Best AI tools for< Debt Collector >

Infographic

20 - AI tool Sites

TrueAccord

TrueAccord is an industry-leading recovery and collections platform powered by machine learning and a consumer-friendly digital experience. It offers third-party collection services for better relationships and faster recoveries through engagement, commitment, and resolution. TrueAccord's platform can handle delinquency needs from one day past due through charge off, with features like HeartBeat for better results, self-serve digital experience for consumers, scalability in delinquency infrastructure, and end-to-end personalization. The platform is trusted by market leaders and loved by consumers, providing a full-service digital-first debt collection agency.

coeo

coeo is a technology-based debt collection company that utilizes cutting-edge AI processes and behavioral research insights to harmonize customer relationships. They offer tailored debt collection solutions with a focus on customer satisfaction and efficiency. With an international presence in seven European countries, coeo combines the capacity and competence of a large corporation with the flexibility of a medium-sized company and the spirit of a fintech start-up. Their success is driven by a robust tech stack, extensive data pool, and continuous performance management.

SmartDispute.ai

SmartDispute.ai is an AI-powered credit repair application that helps users improve their credit scores by leveraging artificial intelligence technology. The application offers a patented Smart Dispute System™ technology that identifies and helps remove negative accounts from credit reports, making it one of the most effective credit repair systems available. Users can easily repair their own credit with the help of SmartDispute.ai's automated processes and fact-based dispute method. The application provides users with a simple and clearly explained process, allowing them to track their progress and see significant improvements in their credit scores over time.

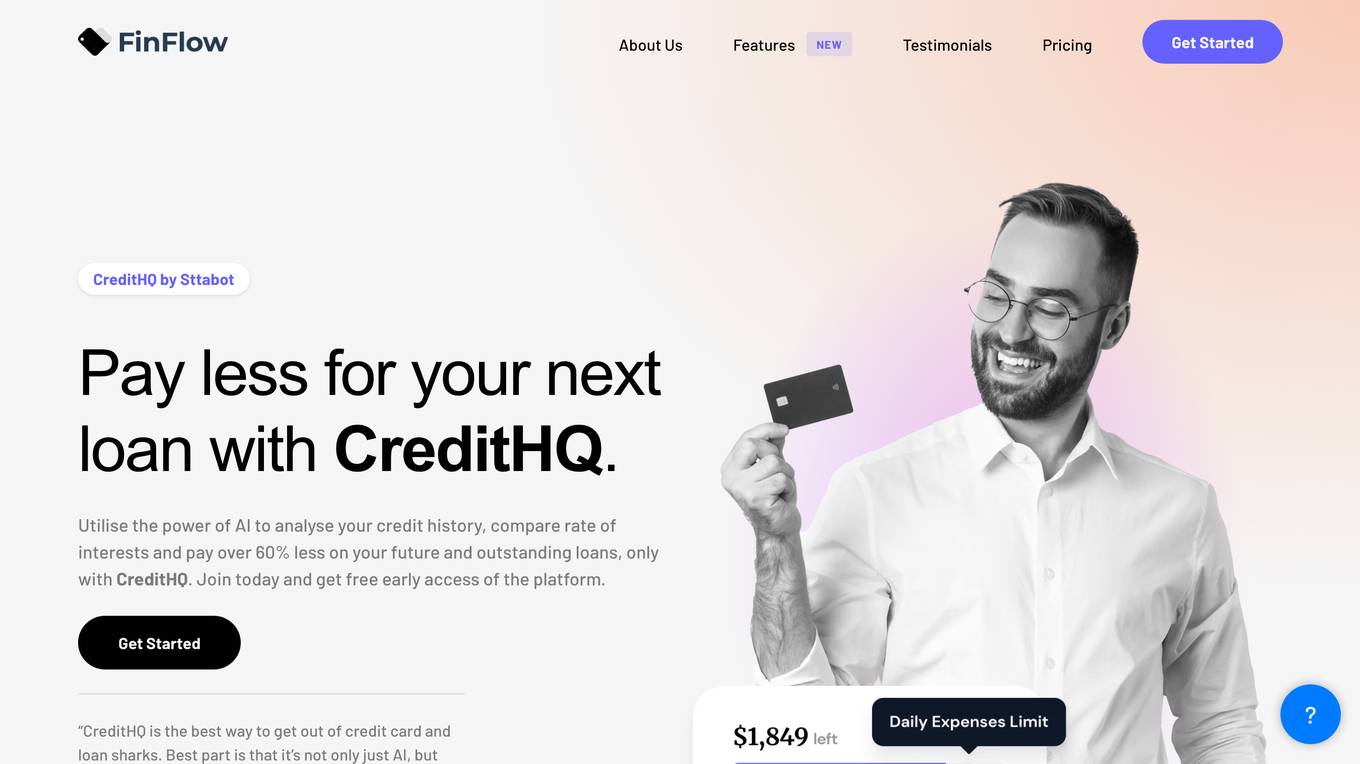

CreditHQ

CreditHQ is an AI-powered loan restructuring platform that helps users analyze their credit history, compare interest rates, and save money on their loans. The platform offers a range of features, including a credit score simulator, a budgeting tool, and a debt management tool. CreditHQ is trusted by over 5,500 users and companies globally.

AI Credit Repair

AI Credit Repair is an AI-powered application designed to help users improve their credit score by providing tools such as credit card utilization builder, public records remover, dispute letter generator, and SMS alerts. The application assists users in managing their credit card payments, disputing collections, and staying on top of their credit-related activities. By leveraging artificial intelligence technology, AI Credit Repair aims to simplify the credit repair process and empower users to build a better financial future.

Growfin

Growfin is an Accounts Receivable (AR) Automation Software that partners with Zuora to power the future of Order-to-Cash with AI technology. The platform helps businesses streamline their collections process, prioritize accounts, automate follow-ups, and accelerate cash application. By leveraging Behavioral AI, Growfin offers real-time visibility, effortless collaboration, increased productivity, and reliable predictability in managing accounts receivable. The application is designed to reduce Days Sales Outstanding (DSO), enhance cash flow visibility, predict cash flow, close books faster, and improve customer relationships.

ThinkML

ThinkML is a comprehensive platform that provides the latest news, articles, and blogs about Artificial Intelligence. It covers a wide range of topics such as Explainable AI (XAI), AI video generator tools, AI voice over generator tools, AI tools for architects, AI image generator tools, AI tools for coding, AI video quality enhancer tools, and more. The platform aims to educate and inform users about the advancements in AI technology, trends to watch, achievements, and applications in various industries. ThinkML also offers insights on deep learning, metaverse, LLMs, and provides training resources for individuals interested in AI and related fields.

InteliConvo®

InteliConvo® is a state-of-the-art AI-powered speech analytics and automation platform that enables businesses to process and analyze recorded customer conversations. It provides valuable insights into customer buying patterns, intents, sentiments, and feedback, which can be utilized to automate workflows, improve team performance, accelerate sales, enhance debt collections, boost customer experience, and ensure compliance. The platform offers features like multilingual support, flexible deployment options, hot lead identification, debt default prediction, brand building insights, and compliance monitoring.

365mvps

365mvps is a community-driven and AI-generated platform that offers SaaS MVP ideas. Users can explore various MVP concepts, including SEO crawler for insights with AI, selling private access to repositories, and pay-to-vote feature on requests. The platform showcases the latest MVPs in different categories, such as bus transportation tracking, debt collection services, reservation systems, online course creation, and pricing structure optimization. It aims to simplify business processes and decision-making by leveraging AI technologies and community input.

Cognitive Calls

Cognitive Calls is an AI-powered platform that enables users to automate incoming and outgoing phone and web calls. It offers solutions for various industries such as customer support, appointment scheduling, technical support, real estate, hospitality, insurance, surveys, sales follow-up, recruiting, debt collection, telehealth check-ins, reminders, alerts, voice assistants, learning apps, role-playing scenarios, ecommerce, drive-through systems, automotive systems, and robotic controls. The platform aims to enhance customer interactions by providing personalized support and efficient call handling through voice AI technology.

Tamarack

Tamarack is a technology company specializing in equipment finance, offering AI-powered applications and data-centric technologies to enhance operational efficiency and business performance. They provide a range of solutions, from business intelligence to professional services, tailored for the equipment finance industry. Tamarack's AI Predictors and DataConsole are designed to streamline workflows and improve outcomes for stakeholders. With a focus on innovation and customer experience, Tamarack aims to empower clients with online functionality and predictive analytics. Their expertise spans from origination to portfolio management, delivering industry-specific solutions for better performance.

Clerkie

Clerkie is a powerful debt repayment and optimization platform that offers a full-service automation solution powered by machine learning and human expertise. It helps lenders, both big and small, to manage and optimize their loan portfolios efficiently. With features like smart payment experience, AI-driven repayment strategies, real-time reporting, and easy integration, Clerkie ensures a seamless and secure experience for lenders and borrowers alike.

Paymefy

Paymefy is a platform designed to optimize debt management by providing digital solutions to streamline and secure the payment process for businesses. It offers features such as Customer Journey optimization, User Behaviours analysis, Payment Gateways integration, and Payment flexibilizations. Paymefy aims to help businesses accelerate collections, reduce payment delays, and improve accounts receivable management through automation, segmentation, and control of the entire billing cycle. It caters to various industries like Utility, Telecommunications, Financial, and others, providing tailored solutions for CFOs, Controllers, AR Managers, and Financial Operations. The platform leverages advanced Artificial Intelligence to deliver personalized payment experiences, increase payment rates, and ensure brand consistency. Paymefy also emphasizes data security, collaboration tools, mobile app access, and maintenance for a seamless user experience.

Respaid

Respaid is a B2B collections tool that focuses on respectful and efficient debt recovery. It utilizes AI-powered precision messaging to optimize communication with debtors, resulting in a 50% collection rate and 30x faster performance than traditional methods. The tool offers features such as direct payments, database cleaning, and insights into why customers aren't paying. Respaid aims to protect your brand reputation while helping you recover unpaid invoices in a respectful manner.

AI Tech Debt Analysis Tool

This website is an AI tool that helps senior developers analyze AI tech debt. AI tech debt is the technical debt that accumulates when AI systems are developed and deployed. It can be difficult to identify and quantify AI tech debt, but it can have a significant impact on the performance and reliability of AI systems. This tool uses a variety of techniques to analyze AI tech debt, including static analysis, dynamic analysis, and machine learning. It can help senior developers to identify and quantify AI tech debt, and to develop strategies to reduce it.

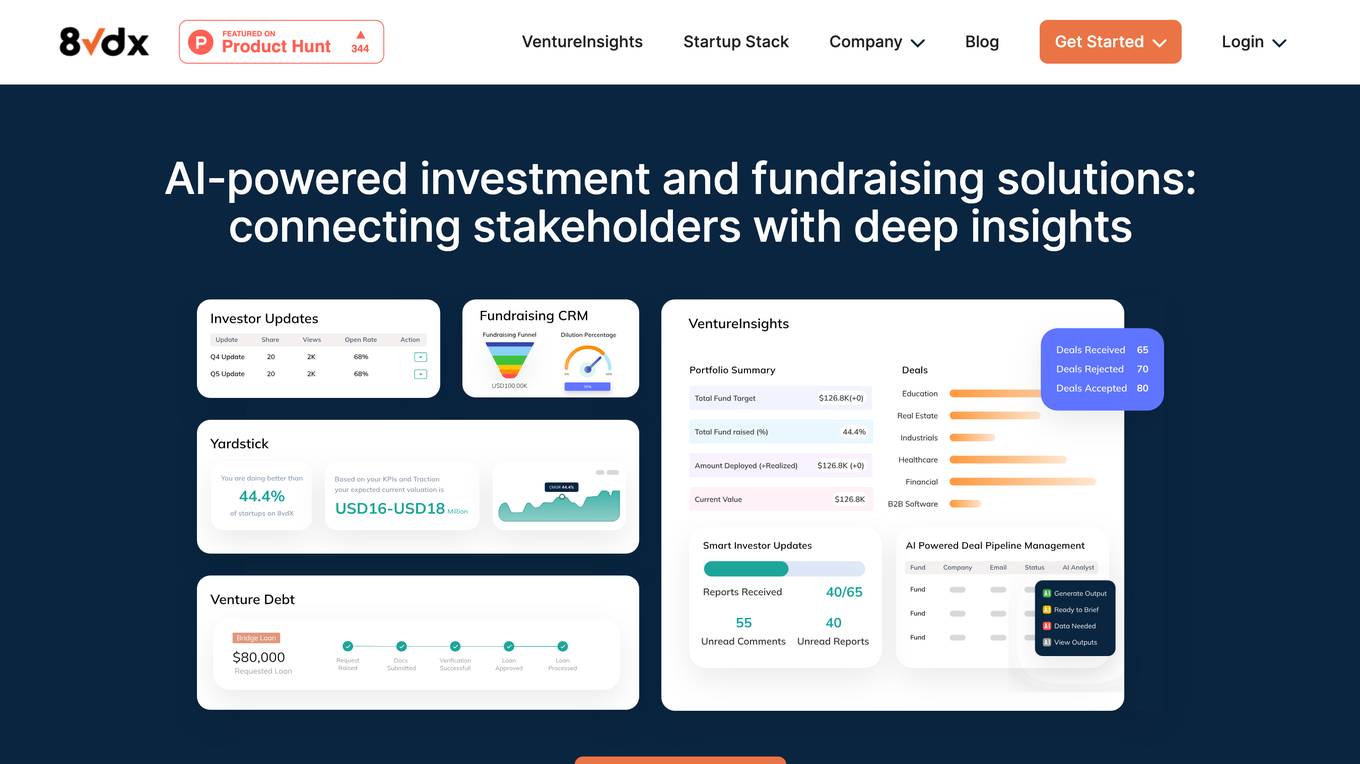

VantedgeAI

VantedgeAI is an AI application that offers fine-tuned AI models for credit funds, revolutionizing credit investing workflows with faster, smarter, and cost-effective solutions. The application transforms manual processes into scalable, automated workflows tailored for Private Credit and Hedge Funds. VantedgeAI is trusted by market leaders in the industry, providing unique AI-driven insights to maintain a competitive advantage and ensure data security and privacy through SOC 2 compliance. The application offers advanced AI solutions for credit investing, including automated investment memo generation, data extraction for Excel models, portfolio monitoring, loan reconciliation, smart bond screening, real-time data querying with AI bots, and more.

wallet.AI

wallet.AI is an AI application that provides smart machines to inform users about their financial behavior. Founded in San Francisco in 2012, wallet.AI builds intelligent engines that analyze millions of pieces of data to help users make better daily financial decisions. The application aims to assist people in making informed financial choices by leveraging artificial intelligence technology.

Codiga

Codiga is a static code analysis tool that helps developers write clean, safe, and secure code. It works in real-time in your IDE and CI/CD pipelines, and it can be customized to meet your specific needs. Codiga supports a wide range of languages and frameworks, and it integrates with popular tools like GitHub, GitLab, and Bitbucket.

TheFinAdvisor

TheFinAdvisor.com is an AI financial advisor platform that offers personalized investment strategies and expert guidance tailored to individual financial goals. Users can receive assistance in managing student loans, credit cards, debt restructuring, home purchases, car/truck acquisitions, house market investments, early retirement planning, world travel, and business building. The platform also provides insights on financial topics, encourages user questions, and facilitates community connections with financial experts. Additionally, users can explore various financial services, share reviews, and monetize content as financial influencers.

Fine

Fine is an AI-powered software development tool that automates mundane and complex tasks, allowing developers to focus on driving innovation. Its AI agents integrate seamlessly into your team and toolset, transforming your development workflow by automating tasks such as transforming Jira tickets into pull requests, streamlining code reviews, and simplifying migrations.

0 - Open Source Tools

20 - OpenAI Gpts

Debt Management Advisor

Advises on debt management strategies to improve financial stability.

Debt Dodger

Avoid Debt Accumulation with Credit Card Interest Insights. Find out how much interest you will pay before you make that purchase with your credit card.

Wettelijke rente berekenen

✅ Bereken de wettelijke rente in Nederland voor handelstransacties: 12 % per 1 juli 2023 en de wettelijke rente voor consumententransacties: 6 % per 1 juli 2023 hier:

Pay Later

Explains 'buy now, pay later' and recommends providers in a financial, informative tone.

Personal Loan

Discusses personal loans, payment methods, and financial options informatively.