Best AI tools for< Financial Underwriter >

Infographic

20 - AI tool Sites

Underwrite.ai

Underwrite.ai is a platform that leverages advances in artificial intelligence and machine learning to provide lenders with nonlinear, dynamic models of credit risk. By analyzing thousands of data points from credit bureau sources, the application accurately models credit risk for consumers and small businesses, outperforming traditional approaches. Underwrite.ai offers a unique underwriting methodology that focuses on outcomes such as profitability and customer lifetime value, allowing organizations to enhance their lending performance without the need for capital investment or lengthy build times. The platform's models are continuously learning and adapting to market changes in real-time, providing explainable decisions in milliseconds.

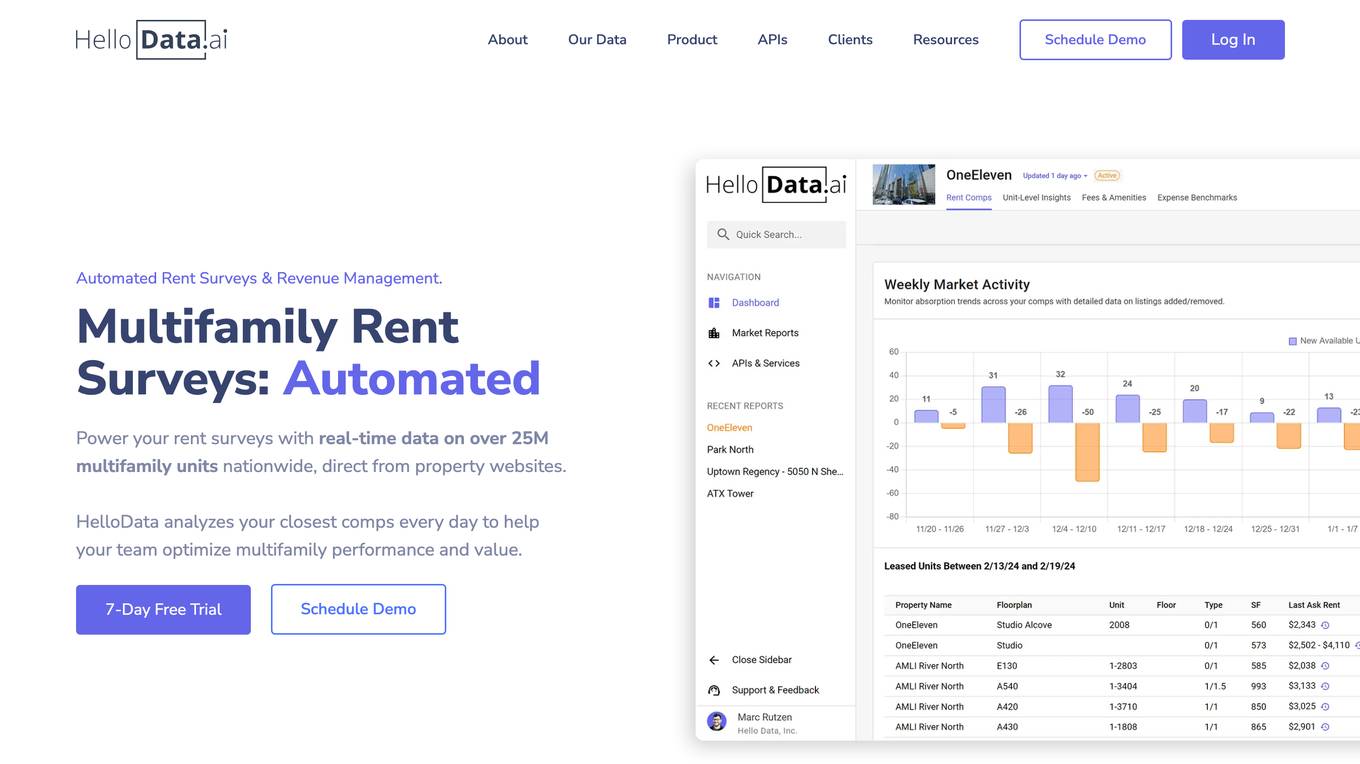

HelloData

HelloData is an AI-powered multifamily market analysis platform that automates market surveys, unit-level rent analysis, concessions monitoring, and development feasibility reports. It provides financial analysis tools to underwrite multifamily deals quickly and accurately. With custom query builders and Proptech APIs, users can analyze and download market data in bulk. HelloData is used by over 15,000 multifamily professionals to save time on market research and deal analysis, offering real-time property data and insights for operators, developers, investors, brokers, and Proptech companies.

Arya.ai

Arya.ai is an AI tool designed for Banks, Insurers, and Financial Services to deploy safe, responsible, and auditable AI applications. It offers a range of AI Apps, ML Observability Tools, and a Decisioning Platform. Arya.ai provides curated APIs, ML explainability, monitoring, and audit capabilities. The platform includes task-specific AI models for autonomous underwriting, claims processing, fraud monitoring, and more. Arya.ai aims to facilitate the rapid deployment and scaling of AI applications while ensuring institution-wide adoption of responsible AI practices.

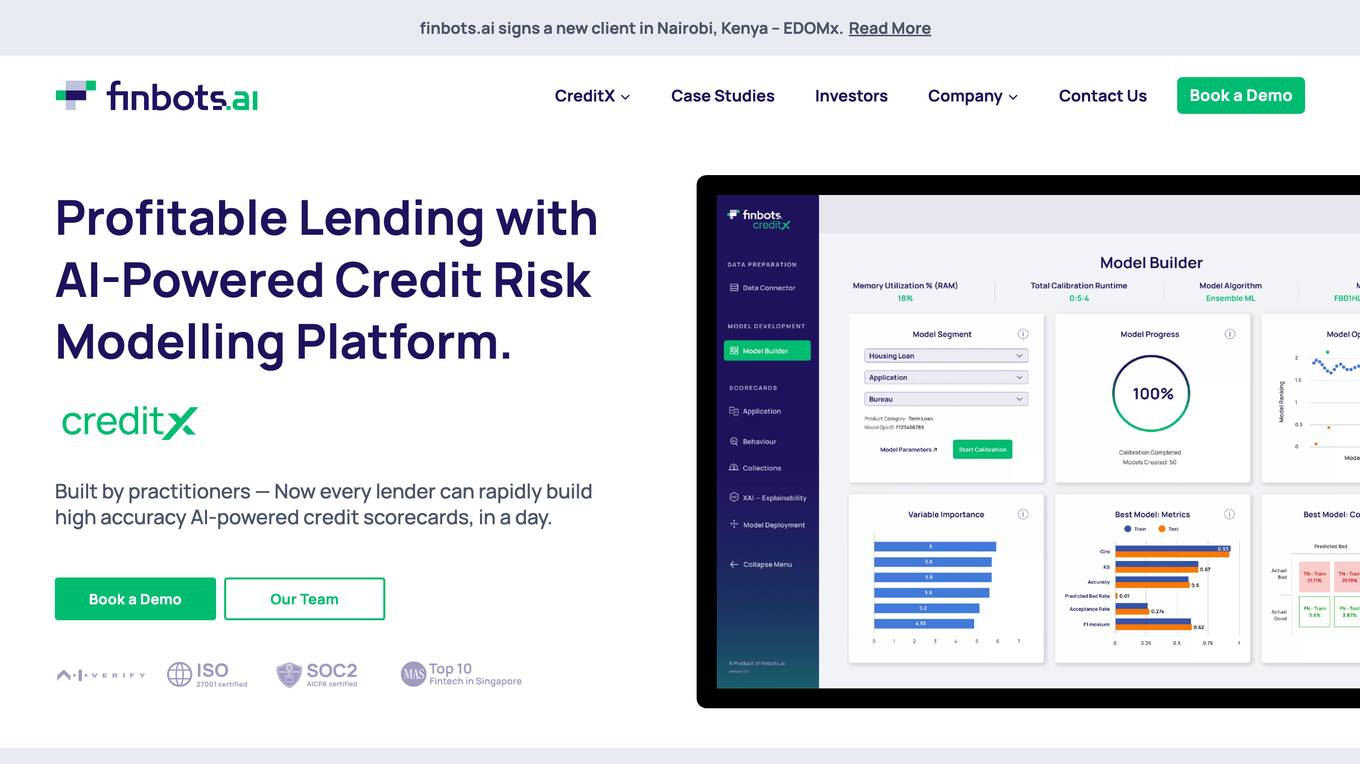

Finbots.ai

Finbots.ai is a trusted AI credit risk platform that offers AI credit scoring to boost lending profits and reduce non-performing loans. The platform provides the highest accuracy in the market, allowing users to build scorecards in a day without the need for coding. It helps in making instant decisions, increasing revenue, reducing risk, and improving operational efficiency. Finbots.ai is utilized by various financial institutions to enhance credit risk management, improve profitability, and drive down the cost of risk through AI-enabled models.

VantedgeAI

VantedgeAI is an AI application that offers fine-tuned AI models for credit funds, revolutionizing credit investing workflows with faster, smarter, and cost-effective solutions. The application transforms manual processes into scalable, automated workflows tailored for Private Credit and Hedge Funds. VantedgeAI is trusted by market leaders in the industry, providing unique AI-driven insights to maintain a competitive advantage and ensure data security and privacy through SOC 2 compliance. The application offers advanced AI solutions for credit investing, including automated investment memo generation, data extraction for Excel models, portfolio monitoring, loan reconciliation, smart bond screening, real-time data querying with AI bots, and more.

FlowX.AI

FlowX.AI is a Multi-Agent AI Platform designed for Banking and Insurance Modernization. It offers a cutting-edge AI-native agentic platform for building and deploying AI agents and mission-critical AI-enabled systems in highly regulated industries. The platform enables businesses to build the next generation of banking and insurance systems in weeks, not years, by providing faster development, time to market, and reduced maintenance and implementation costs.

Kasisto

Kasisto is a conversational AI platform that provides financial institutions with the ability to create personalized, automated, and engaging digital experiences for their customers and employees. Kasisto's platform is infused with unmatched financial literacy and augments your workforce with remarkably competent digital bankers who facilitate accurate, human-like conversations and empower your teams with “in-the-moment” financial knowledge.

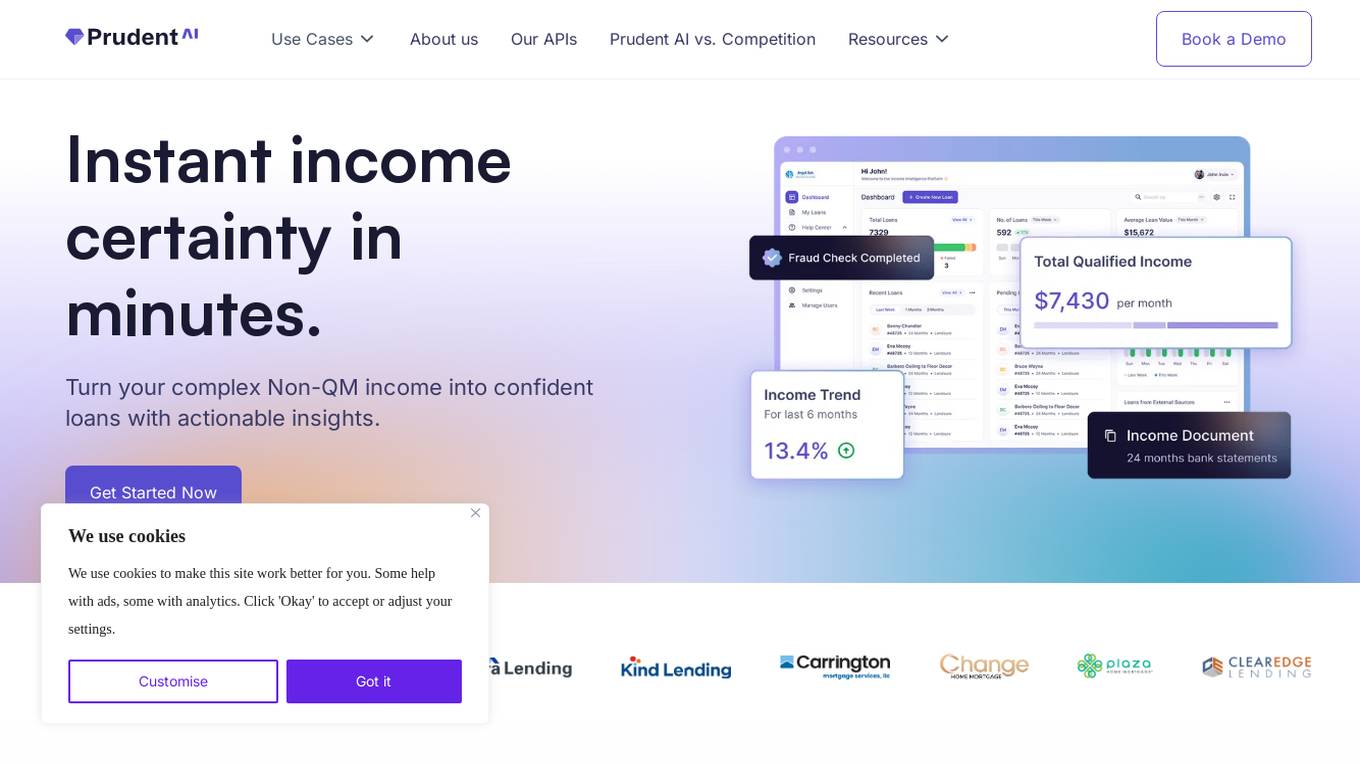

Prudent AI

Prudent AI is an AI-powered Income Intelligence Platform designed for lenders, offering fast data extraction, proactive fraud prevention, and in-depth insights on borrower income. The platform simplifies complex income calculations, streamlines the lending process, and enables lenders to make confident loan decisions quickly. Prudent AI is trusted by various lending institutions and has been proven to increase productivity, save time, and improve submission accuracy.

CreditHQ

CreditHQ is an AI-powered loan restructuring platform that helps users analyze their credit history, compare interest rates, and save money on their loans. The platform offers a range of features, including a credit score simulator, a budgeting tool, and a debt management tool. CreditHQ is trusted by over 5,500 users and companies globally.

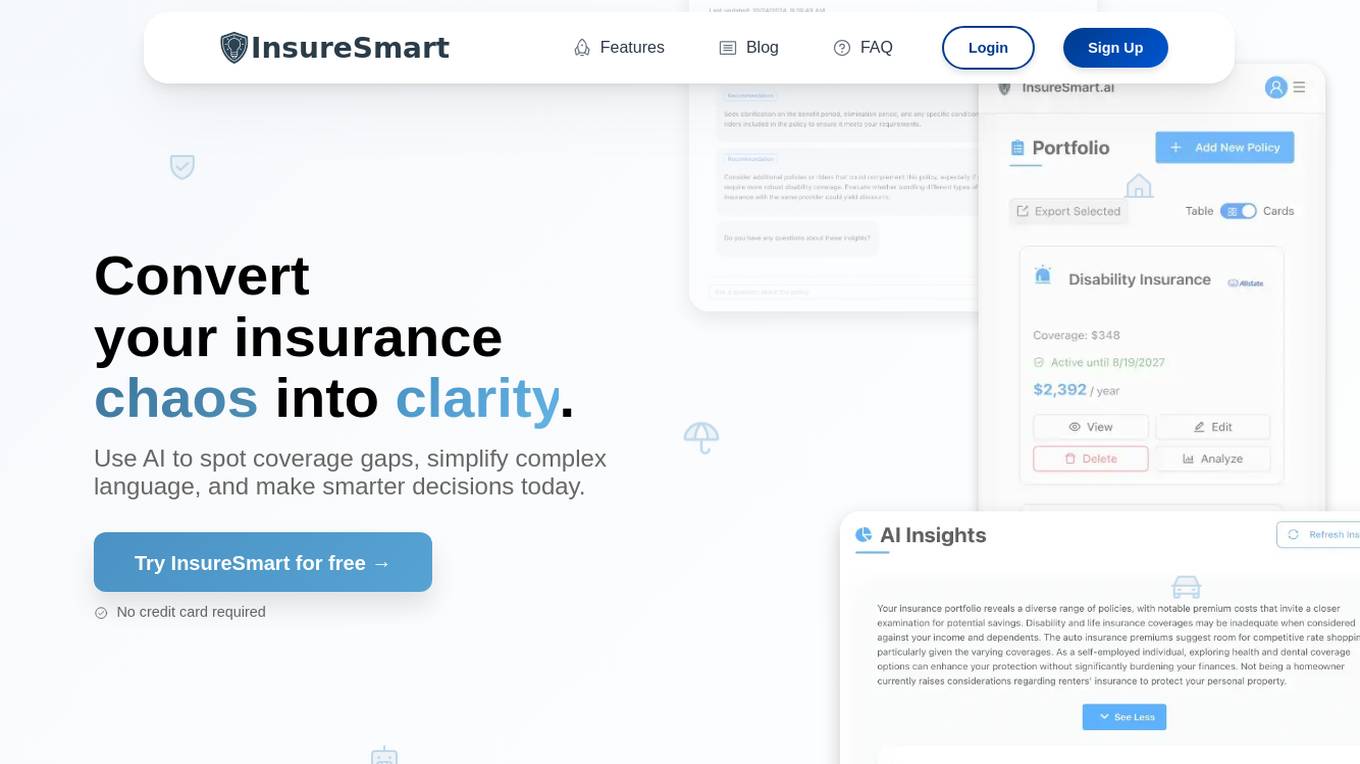

InsureSmart

InsureSmart is an AI-powered platform that empowers users to take control of their insurance needs. By leveraging artificial intelligence technology, InsureSmart offers personalized insurance solutions tailored to individual requirements. The platform provides a seamless and user-friendly experience for users to manage and optimize their insurance policies efficiently. With InsureSmart, users can access smart recommendations, compare insurance plans, and make informed decisions to secure their financial well-being.

Scienaptic Systems

Scienaptic Systems is an AI-powered Credit Decisioning Platform that revolutionizes the lending industry by automating credit underwriting processes, leveraging alternate data points, and offering self-learning models for instant credit decisions. The platform helps lenders identify creditworthy borrowers, streamline customer experience, and ensure fair lending practices through explainable AI models. Scienaptic's suite of AI-enabled technologies enables lenders to say 'Yes' to more borrowers at lower risk, providing a 360-degree risk assessment before approving applications. The platform integrates seamlessly with existing lending ecosystems, ensuring disruption-free deployment and better risk predictions through a single API call.

Perfios

Perfios is an AI-powered FinTech software company that offers digital solutions for various industries such as banking, insurance, fintech, payments, e-commerce, legal, gaming, and more. Their platform provides end-to-end solutions for digital onboarding, underwriting, risk assessment, fraud detection, and customer engagement. Perfios leverages AI and machine learning technologies to streamline processes, enhance operational efficiency, and improve decision-making in financial services. With a wide range of products and features, Perfios aims to transform the way businesses experience technology and make data-driven decisions.

FairPlay

FairPlay is a Fairness-as-a-Service solution designed for financial institutions, offering AI-powered tools to assess automated decisioning models quickly. It helps in increasing fairness and profits by optimizing marketing, underwriting, and pricing strategies. The application provides features such as Fairness Optimizer, Second Look, Customer Composition, Redline Status, and Proxy Detection. FairPlay enables users to identify and overcome tradeoffs between performance and disparity, assess geographic fairness, de-bias proxies for protected classes, and tune models to reduce disparities without increasing risk. It offers advantages like increased compliance, speed, and readiness through automation, higher approval rates with no increase in risk, and rigorous Fair Lending analysis for sponsor banks and regulators. However, some disadvantages include the need for data integration, potential bias in AI algorithms, and the requirement for technical expertise to interpret results.

Lama AI

Lama AI is an AI-powered platform designed to revolutionize business lending processes for banks and financial institutions. It offers advanced features, rapid configurability, and exceptional support to streamline loan origination, underwriting, and decision-making. By leveraging the power of AI, Lama AI enables banks to boost business growth potential, improve profitability, and enhance customer experience through contextual onboarding, decisioning workspace, expanded credit access, and pre-qualified applications. The platform also provides white-labeled solutions, API-first integration, high configurability, built-in AI models, and access to a network of bank lenders, all while ensuring bank-grade security and compliance standards.

Financial Planning

The Financial Planning website is a comprehensive platform that offers insights and resources on various aspects of financial planning, including tax investing, wealth management, estate planning, retirement planning, practice management, regulation and compliance, technology, industry news, and opinion pieces. The site covers a wide range of topics relevant to financial advisors and professionals in the wealth management industry. It also features articles on emerging trends, investment strategies, industry updates, and expert opinions to help readers stay informed and make informed decisions.

SymphonyAI NetReveal Financial Services

SymphonyAI NetReveal Financial Services is an AI-powered platform that offers solutions for financial crime prevention in various industries such as banking, insurance, financial markets, and private banking. The platform utilizes predictive and generative AI applications to enhance efficiency, reduce fraud, streamline compliance, and maximize output. SymphonyAI provides a fundamentally different approach to AI by combining high-value AI capabilities with industry-leading predictive and generative AI technologies. The platform offers a range of solutions including transaction monitoring, customer due diligence, payment fraud detection, and enterprise investigation management. SymphonyAI aims to revolutionize financial crime prevention by leveraging AI to detect suspicious activity, expedite investigations, and improve compliance operations.

SymphonyAI Financial Crime Prevention AI SaaS Solutions

SymphonyAI offers AI SaaS solutions for financial crime prevention, helping organizations detect fraud, conduct customer due diligence, and prevent payment fraud. Their solutions leverage generative and predictive AI to enhance efficiency and effectiveness in investigating financial crimes. SymphonyAI's products cater to industries like banking, insurance, financial markets, and private banking, providing rapid deployment, scalability, and seamless integration to meet regulatory compliance requirements.

Intuit Assist

Intuit Assist is a generative AI-powered financial assistant designed to help you achieve financial confidence. It is a comprehensive platform that offers a wide range of financial tools and services, including TurboTax, Credit Karma, QuickBooks, and Mailchimp. Intuit Assist can help you with a variety of financial tasks, such as filing your taxes, managing your credit, tracking your expenses, and invoicing your clients. It is a valuable tool for anyone who wants to take control of their finances and achieve financial success.

Roic AI

Roic AI is an AI tool designed to provide users with essential financial data for analyzing companies. It offers comprehensive company summaries, 30+ years of financial statements, and earnings call transcripts in a single location. Users can access crucial information about popular companies like Apple Inc. and Microsoft Corporation through this platform.

CityFALCON

CityFALCON is a financial and business due diligence platform that provides a range of solutions for the needs of a wide audience, including retail investors, retail traders, daily business news readers, brokers, students, professors, academia, wealth managers, financial advisors, P2P crowdfunding, VC, PE, institutional investors, treasury, consultancy, legal, accounting, central banks, and regulatory agencies. The platform offers a variety of features and content, including a CityFALCON Score, watchlists, similar stories, grouping news on charts, key headlines, sentiment content translation, content news premium publications, insider transactions, official company filings, investor relations, ESG content, and languages.

0 - Open Source Tools

20 - OpenAI Gpts

Credit Analyst

Analyzes financial data to assess creditworthiness, aiding in lending decisions and solutions.

Lifeeventprobabilityanalyzer

Map or simulate a scenario real time analyze probability of a life event coming true based on circumstances

Financial Cybersecurity Analyst - Lockley Cash v1

stunspot's advisor for all things Financial Cybersec

Financial Sentiment Analyst

A sentiment analysis tool for evaluating management-related texts.