SmartDispute.ai

Repair Your Credit with the Power of AI

SmartDispute.ai is an AI-powered credit repair application that helps users improve their credit scores by leveraging artificial intelligence technology. The application offers a patented Smart Dispute System™ technology that identifies and helps remove negative accounts from credit reports, making it one of the most effective credit repair systems available. Users can easily repair their own credit with the help of SmartDispute.ai's automated processes and fact-based dispute method. The application provides users with a simple and clearly explained process, allowing them to track their progress and see significant improvements in their credit scores over time.

For Tasks:

Click tags to check more tools for each tasksFor Jobs:

Features

Advantages

Disadvantages

Frequently Asked Questions

Alternative AI tools for SmartDispute.ai

Similar sites

SmartDispute.ai

SmartDispute.ai is an AI-powered credit repair application that helps users improve their credit scores by leveraging artificial intelligence technology. The application offers a patented Smart Dispute System™ technology that identifies and helps remove negative accounts from credit reports, making it one of the most effective credit repair systems available. Users can easily repair their own credit with the help of SmartDispute.ai's automated processes and fact-based dispute method. The application provides users with a simple and clearly explained process, allowing them to track their progress and see significant improvements in their credit scores over time.

AI Credit Repair

AI Credit Repair is an AI-powered application designed to help users improve their credit score by providing tools such as credit card utilization builder, public records remover, dispute letter generator, and SMS alerts. The application assists users in managing their credit card payments, disputing collections, and staying on top of their credit-related activities. By leveraging artificial intelligence technology, AI Credit Repair aims to simplify the credit repair process and empower users to build a better financial future.

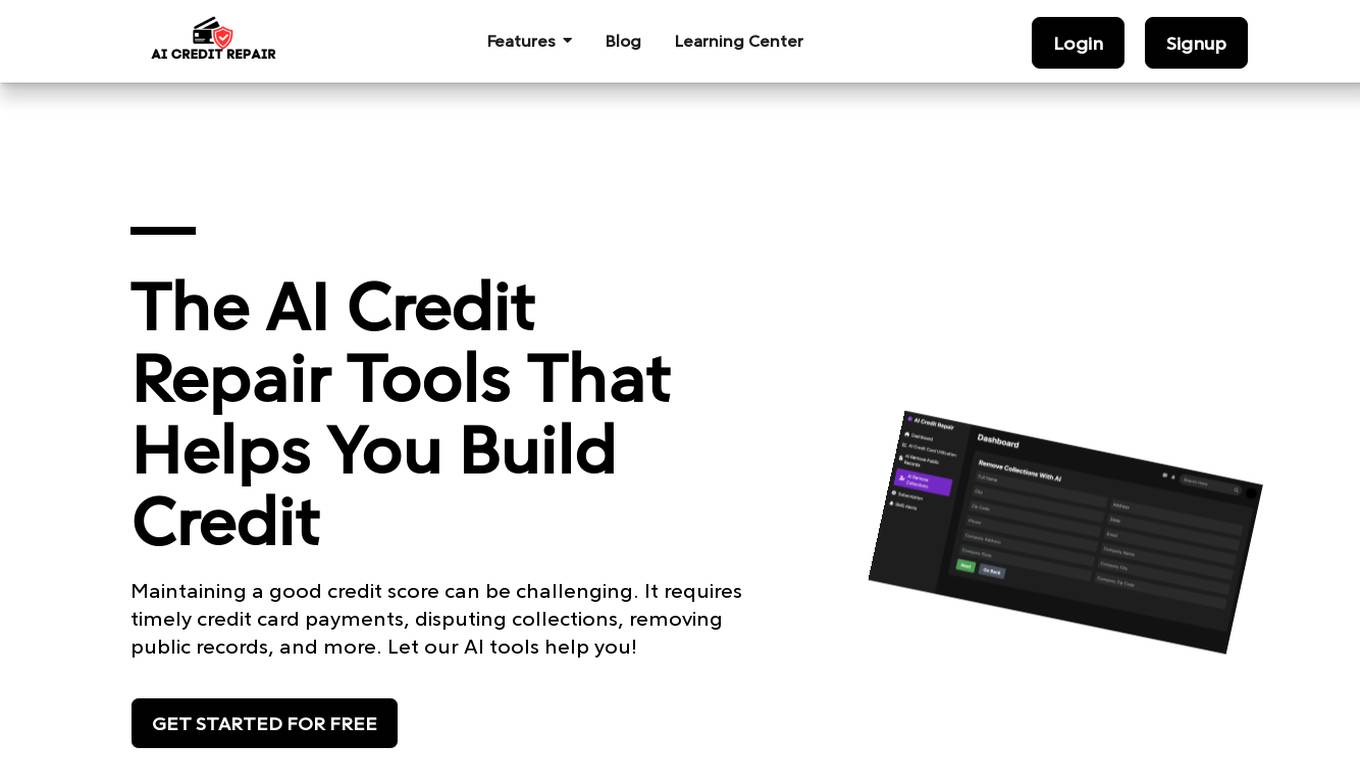

Chargezoom

Chargezoom is an AI-powered accounts receivable (AR) solution that helps businesses get paid faster. It automates many of the tasks associated with AR, such as invoicing, payment reminders, and reconciliation. Chargezoom also provides businesses with insights into their AR performance, so they can make better decisions about how to manage their cash flow. Chargezoom is a cloud-based solution that is easy to use and integrates with a variety of accounting software programs.

Hebbia

Hebbia is an AI-powered tool that helps users collaborate with LLMs more confidently and efficiently. It allows users to ask questions about all their documents, up to millions at a time, and provides important answers that are not limited to the top few results. Hebbia is designed to execute workflows with hundreds of steps over any amount of sources, turning prompts into processes. It is a trustworthy AI system that shows its work at each step, allowing users to verify, trust, and collaborate with AI. Hebbia is used by the largest enterprises, financial institutions, governments, and law firms in the world.

Leena AI

Leena AI is a Gen AI employee assistant that reduces IT, HR, Finance tickets. It guarantees a 70% self-service ratio in the contract. Leena AI centralizes knowledge that is scattered across the enterprise, making information easy to find right on chat with a simple query. The knowledge is auto-updated when changes are made, so your employees always get support that is both relevant and accurate. Leena AI integrates with all knowledge base systems within your enterprise from day one, eliminating the need for any consolidation or migration effort across the knowledge base systems. The work assistant tailors responses to employee queries based on their role, team and access level which boosts employee experience while adhering to security protocols and preventing unauthorized access to information. Leena AI analyzes historically closed tickets and learns from their resolutions to create knowledge articles that can prevent similar tickets from being raised again. Leena AI breaks down large policy documents and knowledge articles into consumable snippets so the responses are sharper and more specific to the employee’s query.

金数据AI考试

The website offers an AI testing system that allows users to generate test questions instantly. It features a smart question bank, rapid question generation, and immediate test creation. Users can try out various test questions, such as generating knowledge test questions for car sales, company compliance standards, and real estate tax rate knowledge. The system ensures each test paper has similar content and difficulty levels. It also provides random question selection to reduce cheating possibilities. Employees can access the test link directly, view test scores immediately after submission, and check incorrect answers with explanations. The system supports single sign-on via WeChat for employee verification and record-keeping of employee rankings and test attempts. The platform prioritizes enterprise data security with a three-level network security rating, ISO/IEC 27001 information security management system, and ISO/IEC 27701 privacy information management system.

notreload

notreload is an AI-based web service that helps users automate public web content monitoring for investing and trading purposes. Its AI and Natural Language Processing (NLP) technology uncover relevant data points within millions of documents and posts instantly. notreload scours all sources of company news, then filters out the noise to deliver short-form stories consisting of only stock-moving content. It tracks anything and alerts you anywhere, eliminating the need for constant checking and re-checking.

Hypertype

Hypertype is an AI-powered email assistant that helps businesses save time and improve the quality of their customer communications. It automatically drafts emails with the most relevant information retrieved from your data, in seconds. This can save you up to 70% of the time you spend drafting emails, and it can also help you to provide more personalized and effective responses to your customers. Hypertype is used by over 2,000 businesses worldwide, and it has been featured in Forbes, The Wall Street Journal, and The New York Times.

EasyCallScript

EasyCallScript is a live call script application powered by AI technology, designed to enhance cold calling experiences for sales representatives. The tool provides instant confidence on the phone by adapting scripts for each lead and guiding users through calls without the need for CRM integration or specific data. With EasyCallScript, users can efficiently handle objections, maintain a consistent company culture, and focus on building relationships while the AI focuses on the sales objective. The application offers different pricing plans with one-time payments and unlimited user profiles, making it a valuable tool for sales professionals seeking to improve their call performance.

Hebbia

Hebbia is an AI tool designed to help users collaborate with AI agents more confidently over all the documents that matter. It offers Matrix agents that can handle questions about millions of documents at a time, executing workflows with hundreds of steps. Hebbia is known for its Trustworthy AI approach, showing its work at each step to build user trust. The tool is used by top enterprises, financial institutions, governments, and law firms worldwide, saving users time and making them more efficient in their work.

DoNotPay

DoNotPay is an AI-powered platform that helps consumers fight big corporations, protect their privacy, find hidden money, and beat bureaucracy. It offers a wide range of tools and services to help users with tasks such as disputing traffic tickets, canceling subscriptions, and getting refunds. DoNotPay is not a law firm and is not licensed to practice law. It provides a platform for legal information and self-help.

Opnbx

Opnbx is a bespoke revenue operating platform that helps sales teams understand their target market and prioritize their sales and marketing efforts. It uses AI to learn from a company's revenue team and scour billions of data points to give a real-time view of the market. Opnbx also provides insights into which companies are in buying mode right now and which prospects are visiting a company's website in real-time. It provides persona and contact details, including mobile numbers and email addresses, and has an AI email writing platform that provides the right research to create personalized and relevant messages in seconds.

DocAI

DocAI is an API-driven platform that enables you to implement contracts AI into your applications, without requiring development from the ground-up. Our AI identifies and extracts 1,300+ common legal clauses, provisions and data points from a variety of document types. Our AI is a low-code experience for all. Easily train new fields without the need for a data scientist. All you need is subject matter expertise. Flexible and scalable. Flexible deployment options in the Zuva hosted cloud or on prem, across multiple geographical regions. Reliable, expert-built AI our customers can trust. Over 1,300+ out of the box AI fields that are built and trained by experienced lawyers and subject matter experts. Fields identify and extract common legal clauses, provisions and data points from unstructured documents and contracts, including ones written in non-standard language.

SellScale

SellScale is a superintelligence that helps run your top of funnel. It is an integrated suite of tools built for sales that takes your copy beyond personalization, provides instant response systems, and allows you to chat with your AI. SellScale also spins up new domains, monitors blacklists, and keeps you out of spam. It seamlessly integrates into your CRM and helps you track what's working and what's not.

Jochem

Jochem is an AI tool designed to provide accurate answers quickly and enhance knowledge on-the-go. It helps users get instant answers to their questions, connects them with experts within the company, and continuously learns to improve performance. Jochem eliminates the need to search through files and articles by offering a smart matching system based on expertise. It also allows users to easily add and update the knowledge base, ensuring full control and transparency.

SpeedLegal

SpeedLegal is a technological startup that uses Machine Learning technology (specifically Deep Learning, LLMs and genAI) to highlight the terms and the key risks of any contract. We analyze your documents and send you a simplified report so you can make a more informed decision before signing your name on the dotted line.

For similar tasks

SmartDispute.ai

SmartDispute.ai is an AI-powered credit repair application that helps users improve their credit scores by leveraging artificial intelligence technology. The application offers a patented Smart Dispute System™ technology that identifies and helps remove negative accounts from credit reports, making it one of the most effective credit repair systems available. Users can easily repair their own credit with the help of SmartDispute.ai's automated processes and fact-based dispute method. The application provides users with a simple and clearly explained process, allowing them to track their progress and see significant improvements in their credit scores over time.

Dispute AI™

Dispute AI™ is an AI-powered DIY credit repair solution that revolutionizes the way individuals take control of their credit. With over 20 years of expertise in credit repair and financial empowerment, Dispute AI™ delivers personalized strategies backed by cutting-edge artificial intelligence to simplify and streamline the credit repair process. The platform offers tailored AI-driven tactics to challenge and resolve inaccurate credit report items effectively, providing actionable, data-driven recommendations to improve credit scores. Users can handle credit repair on their terms, anytime, anywhere, without the need to hire expensive credit repair companies. Dispute AI™ aims to make credit improvement accessible, efficient, and impactful, empowering individuals to achieve financial freedom.

For similar jobs

BlinkAI

BlinkAI is an innovative AI tool that provides GPTs with superpowers by giving them a wallet, enabling them to function as personal financial assistants, bankers, money managers, shoppers, and more. It aims to enhance Web3 user experience by leveraging AI capabilities. The tool empowers users to accomplish tasks more efficiently and effectively.

SmartDispute.ai

SmartDispute.ai is an AI-powered credit repair application that helps users improve their credit scores by leveraging artificial intelligence technology. The application offers a patented Smart Dispute System™ technology that identifies and helps remove negative accounts from credit reports, making it one of the most effective credit repair systems available. Users can easily repair their own credit with the help of SmartDispute.ai's automated processes and fact-based dispute method. The application provides users with a simple and clearly explained process, allowing them to track their progress and see significant improvements in their credit scores over time.

VABOT

VABOT is an ecosystem of advanced, AI-powered enterprise and consumer-facing solutions integrating blockchain and artificial intelligence to improve users' daily lives and preserve time. It offers tailored virtual assistant bots for various industries like hospitality, retail, travel, health, and finance. The $VABT token serves as the native currency for VABOT, enabling subscriptions, staking, and rewards within the ecosystem. VABOT ensures data security with advanced encryption protocols and offers a roadmap for future development.

Dispute AI™

Dispute AI™ is an AI-powered DIY credit repair solution that revolutionizes the way individuals take control of their credit. With over 20 years of expertise in credit repair and financial empowerment, Dispute AI™ delivers personalized strategies backed by cutting-edge artificial intelligence to simplify and streamline the credit repair process. The platform offers tailored AI-driven tactics to challenge and resolve inaccurate credit report items effectively, providing actionable, data-driven recommendations to improve credit scores. Users can handle credit repair on their terms, anytime, anywhere, without the need to hire expensive credit repair companies. Dispute AI™ aims to make credit improvement accessible, efficient, and impactful, empowering individuals to achieve financial freedom.

CreditHQ

CreditHQ is an AI-powered loan restructuring platform that helps users analyze their credit history, compare interest rates, and save money on their loans. The platform offers a range of features, including a credit score simulator, a budgeting tool, and a debt management tool. CreditHQ is trusted by over 5,500 users and companies globally.

Cushion

Cushion is an AI-powered tool designed to simplify bill management and credit building. It securely connects to your accounts, organizes bills, and offers insights to help you budget better. With features like automatic bill tracking, virtual Cushion card payments, and credit history building, Cushion aims to make bill payments painless and credit building seamless.

Cleo

Cleo is an AI-powered financial management tool that helps users with budgeting, saving, building credit, and managing their finances. It offers features like cash advances, budgeting tips, credit building tools, and personalized financial advice. Cleo uses AI technology to provide users with insights and recommendations to improve their financial health. The application aims to make money management easy and accessible for everyone, without the need for credit checks or complex financial jargon.

AI Credit Repair

AI Credit Repair is an AI-powered application designed to help users improve their credit score by providing tools such as credit card utilization builder, public records remover, dispute letter generator, and SMS alerts. The application assists users in managing their credit card payments, disputing collections, and staying on top of their credit-related activities. By leveraging artificial intelligence technology, AI Credit Repair aims to simplify the credit repair process and empower users to build a better financial future.

TrueAccord

TrueAccord is an industry-leading recovery and collections platform powered by machine learning and a consumer-friendly digital experience. It offers third-party collection services for better relationships and faster recoveries through engagement, commitment, and resolution. TrueAccord's platform can handle delinquency needs from one day past due through charge off, with features like HeartBeat for better results, self-serve digital experience for consumers, scalability in delinquency infrastructure, and end-to-end personalization. The platform is trusted by market leaders and loved by consumers, providing a full-service digital-first debt collection agency.

coeo

coeo is a technology-based debt collection company that utilizes cutting-edge AI processes and behavioral research insights to harmonize customer relationships. They offer tailored debt collection solutions with a focus on customer satisfaction and efficiency. With an international presence in seven European countries, coeo combines the capacity and competence of a large corporation with the flexibility of a medium-sized company and the spirit of a fintech start-up. Their success is driven by a robust tech stack, extensive data pool, and continuous performance management.

Formula Wizard

Formula Wizard is an AI-powered software designed to assist users in writing Excel, Airtable, and Notion formulas effortlessly. By leveraging artificial intelligence, the application automates the process of formula creation, allowing users to save time and focus on more critical tasks. With features like automating tedious tasks, unlocking insights from data, and customizing templates, Formula Wizard streamlines the formula-writing process for various spreadsheet applications.

Eilla

Eilla is an AI-native M&A advisory platform designed for small and medium businesses (SMBs) looking to sell their companies. By combining top-tier M&A advisors with advanced AI algorithms, Eilla aims to deliver faster and higher-value outcomes for its clients. The platform automates manual tasks, surfaces hidden buyers, drives valuation, and creates competitive tension to push offers higher. Eilla provides expert advisory services, market intelligence, and a frictionless preparation process to make the selling experience efficient and effective. With decades of expertise backed by technology, Eilla has executed transactions worth over $100 billion and is trusted by numerous funds and banks.

StockGPT

StockGPT is an AI-powered financial research assistant that provides knowledge of earnings releases, financial reports, and fundamental information for S&P 500 and Nasdaq companies. It offers features like AI search, customizable filters, up-to-date data, and industry research to help users analyze companies and markets more efficiently.

ChatBTC

ChatBTC is an AI tool designed to help users learn about bitcoin technology and history. It provides AI responses to questions related to bitcoin technology, such as approaches to mitigating fee sniping, the benefits of SegWit, and the differences between PTLCs and HTLCs. The tool features AI bots representing various bitcoin experts who provide insights and explanations on different aspects of bitcoin technology. ChatBTC aims to educate users through AI-generated content sourced from reputable sources like the bitcoin-dev mailing list and Bitcoin StackExchange.

Capsolver

Capsolver is an AI-powered application that offers fast and seamless automatic captcha solving services. It provides solutions for various types of captchas, including reCAPTCHA, Geetest, ImageToText, Cloudflare, and more. Capsolver ensures easy integration with multiple language support and ready-to-use code examples, making it effortless to implement in web projects. The application caters to a wide range of industries, such as web testing, social media, market research, SEO, online shopping, online gaming, and financial services. Capsolver is known for its reliability, flexibility, and customization options, making it a preferred choice for enterprises seeking efficient captcha solving solutions.

Kupiks

Kupiks is a platform that provides access to alternative data for prediction markets. Users can join the waitlist to get early access to real-time alternative data signals from various sources. The platform offers powerful analytics tools for data-driven decision-making and instant alerts for tracking market shifts. Kupiks aims to help users make better predictions by leveraging alternative data.

Susterra

Susterra is an advanced analytics platform for Public Finance stakeholders, aiming to catalyze urban development by providing powerful insights. The platform integrates leading practices from academia, utilizes public data growth, and leverages technology and innovation, including ML and AI. Susterra offers solutions like TerraScore, TerraVision, TerraView, and Impact IQ, enabling sophisticated evaluation of public benefit programs across various sectors like Utilities, Education, Healthcare, and more. The platform also specializes in data visualization tools and is powered by Google Cloud.

Receiptor AI

Receiptor AI is an automated bookkeeping tool that leverages artificial intelligence to streamline the process of managing receipts and invoices. It finds, extracts, categorizes, and syncs data from various sources like emails, WhatsApp, and manual uploads to accounting software such as Xero and QuickBooks. The tool aims to save time, money, and reduce stress by automating tedious bookkeeping tasks, making financial records always complete and audit-ready. With features like automatic extraction, retroactive email analysis, real-time expense analytics, and smart AI categorization, Receiptor AI offers a novel approach to accounting that simplifies the workflow for individuals, businesses, and accountants.

Nanonets

Nanonets is an AI-powered intelligent document processing and workflow automation platform that helps businesses extract valuable information from unstructured data, automate repetitive tasks, and make faster, more informed decisions. The platform offers solutions for various industries and functions, such as finance & accounting, supply chain & operations, human resources, customer support, and legal. Nanonets' AI agents and no-code platform enable businesses to streamline complex processes and achieve measurable ROI in a short period. With a focus on automation, Nanonets empowers users to optimize workflows, reduce manual effort, and enhance efficiency across different use cases.

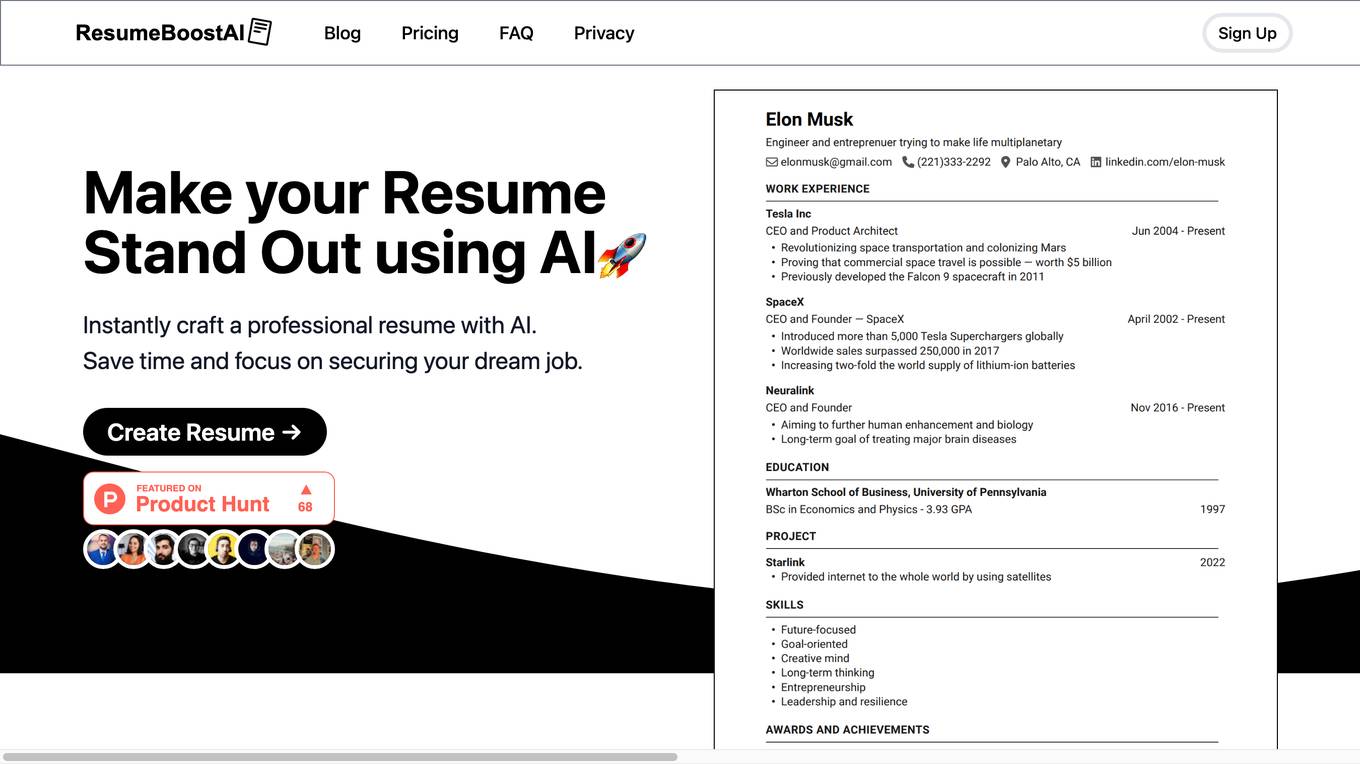

ResumeBoostAI

ResumeBoostAI is a free AI resume builder that helps job seekers create professional resumes and cover letters online. The platform offers a suite of innovative AI tools to streamline the job application process, save time, and increase the chances of landing a dream job. With features like resume parsing, bullet point generation, cover letter customization, and ATS-friendly templates, ResumeBoostAI aims to revolutionize the way resumes are created and optimized for job applications.

AITax

AITax.com is a website that appears to be related to tax services, but due to a privacy error, the connection is not secure. The site seems to have an expired security certificate, which may pose a risk to users' information security. The site prompts users to proceed at their own risk, indicating potential security vulnerabilities.

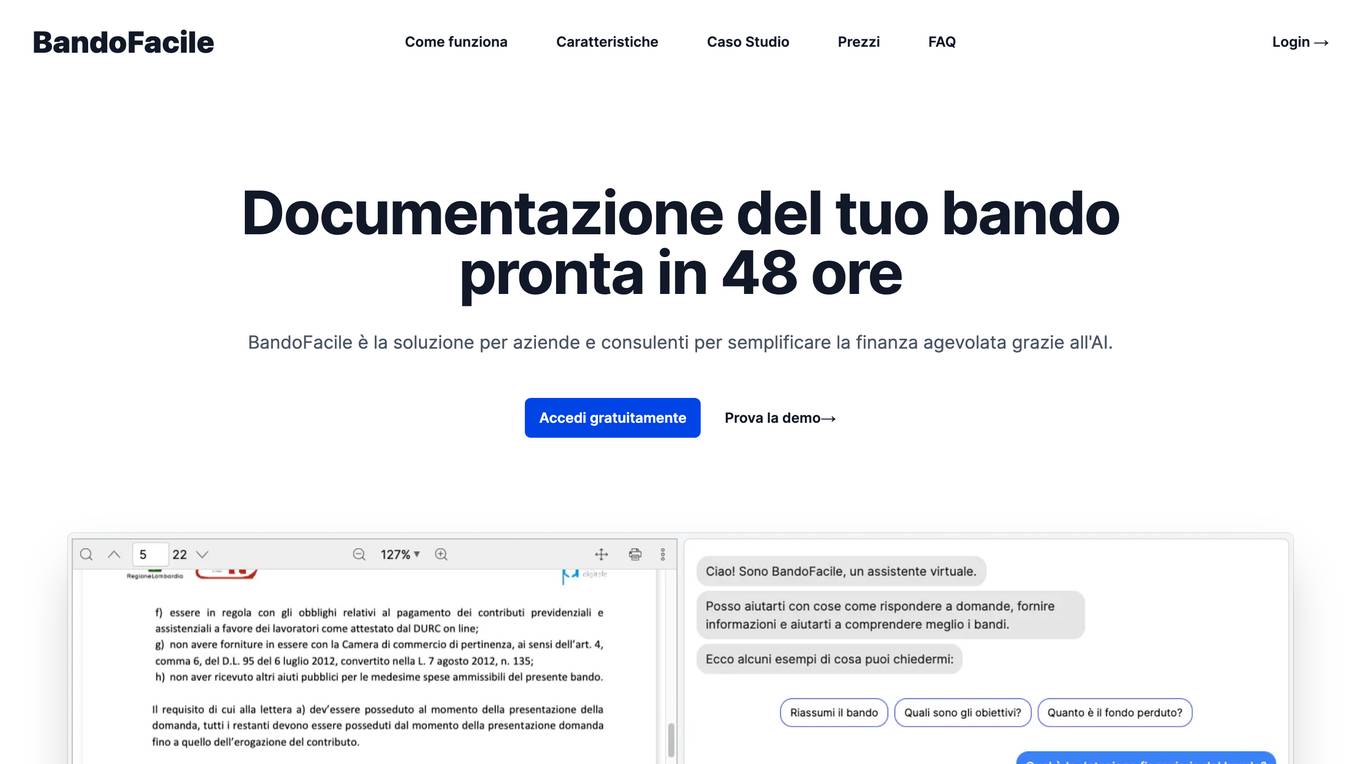

Bandofacile

Bandofacile is an AI-powered platform designed to simplify the process of accessing and applying for financial grants and opportunities for companies and consultants. By leveraging artificial intelligence, Bandofacile streamlines the process of finding, responding to, and completing grant applications, providing tailored documentation based on the user's needs. The platform offers various services, including assistance in finding relevant grants, receiving notifications for new opportunities, utilizing a virtual assistant for answering queries, and personalized consultancy support. Bandofacile aims to make the financial assistance process stress-free and efficient for users, helping them save time and enhance the effectiveness of their applications.

ChatCSV

ChatCSV is a personal data analyst tool that allows users to upload CSV files and ask questions in natural language. It generates common questions about the data, visualizes answers with charts, and maintains chat history. It is useful for industries like retail, finance, banking, marketing, and advertising to understand trends, customer behavior, and more.

StockNewsAI

StockNewsAI is an AI-powered platform that provides real-time analysis and insights on stock market news. The platform utilizes advanced algorithms to scan and analyze news articles, social media, and market data to deliver accurate and timely information to investors. With StockNewsAI, users can stay informed about market trends, company announcements, and other relevant news that may impact stock prices. The platform offers customizable alerts, sentiment analysis, and predictive analytics to help users make informed investment decisions.