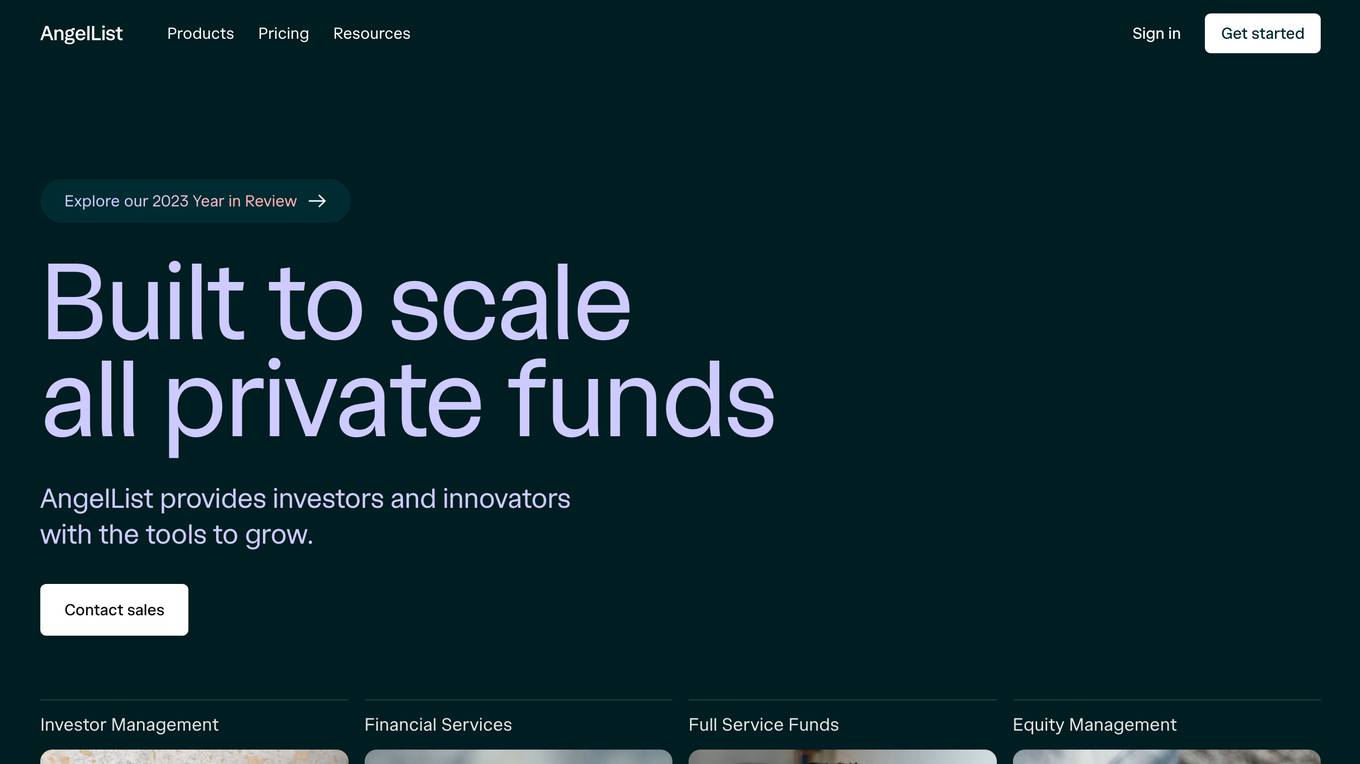

AngelList

Empowering Venture Growth

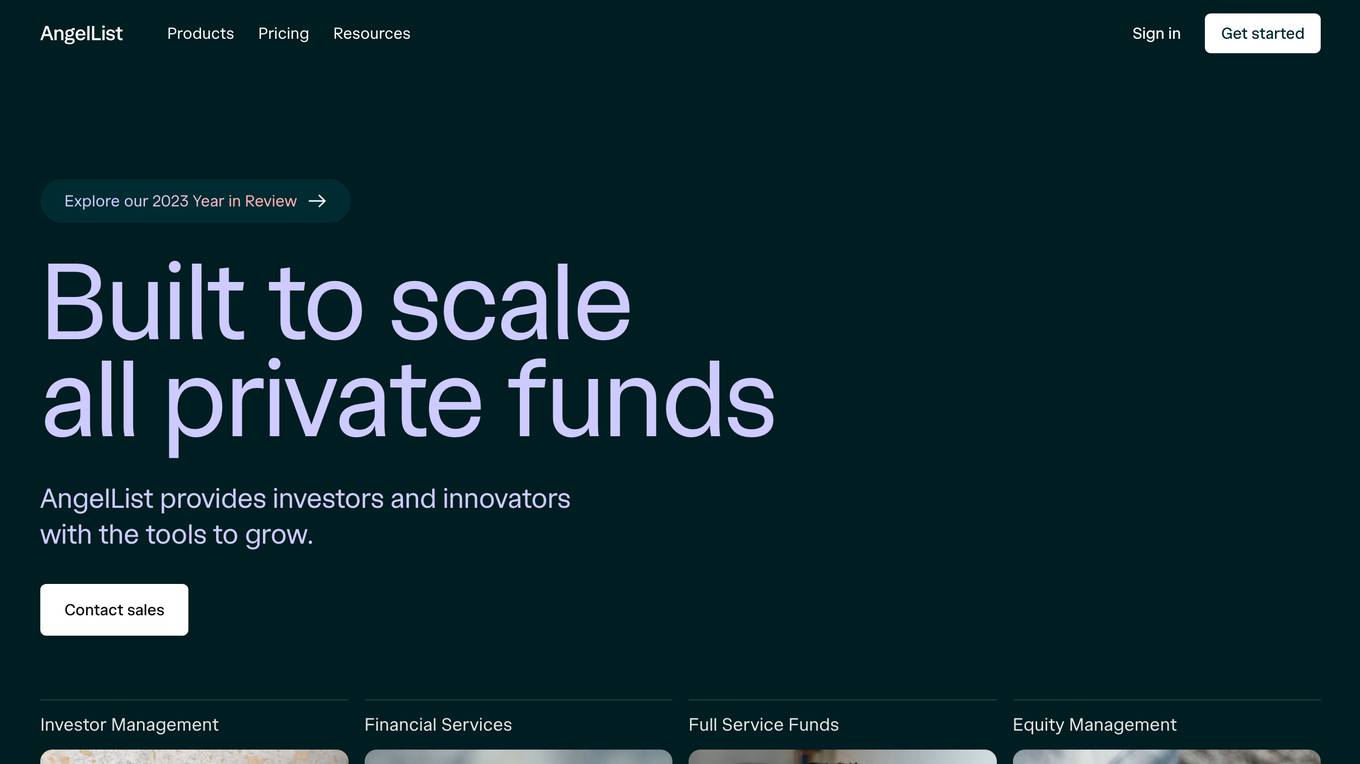

AngelList is a platform that provides tools for investors and innovators to grow their venture funds. It offers solutions for venture funds, SPVs, scout funds, and digital subscriptions, along with full service fund management. With over half of top-tier VC deals running through the platform, AngelList plays a crucial role in fueling innovation and bridging gaps in the VC market.

For Tasks:

Click tags to check more tools for each tasksFor Jobs:

Features

Advantages

Disadvantages

Frequently Asked Questions

Alternative AI tools for AngelList

Similar sites

AngelList

AngelList is a platform that provides tools for investors and innovators to grow their venture funds. It offers solutions for venture funds, SPVs, scout funds, and digital subscriptions, along with full service fund management. With over half of top-tier VC deals running through the platform, AngelList plays a crucial role in fueling innovation and bridging gaps in the VC market.

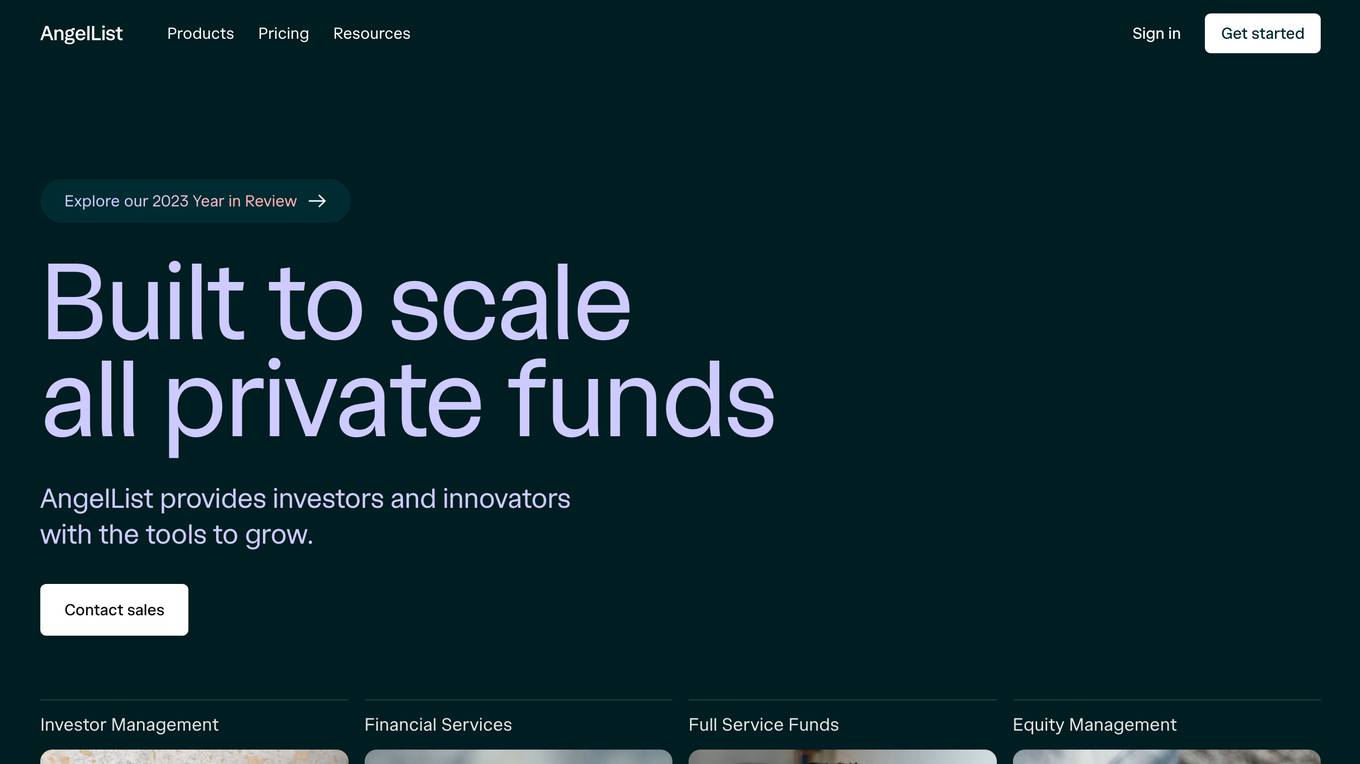

FundEze

FundEze is an intelligent investment platform that revolutionizes the capital raise process by facilitating seamless discovery and swift closures. It connects entrepreneurs and investors to streamline and elevate the entirety of the capital-raising process. FundEze leverages AI-powered algorithms to efficiently match startups with potential investors, offering personalized advice and expert guidance to enhance investment success. The platform provides a user-friendly marketplace for innovative ideas and strategic investments, ensuring data security and value for money. FundEze aims to fuel access to capital for startups and scaleups, supporting local and international businesses in starting, scaling, and succeeding.

SuperWarm.AI

SuperWarm.AI is an AI-powered matchmaking platform designed for startups and investors. It leverages artificial intelligence to provide personalized and curated matches based on vertical, stage, and traction, aiming to streamline the investor-startup connection process. The platform offers benefits for both startups and investors, increasing the chances of securing funding, saving time and resources, and providing expert insights from the SuperWarm community.

ProAI

ProAI is an AI-powered platform that offers tailored solutions for starting, growing, and funding businesses. It provides tools for business planning, funding, market research, and an AI-based business advisor. The platform integrates resources to develop strategic plans, raise capital, optimize positioning, and provide on-demand guidance for growth. ProAI's AI Business Advisor offers customized recommendations and advice based on continuous analysis of data and metrics, helping businesses increase revenue, scale into new markets, and refine strategies.

Finta

Finta is an AI-powered platform designed to streamline fundraising processes for startups and high-growth companies. Trusted by over 8,000 top-tier companies, funds, and partners, Finta offers tools to optimize fundraising potential, enhance investor relations, and provide real-time insights. The platform leverages AI technology to personalize email scripts, recommend top investors, and facilitate warm introductions. Finta also features a comprehensive CRM system, due diligence smart links, and a collaborative environment for team members, shareholders, and advisors. With a focus on empowering users with tools and knowledge, Finta aims to revolutionize the fundraising experience.

Accorata

Accorata is an AI deal sourcing platform designed for early-stage investors. It helps investors navigate the crowded market by quickly finding and verifying investment opportunities that align with their investment thesis. The platform offers lightning-fast startup signals, automated processing of incoming deals, AI-boosted founder due diligence, and data stored on secure servers. Accorata is trusted by over 50 early-stage investors and offers different pricing plans tailored to the needs of different users.

Platvix

Platvix is an AI-powered platform that connects startups with investors. It offers a range of features to help startups find the right investors and to help investors find the most promising startups. Platvix's matchmaking engine uses AI to pair startups with investors based on their compatibility. The platform also provides investors with detailed insights into startup performance metrics and market trends. Platvix is designed to address the challenges that startups and investors face in connecting with each other. It provides a secure and transparent platform for startups to raise funding and for investors to find new investment opportunities.

NVentures

NVentures is NVIDIA's venture capital arm that invests in technology visionaries solving complex problems to reshape the world. They build long-term partnerships with bold teams to accelerate their journeys. NVentures provides insightful diligence and resources to unlock the potential of innovative companies.

Streetbeat

Streetbeat is an innovative investment platform that simplifies and automates investing activities. It serves as a solution for navigating the complexity of financial markets and deriving actionable insights. Streetbeat offers AI Agents for businesses to automate tasks and enhance client services, while individuals can access an AI-powered financial advisor to manage investments. The platform aims to make investing more accessible and efficient for users.

Jobs Originalis

Jobs Originalis is an Intelligent Composable OS designed for the Private Capital Markets. It aims to help users save time and focus on the creative aspects of their work. The platform offers a range of tools and features to streamline processes and enhance productivity in the private capital market sector.

Eilla

Eilla is an AI-native M&A advisory platform designed for small and medium businesses (SMBs) looking to sell their companies. By combining top-tier M&A advisors with advanced AI algorithms, Eilla aims to deliver faster and higher-value outcomes for its clients. The platform automates manual tasks, surfaces hidden buyers, drives valuation, and creates competitive tension to push offers higher. Eilla provides expert advisory services, market intelligence, and a frictionless preparation process to make the selling experience efficient and effective. With decades of expertise backed by technology, Eilla has executed transactions worth over $100 billion and is trusted by numerous funds and banks.

Hermes by ConsX

Hermes by ConsX is an AI-driven Equity Research Center that empowers users to make informed investment decisions in the stock market. The platform offers AlphaFlex Portfolio for strong returns with reduced risk, and AlphaFlex Equity Research Hub for real-time research on over 6,000 companies. By combining human expertise with AI-driven insights, Hermes by ConsX provides cutting-edge tools for investors to navigate market conditions and build generational wealth.

FinSMEs

FinSMEs is an AI-powered website that provides the latest news and updates on venture capital investments and market intelligence. The platform covers funding rounds, strategic collaborations, and developments in the AI industry. Users can stay informed about innovative startups, funding trends, and emerging technologies in the USA, UK, Germany, France, Canada, India, and Italy.

Startup.ai

Startup.ai is an AI-focused incubator and venture builder that specializes in launching and scaling disruptive B2C startups. They leverage leading domain brands, in-house idea generation, deep market analysis, and a proprietary methodology to transform high-potential concepts into globally competitive businesses. The platform provides equity-driven partnerships, rapid market entry, and strategic marketing services to empower startups in the AI space.

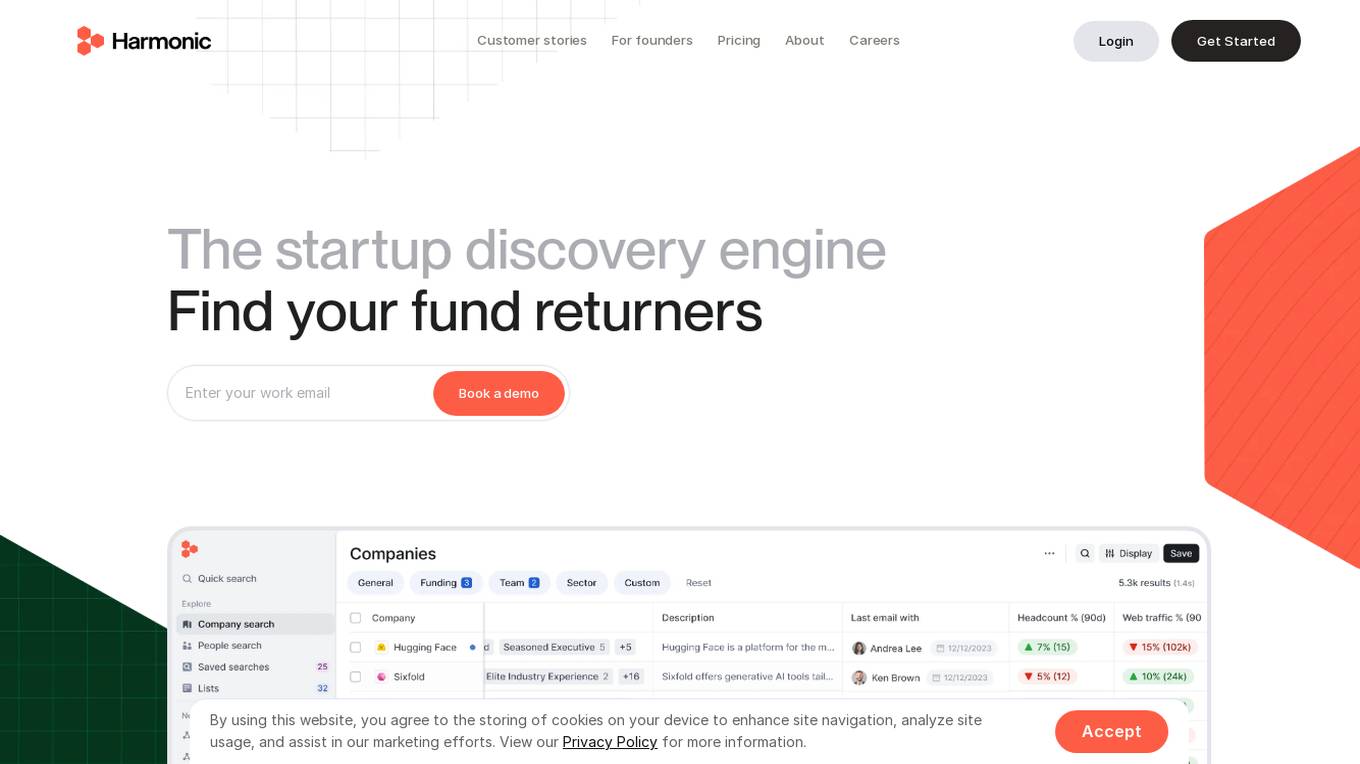

Harmonic.ai

Harmonic.ai is a startup database platform that offers a comprehensive database of companies and individuals, enabling users to identify new opportunities, scout for startups, and make informed investment decisions. The platform is powered by AI technology, providing users with sourcing superpowers and the ability to discover hidden gems in the startup ecosystem. Harmonic.ai offers features such as hyper-specific searches, industry or product descriptions to find companies, market maps, talent flows, and real-time alerts. Users can also evaluate founding team experience, analyze key competitors, and assess funding and investors. The platform is designed to help users stay up to date with the latest industry trends and make data-driven decisions.

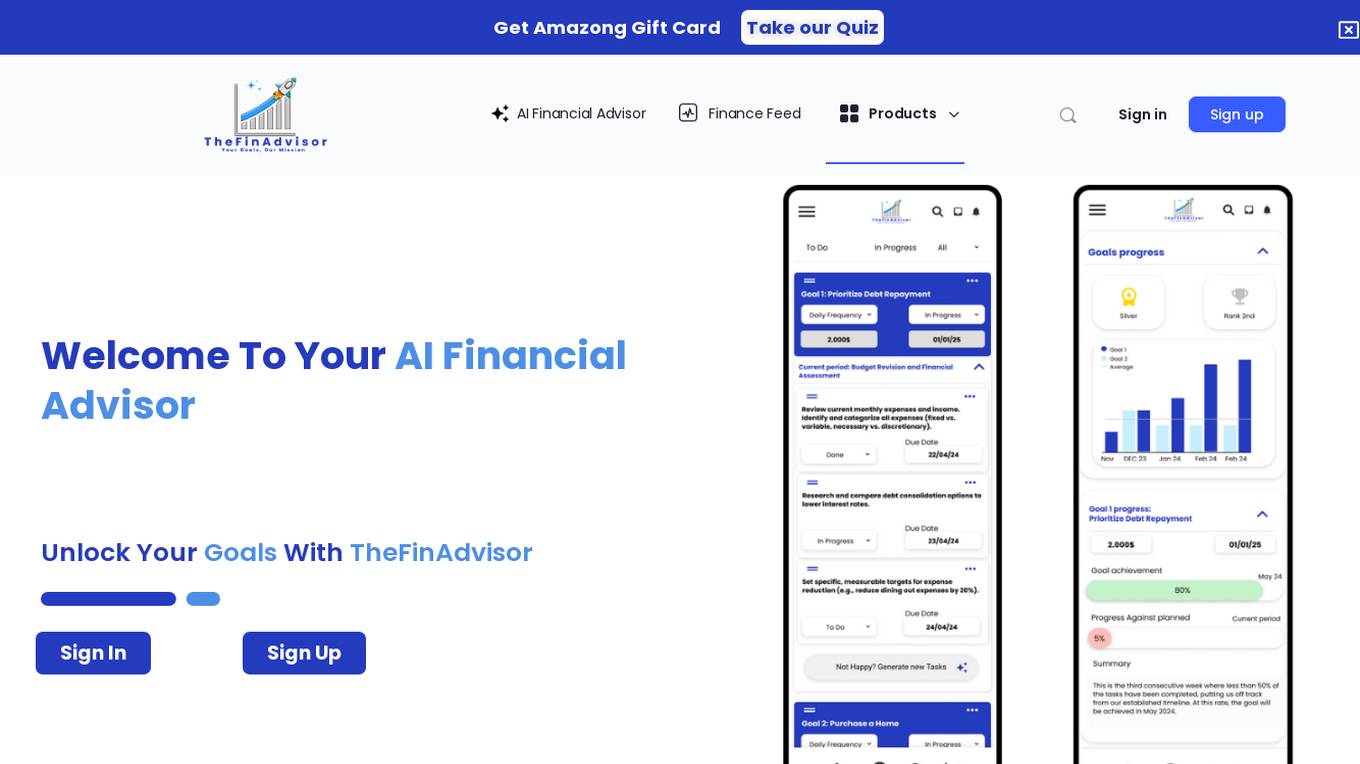

TheFinAdvisor

TheFinAdvisor.com is an AI financial advisor platform that offers personalized investment strategies and expert guidance tailored to individual financial goals. Users can receive assistance in managing student loans, credit cards, debt restructuring, home purchases, car/truck acquisitions, house market investments, early retirement planning, world travel, and business building. The platform also provides insights on financial topics, encourages user questions, and facilitates community connections with financial experts. Additionally, users can explore various financial services, share reviews, and monetize content as financial influencers.

For similar tasks

AngelList

AngelList is a platform that provides tools for investors and innovators to grow their venture funds. It offers solutions for venture funds, SPVs, scout funds, and digital subscriptions, along with full service fund management. With over half of top-tier VC deals running through the platform, AngelList plays a crucial role in fueling innovation and bridging gaps in the VC market.

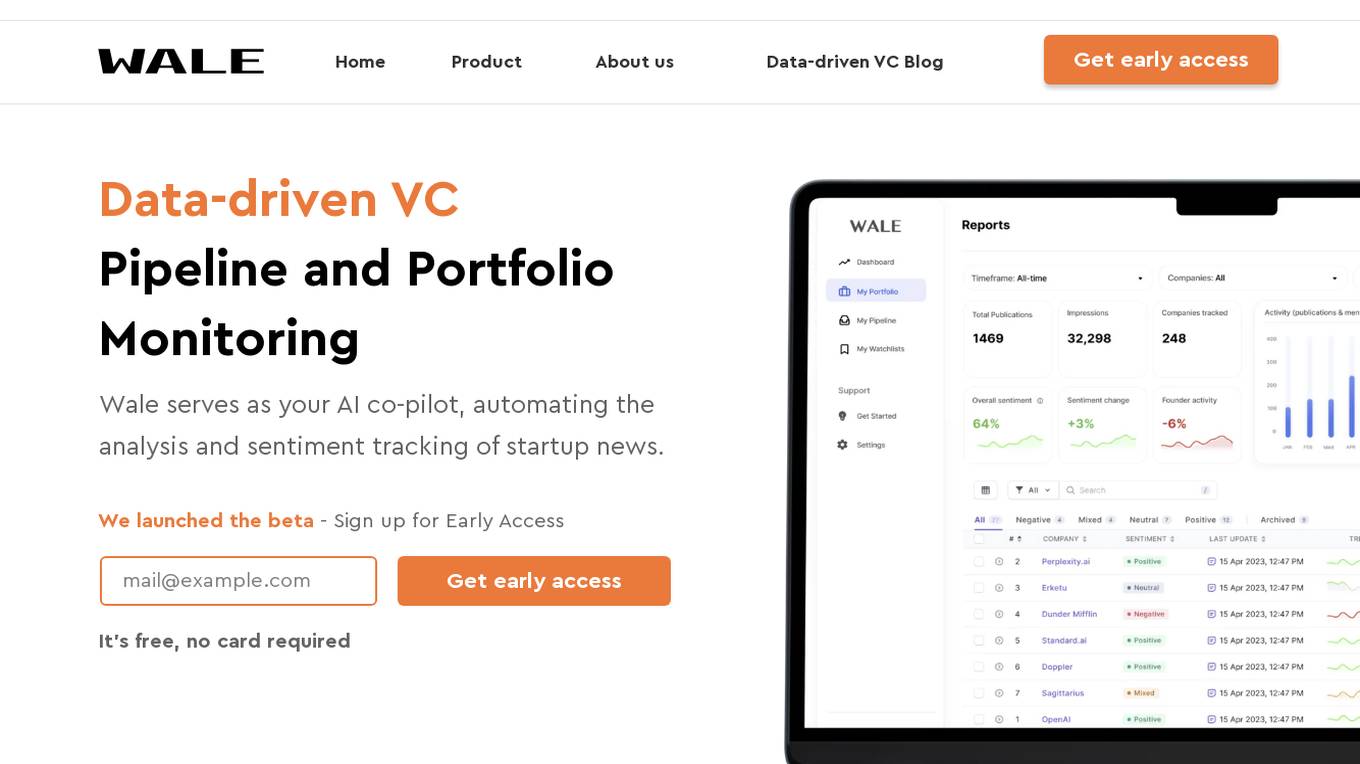

Wale.ai

Wale.ai is an AI co-pilot designed for venture capital investors. It automates the analysis and sentiment tracking of startup news, providing comprehensive sentiment analysis of positive and negative mentions. The platform offers advanced AI analytics, seamless integration with various tools, and delivers actionable insights to enhance portfolio or pipeline management. Founded by Sergey Mosunov and Valentin Riabtsev, Wale.ai is a data-driven VC tool that helps users stay informed and make informed investment decisions.

CryptoRobotics

The website is a platform offering Crypto Trading Bots for spot and futures exchanges, along with features like automated trading, copy trading, signal trading, and portfolio management. Users can access expert trading strategies, demo trading, and pay only for profitable trades. The platform provides a user-friendly experience for both beginners and pro traders, with built-in risk management and customizable settings. It also offers a mobile app for managing bots on the go.

Stockaivisor

Stockaivisor is an AI-driven platform that offers comprehensive stock analysis, financial statement analysis, risk assessment, and predictive analytics for investors. With over 20,000 stocks and portfolios, the platform provides advanced insights through generative AI technology, predictive correlation models, and automated portfolio management. Stockaivisor empowers users to make informed decisions, anticipate market shifts, and optimize their investment strategies with data-driven trading signals. The platform also features dedicated customer support and tools for stock and portfolio screening, making it a valuable resource for both novice and experienced investors.

Rize Capital

Rize Capital is an AI-powered investment chatbot designed to provide fast, accurate answers to complex financial and investment questions. It offers real-time data on stocks, cryptocurrencies, ETFs, and more, leveraging institutional investment data and large language models. The chatbot aims to simplify the journey through financial markets by providing personalized insights, portfolio analysis, and alternative data access.

Cryptohopper

Cryptohopper is a powerful crypto trading bot that allows users to automate their trading strategies, manage their portfolio across multiple exchanges, and leverage advanced trading tools like DCA, market-making, and arbitrage. With features such as social trading, AI trading, and a strategy designer, Cryptohopper caters to a wide range of users, from beginners to advanced traders. The platform also offers a marketplace for trading signals, strategies, and bot templates, making it easy for users to trade like experts without coding skills. Cryptohopper prioritizes security and privacy, providing industry-leading security protocols to protect users' accounts and data.

Raizer

Raizer is an online platform that connects startups with investors. It offers a variety of features to help startups raise capital, including a database of over 55,000 investors, AI-powered outreach tools, and warm intro requests. Raizer also provides resources and guidance to help startups prepare for fundraising, such as a fundraising guide and tips from experienced founders.

DimeADozen.AI

DimeADozen.AI is an AI-powered business validation tool that helps entrepreneurs validate their business ideas in seconds. It provides a comprehensive business report that includes market research, launch and scale strategies, and fundraising advice. DimeADozen.AI is designed to help entrepreneurs make informed decisions about their business ideas and increase their chances of success.

Finta

Finta is the world's first GPT powered CRM, built explicitly for creating meaningful investor interactions and automatically driving your funnel forward with AI personalized email scripts. It is a tracker CRM with AI automation at its core, designed to help founders and investors connect and close deals. Finta uses AI to prospect the best investors for your company's offering, provides a shareable deal link for investors to commit and send funds, and automates your fundraising workflow end to end.

ProAI

ProAI is an AI-powered platform that offers tailored solutions for starting, growing, and funding businesses. It provides tools for business planning, funding, market research, and an AI-based business advisor. The platform integrates resources to develop strategic plans, raise capital, optimize positioning, and provide on-demand guidance for growth. ProAI's AI Business Advisor offers customized recommendations and advice based on continuous analysis of data and metrics, helping businesses increase revenue, scale into new markets, and refine strategies.

For similar jobs

Rationale

Rationale is a cutting-edge decision-making AI tool that leverages the power of the latest GPT technology and in-context learning. It is designed to assist users in making informed decisions by providing valuable insights and recommendations based on the data provided. With its advanced algorithms and machine learning capabilities, Rationale aims to streamline the decision-making process and enhance overall efficiency.

Thirdai

Thirdai.com is an AI-powered platform that offers a range of tools and applications to enhance productivity and decision-making. The platform leverages advanced algorithms and machine learning to provide insights and solutions across various domains such as finance, marketing, and healthcare. Users can access a suite of AI tools to analyze data, automate tasks, and optimize processes. With a user-friendly interface and robust features, Thirdai.com is a valuable resource for individuals and businesses seeking to leverage AI technology for improved outcomes.

Dispute AI™

Dispute AI™ is an AI-powered DIY credit repair solution that leverages cutting-edge artificial intelligence to provide personalized strategies for boosting credit scores. The platform offers actionable insights, data-driven recommendations, and a fast, affordable, and flexible credit repair process. With over 20 years of expertise in credit repair, Dispute AI™ aims to revolutionize the way individuals take control of their credit by providing innovative tools that simplify and streamline the credit repair process.

b-cube.ai

b-cube.ai is an AI application that provides services related to crypto-assets. The platform is currently impacted by the EU's MiCA regulation, leading to a halt in new registrations and a planned cessation of operations. Existing users can access unstaking services until the platform shuts down. The company is considering operating under a new regulatory framework outside the EU. b-cube.ai s.r.l holds the rights to the platform from 2022 to 2025.

AngelList

AngelList is a platform that provides tools for investors and innovators to grow their venture funds. It offers solutions for venture funds, SPVs, scout funds, and digital subscriptions, along with full service fund management. With over half of top-tier VC deals running through the platform, AngelList plays a crucial role in fueling innovation and bridging gaps in the VC market.

Scope Ai Platform

The website is an AI tool called Scope Ai Platform that provides property, owner, investor, and lender intelligence. It offers nationwide coverage, predictive scoring, and tailored insights to help users find opportunities, connect with the right people, and make faster decisions in various markets. The platform combines massive data coverage with advanced predictive modeling to deliver actionable intelligence for business growth. It caters to industries such as insurance, retail, investment, luxury goods, and more, offering solutions for unique data challenges. The platform is compliance-ready, built on public and licensed non-credit data without credit bureau information or live tracking.

Investor Hunter

The website investor-hunter.com seems to be inaccessible, showing an 'Access Denied' message. It appears that the user does not have permission to access the content on the server. The error message references a specific server code, indicating a technical issue preventing access to the GoDaddy website for sale. The website may be related to domain investing or hunting for investment opportunities, but without access, the exact nature of the site remains unknown.

Collie.ai

Collie.ai is an AI-powered tool designed to assist users in various tasks. It offers a wide range of features and advantages to streamline workflows and improve productivity. The tool is known for its user-friendly interface and efficient performance. Collie.ai is suitable for individuals and businesses looking to leverage AI technology for enhanced decision-making and task automation.

Mudrex

Mudrex is a cryptocurrency investment platform that provides users with tools and resources to make informed investment decisions. The platform offers a variety of features, including price predictions, investment guides, and how-to's. Mudrex also has a team of experts who provide support and guidance to users.

PeerAI

PeerAI is an advanced AI tool that leverages cutting-edge artificial intelligence technology to provide users with personalized insights and recommendations. The platform utilizes machine learning algorithms to analyze data and generate actionable suggestions across various domains, including business, marketing, finance, and more. PeerAI empowers users to make informed decisions, optimize strategies, and enhance performance through data-driven intelligence.

MyLoans.ai

MyLoans.ai is a free AI tool designed to provide personalized guidance for complex student loans. It offers instant, clear, and accurate answers to student loan queries, helping borrowers make informed decisions about their financial future. By skipping expensive advisors and confusing government websites, MyLoans.ai aims to save users thousands of dollars by leveraging official government sources for guidance.

AI VC

AI VC was a project that is no longer active. It was likely an AI tool or application related to venture capital. The project may have involved using artificial intelligence to analyze investment opportunities, predict market trends, or provide insights for venture capitalists. Unfortunately, the project is no longer operational, but it may have offered valuable resources and information for individuals interested in the intersection of AI and venture capital.

Langdock

Langdock is an all-in-one AI platform designed for companies to roll out AI to all employees and enable developers to build custom AI workflows. It offers powerful AI chat, use-case-specific assistants, AI workplace search, and API for building and running agents. Langdock provides model-agnostic, privacy-first, scalable, and measurable features, with expert support assistants for various tasks. The platform is enterprise trusted, with a focus on security and compliance. It is hosted in Europe and offers a 7-day free trial for users to get started.

Skeptical Tom

Skeptical Tom is an AI tool designed to help users control their impulsive shopping habits. The AI Cat feature provides personalized guidance to curb impulsive buys, offering wise whispers to guide users' wallets. Users can reach out to the team at [email protected] for any issues or queries.

Numeno

Numeno is an AI tool that allows users to personalize every customer touchpoint without the need for data. It enables businesses to tailor product recommendations, content, gaming experiences, educational content, financial services, and marketing campaigns based on real-time user interactions. Numeno's dead-simple API simplifies the process of personalizing user experiences by creating rich models of user behavior and preferences over time.

FutureGPT

FutureGPT is an AI tool that leverages the power of GPT-4 to provide advanced predictive capabilities. Users can enhance their results by utilizing this tool, which offers paid predictions. By enabling JavaScript, users can access the app and explore its features to receive accurate and insightful predictions for various purposes. FutureGPT aims to streamline decision-making processes and optimize outcomes through cutting-edge AI technology.

Casca

Casca is a revolutionary AI-native Loan Origination System that helps banks and non-bank lenders automate 90% of manual effort in business loan origination. By leveraging AI technology, Casca enables financial institutions to process loans 10x faster, achieve 3x higher conversion rates, and save significant time for loan officers. With features like AI Loan Assistant, digital application processing, KYB checks automation, and document analysis, Casca transforms the loan origination process into a seamless and efficient experience for both lenders and borrowers.

Price Prediction AI Robo Advisor

The website is an AI tool called Price Prediction AI Robo Advisor, developed by Regulus Technologies. It provides cryptocurrency trading predictions and news updates. Users can access the platform in multiple languages and find information about various cryptocurrencies. The tool offers price predictions for popular cryptocurrencies like Bitcoin, Ethereum, and Ripple, along with customer support and company details.

CreditHQ

CreditHQ is an AI-powered loan restructuring platform that helps users analyze their credit history, compare interest rates, and save money on their loans. The platform offers a range of features, including a credit score simulator, a budgeting tool, and a debt management tool. CreditHQ is trusted by over 5,500 users and companies globally.

CanTax.ai

CanTax.ai is an AI-powered platform offering instant tax help for Canadians. It provides personalized tax advice tailored to individual financial needs, ensuring privacy and security with industry-leading encryption protocols. The platform's artificial intelligence is proficiently trained on federal and provincial tax legislation, offering comprehensive knowledge and 24/7 availability. CanTax aims to simplify the tax filing process and empower Canadians with expert-level tax guidance.

Mojju

Mojju is a platform offering unique and powerful AI tools built by a dedicated team of experts. The tools include productivity tools, various assistants & guides, business & finance tools, and more. Mojju provides GPTs with API and Knowledge base support, featuring integrations with popular services like Zapier. Users can access custom GPTs for different domains such as business, design, developers, productivity, learning, crypto, finance, lifestyle, and well-being.

KGiSL

KGiSL is a BFSI-centric multiproduct enterprise software company focused on insurance, capital markets, and wealth management segments, delivering AI and ML-driven products for a transformative edge. The company offers a wide range of solutions for various industries, including digital transformation, automation, analytics, and IT infrastructure management. KGiSL aims to empower its clients through innovative technologies such as Machine Learning, Artificial Intelligence, Analytics, and Cloud services to enhance productivity and deliver exceptional customer experiences.

FinChat.io

FinChat.io is a comprehensive AI-powered stock research platform that provides institutional-quality data and insights to investors. With FinChat.io, you can access accurate financial data on over 100,000 global public companies, as well as company revenue and profit segments, KPIs, analyst estimates, price targets, and ratings. FinChat.io also utilizes cutting-edge AI to build summaries, models, and visualizations, making it easy to understand complex financial data. Additionally, FinChat.io offers a customizable terminal, allowing you to track what matters most to you and auto-save your research. With FinChat.io, you can work faster than ever and make better investment decisions.

Soon

Soon is a fully automated crypto investing platform that makes it easy for anyone to invest in crypto, regardless of their experience level. With Soon, you can set up simple buying and selling schedules, automatically reinvest your profits, and even track your capital gains taxes. Soon also provides a robust set of investing features, such as auto-pilot selling, reimburse spending, and stop loss, to give you powerful tools in a simple, intuitive app.