Best AI tools for< Insurance Analyst >

Infographic

20 - AI tool Sites

BluePond GenAI PaaS

BluePond GenAI PaaS is an automation and insights powerhouse tailored for Property and Casualty Insurance. It offers end-to-end execution support from GenAI data scientists, engineers & human-in-the-loop processing. The platform provides automated intake extraction, classification enrichment, validation, complex document analysis, workflow automation, and decisioning. Users benefit from rapid deployment, complete control of data & IP, and pre-trained P&C domain library. BluePond GenAI PaaS aims to energize and expedite GenAI initiatives throughout the insurance value chain.

Roots

Roots is an AI Agent Platform designed specifically for the insurance industry, offering a comprehensive suite of tools and features to enhance operational efficiency, streamline processes, and improve customer experiences. The platform includes AI Agents, InsurGPT™, Cockpit, Human-in-the-Loop, Workflow Orchestration, and Responsible AI components. Roots aims to revolutionize insurance automation by providing transparent, ethical, and trustworthy AI solutions tailored for insurance companies.

Gradient AI

Gradient AI is a leading provider of artificial intelligence solutions for the insurance industry. Their solutions improve loss ratios and profitability by predicting underwriting and claims risks with greater accuracy, as well as reducing quote turnaround times and claim expenses through intelligent automation.

Wisedocs

Wisedocs is an AI-powered platform that specializes in medical record reviews, summaries, and insights for claims processing. The platform offers intelligent features such as medical chronologies, workflows, deduplication, intelligent OCR, and insights summaries. Wisedocs streamlines the process of reviewing medical records for insurance, legal, and independent medical evaluation firms, providing speed, accuracy, and efficiency in claims processing. The platform automates tasks that were previously laborious and error-prone, making it a valuable tool for industries dealing with complex medical records.

ZestyAI

ZestyAI is an artificial intelligence tool that helps users make brilliant climate and property risk decisions. The tool uses AI to provide insights on property values and risk exposure to natural disasters. It offers products such as Property Insights, Digital Roof, Roof Age, Location Insights, and Climate Risk Models to evaluate and understand property risks. ZestyAI is trusted by top insurers in North America and aims to bring a ten times return on investment to its customers.

Novo AI

Novo AI is an AI application that empowers financial institutions by leveraging Generative AI and Large Language Models to streamline operations, maximize insights, and automate processes like claims processing and customer support traditionally handled by humans. The application helps insurance companies understand claim documents, automate claims processing, optimize pricing strategies, and improve customer satisfaction. For banks, Novo AI automates document processing across multiple languages and simplifies adverse media screenings through efficient research on live internet data.

Attestiv

Attestiv is an AI-powered digital content analysis and forensics platform that offers solutions to prevent fraud, losses, and cyber threats from deepfakes. The platform helps in reducing costs through automated photo, video, and document inspection and analysis, protecting company reputation, and monetizing trust in secure systems. Attestiv's technology provides validation and authenticity for all digital assets, safeguarding against altered photos, videos, and documents that are increasingly easy to create but difficult to detect. The platform uses patented AI technology to ensure the authenticity of uploaded media and offers sector-agnostic solutions for various industries.

Thales Labs AI

Thales Labs is a premier AI research lab and incubator empowering entrepreneurs and domain experts to revolutionize industries with large language models and web3. They focus on fostering innovation in sectors like Insurance, Finance, Healthcare, Pharma, Law, and Journalism. The user-friendly app allows experts to build AI applications using their natural language skills, with support from skilled engineers for complex challenges. Join Thales Labs to transform industries, unlock new opportunities, and create value with AI-driven innovation.

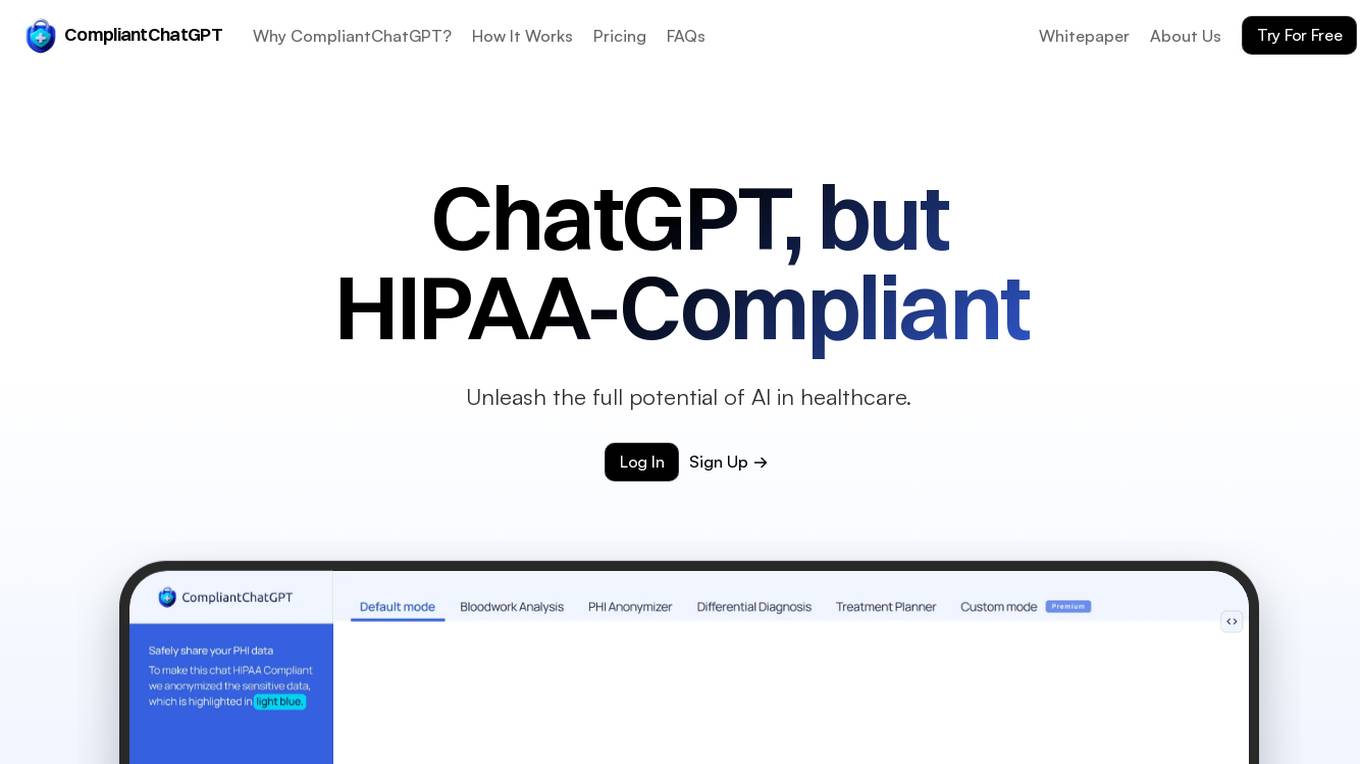

CompliantChatGPT

CompliantChatGPT is a HIPAA-compliant platform that allows users to utilize OpenAI's GPT models for healthcare-related tasks while maintaining data privacy and security. It anonymizes protected health information (PHI) by replacing it with tokens, ensuring compliance with HIPAA regulations. The platform offers various modes tailored to specific healthcare needs, including bloodwork analysis, PHI anonymization, diagnosis assistance, and treatment planning. CompliantChatGPT streamlines healthcare tasks, enhances productivity, and provides user-friendly assistance through its intuitive interface.

Insurance Policy AI

This application utilizes AI technology to simplify the complex process of understanding health insurance policies. Unlike other apps that focus on insurance search and comparison, this app specializes in deciphering the intricate language found in policies. It provides instant access to policy analysis with a one-time payment, empowering users to gain clarity and make informed decisions regarding their health insurance coverage.

CARCO

CARCO is an advanced Mobile AI Fraud Prevention application designed to protect insurance carriers and consumers by identifying and preventing risk events and fraudulent activities. The application streamlines the inspection process through integrated AI and fraud alert validation technology, providing a back-office solution that is easily integrated into mobile platforms, cost-effective, and fraud-detecting. CARCO also offers NMVTIS, a premier system in the U.S. that requires reporting of vehicle title data. With over 50 million transactions completed to date, CARCO has a proven track record in fraud prevention and risk mitigation for the insurance industry.

Gradient AI

Gradient AI is a leading provider of artificial intelligence solutions for the insurance industry. Its solutions improve loss ratios and profitability by predicting underwriting and claims risks with greater accuracy, as well as reducing quote turnaround times and claim expenses through intelligent automation.

FlowX.AI

FlowX.AI is a Multi-Agent AI Platform designed for Banking and Insurance Modernization. It offers a cutting-edge AI-native agentic platform for building and deploying AI agents and mission-critical AI-enabled systems in highly regulated industries. The platform enables businesses to build the next generation of banking and insurance systems in weeks, not years, by providing faster development, time to market, and reduced maintenance and implementation costs.

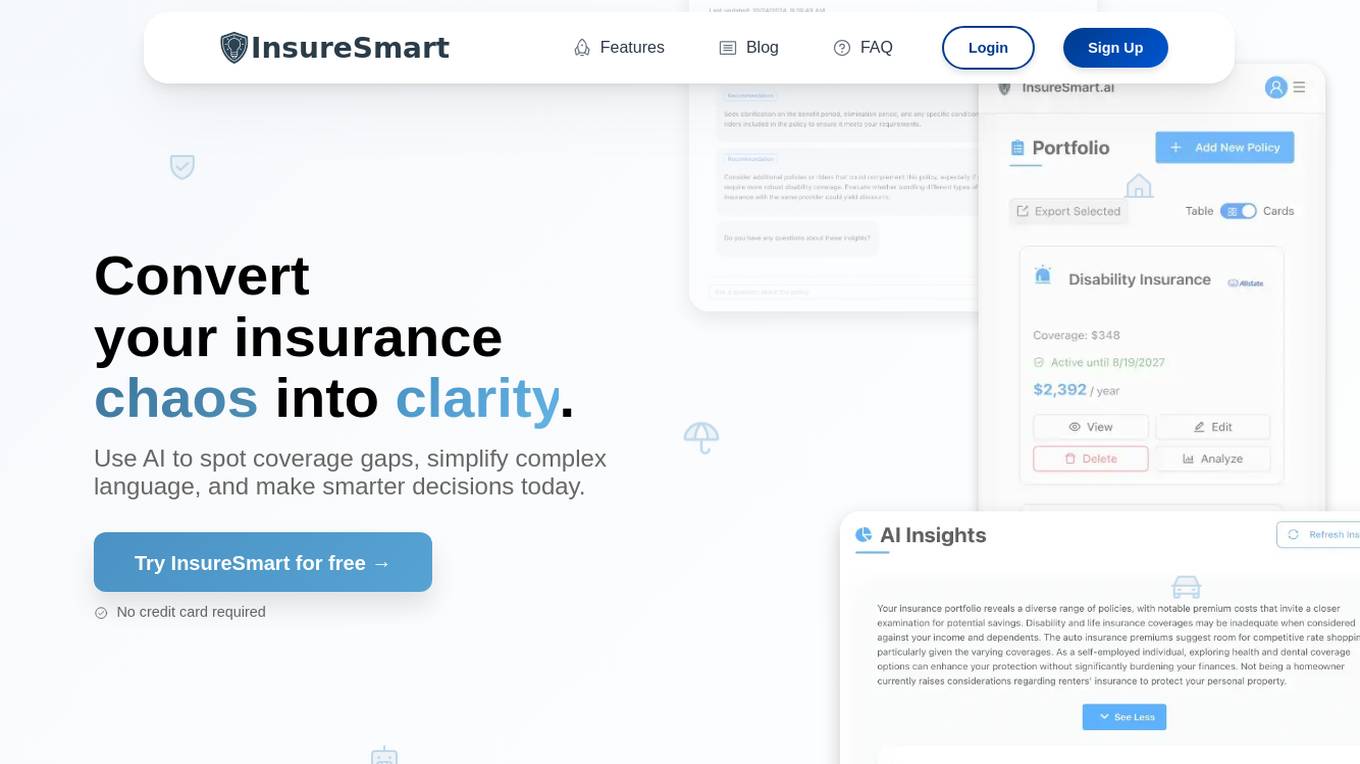

InsureSmart

InsureSmart is an AI-powered platform that empowers users to take control of their insurance needs. By leveraging artificial intelligence technology, InsureSmart offers personalized insurance solutions tailored to individual requirements. The platform provides a seamless and user-friendly experience for users to manage and optimize their insurance policies efficiently. With InsureSmart, users can access smart recommendations, compare insurance plans, and make informed decisions to secure their financial well-being.

Convr

Convr is an AI-driven underwriting analysis platform that helps commercial P&C insurance organizations transform their underwriting operations. It provides a modularized AI underwriting and intelligent document automation workbench that enriches and expedites the commercial insurance new business and renewal submission flow with underwriting insights, business classification, and risk scoring. Convr's mission is to solve the last big problem of commercial insurance while improving profitability and increasing efficiency.

Convr

Convr is a modularized AI underwriting and intelligent document automation workbench that enriches and expedites the commercial insurance new business and renewal submission flow with underwriting insights, business classification and risk scoring. As a trusted technology partner and advisor with deep industry expertise, we help insurance organizations transform their underwriting operations through our AI-driven digital underwriting analysis platform.

Peslac AI

Peslac AI is an intelligent document processing and data extraction tool that offers efficient document processing, custom workflows, and secure digital signatures. It automates the extraction of data from various document types using advanced AI technology, transforms unstructured documents into actionable insights, and streamlines document-heavy workflows with intelligent automation. Peslac serves industries such as insurance, finance, healthcare, legal, and others by automating claims processing, compliance documentation, patient records processing, legal forms, and more. The tool provides seamless integration via API, precise data extraction, and customizable AI models to enhance operational efficiency and accuracy.

KGiSL

KGiSL is a BFSI-centric multiproduct enterprise software company focused on insurance, capital markets, and wealth management segments, delivering AI and ML-driven products for a transformative edge. The company offers a wide range of solutions for various industries, including digital transformation, automation, analytics, and IT infrastructure management. KGiSL aims to empower its clients through innovative technologies such as Machine Learning, Artificial Intelligence, Analytics, and Cloud services to enhance productivity and deliver exceptional customer experiences.

Sixfold

Sixfold is a risk assessment AI solution designed exclusively for insurance underwriters. The platform enhances underwriting efficiency, accuracy, and transparency for insurers, MGAs, and reinsurers. Sixfold's AI capabilities enable faster case reviews, appetite-aware risk insights, and data gathering from days to minutes. The application ingests underwriting guidelines, extracts risk data, and provides tailored risk insights to align with unique risk preferences. It offers customized solutions for various insurance lines and features intake prioritization, contextual risk insights, risk signal detection, inconsistency identification, and data summarization.

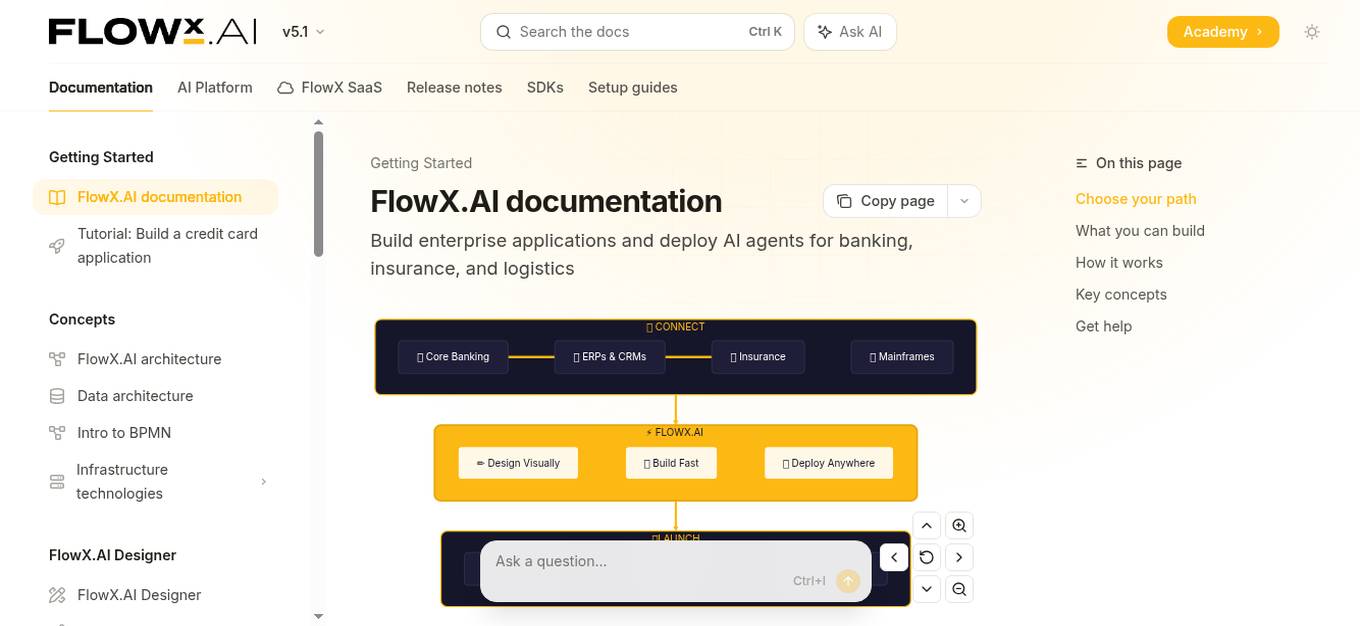

FlowX.AI

FlowX.AI is an enterprise platform designed for building business applications and deploying AI agents in regulated industries. It allows users to connect existing systems, design processes visually, and launch mission-critical solutions without the need to replace core infrastructure. The platform offers features such as building projects, managing project flows, integrating APIs, deploying AI agents, and more. FlowX.AI aims to streamline processes, enhance efficiency, and improve customer experiences in various industries.

0 - Open Source Tools

20 - OpenAI Gpts

👑 Data Privacy for Insurance Companies 👑

Insurance providers collect and process personal health, financial, and property information, making it crucial to implement comprehensive data protection strategies.

Environmental Disaster Analyst

Simulates and analyzes potential environmental disaster scenarios for preparedness.

Health Insighter

Simply type "news" for easy to digest updates in the Healthcare industry, or be as specific as you want and get the top healthcare news from reliable sources. Healthtech, patient care, insurance policies, provider networks, value based care, behavioral health, condition management, therapy.

Lifeeventprobabilityanalyzer

Map or simulate a scenario real time analyze probability of a life event coming true based on circumstances

RansomChatGPT

I'm a ransomware negotiation simulation and analysis bot trained with over 131 real-life negotiations. Type "start negotiation" to begin! New feature: Type "threat actor personality test"

PMJAY Financial Assistant

Expert in managing and tracking payment recoveries for Hope Hospital.

CPF Guide Bot

An informative guide on CPF in Singapore, offering insights on effective fund management. Not financial advice.

Employer Self-Funded Health Plan Strategist

Expert in self-funded health plans, focusing on finance, stop loss, and data analytics.