Further AI

Empowering Insurance Operations with AI Teammates

Further AI is an AI application designed to revolutionize insurance operations by providing AI Teammates for various tasks such as quote generation, policy checking, and renewal follow-ups. The platform aims to enhance efficiency, reduce errors, and automate repetitive tasks in the insurance industry. Further AI offers innovative solutions for insurance brokers, general agents, and insurers, allowing them to scale their business without the need for additional hiring. By leveraging AI technology, users can streamline workflows, automate client calls, navigate portals, and extract data from complex documents with ease and accuracy.

For Tasks:

Click tags to check more tools for each tasksFor Jobs:

Features

Advantages

Disadvantages

Frequently Asked Questions

Alternative AI tools for Further AI

Similar sites

Further AI

Further AI is an AI application designed to revolutionize insurance operations by providing AI Teammates for various tasks such as quote generation, policy checking, and renewal follow-ups. The platform aims to enhance efficiency, reduce errors, and automate repetitive tasks in the insurance industry. Further AI offers innovative solutions for insurance brokers, general agents, and insurers, allowing them to scale their business without the need for additional hiring. By leveraging AI technology, users can streamline workflows, automate client calls, navigate portals, and extract data from complex documents with ease and accuracy.

Quandri

Quandri is a digital workforce solution that automates repetitive tasks for insurance brokerages and agencies. By leveraging advanced automation and AI, Quandri's digital workers can help businesses save time, reduce errors, and increase efficiency. Quandri's out-of-the-box digital workers can be deployed seamlessly into any agency or brokerage, and can be trained to perform a variety of tasks, including EDI processing, closing broker activities, eDoc processing, inbound lead management, and renewal reviews. With Quandri, businesses can free up their team's time to focus on more value-producing activities, such as building relationships with clients and growing their business.

Roots

Roots is an AI Agent Platform designed specifically for the insurance industry, offering a comprehensive suite of tools and features to enhance operational efficiency, streamline processes, and improve customer experiences. The platform includes AI Agents, InsurGPT™, Cockpit, Human-in-the-Loop, Workflow Orchestration, and Responsible AI components. Roots aims to revolutionize insurance automation by providing transparent, ethical, and trustworthy AI solutions tailored for insurance companies.

InsureSmart

InsureSmart is an AI-powered platform that empowers users to take control of their insurance needs. By leveraging artificial intelligence technology, InsureSmart offers personalized insurance solutions tailored to individual requirements. The platform provides a seamless and user-friendly experience for users to manage and optimize their insurance policies efficiently. With InsureSmart, users can access smart recommendations, compare insurance plans, and make informed decisions to secure their financial well-being.

Zimply

Zimply is an AI tool that offers solutions for automating processes and work tasks. It provides AI assistants for various functions such as order registration, purchase order matching, accounting, and leads generation. Zimply aims to streamline operations, enhance efficiency, and simplify tasks through intelligent automation. The platform caters to different industries by offering AI-assistants that can work in systems where repetitive tasks are prevalent. With a focus on minimizing errors, reducing costs, and providing 24/7 availability, Zimply helps businesses optimize their workflows and free up time for more critical activities.

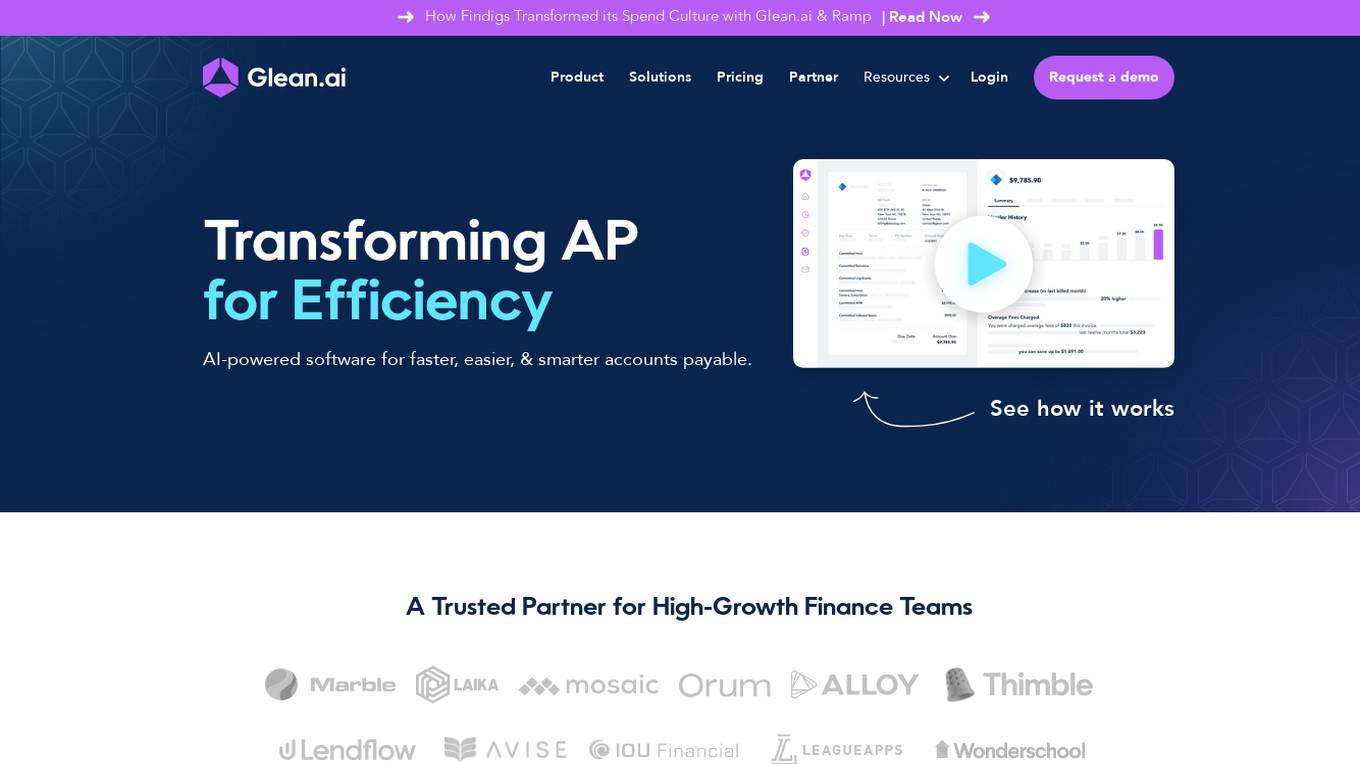

Glean.ai

Glean.ai is an AI-powered software designed to enhance accounts payable (AP) processes, making them faster, easier, and smarter. It offers a range of features to streamline AP tasks, including automated data extraction, GL coding, bill approvals and payments, accruals, prepaid amortizations, and more. Glean.ai also provides valuable insights into spending patterns, helping businesses identify areas of overspending and uncover opportunities for cost savings. With its user-friendly interface and robust data benchmarking capabilities, Glean.ai empowers accounting and FP&A teams to collaborate seamlessly, plan effectively, and make informed decisions regarding vendor spend.

AizenFlow

AizenFlow is an AI-powered platform designed to help freight professionals quickly find, vet, and connect with carriers across North America. It streamlines the carrier vetting process by providing compliance, insurance, inspection data, and asset numbers in one convenient place, allowing users to make informed decisions and book with confidence. AizenFlow aims to eliminate the time-consuming and manual tasks involved in carrier vetting, enabling users to focus on booking more loads and building better relationships.

Silverwork Solutions

Silverwork Solutions is a fintech company that provides AI-powered mortgage automation solutions. Its Digital Workforce Solutions are role-based autonomous bots that integrate seamlessly into loan manufacturing processes, from application to post-closing. These bots utilize AI to make predictions and decisions, enhancing the loan processing experience. Silverwork's solutions empower lenders to realize the full potential of automation and transform their operations, allowing them to focus on higher-value activities while the bots handle repetitive tasks.

TitleCorp.AI

TitleCorp.AI is a dynamic company specializing in the research and development of title insurance and real estate services that leverage advanced technologies like artificial intelligence and blockchain to enhance the transactional experience for clients. By simplifying complex title workflows, TitleCorp aims to reduce the time it takes to complete real estate transactions while minimizing risks associated with title claims. The company is committed to innovation and aims to provide more efficient, accurate, and secure title insurance services compared to traditional methods.

FlowX.AI

FlowX.AI is a Multi-Agent AI Platform designed for Banking and Insurance Modernization. It offers a cutting-edge AI-native agentic platform for building and deploying AI agents and mission-critical AI-enabled systems in highly regulated industries. The platform enables businesses to build the next generation of banking and insurance systems in weeks, not years, by providing faster development, time to market, and reduced maintenance and implementation costs.

Chargezoom

Chargezoom is an AI-powered accounts receivable (AR) solution that helps businesses get paid faster. It automates many of the tasks associated with AR, such as invoicing, payment reminders, and reconciliation. Chargezoom also provides businesses with insights into their AR performance, so they can make better decisions about how to manage their cash flow. Chargezoom is a cloud-based solution that is easy to use and integrates with a variety of accounting software programs.

Synthreo

Synthreo is an AI tool that empowers businesses to streamline operations, reduce costs, and drive growth through intelligent AI agents. It provides cutting-edge AI agent solutions that automate routine tasks, enhance decision-making, and create seamless collaboration between human teams and digital labor. Synthreo offers transformative advantages for businesses of all sizes, enabling operational efficiency and strategic growth. The platform implements advanced security measures, complies with industry standards, and upholds ethical AI usage. Businesses can leverage AI-powered digital labor to achieve unprecedented efficiency, innovation, and growth.

EliseAI

EliseAI is an industry-leading AI application designed for the housing and healthcare sectors. It offers a comprehensive suite of AI solutions for property management companies, assisting in leasing, maintenance, renewals, and delinquency management. EliseAI streamlines communication across multiple channels, providing personalized, omni-channel support to prospects and residents. The platform automates tasks such as responding to maintenance requests, sending renewal reminders, and reducing delinquencies through automated reminders and follow-ups. With features like voice, text, email, and chat support, EliseAI enhances the prospect-to-resident journey, improving operational efficiency and resident satisfaction.

Tonkean

Tonkean is an enterprise intake orchestration platform powered by AI. It helps businesses automate and streamline their intake processes, such as procurement, legal, and more. Tonkean's AI-powered features include an intelligent AI Front Door, guided intake, request status tracker, and custom apps for ops teams. With Tonkean, businesses can increase adoption, efficiency, and compliance in their intake processes.

i10X

i10X is an all-in-one AI tool that provides users with a comprehensive workspace to chat with AI, create images and videos, analyze documents, and access over 500 specialized AI agents. It offers productivity gains by streamlining workflows, saving time on repetitive tasks, and reducing software costs. i10X caters to various roles and needs, such as entrepreneurs, content creators, students, consultants, and HR professionals, by offering features like business plan creation, market research analysis, product strategy development, financial modeling, and more. With a focus on efficiency and reliability, i10X ensures plagiarism-free and original outputs for users to confidently publish and present their work. The tool is cost-effective, with a subscription model that saves users up to 90% compared to paying for separate AI tools. i10X is designed to enhance work efficiency, keep users focused, and provide a seamless workspace for diverse tasks.

Canopy

Canopy is an all-in-one practice management software for accounting and tax firms. It helps firms manage their clients, documents, workflow, time and billing, and more. Canopy is designed to help firms work more efficiently and effectively, so they can focus on providing better client experiences.

For similar tasks

Further AI

Further AI is an AI application designed to revolutionize insurance operations by providing AI Teammates for various tasks such as quote generation, policy checking, and renewal follow-ups. The platform aims to enhance efficiency, reduce errors, and automate repetitive tasks in the insurance industry. Further AI offers innovative solutions for insurance brokers, general agents, and insurers, allowing them to scale their business without the need for additional hiring. By leveraging AI technology, users can streamline workflows, automate client calls, navigate portals, and extract data from complex documents with ease and accuracy.

Doc2Lang

Doc2Lang is an AI-powered document translation service that offers fast and accurate translations for various file formats including Excel, Word, PowerPoint, and PDF. Users can upload their files, have them automatically translated by the AI, and then download the translated documents. The service provides high-quality translations tailored to business needs and ensures security by allowing users to delete uploaded files for data removal. With a simple and convenient process, flexible billing options, and support for multiple languages, Doc2Lang is a reliable solution for document translation needs.

For similar jobs

Wolters Kluwer ELM Solutions

Wolters Kluwer ELM Solutions is a leading provider of enterprise legal spend and matter management, AI legal bill review, and legal analytics solutions. Our innovative technology and end-to-end customer experience help corporate legal and insurance claims departments drive world-class business outcomes.

Gradient AI

Gradient AI is a leading provider of artificial intelligence solutions for the insurance industry. Their solutions improve loss ratios and profitability by predicting underwriting and claims risks with greater accuracy, as well as reducing quote turnaround times and claim expenses through intelligent automation.

Arya.ai

Arya.ai is an AI tool designed for Banks, Insurers, and Financial Services to deploy safe, responsible, and auditable AI applications. It offers a range of AI Apps, ML Observability Tools, and a Decisioning Platform. Arya.ai provides curated APIs, ML explainability, monitoring, and audit capabilities. The platform includes task-specific AI models for autonomous underwriting, claims processing, fraud monitoring, and more. Arya.ai aims to facilitate the rapid deployment and scaling of AI applications while ensuring institution-wide adoption of responsible AI practices.

Further AI

Further AI is an AI application designed to revolutionize insurance operations by providing AI Teammates for various tasks such as quote generation, policy checking, and renewal follow-ups. The platform aims to enhance efficiency, reduce errors, and automate repetitive tasks in the insurance industry. Further AI offers innovative solutions for insurance brokers, general agents, and insurers, allowing them to scale their business without the need for additional hiring. By leveraging AI technology, users can streamline workflows, automate client calls, navigate portals, and extract data from complex documents with ease and accuracy.

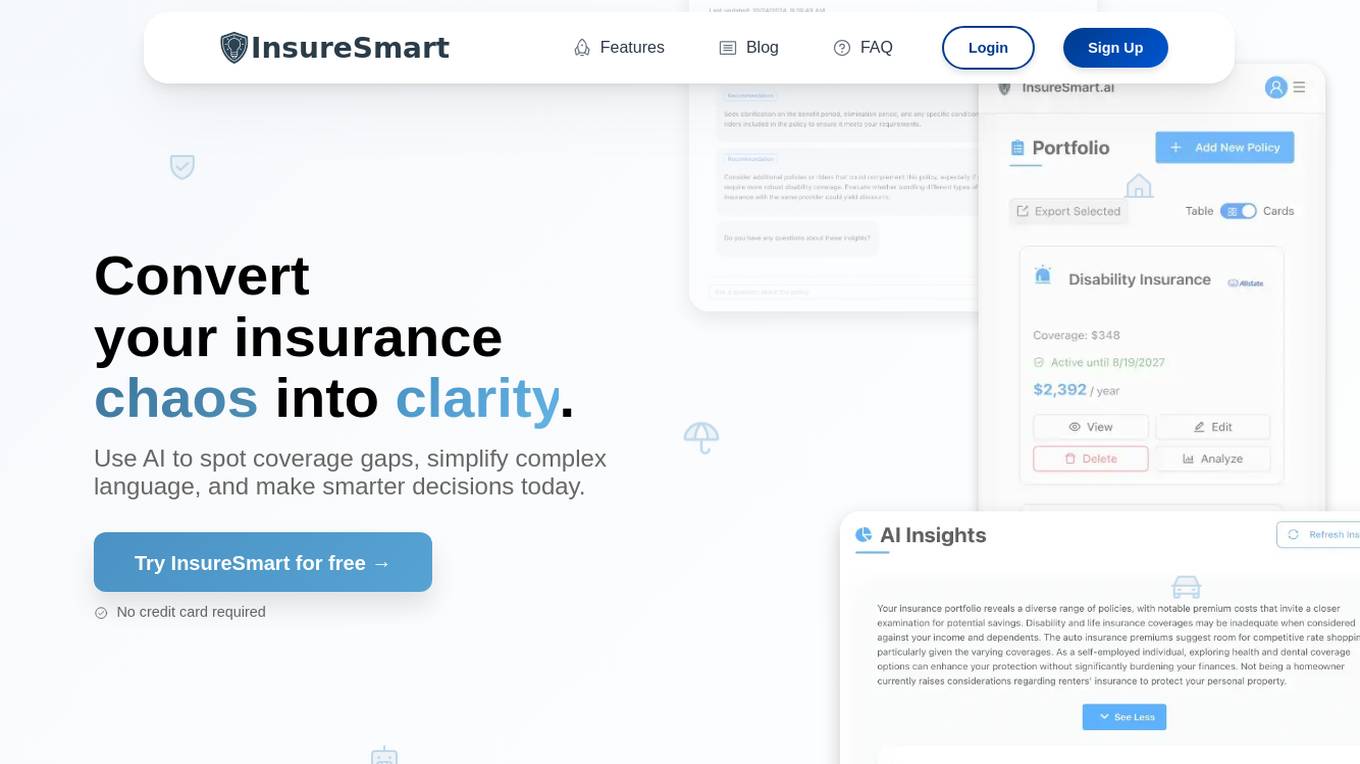

InsureSmart

InsureSmart is an AI-powered platform that empowers users to take control of their insurance needs. By leveraging artificial intelligence technology, InsureSmart offers personalized insurance solutions tailored to individual requirements. The platform provides a seamless and user-friendly experience for users to manage and optimize their insurance policies efficiently. With InsureSmart, users can access smart recommendations, compare insurance plans, and make informed decisions to secure their financial well-being.

Focalx

Focalx is an AI-powered vehicle inspection technology that revolutionizes vehicle handovers in automotive and logistics industries. It empowers inspections, digitalizes vehicle condition tracking, and accelerates claims, repairs, and recovery processes. Focalx's Visual AI detects damages instantly, generates detailed vehicle condition reports, and provides actionable insights for managing damages and inspections. The application is trusted by businesses worldwide for its transparency, efficiency, and cost-saving benefits.

Verisquad

Verisquad is an AI-powered platform that specializes in claim verification. It leverages advanced artificial intelligence algorithms to streamline and automate the process of verifying claims, ensuring accuracy and efficiency. By harnessing the power of AI, Verisquad offers a reliable solution for businesses and individuals seeking to validate claims quickly and effectively.

Roots

Roots is an AI Agent Platform designed specifically for the insurance industry, offering a comprehensive suite of tools and features to enhance operational efficiency, streamline processes, and improve customer experiences. The platform includes AI Agents, InsurGPT™, Cockpit, Human-in-the-Loop, Workflow Orchestration, and Responsible AI components. Roots aims to revolutionize insurance automation by providing transparent, ethical, and trustworthy AI solutions tailored for insurance companies.

Empathy

Empathy is a platform that offers support for life's hardest moments, from planning a legacy to navigating loss. It partners with leading organizations to provide practical, emotional, and logistical support on demand. Empathy helps individuals and families move forward by offering tools and guidance for funeral planning, estate tasks, emotional support, and legacy planning. The platform aims to reduce complexity and deliver meaningful outcomes by empowering people to plan for and move through life's biggest transitions.

Quandri

Quandri is a digital workforce solution that automates repetitive tasks for insurance brokerages and agencies. By leveraging advanced automation and AI, Quandri's digital workers can help businesses save time, reduce errors, and increase efficiency. Quandri's out-of-the-box digital workers can be deployed seamlessly into any agency or brokerage, and can be trained to perform a variety of tasks, including EDI processing, closing broker activities, eDoc processing, inbound lead management, and renewal reviews. With Quandri, businesses can free up their team's time to focus on more value-producing activities, such as building relationships with clients and growing their business.

Insurance Policy AI

This application utilizes AI technology to simplify the complex process of understanding health insurance policies. Unlike other apps that focus on insurance search and comparison, this app specializes in deciphering the intricate language found in policies. It provides instant access to policy analysis with a one-time payment, empowering users to gain clarity and make informed decisions regarding their health insurance coverage.

StrAIberry

StrAIberry is an AI solution for the Patient, Insurance, Dentist triangle that can organize and solve the issues of personal oral hygiene, appointment setting, second eye opinion with the highest precision for dentists, insurance fraud, and risk management for insurance while saving cost, time and paper waste.

Convr

Convr is an AI-driven underwriting analysis platform that helps commercial P&C insurance organizations transform their underwriting operations. It provides a modularized AI underwriting and intelligent document automation workbench that enriches and expedites the commercial insurance new business and renewal submission flow with underwriting insights, business classification, and risk scoring. Convr's mission is to solve the last big problem of commercial insurance while improving profitability and increasing efficiency.

Nestor

Nestor is an AI-powered insurance assistant that provides clear and jargon-free answers to all your insurance questions. It can audit your insurance contracts, identify potential over-insurance or under-insurance, and suggest ways to improve your coverage. Nestor is constantly learning and can provide expert advice on a wide range of insurance topics.

Convr

Convr is a modularized AI underwriting and intelligent document automation workbench that enriches and expedites the commercial insurance new business and renewal submission flow with underwriting insights, business classification and risk scoring. As a trusted technology partner and advisor with deep industry expertise, we help insurance organizations transform their underwriting operations through our AI-driven digital underwriting analysis platform.

SimpleTalk AI

SimpleTalk AI is an advanced AI application that offers voice AI technology to businesses, enabling them to streamline customer interactions, automate tasks, and enhance communication efficiency. With features like universal calendar syncing, conversational AI voicemail replacement, seamless handoff capability, intelligent real-time interaction, and global communication capabilities, SimpleTalk AI revolutionizes customer relationship management. The application provides custom-made voice AI agents for various industries, such as real estate, solar, health insurance, tech support, and credit repair, offering tailored solutions for different use cases. SimpleTalk AI empowers businesses to break language barriers, automate for efficiency, innovate customer service, and maximize savings by leveraging AI-driven communication solutions.

Feathery

Feathery is an AI-powered platform that enables users to create powerful forms and workflows without the need for coding. It offers advanced features such as AI data extraction, document intelligence, signatures, and collaboration tools. Feathery caters to various industries like insurance, healthcare, financial services, software, and education, providing solutions to streamline processes and enhance user experiences. The platform is designed to automate form workflows, extract and fill documents, and connect with different systems, making it a versatile tool for data management and workflow optimization.

Federato

Federato is an AI-powered platform that integrates Google Cloud's AI capabilities to provide new AI underwriting solutions for the insurance industry. It aims to revolutionize underwriting processes by leveraging AI technology to enhance risk assessment, portfolio management, and decision-making. Federato's RiskOps platform empowers underwriters with powerful insights, real-time risk selection guidance, and unified underwriting workflows, enabling them to make more informed decisions and improve operational efficiency.

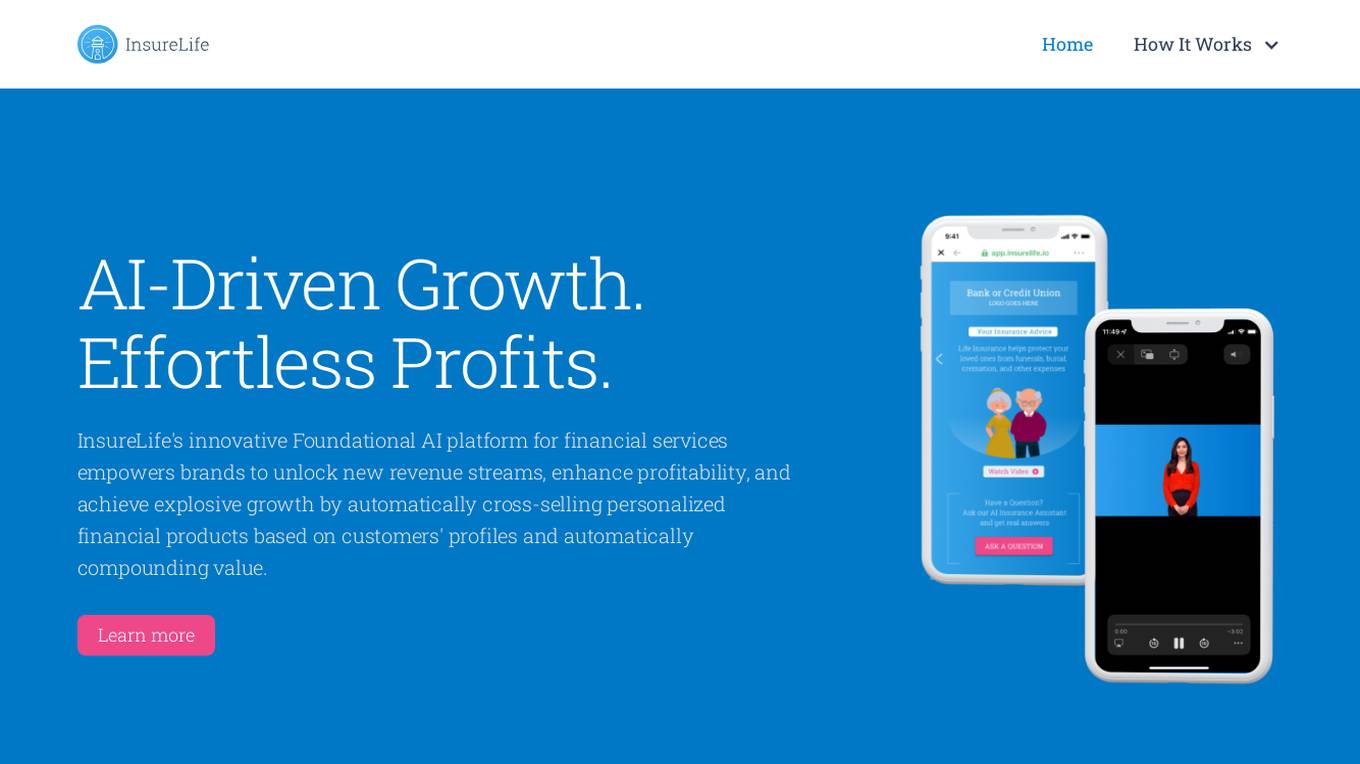

InsureLife

InsureLife is an AI-powered insurance distribution platform that offers an innovative Foundational AI platform for financial services. The platform enables brands to increase revenue, enhance profitability, and achieve growth by automatically cross-selling personalized financial products based on customer profiles. InsureLife's Agentic AI platform provides a frictionless experience for customers, boosting profitability through personalized product recommendations. The platform seamlessly integrates into existing workflows without complex integrations or subscription fees.

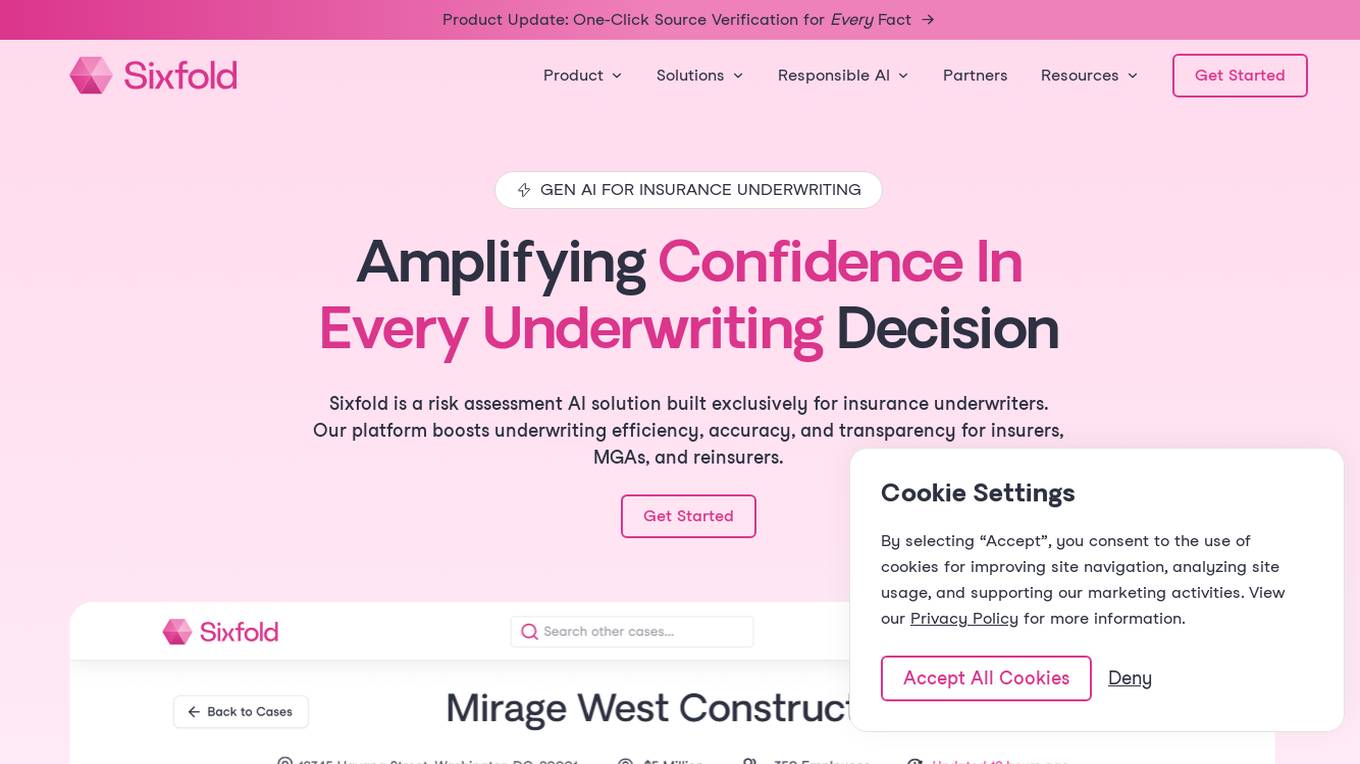

Sixfold

Sixfold is a risk assessment AI solution designed exclusively for insurance underwriters. The platform enhances underwriting efficiency, accuracy, and transparency for insurers, MGAs, and reinsurers. Sixfold's AI capabilities enable faster case reviews, appetite-aware risk insights, and data gathering from days to minutes. The application ingests underwriting guidelines, extracts risk data, and provides tailored risk insights to align with unique risk preferences. It offers customized solutions for various insurance lines and features intake prioritization, contextual risk insights, risk signal detection, inconsistency identification, and data summarization.

Sonant

Sonant is an AI receptionist designed specifically for insurance agencies, brokers, and distributors. It aims to turn routine incoming calls into revenue within a short period of time. The AI tool enables 24/7 personalized service with zero waiting times, multilingual capabilities, and the ability to transfer calls to human agents when necessary. Sonant helps agencies improve productivity, profitability, and client satisfaction by automating routine tasks, appointment scheduling, quote intaking, and post-call notes. It is GDPR compliant and integrates seamlessly with popular Agency Management Systems and CRM software.

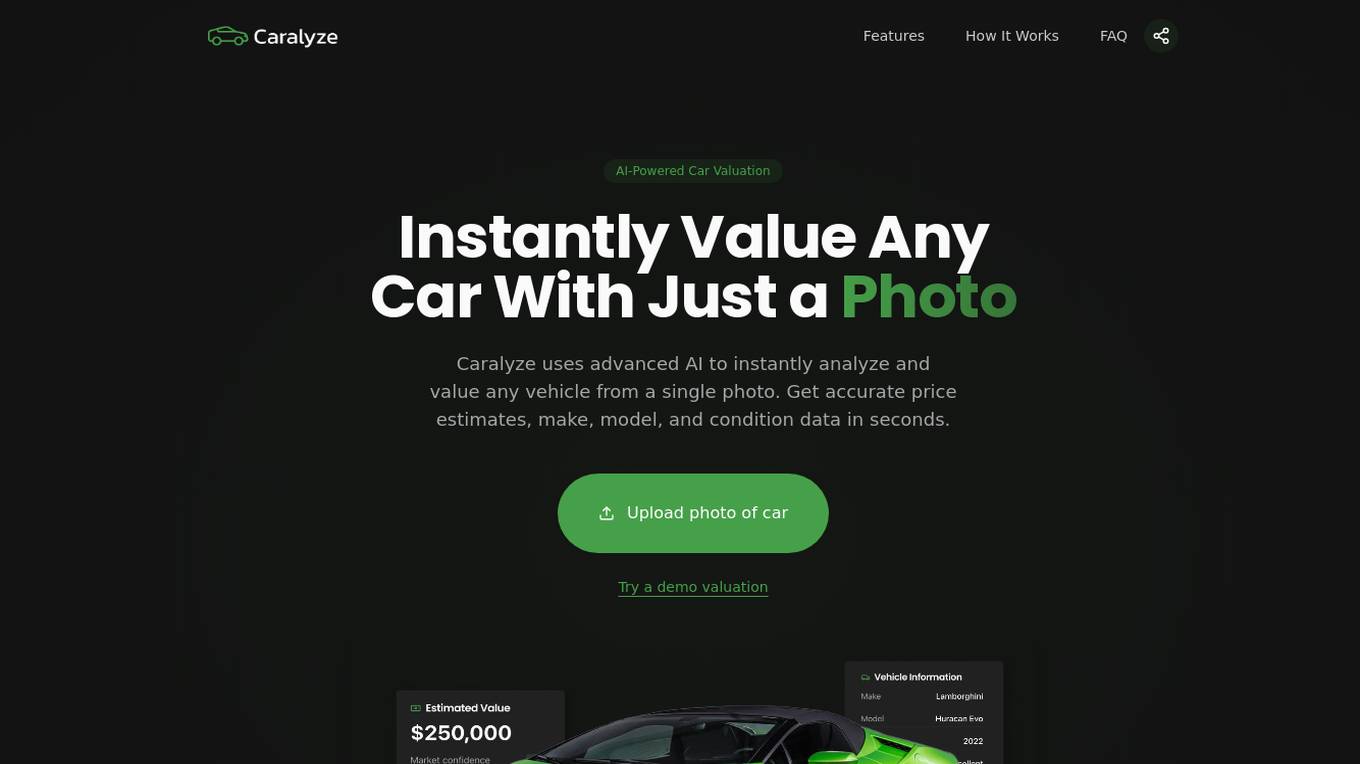

Caralyze

Caralyze is an AI tool that provides instant car valuation based on a single photo. By leveraging advanced artificial intelligence algorithms, Caralyze accurately assesses the value of a car by analyzing key features and market trends. Users can simply upload a photo of their car and receive a quick and reliable valuation, saving time and effort compared to traditional methods. With Caralyze, car owners can make informed decisions when selling, buying, or insuring their vehicles.

EHVA.ai

EHVA.ai is a Conversational AI tool that combines heart and science to create a unique AI experience. It offers AI phone technology that talks to people by phone to achieve various goals. EHVA.ai provides non-conversational features like AI Backstopping and AI Looking Glass, enhancing productivity and accuracy in different industries. The application aims to bridge the gap between human interaction and AI technology, offering a human-like experience with the efficiency of artificial intelligence.

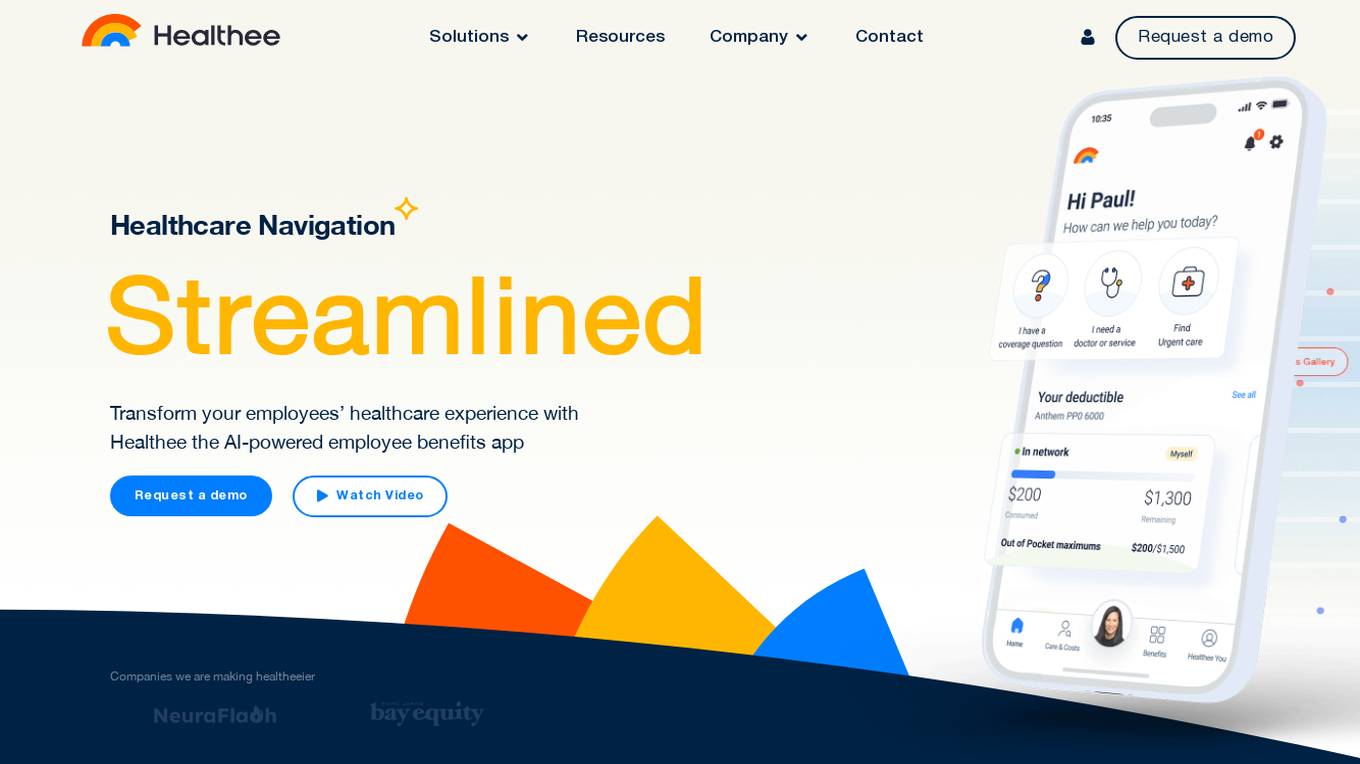

Healthee

Healthee is an AI-powered employee benefits app that simplifies healthcare navigation for employees and stakeholders. It provides personalized answers to healthcare queries, streamlines open enrollment processes, and offers real-time insights and data-driven preventive care recommendations. With Healthee, employees can access vital health plan information anytime through a user-friendly mobile app.