Best AI tools for< Loan Processor >

Infographic

20 - AI tool Sites

Casca

Casca is a revolutionary AI-native Loan Origination System that helps banks and non-bank lenders automate 90% of manual effort in business loan origination. By leveraging AI technology, Casca enables financial institutions to process loans 10x faster, achieve 3x higher conversion rates, and save significant time for loan officers. With features like AI Loan Assistant, digital application processing, KYB checks automation, and document analysis, Casca transforms the loan origination process into a seamless and efficient experience for both lenders and borrowers.

Silverwork Solutions

Silverwork Solutions is a fintech company that provides AI-powered mortgage automation solutions. Its Digital Workforce Solutions are role-based autonomous bots that integrate seamlessly into loan manufacturing processes, from application to post-closing. These bots utilize AI to make predictions and decisions, enhancing the loan processing experience. Silverwork's solutions empower lenders to realize the full potential of automation and transform their operations, allowing them to focus on higher-value activities while the bots handle repetitive tasks.

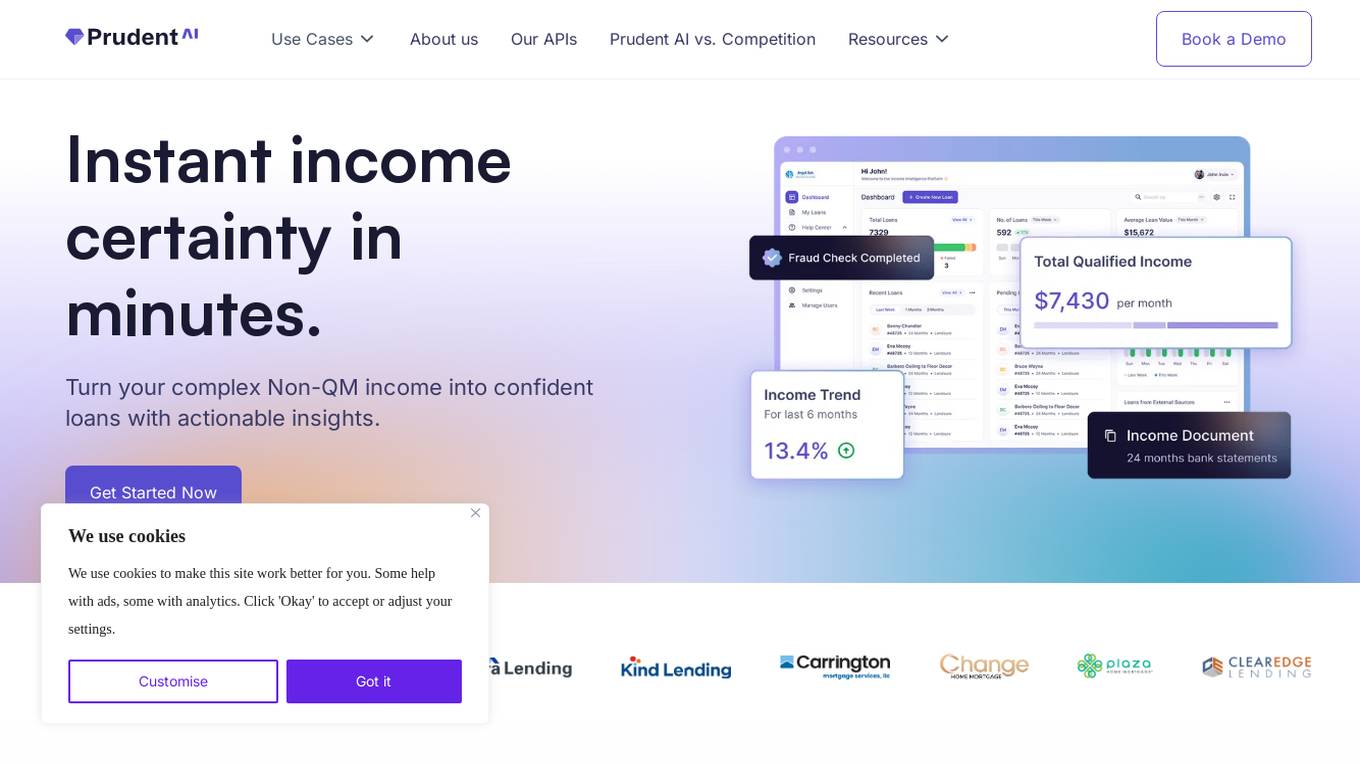

Prudent AI

Prudent AI is an AI-powered Income Intelligence Platform designed for lenders, offering fast data extraction, proactive fraud prevention, and in-depth insights on borrower income. The platform simplifies complex income calculations, streamlines the lending process, and enables lenders to make confident loan decisions quickly. Prudent AI is trusted by various lending institutions and has been proven to increase productivity, save time, and improve submission accuracy.

Kasisto

Kasisto is a conversational AI platform that provides financial institutions with the ability to create personalized, automated, and engaging digital experiences for their customers and employees. Kasisto's platform is infused with unmatched financial literacy and augments your workforce with remarkably competent digital bankers who facilitate accurate, human-like conversations and empower your teams with “in-the-moment” financial knowledge.

Ocrolus

Ocrolus is an intelligent document automation software that leverages AI-driven document processing automation with Human-in-the-Loop. It offers capabilities such as classifying, capturing, detecting, and analyzing documents, with use cases in cash flow, income, address, employment, and identity verification. Ocrolus caters to various industries like small business lending, mortgage, consumer finance, and multifamily housing. The platform provides resources for developers, including guides on income verification, fraud detection, and business process automation. Users can explore the API to build innovative customer experiences and make faster and more accurate financial decisions.

Obviously AI

Obviously AI is a no-code AI tool that allows users to build and deploy machine learning models without writing any code. It is designed to be easy to use, even for those with no data science experience. Obviously AI offers a variety of features, including model building, model deployment, model monitoring, and integration with other tools. It also provides expert support from a dedicated data scientist.

Digilytics

Digilytics is an AI tool designed to help lenders make smarter, faster, and more confident decisions by turning complex data into accurate insights. The tool offers purpose-built AI solutions for mortgage lenders, asset finance lenders, and SME lenders, increasing operational efficiency, ensuring reliable decisions, and maintaining compliance. Digilytics helps lenders balance innovation with stability, leading to a reduction in time-to-offer, an increase in productivity, and a boost in gross lending. The tool streamlines workflows, elevates borrower experience, and provides automated affordability and underwriting workflows for modernizing lending operations.

Underwrite.ai

Underwrite.ai is a platform that leverages advances in artificial intelligence and machine learning to provide lenders with nonlinear, dynamic models of credit risk. By analyzing thousands of data points from credit bureau sources, the application accurately models credit risk for consumers and small businesses, outperforming traditional approaches. Underwrite.ai offers a unique underwriting methodology that focuses on outcomes such as profitability and customer lifetime value, allowing organizations to enhance their lending performance without the need for capital investment or lengthy build times. The platform's models are continuously learning and adapting to market changes in real-time, providing explainable decisions in milliseconds.

Lama AI

Lama AI is an AI-powered platform designed to revolutionize business lending processes for banks and financial institutions. It offers advanced features, rapid configurability, and exceptional support to streamline loan origination, underwriting, and decision-making. By leveraging the power of AI, Lama AI enables banks to boost business growth potential, improve profitability, and enhance customer experience through contextual onboarding, decisioning workspace, expanded credit access, and pre-qualified applications. The platform also provides white-labeled solutions, API-first integration, high configurability, built-in AI models, and access to a network of bank lenders, all while ensuring bank-grade security and compliance standards.

Scienaptic Systems

Scienaptic Systems is an AI-powered Credit Decisioning Platform that revolutionizes the lending industry by automating credit underwriting processes, leveraging alternate data points, and offering self-learning models for instant credit decisions. The platform helps lenders identify creditworthy borrowers, streamline customer experience, and ensure fair lending practices through explainable AI models. Scienaptic's suite of AI-enabled technologies enables lenders to say 'Yes' to more borrowers at lower risk, providing a 360-degree risk assessment before approving applications. The platform integrates seamlessly with existing lending ecosystems, ensuring disruption-free deployment and better risk predictions through a single API call.

Dispute AI™

Dispute AI™ is an AI-powered DIY credit repair solution that revolutionizes the way individuals take control of their credit. With over 20 years of expertise in credit repair and financial empowerment, Dispute AI™ delivers personalized strategies backed by cutting-edge artificial intelligence to simplify and streamline the credit repair process. The platform offers tailored AI-driven tactics to challenge and resolve inaccurate credit report items effectively, providing actionable, data-driven recommendations to improve credit scores. Users can handle credit repair on their terms, anytime, anywhere, without the need to hire expensive credit repair companies. Dispute AI™ aims to make credit improvement accessible, efficient, and impactful, empowering individuals to achieve financial freedom.

SmartDispute.ai

SmartDispute.ai is an AI-powered credit repair application that helps users improve their credit scores by leveraging artificial intelligence technology. The application offers a patented Smart Dispute System™ technology that identifies and helps remove negative accounts from credit reports, making it one of the most effective credit repair systems available. Users can easily repair their own credit with the help of SmartDispute.ai's automated processes and fact-based dispute method. The application provides users with a simple and clearly explained process, allowing them to track their progress and see significant improvements in their credit scores over time.

AI Credit Repair

AI Credit Repair is an AI-powered application designed to help users improve their credit score by providing tools such as credit card utilization builder, public records remover, dispute letter generator, and SMS alerts. The application assists users in managing their credit card payments, disputing collections, and staying on top of their credit-related activities. By leveraging artificial intelligence technology, AI Credit Repair aims to simplify the credit repair process and empower users to build a better financial future.

Cape.ai

Cape.ai is an agentic AI platform designed for financial operations, offering AI-powered automation to enhance reach, insight, and efficiency in daily operations for financial firms. The platform is built on real-world customer use cases, providing tangible business ROI by integrating structured and unstructured data sources, automating complex manual processes, and offering context-aware insights. Users have control over their data and processes, with customizable workflows and human-in-the-loop capabilities. Cape.ai enables flexible implementation of agentic and deterministic automation, with seamless integrations for various financial workflows and direct access to leading financial data providers. The platform empowers users to create powerful AI agents without technical barriers, unlocking real business value with speed and confidence.

Houmify

Houmify.com is an AI-powered property companion that offers personalized real estate solutions. The platform uses artificial intelligence to guide users in accessing the best services related to selling a home, buying a home, loan & refinance, and home maintenance. Users can interact with the AI Agent to get expert advice and recommendations tailored to their specific needs and preferences. The website also provides informative posts and articles on real estate topics to help users make informed decisions. With a focus on user experience and convenience, Houmify aims to simplify the real estate process and empower individuals in their property transactions.

FOCAL

FOCAL is an AI-driven platform designed for AML compliance and anti-fraud purposes. It offers solutions for verification, customer due diligence, fraud prevention, and financial insights. The platform leverages AI technology to streamline onboarding processes, enhance trust through advanced customer screening, and detect and prevent fraud using advanced AI algorithms. FOCAL is tailored to meet industry-specific needs, provides seamless integration with existing systems, and offers localized expertise with global standards for regulatory compliance.

VantedgeAI

VantedgeAI is an AI application that offers fine-tuned AI models for credit funds, revolutionizing credit investing workflows with faster, smarter, and cost-effective solutions. The application transforms manual processes into scalable, automated workflows tailored for Private Credit and Hedge Funds. VantedgeAI is trusted by market leaders to provide unique AI-driven insights, accelerate analysis, enhance accuracy, and ensure data security and privacy through SOC 2 compliance. The application automates investment memo generation, data extraction for Excel models, portfolio monitoring, loan reconciliation, smart bond screening, and real-time data querying with AI bots.

CreditHQ

CreditHQ is an AI-powered loan restructuring platform that helps users analyze their credit history, compare interest rates, and save money on their loans. The platform offers a range of features, including a credit score simulator, a budgeting tool, and a debt management tool. CreditHQ is trusted by over 5,500 users and companies globally.

MyLoans.ai

MyLoans.ai is a free AI tool designed to provide personalized guidance for complex student loans. It offers instant, clear, and accurate answers to student loan queries, helping borrowers make informed decisions about their financial future. By skipping expensive advisors and confusing government websites, MyLoans.ai aims to save users thousands of dollars by leveraging official government sources for guidance.

CUBE3.AI

CUBE3.AI is a real-time crypto fraud prevention tool that utilizes AI technology to identify and prevent various types of fraudulent activities in the blockchain ecosystem. It offers features such as risk assessment, real-time transaction security, automated protection, instant alerts, and seamless compliance management. The tool helps users protect their assets, customers, and reputation by proactively detecting and blocking fraud in real-time.

0 - Open Source Tools

20 - OpenAI Gpts

Loan Management Software

Loan management software expertise. Get the most powerful loan origination and loan servicing software on the market.

Fast Loan

Discusses fast loans, application processes, and financial considerations informatively.

Sebastian

Answers questions by home owners and home buyers about Residential Mortgage products and rates and how to get started in the process of buying a new home or refinancing their current property

SBA Loan Advisor

Using public SBA data to help you find the best fit lender for your small business

Top Loan Apps Expert

An AI tool offering expert advice on financial products, focusing on Top Loan Apps, best lending apps, fast cash advance apps, online loan apps, instant loan apps, and emergency loan apps. This tool provides insights, comparisons, and guidance for users seeking quick and reliable loan solutions.

Personal Loan

Discusses personal loans, payment methods, and financial options informatively.

GPT Loans Analyzer

An economic advisor for loan feasibility, market analysis, and investment advice.

Borrower's Defense Assistant

Assistance in understanding and filling out the Borrower's Defense to Repayment Form provided by the United States Department of Education.

Solvo

Buying something new? Let me show you how much it will *really* cost you over time. What is it, and how much are you paying?

Pay Later

Explains 'buy now, pay later' and recommends providers in a financial, informative tone.