Roots

Unlock the future of insurance with Roots' AI Agent Platform

Roots is an AI Agent Platform designed specifically for the insurance industry, offering a comprehensive suite of tools and features to enhance operational efficiency, streamline processes, and improve customer experiences. The platform includes AI Agents, InsurGPT™, Cockpit, Human-in-the-Loop, Workflow Orchestration, and Responsible AI components. Roots aims to revolutionize insurance automation by providing transparent, ethical, and trustworthy AI solutions tailored for insurance companies.

For Tasks:

Click tags to check more tools for each tasksFor Jobs:

Features

Advantages

Disadvantages

Frequently Asked Questions

Alternative AI tools for Roots

Similar sites

Roots

Roots is an AI Agent Platform designed specifically for the insurance industry, offering a comprehensive suite of tools and features to enhance operational efficiency, streamline processes, and improve customer experiences. The platform includes AI Agents, InsurGPT™, Cockpit, Human-in-the-Loop, Workflow Orchestration, and Responsible AI components. Roots aims to revolutionize insurance automation by providing transparent, ethical, and trustworthy AI solutions tailored for insurance companies.

Further AI

Further AI is an AI application designed to revolutionize insurance operations by providing AI Teammates for various tasks such as quote generation, policy checking, and renewal follow-ups. The platform aims to enhance efficiency, reduce errors, and automate repetitive tasks in the insurance industry. Further AI offers innovative solutions for insurance brokers, general agents, and insurers, allowing them to scale their business without the need for additional hiring. By leveraging AI technology, users can streamline workflows, automate client calls, navigate portals, and extract data from complex documents with ease and accuracy.

FlowX.AI

FlowX.AI is a Multi-Agent AI Platform designed for Banking and Insurance Modernization. It offers a cutting-edge AI-native agentic platform for building and deploying AI agents and mission-critical AI-enabled systems in highly regulated industries. The platform enables businesses to build the next generation of banking and insurance systems in weeks, not years, by providing faster development, time to market, and reduced maintenance and implementation costs.

Perfios

Perfios is an AI-powered FinTech software company that offers digital solutions for various industries such as banking, insurance, fintech, payments, e-commerce, legal, gaming, and more. Their platform provides end-to-end solutions for digital onboarding, underwriting, risk assessment, fraud detection, and customer engagement. Perfios leverages AI and machine learning technologies to streamline processes, enhance operational efficiency, and improve decision-making in financial services. With a wide range of products and features, Perfios aims to transform the way businesses experience technology and make data-driven decisions.

Thoughtful

Thoughtful is an AI-powered revenue cycle automation platform that offers efficiency reports, eligibility verification, patient intake automation, claims processing, and more. It deploys AI across healthcare organizations to maximize profitability, reduce errors, and enhance operational excellence. Thoughtful's AI agents work tirelessly, 10x more efficiently than humans, and never get tired. The platform helps providers improve revenue cycle management, financial health, HR processes, and healthcare IT operations through seamless integration, reduced overhead, and significant performance improvements. Thoughtful offers a white-glove service, custom-built platform, seamless integration with all healthcare applications, and performance-based contracting with refund and value guarantees.

Synthreo

Synthreo is an AI tool that empowers businesses to streamline operations, reduce costs, and drive growth through intelligent AI agents. It provides cutting-edge AI agent solutions that automate routine tasks, enhance decision-making, and create seamless collaboration between human teams and digital labor. Synthreo offers transformative advantages for businesses of all sizes, enabling operational efficiency and strategic growth. The platform implements advanced security measures, complies with industry standards, and upholds ethical AI usage. Businesses can leverage AI-powered digital labor to achieve unprecedented efficiency, innovation, and growth.

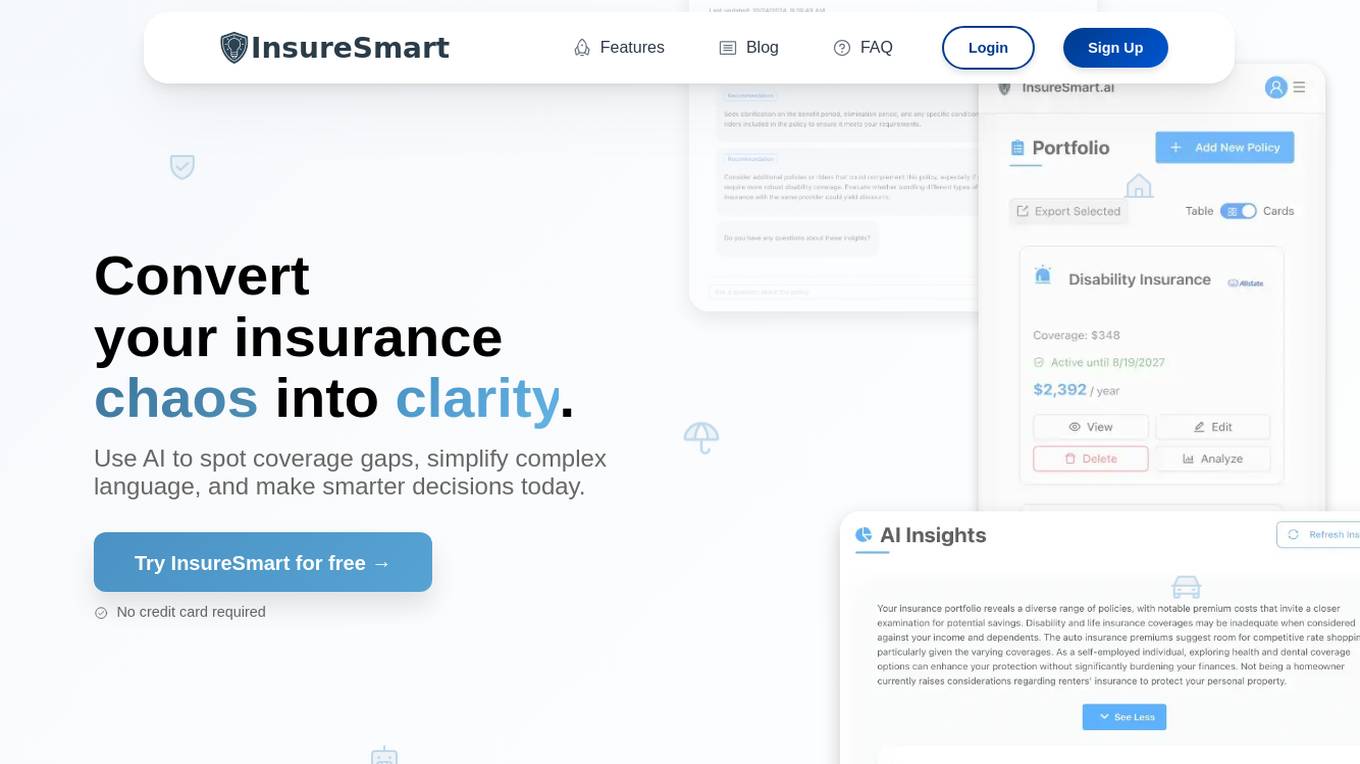

InsureSmart

InsureSmart is an AI-powered platform that empowers users to take control of their insurance needs. By leveraging artificial intelligence technology, InsureSmart offers personalized insurance solutions tailored to individual requirements. The platform provides a seamless and user-friendly experience for users to manage and optimize their insurance policies efficiently. With InsureSmart, users can access smart recommendations, compare insurance plans, and make informed decisions to secure their financial well-being.

Chima

Chima is an AI tool that is revolutionizing the enterprise landscape by offering Complex Human Reasoning Systems powered by AI. It automates various functions, enhances customer targeting, and improves business operations. Chima ensures industry-grade security and compliance, making it a reliable choice for enterprises looking to leverage AI for growth and efficiency.

Quandri

Quandri is a digital workforce solution that automates repetitive tasks for insurance brokerages and agencies. By leveraging advanced automation and AI, Quandri's digital workers can help businesses save time, reduce errors, and increase efficiency. Quandri's out-of-the-box digital workers can be deployed seamlessly into any agency or brokerage, and can be trained to perform a variety of tasks, including EDI processing, closing broker activities, eDoc processing, inbound lead management, and renewal reviews. With Quandri, businesses can free up their team's time to focus on more value-producing activities, such as building relationships with clients and growing their business.

Saxon AI

Saxon AI is an enterprise AI partner providing Agentic AI solutions tailored to various industries and teams. Their AI suite, AIssist, offers accelerated B2B sales growth, smarter financial decisions, faster legal reviews, streamlined HR processes, optimized procurement spend, proactive customer support, faster IT issue resolution, and leaner, more agile operations. Saxon focuses on AI that adds to the top line, not the to-do list, with verticalized solutions for different industries and role-specific AI agents. Their 4A framework combines apps, analytics, AI, and automation to ensure impactful and future-ready AI investments. Saxon also offers purpose-built solutions, accelerators, and a partner ecosystem to enhance client value.

TitleCorp.AI

TitleCorp.AI is a dynamic company specializing in the research and development of title insurance and real estate services that leverage advanced technologies like artificial intelligence and blockchain to enhance the transactional experience for clients. By simplifying complex title workflows, TitleCorp aims to reduce the time it takes to complete real estate transactions while minimizing risks associated with title claims. The company is committed to innovation and aims to provide more efficient, accurate, and secure title insurance services compared to traditional methods.

GoodGist

GoodGist is an Agentic AI platform for Business Process Automation that goes beyond traditional RPA tools by offering Adaptive Multi-Agent AI with Human-in-the-loop workflows. It enables end-to-end process automation, supports unstructured and multimodal data, ensures real-time decision-making, and maintains human oversight for scalable performance. GoodGist caters to various industries like manufacturing, supply chain, banking, insurance, healthcare, retail, and CPG, providing enterprise-grade security, compliance, and rapid ROI.

Inventive AI

Inventive AI is an advanced AI-powered RFP (Request for Proposal) software that revolutionizes the way businesses handle RFPs. It offers a suite of AI agents that provide context-aware responses, unified knowledge hub, AI content manager, and AI agents hub to boost productivity and competitive advantage. The platform ensures response accuracy, eliminates stale content, and integrates with various knowledge sources. Inventive AI helps users achieve higher win rates, faster RFP workflows, and improved proposal quality.

Ontra

Ontra is an AI-powered platform that offers contract automation, fundraising insights, and entity management solutions for private markets. With a focus on streamlining workflows and unlocking valuable insights, Ontra serves over 800 global investment firms. The platform leverages cutting-edge AI technology, including the Synapse AI engine powered by OpenAI's GPT-4, to automate routine legal workflows and improve efficiency in contract negotiation, compliance, and entity management.

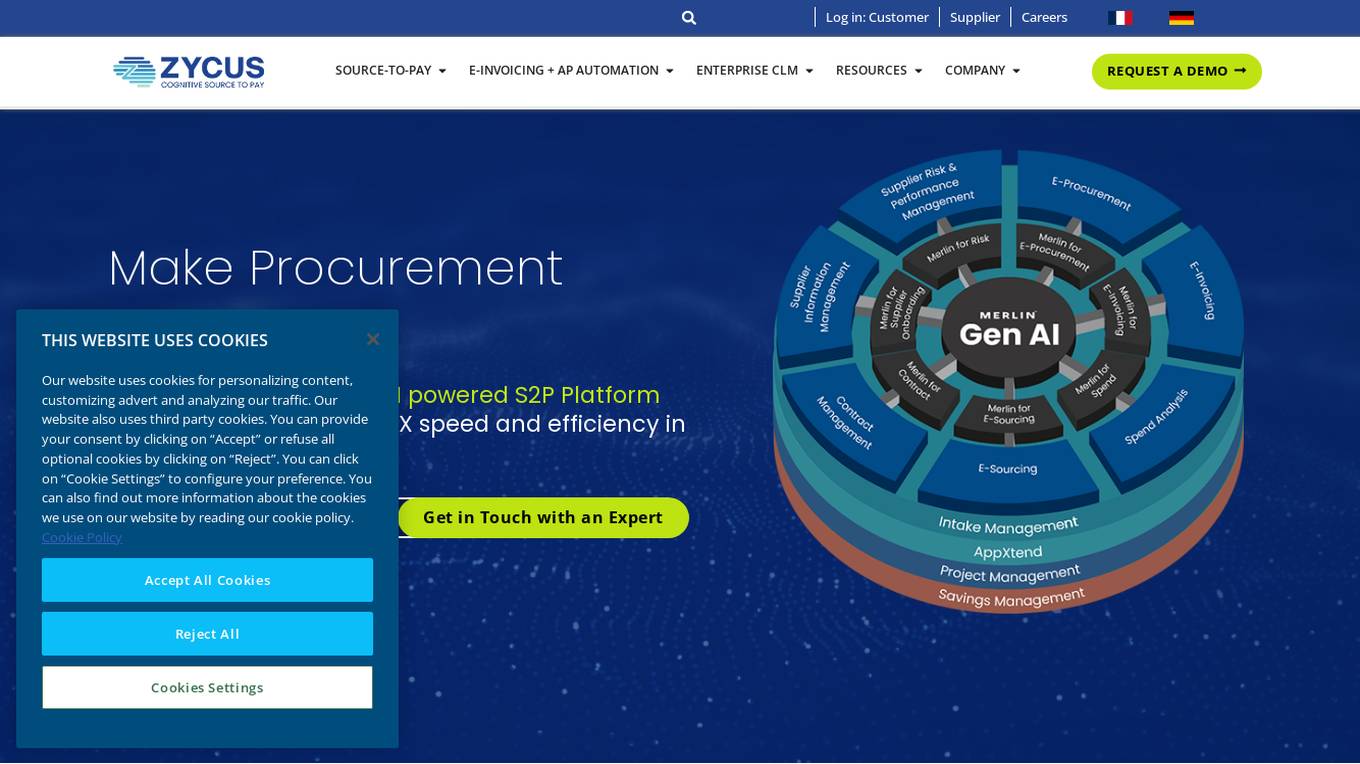

Zycus

Zycus is an AI-powered procurement software that offers a comprehensive suite of source-to-pay solutions. It leverages Generative AI to enhance speed and efficiency in procurement processes. The platform includes features such as Merlin AI for contracts, e-procurement, e-invoicing, spend analysis, and supplier management. Zycus is known for its innovative approach, value addition to businesses, and user-friendly interface.

Tonkean

Tonkean is an enterprise intake orchestration platform powered by AI. It helps businesses automate and streamline their intake processes, such as procurement, legal, and more. Tonkean's AI-powered features include an intelligent AI Front Door, guided intake, request status tracker, and custom apps for ops teams. With Tonkean, businesses can increase adoption, efficiency, and compliance in their intake processes.

For similar tasks

Roots

Roots is an AI Agent Platform designed specifically for the insurance industry, offering a comprehensive suite of tools and features to enhance operational efficiency, streamline processes, and improve customer experiences. The platform includes AI Agents, InsurGPT™, Cockpit, Human-in-the-Loop, Workflow Orchestration, and Responsible AI components. Roots aims to revolutionize insurance automation by providing transparent, ethical, and trustworthy AI solutions tailored for insurance companies.

For similar jobs

Wolters Kluwer ELM Solutions

Wolters Kluwer ELM Solutions is a leading provider of enterprise legal spend and matter management, AI legal bill review, and legal analytics solutions. Our innovative technology and end-to-end customer experience help corporate legal and insurance claims departments drive world-class business outcomes.

Gradient AI

Gradient AI is a leading provider of artificial intelligence solutions for the insurance industry. Their solutions improve loss ratios and profitability by predicting underwriting and claims risks with greater accuracy, as well as reducing quote turnaround times and claim expenses through intelligent automation.

Arya.ai

Arya.ai is an AI tool designed for Banks, Insurers, and Financial Services to deploy safe, responsible, and auditable AI applications. It offers a range of AI Apps, ML Observability Tools, and a Decisioning Platform. Arya.ai provides curated APIs, ML explainability, monitoring, and audit capabilities. The platform includes task-specific AI models for autonomous underwriting, claims processing, fraud monitoring, and more. Arya.ai aims to facilitate the rapid deployment and scaling of AI applications while ensuring institution-wide adoption of responsible AI practices.

Further AI

Further AI is an AI application designed to revolutionize insurance operations by providing AI Teammates for various tasks such as quote generation, policy checking, and renewal follow-ups. The platform aims to enhance efficiency, reduce errors, and automate repetitive tasks in the insurance industry. Further AI offers innovative solutions for insurance brokers, general agents, and insurers, allowing them to scale their business without the need for additional hiring. By leveraging AI technology, users can streamline workflows, automate client calls, navigate portals, and extract data from complex documents with ease and accuracy.

InsureSmart

InsureSmart is an AI-powered platform that empowers users to take control of their insurance needs. By leveraging artificial intelligence technology, InsureSmart offers personalized insurance solutions tailored to individual requirements. The platform provides a seamless and user-friendly experience for users to manage and optimize their insurance policies efficiently. With InsureSmart, users can access smart recommendations, compare insurance plans, and make informed decisions to secure their financial well-being.

Focalx

Focalx is an AI-powered vehicle inspection technology that revolutionizes vehicle handovers in automotive and logistics industries. It empowers inspections, digitalizes vehicle condition tracking, and accelerates claims, repairs, and recovery processes. Focalx's Visual AI detects damages instantly, generates detailed vehicle condition reports, and provides actionable insights for managing damages and inspections. The application is trusted by businesses worldwide for its transparency, efficiency, and cost-saving benefits.

Verisquad

Verisquad is an AI-powered platform that specializes in claim verification. It leverages advanced artificial intelligence algorithms to streamline and automate the process of verifying claims, ensuring accuracy and efficiency. By harnessing the power of AI, Verisquad offers a reliable solution for businesses and individuals seeking to validate claims quickly and effectively.

Roots

Roots is an AI Agent Platform designed specifically for the insurance industry, offering a comprehensive suite of tools and features to enhance operational efficiency, streamline processes, and improve customer experiences. The platform includes AI Agents, InsurGPT™, Cockpit, Human-in-the-Loop, Workflow Orchestration, and Responsible AI components. Roots aims to revolutionize insurance automation by providing transparent, ethical, and trustworthy AI solutions tailored for insurance companies.

Novo AI

Novo AI is an AI application that empowers financial institutions by leveraging Generative AI and Large Language Models to streamline operations, maximize insights, and automate processes like claims processing and customer support traditionally handled by humans. The application helps insurance companies understand claim documents, automate claims processing, optimize pricing strategies, and improve customer satisfaction. For banks, Novo AI automates document processing across multiple languages and simplifies adverse media screenings through efficient research on live internet data.

ZestyAI

ZestyAI is an artificial intelligence tool that helps users make brilliant climate and property risk decisions. The tool uses AI to provide insights on property values and risk exposure to natural disasters. It offers products such as Property Insights, Digital Roof, Roof Age, Location Insights, and Climate Risk Models to evaluate and understand property risks. ZestyAI is trusted by top insurers in North America and aims to bring a ten times return on investment to its customers.

Wisedocs

Wisedocs is an AI-powered platform that specializes in medical record reviews, summaries, and insights for claims processing. The platform offers intelligent features such as medical chronologies, workflows, deduplication, intelligent OCR, and insights summaries. Wisedocs streamlines the process of reviewing medical records for insurance, legal, and independent medical evaluation firms, providing speed, accuracy, and efficiency in claims processing. The platform automates tasks that were previously laborious and error-prone, making it a valuable tool for industries dealing with complex medical records.

Thales Labs AI

Thales Labs is a premier AI research lab and incubator empowering entrepreneurs and domain experts to revolutionize industries with large language models and web3. They focus on fostering innovation in sectors like Insurance, Finance, Healthcare, Pharma, Law, and Journalism. The user-friendly app allows experts to build AI applications using their natural language skills, with support from skilled engineers for complex challenges. Join Thales Labs to transform industries, unlock new opportunities, and create value with AI-driven innovation.

BluePond GenAI PaaS

BluePond GenAI PaaS is an automation and insights powerhouse tailored for Property and Casualty Insurance. It offers end-to-end execution support from GenAI data scientists, engineers & human-in-the-loop processing. The platform provides automated intake extraction, classification enrichment, validation, complex document analysis, workflow automation, and decisioning. Users benefit from rapid deployment, complete control of data & IP, and pre-trained P&C domain library. BluePond GenAI PaaS aims to energize and expedite GenAI initiatives throughout the insurance value chain.

Attestiv

Attestiv is an AI-powered digital content analysis and forensics platform that offers solutions to prevent fraud, losses, and cyber threats from deepfakes. The platform helps in reducing costs through automated photo, video, and document inspection and analysis, protecting company reputation, and monetizing trust in secure systems. Attestiv's technology provides validation and authenticity for all digital assets, safeguarding against altered photos, videos, and documents that are increasingly easy to create but difficult to detect. The platform uses patented AI technology to ensure the authenticity of uploaded media and offers sector-agnostic solutions for various industries.

Convr

Convr is an AI-driven underwriting analysis platform that helps commercial P&C insurance organizations transform their underwriting operations. It provides a modularized AI underwriting and intelligent document automation workbench that enriches and expedites the commercial insurance new business and renewal submission flow with underwriting insights, business classification, and risk scoring. Convr's mission is to solve the last big problem of commercial insurance while improving profitability and increasing efficiency.

Silverwork Solutions

Silverwork Solutions is a fintech company that provides AI-powered mortgage automation solutions. Its Digital Workforce Solutions are role-based autonomous bots that integrate seamlessly into loan manufacturing processes, from application to post-closing. These bots utilize AI to make predictions and decisions, enhancing the loan processing experience. Silverwork's solutions empower lenders to realize the full potential of automation and transform their operations, allowing them to focus on higher-value activities while the bots handle repetitive tasks.

Convr

Convr is a modularized AI underwriting and intelligent document automation workbench that enriches and expedites the commercial insurance new business and renewal submission flow with underwriting insights, business classification and risk scoring. As a trusted technology partner and advisor with deep industry expertise, we help insurance organizations transform their underwriting operations through our AI-driven digital underwriting analysis platform.

Kasisto

Kasisto is a conversational AI platform that provides financial institutions with the ability to create personalized, automated, and engaging digital experiences for their customers and employees. Kasisto's platform is infused with unmatched financial literacy and augments your workforce with remarkably competent digital bankers who facilitate accurate, human-like conversations and empower your teams with “in-the-moment” financial knowledge.

CARCO

CARCO is an advanced Mobile AI Fraud Prevention application designed to protect insurance carriers and consumers by identifying and preventing risk events and fraudulent activities. The application streamlines the inspection process through integrated AI and fraud alert validation technology, providing a back-office solution that is easily integrated into mobile platforms, cost-effective, and fraud-detecting. CARCO also offers NMVTIS, a premier system in the U.S. that requires reporting of vehicle title data. With over 50 million transactions completed to date, CARCO has a proven track record in fraud prevention and risk mitigation for the insurance industry.

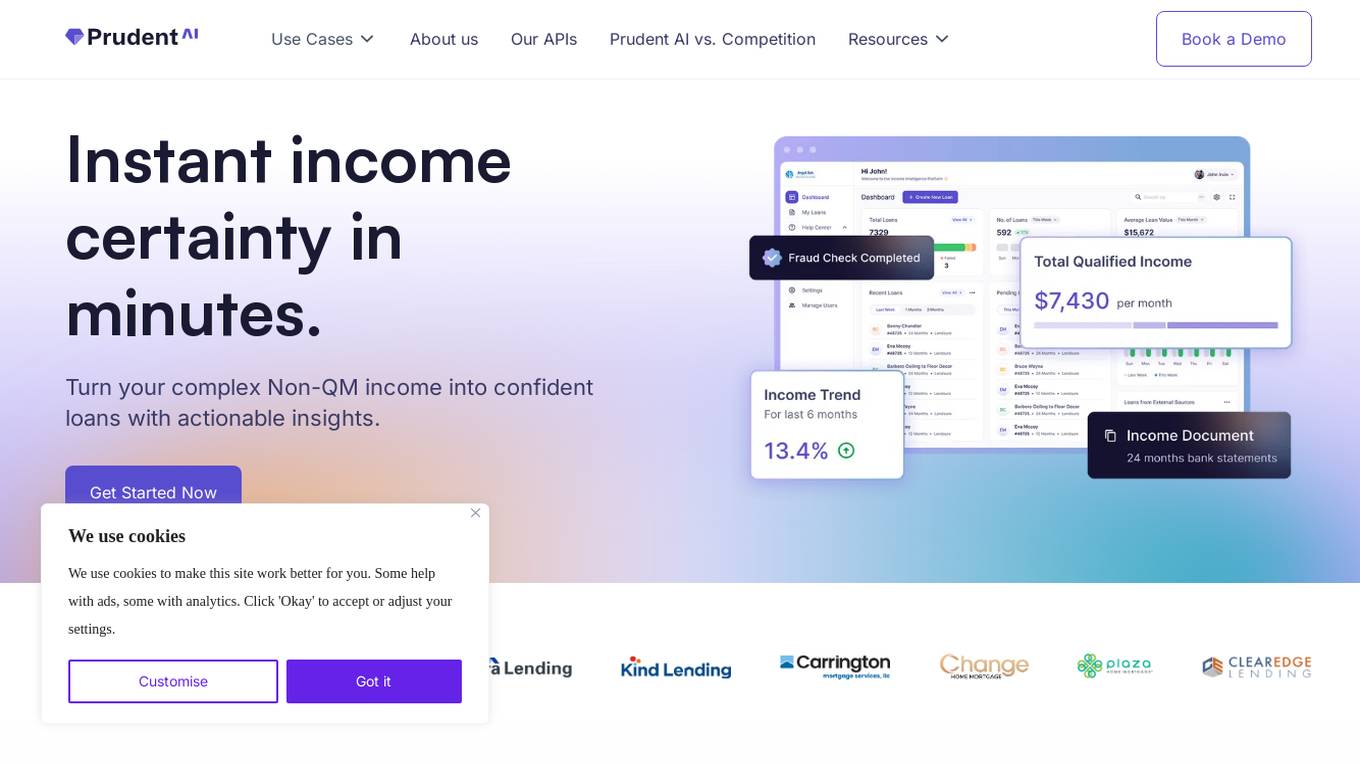

Prudent AI

Prudent AI is an AI-powered Income Intelligence Platform designed for lenders, offering fast data extraction, proactive fraud prevention, and in-depth insights on borrower income. The platform simplifies complex income calculations, streamlines the lending process, and enables lenders to make confident loan decisions quickly. Prudent AI is trusted by various lending institutions and has been proven to increase productivity, save time, and improve submission accuracy.

Plnar

Plnar is a smartphone imagery platform powered by AI that transforms smartphone photos into accurate 3D models, precise measurements, and fast estimates. It allows users to capture spatial-ready imagery without special equipment, enabling self-service for policyholders and providing field solutions for adjusters. Plnar standardizes data formats from a single smartphone image, generating reliable data for claims, underwriting, and more. The platform integrates services into one streamlined solution, eliminating inconsistencies and manual entry.