Nestor

Revolutionizing insurance with Artificial Intelligence

Nestor is an AI-powered insurance assistant that provides clear and jargon-free answers to all your insurance questions. It can audit your insurance contracts, identify potential over-insurance or under-insurance, and suggest ways to improve your coverage. Nestor is constantly learning and can provide expert advice on a wide range of insurance topics.

For Tasks:

Click tags to check more tools for each tasksFor Jobs:

Features

Advantages

Disadvantages

Frequently Asked Questions

Alternative AI tools for Nestor

Similar sites

Nestor

Nestor is an AI-powered insurance assistant that provides clear and jargon-free answers to all your insurance questions. It can audit your insurance contracts, identify potential over-insurance or under-insurance, and suggest ways to improve your coverage. Nestor is constantly learning and can provide expert advice on a wide range of insurance topics.

Insurance Policy AI

This application utilizes AI technology to simplify the complex process of understanding health insurance policies. Unlike other apps that focus on insurance search and comparison, this app specializes in deciphering the intricate language found in policies. It provides instant access to policy analysis with a one-time payment, empowering users to gain clarity and make informed decisions regarding their health insurance coverage.

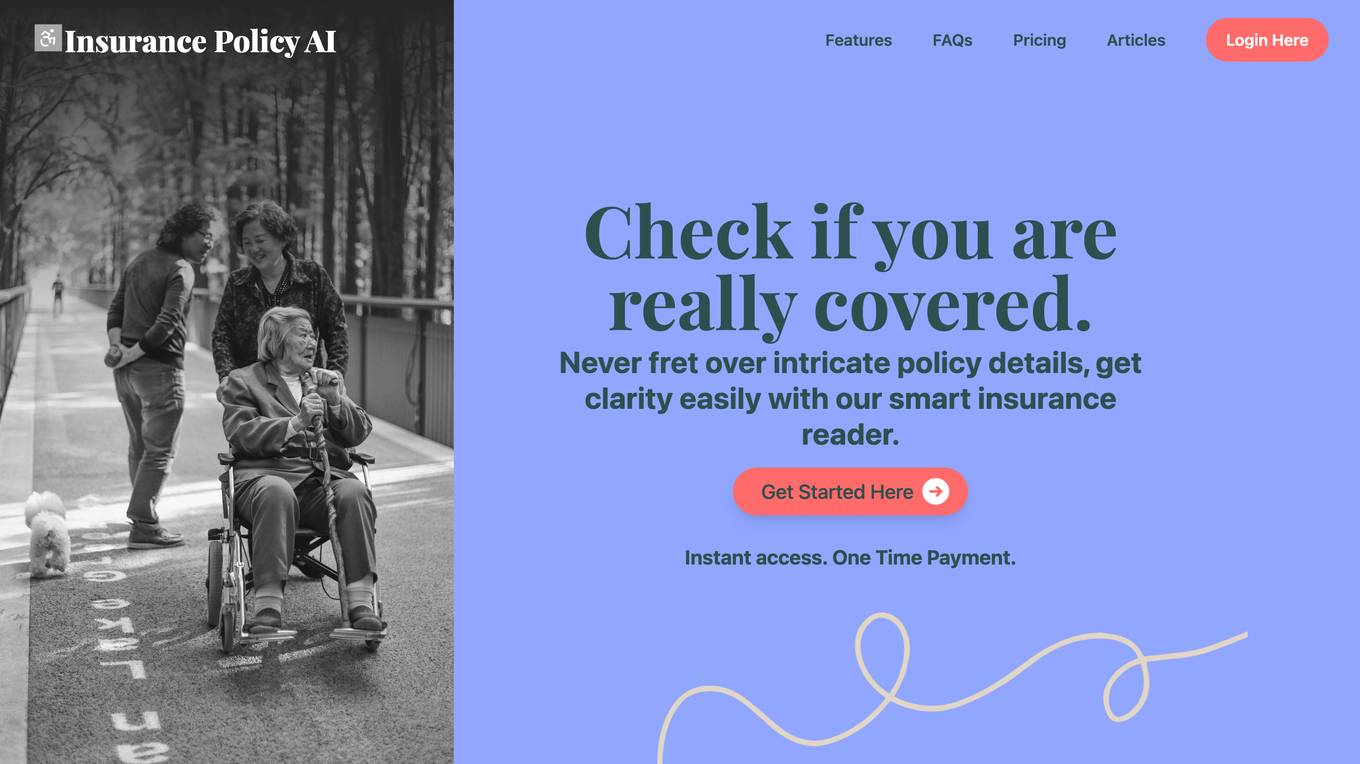

InsureSmart

InsureSmart is an AI-powered platform that empowers users to take control of their insurance needs. By leveraging artificial intelligence technology, InsureSmart offers personalized insurance solutions tailored to individual requirements. The platform provides a seamless and user-friendly experience for users to manage and optimize their insurance policies efficiently. With InsureSmart, users can access smart recommendations, compare insurance plans, and make informed decisions to secure their financial well-being.

Gradient AI

Gradient AI is a leading provider of artificial intelligence solutions for the insurance industry. Their solutions improve loss ratios and profitability by predicting underwriting and claims risks with greater accuracy, as well as reducing quote turnaround times and claim expenses through intelligent automation.

Gradient AI

Gradient AI is a leading provider of artificial intelligence solutions for the insurance industry. Its solutions improve loss ratios and profitability by predicting underwriting and claims risks with greater accuracy, as well as reducing quote turnaround times and claim expenses through intelligent automation.

Convr

Convr is an AI-driven underwriting analysis platform that helps commercial P&C insurance organizations transform their underwriting operations. It provides a modularized AI underwriting and intelligent document automation workbench that enriches and expedites the commercial insurance new business and renewal submission flow with underwriting insights, business classification, and risk scoring. Convr's mission is to solve the last big problem of commercial insurance while improving profitability and increasing efficiency.

Convr

Convr is a modularized AI underwriting and intelligent document automation workbench that enriches and expedites the commercial insurance new business and renewal submission flow with underwriting insights, business classification and risk scoring. As a trusted technology partner and advisor with deep industry expertise, we help insurance organizations transform their underwriting operations through our AI-driven digital underwriting analysis platform.

DoNotPay

DoNotPay is an AI-powered platform that helps consumers fight big corporations, protect their privacy, find hidden money, and beat bureaucracy. It offers a wide range of tools and services to help users with tasks such as disputing traffic tickets, canceling subscriptions, and getting refunds. DoNotPay is not a law firm and is not licensed to practice law. It provides a platform for legal information and self-help.

Dispute AI™

Dispute AI™ is an AI-powered DIY credit repair solution that revolutionizes the way individuals take control of their credit. With over 20 years of expertise in credit repair and financial empowerment, Dispute AI™ delivers personalized strategies backed by cutting-edge artificial intelligence to simplify and streamline the credit repair process. The platform offers tailored AI-driven tactics to challenge and resolve inaccurate credit report items effectively, providing actionable, data-driven recommendations to improve credit scores. Users can handle credit repair on their terms, anytime, anywhere, without the need to hire expensive credit repair companies. Dispute AI™ aims to make credit improvement accessible, efficient, and impactful, empowering individuals to achieve financial freedom.

Go Legal AI

Go Legal AI is the UK's #1 Consumer Legal Tech Platform offering online legal services, support, and advice from top lawyers. The platform provides free lawyer consultations, generates legal documents 10x faster with award-winning Legal AI, reviews legal documents 90% faster, and offers expert advice from top lawyers and service providers at discounted rates. Users can get instant answers 24/7, collaborate and sign documents, monitor supply chain risks with instant alerts, and save money with exclusive deals from partners. The platform caters to both individuals and businesses, providing smart templates, risk & insolvency tracking, business health checks, legal insights, how-to guides, and glossaries.

CARCO

CARCO is an advanced Mobile AI Fraud Prevention application designed to protect insurance carriers and consumers by identifying and preventing risk events and fraudulent activities. The application streamlines the inspection process through integrated AI and fraud alert validation technology, providing a back-office solution that is easily integrated into mobile platforms, cost-effective, and fraud-detecting. CARCO also offers NMVTIS, a premier system in the U.S. that requires reporting of vehicle title data. With over 50 million transactions completed to date, CARCO has a proven track record in fraud prevention and risk mitigation for the insurance industry.

AskLegal.bot

AskLegal.bot is a free AI-powered legal assistant that provides instant answers to your legal questions. With our proprietary AI technology, we synthesize information from thousands of sources to offer tailored guidance that aligns with current laws and regulations. Our self-service document review tool helps you understand various legal documents, including rental agreements, employment contracts, service agreements, insurance policies, and more. AskLegal.bot is confidential and secure, ensuring the privacy of your discussions with top-tier data security and privacy measures.

Ask AI Lawyer

Ask AI Lawyer is a free online legal information service that utilizes advanced artificial intelligence technology to provide answers to legal questions within 5 minutes. It is powered by OpenAI's GPT models and offers general legal information on various topics such as traffic laws, business start-ups, tax law, family law, business contracts, employment law, landlord/tenant matters, wills and trusts, and real estate law. The AI analyzes user questions, cross-references them with a database of legal information, and provides comprehensive answers. Answers are published publicly under the "Latest Questions" section for everyone to view. The service is designed to provide quick and easy access to legal information but should not be considered as a substitute for professional legal advice.

CompFox

CompFox is an AI-enhanced legal research tool designed for workers' compensation professionals in California. It streamlines legal research by providing access to a comprehensive database of workers' compensation case law and statutory codes. With features like AI-driven search, chat for case-specific analysis, intelligent case file analysis, collaborative research folders, and one-stop statutory code search, CompFox helps attorneys and insurance adjusters save time, reduce stress, and improve case outcomes.

GiveFlag

GiveFlag is an AI-powered platform designed to assist businesses in solving problems more effectively. It offers a comprehensive solution by analyzing various documents such as business intelligence reports, form 10-K filings, policy analysis, contracts, lead generation, legislation analysis, credit card FAQ, overseas land rights, academic papers, privacy policies, insurance reviews, business plans, Excel docs, M&A transactions, VC deals, and scenario analysis. Additionally, GiveFlag helps users find potential customers, vendors, partners, and investors quickly by providing contact information based on specific search terms. The platform emphasizes the collaboration between AI technology and human experts to enhance problem-solving capabilities and automate administrative tasks.

TitleCorp.AI

TitleCorp.AI is a dynamic company specializing in the research and development of title insurance and real estate services that leverage advanced technologies like artificial intelligence and blockchain to enhance the transactional experience for clients. By simplifying complex title workflows, TitleCorp aims to reduce the time it takes to complete real estate transactions while minimizing risks associated with title claims. The company is committed to innovation and aims to provide more efficient, accurate, and secure title insurance services compared to traditional methods.

For similar tasks

Nestor

Nestor is an AI-powered insurance assistant that provides clear and jargon-free answers to all your insurance questions. It can audit your insurance contracts, identify potential over-insurance or under-insurance, and suggest ways to improve your coverage. Nestor is constantly learning and can provide expert advice on a wide range of insurance topics.

BluePond GenAI PaaS

BluePond GenAI PaaS is an automation and insights powerhouse tailored for Property and Casualty Insurance. It offers end-to-end execution support from GenAI data scientists, engineers & human-in-the-loop processing. The platform provides automated intake extraction, classification enrichment, validation, complex document analysis, workflow automation, and decisioning. Users benefit from rapid deployment, complete control of data & IP, and pre-trained P&C domain library. BluePond GenAI PaaS aims to energize and expedite GenAI initiatives throughout the insurance value chain.

For similar jobs

Empathy

Empathy is a platform that offers support solutions for life's hardest moments, focusing on helping people through transitions such as legacy planning, loss, and leave. The platform provides practical, emotional, and logistical support on demand, aiming to empower individuals to navigate life's toughest transitions with ease. Empathy is trusted by industry leaders and offers category-creating solutions like Loss Support and LifeVault to assist individuals and families in moving forward after challenging experiences.

Quandri

Quandri is a digital workforce solution that automates repetitive tasks for insurance brokerages and agencies. By leveraging advanced automation and AI, Quandri's digital workers can help businesses save time, reduce errors, and increase efficiency. Quandri's out-of-the-box digital workers can be deployed seamlessly into any agency or brokerage, and can be trained to perform a variety of tasks, including EDI processing, closing broker activities, eDoc processing, inbound lead management, and renewal reviews. With Quandri, businesses can free up their team's time to focus on more value-producing activities, such as building relationships with clients and growing their business.

Insurance Policy AI

This application utilizes AI technology to simplify the complex process of understanding health insurance policies. Unlike other apps that focus on insurance search and comparison, this app specializes in deciphering the intricate language found in policies. It provides instant access to policy analysis with a one-time payment, empowering users to gain clarity and make informed decisions regarding their health insurance coverage.

StrAIberry

StrAIberry is an AI solution for the Patient, Insurance, Dentist triangle that can organize and solve the issues of personal oral hygiene, appointment setting, second eye opinion with the highest precision for dentists, insurance fraud, and risk management for insurance while saving cost, time and paper waste.

Convr

Convr is an AI-driven underwriting analysis platform that helps commercial P&C insurance organizations transform their underwriting operations. It provides a modularized AI underwriting and intelligent document automation workbench that enriches and expedites the commercial insurance new business and renewal submission flow with underwriting insights, business classification, and risk scoring. Convr's mission is to solve the last big problem of commercial insurance while improving profitability and increasing efficiency.

Gradient AI

Gradient AI is a leading provider of artificial intelligence solutions for the insurance industry. Their solutions improve loss ratios and profitability by predicting underwriting and claims risks with greater accuracy, as well as reducing quote turnaround times and claim expenses through intelligent automation.

Nestor

Nestor is an AI-powered insurance assistant that provides clear and jargon-free answers to all your insurance questions. It can audit your insurance contracts, identify potential over-insurance or under-insurance, and suggest ways to improve your coverage. Nestor is constantly learning and can provide expert advice on a wide range of insurance topics.

Convr

Convr is a modularized AI underwriting and intelligent document automation workbench that enriches and expedites the commercial insurance new business and renewal submission flow with underwriting insights, business classification and risk scoring. As a trusted technology partner and advisor with deep industry expertise, we help insurance organizations transform their underwriting operations through our AI-driven digital underwriting analysis platform.

SimpleTalk AI

SimpleTalk AI is an advanced AI application that offers voice AI technology to businesses, enabling them to streamline customer interactions, automate tasks, and enhance communication efficiency. With features like universal calendar syncing, conversational AI voicemail replacement, seamless handoff capability, intelligent real-time interaction, and global communication capabilities, SimpleTalk AI revolutionizes customer relationship management. The application provides custom-made voice AI agents for various industries, such as real estate, solar, health insurance, tech support, and credit repair, offering tailored solutions for different use cases. SimpleTalk AI empowers businesses to break language barriers, automate for efficiency, innovate customer service, and maximize savings by leveraging AI-driven communication solutions.

Feathery

Feathery is an AI-powered platform that enables users to create powerful forms and workflows without the need for coding. It offers advanced features such as AI data extraction, document intelligence, signatures, and collaboration tools. Feathery caters to various industries like insurance, healthcare, financial services, software, and education, providing solutions to streamline processes and enhance user experiences. The platform is designed to automate form workflows, extract and fill documents, and connect with different systems, making it a versatile tool for data management and workflow optimization.

Federato

Federato is an AI-powered platform that integrates Google Cloud's AI capabilities to provide new AI underwriting solutions for the insurance industry. It aims to revolutionize underwriting processes by leveraging AI technology to enhance risk assessment, portfolio management, and decision-making. Federato's RiskOps platform empowers underwriters with powerful insights, real-time risk selection guidance, and unified underwriting workflows, enabling them to make more informed decisions and improve operational efficiency.

Further AI

Further AI is an AI application designed to revolutionize insurance operations by providing AI Teammates for various tasks such as quote generation, policy checking, and renewal follow-ups. The platform aims to enhance efficiency, reduce errors, and automate repetitive tasks in the insurance industry. Further AI offers innovative solutions for insurance brokers, general agents, and insurers, allowing them to scale their business without the need for additional hiring. By leveraging AI technology, users can streamline workflows, automate client calls, navigate portals, and extract data from complex documents with ease and accuracy.

InsureLife

InsureLife is an AI-powered insurance distribution platform that offers an innovative Foundational AI platform for financial services. The platform enables brands to increase revenue, enhance profitability, and achieve growth by automatically cross-selling personalized financial products based on customer profiles. InsureLife's Agentic AI platform provides a frictionless experience for customers, boosting profitability through personalized product recommendations. The platform seamlessly integrates into existing workflows without complex integrations or subscription fees.

InsureSmart

InsureSmart is an AI-powered platform that empowers users to take control of their insurance needs. By leveraging artificial intelligence technology, InsureSmart offers personalized insurance solutions tailored to individual requirements. The platform provides a seamless and user-friendly experience for users to manage and optimize their insurance policies efficiently. With InsureSmart, users can access smart recommendations, compare insurance plans, and make informed decisions to secure their financial well-being.

Focalx

Focalx is an AI-powered vehicle inspection technology that revolutionizes vehicle handovers in automotive and logistics industries. It empowers inspections, digitalizes vehicle condition tracking, and accelerates claims, repairs, and recovery processes. Focalx's Visual AI detects damages instantly, generates detailed vehicle condition reports, and provides actionable insights for managing damages and inspections. The application is trusted by businesses worldwide for its transparency, efficiency, and cost-saving benefits.

Sixfold

Sixfold is a risk assessment AI solution designed exclusively for insurance underwriters. The platform enhances underwriting efficiency, accuracy, and transparency for insurers, MGAs, and reinsurers. Sixfold's AI capabilities enable faster case reviews, appetite-aware risk insights, and data gathering from days to minutes. The application ingests underwriting guidelines, extracts risk data, and provides tailored risk insights to align with unique risk preferences. It offers customized solutions for various insurance lines and features intake prioritization, contextual risk insights, risk signal detection, inconsistency identification, and data summarization.

Sonant

Sonant is an AI receptionist designed specifically for insurance agencies, brokers, and distributors. It aims to turn routine incoming calls into revenue within a short period of time. The AI tool enables 24/7 personalized service with zero waiting times, multilingual capabilities, and the ability to transfer calls to human agents when necessary. Sonant helps agencies improve productivity, profitability, and client satisfaction by automating routine tasks, appointment scheduling, quote intaking, and post-call notes. It is GDPR compliant and integrates seamlessly with popular Agency Management Systems and CRM software.

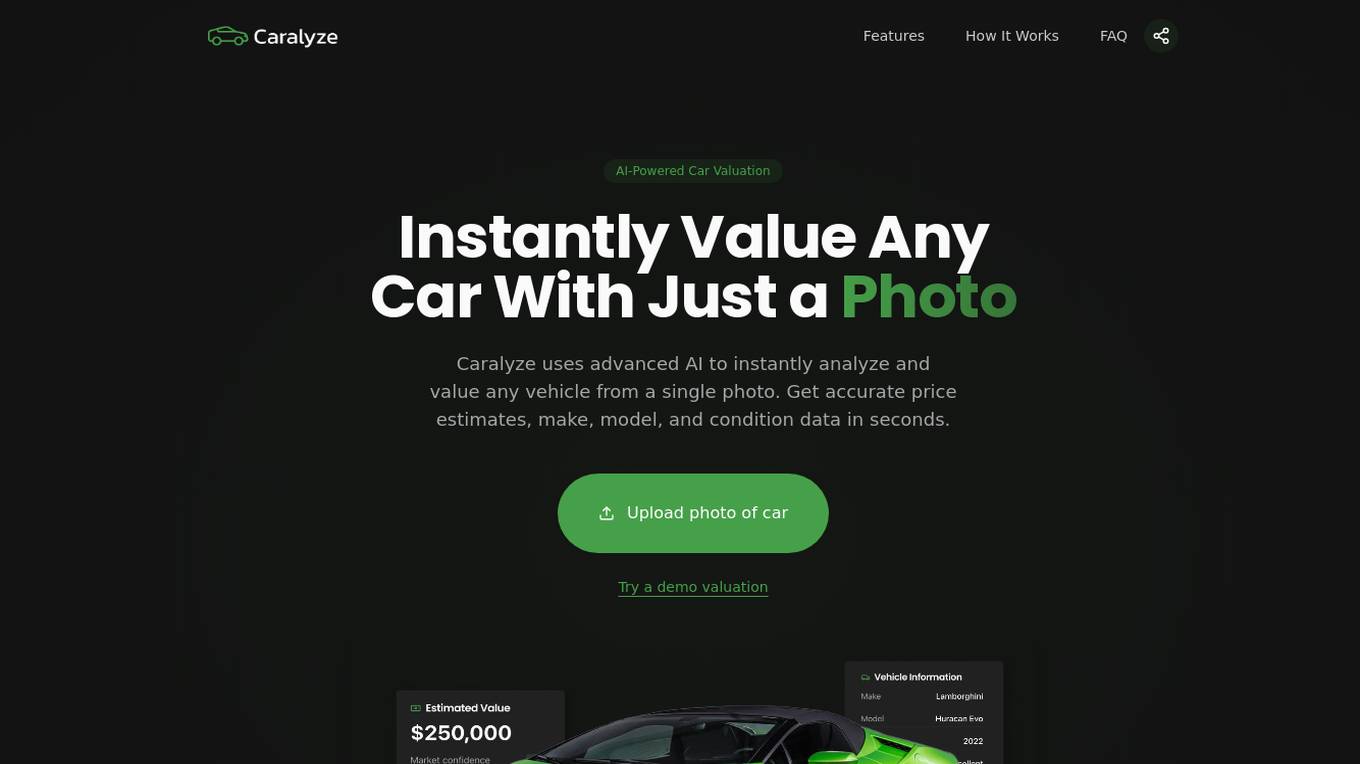

Caralyze

Caralyze is an AI tool that provides instant car valuation based on a single photo. By leveraging advanced artificial intelligence algorithms, Caralyze accurately assesses the value of a car by analyzing key features and market trends. Users can simply upload a photo of their car and receive a quick and reliable valuation, saving time and effort compared to traditional methods. With Caralyze, car owners can make informed decisions when selling, buying, or insuring their vehicles.

Verisquad

Verisquad is an AI-powered platform that specializes in claim verification. It leverages advanced artificial intelligence algorithms to streamline and automate the process of verifying claims, ensuring accuracy and efficiency. By harnessing the power of AI, Verisquad offers a reliable solution for businesses and individuals seeking to validate claims quickly and effectively.

EHVA.ai

EHVA.ai is a Conversational AI tool that combines heart and science to create a unique AI experience. It offers AI phone technology that talks to people by phone to achieve various goals. EHVA.ai provides non-conversational features like AI Backstopping and AI Looking Glass, enhancing productivity and accuracy in different industries. The application aims to bridge the gap between human interaction and AI technology, offering a human-like experience with the efficiency of artificial intelligence.

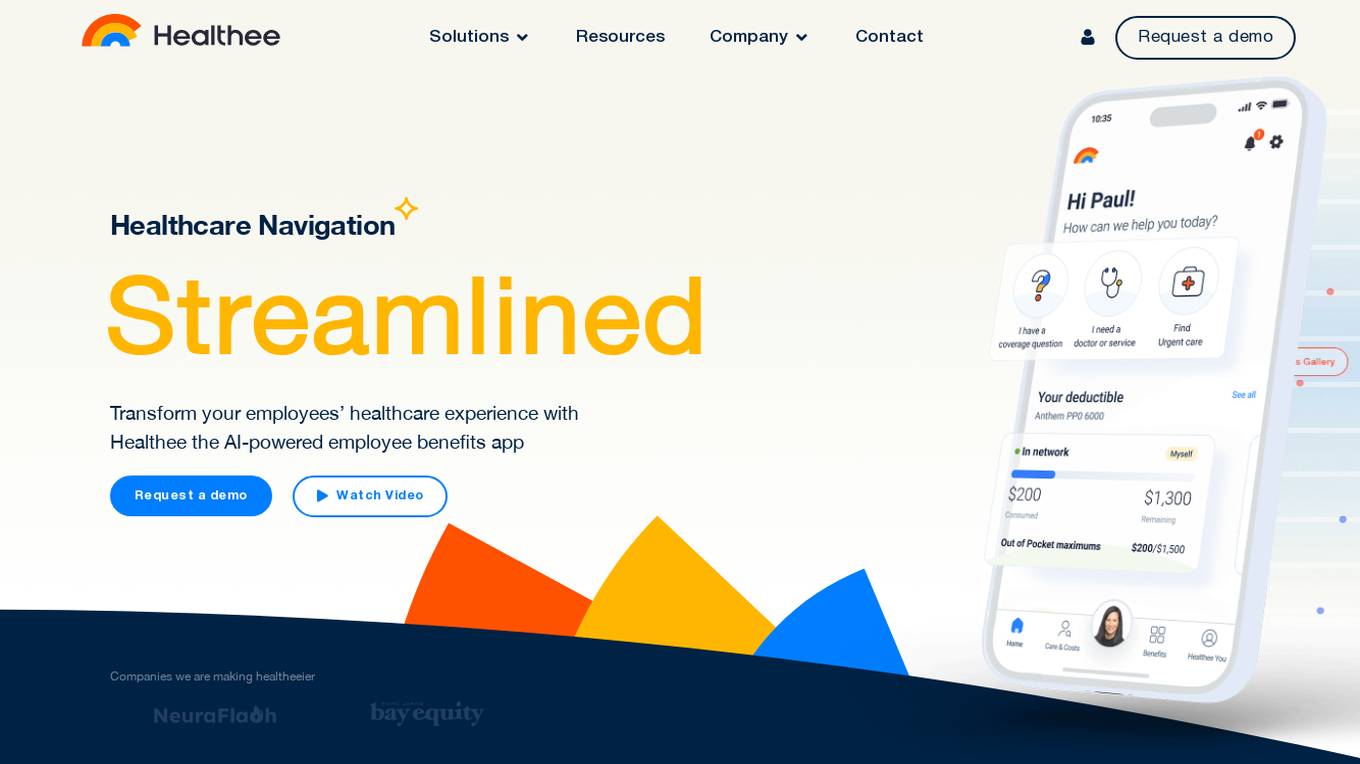

Healthee

Healthee is an AI-powered employee benefits app that simplifies healthcare navigation for employees and stakeholders. It provides personalized answers to healthcare queries, streamlines open enrollment processes, and offers real-time insights and data-driven preventive care recommendations. With Healthee, employees can access vital health plan information anytime through a user-friendly mobile app.

StrataReports

StrataReports is an AI-driven tool that specializes in transforming lengthy condo documents into comprehensive insights for real estate professionals, insurance brokers, and property buyers and sellers. By leveraging cutting-edge AI technology, the platform reads, analyzes, and summarizes complex documents to provide rapid yet in-depth understanding of building positives and drawbacks. With customizable reporting options and an interactive chatbot, StrataReports empowers users to make informed decisions with confidence in the Canadian real estate market.

VUW.ai

VUW.ai is a unique virtual underwriting platform that offers end-to-end digital trading solutions for specialty insurance lines. The platform leverages machine learning to improve risk selection, reduce volatility, increase consistency, and enhance profitability and underwriting controls while lowering operating costs. VUW.ai aims to revolutionize the insurance market by providing a cost-effective and tech-based underwriting solution that caters to brokers and capacity providers. The platform also offers services in Property, Casualty, and Marine Cargo business, with plans to expand into other classes like Livestock, Fine Art, and Political Violence.

BluePond GenAI PaaS

BluePond GenAI PaaS is an automation and insights powerhouse tailored for Property and Casualty Insurance. It offers end-to-end execution support from GenAI data scientists, engineers & human-in-the-loop processing. The platform provides automated intake extraction, classification enrichment, validation, complex document analysis, workflow automation, and decisioning. Users benefit from rapid deployment, complete control of data & IP, and pre-trained P&C domain library. BluePond GenAI PaaS aims to energize and expedite GenAI initiatives throughout the insurance value chain.