Best AI tools for< Insurance Executive >

Infographic

20 - AI tool Sites

VUW.ai

VUW.ai is a unique virtual underwriting platform that offers end-to-end digital trading solutions for specialty insurance lines. The platform leverages machine learning to improve risk selection, reduce volatility, increase consistency, and enhance profitability and underwriting controls while lowering operating costs. VUW.ai aims to revolutionize the insurance market by providing a cost-effective and tech-based underwriting solution that caters to brokers and capacity providers. The platform also offers services in Property, Casualty, and Marine Cargo business, with plans to expand into other classes like Livestock, Fine Art, and Political Violence.

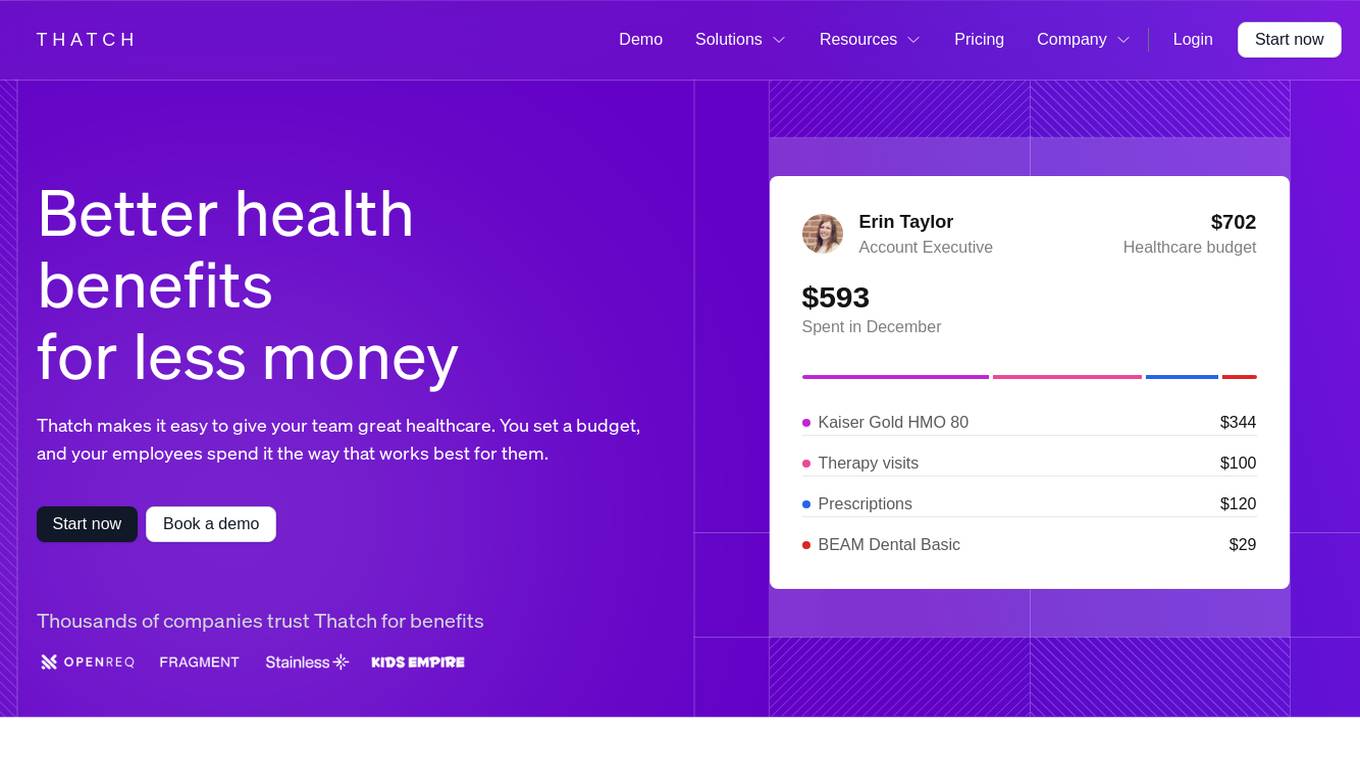

Thatch

Thatch is a modern health benefits platform that offers a personalized healthcare experience to employees using an ICHRA. It provides a flexible and affordable way for companies to offer healthcare benefits by allowing them to set a budget and empower team members to choose their preferred healthcare options. Thatch simplifies benefits administration, helps in budgeting, and offers a Thatch Visa debit card for easy payment of healthcare costs. The platform works with all payroll providers and insurance plans, making it a convenient solution for companies of all sizes.

EvenUp

EvenUp is a unified, AI-powered Claims Intelligence Platform that assists legal professionals in managing various aspects of personal injury cases. The platform offers AI-powered tools like Case Companion, Demands™, MedChrons™, Executive Analytics™, Case Preparation™, Negotiation Preparation™, Settlement Repository™, and Piai™ to streamline case management, document analysis, negotiation preparation, and settlement outcomes. EvenUp aims to provide accurate and data-driven insights to maximize case value and settlement outcomes for law firms dealing with personal injury cases.

Meera

Meera is a conversational text messaging platform designed for sales and marketing professionals to automate tedious tasks, engage leads effectively, and increase sales conversions. By leveraging AI technology, Meera helps businesses in various industries such as higher education, insurance, contact centers, financial services, and home services to streamline processes, nurture leads, and improve customer interactions. The platform offers features like lead qualification and nurturing, event management, live call transfers, appointment scheduling, and operations automation. Meera stands out by providing expert guidance, seamless integration with existing tech stacks, and a user-friendly interface. The application empowers users to send human-like text messages, schedule meetings, and boost connect rates, ultimately enhancing customer engagement and driving revenue growth.

MaestroQA

MaestroQA is a comprehensive Call Center Quality Assurance Software that offers a range of products and features to enhance QA processes. It provides customizable report builders, scorecard builders, calibration workflows, coaching workflows, automated QA workflows, screen capture, accurate transcriptions, root cause analysis, performance dashboards, AI grading assist, analytics, and integrations with various platforms. The platform caters to industries like eCommerce, financial services, gambling, insurance, B2B software, social media, and media, offering solutions for QA managers, team leaders, and executives.

BluePond GenAI PaaS

BluePond GenAI PaaS is an automation and insights powerhouse tailored for Property and Casualty Insurance. It offers end-to-end execution support from GenAI data scientists, engineers & human-in-the-loop processing. The platform provides automated intake extraction, classification enrichment, validation, complex document analysis, workflow automation, and decisioning. Users benefit from rapid deployment, complete control of data & IP, and pre-trained P&C domain library. BluePond GenAI PaaS aims to energize and expedite GenAI initiatives throughout the insurance value chain.

aqua

aqua is a comprehensive Quality Assurance (QA) management tool designed to streamline testing processes and enhance testing efficiency. It offers a wide range of features such as AI Copilot, bug reporting, test management, requirements management, user acceptance testing, and automation management. aqua caters to various industries including banking, insurance, manufacturing, government, tech companies, and medical sectors, helping organizations improve testing productivity, software quality, and defect detection ratios. The tool integrates with popular platforms like Jira, Jenkins, JMeter, and offers both Cloud and On-Premise deployment options. With AI-enhanced capabilities, aqua aims to make testing faster, more efficient, and error-free.

Invoca

Invoca is a Conversation Intelligence AI Leader that offers a Revenue Execution Platform to help marketing, sales, and contact centers drive more revenue. The platform provides solutions for call tracking, artificial intelligence, and interaction management. It integrates with Google, social advertising platforms, and offers APIs & webhooks. Invoca caters to various industries such as automotive, financial services, healthcare, insurance, retail, telecom, and travel & hospitality. The platform helps optimize ad spend, boost campaign performance, prioritize high-value callers, improve agent performance, and streamline data activation.

Insurance Policy AI

This application utilizes AI technology to simplify the complex process of understanding health insurance policies. Unlike other apps that focus on insurance search and comparison, this app specializes in deciphering the intricate language found in policies. It provides instant access to policy analysis with a one-time payment, empowering users to gain clarity and make informed decisions regarding their health insurance coverage.

CARCO

CARCO is an advanced Mobile AI Fraud Prevention application designed to protect insurance carriers and consumers by identifying and preventing risk events and fraudulent activities. The application streamlines the inspection process through integrated AI and fraud alert validation technology, providing a back-office solution that is easily integrated into mobile platforms, cost-effective, and fraud-detecting. CARCO also offers NMVTIS, a premier system in the U.S. that requires reporting of vehicle title data. With over 50 million transactions completed to date, CARCO has a proven track record in fraud prevention and risk mitigation for the insurance industry.

Nestor

Nestor is an AI-powered insurance assistant that provides clear and jargon-free answers to all your insurance questions. It can audit your insurance contracts, identify potential over-insurance or under-insurance, and suggest ways to improve your coverage. Nestor is constantly learning and can provide expert advice on a wide range of insurance topics.

Quandri

Quandri is a digital workforce solution that automates repetitive tasks for insurance brokerages and agencies. By leveraging advanced automation and AI, Quandri's digital workers can help businesses save time, reduce errors, and increase efficiency. Quandri's out-of-the-box digital workers can be deployed seamlessly into any agency or brokerage, and can be trained to perform a variety of tasks, including EDI processing, closing broker activities, eDoc processing, inbound lead management, and renewal reviews. With Quandri, businesses can free up their team's time to focus on more value-producing activities, such as building relationships with clients and growing their business.

Further AI

Further AI is an AI application designed to revolutionize insurance operations by providing AI Teammates for various tasks such as quote generation, policy checking, and renewal follow-ups. The platform aims to enhance efficiency, reduce errors, and automate repetitive tasks in the insurance industry. Further AI offers innovative solutions for insurance brokers, general agents, and insurers, allowing them to scale their business without the need for additional hiring. By leveraging AI technology, users can streamline workflows, automate client calls, navigate portals, and extract data from complex documents with ease and accuracy.

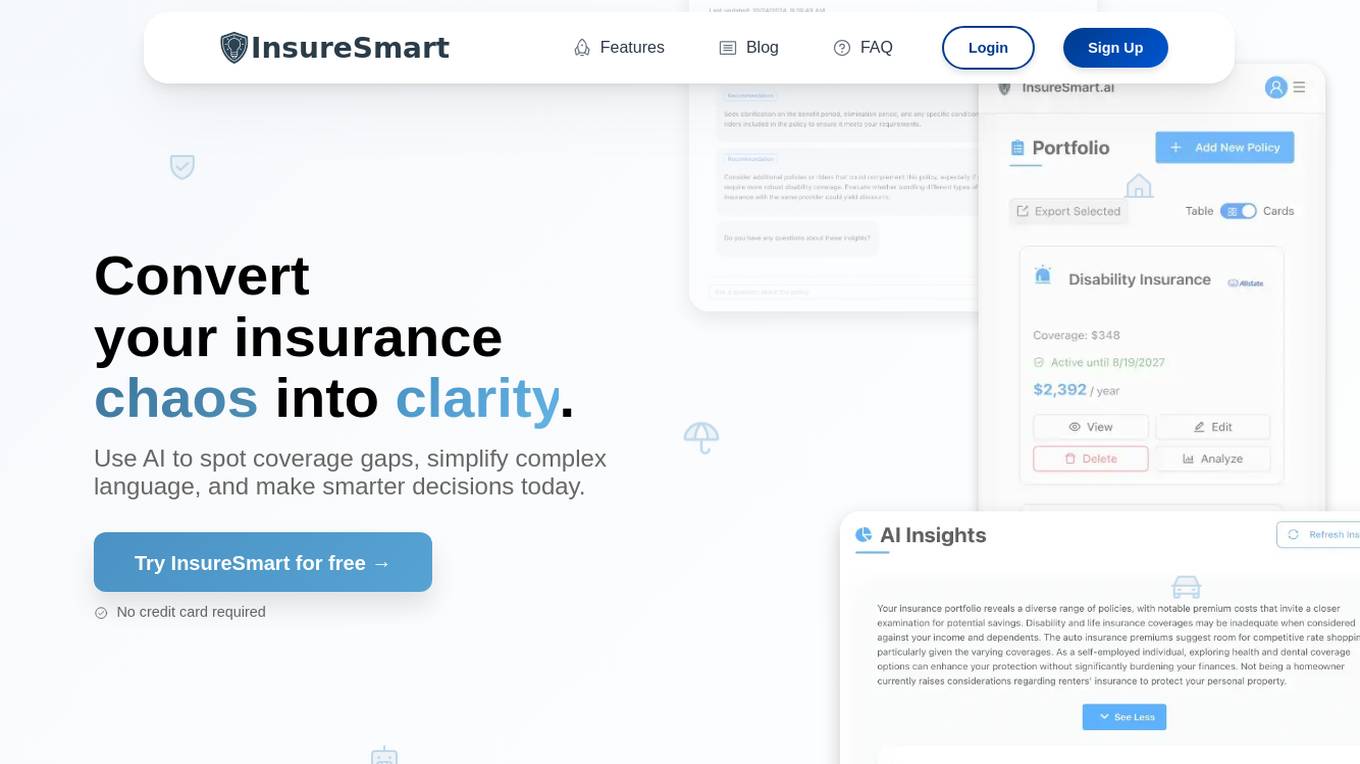

InsureSmart

InsureSmart is an AI-powered platform that empowers users to take control of their insurance needs. By leveraging artificial intelligence technology, InsureSmart offers personalized insurance solutions tailored to individual requirements. The platform provides a seamless and user-friendly experience for users to manage and optimize their insurance policies efficiently. With InsureSmart, users can access smart recommendations, compare insurance plans, and make informed decisions to secure their financial well-being.

Roots

Roots is an AI Agent Platform designed specifically for the insurance industry, offering a comprehensive suite of tools and features to enhance operational efficiency, streamline processes, and improve customer experiences. The platform includes AI Agents, InsurGPT™, Cockpit, Human-in-the-Loop, Workflow Orchestration, and Responsible AI components. Roots aims to revolutionize insurance automation by providing transparent, ethical, and trustworthy AI solutions tailored for insurance companies.

Convr

Convr is an AI-driven underwriting analysis platform that helps commercial P&C insurance organizations transform their underwriting operations. It provides a modularized AI underwriting and intelligent document automation workbench that enriches and expedites the commercial insurance new business and renewal submission flow with underwriting insights, business classification, and risk scoring. Convr's mission is to solve the last big problem of commercial insurance while improving profitability and increasing efficiency.

Convr

Convr is a modularized AI underwriting and intelligent document automation workbench that enriches and expedites the commercial insurance new business and renewal submission flow with underwriting insights, business classification and risk scoring. As a trusted technology partner and advisor with deep industry expertise, we help insurance organizations transform their underwriting operations through our AI-driven digital underwriting analysis platform.

FlowX.AI

FlowX.AI is a Multi-Agent AI Platform designed for Banking and Insurance Modernization. It offers a cutting-edge AI-native agentic platform for building and deploying AI agents and mission-critical AI-enabled systems in highly regulated industries. The platform enables businesses to build the next generation of banking and insurance systems in weeks, not years, by providing faster development, time to market, and reduced maintenance and implementation costs.

Gradient AI

Gradient AI is a leading provider of artificial intelligence solutions for the insurance industry. Its solutions improve loss ratios and profitability by predicting underwriting and claims risks with greater accuracy, as well as reducing quote turnaround times and claim expenses through intelligent automation.

Sonant

Sonant is an AI receptionist designed specifically for insurance agencies, brokers, and distributors. It aims to turn routine incoming calls into revenue within a short period of time. The AI tool enables 24/7 personalized service with zero waiting times, multilingual capabilities, and the ability to transfer calls to human agents when necessary. Sonant helps agencies improve productivity, profitability, and client satisfaction by automating routine tasks, appointment scheduling, quote intaking, and post-call notes. It is GDPR compliant and integrates seamlessly with popular Agency Management Systems and CRM software.

0 - Open Source Tools

20 - OpenAI Gpts

Health Insurance Navigator

A helpful guide for choosing and understanding health insurance plans.

AI and Insurance Strategy Consultant

Formal yet witty AI & Insurance expert. Powered by Breebs (www.breebs.com)

👑 Data Privacy for Insurance Companies 👑

Insurance providers collect and process personal health, financial, and property information, making it crucial to implement comprehensive data protection strategies.

Life Insurance Leads Bot

Badass Insurance Leads helps insurance agents from across the United States find the best aged life insurance leads to sell policies to.

ZEN Influencer Insurance

I create social media influencer insurance plans with a focus on legal compliance.

Claims Brother

Chat with your new personal insurance and claims assistant - you will only need to upload your insurance policy and he will tell you if you are covered for a specific event

Travel Advisor

Travel expert offering advice on travel, travel insurance, packing, and ticket buying. Contact: [email protected]

Mindful Match

A mental health assistant to help choose a therapist based on needs, insurance, and location.

Health Insighter

Simply type "news" for easy to digest updates in the Healthcare industry, or be as specific as you want and get the top healthcare news from reliable sources. Healthtech, patient care, insurance policies, provider networks, value based care, behavioral health, condition management, therapy.

Personal Cryptoasset Security Wizard

An easy to understand wizard that guides you through questions about how to protect, back up and inherit essential digital information and assets such as crypto seed phrases, private keys, digital art, wallets, IDs, health and insurance information for you and your family.

Outsourcing-assistenten (forsikring)

Dansk vejledning i outsourcing regler for forsikringsselskaber

Sozialversicherungs-Agent

Für Fragen zu den Schweizer Sozialversicherungen. Das GPT kennt Themen wie AHV/IV, EO, Familienzulagen und antwortet ohne Gewähr 🤥. Ist kein Angebot der verwendeten öffentlichen Quellen 😷.