Best AI tools for< Quantitative Researcher >

Infographic

19 - AI tool Sites

b-cube.ai

b-cube.ai is a regulated quantamental trading platform that utilizes AI, quantitative models, and fundamentals to generate superior returns for institutional clients. The platform follows a Quantamental strategy, combining AI-generated signals with human verification to trade confidently and maximize profits. It offers two main funds, the AI Alpha Strategy Fund and the B3X Market Neutral Fund, each targeting different market opportunities. Additionally, b-cube.ai has its native token, BCUBE, which is used for value accrual and deflationary pressure through trading profits. The platform aims to provide consistent success over its 7-year track record.

Avanzai

Avanzai is a workflow automation tool tailored for financial services, offering AI-driven solutions to streamline processes and enhance decision-making. The platform enables funds to leverage custom data for generating valuable insights, from market trend analysis to risk assessment. With a focus on simplifying complex financial workflows, Avanzai empowers users to explore, visualize, and analyze data efficiently, without the need for extensive setup. Through open-source demos and customizable data integrations, institutions can harness the power of AI to optimize macro analysis, instrument screening, risk analytics, and factor modeling.

STRATxAI

STRATxAI is an AI-powered quantitative investment platform that offers custom AI model portfolios tailored to clients' investment philosophy, risk tolerance, and objectives. The platform harnesses machine learning to deliver data-driven insights for security analysis, portfolio construction, and management. Powered by the proprietary investment engine Alana, STRATxAI processes over 8 billion financial data points daily to uncover hidden alpha beyond traditional methods. Clients benefit from smarter decision-making, better risk-adjusted returns, optimized portfolio management, and savings on resources. The platform is designed to enhance investment decisions for forward-thinking investors by leveraging AI technology.

AlphaWatch

The website offers a precision workflow tool for enterprises in the finance industry, combining AI technology with human oversight to empower financial decisions. It provides features such as accurate search citations, multilingual models, and complex human-in-loop automation. The tool integrates seamlessly with existing platforms, offers time savings, and self-improving models. It is backed by innovative generative AI solutions and neural search capabilities, with a focus on transforming data processes and decision-making in finance.

EquBot

EquBot is an AI tool designed for investment and wealth management. It offers non-advisory institutional solutions powered by IBM Watson. The tool can be accessed at www.QuantumStreetAI.com. EquBot is based in San Francisco, California, and provides advanced AI-driven services to optimize investment decisions and wealth management strategies.

Toggle Terminal

Toggle Terminal is an AI-powered platform that brings data to life with natural language. It offers a suite of award-winning analytic tools wrapped in an accessible, natural language-based user experience. Users can ask questions in plain language and receive immediate, data-backed answers without the need for coding or spreadsheet manipulation. Toggle Terminal provides institutional-grade analytical tools for scenario testing, asset intelligence, chart exploration, and idea discovery. It helps users connect data, test market hypotheses, screen securities, and explore hidden relationships between organizations. Additionally, Toggle AI offers customized AI solutions and integrations for institutional investors in asset management and capital markets.

Quantum AI

Quantum AI is an advanced AI-powered trading platform that revolutionizes the trading experience by empowering users to make intelligent and strategic decisions. The platform offers a user-friendly interface, automated trading system, expert-designed strategies, risk-free demo mode, and top-level security. With round-the-clock expert assistance, exceptional satisfaction levels, and multilingual support, Quantum AI ensures a seamless trading experience for users worldwide.

The Trading AI

The Trading AI is a generative AI financial platform that revolutionizes investment decisions. It offers an all-in-one solution for portfolio management, AI-assisted strategies, backtesting, and algorithmic trading. The platform features an intuitive user-friendly interface, lightning-fast backtesting, advanced live dashboard, and a strategy builder requiring no programming skills. Users can join the VIP Club for exclusive advantages, participate in tournaments, and monetize their strategies in the marketplace. The platform leverages AI to provide data-backed intelligence for optimized trading decisions.

MetaMevs

MetaMevs is an advanced AI-powered trading solution designed to maximize profits in the fast-paced world of decentralized finance (DeFi). The platform offers cutting-edge technology and customizable solutions to help traders stay ahead of the curve and capitalize on market opportunities. With features like Sandwich Mevbot, HFT Futures and Spot Bot, FlashLoan Arbitrage Bot, and MetaMev Sniper, MetaMevs provides unmatched performance, security, and reliability for users to optimize their trading strategies.

Finance Wizard

Finance Wizard is an AI-powered financial analytics tool that provides users with advanced stock predictions and market insights. By leveraging cutting-edge AI technology, Finance Wizard automates data analysis, allowing investors to focus on strategic decision-making rather than spending hours on market research. The tool is designed to empower users with accurate predictions and real-time insights to optimize trading strategies and enhance market understanding.

AskJimmy

AskJimmy is a platform for AI agents focused on finance and trading. It offers exposure to a diverse range of strategies managed by top-notch AI Agents. The platform allows users to compose autonomous agents and trading strategies with extreme customization. It aims to create a decentralized multi-strategy collaborative hedge-fund powered by AI agents. AskJimmy is designed to aggregate non-correlated autonomous agent strategies into a diversified subnet, shaping the future of multi-strategies decentralized hedge-fund.

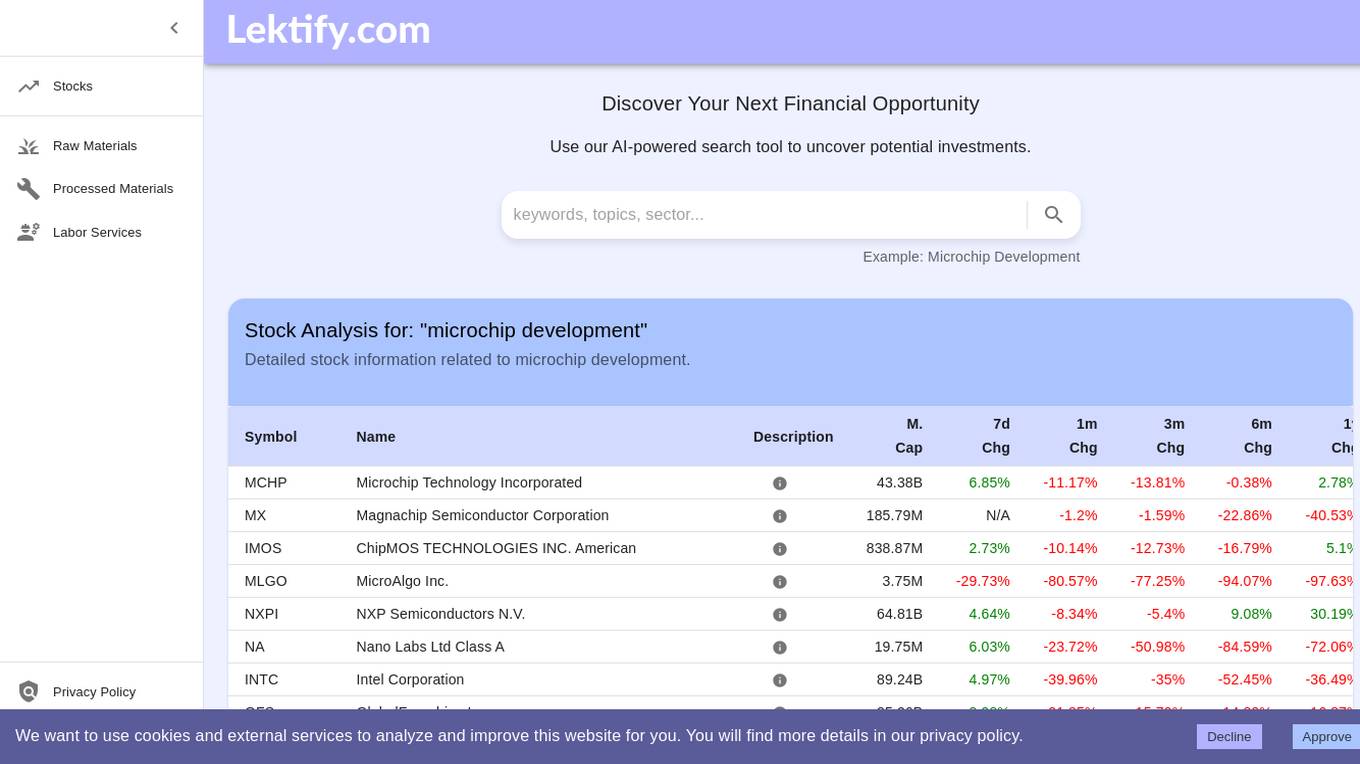

Lektify

Lektify is an AI-powered platform designed to revolutionize the way users manage their investment portfolios. By leveraging advanced artificial intelligence algorithms, Lektify helps users discover top-performing stocks and make informed investment decisions. The platform provides valuable insights and recommendations based on extensive data analysis, enabling users to optimize their investment strategies and maximize returns. With Lektify, users can stay ahead of market trends and enhance their portfolio performance with confidence.

Simudyne

Simudyne is an enterprise simulation software powered by AI technology. It allows large financial institutions to simulate various future scenarios efficiently and measure their impact in a safe virtual environment. The software offers solutions for environment, social and governance issues, market execution, financial crime analytics, and risk management. Simudyne's technology is secure, distributable, and Cloudera certified, providing a robust library of code for specialized functions. The platform also utilizes agent-based modeling to bridge the gap between theoretical and real-world scenarios in the financial services sector.

Quadrature

Quadrature is an AI-powered automated trading business founded by programmers in 2010. The company utilizes sophisticated data and powerful technology to trade securities globally based on predictions made by statistical models. Their long-term vision is to trade all liquid electronically tradeable asset classes across all horizons to generate consistent, significant returns on their proprietary capital. Quadrature Climate Foundation (QCF) was established in 2019 as an independent foundation dedicated to addressing climate change through science-led philanthropy and high-impact solutions.

Sagehood

Sagehood is an AI-driven platform that provides real-time market intelligence for investors in the finance sector. By harnessing AI-driven insights, Sagehood helps users stay ahead in the dynamic world of finance by offering intelligent analysis, deep-dive analysis, strategic execution, and intelligent synthesis. The platform aims to optimize investment strategies and enhance decision-making by leveraging AI technology to analyze vast amounts of data and provide actionable insights. With advanced features for informed decision-making and a focus on minimizing bias while maximizing insight, Sagehood offers tailored intelligence to help users make data-driven investment decisions.

Archaide TradeLab

Archaide TradeLab is an AI-powered platform designed for algorithmic trading, enabling users to easily automate their trading strategies using simple English prompts. The platform allows users to quickly and reliably launch custom trading bots without the need for coding, streamlining deployment and providing data-driven insights for smarter trading decisions. With a focus on security and privacy, Archaide TradeLab ensures that users have complete control over their data and strategies, offering a secure environment for algorithmic trading.

Bigdata.com

Bigdata.com is a platform that powers AI agents for finance, offering instant insights, accelerating research, automating workflows, and enhancing returns. It provides a complete data ecosystem, including a content store with web, paywalled, and internal data, and offers features like intelligent chat, market briefs, smart watchlists, and automated workflows. The platform is designed for investors, analysts, tech & innovation leaders, developers, and engineers in the finance industry, providing access to premium data, reliable search, and enterprise-grade governance.

TradeOS AI

TradeOS AI is an advanced AI tool designed to provide professional insights for traders and investors. The platform utilizes cutting-edge artificial intelligence algorithms to analyze market trends, predict price movements, and offer personalized trading recommendations. With TradeOS AI, users can access real-time data, historical analysis, and market sentiment indicators to make informed decisions and optimize their trading strategies. Whether you are a novice trader or an experienced investor, TradeOS AI empowers you with the tools and knowledge needed to succeed in the financial markets.

Bobby™

Bobby™ is a cutting-edge AI platform designed for traders to track market manipulation and enhance trading strategies. It allows users to input trading rules in plain English and converts them into automated strategies without the need for coding. The platform offers features such as AI-powered analysis, pattern recognition, social sentiment tracking, and automated trading strategies, making it a valuable tool for traders looking to optimize their trading performance.

20 - Open Source Tools

PIXIU

PIXIU is a project designed to support the development, fine-tuning, and evaluation of Large Language Models (LLMs) in the financial domain. It includes components like FinBen, a Financial Language Understanding and Prediction Evaluation Benchmark, FIT, a Financial Instruction Dataset, and FinMA, a Financial Large Language Model. The project provides open resources, multi-task and multi-modal financial data, and diverse financial tasks for training and evaluation. It aims to encourage open research and transparency in the financial NLP field.

finagg

finagg is a Python package that provides implementations of popular and free financial APIs, tools for aggregating historical data from those APIs into SQL databases, and tools for transforming aggregated data into features useful for analysis and AI/ML. It offers documentation, installation instructions, and basic usage examples for exploring various financial APIs and features. Users can install recommended datasets from 3rd party APIs into a local SQL database, access Bureau of Economic Analysis (BEA) data, Federal Reserve Economic Data (FRED), Securities and Exchange Commission (SEC) filings, and more. The package also allows users to explore raw data features, install refined data features, and perform refined aggregations of raw data. Configuration options for API keys, user agents, and data locations are provided, along with information on dependencies and related projects.

FinRobot

FinRobot is an open-source AI agent platform designed for financial applications using large language models. It transcends the scope of FinGPT, offering a comprehensive solution that integrates a diverse array of AI technologies. The platform's versatility and adaptability cater to the multifaceted needs of the financial industry. FinRobot's ecosystem is organized into four layers, including Financial AI Agents Layer, Financial LLMs Algorithms Layer, LLMOps and DataOps Layers, and Multi-source LLM Foundation Models Layer. The platform's agent workflow involves Perception, Brain, and Action modules to capture, process, and execute financial data and insights. The Smart Scheduler optimizes model diversity and selection for tasks, managed by components like Director Agent, Agent Registration, Agent Adaptor, and Task Manager. The tool provides a structured file organization with subfolders for agents, data sources, and functional modules, along with installation instructions and hands-on tutorials.

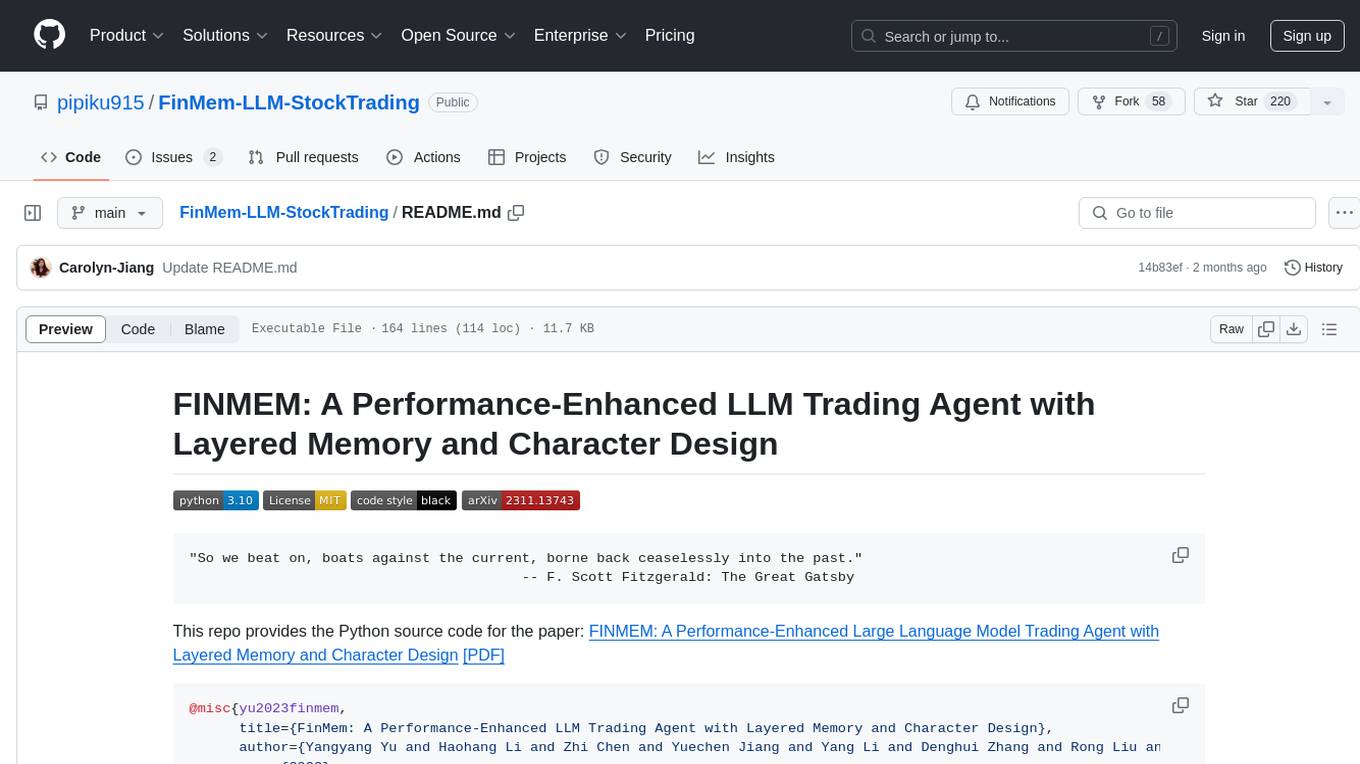

FinMem-LLM-StockTrading

This repository contains the Python source code for FINMEM, a Performance-Enhanced Large Language Model Trading Agent with Layered Memory and Character Design. It introduces FinMem, a novel LLM-based agent framework devised for financial decision-making, encompassing three core modules: Profiling, Memory with layered processing, and Decision-making. FinMem's memory module aligns closely with the cognitive structure of human traders, offering robust interpretability and real-time tuning. The framework enables the agent to self-evolve its professional knowledge, react agilely to new investment cues, and continuously refine trading decisions in the volatile financial environment. It presents a cutting-edge LLM agent framework for automated trading, boosting cumulative investment returns.

LLMs-in-Finance

This repository focuses on the application of Large Language Models (LLMs) in the field of finance. It provides insights and knowledge about how LLMs can be utilized in various scenarios within the finance industry, particularly in generating AI agents. The repository aims to explore the potential of LLMs to enhance financial processes and decision-making through the use of advanced natural language processing techniques.

gpt-bitcoin

The gpt-bitcoin repository is focused on creating an automated trading system for Bitcoin using GPT AI technology. It provides different versions of trading strategies utilizing various data sources such as OHLCV, Moving Averages, RSI, Stochastic Oscillator, MACD, Bollinger Bands, Orderbook Data, news data, fear/greed index, and chart images. Users can set up the system by creating a .env file with necessary API keys and installing required dependencies. The repository also includes instructions for setting up the environment on local machines and AWS EC2 Ubuntu servers. The future plan includes expanding the system to support other cryptocurrency exchanges like Bithumb, Binance, Coinbase, OKX, and Bybit.

solana-trading-bot

Solana AI Trade Bot is an advanced trading tool specifically designed for meme token trading on the Solana blockchain. It leverages AI technology powered by GPT-4.0 to automate trades, identify low-risk/high-potential tokens, and assist in token creation and management. The bot offers cross-platform compatibility and a range of configurable settings for buying, selling, and filtering tokens. Users can benefit from real-time AI support and enhance their trading experience with features like automatic selling, slippage management, and profit/loss calculations. To optimize performance, it is recommended to connect the bot to a private light node for efficient trading execution.

ai-hedge-fund

AI Hedge Fund is a proof of concept for an AI-powered hedge fund that explores the use of AI to make trading decisions. The project is for educational purposes only and simulates trading decisions without actual trading. It employs agents like Market Data Analyst, Valuation Agent, Sentiment Agent, Fundamentals Agent, Technical Analyst, Risk Manager, and Portfolio Manager to gather and analyze data, calculate risk metrics, and make trading decisions.

moon-dev-ai-agents-for-trading

Moon Dev AI Agents for Trading is an experimental project exploring the potential of artificial financial intelligence for trading and investing research. The project aims to develop AI agents to complement and potentially replace human trading operations by addressing common trading challenges such as emotional reactions, ego-driven decisions, inconsistent execution, fatigue effects, impatience, and fear & greed cycles. The project focuses on research areas like risk control, exit timing, entry strategies, sentiment collection, and strategy execution. It is important to note that this project is not a profitable trading solution and involves substantial risk of loss.

labo

LABO is a time series forecasting and analysis framework that integrates pre-trained and fine-tuned LLMs with multi-domain agent-based systems. It allows users to create and tune agents easily for various scenarios, such as stock market trend prediction and web public opinion analysis. LABO requires a specific runtime environment setup, including system requirements, Python environment, dependency installations, and configurations. Users can fine-tune their own models using LABO's Low-Rank Adaptation (LoRA) for computational efficiency and continuous model updates. Additionally, LABO provides a Python library for building model training pipelines and customizing agents for specific tasks.

PredictorLLM

PredictorLLM is an advanced trading agent framework that utilizes large language models to automate trading in financial markets. It includes a profiling module to establish agent characteristics, a layered memory module for retaining and prioritizing financial data, and a decision-making module to convert insights into trading strategies. The framework mimics professional traders' behavior, surpassing human limitations in data processing and continuously evolving to adapt to market conditions for superior investment outcomes.

go-stock

Go-stock is a tool for analyzing stock market data using the Go programming language. It provides functionalities for fetching stock data, performing technical analysis, and visualizing trends. With Go-stock, users can easily retrieve historical stock prices, calculate moving averages, and plot candlestick charts. This tool is designed to help investors and traders make informed decisions based on data-driven insights.

FinAnGPT-Pro

FinAnGPT-Pro is a financial data downloader and AI query system that downloads quarterly and annual financial data for stocks from EOD Historical Data, storing it in MongoDB and Google BigQuery. It includes an AI-powered natural language interface for querying financial data. Users can set up the tool by following the prerequisites and setup instructions provided in the README. The tool allows users to download financial data for all stocks in a watchlist or for a single stock, query financial data using a natural language interface, and receive responses in a structured format. Important considerations include error handling, rate limiting, data validation, BigQuery costs, MongoDB connection, and security measures for API keys and credentials.

OpenBB

The OpenBB Platform is the first financial platform that is free and fully open source, offering access to equity, options, crypto, forex, macro economy, fixed income, and more. It provides a broad range of extensions to enhance the user experience according to their needs. Users can sign up to the OpenBB Hub to maximize the benefits of the OpenBB ecosystem. Additionally, the platform includes an AI-powered Research and Analytics Workspace for free. There is also an open source AI financial analyst agent available that can access all the data within OpenBB.

awesome-quant-ai

Awesome Quant AI is a curated list of resources focusing on quantitative investment and trading strategies using artificial intelligence and machine learning in finance. It covers key challenges in quantitative finance, AI/ML technical fit, predictive modeling, sequential decision-making, synthetic data generation, contextual reasoning, mathematical foundations, design approach, quantitative trading strategies, tools and platforms, learning resources, books, research papers, community, and conferences. The repository aims to provide a comprehensive resource for those interested in the intersection of AI, machine learning, and quantitative finance, with a focus on extracting alpha while managing risk in financial systems.

BizFinBench

BizFinBench is a benchmark tool designed for evaluating large language models (LLMs) in logic-heavy and precision-critical domains such as finance. It comprises over 100,000 bilingual financial questions rooted in real-world business scenarios. The tool covers five dimensions: numerical calculation, reasoning, information extraction, prediction recognition, and knowledge-based question answering, mapped to nine fine-grained categories. BizFinBench aims to assess the capacity of LLMs in real-world financial scenarios and provides insights into their strengths and limitations.

PanWatch

PanWatch is a private AI stock assistant for real-time market monitoring, intelligent technical analysis, and multi-account portfolio management. It offers data privacy through self-hosted deployment, AI-native features that understand user's holdings, style, and goals, and easy setup with Docker. The core functions include intelligent agent system for pre-market analysis, real-time intraday monitoring, end-of-day reports, and news updates. It also provides professional technical analysis with trend indicators, momentum indicators, volume-price analysis, pattern recognition, and support/resistance calculations. PanWatch supports multiple markets and accounts, covering A shares, Hong Kong stocks, and US stocks, with customizable trading styles for accurate AI suggestions. Notifications are available through various channels like Telegram, WeChat Work, DingTalk, Feishu, Bark, and custom webhooks.

atlas-research-notebooks

A collection of open source sample codes and research notebooks created using the atlas-research.io platform. Enables rapid code prototyping, data wrangling, trading strategy development, academic research reproduction, and collaborative research. Repository structure includes sections for cryptocurrency analysis, economics research, and machine learning models. Requires Python 3.11+, Jupyter Notebook or JupyterLab, and necessary packages installed per notebook. Utilizes Jupytext to manage notebooks as Python scripts for better version control and code review. Demonstrates key platform features such as interactive development, data integration, visualization, reproducibility, and collaboration.

quantcoder

QuantCoder is a local-first CLI tool that generates QuantConnect trading algorithms from academic research papers. It uses local LLMs for code generation, refinement, and error fixing. The tool does not require cloud API keys and offers models for reasoning, summarization, and chat. Users can interact with QuantCoder through interactive, CLI, programmatic, and autonomous modes. It also features an evolution mode inspired by AlphaEvolve, backtesting with detailed metrics, library building, and integration with QuantConnect for backtesting and deployment. The tool's architecture includes components for CLI, configuration management, NLP, multi-agent system, evolution engine, self-improving pipeline, library builder, and integration with QuantConnect MCP.

composer-trade-mcp

Composer Trade MCP is the official Composer Model Context Protocol (MCP) server designed for LLMs like Cursor and Claude to validate investment ideas through backtesting and trade multiple strategies in parallel. Users can create automated investing strategies using indicators like RSI, MA, and EMA, backtest their ideas, find tailored strategies, monitor performance, and control investments. The tool provides a fast feedback loop for AI to validate hypotheses and offers a diverse range of equity and crypto offerings for building portfolios.

20 - OpenAI Gpts

Quant Jiang

"My quantitative, my math specialist. Look at him, you notice anything different about him? Look at his face."

Qually the Qualitative Researcher

Expert in health qualitative research and thematic analysis.

Qualitative Quest

I'm Qualitative Quest, here to offer concise advice on qualitative research methods, analysis techniques, and tools.

Math Mentor XL

Expert math tutor and problem solver with online research and data analysis skills.

Tech Stock Analyst

Analyzes tech stocks with in-depth, qualitative and quantitative analysis

How to Measure Anything

对各种量化问题进行拆解和粗略的估算。注意这种估算主要是靠推测,而不是靠准确的数据,因此仅供参考。理想情况下,估算结果和真实值差距可能在1个数量级以内。即使数值不准确,也希望拆解思路对你有所启发。

VaultCraft Trainer

VaultCraft trains users to create automated yield strategies using the VaultCraft VCI & SDK

Nimbus

Expert in CFA, quant, software engineering, data science, and economics for investment strategies.