Sixfold

Amplifying Confidence In Every Underwriting Decision

Sixfold is a risk assessment AI solution designed exclusively for insurance underwriters. The platform enhances underwriting efficiency, accuracy, and transparency for insurers, MGAs, and reinsurers. Sixfold's AI capabilities enable faster case reviews, appetite-aware risk insights, and data gathering from days to minutes. The application ingests underwriting guidelines, extracts risk data, and provides tailored risk insights to align with unique risk preferences. It offers customized solutions for various insurance lines and features intake prioritization, contextual risk insights, risk signal detection, inconsistency identification, and data summarization.

For Tasks:

Click tags to check more tools for each tasksFor Jobs:

Features

Advantages

Disadvantages

Frequently Asked Questions

Alternative AI tools for Sixfold

Similar sites

Sixfold

Sixfold is a risk assessment AI solution designed exclusively for insurance underwriters. The platform enhances underwriting efficiency, accuracy, and transparency for insurers, MGAs, and reinsurers. Sixfold's AI capabilities enable faster case reviews, appetite-aware risk insights, and data gathering from days to minutes. The application ingests underwriting guidelines, extracts risk data, and provides tailored risk insights to align with unique risk preferences. It offers customized solutions for various insurance lines and features intake prioritization, contextual risk insights, risk signal detection, inconsistency identification, and data summarization.

Gradient AI

Gradient AI is a leading provider of artificial intelligence solutions for the insurance industry. Its solutions improve loss ratios and profitability by predicting underwriting and claims risks with greater accuracy, as well as reducing quote turnaround times and claim expenses through intelligent automation.

Convr

Convr is an AI-driven underwriting analysis platform that helps commercial P&C insurance organizations transform their underwriting operations. It provides a modularized AI underwriting and intelligent document automation workbench that enriches and expedites the commercial insurance new business and renewal submission flow with underwriting insights, business classification, and risk scoring. Convr's mission is to solve the last big problem of commercial insurance while improving profitability and increasing efficiency.

Convr

Convr is a modularized AI underwriting and intelligent document automation workbench that enriches and expedites the commercial insurance new business and renewal submission flow with underwriting insights, business classification and risk scoring. As a trusted technology partner and advisor with deep industry expertise, we help insurance organizations transform their underwriting operations through our AI-driven digital underwriting analysis platform.

Gradient AI

Gradient AI is a leading provider of artificial intelligence solutions for the insurance industry. Their solutions improve loss ratios and profitability by predicting underwriting and claims risks with greater accuracy, as well as reducing quote turnaround times and claim expenses through intelligent automation.

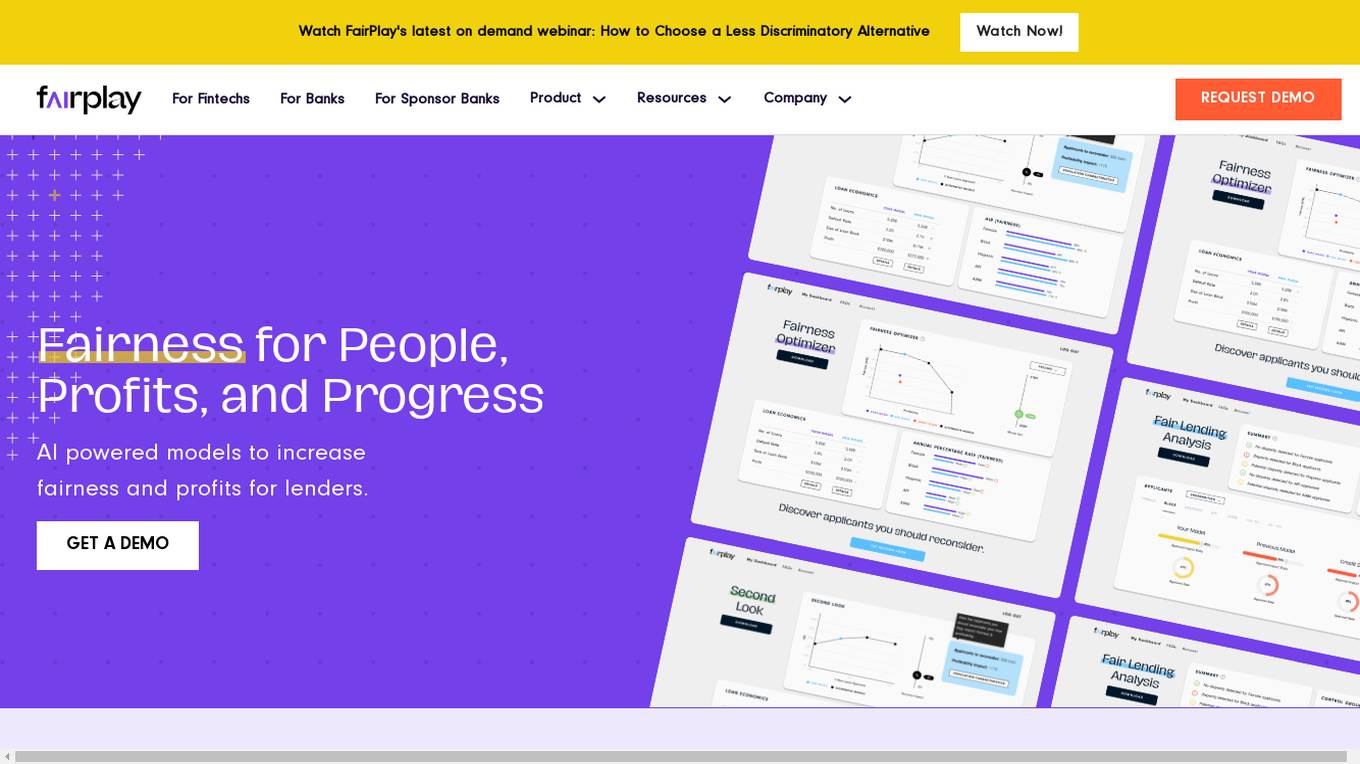

FairPlay

FairPlay is a Fairness-as-a-Service solution designed for financial institutions, offering AI-powered tools to assess automated decisioning models quickly. It helps in increasing fairness and profits by optimizing marketing, underwriting, and pricing strategies. The application provides features such as Fairness Optimizer, Second Look, Customer Composition, Redline Status, and Proxy Detection. FairPlay enables users to identify and overcome tradeoffs between performance and disparity, assess geographic fairness, de-bias proxies for protected classes, and tune models to reduce disparities without increasing risk. It offers advantages like increased compliance, speed, and readiness through automation, higher approval rates with no increase in risk, and rigorous Fair Lending analysis for sponsor banks and regulators. However, some disadvantages include the need for data integration, potential bias in AI algorithms, and the requirement for technical expertise to interpret results.

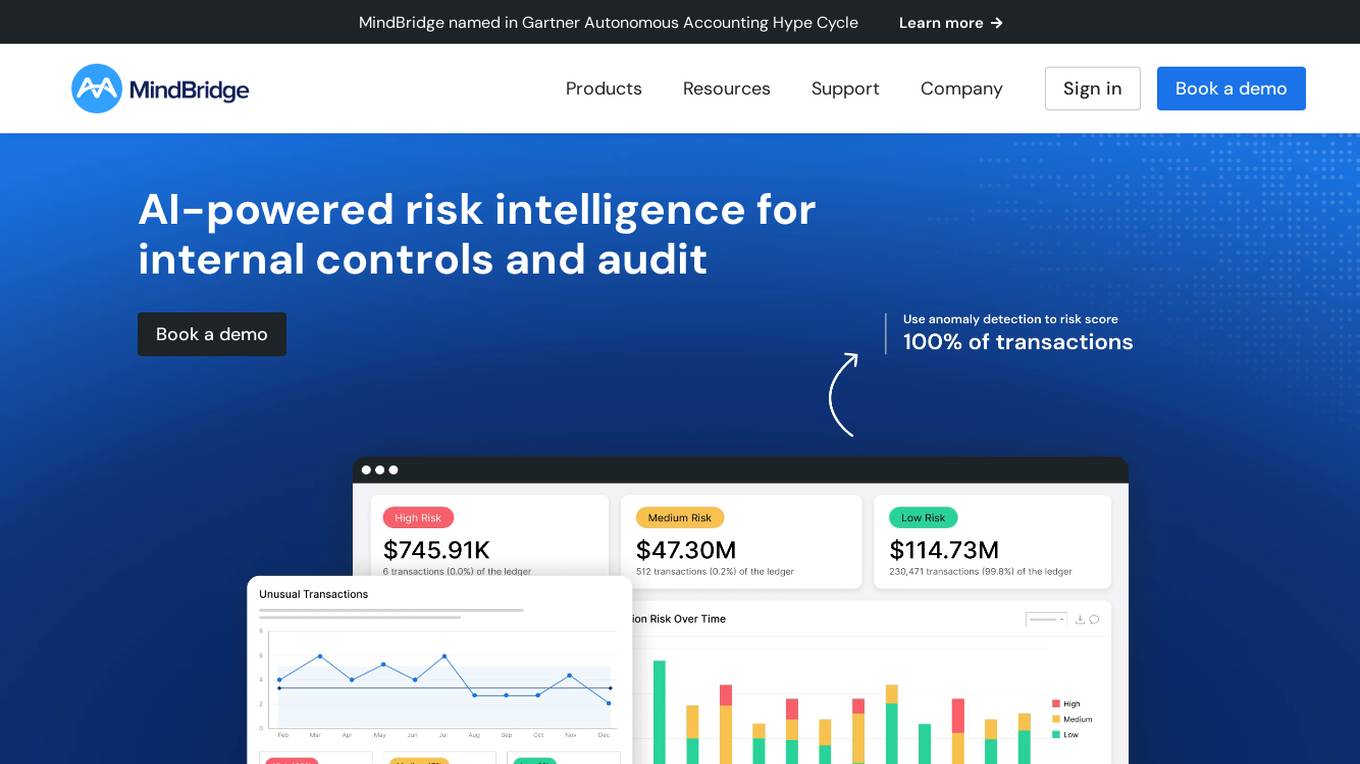

MindBridge

MindBridge is a global leader in financial risk discovery and anomaly detection. The MindBridge AI Platform drives insights and assesses risks across critical business operations. It offers various products like General Ledger Analysis, Company Card Risk Analytics, Payroll Risk Analytics, Revenue Risk Analytics, and Vendor Invoice Risk Analytics. With over 250 unique machine learning control points, statistical methods, and traditional rules, MindBridge is deployed to over 27,000 accounting, finance, and audit professionals globally.

Federato

Federato is an AI-powered platform that integrates Google Cloud's AI capabilities to provide new AI underwriting solutions for the insurance industry. It aims to revolutionize underwriting processes by leveraging AI technology to enhance risk assessment, portfolio management, and decision-making. Federato's RiskOps platform empowers underwriters with powerful insights, real-time risk selection guidance, and unified underwriting workflows, enabling them to make more informed decisions and improve operational efficiency.

FOCAL

FOCAL is an AI-driven platform designed for AML compliance and anti-fraud purposes. It offers solutions for verification, customer due diligence, fraud prevention, and financial insights. The platform leverages AI technology to streamline onboarding processes, enhance trust through advanced customer screening, and detect and prevent fraud using advanced AI algorithms. FOCAL is tailored to meet industry-specific needs, provides seamless integration with existing systems, and offers localized expertise with global standards for regulatory compliance.

Underwrite.ai

Underwrite.ai is a platform that leverages advances in artificial intelligence and machine learning to provide lenders with nonlinear, dynamic models of credit risk. By analyzing thousands of data points from credit bureau sources, the application accurately models credit risk for consumers and small businesses, outperforming traditional approaches. Underwrite.ai offers a unique underwriting methodology that focuses on outcomes such as profitability and customer lifetime value, allowing organizations to enhance their lending performance without the need for capital investment or lengthy build times. The platform's models are continuously learning and adapting to market changes in real-time, providing explainable decisions in milliseconds.

Zest AI

Zest AI is an AI-driven credit underwriting software that offers a complete solution for AI-driven lending. It enables users to build custom machine learning risk models, adopt model assessment and regulatory compliance, and operate performance management and model monitoring. Zest AI helps increase approvals, manage risk, control loss, drive operational efficiency, automate credit decisioning, and improve borrower experience while ensuring fair lending practices. The software is designed to provide powerful AI for better lending outcomes by accelerating loan growth and expanding credit access through accurate risk prediction and faster credit decisions.

Zest AI

Zest AI is an AI-driven credit underwriting software that offers a complete solution for AI-driven lending. It enables users to build custom machine learning risk models, adopt model assessment and regulatory compliance, and operate performance management and model monitoring. Zest AI helps increase approvals, manage risk, control loss, drive operational efficiency, automate credit decisioning, and improve borrower experience while ensuring fair lending practices. The software is designed to provide fair and transparent credit for everyone, making lending more accessible and inclusive.

Pascal

Pascal is an AI-powered risk-based KYC & AML screening and monitoring platform that offers users the ability to assess findings faster and more accurately than other compliance tools. It utilizes AI, machine learning, and Natural Language Processing to analyze open-source and client-specific data, interpret adverse media in multiple languages, simplify onboarding processes, provide continuous monitoring, reduce false positives, and enhance compliance decision-making.

expert.ai

expert.ai is an AI platform that offers natural language technologies and responsible AI integrations across various industries such as insurance, banking, publishing, and more. The platform helps streamline operations, extract critical data, drive revelations, ensure compliance, and deliver key information for businesses. With a focus on responsible AI, expert.ai provides solutions for insurers, pharmaceuticals, publishers, and financial services companies to reduce errors, save time, lower costs, and accelerate intelligent process automation.

Roots

Roots is an AI Agent Platform designed specifically for the insurance industry, offering a comprehensive suite of tools and features to enhance operational efficiency, streamline processes, and improve customer experiences. The platform includes AI Agents, InsurGPT™, Cockpit, Human-in-the-Loop, Workflow Orchestration, and Responsible AI components. Roots aims to revolutionize insurance automation by providing transparent, ethical, and trustworthy AI solutions tailored for insurance companies.

SymphonyAI NetReveal Financial Services

SymphonyAI NetReveal Financial Services is an AI-powered platform that offers solutions for financial crime prevention in various industries such as banking, insurance, financial markets, and private banking. The platform utilizes predictive and generative AI applications to enhance efficiency, reduce fraud, streamline compliance, and maximize output. SymphonyAI provides a fundamentally different approach to AI by combining high-value AI capabilities with industry-leading predictive and generative AI technologies. The platform offers a range of solutions including transaction monitoring, customer due diligence, payment fraud detection, and enterprise investigation management. SymphonyAI aims to revolutionize financial crime prevention by leveraging AI to detect suspicious activity, expedite investigations, and improve compliance operations.

For similar tasks

PowerPM AI

PowerPM AI is an advanced project management tool that leverages artificial intelligence to streamline project planning, tracking, and execution. It offers a user-friendly interface with powerful features to enhance project management efficiency. With intelligent automation and predictive analytics, PowerPM AI helps project managers make informed decisions and optimize project outcomes. The tool integrates seamlessly with popular project management platforms and provides real-time insights to drive project success.

Exante

Exante is an AI-powered contract intelligence platform that offers a single source of truth for organizations' contracts. It revolutionizes contract handling by providing centralized, secure storage, AI-powered extraction and organization of unstructured data, real-time visibility, user-friendly reporting, and collaboration tools. The platform aims to streamline processes, reduce risks, and improve compliance for efficient contract management. Exante delivers tangible value by automating data extraction, reducing costs, improving accuracy, reinforcing compliance, enhancing accessibility, and providing actionable insights.

ScamAlert

ScamAlert is an AI-powered application designed to help users avert scams in a smarter way. By adopting the power of AI and building smart systems, ScamAlert protects users from being scammed by analyzing risks, conducting manual reviews, providing timely alerts, and fostering a social community to prevent similar scams. The application enhances the online experience by taking care of risky aspects while empowering users to make well-informed decisions.

Center for AI Safety (CAIS)

The Center for AI Safety (CAIS) is a research and field-building nonprofit organization based in San Francisco. They conduct impactful research, advocacy projects, and provide resources to reduce societal-scale risks associated with artificial intelligence (AI). CAIS focuses on technical AI safety research, field-building projects, and offers a compute cluster for AI/ML safety projects. They aim to develop and use AI safely to benefit society, addressing inherent risks and advocating for safety standards.

Intuition Machines

Intuition Machines is a leading provider of Privacy-Preserving AI/ML platforms and research solutions. They offer products and services that cater to category leaders worldwide, focusing on AI/ML research, security, and risk analysis. Their innovative solutions help enterprises prepare for the future by leveraging AI for a wide range of problems. With a strong emphasis on privacy and security, Intuition Machines is at the forefront of developing cutting-edge AI technologies.

Sixfold

Sixfold is a risk assessment AI solution designed exclusively for insurance underwriters. The platform enhances underwriting efficiency, accuracy, and transparency for insurers, MGAs, and reinsurers. Sixfold's AI capabilities enable faster case reviews, appetite-aware risk insights, and data gathering from days to minutes. The application ingests underwriting guidelines, extracts risk data, and provides tailored risk insights to align with unique risk preferences. It offers customized solutions for various insurance lines and features intake prioritization, contextual risk insights, risk signal detection, inconsistency identification, and data summarization.

Springs

Springs is a custom AI compliance solution provider for enterprises across industries such as Pharma & Life Sciences, Food Safety, and Manufacturing. Their AI-based compliance software is designed to adapt to specific industry needs, scale with requirements, and ensure organizations are always audit-ready. The platform offers features like regulatory intelligence, gap analysis, compliance management, and customizable workflows to streamline compliance processes. Springs aims to reduce costs, mitigate risks, and improve quality through intelligent compliance solutions.

Nelson

The website is an AI-powered research companion called Nelson, designed to provide rapid and comprehensive answers to complex intelligence, diligence, and geopolitical risk questions. It offers a natural language interface for research queries, hand-selected sources by veteran analysts, and deep regional knowledge. Nelson is trusted by professionals for its reliable and accurate analysis, supporting professional-level research workflows.

BoostIO.ai

BoostIO.ai is a website that appears to be a domain for sale on GoDaddy. The site is currently inaccessible, showing an 'Access Denied' error message. It seems to be related to boosting or enhancing AI capabilities, but the specific details are not available due to the access restriction.

Octopulse.ai

Octopulse.ai is an AI-powered platform designed to provide advanced analytics and insights for businesses. It offers a wide range of AI-driven solutions to help companies make data-driven decisions and optimize their operations. The platform utilizes cutting-edge AI algorithms to analyze large datasets and extract valuable information for users. Octopulse.ai is user-friendly and customizable, making it suitable for businesses of all sizes across various industries.

iQ Suite

iQ Suite is an advanced AI application developed by Blue Hex Software, offering a comprehensive suite of AI solutions to empower businesses with cutting-edge generative AI capabilities. The application revolutionizes workflows, amplifies productivity, and enhances customer experience by delivering insights beyond imagination, supreme data analytics, and transforming data into knowledge with AI-driven document analysis. iQ Suite ensures data security at the core, with advanced encryption and protection protocols, seamless integration with existing systems, and real-time monitoring capabilities. The application also offers customizable security settings and personalized solutions tailored to meet specific business needs.

PnP.ai

PnP.ai is an advanced AI-powered platform that offers a wide range of tools and solutions for businesses and individuals. It leverages cutting-edge artificial intelligence technology to provide users with intelligent automation, data analysis, and decision-making capabilities. With a user-friendly interface and powerful features, PnP.ai helps streamline processes, improve efficiency, and drive innovation across various industries.

Flexxon

Flexxon is a leading industrial SSD & NAND manufacturer dedicated to ensuring data security and reliability. They offer a wide range of industrial-grade SSD and NAND products, including USB flash memory devices, memory cards, PATA SSD, SATA SSD, eMMC storage solutions, and PCIe NVMe SSD. Their flagship product is the Flexxon CyberSecure SSD, which is the world's first AI-powered cybersecurity solution providing real-time data protection at the storage level. Flexxon values product longevity, quality, and reliability, offering customizable memory solutions and strong technical support to their customers worldwide.

Innovation Acceleration

Innovation Acceleration is an AI-powered platform that empowers organizations to unlock their creative potential through the integration of advanced AI technologies and structured innovation frameworks. The platform offers a systematic and repeatable approach to creative thinking using Systematic Inventive Thinking (SIT) and Natural Language Processing (NLP) tools such as Large Language Models (LLMs) and generative AI (GenAI). Innovation Acceleration aims to accelerate the innovation process by guiding users through creating customized, industry-leading products, processes, strategies, and marketing innovations.

For similar jobs

Empathy

Empathy is a platform that offers support for life's hardest moments, from planning a legacy to navigating loss. It partners with leading organizations to provide practical, emotional, and logistical support on demand. Empathy helps individuals and families move forward by offering tools and guidance for funeral planning, estate tasks, emotional support, and legacy planning. The platform aims to reduce complexity and deliver meaningful outcomes by empowering people to plan for and move through life's biggest transitions.

Quandri

Quandri is a digital workforce solution that automates repetitive tasks for insurance brokerages and agencies. By leveraging advanced automation and AI, Quandri's digital workers can help businesses save time, reduce errors, and increase efficiency. Quandri's out-of-the-box digital workers can be deployed seamlessly into any agency or brokerage, and can be trained to perform a variety of tasks, including EDI processing, closing broker activities, eDoc processing, inbound lead management, and renewal reviews. With Quandri, businesses can free up their team's time to focus on more value-producing activities, such as building relationships with clients and growing their business.

Insurance Policy AI

This application utilizes AI technology to simplify the complex process of understanding health insurance policies. Unlike other apps that focus on insurance search and comparison, this app specializes in deciphering the intricate language found in policies. It provides instant access to policy analysis with a one-time payment, empowering users to gain clarity and make informed decisions regarding their health insurance coverage.

StrAIberry

StrAIberry is an AI solution for the Patient, Insurance, Dentist triangle that can organize and solve the issues of personal oral hygiene, appointment setting, second eye opinion with the highest precision for dentists, insurance fraud, and risk management for insurance while saving cost, time and paper waste.

Convr

Convr is an AI-driven underwriting analysis platform that helps commercial P&C insurance organizations transform their underwriting operations. It provides a modularized AI underwriting and intelligent document automation workbench that enriches and expedites the commercial insurance new business and renewal submission flow with underwriting insights, business classification, and risk scoring. Convr's mission is to solve the last big problem of commercial insurance while improving profitability and increasing efficiency.

Gradient AI

Gradient AI is a leading provider of artificial intelligence solutions for the insurance industry. Their solutions improve loss ratios and profitability by predicting underwriting and claims risks with greater accuracy, as well as reducing quote turnaround times and claim expenses through intelligent automation.

Nestor

Nestor is an AI-powered insurance assistant that provides clear and jargon-free answers to all your insurance questions. It can audit your insurance contracts, identify potential over-insurance or under-insurance, and suggest ways to improve your coverage. Nestor is constantly learning and can provide expert advice on a wide range of insurance topics.

Convr

Convr is a modularized AI underwriting and intelligent document automation workbench that enriches and expedites the commercial insurance new business and renewal submission flow with underwriting insights, business classification and risk scoring. As a trusted technology partner and advisor with deep industry expertise, we help insurance organizations transform their underwriting operations through our AI-driven digital underwriting analysis platform.

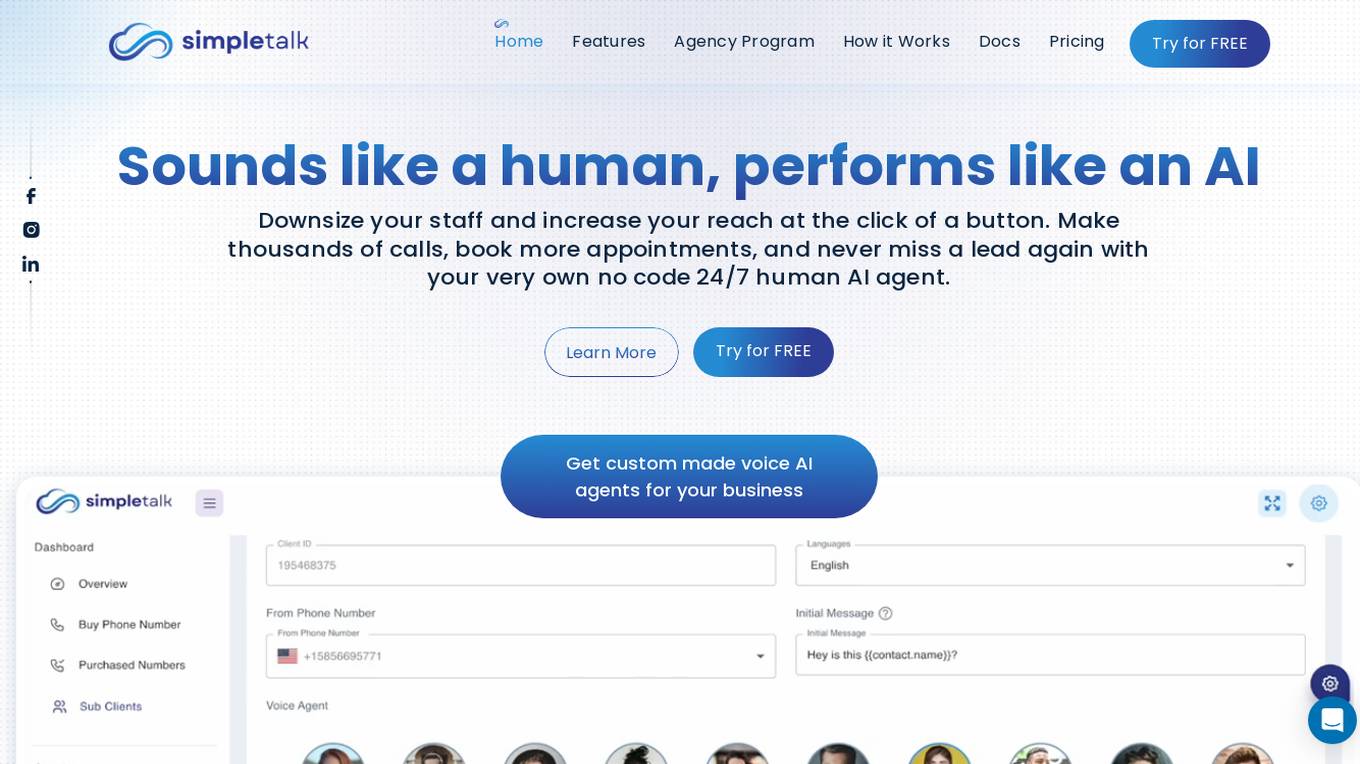

SimpleTalk AI

SimpleTalk AI is an advanced AI application that offers voice AI technology to businesses, enabling them to streamline customer interactions, automate tasks, and enhance communication efficiency. With features like universal calendar syncing, conversational AI voicemail replacement, seamless handoff capability, intelligent real-time interaction, and global communication capabilities, SimpleTalk AI revolutionizes customer relationship management. The application provides custom-made voice AI agents for various industries, such as real estate, solar, health insurance, tech support, and credit repair, offering tailored solutions for different use cases. SimpleTalk AI empowers businesses to break language barriers, automate for efficiency, innovate customer service, and maximize savings by leveraging AI-driven communication solutions.

Feathery

Feathery is an AI-powered platform that enables users to create powerful forms and workflows without the need for coding. It offers advanced features such as AI data extraction, document intelligence, signatures, and collaboration tools. Feathery caters to various industries like insurance, healthcare, financial services, software, and education, providing solutions to streamline processes and enhance user experiences. The platform is designed to automate form workflows, extract and fill documents, and connect with different systems, making it a versatile tool for data management and workflow optimization.

Federato

Federato is an AI-powered platform that integrates Google Cloud's AI capabilities to provide new AI underwriting solutions for the insurance industry. It aims to revolutionize underwriting processes by leveraging AI technology to enhance risk assessment, portfolio management, and decision-making. Federato's RiskOps platform empowers underwriters with powerful insights, real-time risk selection guidance, and unified underwriting workflows, enabling them to make more informed decisions and improve operational efficiency.

Further AI

Further AI is an AI application designed to revolutionize insurance operations by providing AI Teammates for various tasks such as quote generation, policy checking, and renewal follow-ups. The platform aims to enhance efficiency, reduce errors, and automate repetitive tasks in the insurance industry. Further AI offers innovative solutions for insurance brokers, general agents, and insurers, allowing them to scale their business without the need for additional hiring. By leveraging AI technology, users can streamline workflows, automate client calls, navigate portals, and extract data from complex documents with ease and accuracy.

InsureLife

InsureLife is an AI-powered insurance distribution platform that offers an innovative Foundational AI platform for financial services. The platform enables brands to increase revenue, enhance profitability, and achieve growth by automatically cross-selling personalized financial products based on customer profiles. InsureLife's Agentic AI platform provides a frictionless experience for customers, boosting profitability through personalized product recommendations. The platform seamlessly integrates into existing workflows without complex integrations or subscription fees.

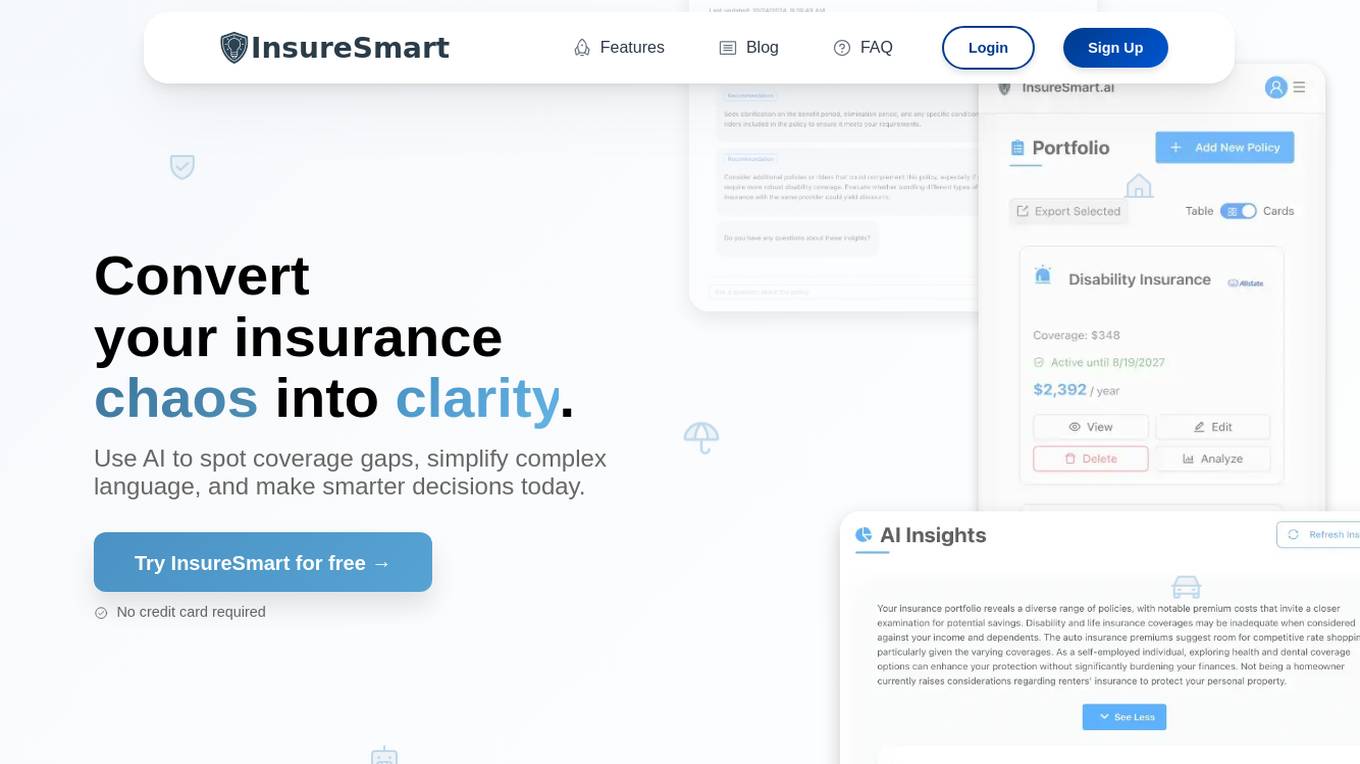

InsureSmart

InsureSmart is an AI-powered platform that empowers users to take control of their insurance needs. By leveraging artificial intelligence technology, InsureSmart offers personalized insurance solutions tailored to individual requirements. The platform provides a seamless and user-friendly experience for users to manage and optimize their insurance policies efficiently. With InsureSmart, users can access smart recommendations, compare insurance plans, and make informed decisions to secure their financial well-being.

Focalx

Focalx is an AI-powered vehicle inspection technology that revolutionizes vehicle handovers in automotive and logistics industries. It empowers inspections, digitalizes vehicle condition tracking, and accelerates claims, repairs, and recovery processes. Focalx's Visual AI detects damages instantly, generates detailed vehicle condition reports, and provides actionable insights for managing damages and inspections. The application is trusted by businesses worldwide for its transparency, efficiency, and cost-saving benefits.

Sixfold

Sixfold is a risk assessment AI solution designed exclusively for insurance underwriters. The platform enhances underwriting efficiency, accuracy, and transparency for insurers, MGAs, and reinsurers. Sixfold's AI capabilities enable faster case reviews, appetite-aware risk insights, and data gathering from days to minutes. The application ingests underwriting guidelines, extracts risk data, and provides tailored risk insights to align with unique risk preferences. It offers customized solutions for various insurance lines and features intake prioritization, contextual risk insights, risk signal detection, inconsistency identification, and data summarization.

Sonant

Sonant is an AI receptionist designed specifically for insurance agencies, brokers, and distributors. It aims to turn routine incoming calls into revenue within a short period of time. The AI tool enables 24/7 personalized service with zero waiting times, multilingual capabilities, and the ability to transfer calls to human agents when necessary. Sonant helps agencies improve productivity, profitability, and client satisfaction by automating routine tasks, appointment scheduling, quote intaking, and post-call notes. It is GDPR compliant and integrates seamlessly with popular Agency Management Systems and CRM software.

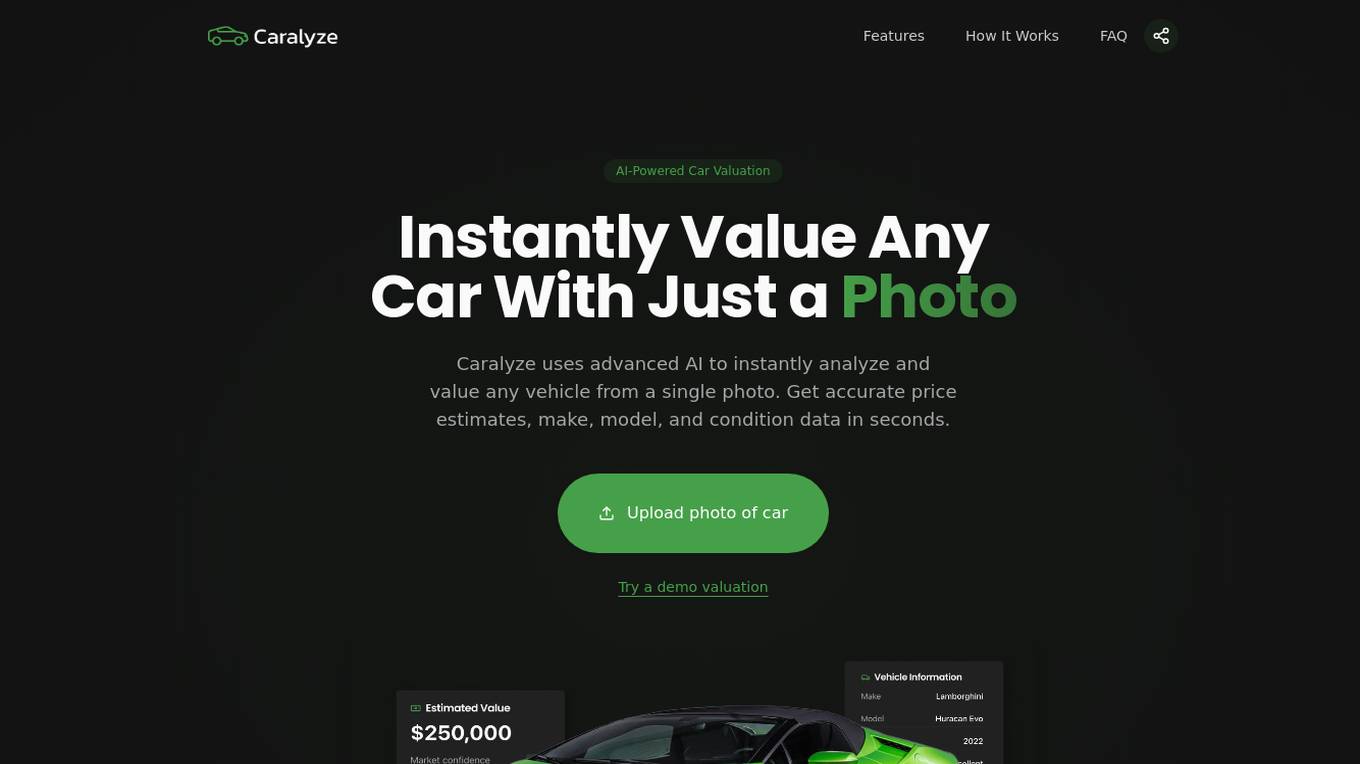

Caralyze

Caralyze is an AI tool that provides instant car valuation based on a single photo. By leveraging advanced artificial intelligence algorithms, Caralyze accurately assesses the value of a car by analyzing key features and market trends. Users can simply upload a photo of their car and receive a quick and reliable valuation, saving time and effort compared to traditional methods. With Caralyze, car owners can make informed decisions when selling, buying, or insuring their vehicles.

Verisquad

Verisquad is an AI-powered platform that specializes in claim verification. It leverages advanced artificial intelligence algorithms to streamline and automate the process of verifying claims, ensuring accuracy and efficiency. By harnessing the power of AI, Verisquad offers a reliable solution for businesses and individuals seeking to validate claims quickly and effectively.

EHVA.ai

EHVA.ai is a Conversational AI tool that combines heart and science to create a unique AI experience. It offers AI phone technology that talks to people by phone to achieve various goals. EHVA.ai provides non-conversational features like AI Backstopping and AI Looking Glass, enhancing productivity and accuracy in different industries. The application aims to bridge the gap between human interaction and AI technology, offering a human-like experience with the efficiency of artificial intelligence.

FlowX.AI

FlowX.AI is a Multi-Agent AI Platform designed for Banking and Insurance Modernization. It offers a cutting-edge AI-native agentic platform for building and deploying AI agents and mission-critical AI-enabled systems in highly regulated industries. The platform enables businesses to build the next generation of banking and insurance systems in weeks, not years, by providing faster development, time to market, and reduced maintenance and implementation costs.

Nauto

Nauto is an AI-powered fleet management software that helps businesses improve driver safety and reduce collisions. It uses a dual-facing camera and external sensors to detect distracted and drowsy driving, as well as in-cabin and external risks. Nauto's predictive AI algorithms can assess, predict, and alert drivers of imminent risks to avoid collisions. It also provides real-time alerts to end distracted and drowsy driving, and self-guided coaching videos to help drivers improve their behavior. Nauto's claims management feature can quickly and reliably process and resolve claims, resulting in millions of dollars saved. Overall, Nauto is a comprehensive driver and vehicle safety platform that can help businesses reduce risk, improve safety, and save money.

Gradient AI

Gradient AI is a leading provider of artificial intelligence solutions for the insurance industry. Its solutions improve loss ratios and profitability by predicting underwriting and claims risks with greater accuracy, as well as reducing quote turnaround times and claim expenses through intelligent automation.

VUW.ai

VUW.ai is a unique virtual underwriting platform that offers end-to-end digital trading solutions for specialty insurance lines. The platform leverages machine learning to improve risk selection, reduce volatility, increase consistency, and enhance profitability and underwriting controls while lowering operating costs. VUW.ai aims to revolutionize the insurance market by providing a cost-effective and tech-based underwriting solution that caters to brokers and capacity providers. The platform also offers services in Property, Casualty, and Marine Cargo business, with plans to expand into other classes like Livestock, Fine Art, and Political Violence.