stock-trading

AI小模型股票自动交易系统后端项目,使用DL4J框架实现LSTM模型实现股票价格预测和自动化股票交易,后端技术栈包含springboot,mysql,MongoDB,quartZ,k8s, mybatis-plus, webSocket, OCR文字识别等技术框架

Stars: 85

StockTrading AI is a small model stock automatic trading system that integrates with securities platforms, implements automated stock trading, utilizes QuartZ for scheduled tasks to update data daily, employs DL4J framework for LSTM model guidance on stock buying with T+1 short-term trading strategy, utilizes K8S+GithubAction for DevOps, and supports distributed offline training. Future optimizations include obtaining more historical stock data for incremental model training and tuning model hyperparameters to improve price trend prediction accuracy. The system provides various page displays for profit data statistics, trade order queries, stock price viewing, model prediction performance, scheduled task scheduling, and real-time log tracking.

README:

https://www.yuque.com/mwangli/ha7323/axga8dz9imansvl4

http:124.220.36.95:8000 用户名/密码:guest

- 对接证券平台,实现股票自动化交易

- 使用QuartZ定时任务调度,每日自动更新数据

- 使用DL4J框架实现LSTM模型指导股票买入,采用T+1短线交易策略

- 利用K8S+GithubAction实现DevOps

- 支持分布式离线训练

- 获得更多股票历史数据用于模型增量迭代训练

- 模型超参数调优提高预测价格趋势准确率

For Tasks:

Click tags to check more tools for each tasksFor Jobs:

Alternative AI tools for stock-trading

Similar Open Source Tools

stock-trading

StockTrading AI is a small model stock automatic trading system that integrates with securities platforms, implements automated stock trading, utilizes QuartZ for scheduled tasks to update data daily, employs DL4J framework for LSTM model guidance on stock buying with T+1 short-term trading strategy, utilizes K8S+GithubAction for DevOps, and supports distributed offline training. Future optimizations include obtaining more historical stock data for incremental model training and tuning model hyperparameters to improve price trend prediction accuracy. The system provides various page displays for profit data statistics, trade order queries, stock price viewing, model prediction performance, scheduled task scheduling, and real-time log tracking.

Train-llm-from-scratch

Train-llm-from-scratch is a repository that guides users through training a Large Language Model (LLM) from scratch. The model size can be adjusted based on available computing power. The repository utilizes deepspeed for distributed training and includes detailed explanations of the code and key steps at each stage to facilitate learning. Users can train their own tokenizer or use pre-trained tokenizers like ChatGLM2-6B. The repository provides information on preparing pre-training data, processing training data, and recommended SFT data for fine-tuning. It also references other projects and books related to LLM training.

qgate-model

QGate-Model is a machine learning meta-model with synthetic data, designed for MLOps and feature store. It is independent of machine learning solutions, with definitions in JSON and data in CSV/parquet formats. This meta-model is useful for comparing capabilities and functions of machine learning solutions, independently testing new versions of machine learning solutions, and conducting various types of tests (unit, sanity, smoke, system, regression, function, acceptance, performance, shadow, etc.). It can also be used for external test coverage when internal test coverage is not available or weak.

Chat2DB

Chat2DB is an AI-driven data development and analysis platform that enables users to communicate with databases using natural language. It supports a wide range of databases, including MySQL, PostgreSQL, Oracle, SQLServer, SQLite, MariaDB, ClickHouse, DM, Presto, DB2, OceanBase, Hive, KingBase, MongoDB, Redis, and Snowflake. Chat2DB provides a user-friendly interface that allows users to query databases, generate reports, and explore data using natural language commands. It also offers a variety of features to help users improve their productivity, such as auto-completion, syntax highlighting, and error checking.

ERNIE

ERNIE 4.5 is a family of large-scale multimodal models with 10 distinct variants, including Mixture-of-Experts (MoE) models with 47B and 3B active parameters. The models feature a novel heterogeneous modality structure supporting parameter sharing across modalities while allowing dedicated parameters for each individual modality. Trained with optimal efficiency using PaddlePaddle deep learning framework, ERNIE 4.5 models achieve state-of-the-art performance across text and multimodal benchmarks, enhancing multimodal understanding without compromising performance on text-related tasks. The open-source development toolkits for ERNIE 4.5 offer industrial-grade capabilities, resource-efficient training and inference workflows, and multi-hardware compatibility.

enhance_llm

The enhance_llm repository contains three main parts: 1. Vector model domain fine-tuning based on llama_index and qwen fine-tuning BGE vector model. 2. Large model domain fine-tuning based on PEFT fine-tuning qwen1.5-7b-chat, with sft and dpo. 3. High-order retrieval enhanced generation (RAG) system based on the above domain work, implementing a two-stage RAG system. It includes query rewriting, recall reordering, retrieval reordering, multi-turn dialogue, and more. The repository also provides hardware and environment configurations along with star history and licensing information.

xpert

Xpert is a powerful tool for data analysis and visualization. It provides a user-friendly interface to explore and manipulate datasets, perform statistical analysis, and create insightful visualizations. With Xpert, users can easily import data from various sources, clean and preprocess data, analyze trends and patterns, and generate interactive charts and graphs. Whether you are a data scientist, analyst, researcher, or student, Xpert simplifies the process of data analysis and visualization, making it accessible to users with varying levels of expertise.

IntelliQ

IntelliQ is an open-source project aimed at providing a multi-turn question-answering system based on a large language model (LLM). The system combines advanced intent recognition and slot filling technology to enhance the depth of understanding and accuracy of responses in conversation systems. It offers a flexible and efficient solution for developers to build and optimize various conversational applications. The system features multi-turn dialogue management, intent recognition, slot filling, interface slot technology for real-time data retrieval and processing, adaptive learning for improving response accuracy and speed, and easy integration with detailed API documentation supporting multiple programming languages and platforms.

MaxKB

MaxKB is a knowledge base Q&A system based on the LLM large language model. MaxKB = Max Knowledge Base, which aims to become the most powerful brain of the enterprise.

FinVeda

FinVeda is a dynamic financial literacy app that aims to solve the problem of low financial literacy rates in India by providing a platform for financial education. It features an AI chatbot, finance blogs, market trends analysis, SIP calculator, and finance quiz to help users learn finance with finesse. The app is free and open-source, licensed under the GNU General Public License v3.0. FinVeda was developed at IIT Jammu's Udyamitsav'24 Hackathon, where it won first place in the GenAI track and third place overall.

KB-Builder

KB Builder is an open-source knowledge base generation system based on the LLM large language model. It utilizes the RAG (Retrieval-Augmented Generation) data generation enhancement method to provide users with the ability to enhance knowledge generation and quickly build knowledge bases based on RAG. It aims to be the central hub for knowledge construction in enterprises, offering platform-based intelligent dialogue services and document knowledge base management functionality. Users can upload docx, pdf, txt, and md format documents and generate high-quality knowledge base question-answer pairs by invoking large models through the 'Parse Document' feature.

AceCoder

AceCoder is a tool that introduces a fully automated pipeline for synthesizing large-scale reliable tests used for reward model training and reinforcement learning in the coding scenario. It curates datasets, trains reward models, and performs RL training to improve coding abilities of language models. The tool aims to unlock the potential of RL training for code generation models and push the boundaries of LLM's coding abilities.

archestra

Archestra is an enterprise-grade platform that enables non-technical users to safely leverage AI agents and MCP servers. It provides a secure runtime environment for AI interactions with sandboxing, resource controls, and prompt injection prevention. The platform supports MCP Protocol and is designed with a local-first architecture, enterprise-level security, and extensible tool system.

sealos

Sealos is a cloud operating system distribution based on the Kubernetes kernel, designed for a seamless development lifecycle. It allows users to spin up full-stack environments in seconds, effortlessly push releases, and scale production seamlessly. With core features like easy application management, quick database creation, and cloud universality, Sealos offers efficient and economical cloud management with high universality and ease of use. The platform also emphasizes agility and security through its multi-tenancy sharing model. Sealos is supported by a community offering full documentation, Discord support, and active development roadmap.

sglang

SGLang is a structured generation language designed for large language models (LLMs). It makes your interaction with LLMs faster and more controllable by co-designing the frontend language and the runtime system. The core features of SGLang include: - **A Flexible Front-End Language**: This allows for easy programming of LLM applications with multiple chained generation calls, advanced prompting techniques, control flow, multiple modalities, parallelism, and external interaction. - **A High-Performance Runtime with RadixAttention**: This feature significantly accelerates the execution of complex LLM programs by automatic KV cache reuse across multiple calls. It also supports other common techniques like continuous batching and tensor parallelism.

For similar tasks

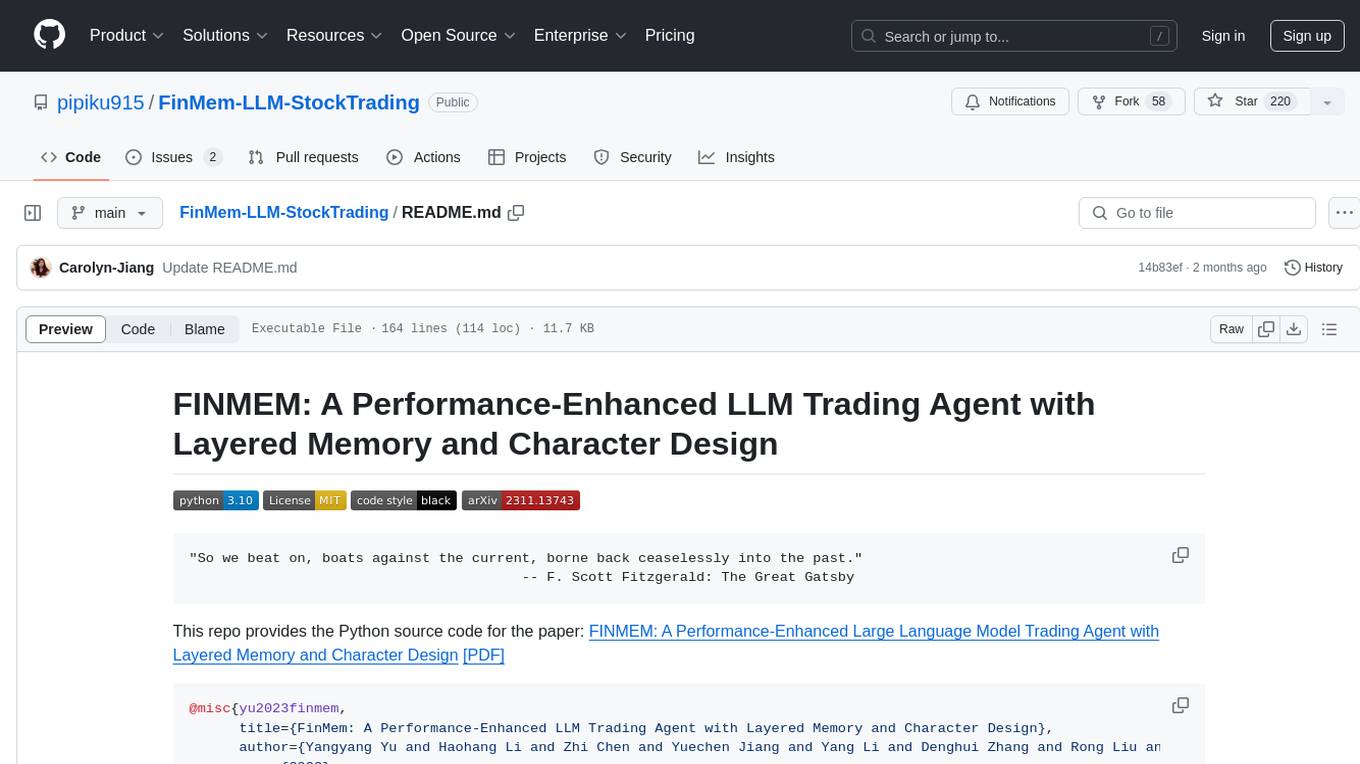

FinMem-LLM-StockTrading

This repository contains the Python source code for FINMEM, a Performance-Enhanced Large Language Model Trading Agent with Layered Memory and Character Design. It introduces FinMem, a novel LLM-based agent framework devised for financial decision-making, encompassing three core modules: Profiling, Memory with layered processing, and Decision-making. FinMem's memory module aligns closely with the cognitive structure of human traders, offering robust interpretability and real-time tuning. The framework enables the agent to self-evolve its professional knowledge, react agilely to new investment cues, and continuously refine trading decisions in the volatile financial environment. It presents a cutting-edge LLM agent framework for automated trading, boosting cumulative investment returns.

RainbowGPT

RainbowGPT is a versatile tool that offers a range of functionalities, including Stock Analysis for financial decision-making, MySQL Management for database navigation, and integration of AI technologies like GPT-4 and ChatGlm3. It provides a user-friendly interface suitable for all skill levels, ensuring seamless information flow and continuous expansion of emerging technologies. The tool enhances adaptability, creativity, and insight, making it a valuable asset for various projects and tasks.

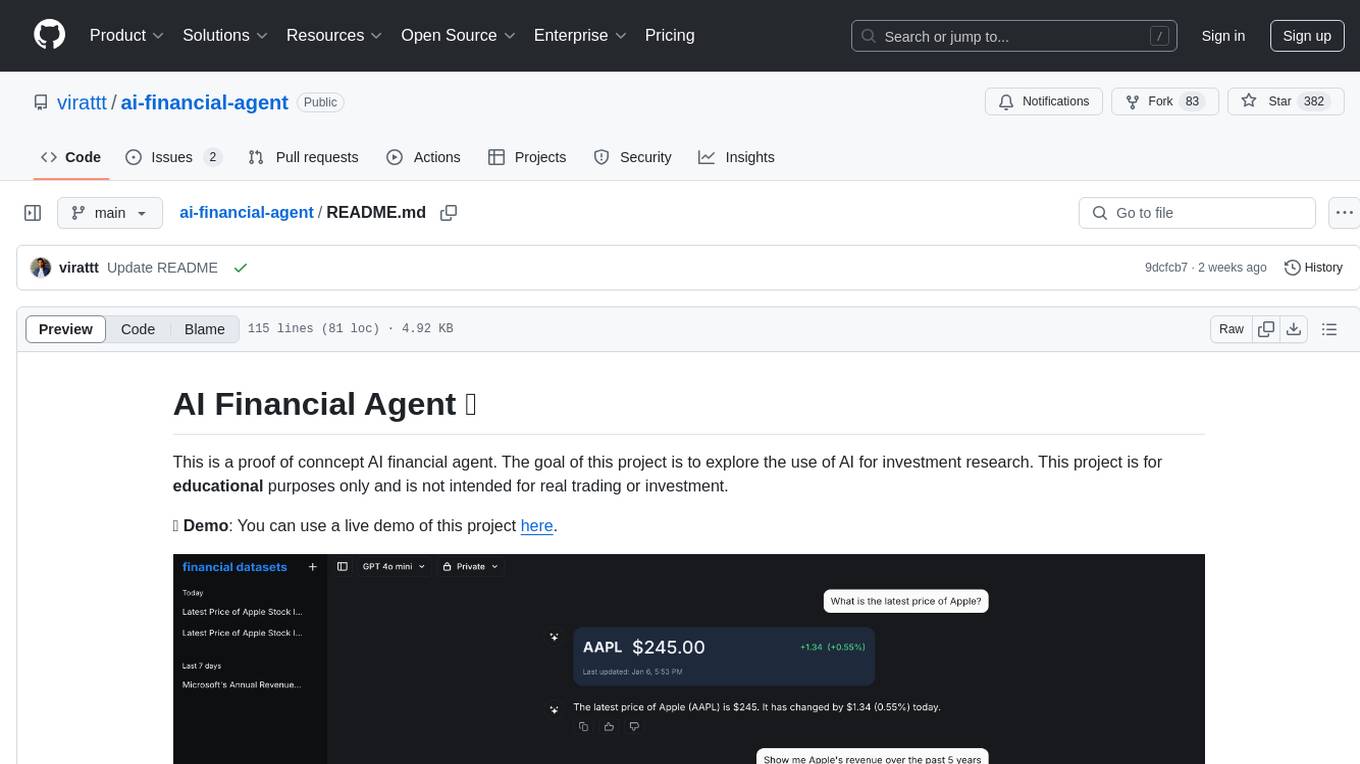

ai-financial-agent

AI Financial Agent is a proof of concept project exploring the use of AI for investment research. It provides an AI SDK with a unified API for generating text and structured objects, along with access to real-time and historical stock market data optimized for AI financial agents. The project includes features like dynamic chat interfaces, support for multiple model providers, and styling with Tailwind CSS. Users can deploy their own version of the AI Financial Agent using Vercel and GitHub integration.

stock-trading

StockTrading AI is a small model stock automatic trading system that integrates with securities platforms, implements automated stock trading, utilizes QuartZ for scheduled tasks to update data daily, employs DL4J framework for LSTM model guidance on stock buying with T+1 short-term trading strategy, utilizes K8S+GithubAction for DevOps, and supports distributed offline training. Future optimizations include obtaining more historical stock data for incremental model training and tuning model hyperparameters to improve price trend prediction accuracy. The system provides various page displays for profit data statistics, trade order queries, stock price viewing, model prediction performance, scheduled task scheduling, and real-time log tracking.

FinanceMCP

FinanceMCP is a professional financial data server based on the MCP protocol, integrating the Tushare API to provide real-time financial data and technical indicator analysis for AI assistants like Claude. It offers various free public cloud services, including a web-based experience version and desktop configuration for production environments. The core features include an intelligent technical indicator system with 5 core indicators, comprehensive market coverage across 10 markets, tools for stock, index, company, macroeconomic, and fund data analysis, as well as specific modules for analyzing US and Hong Kong stock companies. The tool supports tasks like stock technical analysis, comprehensive analysis, news and macroeconomic analysis, fund and bond data queries, among others. It can be locally deployed using Streamable HTTP or SSE modes, with detailed installation and configuration instructions provided.

PanWatch

PanWatch is a private AI stock assistant for real-time market monitoring, intelligent technical analysis, and multi-account portfolio management. It offers data privacy through self-hosted deployment, AI-native features that understand user's holdings, style, and goals, and easy setup with Docker. The core functions include intelligent agent system for pre-market analysis, real-time intraday monitoring, end-of-day reports, and news updates. It also provides professional technical analysis with trend indicators, momentum indicators, volume-price analysis, pattern recognition, and support/resistance calculations. PanWatch supports multiple markets and accounts, covering A shares, Hong Kong stocks, and US stocks, with customizable trading styles for accurate AI suggestions. Notifications are available through various channels like Telegram, WeChat Work, DingTalk, Feishu, Bark, and custom webhooks.

Time-LLM

Time-LLM is a reprogramming framework that repurposes large language models (LLMs) for time series forecasting. It allows users to treat time series analysis as a 'language task' and effectively leverage pre-trained LLMs for forecasting. The framework involves reprogramming time series data into text representations and providing declarative prompts to guide the LLM reasoning process. Time-LLM supports various backbone models such as Llama-7B, GPT-2, and BERT, offering flexibility in model selection. The tool provides a general framework for repurposing language models for time series forecasting tasks.

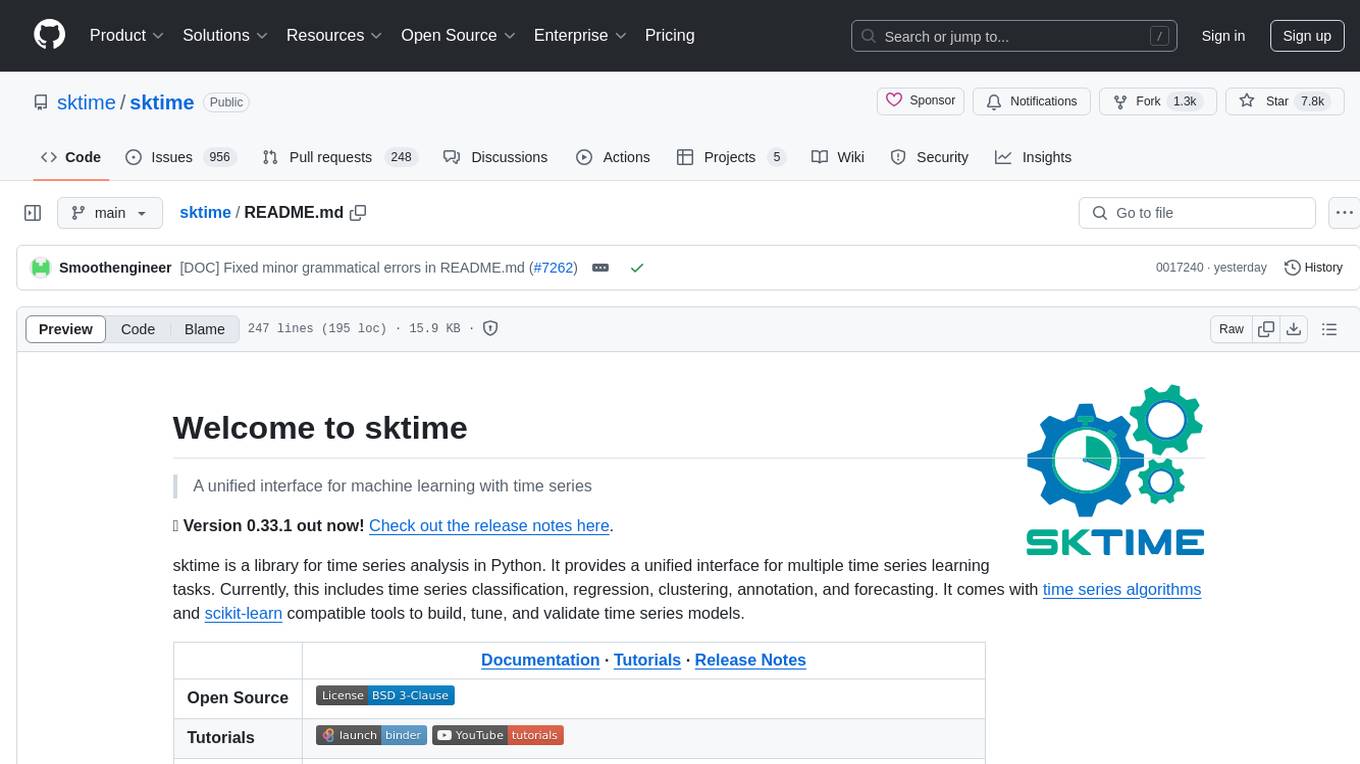

sktime

sktime is a Python library for time series analysis that provides a unified interface for various time series learning tasks such as classification, regression, clustering, annotation, and forecasting. It offers time series algorithms and tools compatible with scikit-learn for building, tuning, and validating time series models. sktime aims to enhance the interoperability and usability of the time series analysis ecosystem by empowering users to apply algorithms across different tasks and providing interfaces to related libraries like scikit-learn, statsmodels, tsfresh, PyOD, and fbprophet.

For similar jobs

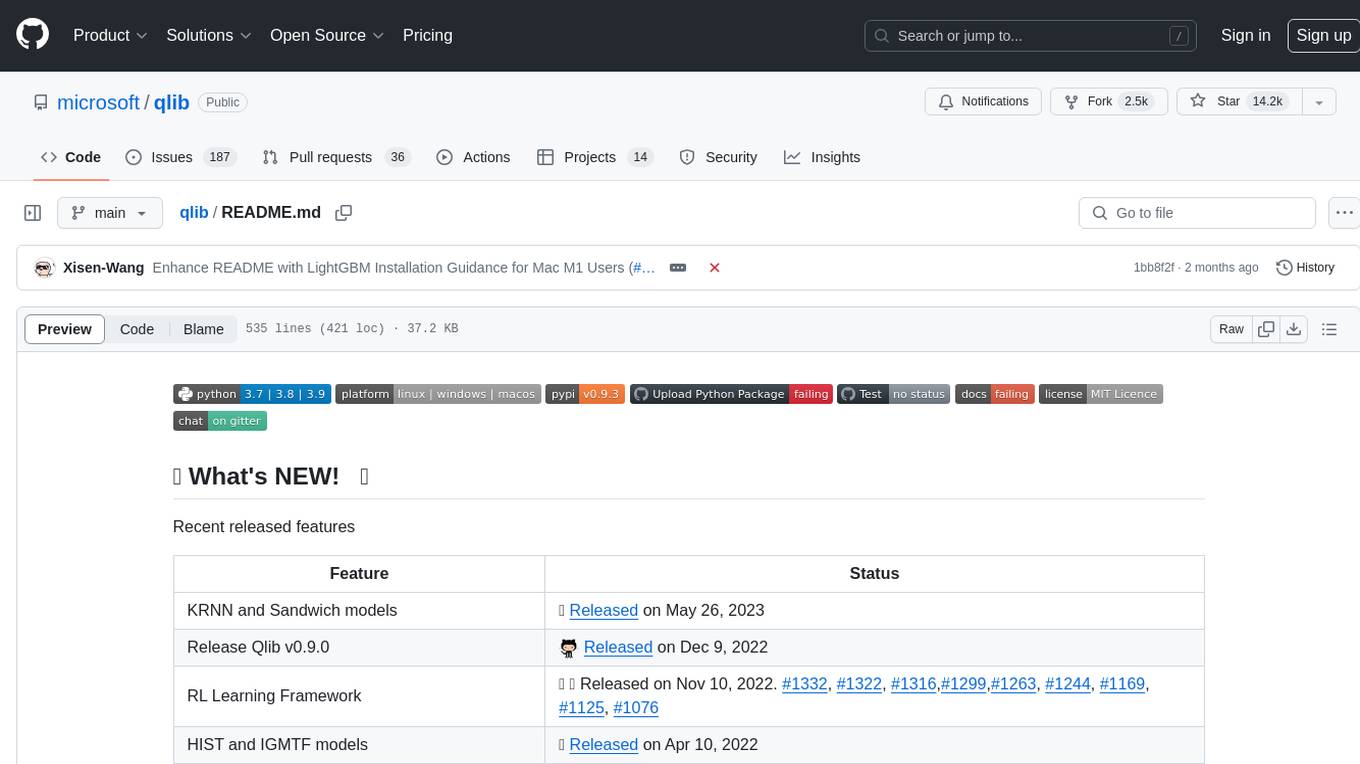

qlib

Qlib is an open-source, AI-oriented quantitative investment platform that supports diverse machine learning modeling paradigms, including supervised learning, market dynamics modeling, and reinforcement learning. It covers the entire chain of quantitative investment, from alpha seeking to order execution. The platform empowers researchers to explore ideas and implement productions using AI technologies in quantitative investment. Qlib collaboratively solves key challenges in quantitative investment by releasing state-of-the-art research works in various paradigms. It provides a full ML pipeline for data processing, model training, and back-testing, enabling users to perform tasks such as forecasting market patterns, adapting to market dynamics, and modeling continuous investment decisions.

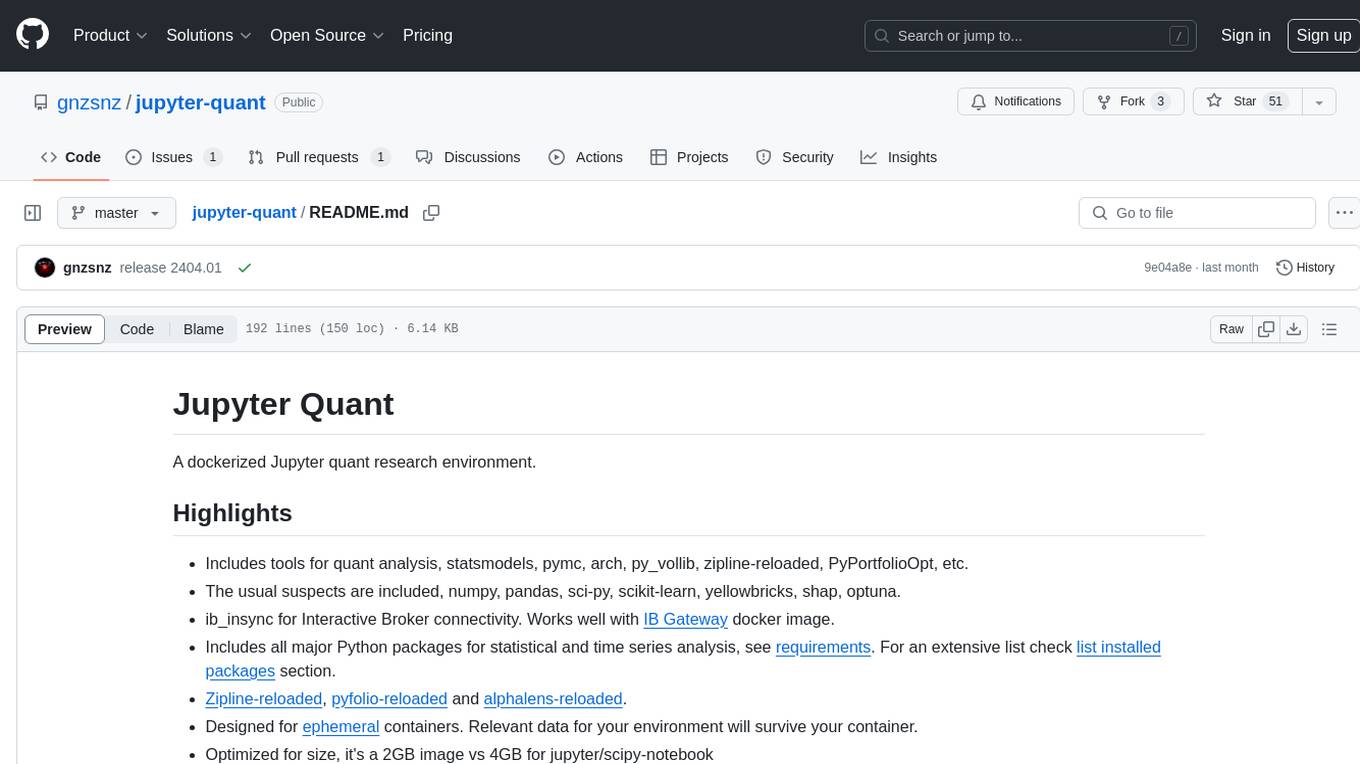

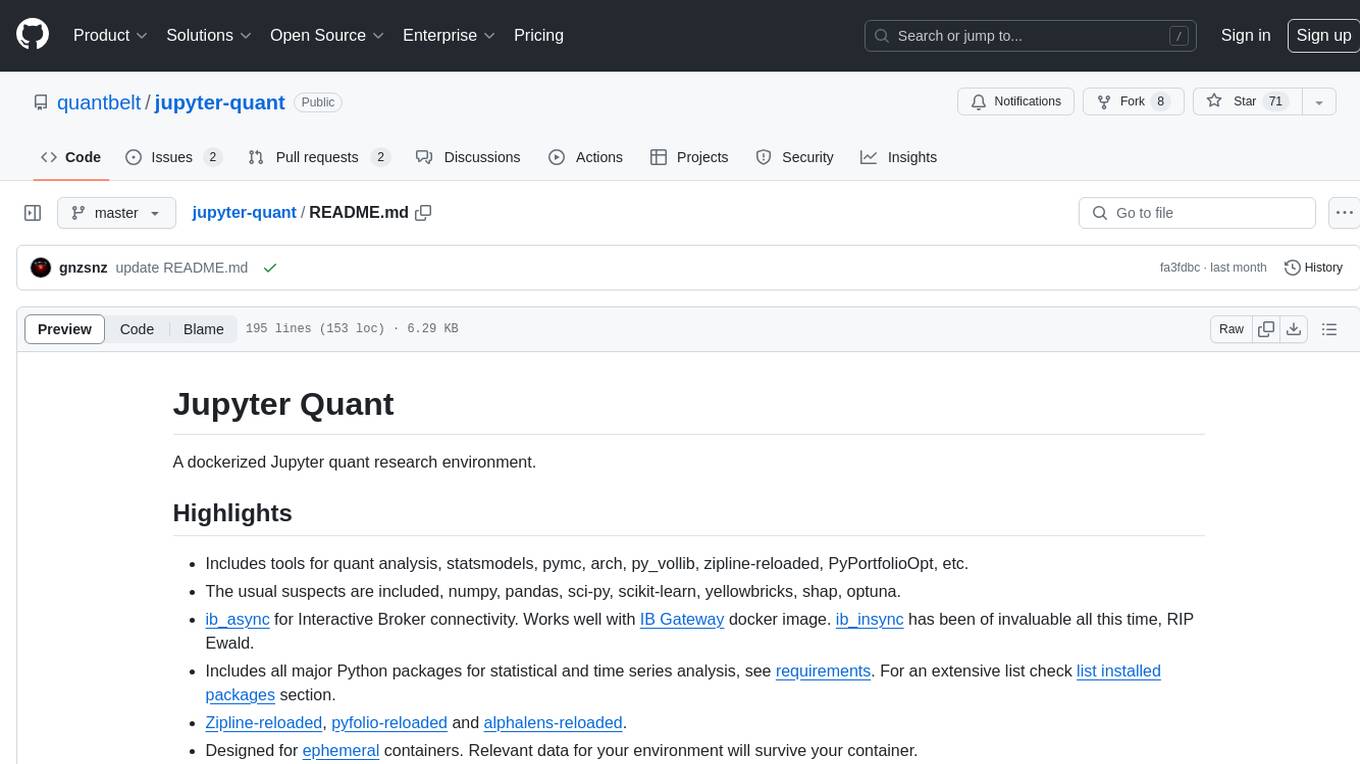

jupyter-quant

Jupyter Quant is a dockerized environment tailored for quantitative research, equipped with essential tools like statsmodels, pymc, arch, py_vollib, zipline-reloaded, PyPortfolioOpt, numpy, pandas, sci-py, scikit-learn, yellowbricks, shap, optuna, ib_insync, Cython, Numba, bottleneck, numexpr, jedi language server, jupyterlab-lsp, black, isort, and more. It does not include conda/mamba and relies on pip for package installation. The image is optimized for size, includes common command line utilities, supports apt cache, and allows for the installation of additional packages. It is designed for ephemeral containers, ensuring data persistence, and offers volumes for data, configuration, and notebooks. Common tasks include setting up the server, managing configurations, setting passwords, listing installed packages, passing parameters to jupyter-lab, running commands in the container, building wheels outside the container, installing dotfiles and SSH keys, and creating SSH tunnels.

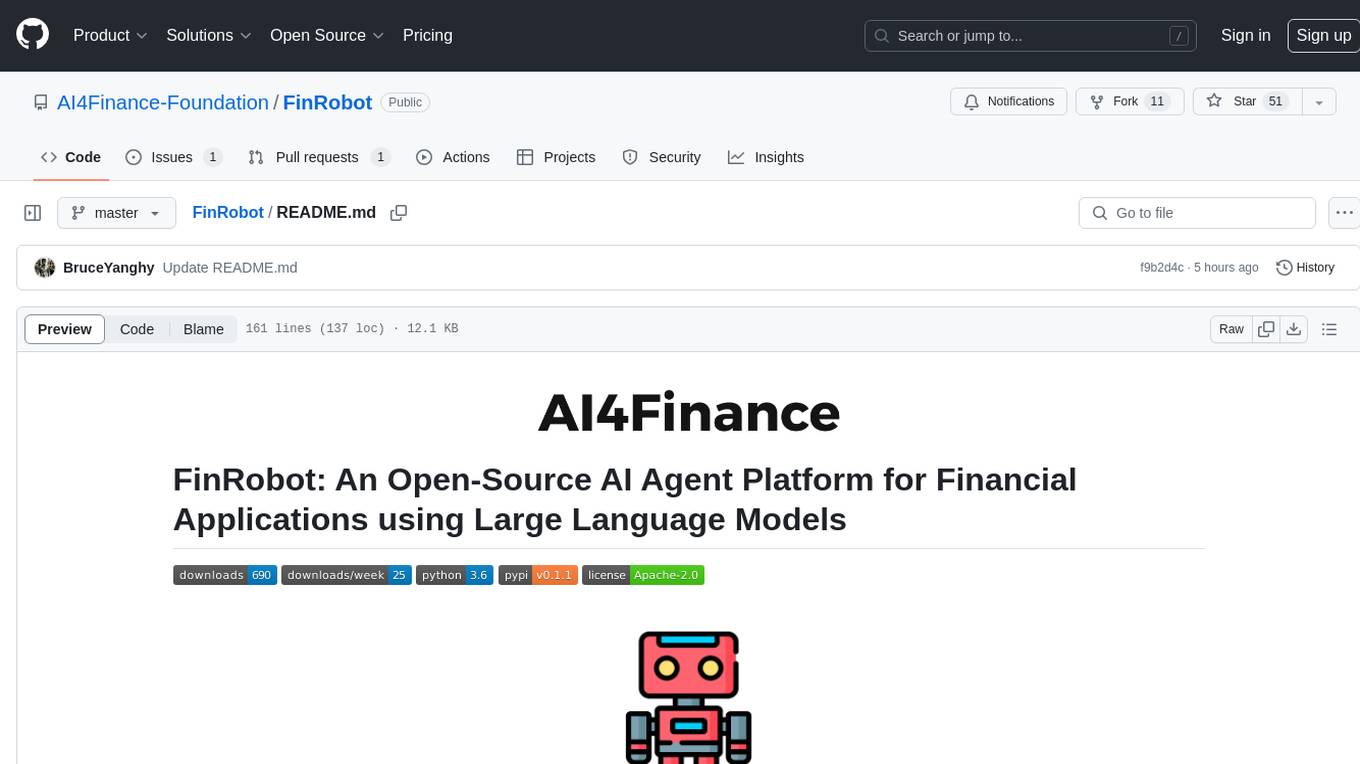

FinRobot

FinRobot is an open-source AI agent platform designed for financial applications using large language models. It transcends the scope of FinGPT, offering a comprehensive solution that integrates a diverse array of AI technologies. The platform's versatility and adaptability cater to the multifaceted needs of the financial industry. FinRobot's ecosystem is organized into four layers, including Financial AI Agents Layer, Financial LLMs Algorithms Layer, LLMOps and DataOps Layers, and Multi-source LLM Foundation Models Layer. The platform's agent workflow involves Perception, Brain, and Action modules to capture, process, and execute financial data and insights. The Smart Scheduler optimizes model diversity and selection for tasks, managed by components like Director Agent, Agent Registration, Agent Adaptor, and Task Manager. The tool provides a structured file organization with subfolders for agents, data sources, and functional modules, along with installation instructions and hands-on tutorials.

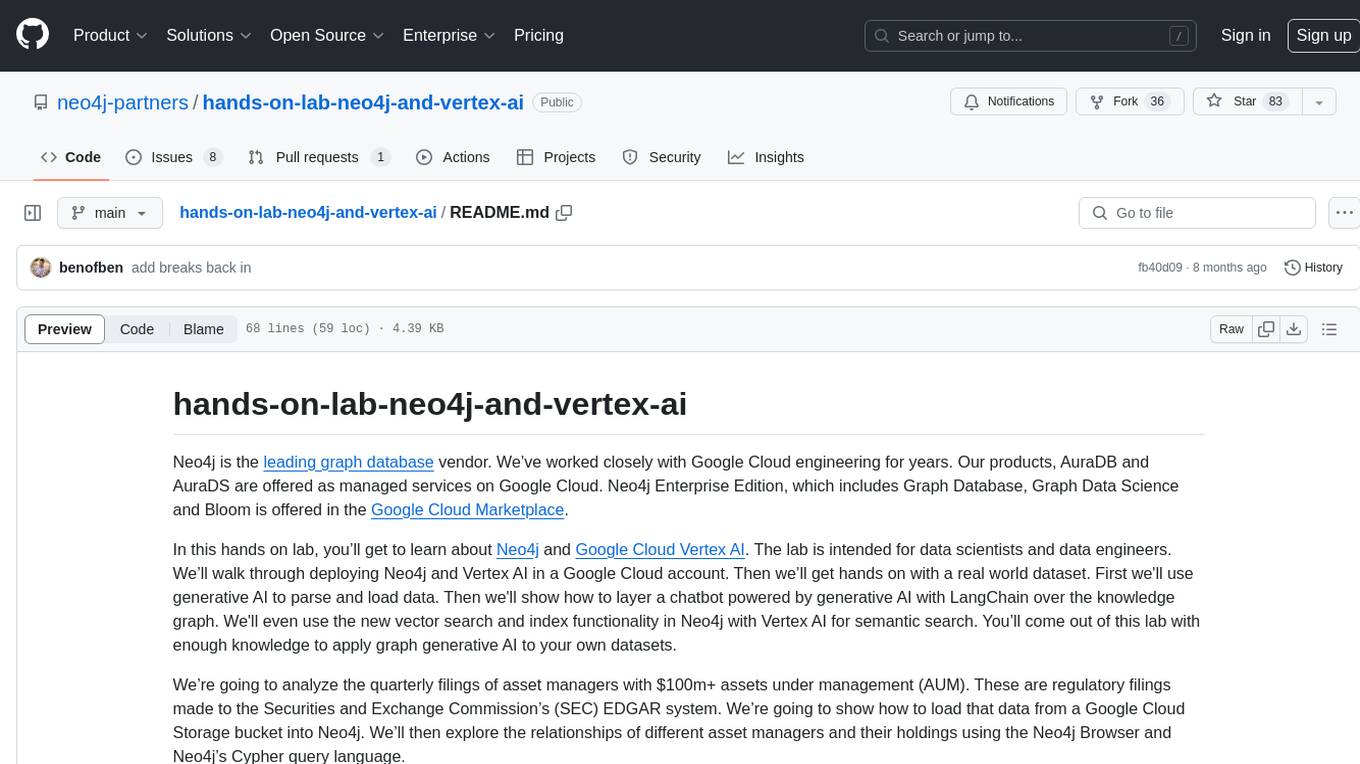

hands-on-lab-neo4j-and-vertex-ai

This repository provides a hands-on lab for learning about Neo4j and Google Cloud Vertex AI. It is intended for data scientists and data engineers to deploy Neo4j and Vertex AI in a Google Cloud account, work with real-world datasets, apply generative AI, build a chatbot over a knowledge graph, and use vector search and index functionality for semantic search. The lab focuses on analyzing quarterly filings of asset managers with $100m+ assets under management, exploring relationships using Neo4j Browser and Cypher query language, and discussing potential applications in capital markets such as algorithmic trading and securities master data management.

jupyter-quant

Jupyter Quant is a dockerized environment tailored for quantitative research, equipped with essential tools like statsmodels, pymc, arch, py_vollib, zipline-reloaded, PyPortfolioOpt, numpy, pandas, sci-py, scikit-learn, yellowbricks, shap, optuna, and more. It provides Interactive Broker connectivity via ib_async and includes major Python packages for statistical and time series analysis. The image is optimized for size, includes jedi language server, jupyterlab-lsp, and common command line utilities. Users can install new packages with sudo, leverage apt cache, and bring their own dot files and SSH keys. The tool is designed for ephemeral containers, ensuring data persistence and flexibility for quantitative analysis tasks.

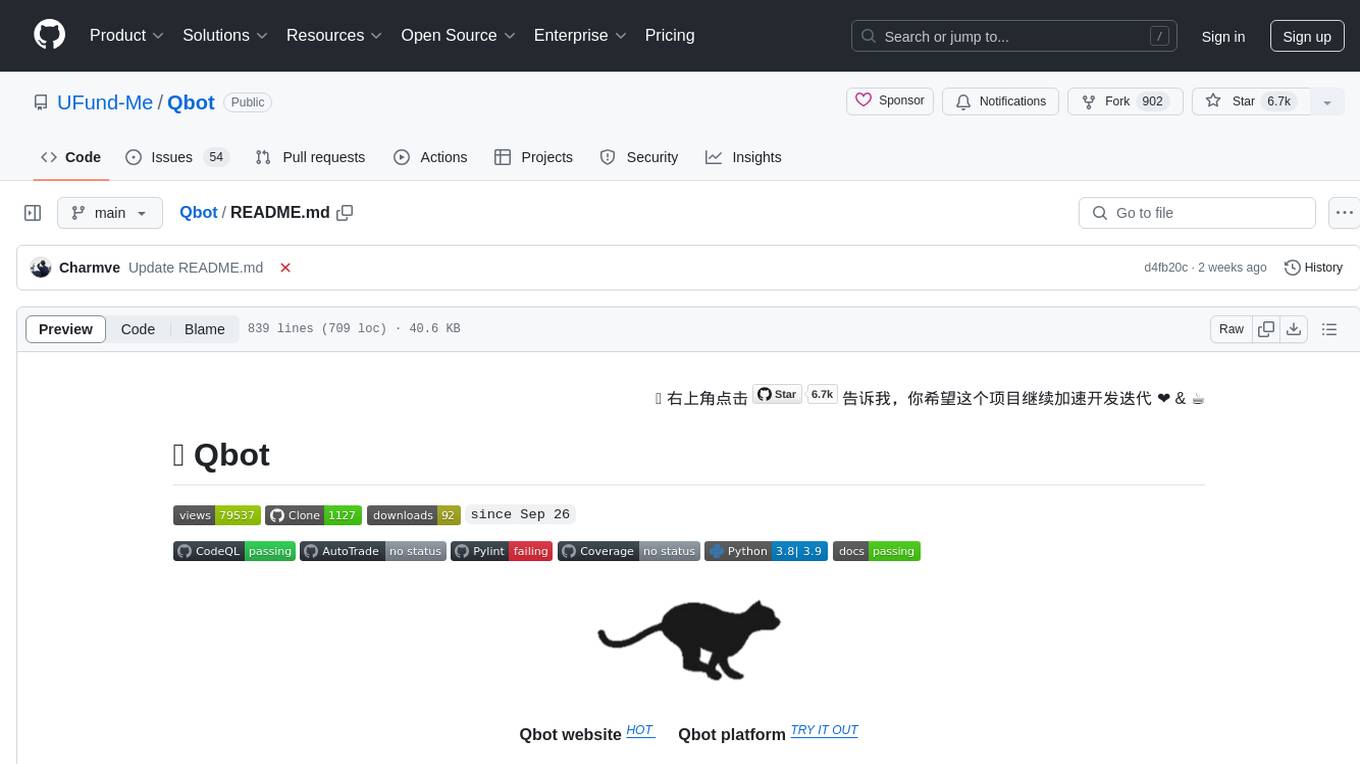

Qbot

Qbot is an AI-oriented automated quantitative investment platform that supports diverse machine learning modeling paradigms, including supervised learning, market dynamics modeling, and reinforcement learning. It provides a full closed-loop process from data acquisition, strategy development, backtesting, simulation trading to live trading. The platform emphasizes AI strategies such as machine learning, reinforcement learning, and deep learning, combined with multi-factor models to enhance returns. Users with some Python knowledge and trading experience can easily utilize the platform to address trading pain points and gaps in the market.

FinMem-LLM-StockTrading

This repository contains the Python source code for FINMEM, a Performance-Enhanced Large Language Model Trading Agent with Layered Memory and Character Design. It introduces FinMem, a novel LLM-based agent framework devised for financial decision-making, encompassing three core modules: Profiling, Memory with layered processing, and Decision-making. FinMem's memory module aligns closely with the cognitive structure of human traders, offering robust interpretability and real-time tuning. The framework enables the agent to self-evolve its professional knowledge, react agilely to new investment cues, and continuously refine trading decisions in the volatile financial environment. It presents a cutting-edge LLM agent framework for automated trading, boosting cumulative investment returns.

LLMs-in-Finance

This repository focuses on the application of Large Language Models (LLMs) in the field of finance. It provides insights and knowledge about how LLMs can be utilized in various scenarios within the finance industry, particularly in generating AI agents. The repository aims to explore the potential of LLMs to enhance financial processes and decision-making through the use of advanced natural language processing techniques.