VUW.ai

Catch the wave of Virtual Underwriting!

VUW.ai is a unique virtual underwriting platform that offers end-to-end digital trading solutions for specialty insurance lines. The platform leverages machine learning to improve risk selection, reduce volatility, increase consistency, and enhance profitability and underwriting controls while lowering operating costs. VUW.ai aims to revolutionize the insurance market by providing a cost-effective and tech-based underwriting solution that caters to brokers and capacity providers. The platform also offers services in Property, Casualty, and Marine Cargo business, with plans to expand into other classes like Livestock, Fine Art, and Political Violence.

For Tasks:

Click tags to check more tools for each tasksFor Jobs:

Features

Advantages

Disadvantages

Frequently Asked Questions

Alternative AI tools for VUW.ai

Similar sites

VUW.ai

VUW.ai is a unique virtual underwriting platform that offers end-to-end digital trading solutions for specialty insurance lines. The platform leverages machine learning to improve risk selection, reduce volatility, increase consistency, and enhance profitability and underwriting controls while lowering operating costs. VUW.ai aims to revolutionize the insurance market by providing a cost-effective and tech-based underwriting solution that caters to brokers and capacity providers. The platform also offers services in Property, Casualty, and Marine Cargo business, with plans to expand into other classes like Livestock, Fine Art, and Political Violence.

Scope Ai Platform

The website is an AI tool called Scope Ai Platform that provides property, owner, investor, and lender intelligence. It offers nationwide coverage, predictive scoring, and tailored insights to help users find opportunities, connect with the right people, and make faster decisions in various markets. The platform combines massive data coverage with advanced predictive modeling to deliver actionable intelligence for business growth. It caters to industries such as insurance, retail, investment, luxury goods, and more, offering solutions for unique data challenges. The platform is compliance-ready, built on public and licensed non-credit data without credit bureau information or live tracking.

Eilla

Eilla is an AI-native M&A advisory platform designed for small and medium businesses (SMBs) looking to sell their companies. By combining top-tier M&A advisors with advanced AI algorithms, Eilla aims to deliver faster and higher-value outcomes for its clients. The platform automates manual tasks, surfaces hidden buyers, drives valuation, and creates competitive tension to push offers higher. Eilla provides expert advisory services, market intelligence, and a frictionless preparation process to make the selling experience efficient and effective. With decades of expertise backed by technology, Eilla has executed transactions worth over $100 billion and is trusted by numerous funds and banks.

Dark Pools

Dark Pools is a leading provider of AI-powered solutions for the financial industry. Our mission is to empower our clients with the tools and insights they need to make better decisions, improve their performance, and stay ahead of the competition. We offer a range of products and services that leverage AI to automate tasks, optimize workflows, and generate actionable insights. Our solutions are used by a wide range of financial institutions, including hedge funds, asset managers, and banks.

Convr

Convr is an AI-driven underwriting analysis platform that helps commercial P&C insurance organizations transform their underwriting operations. It provides a modularized AI underwriting and intelligent document automation workbench that enriches and expedites the commercial insurance new business and renewal submission flow with underwriting insights, business classification, and risk scoring. Convr's mission is to solve the last big problem of commercial insurance while improving profitability and increasing efficiency.

Underwrite.ai

Underwrite.ai is a platform that leverages advances in artificial intelligence and machine learning to provide lenders with nonlinear, dynamic models of credit risk. By analyzing thousands of data points from credit bureau sources, the application accurately models credit risk for consumers and small businesses, outperforming traditional approaches. Underwrite.ai offers a unique underwriting methodology that focuses on outcomes such as profitability and customer lifetime value, allowing organizations to enhance their lending performance without the need for capital investment or lengthy build times. The platform's models are continuously learning and adapting to market changes in real-time, providing explainable decisions in milliseconds.

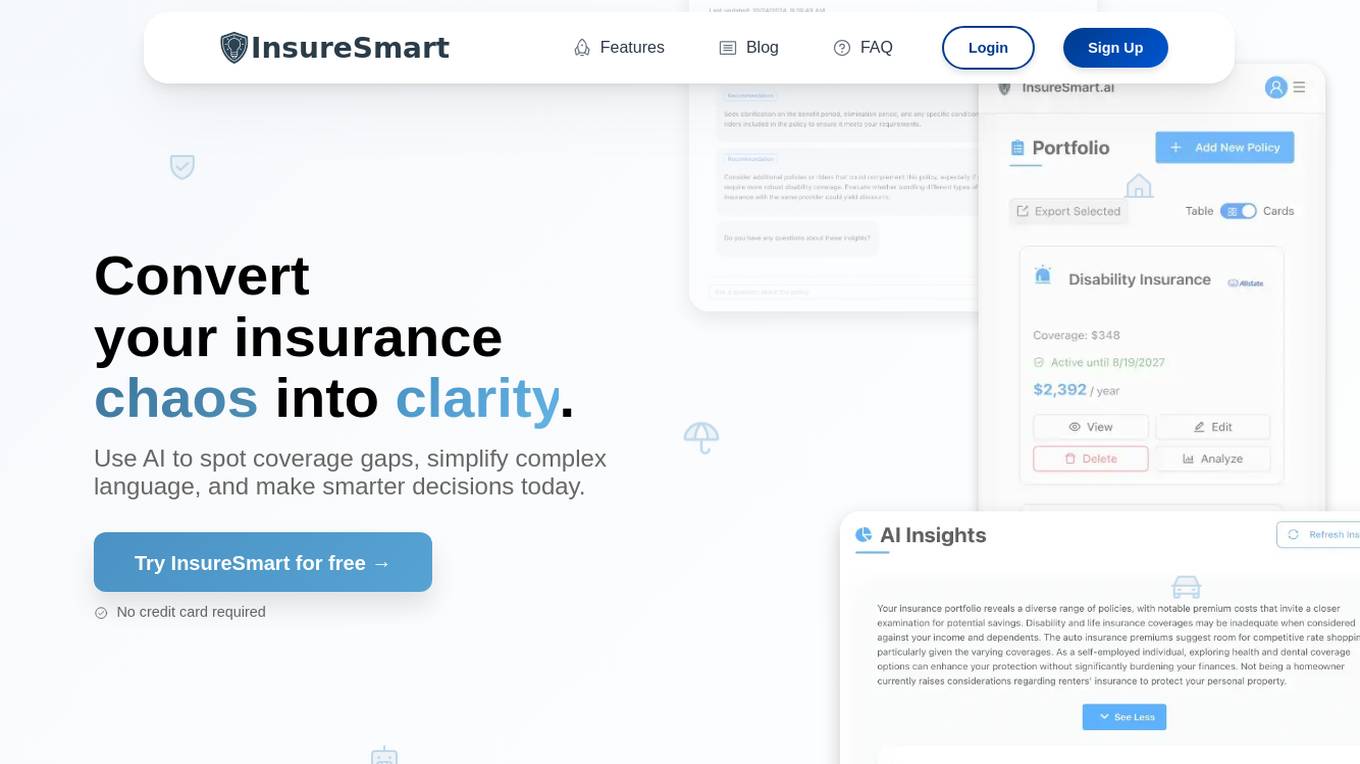

InsureSmart

InsureSmart is an AI-powered platform that empowers users to take control of their insurance needs. By leveraging artificial intelligence technology, InsureSmart offers personalized insurance solutions tailored to individual requirements. The platform provides a seamless and user-friendly experience for users to manage and optimize their insurance policies efficiently. With InsureSmart, users can access smart recommendations, compare insurance plans, and make informed decisions to secure their financial well-being.

Convr

Convr is a modularized AI underwriting and intelligent document automation workbench that enriches and expedites the commercial insurance new business and renewal submission flow with underwriting insights, business classification and risk scoring. As a trusted technology partner and advisor with deep industry expertise, we help insurance organizations transform their underwriting operations through our AI-driven digital underwriting analysis platform.

AnalyStock.ai

AnalyStock.ai is a financial application leveraging AI to provide users with a next-generation investment toolbox. It helps users better understand businesses, risks, and make informed investment decisions. The platform offers direct access to the stock market, powerful data-driven tools to build top-ranking portfolios, and insights into company valuations and growth prospects. AnalyStock.ai aims to optimize the investment process, offering a reliable strategy with factors like A-Score, factor investing scores for value, growth, quality, volatility, momentum, and yield. Users can discover hidden gems, fine-tune filters, access company scorecards, perform activity analysis, understand industry dynamics, evaluate capital structure, profitability, and peers' valuation. The application also provides adjustable DCF valuation, portfolio management tools, net asset value computation, monthly commentary, and an AI assistant for personalized insights and assistance.

FinChat.io

FinChat.io is a comprehensive AI-powered stock research platform that provides institutional-quality data and insights to investors. With FinChat.io, you can access accurate financial data on over 100,000 global public companies, as well as company revenue and profit segments, KPIs, analyst estimates, price targets, and ratings. FinChat.io also utilizes cutting-edge AI to build summaries, models, and visualizations, making it easy to understand complex financial data. Additionally, FinChat.io offers a customizable terminal, allowing you to track what matters most to you and auto-save your research. With FinChat.io, you can work faster than ever and make better investment decisions.

Gradient AI

Gradient AI is a leading provider of artificial intelligence solutions for the insurance industry. Their solutions improve loss ratios and profitability by predicting underwriting and claims risks with greater accuracy, as well as reducing quote turnaround times and claim expenses through intelligent automation.

FINQ

FINQ is an AI-driven platform designed to help users build dynamic investment portfolios, follow model portfolios, and optimize investments effortlessly. The platform offers AI-based stocks portfolios with three distinct strategies to outperform the S&P. FINQ assesses financial product risk daily using a data-driven approach and provides users with 100% objectivity by eliminating biases. The AI engine monitors the market 24/7, ensuring users are aware of investment opportunities and offers risk-guided investing to match products with comfort levels.

ficc.ai

ficc.ai is an AI application that revolutionizes municipal bond pricing by providing real-time, accurate AI technology for informed decisions, portfolio optimization, and compliance. The platform offers a user-friendly web app, direct API access, and integration with existing software or vendors. ficc.ai uses cutting-edge AI models developed in-house by market experts and scientists to deliver highly accurate bond prices based on trade size, ensuring valuable output for trading decisions, investment allocations, and compliance oversight.

Foundy

Foundy is an AI-powered platform designed to help business owners and corporate finance firms sell their businesses faster, smarter, and for higher valuations. Leveraging expert advisors, advanced AI technology, and a database of over 1 million transactions, Foundy provides tailored solutions to optimize the acquisition process. By analyzing historical acquisitions, utilizing AI-driven buyer intent signals, and streamlining processes, Foundy aims to secure higher valuations, reduce costs, and accelerate deal timelines for its clients.

Revi

Revi is an AI-enabled deal origination platform designed for Private Equity (PE), Investment Banking (IB), corporate development, and consultants. It offers a sophisticated solution that leverages artificial intelligence to streamline market mapping efforts, track data from over 1,000 sources in real-time, and reduce manual research tasks by 85%. The platform allows users to create complex search queries in natural language, enabling precise identification of M&A targets with unparalleled accuracy.

Lama AI

Lama AI is an AI-powered platform designed to revolutionize business lending processes for banks and financial institutions. It offers advanced features, rapid configurability, and exceptional support to streamline loan origination, underwriting, and decision-making. By leveraging the power of AI, Lama AI enables banks to boost business growth potential, improve profitability, and enhance customer experience through contextual onboarding, decisioning workspace, expanded credit access, and pre-qualified applications. The platform also provides white-labeled solutions, API-first integration, high configurability, built-in AI models, and access to a network of bank lenders, all while ensuring bank-grade security and compliance standards.

For similar tasks

VUW.ai

VUW.ai is a unique virtual underwriting platform that offers end-to-end digital trading solutions for specialty insurance lines. The platform leverages machine learning to improve risk selection, reduce volatility, increase consistency, and enhance profitability and underwriting controls while lowering operating costs. VUW.ai aims to revolutionize the insurance market by providing a cost-effective and tech-based underwriting solution that caters to brokers and capacity providers. The platform also offers services in Property, Casualty, and Marine Cargo business, with plans to expand into other classes like Livestock, Fine Art, and Political Violence.

For similar jobs

VUW.ai

VUW.ai is a unique virtual underwriting platform that offers end-to-end digital trading solutions for specialty insurance lines. The platform leverages machine learning to improve risk selection, reduce volatility, increase consistency, and enhance profitability and underwriting controls while lowering operating costs. VUW.ai aims to revolutionize the insurance market by providing a cost-effective and tech-based underwriting solution that caters to brokers and capacity providers. The platform also offers services in Property, Casualty, and Marine Cargo business, with plans to expand into other classes like Livestock, Fine Art, and Political Violence.

Quandri

Quandri is a digital workforce solution that automates repetitive tasks for insurance brokerages and agencies. By leveraging advanced automation and AI, Quandri's digital workers can help businesses save time, reduce errors, and increase efficiency. Quandri's out-of-the-box digital workers can be deployed seamlessly into any agency or brokerage, and can be trained to perform a variety of tasks, including EDI processing, closing broker activities, eDoc processing, inbound lead management, and renewal reviews. With Quandri, businesses can free up their team's time to focus on more value-producing activities, such as building relationships with clients and growing their business.

Convr

Convr is an AI-driven underwriting analysis platform that helps commercial P&C insurance organizations transform their underwriting operations. It provides a modularized AI underwriting and intelligent document automation workbench that enriches and expedites the commercial insurance new business and renewal submission flow with underwriting insights, business classification, and risk scoring. Convr's mission is to solve the last big problem of commercial insurance while improving profitability and increasing efficiency.

Gradient AI

Gradient AI is a leading provider of artificial intelligence solutions for the insurance industry. Their solutions improve loss ratios and profitability by predicting underwriting and claims risks with greater accuracy, as well as reducing quote turnaround times and claim expenses through intelligent automation.

Healthee

Healthee is an AI-powered employee benefits app that simplifies healthcare navigation for employees and stakeholders. It provides personalized answers to healthcare queries, streamlines open enrollment processes, and offers real-time insights and data-driven preventive care recommendations. With Healthee, employees can access vital health plan information anytime through a user-friendly mobile app.

Nestor

Nestor is an AI-powered insurance assistant that provides clear and jargon-free answers to all your insurance questions. It can audit your insurance contracts, identify potential over-insurance or under-insurance, and suggest ways to improve your coverage. Nestor is constantly learning and can provide expert advice on a wide range of insurance topics.

Convr

Convr is a modularized AI underwriting and intelligent document automation workbench that enriches and expedites the commercial insurance new business and renewal submission flow with underwriting insights, business classification and risk scoring. As a trusted technology partner and advisor with deep industry expertise, we help insurance organizations transform their underwriting operations through our AI-driven digital underwriting analysis platform.

StrataReports

StrataReports is an AI-driven tool that specializes in transforming lengthy condo documents into comprehensive insights for real estate professionals, insurance brokers, and property buyers and sellers. By leveraging cutting-edge AI technology, the platform reads, analyzes, and summarizes complex documents to provide rapid yet in-depth understanding of building positives and drawbacks. With customizable reporting options and an interactive chatbot, StrataReports empowers users to make informed decisions with confidence in the Canadian real estate market.

BluePond GenAI PaaS

BluePond GenAI PaaS is an automation and insights powerhouse tailored for Property and Casualty Insurance. It offers end-to-end execution support from GenAI data scientists, engineers & human-in-the-loop processing. The platform provides automated intake extraction, classification enrichment, validation, complex document analysis, workflow automation, and decisioning. Users benefit from rapid deployment, complete control of data & IP, and pre-trained P&C domain library. BluePond GenAI PaaS aims to energize and expedite GenAI initiatives throughout the insurance value chain.

Further AI

Further AI is an AI application designed to revolutionize insurance operations by providing AI Teammates for various tasks such as quote generation, policy checking, and renewal follow-ups. The platform aims to enhance efficiency, reduce errors, and automate repetitive tasks in the insurance industry. Further AI offers innovative solutions for insurance brokers, general agents, and insurers, allowing them to scale their business without the need for additional hiring. By leveraging AI technology, users can streamline workflows, automate client calls, navigate portals, and extract data from complex documents with ease and accuracy.

Sonant

Sonant is an AI receptionist designed specifically for insurance agencies, brokers, and distributors. It aims to turn routine incoming calls into revenue within a short period of time. The AI tool enables 24/7 personalized service with zero waiting times, multilingual capabilities, and the ability to transfer calls to human agents when necessary. Sonant helps agencies improve productivity, profitability, and client satisfaction by automating routine tasks, appointment scheduling, quote intaking, and post-call notes. It is GDPR compliant and integrates seamlessly with popular Agency Management Systems and CRM software.

FlowX.AI

FlowX.AI is a Multi-Agent AI Platform designed for Banking and Insurance Modernization. It offers a cutting-edge AI-native agentic platform for building and deploying AI agents and mission-critical AI-enabled systems in highly regulated industries. The platform enables businesses to build the next generation of banking and insurance systems in weeks, not years, by providing faster development, time to market, and reduced maintenance and implementation costs.

Insurance Policy AI

This application utilizes AI technology to simplify the complex process of understanding health insurance policies. Unlike other apps that focus on insurance search and comparison, this app specializes in deciphering the intricate language found in policies. It provides instant access to policy analysis with a one-time payment, empowering users to gain clarity and make informed decisions regarding their health insurance coverage.

Nauto

Nauto is an AI-powered fleet management software that helps businesses improve driver safety and reduce collisions. It uses a dual-facing camera and external sensors to detect distracted and drowsy driving, as well as in-cabin and external risks. Nauto's predictive AI algorithms can assess, predict, and alert drivers of imminent risks to avoid collisions. It also provides real-time alerts to end distracted and drowsy driving, and self-guided coaching videos to help drivers improve their behavior. Nauto's claims management feature can quickly and reliably process and resolve claims, resulting in millions of dollars saved. Overall, Nauto is a comprehensive driver and vehicle safety platform that can help businesses reduce risk, improve safety, and save money.

Gradient AI

Gradient AI is a leading provider of artificial intelligence solutions for the insurance industry. Its solutions improve loss ratios and profitability by predicting underwriting and claims risks with greater accuracy, as well as reducing quote turnaround times and claim expenses through intelligent automation.

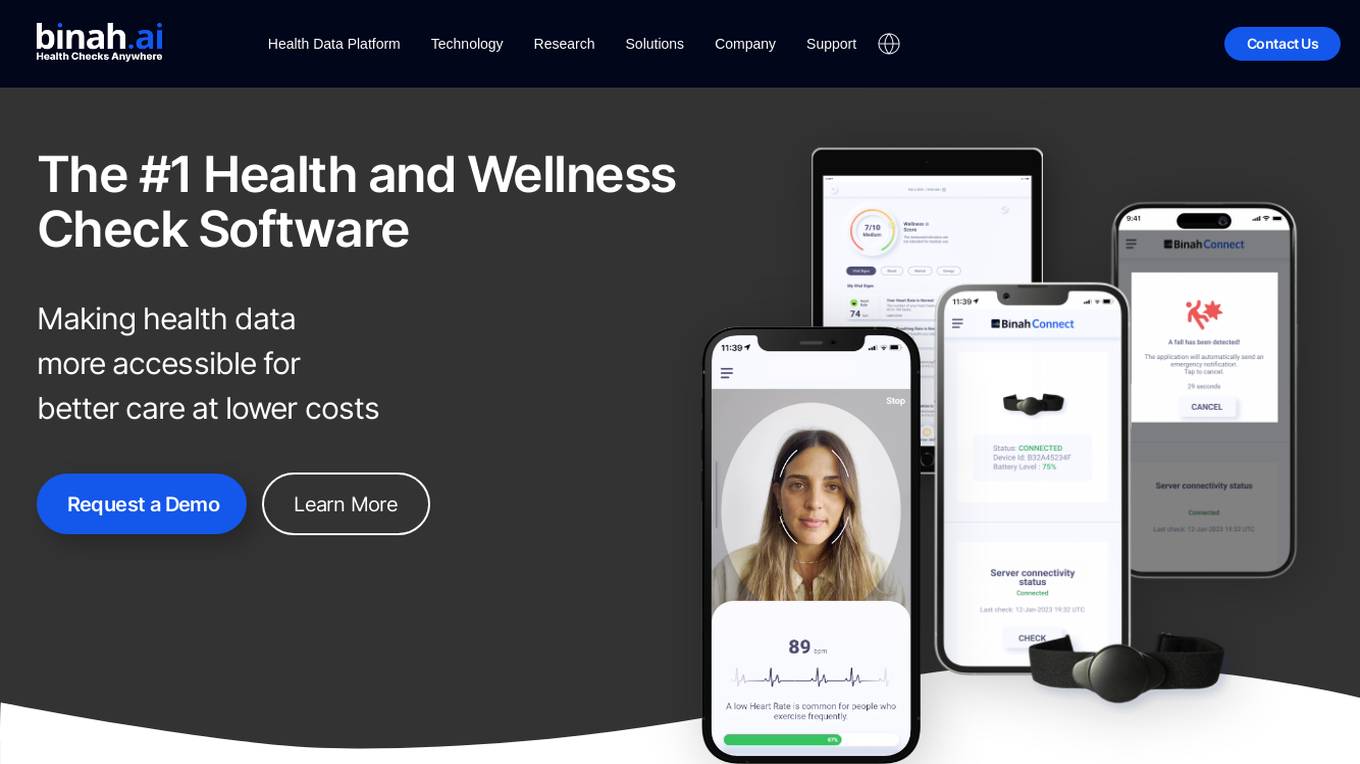

Binah.ai

Binah.ai is an AI-powered Health Data Platform that offers a software solution for video-based vital signs monitoring. The platform enables users to measure various health and wellness indicators using a smartphone, tablet, or laptop. It provides support for continuous monitoring through a raw PPG signal from external sensors and offers a range of features such as blood pressure monitoring, heart rate variability, oxygen saturation, and more. Binah.ai aims to make health data more accessible for better care at lower costs by leveraging AI and deep learning algorithms.

Federato

Federato is an AI-powered platform that integrates Google Cloud's AI capabilities to provide new AI underwriting solutions for the insurance industry. It aims to revolutionize underwriting processes by leveraging AI technology to enhance risk assessment, portfolio management, and decision-making. Federato's RiskOps platform empowers underwriters with powerful insights, real-time risk selection guidance, and unified underwriting workflows, enabling them to make more informed decisions and improve operational efficiency.

Restb.ai

Restb.ai is a leading provider of visual insights for real estate companies, utilizing computer vision and AI to analyze property images. The application offers solutions for AVMs, iBuyers, investors, appraisals, inspections, property search, marketing, insurance companies, and more. By providing actionable and unique data at scale, Restb.ai helps improve valuation accuracy, automate manual processes, and enhance property interactions. The platform enables users to leverage visual insights to optimize valuations, automate report quality checks, enhance listings, improve data collection, and more.

Sixfold

Sixfold is a risk assessment AI solution designed exclusively for insurance underwriters. The platform enhances underwriting efficiency, accuracy, and transparency for insurers, MGAs, and reinsurers. Sixfold's AI capabilities enable faster case reviews, appetite-aware risk insights, and data gathering from days to minutes. The application ingests underwriting guidelines, extracts risk data, and provides tailored risk insights to align with unique risk preferences. It offers customized solutions for various insurance lines and features intake prioritization, contextual risk insights, risk signal detection, inconsistency identification, and data summarization.

Ferret

Ferret is an AI-powered relationship intelligence tool designed to provide curated relationship insights and monitoring to help users avoid high-risk individuals and identify promising opportunities. It utilizes AI technology to offer personal and business relationship intelligence, including access to news archives, insights on white-collar crime, corporate ownership details, legal records, and more. The tool is designed to enhance users' understanding of their personal and professional networks, enabling them to make informed decisions and mitigate risks effectively.

b-cube.ai

b-cube.ai is a regulated quantamental trading platform that utilizes AI, quantitative models, and fundamentals to generate superior returns for institutional clients. The platform follows a Quantamental strategy, combining AI-generated signals with human verification to trade confidently and maximize profits. It offers two main funds, the AI Alpha Strategy Fund and the B3X Market Neutral Fund, each targeting different market opportunities. Additionally, b-cube.ai has its native token, BCUBE, which is used for value accrual and deflationary pressure through trading profits. The platform aims to provide consistent success over its 7-year track record.

VantedgeAI

VantedgeAI is an AI application that offers fine-tuned AI models for credit funds, revolutionizing credit investing workflows with faster, smarter, and cost-effective solutions. The application transforms manual processes into scalable, automated workflows tailored for Private Credit and Hedge Funds. VantedgeAI is trusted by market leaders in the industry, providing unique AI-driven insights to maintain a competitive advantage and ensure data security and privacy through SOC 2 compliance. The application offers advanced AI solutions for credit investing, including automated investment memo generation, data extraction for Excel models, portfolio monitoring, loan reconciliation, smart bond screening, real-time data querying with AI bots, and more.

Telescope

Telescope is an AI-powered platform for finance that offers a range of solutions for trading, investing, portfolio insights, signal detection, content conversion, compliance, and more. It combines frontier language models with safety and compliance features to provide trustworthy AI intelligence for financial institutions. The platform enables users to personalize solutions, enhance engagement, scale portfolio strategies, and embed AI recommendations in various financial activities.

Ascento

Ascento is an AI-powered security solution that combines robotics and artificial intelligence to secure assets and provide quantitative insights of premises. The application offers features such as detecting people on premises, verifying perimeter integrity, recording property lights, scanning for thermal anomalies, controlling parking lots, and checking doors and windows. Ascento provides advantages like faster threat detection with greater accuracy, cost reduction, autonomous all-terrain robot capabilities, encrypted live communication, and integration with existing video management systems. However, some disadvantages include the need for immediate cost-benefits, training and onboarding requirements, and limited battery life for autonomous charging. The application is suitable for various industries and offers a turnkey solution with 24/7 support and fast replacements.