Best AI tools for< Credit Counselor >

Infographic

20 - AI tool Sites

AI Credit Repair

AI Credit Repair is an AI-powered application designed to help users improve their credit score by providing tools such as credit card utilization builder, public records remover, dispute letter generator, and SMS alerts. The application assists users in managing their credit card payments, disputing collections, and staying on top of their credit-related activities. By leveraging artificial intelligence technology, AI Credit Repair aims to simplify the credit repair process and empower users to build a better financial future.

Dispute AI™

Dispute AI™ is an AI-powered DIY credit repair solution that leverages cutting-edge artificial intelligence to provide personalized strategies for boosting credit scores. The platform offers actionable insights, data-driven recommendations, and a fast, affordable, and flexible credit repair process. With over 20 years of expertise in credit repair, Dispute AI™ aims to revolutionize the way individuals take control of their credit by providing innovative tools that simplify and streamline the credit repair process.

SmartDispute.ai

SmartDispute.ai is an AI-powered credit repair application that helps users improve their credit scores by leveraging artificial intelligence technology. The application offers a patented Smart Dispute System™ technology that identifies and helps remove negative accounts from credit reports, making it one of the most effective credit repair systems available. Users can easily repair their own credit with the help of SmartDispute.ai's automated processes and fact-based dispute method. The application provides users with a simple and clearly explained process, allowing them to track their progress and see significant improvements in their credit scores over time.

Cushion

Cushion is an AI-powered tool designed to simplify bill management and credit building. It securely connects to your accounts, organizes bills, and offers insights to help you budget better. With features like automatic bill tracking, virtual Cushion card payments, and credit history building, Cushion aims to make bill payments painless and credit building seamless.

Cleo

Cleo is an AI-powered financial management tool that helps users with budgeting, saving, building credit, and managing their finances. It offers features like cash advances, budgeting tips, credit building tools, and personalized financial advice. Cleo uses AI technology to provide users with insights and recommendations to improve their financial health. The application aims to make money management easy and accessible for everyone, without the need for credit checks or complex financial jargon.

CreditHQ

CreditHQ is an AI-powered loan restructuring platform that helps users analyze their credit history, compare interest rates, and save money on their loans. The platform offers a range of features, including a credit score simulator, a budgeting tool, and a debt management tool. CreditHQ is trusted by over 5,500 users and companies globally.

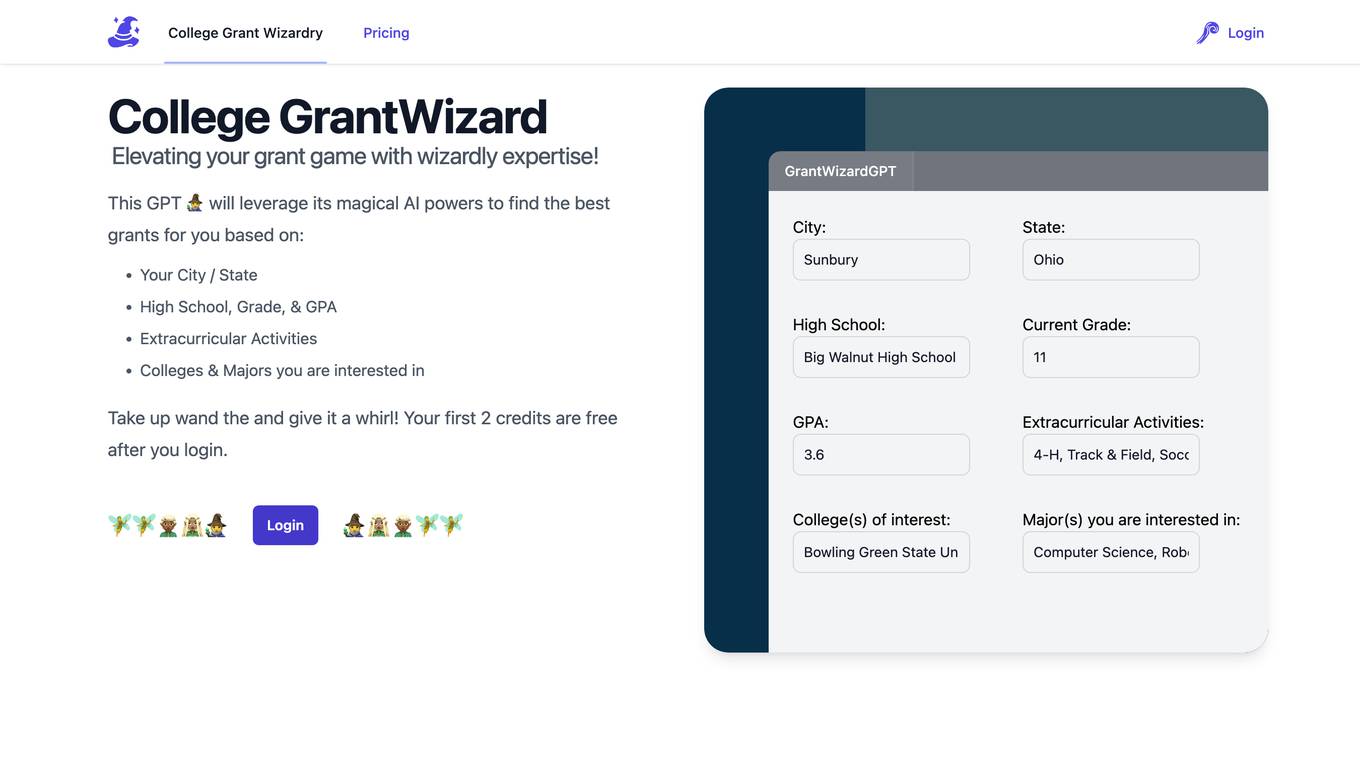

GrantWizard

GrantWizard is an AI-powered tool designed to assist students in finding the best grants for their college education. By leveraging magical AI powers, GrantWizard considers various factors such as the student's city/state, high school details, GPA, extracurricular activities, colleges of interest, and preferred majors to provide personalized grant recommendations. Users can access the platform after logging in and receive two free credits to get started. GrantWizard aims to simplify the grant search process and help students elevate their grant game with wizardly expertise.

VantedgeAI

VantedgeAI is an AI application that offers fine-tuned AI models for credit funds, revolutionizing credit investing workflows with faster, smarter, and cost-effective solutions. The application transforms manual processes into scalable, automated workflows tailored for Private Credit and Hedge Funds. VantedgeAI is trusted by market leaders in the industry, providing unique AI-driven insights to maintain a competitive advantage and ensure data security and privacy through SOC 2 compliance. The application offers advanced AI solutions for credit investing, including automated investment memo generation, data extraction for Excel models, portfolio monitoring, loan reconciliation, smart bond screening, real-time data querying with AI bots, and more.

Underwrite.ai

Underwrite.ai is a platform that leverages advances in artificial intelligence and machine learning to provide lenders with nonlinear, dynamic models of credit risk. By analyzing thousands of data points from credit bureau sources, the application accurately models credit risk for consumers and small businesses, outperforming traditional approaches. Underwrite.ai offers a unique underwriting methodology that focuses on outcomes such as profitability and customer lifetime value, allowing organizations to enhance their lending performance without the need for capital investment or lengthy build times. The platform's models are continuously learning and adapting to market changes in real-time, providing explainable decisions in milliseconds.

Slot Pulsa Indosat

Slot Pulsa Indosat is a trusted website in Indonesia for depositing credit for Tri and IM3 without deductions of 10k. Users can download the application to shop for various exclusive products with special promotions. The platform offers a comfortable and fair gaming environment with high RTP slots for easy player wins. Akang69 slot is a popular provider of credit slot games with fast 24/7 online service and quick admin responses, making it the most trusted and popular cheap credit slot site. Users can register for free and enjoy various attractive promotions for a top-notch gaming experience.

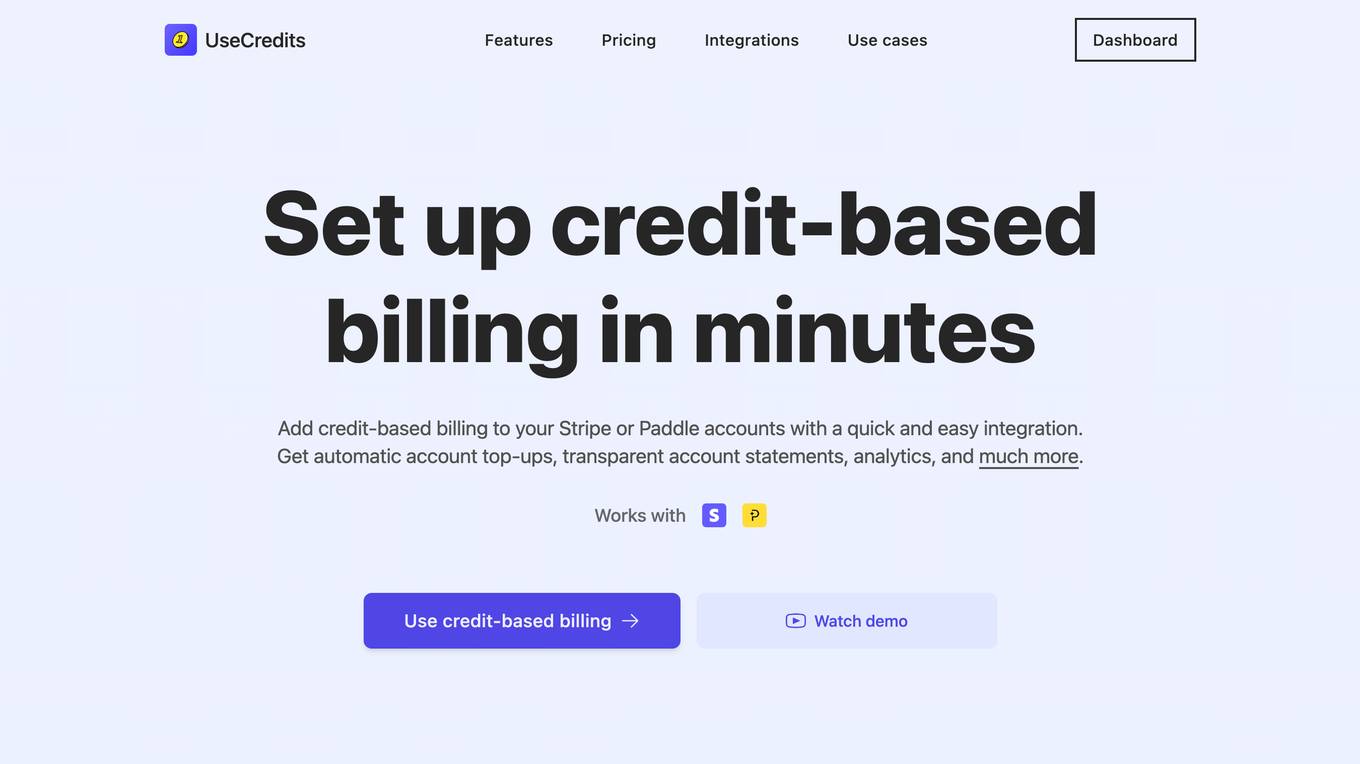

UseCredits

UseCredits is a hassle-free credit-based billing integration that allows you to easily add credit-based billing to your Stripe or Paddle accounts. With UseCredits, you can set credits for your products, get automatic account top-ups, transparent account statements, analytics, and much more. UseCredits is flexible and un-opinionated, making it suitable for a variety of use cases, including generative AI SaaS, email or SMS API, and games and entertainment.

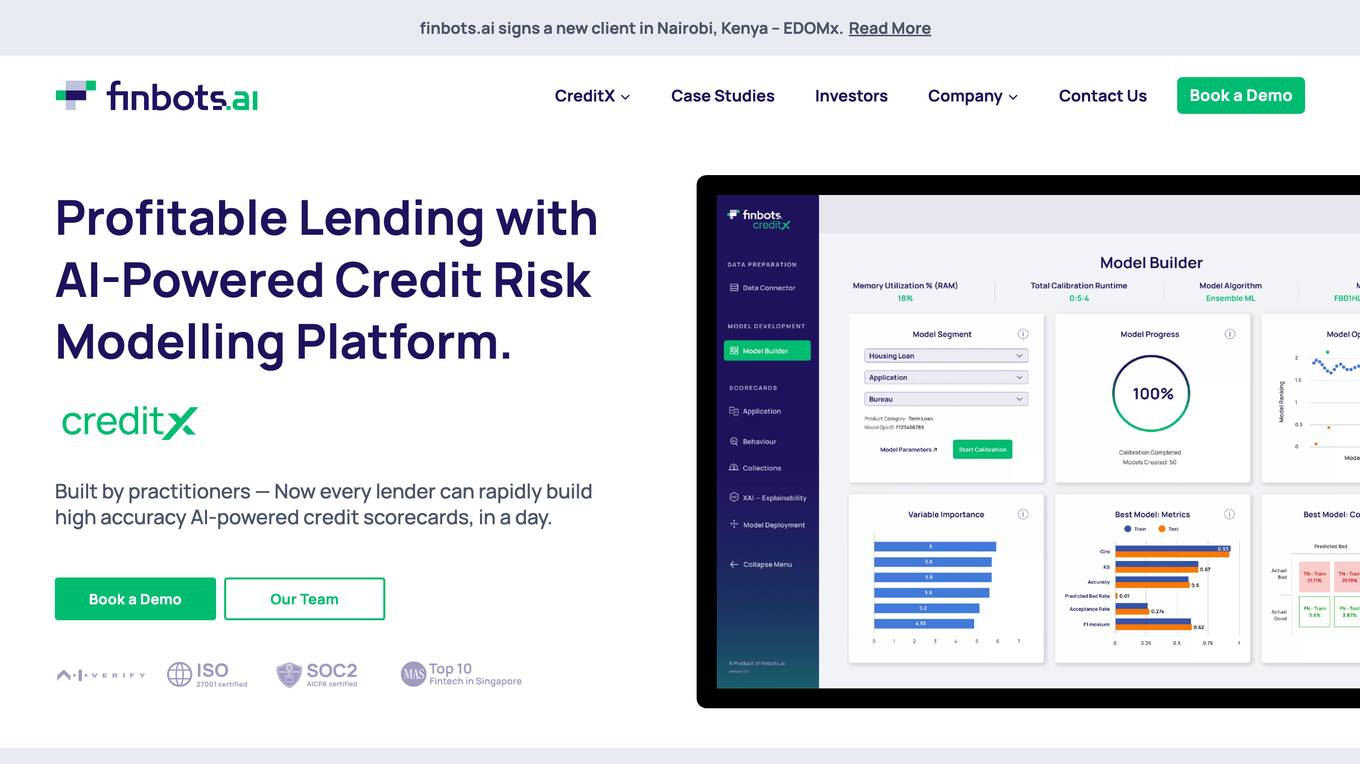

Finbots.ai

Finbots.ai is a trusted AI credit risk platform that offers AI credit scoring to boost lending profits and reduce non-performing loans. The platform provides the highest accuracy in the market, allowing users to build scorecards in a day without the need for coding. It helps in making instant decisions, increasing revenue, reducing risk, and improving operational efficiency. Finbots.ai is utilized by various financial institutions to enhance credit risk management, improve profitability, and drive down the cost of risk through AI-enabled models.

Scienaptic Systems

Scienaptic Systems is an AI-powered Credit Decisioning Platform that revolutionizes the lending industry by automating credit underwriting processes, leveraging alternate data points, and offering self-learning models for instant credit decisions. The platform helps lenders identify creditworthy borrowers, streamline customer experience, and ensure fair lending practices through explainable AI models. Scienaptic's suite of AI-enabled technologies enables lenders to say 'Yes' to more borrowers at lower risk, providing a 360-degree risk assessment before approving applications. The platform integrates seamlessly with existing lending ecosystems, ensuring disruption-free deployment and better risk predictions through a single API call.

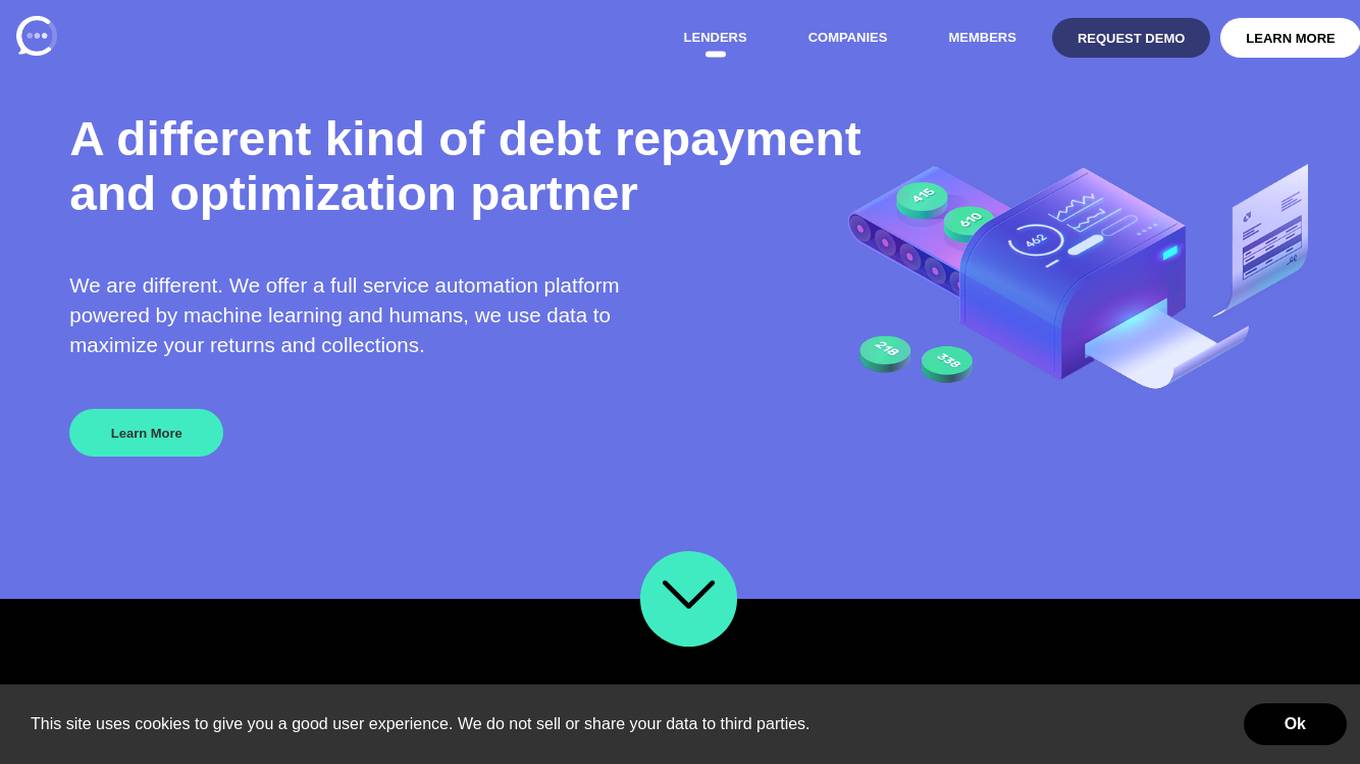

Clerkie

Clerkie is a powerful debt repayment and optimization platform that offers a full-service automation solution powered by machine learning and human expertise. It helps lenders, both big and small, to manage and optimize their loan portfolios efficiently. With features like smart payment experience, AI-driven repayment strategies, real-time reporting, and easy integration, Clerkie ensures a seamless and secure experience for lenders and borrowers alike.

wallet.AI

wallet.AI is an AI application that provides smart machines to inform users about their financial behavior. Founded in San Francisco in 2012, wallet.AI builds intelligent engines that analyze millions of pieces of data to help users make better daily financial decisions. The application aims to assist people in making informed financial choices by leveraging artificial intelligence technology.

Nero Platinum Suite

Nero Platinum Suite is a comprehensive software collection for Windows PCs that provides a wide range of multimedia capabilities, including burning, managing, optimizing, and editing photos, videos, and music files. It includes various AI-powered features such as the Nero AI Image Upscaler, Nero AI Video Upscaler, and Nero AI Photo Tagger, which enhance and simplify multimedia tasks.

Veriff

Veriff is an AI-powered identity verification platform that combines automation and human expertise to detect deepfakes, prevent fraud, and onboard verified customers globally. It offers a range of verification services including identity & document verification, biometric authentication, age estimation, fraud prevention, and more. Veriff helps businesses restore trust to the internet by providing fast, accurate, and secure identity verification solutions that comply with global regulations and standards.

Bibit AI

Bibit AI is a real estate marketing AI designed to enhance the efficiency and effectiveness of real estate marketing and sales. It can help create listings, descriptions, and property content, and offers a host of other features. Bibit AI is the world's first AI for Real Estate. We are transforming the real estate industry by boosting efficiency and simplifying tasks like listing creation and content generation.

Zest AI

Zest AI is an AI-driven credit underwriting software that offers a complete solution for AI-driven lending. It enables users to build custom machine learning risk models, adopt model assessment and regulatory compliance, and operate performance management and model monitoring. Zest AI helps increase approvals, manage risk, control loss, drive operational efficiency, automate credit decisioning, and improve borrower experience while ensuring fair lending practices. The software is designed to provide fair and transparent credit for everyone, making lending more accessible and inclusive.

FinFloh

FinFloh is an AI-powered Accounts Receivable Software that automates the accounts receivable process effortlessly with features like credit decisioning, collections, cash application, invoice verification, and dispute resolution. It enhances collections efficiency, reduces decision-making time, and improves cash flows for B2B finance teams worldwide. The software integrates with ERP/CRM systems, offers predictive analytics, and AI-driven credit scoring to optimize accounts receivable management. FinFloh ensures secure data handling and seamless communication between finance, sales, and customer support teams, ultimately leading to increased cash flow and reduced DSO.

0 - Open Source Tools

23 - OpenAI Gpts

CREDIT411

Providing information on consumer credit laws, regulations and resources. Because when it comes to credit, what you don't know CAN hurt you.

Personal Finance Canada GPT

A GPT designed to provide everyday financial advice and tools to Canadians, primarily inspired by the subreddit Personal Finance Canada.

Debt Management Advisor

Advises on debt management strategies to improve financial stability.

Debt Dodger

Avoid Debt Accumulation with Credit Card Interest Insights. Find out how much interest you will pay before you make that purchase with your credit card.

Top Loan Apps Expert

An AI tool offering expert advice on financial products, focusing on Top Loan Apps, best lending apps, fast cash advance apps, online loan apps, instant loan apps, and emergency loan apps. This tool provides insights, comparisons, and guidance for users seeking quick and reliable loan solutions.

Pay Later

Explains 'buy now, pay later' and recommends providers in a financial, informative tone.

Credit Card Companion

Balanced guidance on credit cards for young people, with a mix of formal and casual tones

Personal Loan

Discusses personal loans, payment methods, and financial options informatively.

Fast Loan

Discusses fast loans, application processes, and financial considerations informatively.

Finance Guide

Multilingual advisor on microfinance, focusing on clarity and educational content.

Credit Card Advisor

Expert on credit cards, offering advice on choosing and using them wisely.

Couples Financial Planner

Aids couples in managing joint finances, budgeting for future goals, and navigating financial challenges together.