Best AI tools for< Insurance Risk Manager >

Infographic

20 - AI tool Sites

Gradient AI

Gradient AI is a leading provider of artificial intelligence solutions for the insurance industry. Its solutions improve loss ratios and profitability by predicting underwriting and claims risks with greater accuracy, as well as reducing quote turnaround times and claim expenses through intelligent automation.

Nestor

Nestor is an AI-powered insurance assistant that provides clear and jargon-free answers to all your insurance questions. It can audit your insurance contracts, identify potential over-insurance or under-insurance, and suggest ways to improve your coverage. Nestor is constantly learning and can provide expert advice on a wide range of insurance topics.

Convr

Convr is an AI-driven underwriting analysis platform that helps commercial P&C insurance organizations transform their underwriting operations. It provides a modularized AI underwriting and intelligent document automation workbench that enriches and expedites the commercial insurance new business and renewal submission flow with underwriting insights, business classification, and risk scoring. Convr's mission is to solve the last big problem of commercial insurance while improving profitability and increasing efficiency.

Convr

Convr is a modularized AI underwriting and intelligent document automation workbench that enriches and expedites the commercial insurance new business and renewal submission flow with underwriting insights, business classification and risk scoring. As a trusted technology partner and advisor with deep industry expertise, we help insurance organizations transform their underwriting operations through our AI-driven digital underwriting analysis platform.

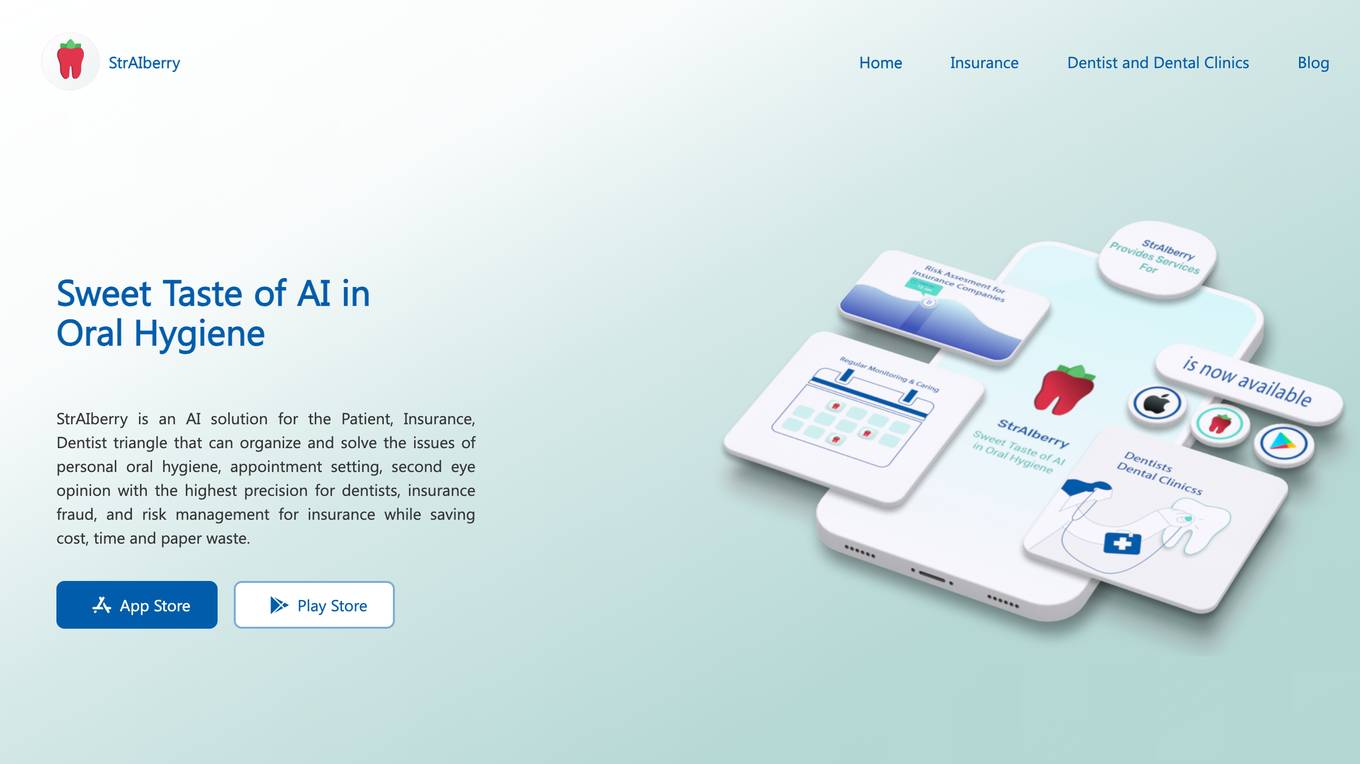

StrAIberry

StrAIberry is an AI solution for the Patient, Insurance, Dentist triangle that can organize and solve the issues of personal oral hygiene, appointment setting, second eye opinion with the highest precision for dentists, insurance fraud, and risk management for insurance while saving cost, time and paper waste.

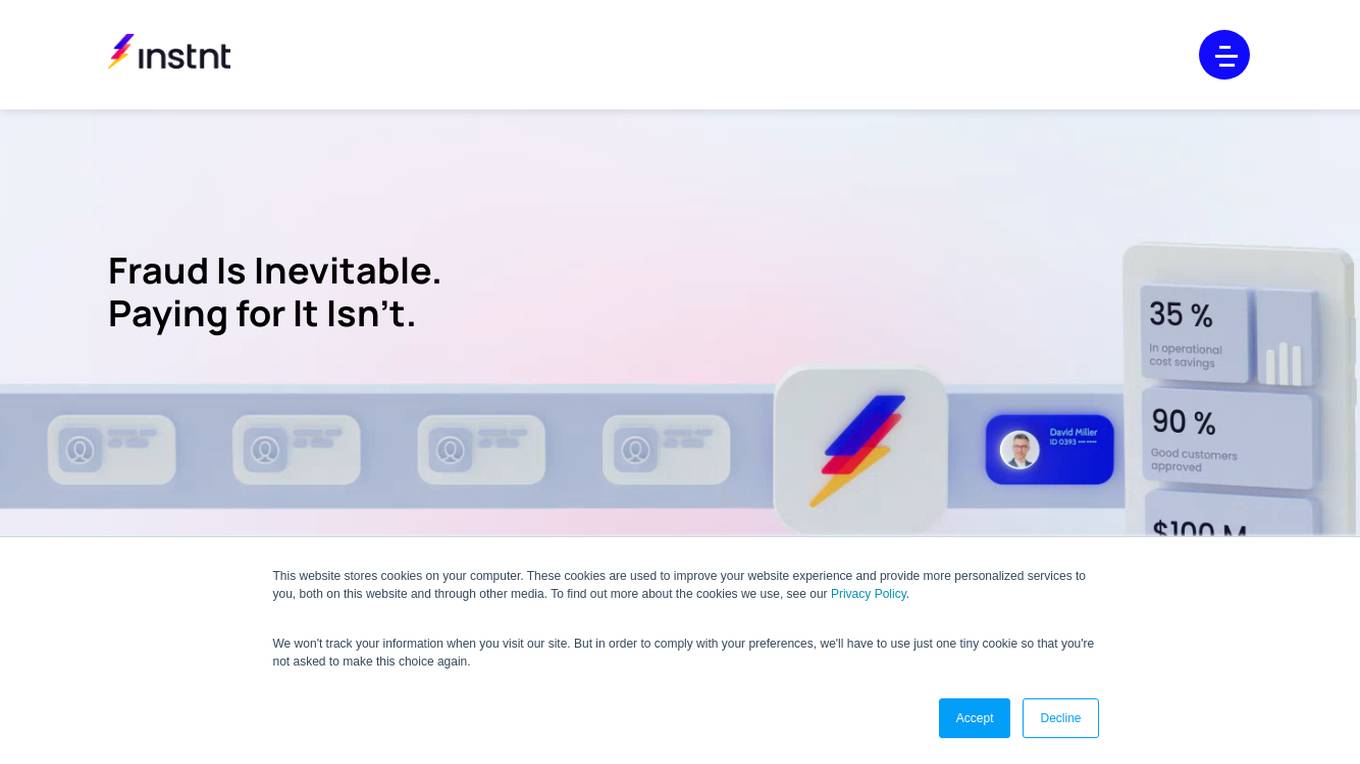

Instnt

Instnt is an AI-powered fraud prevention solution that helps businesses increase approval rates while significantly reducing fraud risk. It eliminates financial risk by shifting fraud losses to A-rated insurers, allowing businesses to grow fearlessly and protect effortlessly. Instnt combines seamless fraud prevention and KYC checks to validate users from day one, ensuring businesses stay protected. The platform offers a comprehensive solution with advanced fraud prevention technology, performance-based pricing, and up to $100M in fraud loss insurance. Instnt is suitable for various industries such as finance, government, e-commerce, crypto, gaming, and healthcare.

ZestyAI

ZestyAI is an artificial intelligence tool that helps users make brilliant climate and property risk decisions. The tool uses AI to provide insights on property values and risk exposure to natural disasters. It offers products such as Property Insights, Digital Roof, Roof Age, Location Insights, and Climate Risk Models to evaluate and understand property risks. ZestyAI is trusted by top insurers in North America and aims to bring a ten times return on investment to its customers.

Sixfold

Sixfold is a risk assessment AI solution designed exclusively for insurance underwriters. The platform enhances underwriting efficiency, accuracy, and transparency for insurers, MGAs, and reinsurers. Sixfold's AI capabilities enable faster case reviews, appetite-aware risk insights, and data gathering from days to minutes. The application ingests underwriting guidelines, extracts risk data, and provides tailored risk insights to align with unique risk preferences. It offers customized solutions for various insurance lines and features intake prioritization, contextual risk insights, risk signal detection, inconsistency identification, and data summarization.

KGiSL

KGiSL is a BFSI-centric multiproduct enterprise software company focused on insurance, capital markets, and wealth management segments, delivering AI and ML-driven products for a transformative edge. The company offers a wide range of solutions for various industries, including digital transformation, automation, analytics, and IT infrastructure management. KGiSL aims to empower its clients through innovative technologies such as Machine Learning, Artificial Intelligence, Analytics, and Cloud services to enhance productivity and deliver exceptional customer experiences.

Novo AI

Novo AI is an AI application that empowers financial institutions by leveraging Generative AI and Large Language Models to streamline operations, maximize insights, and automate processes like claims processing and customer support traditionally handled by humans. The application helps insurance companies understand claim documents, automate claims processing, optimize pricing strategies, and improve customer satisfaction. For banks, Novo AI automates document processing across multiple languages and simplifies adverse media screenings through efficient research on live internet data.

Nauto

Nauto is an AI-powered fleet management software that helps businesses improve driver safety and reduce collisions. It uses a dual-facing camera and external sensors to detect distracted and drowsy driving, as well as in-cabin and external risks. Nauto's predictive AI algorithms can assess, predict, and alert drivers of imminent risks to avoid collisions. It also provides real-time alerts to end distracted and drowsy driving, and self-guided coaching videos to help drivers improve their behavior. Nauto's claims management feature can quickly and reliably process and resolve claims, resulting in millions of dollars saved. Overall, Nauto is a comprehensive driver and vehicle safety platform that can help businesses reduce risk, improve safety, and save money.

Perfios

Perfios is an AI-powered FinTech software company that offers digital solutions for various industries such as banking, insurance, fintech, payments, e-commerce, legal, gaming, and more. Their platform provides end-to-end solutions for digital onboarding, underwriting, risk assessment, fraud detection, and customer engagement. Perfios leverages AI and machine learning technologies to streamline processes, enhance operational efficiency, and improve decision-making in financial services. With a wide range of products and features, Perfios aims to transform the way businesses experience technology and make data-driven decisions.

IntelleWings

IntelleWings is an advanced AML/CFT compliance solution that offers a suite of products for sanction screening, PEP screening, adverse media screening, and transaction monitoring. Powered by AI and Deep Tech, IntelleWings provides cutting-edge technology to help businesses detect fraud and simplify their CDD process. The platform is designed to meet the AML/CFT requirements of various industries, including banks, insurance companies, e-commerce platforms, and more. With a global database and automated reports, IntelleWings offers a seamless and efficient experience for users.

Rainbird Decision Intelligence

Rainbird Decision Intelligence is an AI-powered platform that automates complex decision-making processes with trust and explainability. It leverages advanced reasoning engines to bridge data and processes, ensuring reliable and traceable AI-powered decisions. Rainbird is used across various industries such as banking, financial services, healthcare, legal, and insurance to streamline operations and enhance decision-making capabilities.

Plat.AI

Plat.AI is an automated predictive analytics software that offers model building solutions for various industries such as finance, insurance, and marketing. It provides a real-time decision-making engine that allows users to build and maintain AI models without any coding experience. The platform offers features like automated model building, data preprocessing tools, codeless modeling, and personalized approach to data analysis. Plat.AI aims to make predictive analytics easy and accessible for users of all experience levels, ensuring transparency, security, and compliance in decision-making processes.

Neuraspace

Neuraspace is an AI/ML solution that offers smart autonomy for space traffic management, leading the way for Space Domain Awareness and safety. It streamlines operations by automating risk assessment and providing maneuver suggestions up to 5 days before a conjunction. Neuraspace helps satellite operators, launch service providers, defense and governmental organizations, insurance carriers, and regulators manage space traffic efficiently and cost-effectively. The platform detects threats early, provides intelligence, integrates space domain awareness, and uses a global network of sensors for 24/7 real-time protection.

Responsive.ai

Responsive.ai is a foundational software designed for financial advice, aimed at maximizing advisor productivity through workflow automation, client engagement tools, and AI-powered insights. The platform offers solutions like Prioritize for enhancing relationships and revenue growth, Enable for managing documents and integrations, and Dash for creating seamless digital experiences. Responsive empowers advisors with an API-first ecosystem to deliver advice-led financial services and elevate enterprise value.

Federato

Federato is an AI-powered platform that integrates Google Cloud's AI capabilities to provide new AI underwriting solutions for the insurance industry. It aims to revolutionize underwriting processes by leveraging AI technology to enhance risk assessment, portfolio management, and decision-making. Federato's RiskOps platform empowers underwriters with powerful insights, real-time risk selection guidance, and unified underwriting workflows, enabling them to make more informed decisions and improve operational efficiency.

Cambridge Mobile Telematics

Cambridge Mobile Telematics (CMT) is the world's largest telematics service provider, dedicated to making roads and drivers safer. Their AI-driven platform, DriveWell Fusion®, utilizes sensor data from various IoT devices to analyze and improve vehicle and driver behavior. CMT collaborates with auto insurers, automakers, gig companies, and the public sector to enhance risk assessment, safety, claims, and driver improvement programs. With headquarters in Cambridge, MA, and global offices, CMT protects millions of drivers worldwide daily.

Altana

Altana is a dynamic, intelligent, universal map of the global supply chain that offers unprecedented visibility and AI-powered insights to help users focus on critical business needs. It provides collaborative workflows for managing extended supplier and customer networks, applying AI to a vast network of supply chain data. Altana is trusted by governments, logistics providers, and major businesses worldwide for compliance, carbon management, procurement, insurance, and more.

0 - Open Source Tools

20 - OpenAI Gpts

AI and Insurance Strategy Consultant

Formal yet witty AI & Insurance expert. Powered by Breebs (www.breebs.com)

👑 Data Privacy for Insurance Companies 👑

Insurance providers collect and process personal health, financial, and property information, making it crucial to implement comprehensive data protection strategies.

Claims Brother

Chat with your new personal insurance and claims assistant - you will only need to upload your insurance policy and he will tell you if you are covered for a specific event

Lifeeventprobabilityanalyzer

Map or simulate a scenario real time analyze probability of a life event coming true based on circumstances

Environmental Disaster Analyst

Simulates and analyzes potential environmental disaster scenarios for preparedness.

RansomChatGPT

I'm a ransomware negotiation simulation and analysis bot trained with over 131 real-life negotiations. Type "start negotiation" to begin! New feature: Type "threat actor personality test"

ZEN Influencer Insurance

I create social media influencer insurance plans with a focus on legal compliance.

Health Insurance Navigator

A helpful guide for choosing and understanding health insurance plans.

Life Insurance Leads Bot

Badass Insurance Leads helps insurance agents from across the United States find the best aged life insurance leads to sell policies to.