Gradient AI

None

Gradient AI is a leading provider of artificial intelligence solutions for the insurance industry. Its solutions improve loss ratios and profitability by predicting underwriting and claims risks with greater accuracy, as well as reducing quote turnaround times and claim expenses through intelligent automation.

For Tasks:

Click tags to check more tools for each tasksFor Jobs:

Features

Advantages

Disadvantages

Frequently Asked Questions

Alternative AI tools for Gradient AI

Similar sites

Gradient AI

Gradient AI is a leading provider of artificial intelligence solutions for the insurance industry. Its solutions improve loss ratios and profitability by predicting underwriting and claims risks with greater accuracy, as well as reducing quote turnaround times and claim expenses through intelligent automation.

Gradient AI

Gradient AI is a leading provider of artificial intelligence solutions for the insurance industry. Their solutions improve loss ratios and profitability by predicting underwriting and claims risks with greater accuracy, as well as reducing quote turnaround times and claim expenses through intelligent automation.

Convr

Convr is a modularized AI underwriting and intelligent document automation workbench that enriches and expedites the commercial insurance new business and renewal submission flow with underwriting insights, business classification and risk scoring. As a trusted technology partner and advisor with deep industry expertise, we help insurance organizations transform their underwriting operations through our AI-driven digital underwriting analysis platform.

Convr

Convr is an AI-driven underwriting analysis platform that helps commercial P&C insurance organizations transform their underwriting operations. It provides a modularized AI underwriting and intelligent document automation workbench that enriches and expedites the commercial insurance new business and renewal submission flow with underwriting insights, business classification, and risk scoring. Convr's mission is to solve the last big problem of commercial insurance while improving profitability and increasing efficiency.

Sixfold

Sixfold is a risk assessment AI solution designed exclusively for insurance underwriters. The platform enhances underwriting efficiency, accuracy, and transparency for insurers, MGAs, and reinsurers. Sixfold's AI capabilities enable faster case reviews, appetite-aware risk insights, and data gathering from days to minutes. The application ingests underwriting guidelines, extracts risk data, and provides tailored risk insights to align with unique risk preferences. It offers customized solutions for various insurance lines and features intake prioritization, contextual risk insights, risk signal detection, inconsistency identification, and data summarization.

VUW.ai

VUW.ai is a unique virtual underwriting platform that offers end-to-end digital trading solutions for specialty insurance lines. The platform leverages machine learning to improve risk selection, reduce volatility, increase consistency, and enhance profitability and underwriting controls while lowering operating costs. VUW.ai aims to revolutionize the insurance market by providing a cost-effective and tech-based underwriting solution that caters to brokers and capacity providers. The platform also offers services in Property, Casualty, and Marine Cargo business, with plans to expand into other classes like Livestock, Fine Art, and Political Violence.

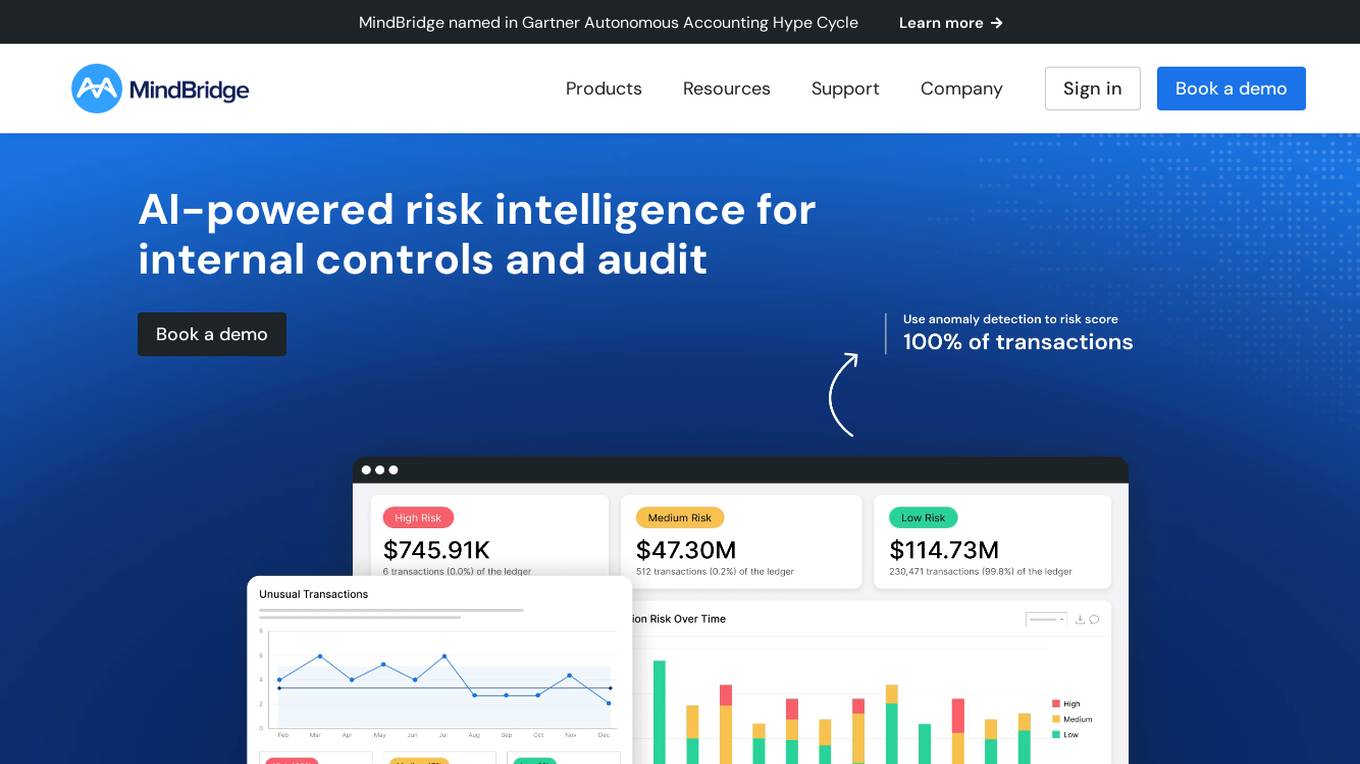

MindBridge

MindBridge is a global leader in financial risk discovery and anomaly detection. The MindBridge AI Platform drives insights and assesses risks across critical business operations. It offers various products like General Ledger Analysis, Company Card Risk Analytics, Payroll Risk Analytics, Revenue Risk Analytics, and Vendor Invoice Risk Analytics. With over 250 unique machine learning control points, statistical methods, and traditional rules, MindBridge is deployed to over 27,000 accounting, finance, and audit professionals globally.

Underwrite.ai

Underwrite.ai is a platform that leverages advances in artificial intelligence and machine learning to provide lenders with nonlinear, dynamic models of credit risk. By analyzing thousands of data points from credit bureau sources, the application accurately models credit risk for consumers and small businesses, outperforming traditional approaches. Underwrite.ai offers a unique underwriting methodology that focuses on outcomes such as profitability and customer lifetime value, allowing organizations to enhance their lending performance without the need for capital investment or lengthy build times. The platform's models are continuously learning and adapting to market changes in real-time, providing explainable decisions in milliseconds.

Federato

Federato is an AI-powered platform that integrates Google Cloud's AI capabilities to provide new AI underwriting solutions for the insurance industry. It aims to revolutionize underwriting processes by leveraging AI technology to enhance risk assessment, portfolio management, and decision-making. Federato's RiskOps platform empowers underwriters with powerful insights, real-time risk selection guidance, and unified underwriting workflows, enabling them to make more informed decisions and improve operational efficiency.

CARCO

CARCO is an advanced Mobile AI Fraud Prevention application designed to protect insurance carriers and consumers by identifying and preventing risk events and fraudulent activities. The application streamlines the inspection process through integrated AI and fraud alert validation technology, providing a back-office solution that is easily integrated into mobile platforms, cost-effective, and fraud-detecting. CARCO also offers NMVTIS, a premier system in the U.S. that requires reporting of vehicle title data. With over 50 million transactions completed to date, CARCO has a proven track record in fraud prevention and risk mitigation for the insurance industry.

Zest AI

Zest AI is an AI-driven credit underwriting software that offers a complete solution for AI-driven lending. It enables users to build custom machine learning risk models, adopt model assessment and regulatory compliance, and operate performance management and model monitoring. Zest AI helps increase approvals, manage risk, control loss, drive operational efficiency, automate credit decisioning, and improve borrower experience while ensuring fair lending practices. The software is designed to provide powerful AI for better lending outcomes by accelerating loan growth and expanding credit access through accurate risk prediction and faster credit decisions.

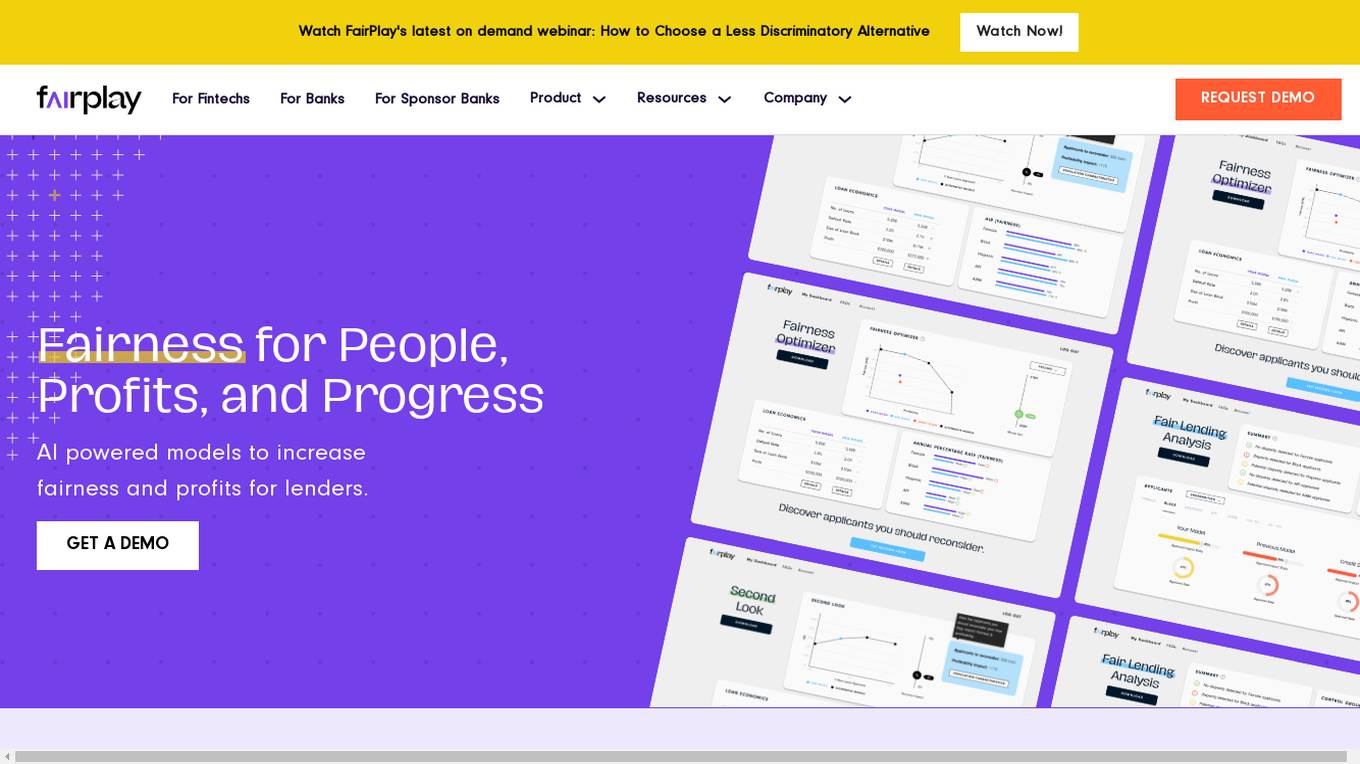

FairPlay

FairPlay is a Fairness-as-a-Service solution designed for financial institutions, offering AI-powered tools to assess automated decisioning models quickly. It helps in increasing fairness and profits by optimizing marketing, underwriting, and pricing strategies. The application provides features such as Fairness Optimizer, Second Look, Customer Composition, Redline Status, and Proxy Detection. FairPlay enables users to identify and overcome tradeoffs between performance and disparity, assess geographic fairness, de-bias proxies for protected classes, and tune models to reduce disparities without increasing risk. It offers advantages like increased compliance, speed, and readiness through automation, higher approval rates with no increase in risk, and rigorous Fair Lending analysis for sponsor banks and regulators. However, some disadvantages include the need for data integration, potential bias in AI algorithms, and the requirement for technical expertise to interpret results.

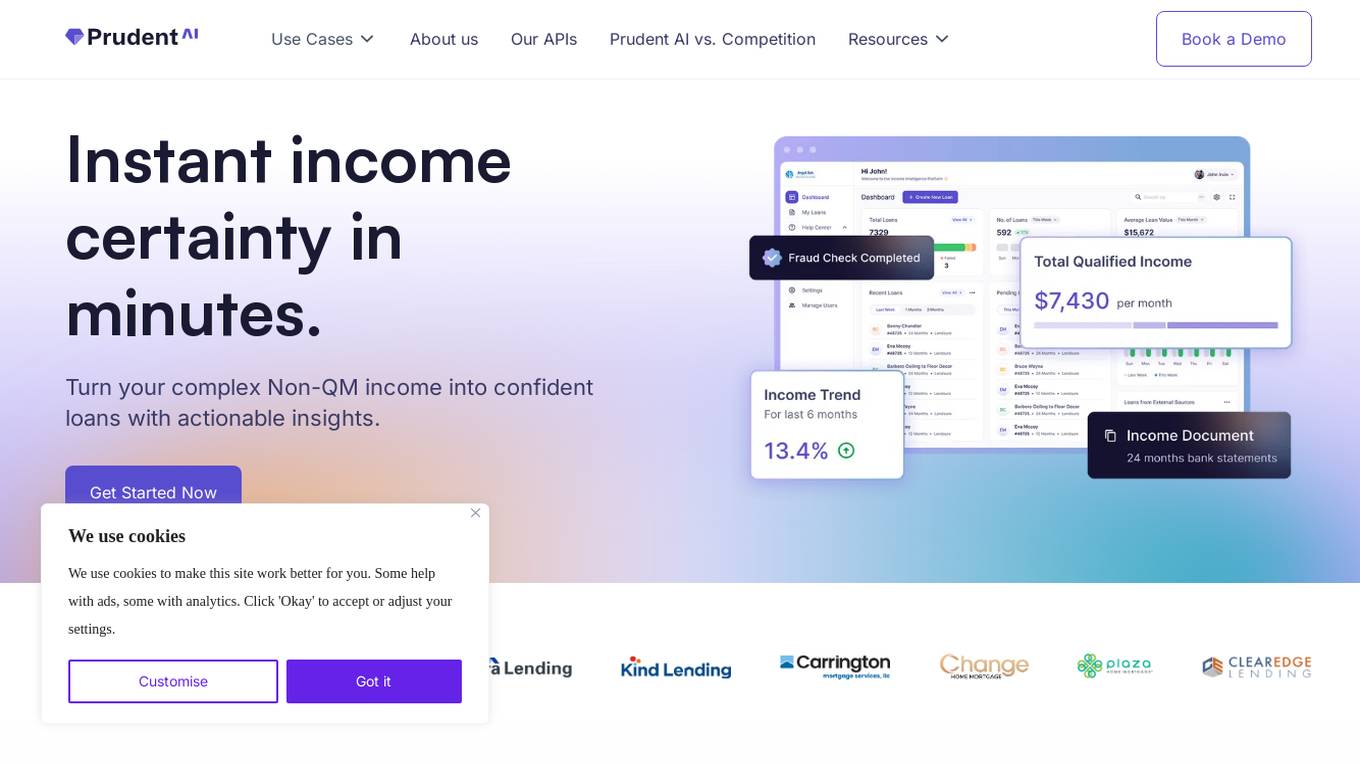

Prudent AI

Prudent AI is an AI-powered Income Intelligence Platform designed for lenders, offering fast data extraction, proactive fraud prevention, and in-depth insights on borrower income. The platform simplifies complex income calculations, streamlines the lending process, and enables lenders to make confident loan decisions quickly. Prudent AI is trusted by various lending institutions and has been proven to increase productivity, save time, and improve submission accuracy.

BluePond GenAI PaaS

BluePond GenAI PaaS is an automation and insights powerhouse tailored for Property and Casualty Insurance. It offers end-to-end execution support from GenAI data scientists, engineers & human-in-the-loop processing. The platform provides automated intake extraction, classification enrichment, validation, complex document analysis, workflow automation, and decisioning. Users benefit from rapid deployment, complete control of data & IP, and pre-trained P&C domain library. BluePond GenAI PaaS aims to energize and expedite GenAI initiatives throughout the insurance value chain.

Zest AI

Zest AI is an AI-driven credit underwriting software that offers a complete solution for AI-driven lending. It enables users to build custom machine learning risk models, adopt model assessment and regulatory compliance, and operate performance management and model monitoring. Zest AI helps increase approvals, manage risk, control loss, drive operational efficiency, automate credit decisioning, and improve borrower experience while ensuring fair lending practices. The software is designed to provide fair and transparent credit for everyone, making lending more accessible and inclusive.

Insurance Policy AI

This application utilizes AI technology to simplify the complex process of understanding health insurance policies. Unlike other apps that focus on insurance search and comparison, this app specializes in deciphering the intricate language found in policies. It provides instant access to policy analysis with a one-time payment, empowering users to gain clarity and make informed decisions regarding their health insurance coverage.

For similar tasks

Gradient AI

Gradient AI is a leading provider of artificial intelligence solutions for the insurance industry. Its solutions improve loss ratios and profitability by predicting underwriting and claims risks with greater accuracy, as well as reducing quote turnaround times and claim expenses through intelligent automation.

Eye for AI

Eye for AI is a comprehensive AI-powered platform that provides a wide range of tools and resources to help businesses and individuals harness the power of AI. With Eye for AI, users can access cutting-edge AI technologies, including natural language processing, computer vision, and machine learning, to automate tasks, improve decision-making, and gain valuable insights from data.

JMIR AI

JMIR AI is a new peer-reviewed journal focused on research and applications for the health artificial intelligence (AI) community. It includes contemporary developments as well as historical examples, with an emphasis on sound methodological evaluations of AI techniques and authoritative analyses. It is intended to be the main source of reliable information for health informatics professionals to learn about how AI techniques can be applied and evaluated.

Convr

Convr is a modularized AI underwriting and intelligent document automation workbench that enriches and expedites the commercial insurance new business and renewal submission flow with underwriting insights, business classification and risk scoring. As a trusted technology partner and advisor with deep industry expertise, we help insurance organizations transform their underwriting operations through our AI-driven digital underwriting analysis platform.

For similar jobs

super.AI

Super.AI provides Intelligent Document Processing (IDP) solutions powered by Large Language Models (LLMs) and human-in-the-loop (HITL) capabilities. It automates document processing tasks such as data extraction, classification, and redaction, enabling businesses to streamline their workflows and improve accuracy. Super.AI's platform leverages cutting-edge AI models from providers like Amazon, Google, and OpenAI to handle complex documents, ensuring high-quality outputs. With its focus on accuracy, flexibility, and scalability, Super.AI caters to various industries, including financial services, insurance, logistics, and healthcare.

Insurance Policy AI

This application utilizes AI technology to simplify the complex process of understanding health insurance policies. Unlike other apps that focus on insurance search and comparison, this app specializes in deciphering the intricate language found in policies. It provides instant access to policy analysis with a one-time payment, empowering users to gain clarity and make informed decisions regarding their health insurance coverage.

Nestor

Nestor is an AI-powered insurance assistant that provides clear and jargon-free answers to all your insurance questions. It can audit your insurance contracts, identify potential over-insurance or under-insurance, and suggest ways to improve your coverage. Nestor is constantly learning and can provide expert advice on a wide range of insurance topics.

Gradient AI

Gradient AI is a leading provider of artificial intelligence solutions for the insurance industry. Its solutions improve loss ratios and profitability by predicting underwriting and claims risks with greater accuracy, as well as reducing quote turnaround times and claim expenses through intelligent automation.

BluePond GenAI PaaS

BluePond GenAI PaaS is an automation and insights powerhouse tailored for Property and Casualty Insurance. It offers end-to-end execution support from GenAI data scientists, engineers & human-in-the-loop processing. The platform provides automated intake extraction, classification enrichment, validation, complex document analysis, workflow automation, and decisioning. Users benefit from rapid deployment, complete control of data & IP, and pre-trained P&C domain library. BluePond GenAI PaaS aims to energize and expedite GenAI initiatives throughout the insurance value chain.

Inoscope

Inoscope is an AI-powered pricing automation tool that transforms photos into professional quotes in minutes. It automates quoting, scoping, and pricing processes completely, eliminating the need for manual expertise and time-consuming tasks. With built-in pricing intelligence, real-time conversation capture, and automatic scope of work generation, Inoscope streamlines workflow for professionals in insurance, trade management, and homeownership. The tool offers instant quote generation, accurate scopes, competitive pricing, and automated documentation, enhancing efficiency and accuracy in claims processing and repair work. Inoscope revolutionizes pricing automation with spatial AI, fraud detection insights, and seamless collaboration features, ensuring precise understanding, perfect clarity, and true collaboration in every project.

FlowX.AI

FlowX.AI is a Multi-Agent AI Platform designed for Banking and Insurance Modernization. It offers a cutting-edge AI-native agentic platform for building and deploying AI agents and mission-critical AI-enabled systems in highly regulated industries. The platform enables businesses to build the next generation of banking and insurance systems in weeks, not years, by providing faster development, time to market, and reduced maintenance and implementation costs.

Nauto

Nauto is an AI-powered fleet management software that helps businesses improve driver safety and reduce collisions. It uses a dual-facing camera and external sensors to detect distracted and drowsy driving, as well as in-cabin and external risks. Nauto's predictive AI algorithms can assess, predict, and alert drivers of imminent risks to avoid collisions. It also provides real-time alerts to end distracted and drowsy driving, and self-guided coaching videos to help drivers improve their behavior. Nauto's claims management feature can quickly and reliably process and resolve claims, resulting in millions of dollars saved. Overall, Nauto is a comprehensive driver and vehicle safety platform that can help businesses reduce risk, improve safety, and save money.

VUW.ai

VUW.ai is a unique virtual underwriting platform that offers end-to-end digital trading solutions for specialty insurance lines. The platform leverages machine learning to improve risk selection, reduce volatility, increase consistency, and enhance profitability and underwriting controls while lowering operating costs. VUW.ai aims to revolutionize the insurance market by providing a cost-effective and tech-based underwriting solution that caters to brokers and capacity providers. The platform also offers services in Property, Casualty, and Marine Cargo business, with plans to expand into other classes like Livestock, Fine Art, and Political Violence.

Binah.ai

Binah.ai is an AI-powered Health Data Platform that offers a software solution for video-based vital signs monitoring. The platform enables users to measure various health and wellness indicators using a smartphone, tablet, or laptop. It provides support for continuous monitoring through a raw PPG signal from external sensors and offers a range of features such as blood pressure monitoring, heart rate variability, oxygen saturation, and more. Binah.ai aims to make health data more accessible for better care at lower costs by leveraging AI and deep learning algorithms.

Federato

Federato is an AI-powered platform that integrates Google Cloud's AI capabilities to provide new AI underwriting solutions for the insurance industry. It aims to revolutionize underwriting processes by leveraging AI technology to enhance risk assessment, portfolio management, and decision-making. Federato's RiskOps platform empowers underwriters with powerful insights, real-time risk selection guidance, and unified underwriting workflows, enabling them to make more informed decisions and improve operational efficiency.

Restb.ai

Restb.ai is a leading provider of visual insights for real estate companies, utilizing computer vision and AI to analyze property images. The application offers solutions for AVMs, iBuyers, investors, appraisals, inspections, property search, marketing, insurance companies, and more. By providing actionable and unique data at scale, Restb.ai helps improve valuation accuracy, automate manual processes, and enhance property interactions. The platform enables users to leverage visual insights to optimize valuations, automate report quality checks, enhance listings, improve data collection, and more.

Sixfold

Sixfold is a risk assessment AI solution designed exclusively for insurance underwriters. The platform enhances underwriting efficiency, accuracy, and transparency for insurers, MGAs, and reinsurers. Sixfold's AI capabilities enable faster case reviews, appetite-aware risk insights, and data gathering from days to minutes. The application ingests underwriting guidelines, extracts risk data, and provides tailored risk insights to align with unique risk preferences. It offers customized solutions for various insurance lines and features intake prioritization, contextual risk insights, risk signal detection, inconsistency identification, and data summarization.