awesome-quant-ai

A curated list of awesome resources for quantitative investment and trading strategies focusing on artificial intelligence and machine learning applications in finance.

Stars: 90

Awesome Quant AI is a curated list of resources focusing on quantitative investment and trading strategies using artificial intelligence and machine learning in finance. It covers key challenges in quantitative finance, AI/ML technical fit, predictive modeling, sequential decision-making, synthetic data generation, contextual reasoning, mathematical foundations, design approach, quantitative trading strategies, tools and platforms, learning resources, books, research papers, community, and conferences. The repository aims to provide a comprehensive resource for those interested in the intersection of AI, machine learning, and quantitative finance, with a focus on extracting alpha while managing risk in financial systems.

README:

A curated list of awesome resources for quantitative investment and trading strategies focusing on artificial intelligence and machine learning applications in finance.

- Introduction

- Design Approach

- Quantitative Trading Strategies

- Tools and Platforms

- Trading Models Comparison

- Learning Resources

- Books

- Research Papers

- Community and Conferences

- Reference

Quantitative investing uses mathematical models and algorithms to determine investment opportunities. This repository aims to provide a comprehensive resource for those interested in the intersection of AI, machine learning, and quantitative finance. At its core, this field addresses three pillars:

-

Key Challenges in Quantitative Finance:

- Efficient Market Hypothesis (EMH): Balancing the tension between market efficiency and exploitable inefficiencies through rigorous statistical testing.

- Factor Validity: Identifying persistent drivers of returns (e.g., value, momentum, quality) and assessing their decay over time due to overcrowding or regime shifts.

- Statistical Arbitrage Limits: Quantifying theoretical profit bounds under constraints like transaction costs, liquidity gaps, and execution latency.

- Cost Modeling: Integrating bid-ask spreads, slippage, taxes, and market impact into strategy design.

-

AI/ML Technical Fit:

- Predictive Modeling (Supervised Learning): Forecasting asset returns, volatility, and risk metrics using labeled data with techniques ranging from linear regression to advanced gradient-boosted trees (XGBoost, LightGBM).

- Pattern Discovery (Unsupervised Learning): Identifying latent structures in data through asset clustering, dimensionality reduction, and anomaly detection to uncover novel factors or market regimes.

- Sequential Decision-Making (Reinforcement Learning): Optimizing trading and execution policies through continuous environment interaction, using algorithms like PPO or DDPG to maximize risk-adjusted returns.

- Synthetic Data Generation (Generative Models): Utilizing GANs, Diffusion Models, and other generative techniques to create realistic market scenarios for robust strategy stress-testing and data augmentation.

- Contextual Reasoning (Large Language & Multimodal Models): Achieving a deep, semantic understanding of unstructured financial text, audio, and image data to decode complex informational alpha from filings, news, and earnings calls, far surpassing traditional sentiment analysis.

-

Mathematical Foundations:

- Stochastic Processes: Modeling price dynamics with Brownian motion, jump-diffusion, or fractional processes.

- Optimization Theory: Mean-CVaR frameworks for balancing returns against tail risks.

- Game Theory: Simulating strategic interactions among market participants (e.g., order-book competition).

Quant AI is the application of advanced computational methods to systematically extract alpha while rigorously managing risk in complex, adaptive financial systems.

A scientifically rational design for a quantitative trading system or strategy should adhere to the following process:

-

Define Objectives and Constraints:

- Specify investment goals (e.g., absolute return, relative return benchmarks, target risk levels).

- Clearly outline risk tolerance, available capital, constraints on trading frequency, and permissible markets and financial instruments.

-

Strategy Identification and Research (Alpha Research):

- Theory-Driven/Literature-Based: Draw inspiration from established strategy types (e.g., statistical arbitrage, factor investing, trend following) detailed in the source material or academic/practitioner literature.

- Data-Driven Discovery: Utilize statistical analysis, econometrics, or machine learning techniques (e.g., supervised learning for price prediction, unsupervised learning for factor discovery or regime identification, NLP for sentiment analysis) to explore data and uncover potential trading signals (Alpha).

- Signal/Strategy Combination: Consider combining multiple, ideally weakly correlated, alpha signals or distinct strategies (e.g., within multi-factor models or multi-strategy frameworks) to enhance portfolio stability and risk-adjusted returns (e.g., Sharpe Ratio).

-

Model Development and Calibration:

- Formalize the core strategy logic into specific mathematical models or algorithmic rules.

- If employing machine learning, select appropriate models (e.g., linear models, tree-based ensembles, neural networks, reinforcement learning agents) and conduct relevant feature engineering.

- Calibrate model parameters judiciously, employing techniques (e.g., regularization, cross-validation) to mitigate the risk of overfitting the training data.

-

Rigorous Backtesting and Validation:

- Conduct thorough backtests using high-quality historical data that accurately reflects market conditions.

- Realistically account for transaction costs (commissions, slippage) and potential market impact/liquidity constraints.

- Perform out-of-sample (OOS) testing and sensitivity analyses to assess robustness. Use cross-validation where appropriate.

- Evaluate performance using robust statistical metrics (e.g., Sharpe ratio, Sortino ratio, maximum drawdown, win rate, profit factor) and assess the statistical significance of the results. Consider methodologies like those proposed by Marcos Lopez de Prado to prevent backtest overfitting.

-

Integrate Robust Risk Management:

- Embed strategy-level risk controls (e.g., stop-losses, position sizing rules based on volatility or risk contribution).

- Apply portfolio-level risk management techniques (e.g., diversification, risk parity principles, asset allocation overlays, correlation monitoring).

- Develop contingency plans for managing exposure during extreme market events (tail risk / black swans).

-

System Implementation and Deployment:

- Select or develop the appropriate technological infrastructure (trading platforms, data feeds, execution systems).

- Ensure data integrity and low-latency, reliable execution capabilities (especially critical for higher-frequency strategies).

- Consider leveraging cloud computing resources for computationally intensive tasks (backtesting, model training) and deployment scalability.

-

Continuous Monitoring and Iteration:

- Post-deployment, continuously monitor live trading performance against expectations and track evolving market conditions.

- Periodically evaluate the strategy's efficacy and diagnose potential performance degradation or alpha decay.

- Based on monitoring feedback and ongoing research, systematically adjust, optimize, refine, or potentially retire the strategy. (Note: For AI-Agent trading paradigms, aspects of this monitoring and adaptation loop may be automated).

- Exploiting pricing inefficiencies among related financial instruments using advanced statistical models.

-

Sub-strategies:

- Mean Reversion: Assuming asset prices will revert to their historical average.

- Pairs Trading: Taking long and short positions in correlated securities.

- Cointegration Analysis: Exploiting long-term price relationships.

- Investing in securities that exhibit characteristics associated with higher returns, such as value, momentum, or size.

-

Factors:

- Value: Selecting undervalued stocks.

- Momentum: Buying recent winners and selling losers.

- Size: Investing in small-cap stocks.

- Quality: Selecting stocks based on financial health indicators.

- Low Volatility: Investing in stocks with lower price fluctuations.

- Rapid trading using powerful computers and algorithms.

-

Approaches:

- Market Making: Providing liquidity by simultaneously placing buy and sell orders.

- Latency Arbitrage: Exploiting tiny price discrepancies.

- Order Flow Prediction: Anticipating and acting on order flow patterns.

- Trading based on the continuation of price trends.

-

Methods:

- Moving Averages: Using price averages to identify trends.

- Breakout Trading: Entering positions when prices move beyond support/resistance levels.

- Momentum Indicators: Using technical indicators to measure price velocity.

- Strategies focused on market volatility rather than directional moves.

-

Methods:

- Options Pricing: Using volatility models for options valuation.

- Volatility Arbitrage: Exploiting differences between implied and realized volatility.

- Allocating capital based on risk, balancing the contributions of different assets to overall portfolio volatility.

-

Implementation:

- Balancing Risk Contributions: Across different asset classes.

- Leveraging Lower-Risk Assets: To achieve the desired risk/return profile.

- Trading based on macroeconomic factors and global market trends.

-

Approaches:

- Global Macro: Trading based on broad economic trends.

- Asset Allocation: Dynamically adjusting portfolio composition based on market conditions.

- Trading based on specific events or news.

-

Examples:

- Merger Arbitrage: Trading around M&A activities.

- Earnings Announcements: Trading based on financial report releases.

- Economic Data Releases: Trading on macroeconomic news.

- Utilizing AI to improve human decision-making processes and improve investment strategies. Deploying algorithms to analyze vast datasets and enhance the accuracy and efficiency of financial models.

-

Techniques:

- Supervised Learning: Predicting outcomes using labeled data.

- Unsupervised Learning: Discovering hidden patterns in data.

- Reinforcement Learning: Learning optimal strategies through environment interaction.

- Natural Language Processing (NLP): Analyzing text data for trading signals.

- Combining multiple strategies to diversify and enhance performance.

-

Examples:

- Multi-Factor Models: Integrating multiple factors in a single strategy.

- Strategy Allocation: Dynamically allocating capital across various quantitative strategies.

| Category | Sub-directions | Technical Stack & Tools | Real-World Applications |

|---|---|---|---|

| AI-Enhanced Traditional Strategies | 1. Factor Investing: - SHAP feature selection for factor validity - Dynamic factor weighting calibration - Nonlinear factor fusion (XGBoost/GNN) 2. Statistical Arbitrage: - Cointegration + Graph Neural Networks - Kalman Filter for pairs trading 3. Trend Following: - CNN for candlestick pattern recognition (e.g., head-and-shoulders) - LSTM anomaly detection for trend reversal signals |

- Pyfolio (performance attribution) - Alphalens (factor testing) - Featuretools (automated feature engineering) - DGL (Graph Neural Network library) |

- Multi-factor equity selection systems (A-shares/US stocks) - Crypto cross-exchange arbitrage - Commodity futures trend tracking strategies |

| End-to-End AI Strategies | 1. Reinforcement Learning (RL): - DDPG/PPO for asset allocation - Deep Q-learning for order execution optimization 2. Transformer-Based Forecasting: - TimesNet for multi-scale volatility prediction - Informer for long-horizon price modeling 3. Multi-Agent Market Simulation: - DeFi liquidity - Adversary behavior inference |

- Stable Baselines3 (RL framework) - Hugging Finance (Transformers for Time Series) - PettingZoo (multi-agent training environment) |

- Adaptive options hedging (Black-Scholes) - Crypto market-making - Stress-testing under extreme market scenarios |

| Cross-Domain Emerging Fields | 1. Crypto Market Making: - Order-book state prediction (LSTM+attention) - MEV arbitrage path optimization 2. ESG Factor Quantification: - BERT for ESG report parsing - ESG-financial metric nonlinear modeling 3. Climate Risk Pricing: - Physical risks: Natural disaster data mapping to asset exposure - Transition risks: Carbon price sensitivity analysis + policy text mining |

- CoinMetrics (crypto data) - SASB standards (ESG metrics) - Bloomberg NEF (climate finance) - TensorFlow Probability (uncertainty quantification) |

- Carbon-neutral ETF dynamic rebalancing - Extreme weather-driven commodity strategies - Blockchain MEV extraction bots |

Comparing three major approaches to quantitative trading: Quantitative Trading, Algorithmic Trading, and AI-Agent Trading.

| Feature | Quantitative Trading | Algorithmic Trading | AI-Agent Trading |

|---|---|---|---|

| Decision Process | Static rules based on mathematical models and historical data | Predefined algorithmic logic with optimization mechanisms | Autonomous learning and decision-making agents adapting to environment changes |

| Adaptability | Low, requires manual parameter and rule adjustments | Medium, self-adapts through parameter optimization | High, real-time learning and adaptation to market conditions |

| Market Understanding | Limited to pre-programmed rule scopes | Medium, can capture some complex patterns | Comprehensive, can understand and adapt to complex market structures |

| Learning Capability | None or limited | Based on supervised learning or parameter optimization | Autonomous learning and exploration abilities, can improve strategies through reinforcement learning |

| Flexibility | Low, fixed rules | Medium, adjustable algorithms but fixed frameworks | High, autonomous adjustment of strategies and objectives |

| Transparency | High, clear and explainable rules | Medium, higher algorithm complexity but traceable | Lower, decision processes may be "black box" |

| Risk Management | Fixed rule-based risk control | Built-in algorithmic risk control mechanisms | Dynamic risk assessment and adaptive risk management |

| Complexity | Low to medium | Medium to high | High, involving complex AI/ML models and architectures |

| Computational Requirements | Lower | Medium | High, especially during training phases |

| Data Dependency | Relies on specific types of historical data | Strong dependency on multiple data sources | Can process multi-dimensional, unstructured data including real-time feedback |

| Maintenance Cost | Lower, simple and stable rules | Medium, requires periodic adjustments and optimization | High, requires continuous monitoring and possible retraining |

| Innovation Potential | Limited by preset rules | Medium, achievable through algorithm optimization | High, can discover new trading strategies and opportunities |

| Typical Applications | Trend following, mean reversion, fundamental quantitative analysis | Statistical arbitrage, high-frequency trading, factor models | Adaptive trading systems, hybrid strategy optimization, multi-objective decision making |

| Recent Developments | Integration of more data sources | Introduction of machine learning to optimize algorithm parameters | Multi-agent collaboration, meta-learning, transfer learning applications |

List of software tools and platforms used in quantitative finance.

- pytrade: python packages and resources for algo-trading https://github.com/PFund-Software-Ltd/pytrade.org

- pybroker: focus on strategies backtesting that use machine learning https://github.com/edtechre/pybroker

| Tool | Strength | Community Activity | Academic Adoption | Enterprise Use |

|---|---|---|---|---|

| Backtrader | Multi-factor strategy backtesting | High | Medium | Medium |

| Zipline | End-to-end trading pipelines | Medium | High | High (Quantopian) |

| QuantConnect | Cross-market support (stocks, crypto) | High | Medium | High |

| TensorTrade | Reinforcement learning prototyping | Medium | Medium | Medium |

| Ray/Rllib | Adaptive strategies in complex environments | High | High | High |

| Provider | Key Features | Use Cases |

|---|---|---|

| Alpha Vantage | Free APIs for stock/crypto data | Historical price/volume analysis |

| Quandl | Premium structured datasets | Macroeconomic/factor data integration |

| Yahoo Finance | Open-source financial data | Basic equity/ETF research |

| Bloomberg Terminal | Institutional-grade market data | High-frequency trading, ESG analytics |

| CoinMetrics | Crypto-specific metrics | On-chain transaction analysis, MEV tracking |

- Interactive Brokers API : Low-latency order execution

- Alpaca : Commission-free algorithmic trading

- AWS SageMaker : Cloud-based ML training/deployment

- Docker/Kubernetes : Containerization for scalable systems

- Jupyter Notebook: Interactive strategy prototyping.

- Databricks: Big-data processing for alternative data streams.

Online courses, tutorials, and workshops focused on quantitative investing and machine learning in finance.

- Algorithmic Trading & Quantitative Analysis Using Python https://www.udemy.com/course/algorithmic-trading-quantitative-analysis-using-python/

- Quantitative Trading Strategies https://finmath.uchicago.edu/curriculum/degree-concentrations/trading/finm-33150/

- Oxford Algorithmic Trading Programme https://www.sbs.ox.ac.uk/programmes/executive-education/online-programmes/oxford-algorithmic-trading-programme

- https://orfe.princeton.edu/research/financial-mathematics

This section curates significant books in the realms of quantitative finance, algorithmic trading, and market data analysis. Each book listed has proven to be invaluable for learning and applying quantitative techniques in the financial markets.

- Quantitative Trading: How to Build Your Own Algorithmic Trading Business by Ernest Chan - A great introduction to quantitative trading for retail traders.

- Algorithmic Trading: Winning Strategies and Their Rationale by Ernest Chan - Advanced strategies for developing and testing algorithmic trading systems.

- Machine Trading: Deploying Computer Algorithms to Conquer the Markets by Ernest Chan - Introduction to strategies in factor models, AI, options, time series analysis, and intraday trading.

- Mechanical Trading Systems by Richard Weissman - Discusses momentum and mean reversion strategies across different time frames.

- Following the Trend by Andreas Clenow - Insightful read on trend following, a popular quantitative trading strategy.

- Trade Your Way to Financial Freedom by Van Tharp - Structured approaches to developing personal trading systems.

- The Mathematics of Money Management by Ralph Vince - Techniques on risk management and optimal portfolio configuration.

- Intermarket Trading Strategies by Markos Katsanos - Explores global market relationships for strategy development.

- Applied Quantitative Methods for Trading and Investment by Christian Dunis et al. - Practical applications of quantitative techniques in trading.

- Algorithmic Trading and DMA by Barry Johnson - An introduction to direct market access and trading strategies.

- Technical Analysis from A to Z by Steven Achelis - A comprehensive guide to technical analysis indicators.

- Finding Alphas: A Quantitative Approach to Building Trading Strategies by Igor Tulchinsky - Discusses the process of finding trading strategies (alphas).

- Algorithmic and High-Frequency Trading by Álvaro Cartea, Sebastian Jaimungal, and José Penalva - Provides an in-depth understanding of high-frequency trading strategies.

- Quantitative Trading: How to Build Your Own Algorithmic Trading Business by Ernest P. Chan - A comprehensive guide to starting a quantitative trading business.

- Building Reliable Trading Systems: Tradable Strategies That Perform As They Backtest and Meet Your Risk-Reward Goals by Keith Fitschen - Focuses on developing trading systems that perform well in real-world conditions.

- Professional Automated Trading: Theory and Practice by Eugene A. Durenard - A practical guide to automated trading systems.

- Quantitative Investing: From Theory to Industry by Lingjie Ma,

- Machine Learning for Algorithmic Trading, 2nd Edition by Stefan Jansen

- Machine Trading: Deploying Computer Algorithms to Conquer the Markets by Ernest P. Chan

- Trading Systems and Methods, 6th Edition by Perry J. Kaufman

- Reminiscences of a Stock Operator by Edwin Lefèvre - Classic insights into the life and trading psychology of Jesse Livermore.

- When Genius Failed by Roger Lowenstein - The rise and fall of Long-Term Capital Management.

- Predictably Irrational by Dan Ariely - A look at the forces that affect our decision-making processes.

- Behavioral Investing by James Montier - Strategies to overcome psychological barriers to successful investing.

- The Laws of Trading by Agustin Lebron - Decision-making strategies from a professional trader's perspective.

- Thinking, Fast and Slow by Daniel Kahneman - A classic on human decision-making and cognitive biases, crucial for understanding market behavior.

- The Undoing Project by Michael Lewis - Chronicles the collaboration between Daniel Kahneman and Amos Tversky and their contributions to behavioral economics.

- Machine Learning for Algorithmic Trading by Stefan Jansen - Techniques for developing automated trading strategies using machine learning.

- Advances in Financial Machine Learning by Marcos Lopez de Prado - Discusses the challenges and opportunities of applying ML/AI in trading.

- Machine Learning for Asset Managers by Marcos Lopez de Prado - Focuses on portfolio construction, feature selection, and identifying overfit models.

- Time Series Analysis by James Hamilton - Statistical methods for analyzing time series data in economics and finance.

- Econometric Analysis by William Greene - A fundamental textbook on econometric methods.

- Wavelet Methods for Time Series Analysis by Donald Percival and Andrew Walden - Utilizes wavelet analysis for financial time series.

- The Elements of Statistical Learning by Hastie, Tibshirani, and Friedman - A comprehensive overview of statistical learning theory and its applications.

- Applied Econometric Time Series by Walter Enders - demonstrates modern techniques for developing models capable of forecasting, interpreting, and testing hypotheses concerning economic data.

- Data-Driven Science and Engineering: Machine Learning, Dynamical Systems, and Control by Steven L. Brunton and J. Nathan Kutz - Focuses on the application of machine learning in scientific and engineering contexts.

- Big Data and Machine Learning in Quantitative Investment by Tony Guida - Explores the role of big data and machine learning in quantitative investment.

- Big Data Science in Finance by Irene Aldridge and Marco Avellaneda - Provides insights into the application of big data science in the financial industry.

- Machine Learning and Data Sciences for Financial Markets: A Guide to Contemporary Practices by Agostino Capponi and Charles-Albert Lehalle - A comprehensive guide to contemporary practices in machine learning and data sciences for financial markets.

- Machine Learning in Finance: From Theory to Practice by Matthew F. Dixon, Igor Halperin, and Paul Bilokon - Covers the theory and practice of applying machine learning in finance.

- Machine Learning For Financial Engineering by László Györfi, György Ottucsák - Focuses on the application of machine learning techniques in financial engineering.

- Convex Optimization by Stephen Boyd and Lieven Vandenberghe - A detailed guide on convex optimization techniques used in finance.

- Financial Calculus by Martin Baxter and Andrew Rennie - An introduction to derivatives pricing using stochastic calculus.

- Stochastic Calculus for Finance I by Steven Shreve - Introduction to stochastic calculus for financial modeling.

- Stochastic Calculus for Finance II by Steven Shreve - Advanced concepts in stochastic calculus for complex financial models.

- Optimization Methods in Finance by Gérard Cornuéjols and Reha Tütüncü - Introduces optimization techniques and their applications in finance.

- Kalman Filtering: with Real-Time Applications by Charles K. Chui and Guanrong Chen - A practical guide to the application of Kalman filtering in real-time systems.

- Modern Portfolio Theory and Investment Analysis by Elton et al. - An in-depth look at Modern Portfolio Theory and its practical applications.

- Options, Futures, and Other Derivatives by John Hull - Essential reading on derivatives trading.

- Asset Management: A Systematic Approach to Factor Investing by Andrew Ang - Discusses a systematic approach to factor investing.

- Portfolio Management under Stress: A Bayesian-Net Approach to Coherent Asset Allocation by Riccardo Rebonato and Alexander Denev - Focuses on portfolio management strategies under stressful market conditions.

- Quantitative Equity Portfolio Management by Ludwig Chincarini and Daehwan Kim - Advanced techniques focused on quantitative equity portfolio management.

- Volatility and Correlation by Riccardo Rebonato - Discusses volatility and correlation in financial markets and their use in risk management.

- Study Guide for Options as a Strategic Investment by Lawrence McMillan - A comprehensive analysis of options strategies for various market conditions.

- Volatility Trading by Euan Sinclair - Practical strategies for trading volatility.

- The Volatility Surface by Jim Gatheral - Properties of the volatility surface and its implications for pricing derivatives.

- Dynamic Hedging: Managing Vanilla and Exotic Options by Nassim Nicholas Taleb - Introduces dynamic hedging strategies and their applications in managing standard and exotic options.

- Python for Finance by Yves Hilpisch - Essential techniques for algorithmic trading and derivatives pricing.

- Python for Algorithmic Trading: From Idea to Cloud Deployment by Yves Hilpisch - Comprehensive guide on implementing trading strategies in Python, from data handling to cloud deployment.

- Python for Finance Cookbook - Second Edition by Eryk Lewinson - Over 80 powerful recipes for effective financial data analysis, using modern Python libraries such as pandas, NumPy, and scikit-learn.

- Python for Data Analysis by Wes McKinney - Written by the creator of the Pandas library, this book is essential for financial data analysis.

- The Man Who Solved the Market: How Jim Simons Launched the Quant Revolution by Gregory Zuckerman - The unbelievable story of Jim Simons, a secretive mathematician who pioneered the era of algorithmic trading and made $23 billion doing it, whose Renaissance's Medallion fund has generated average annual returns of 66 percent since 1988.

- Poor Charlie's Almanack: The Essential Wit and Wisdom of Charles T. Munger by Charles T. Munger, Peter D. Kaufman (Editor), Warren Buffett (Foreword), John Collison (Foreword) - This book offers lessons in investment strategy, philanthropy, and living a rational and ethical life.

- More Money Than God: Hedge Funds and the Making of a New Elite by Sebastian Mallaby - Details the history of hedge funds and their impact on financial markets.

Seminal and recent research that advances the field of quantitative finance.

Information on communities, meetups, and conferences dedicated to quantitative finance.

Feel free to explore these resources to deepen your understanding of quantitative finance and improve your trading strategies.

- 46 awesome books for quant finance, algo trading, and market data analysis https://www.pyquantnews.com/the-pyquant-newsletter/46-books-quant-finance-algo-trading-market-data

- 10 awesome books for Quantitative Trading https://medium.com/@mlblogging.k/10-awesome-books-for-quantitative-trading-fc0d6aa7e6d8

- Books for Algorithmic Trading I Wish I Had Read Sooner https://www.youtube.com/watch?v=ftFptCxm5ZU

- Awesome Systematic Trading https://github.com/paperswithbacktest/awesome-systematic-trading

For Tasks:

Click tags to check more tools for each tasksFor Jobs:

Alternative AI tools for awesome-quant-ai

Similar Open Source Tools

awesome-quant-ai

Awesome Quant AI is a curated list of resources focusing on quantitative investment and trading strategies using artificial intelligence and machine learning in finance. It covers key challenges in quantitative finance, AI/ML technical fit, predictive modeling, sequential decision-making, synthetic data generation, contextual reasoning, mathematical foundations, design approach, quantitative trading strategies, tools and platforms, learning resources, books, research papers, community, and conferences. The repository aims to provide a comprehensive resource for those interested in the intersection of AI, machine learning, and quantitative finance, with a focus on extracting alpha while managing risk in financial systems.

MMMU

MMMU is a benchmark designed to evaluate multimodal models on college-level subject knowledge tasks, covering 30 subjects and 183 subfields with 11.5K questions. It focuses on advanced perception and reasoning with domain-specific knowledge, challenging models to perform tasks akin to those faced by experts. The evaluation of various models highlights substantial challenges, with room for improvement to stimulate the community towards expert artificial general intelligence (AGI).

llm_benchmarks

llm_benchmarks is a collection of benchmarks and datasets for evaluating Large Language Models (LLMs). It includes various tasks and datasets to assess LLMs' knowledge, reasoning, language understanding, and conversational abilities. The repository aims to provide comprehensive evaluation resources for LLMs across different domains and applications, such as education, healthcare, content moderation, coding, and conversational AI. Researchers and developers can leverage these benchmarks to test and improve the performance of LLMs in various real-world scenarios.

rlhf_thinking_model

This repository is a collection of research notes and resources focusing on training large language models (LLMs) and Reinforcement Learning from Human Feedback (RLHF). It includes methodologies, techniques, and state-of-the-art approaches for optimizing preferences and model alignment in LLM training. The purpose is to serve as a reference for researchers and engineers interested in reinforcement learning, large language models, model alignment, and alternative RL-based methods.

policy-synth

Policy Synth is a TypeScript class library that empowers better decision-making for governments and companies by integrating collective and artificial intelligence. It streamlines processes through multi-scale AI agent logic flows, robust APIs, and cutting-edge real-time AI-driven web applications. The tool supports organizations in generating, refining, and implementing smarter, data-informed strategies, fostering collaboration with AI to tackle complex challenges effectively.

xllm

xLLM is an efficient LLM inference framework optimized for Chinese AI accelerators, enabling enterprise-grade deployment with enhanced efficiency and reduced cost. It adopts a service-engine decoupled inference architecture, achieving breakthrough efficiency through technologies like elastic scheduling, dynamic PD disaggregation, multi-stream parallel computing, graph fusion optimization, and global KV cache management. xLLM supports deployment of mainstream large models on Chinese AI accelerators, empowering enterprises in scenarios like intelligent customer service, risk control, supply chain optimization, ad recommendation, and more.

LAMBDA

LAMBDA is a code-free multi-agent data analysis system that utilizes large models to address data analysis challenges in complex data-driven applications. It allows users to perform complex data analysis tasks through human language instruction, seamlessly generate and debug code using two key agent roles, integrate external models and algorithms, and automatically generate reports. The system has demonstrated strong performance on various machine learning datasets, enhancing data science practice by integrating human and artificial intelligence.

Slow_Thinking_with_LLMs

STILL is an open-source project exploring slow-thinking reasoning systems, focusing on o1-like reasoning systems. The project has released technical reports on enhancing LLM reasoning with reward-guided tree search algorithms and implementing slow-thinking reasoning systems using an imitate, explore, and self-improve framework. The project aims to replicate the capabilities of industry-level reasoning systems by fine-tuning reasoning models with long-form thought data and iteratively refining training datasets.

FloTorch

FloTorch is an innovative product designed to simplify and optimize the decision-making process for leveraging Large Language Models (LLMs) in Retrieval Augmented Generation (RAG) systems. It focuses on providing a well-architected framework, maximizing efficiency, eliminating complexity, accelerating selection, and fostering innovation. The tool offers a streamlined, user-friendly approach to help users achieve efficiency, accuracy, and cost-effectiveness in the fast-paced digital landscape of AI.

Awesome-LLM-in-Social-Science

This repository compiles a list of academic papers that evaluate, align, simulate, and provide surveys or perspectives on the use of Large Language Models (LLMs) in the field of Social Science. The papers cover various aspects of LLM research, including assessing their alignment with human values, evaluating their capabilities in tasks such as opinion formation and moral reasoning, and exploring their potential for simulating social interactions and addressing issues in diverse fields of Social Science. The repository aims to provide a comprehensive resource for researchers and practitioners interested in the intersection of LLMs and Social Science.

awesome-artificial-intelligence-research

The 'Awesome Artificial Intelligence Research' repository is a curated list of up-to-date research papers in the field of Artificial Intelligence (AI). It aims to help researchers stay informed about cutting-edge research trends and topics in AI by providing a comprehensive collection of research paper lists. The repository covers various subfields of AI, including Machine Learning, Data Mining, Computer Vision, Natural Language Processing, Audio & Speech, and other applications. It also includes tools for research such as public datasets and new paper recommendations.

AI6127

AI6127 is a course focusing on deep neural networks for natural language processing (NLP). It covers core NLP tasks and machine learning models, emphasizing deep learning methods using libraries like Pytorch. The course aims to teach students state-of-the-art techniques for practical NLP problems, including writing, debugging, and training deep neural models. It also explores advancements in NLP such as Transformers and ChatGPT.

interpret

InterpretML is an open-source package that incorporates state-of-the-art machine learning interpretability techniques under one roof. With this package, you can train interpretable glassbox models and explain blackbox systems. InterpretML helps you understand your model's global behavior, or understand the reasons behind individual predictions. Interpretability is essential for: - Model debugging - Why did my model make this mistake? - Feature Engineering - How can I improve my model? - Detecting fairness issues - Does my model discriminate? - Human-AI cooperation - How can I understand and trust the model's decisions? - Regulatory compliance - Does my model satisfy legal requirements? - High-risk applications - Healthcare, finance, judicial, ...

stochastic-rs

stochastic-rs is a high-performance Rust library for simulating and analyzing stochastic processes. It is designed for applications in quantitative finance, AI training, and statistical modeling, providing efficient tools to generate synthetic data and analyze complex stochastic systems. The library is actively developed and welcomes contributions such as bug reports, feature suggestions, and documentation improvements. It is licensed under the MIT License.

LLMSys-PaperList

This repository provides a comprehensive list of academic papers, articles, tutorials, slides, and projects related to Large Language Model (LLM) systems. It covers various aspects of LLM research, including pre-training, serving, system efficiency optimization, multi-model systems, image generation systems, LLM applications in systems, ML systems, survey papers, LLM benchmarks and leaderboards, and other relevant resources. The repository is regularly updated to include the latest developments in this rapidly evolving field, making it a valuable resource for researchers, practitioners, and anyone interested in staying abreast of the advancements in LLM technology.

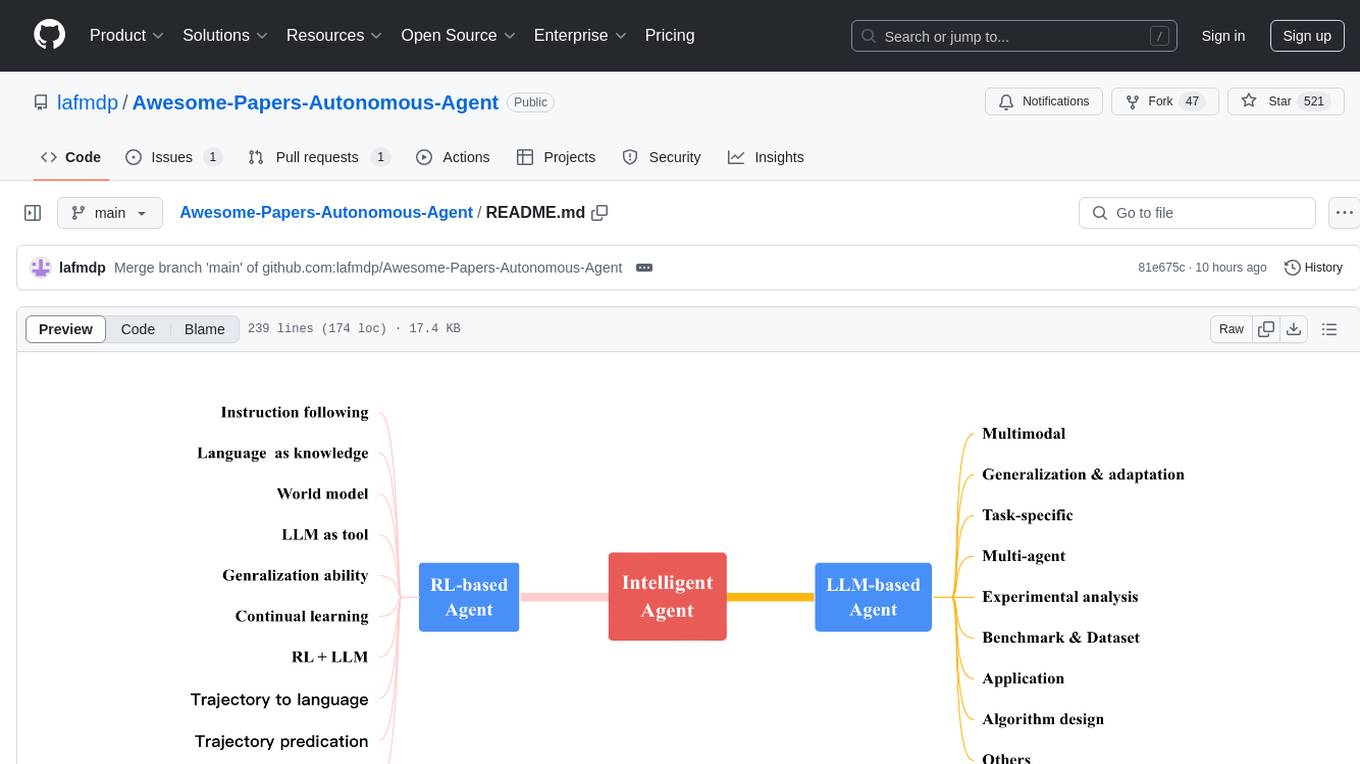

Awesome-Papers-Autonomous-Agent

Awesome-Papers-Autonomous-Agent is a curated collection of recent papers focusing on autonomous agents, specifically interested in RL-based agents and LLM-based agents. The repository aims to provide a comprehensive resource for researchers and practitioners interested in intelligent agents that can achieve goals, acquire knowledge, and continually improve. The collection includes papers on various topics such as instruction following, building agents based on world models, using language as knowledge, leveraging LLMs as a tool, generalization across tasks, continual learning, combining RL and LLM, transformer-based policies, trajectory to language, trajectory prediction, multimodal agents, training LLMs for generalization and adaptation, task-specific designing, multi-agent systems, experimental analysis, benchmarking, applications, algorithm design, and combining with RL.

For similar tasks

stockbot-on-groq

StockBot Powered by Groq is an AI-powered chatbot that provides lightning-fast responses with live interactive stock charts, financial data, news, screeners, and more. Leveraging Groq's speed and Vercel's AI SDK, StockBot offers real-time conversation with natural language processing, interactive TradingView charts, adaptive interfaces, and multi-asset market coverage. It is designed for entertainment and instructional use, not for investment advice.

FinVeda

FinVeda is a dynamic financial literacy app that aims to solve the problem of low financial literacy rates in India by providing a platform for financial education. It features an AI chatbot, finance blogs, market trends analysis, SIP calculator, and finance quiz to help users learn finance with finesse. The app is free and open-source, licensed under the GNU General Public License v3.0. FinVeda was developed at IIT Jammu's Udyamitsav'24 Hackathon, where it won first place in the GenAI track and third place overall.

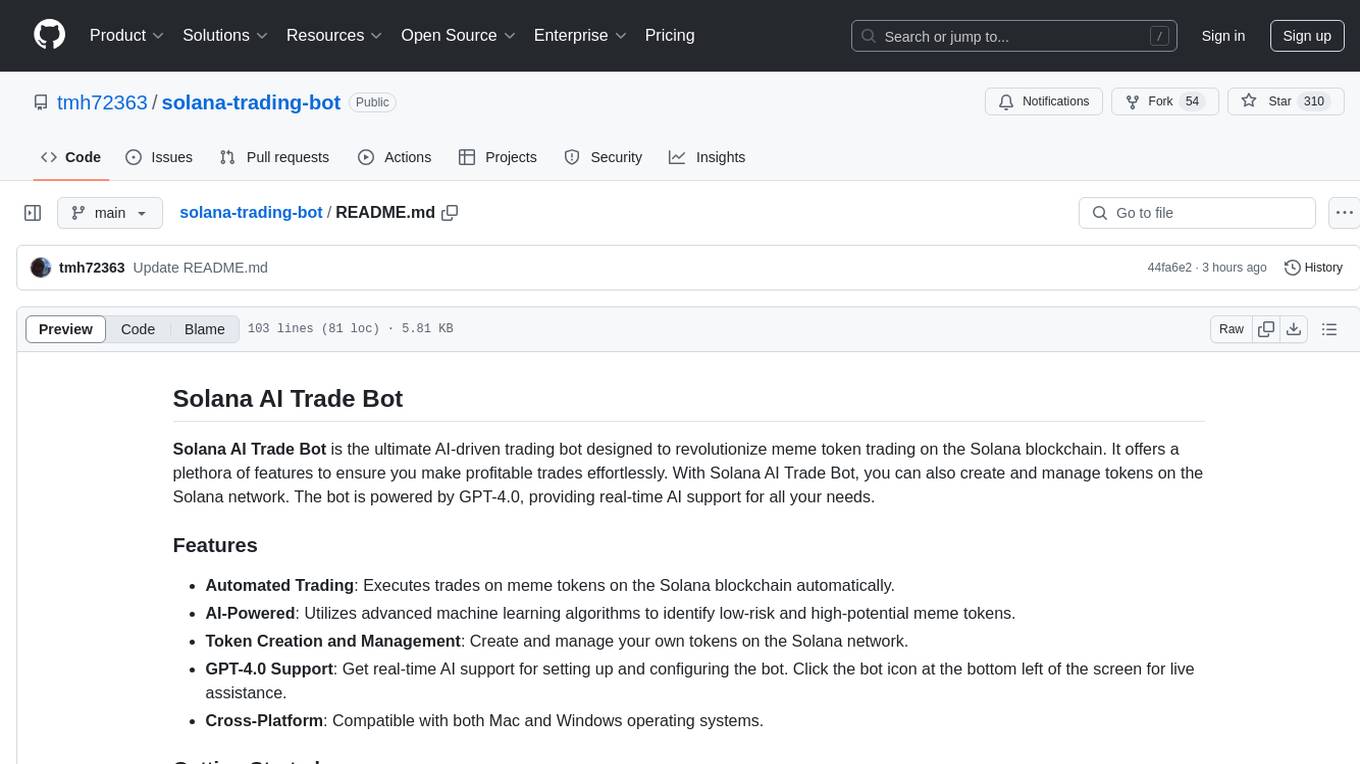

solana-trading-bot

Solana AI Trade Bot is an advanced trading tool specifically designed for meme token trading on the Solana blockchain. It leverages AI technology powered by GPT-4.0 to automate trades, identify low-risk/high-potential tokens, and assist in token creation and management. The bot offers cross-platform compatibility and a range of configurable settings for buying, selling, and filtering tokens. Users can benefit from real-time AI support and enhance their trading experience with features like automatic selling, slippage management, and profit/loss calculations. To optimize performance, it is recommended to connect the bot to a private light node for efficient trading execution.

deer-flow

DeerFlow is a community-driven Deep Research framework that combines language models with specialized tools for tasks like web search, crawling, and Python code execution. It supports FaaS deployment and one-click deployment based on Volcengine. The framework includes core capabilities like LLM integration, search and retrieval, RAG integration, MCP seamless integration, human collaboration, report post-editing, and content creation. The architecture is based on a modular multi-agent system with components like Coordinator, Planner, Research Team, and Text-to-Speech integration. DeerFlow also supports interactive mode, human-in-the-loop mechanism, and command-line arguments for customization.

awesome-quant-ai

Awesome Quant AI is a curated list of resources focusing on quantitative investment and trading strategies using artificial intelligence and machine learning in finance. It covers key challenges in quantitative finance, AI/ML technical fit, predictive modeling, sequential decision-making, synthetic data generation, contextual reasoning, mathematical foundations, design approach, quantitative trading strategies, tools and platforms, learning resources, books, research papers, community, and conferences. The repository aims to provide a comprehensive resource for those interested in the intersection of AI, machine learning, and quantitative finance, with a focus on extracting alpha while managing risk in financial systems.

neuro-san-studio

Neuro SAN Studio is an open-source library for building agent networks across various industries. It simplifies the development of collaborative AI systems by enabling users to create sophisticated multi-agent applications using declarative configuration files. The tool offers features like data-driven configuration, adaptive communication protocols, safe data handling, dynamic agent network designer, flexible tool integration, robust traceability, and cloud-agnostic deployment. It has been used in various use-cases such as automated generation of multi-agent configurations, airline policy assistance, banking operations, market analysis in consumer packaged goods, insurance claims processing, intranet knowledge management, retail operations, telco network support, therapy vignette supervision, and more.

Awesome-AI-Market-Maps

Awesome AI Market Maps is a curated list of Artificial Intelligence startup market maps from 2025 and 2024, featuring over 275 market maps by top VCs, industry analysts, and AI practitioners. The list is organized by quarter, showcasing hot AI topics and the industry's rapid evolution. The data collection workflow includes various tools like ChatGPT, Google Gemini, and human-in-the-loop curation. The repository is regularly updated with new market maps, providing a comprehensive resource for the AI community.

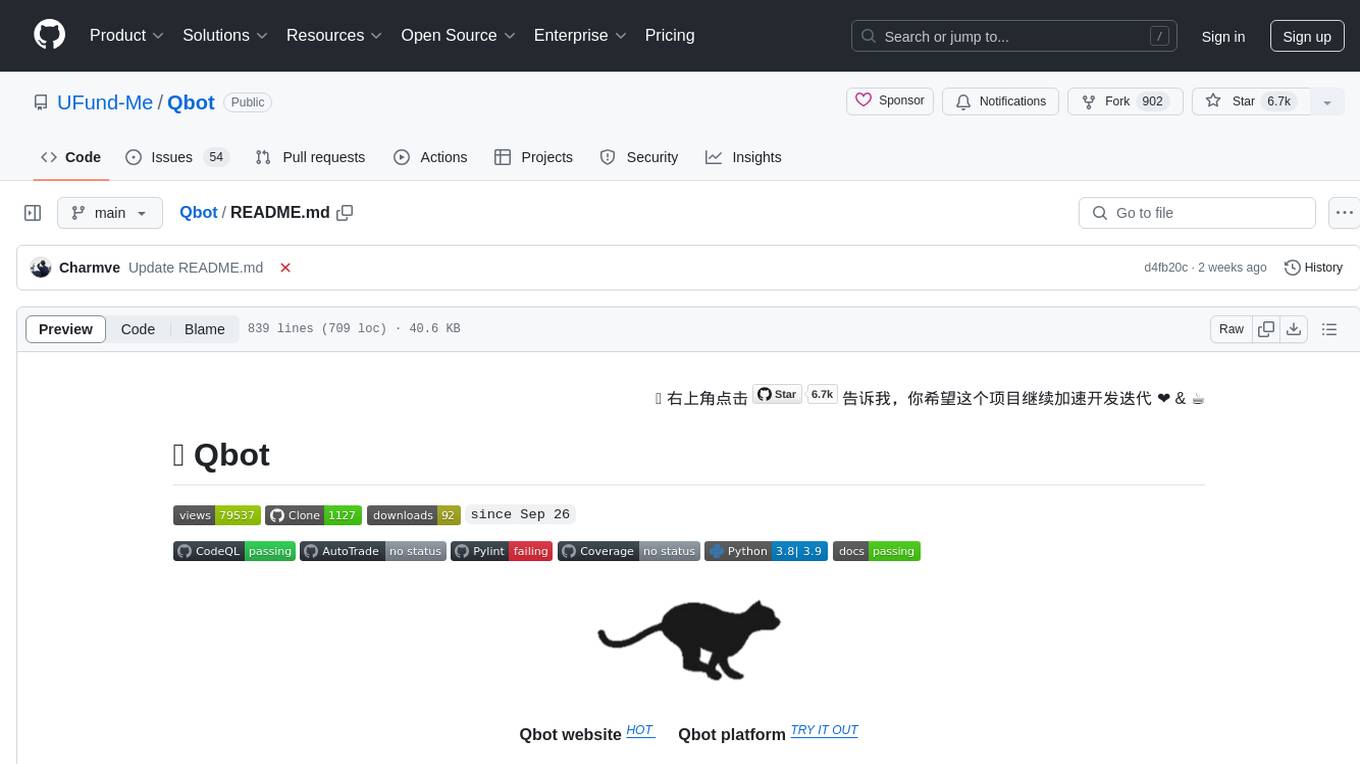

Qbot

Qbot is an AI-oriented automated quantitative investment platform that supports diverse machine learning modeling paradigms, including supervised learning, market dynamics modeling, and reinforcement learning. It provides a full closed-loop process from data acquisition, strategy development, backtesting, simulation trading to live trading. The platform emphasizes AI strategies such as machine learning, reinforcement learning, and deep learning, combined with multi-factor models to enhance returns. Users with some Python knowledge and trading experience can easily utilize the platform to address trading pain points and gaps in the market.

For similar jobs

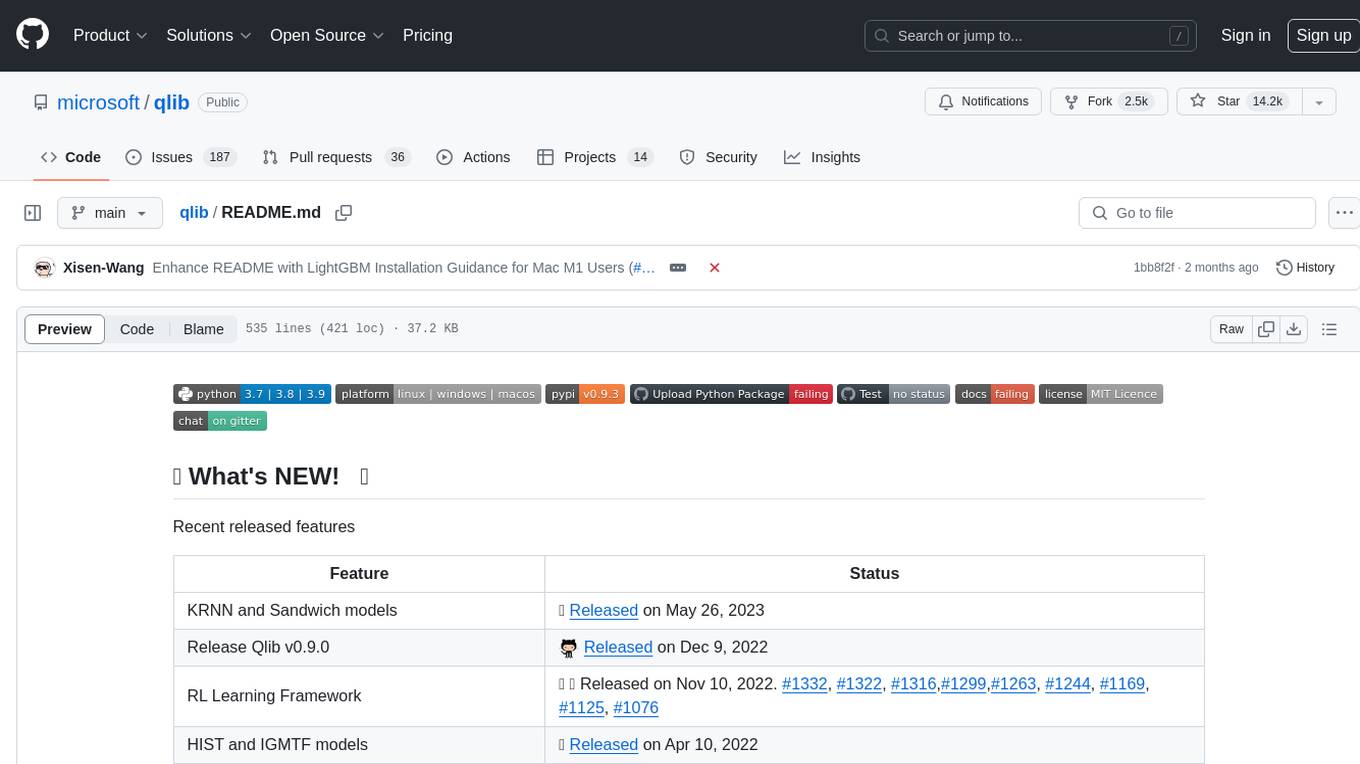

qlib

Qlib is an open-source, AI-oriented quantitative investment platform that supports diverse machine learning modeling paradigms, including supervised learning, market dynamics modeling, and reinforcement learning. It covers the entire chain of quantitative investment, from alpha seeking to order execution. The platform empowers researchers to explore ideas and implement productions using AI technologies in quantitative investment. Qlib collaboratively solves key challenges in quantitative investment by releasing state-of-the-art research works in various paradigms. It provides a full ML pipeline for data processing, model training, and back-testing, enabling users to perform tasks such as forecasting market patterns, adapting to market dynamics, and modeling continuous investment decisions.

jupyter-quant

Jupyter Quant is a dockerized environment tailored for quantitative research, equipped with essential tools like statsmodels, pymc, arch, py_vollib, zipline-reloaded, PyPortfolioOpt, numpy, pandas, sci-py, scikit-learn, yellowbricks, shap, optuna, ib_insync, Cython, Numba, bottleneck, numexpr, jedi language server, jupyterlab-lsp, black, isort, and more. It does not include conda/mamba and relies on pip for package installation. The image is optimized for size, includes common command line utilities, supports apt cache, and allows for the installation of additional packages. It is designed for ephemeral containers, ensuring data persistence, and offers volumes for data, configuration, and notebooks. Common tasks include setting up the server, managing configurations, setting passwords, listing installed packages, passing parameters to jupyter-lab, running commands in the container, building wheels outside the container, installing dotfiles and SSH keys, and creating SSH tunnels.

FinRobot

FinRobot is an open-source AI agent platform designed for financial applications using large language models. It transcends the scope of FinGPT, offering a comprehensive solution that integrates a diverse array of AI technologies. The platform's versatility and adaptability cater to the multifaceted needs of the financial industry. FinRobot's ecosystem is organized into four layers, including Financial AI Agents Layer, Financial LLMs Algorithms Layer, LLMOps and DataOps Layers, and Multi-source LLM Foundation Models Layer. The platform's agent workflow involves Perception, Brain, and Action modules to capture, process, and execute financial data and insights. The Smart Scheduler optimizes model diversity and selection for tasks, managed by components like Director Agent, Agent Registration, Agent Adaptor, and Task Manager. The tool provides a structured file organization with subfolders for agents, data sources, and functional modules, along with installation instructions and hands-on tutorials.

hands-on-lab-neo4j-and-vertex-ai

This repository provides a hands-on lab for learning about Neo4j and Google Cloud Vertex AI. It is intended for data scientists and data engineers to deploy Neo4j and Vertex AI in a Google Cloud account, work with real-world datasets, apply generative AI, build a chatbot over a knowledge graph, and use vector search and index functionality for semantic search. The lab focuses on analyzing quarterly filings of asset managers with $100m+ assets under management, exploring relationships using Neo4j Browser and Cypher query language, and discussing potential applications in capital markets such as algorithmic trading and securities master data management.

jupyter-quant

Jupyter Quant is a dockerized environment tailored for quantitative research, equipped with essential tools like statsmodels, pymc, arch, py_vollib, zipline-reloaded, PyPortfolioOpt, numpy, pandas, sci-py, scikit-learn, yellowbricks, shap, optuna, and more. It provides Interactive Broker connectivity via ib_async and includes major Python packages for statistical and time series analysis. The image is optimized for size, includes jedi language server, jupyterlab-lsp, and common command line utilities. Users can install new packages with sudo, leverage apt cache, and bring their own dot files and SSH keys. The tool is designed for ephemeral containers, ensuring data persistence and flexibility for quantitative analysis tasks.

Qbot

Qbot is an AI-oriented automated quantitative investment platform that supports diverse machine learning modeling paradigms, including supervised learning, market dynamics modeling, and reinforcement learning. It provides a full closed-loop process from data acquisition, strategy development, backtesting, simulation trading to live trading. The platform emphasizes AI strategies such as machine learning, reinforcement learning, and deep learning, combined with multi-factor models to enhance returns. Users with some Python knowledge and trading experience can easily utilize the platform to address trading pain points and gaps in the market.

FinMem-LLM-StockTrading

This repository contains the Python source code for FINMEM, a Performance-Enhanced Large Language Model Trading Agent with Layered Memory and Character Design. It introduces FinMem, a novel LLM-based agent framework devised for financial decision-making, encompassing three core modules: Profiling, Memory with layered processing, and Decision-making. FinMem's memory module aligns closely with the cognitive structure of human traders, offering robust interpretability and real-time tuning. The framework enables the agent to self-evolve its professional knowledge, react agilely to new investment cues, and continuously refine trading decisions in the volatile financial environment. It presents a cutting-edge LLM agent framework for automated trading, boosting cumulative investment returns.

LLMs-in-Finance

This repository focuses on the application of Large Language Models (LLMs) in the field of finance. It provides insights and knowledge about how LLMs can be utilized in various scenarios within the finance industry, particularly in generating AI agents. The repository aims to explore the potential of LLMs to enhance financial processes and decision-making through the use of advanced natural language processing techniques.