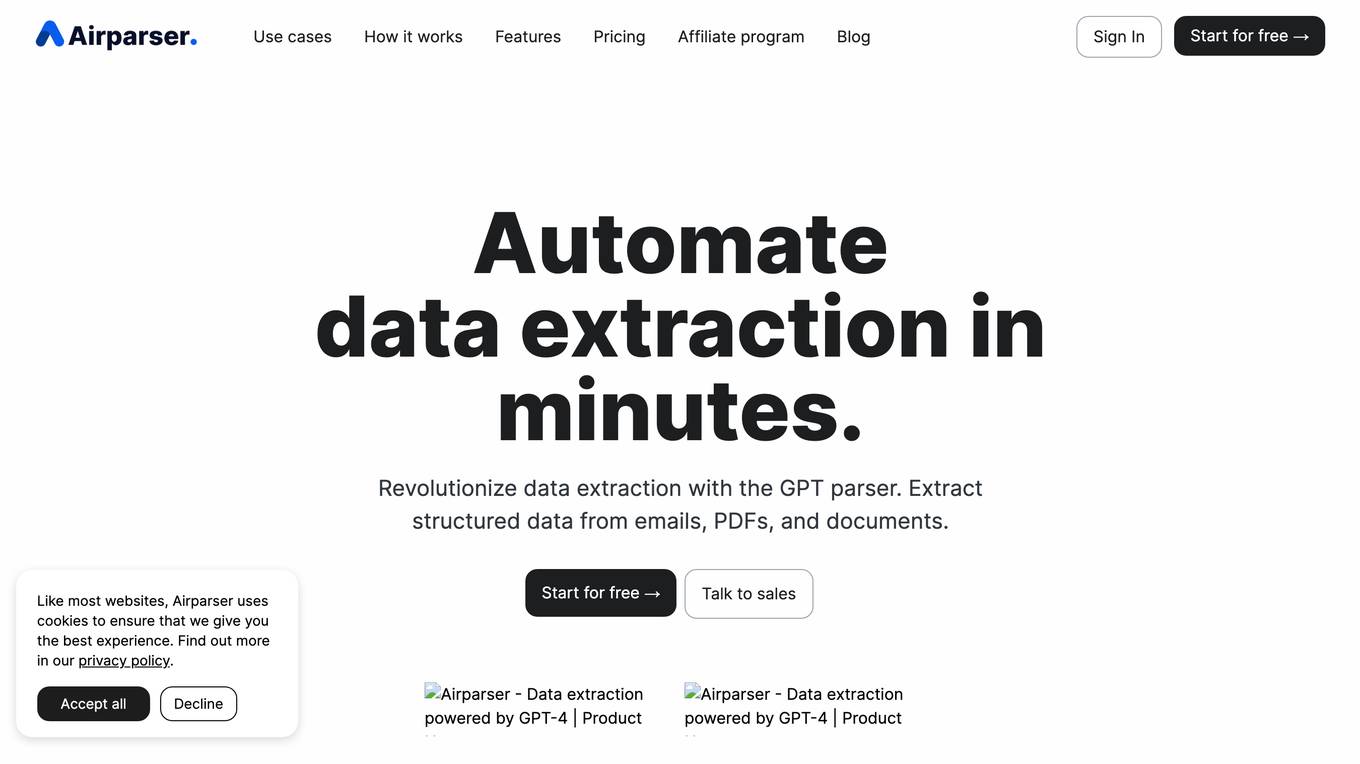

Airparser

Airparser is an AI-powered email and document parser tool that revolutionizes data extraction by utilizing the GPT parser engine. It allows users to automate the extraction of structured data from various sources such as emails, PDFs, documents, and handwritten texts. With features like automatic extraction, export to multiple platforms, and support for multiple languages, Airparser simplifies data extraction processes for individuals and businesses. The tool ensures data security and offers seamless integration with other applications through APIs and webhooks.