Best AI tools for< Financial Crime Specialist >

Infographic

20 - AI tool Sites

Pascal

Pascal is an AI-powered risk-based KYC & AML screening and monitoring platform that offers users a faster and more accurate way to assess findings compared to other compliance tools. It leverages AI, machine learning, and Natural Language Processing to analyze open-source and client-specific data, providing insights to identify and assess risks. Pascal simplifies onboarding processes, offers continuous monitoring, reduces false positives, and enables better decision-making through its intuitive interface. It promotes collaboration among different stakeholders and ensures transparency in compliance procedures.

SymphonyAI Financial Crime Prevention AI SaaS Solutions

SymphonyAI offers AI SaaS solutions for financial crime prevention, helping organizations detect fraud, conduct customer due diligence, and prevent payment fraud. Their solutions leverage generative and predictive AI to enhance efficiency and effectiveness in investigating financial crimes. SymphonyAI's products cater to industries like banking, insurance, financial markets, and private banking, providing rapid deployment, scalability, and seamless integration to meet regulatory compliance requirements.

SymphonyAI NetReveal Financial Services

SymphonyAI NetReveal Financial Services is an AI-powered platform that offers solutions for financial crime prevention in various industries such as banking, insurance, financial markets, and private banking. The platform utilizes predictive and generative AI applications to enhance efficiency, reduce fraud, streamline compliance, and maximize output. SymphonyAI provides a fundamentally different approach to AI by combining high-value AI capabilities with industry-leading predictive and generative AI technologies. The platform offers a range of solutions including transaction monitoring, customer due diligence, payment fraud detection, and enterprise investigation management. SymphonyAI aims to revolutionize financial crime prevention by leveraging AI to detect suspicious activity, expedite investigations, and improve compliance operations.

Napier AI

Napier AI is an AI-powered Anti-Money Laundering platform designed to combat evolving threats in the financial industry. It offers a suite of intelligent compliance products that aim to transform organizations' attitudes towards compliance by focusing on efficiency and outcomes. The platform integrates multiple compliance solutions into one master dashboard, provides flexible deployment options, and offers AI-enhanced insights to empower compliance teams to make faster and more accurate decisions. Napier AI is trusted by leading data providers and financial organizations worldwide for its innovative approach to financial crime compliance.

Unit21

Unit21 is a customizable no-code platform designed for risk and compliance operations. It empowers organizations to combat financial crime by providing end-to-end lifecycle risk analysis, fraud prevention, case management, and real-time monitoring solutions. The platform offers features such as AI Copilot for alert prioritization, Ask Your Data for data analysis, Watchlist & Sanctions for ongoing screening, and more. Unit21 focuses on fraud prevention and AML compliance, simplifying operations and accelerating investigations to respond to financial threats effectively and efficiently.

Flagright

Flagright is an AI-native AML compliance and risk management solution designed for EU and UK fintech startups. It offers a comprehensive platform for screening, monitoring, and investigating AML compliance and fraud cases using AI technology. The platform provides real-time transaction monitoring, automated case management, AI forensics for screening, customer risk assessment, and sanctions screening. Flagright also offers integrations, notifications, bad actor database, CRM, KYB & ID verification, and professional services for tailored AML program design and support. Trusted by financial institutions across 6 continents, Flagright is a modern standard for financial crime compliance.

Quantifind

Quantifind is an AI-powered financial crimes automation platform that specializes in Anti-Money Laundering (AML) and Know Your Customer (KYC) solutions. It offers end-to-end automation impact, best-in-class accuracy, and powerful APIs and applications for risk screening, investigations, and compliance in the financial services and public sector industries. Quantifind's Graphyte platform leverages AI and external data to streamline AML-KYC processes, providing comprehensive data coverage, dynamic risk typologies, and seamless integrations with case management systems.

Simudyne

Simudyne is an enterprise simulation software powered by AI technology. It allows large financial institutions to simulate various future scenarios efficiently and measure their impact in a safe virtual environment. The software offers solutions for environment, social and governance issues, market execution, financial crime analytics, and risk management. Simudyne's technology is secure, distributable, and Cloudera certified, providing a robust library of code for specialized functions. The platform also utilizes agent-based modeling to bridge the gap between theoretical and real-world scenarios in the financial services sector.

Wunderschild

Schwarzthal Tech's Wunderschild is an AI-driven platform for financial crime intelligence. It revolutionizes compliance and investigation techniques by providing intelligence solutions based on network assessment, data linkage, flow aggregation, and machine learning. The platform offers insights on strategic risks related to Politically Exposed Persons, Serious Organised Crime, Terrorism Financing, and more. With features like Compliance, Investigation, Know Your Network, Media Scan, Document Drill, and Transaction Monitoring, Wunderschild helps in detecting suspicious activities, fraud patterns, and risk assessment. The platform is trusted by global companies for KYC, Enhanced Due Diligence, and multi-dimensional risk rating.

Sardine

Sardine is an AI-powered platform for fraud prevention and compliance. It offers a comprehensive suite of products to help banks, retailers, and fintechs detect fraud patterns, prevent money laundering, and stop sophisticated scams. Sardine combines deep device intelligence, behavior biometrics, and identity signals to provide a precise risk score for every customer interaction. The platform also features machine learning models, a rules engine, network graph analysis, anomaly detection, and generative AI capabilities to fight modern threats. Sardine helps reduce fraud rates, decrease false positives, and streamline risk operations with its fully integrated solutions.

DataVisor

DataVisor is a modern, end-to-end fraud and risk SaaS platform powered by AI and advanced machine learning for financial institutions and large organizations. It helps businesses combat various fraud and financial crimes in real time. DataVisor's platform provides comprehensive fraud detection and prevention capabilities, including account onboarding, application fraud, ATO prevention, card fraud, check fraud, FinCrime and AML, and ACH and wire fraud detection. The platform is designed to adapt to new fraud incidents immediately with real-time data signal orchestration and end-to-end workflow automation, minimizing fraud losses and maximizing fraud detection coverage.

DataVisor

DataVisor is a modern, end-to-end fraud and risk SaaS platform powered by AI and advanced machine learning for financial institutions and large organizations. It provides a comprehensive suite of capabilities to combat a variety of fraud and financial crimes in real time. DataVisor's hyper-scalable, modern architecture allows you to leverage transaction logs, user profiles, dark web and other identity signals with real-time analytics to enrich and deliver high quality detection in less than 100-300ms. The platform is optimized to scale to support the largest enterprises with ultra-low latency. DataVisor enables early detection and adaptive response to new and evolving fraud attacks combining rules, machine learning, customizable workflows, device and behavior signals in an all-in-one platform for complete protection. Leading with an Unsupervised approach, DataVisor is the only proven, production-ready solution that can proactively stop fraud attacks before they result in financial loss.

Ferret

Ferret is an AI-powered relationship intelligence tool that provides curated relationship intelligence and monitoring to help users avoid high-risk individuals and spot promising opportunities. It uses AI and proprietary data to offer total transparency into personal and professional networks, uncovering information such as news archives, white-collar crime, corporate ownership, legal records, and more.

Financial Planning

The Financial Planning website is a comprehensive platform that offers insights and resources on various aspects of financial planning, including tax investing, wealth management, estate planning, retirement planning, practice management, regulation and compliance, technology, industry news, and opinion pieces. The site covers a wide range of topics relevant to financial advisors and professionals in the wealth management industry. It also features articles on emerging trends, investment strategies, industry updates, and expert opinions to help readers stay informed and make informed decisions.

Intuit Assist

Intuit Assist is a generative AI-powered financial assistant designed to help you achieve financial confidence. It is a comprehensive platform that offers a wide range of financial tools and services, including TurboTax, Credit Karma, QuickBooks, and Mailchimp. Intuit Assist can help you with a variety of financial tasks, such as filing your taxes, managing your credit, tracking your expenses, and invoicing your clients. It is a valuable tool for anyone who wants to take control of their finances and achieve financial success.

Roic AI

Roic AI is an AI tool designed to provide users with essential financial data for analyzing companies. It offers comprehensive company summaries, 30+ years of financial statements, and earnings call transcripts in a single location. Users can access crucial information about popular companies like Apple Inc. and Microsoft Corporation through this platform.

CityFALCON

CityFALCON is a financial and business due diligence platform that provides a range of solutions for the needs of a wide audience, including retail investors, retail traders, daily business news readers, brokers, students, professors, academia, wealth managers, financial advisors, P2P crowdfunding, VC, PE, institutional investors, treasury, consultancy, legal, accounting, central banks, and regulatory agencies. The platform offers a variety of features and content, including a CityFALCON Score, watchlists, similar stories, grouping news on charts, key headlines, sentiment content translation, content news premium publications, insider transactions, official company filings, investor relations, ESG content, and languages.

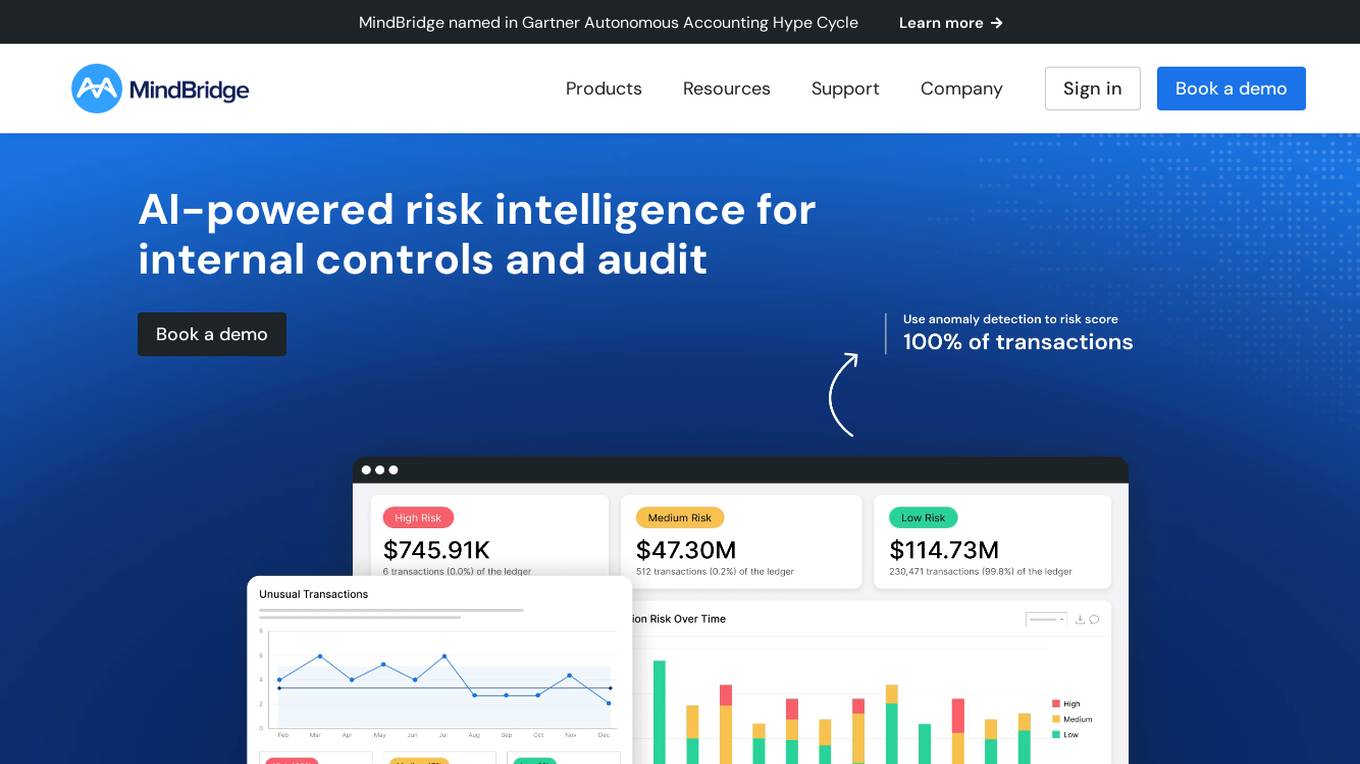

MindBridge

MindBridge is a global leader in financial risk discovery and anomaly detection. The MindBridge AI Platform drives insights and assesses risks across critical business operations. It offers various products like General Ledger Analysis, Company Card Risk Analytics, Payroll Risk Analytics, Revenue Risk Analytics, and Vendor Invoice Risk Analytics. With over 250 unique machine learning control points, statistical methods, and traditional rules, MindBridge is deployed to over 27,000 accounting, finance, and audit professionals globally.

Finlo

Finlo is an AI-powered financial research assistant that provides comprehensive market insights, financial data, and analysis tools for investors. It simplifies complex financial information into understandable insights, offering real-time monitoring, trend analysis, comparative insights, and personalized recommendations to help users make informed investment decisions. With knowledge of earnings releases, financial reports, and fundamental information for S&P 500 and Nasdaq companies, Finlo aims to enhance decision-making and confidence in navigating the stock market.

Ocrolus

Ocrolus is an intelligent document automation software that leverages AI-driven document processing automation with Human-in-the-Loop. It helps in classifying, capturing, detecting, and analyzing various types of documents to streamline processes and make faster and more accurate financial decisions. The software is designed to assist in tasks such as income verification, fraud detection, cash flow analysis, and business process automation across different industries.

20 - Open Source Tools

ciso-assistant-community

CISO Assistant is a tool that helps organizations manage their cybersecurity posture and compliance. It provides a centralized platform for managing security controls, threats, and risks. CISO Assistant also includes a library of pre-built frameworks and tools to help organizations quickly and easily implement best practices.

RD-Agent

RD-Agent is a tool designed to automate critical aspects of industrial R&D processes, focusing on data-driven scenarios to streamline model and data development. It aims to propose new ideas ('R') and implement them ('D') automatically, leading to solutions of significant industrial value. The tool supports scenarios like Automated Quantitative Trading, Data Mining Agent, Research Copilot, and more, with a framework to push the boundaries of research in data science. Users can create a Conda environment, install the RDAgent package from PyPI, configure GPT model, and run various applications for tasks like quantitative trading, model evolution, medical prediction, and more. The tool is intended to enhance R&D processes and boost productivity in industrial settings.

financial-datasets

Financial Datasets is an open-source Python library that allows users to create question and answer financial datasets using Large Language Models (LLMs). With this library, users can easily generate realistic financial datasets from 10-K, 10-Q, PDF, and other financial texts. The library provides three main methods for generating datasets: from any text, from a 10-K filing, or from a PDF URL. Financial Datasets can be used for a variety of tasks, including financial analysis, research, and education.

PIXIU

PIXIU is a project designed to support the development, fine-tuning, and evaluation of Large Language Models (LLMs) in the financial domain. It includes components like FinBen, a Financial Language Understanding and Prediction Evaluation Benchmark, FIT, a Financial Instruction Dataset, and FinMA, a Financial Large Language Model. The project provides open resources, multi-task and multi-modal financial data, and diverse financial tasks for training and evaluation. It aims to encourage open research and transparency in the financial NLP field.

finagg

finagg is a Python package that provides implementations of popular and free financial APIs, tools for aggregating historical data from those APIs into SQL databases, and tools for transforming aggregated data into features useful for analysis and AI/ML. It offers documentation, installation instructions, and basic usage examples for exploring various financial APIs and features. Users can install recommended datasets from 3rd party APIs into a local SQL database, access Bureau of Economic Analysis (BEA) data, Federal Reserve Economic Data (FRED), Securities and Exchange Commission (SEC) filings, and more. The package also allows users to explore raw data features, install refined data features, and perform refined aggregations of raw data. Configuration options for API keys, user agents, and data locations are provided, along with information on dependencies and related projects.

FinRobot

FinRobot is an open-source AI agent platform designed for financial applications using large language models. It transcends the scope of FinGPT, offering a comprehensive solution that integrates a diverse array of AI technologies. The platform's versatility and adaptability cater to the multifaceted needs of the financial industry. FinRobot's ecosystem is organized into four layers, including Financial AI Agents Layer, Financial LLMs Algorithms Layer, LLMOps and DataOps Layers, and Multi-source LLM Foundation Models Layer. The platform's agent workflow involves Perception, Brain, and Action modules to capture, process, and execute financial data and insights. The Smart Scheduler optimizes model diversity and selection for tasks, managed by components like Director Agent, Agent Registration, Agent Adaptor, and Task Manager. The tool provides a structured file organization with subfolders for agents, data sources, and functional modules, along with installation instructions and hands-on tutorials.

stockbot-on-groq

StockBot Powered by Groq is an AI-powered chatbot that provides lightning-fast responses with live interactive stock charts, financial data, news, screeners, and more. Leveraging Groq's speed and Vercel's AI SDK, StockBot offers real-time conversation with natural language processing, interactive TradingView charts, adaptive interfaces, and multi-asset market coverage. It is designed for entertainment and instructional use, not for investment advice.

FinVeda

FinVeda is a dynamic financial literacy app that aims to solve the problem of low financial literacy rates in India by providing a platform for financial education. It features an AI chatbot, finance blogs, market trends analysis, SIP calculator, and finance quiz to help users learn finance with finesse. The app is free and open-source, licensed under the GNU General Public License v3.0. FinVeda was developed at IIT Jammu's Udyamitsav'24 Hackathon, where it won first place in the GenAI track and third place overall.

FinMem-LLM-StockTrading

This repository contains the Python source code for FINMEM, a Performance-Enhanced Large Language Model Trading Agent with Layered Memory and Character Design. It introduces FinMem, a novel LLM-based agent framework devised for financial decision-making, encompassing three core modules: Profiling, Memory with layered processing, and Decision-making. FinMem's memory module aligns closely with the cognitive structure of human traders, offering robust interpretability and real-time tuning. The framework enables the agent to self-evolve its professional knowledge, react agilely to new investment cues, and continuously refine trading decisions in the volatile financial environment. It presents a cutting-edge LLM agent framework for automated trading, boosting cumulative investment returns.

LLMs-in-Finance

This repository focuses on the application of Large Language Models (LLMs) in the field of finance. It provides insights and knowledge about how LLMs can be utilized in various scenarios within the finance industry, particularly in generating AI agents. The repository aims to explore the potential of LLMs to enhance financial processes and decision-making through the use of advanced natural language processing techniques.

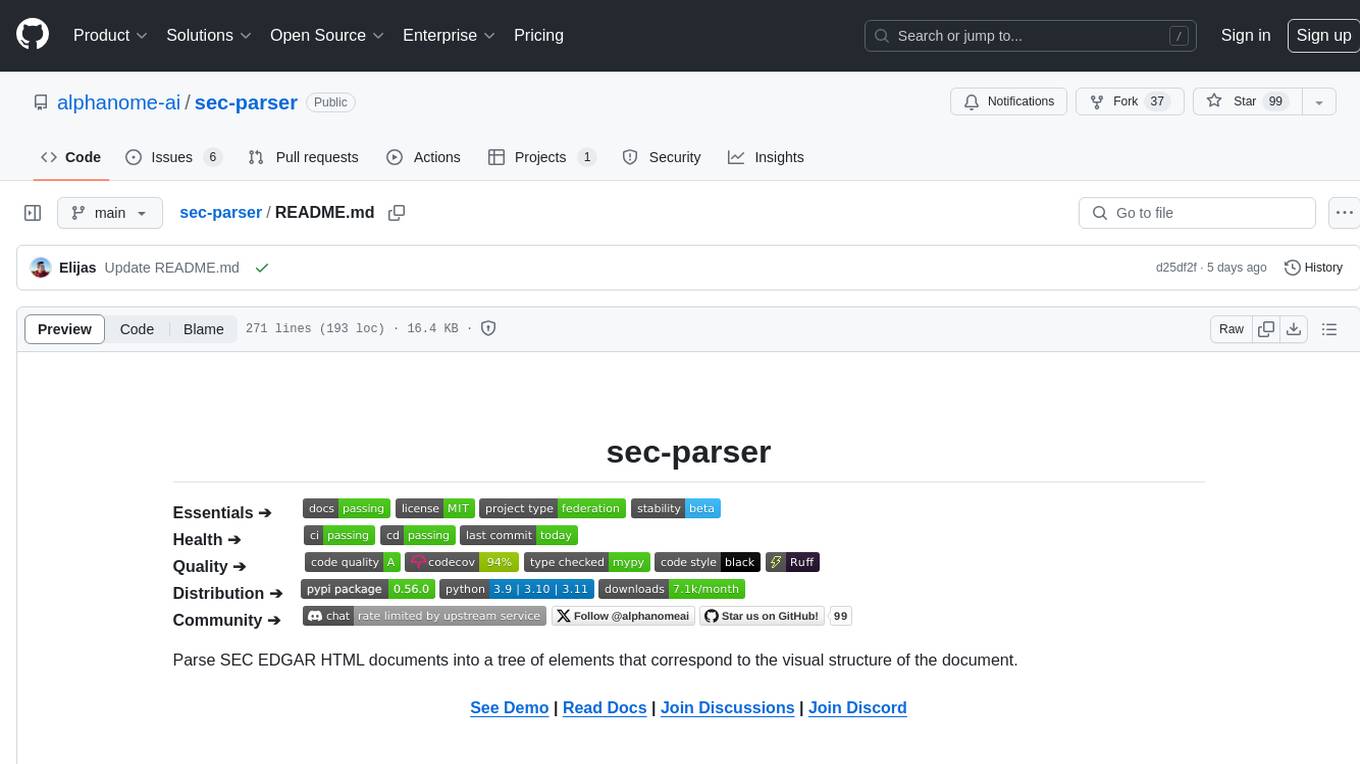

sec-parser

The `sec-parser` project simplifies extracting meaningful information from SEC EDGAR HTML documents by organizing them into semantic elements and a tree structure. It helps in parsing SEC filings for financial and regulatory analysis, analytics and data science, AI and machine learning, causal AI, and large language models. The tool is especially beneficial for AI, ML, and LLM applications by streamlining data pre-processing and feature extraction.

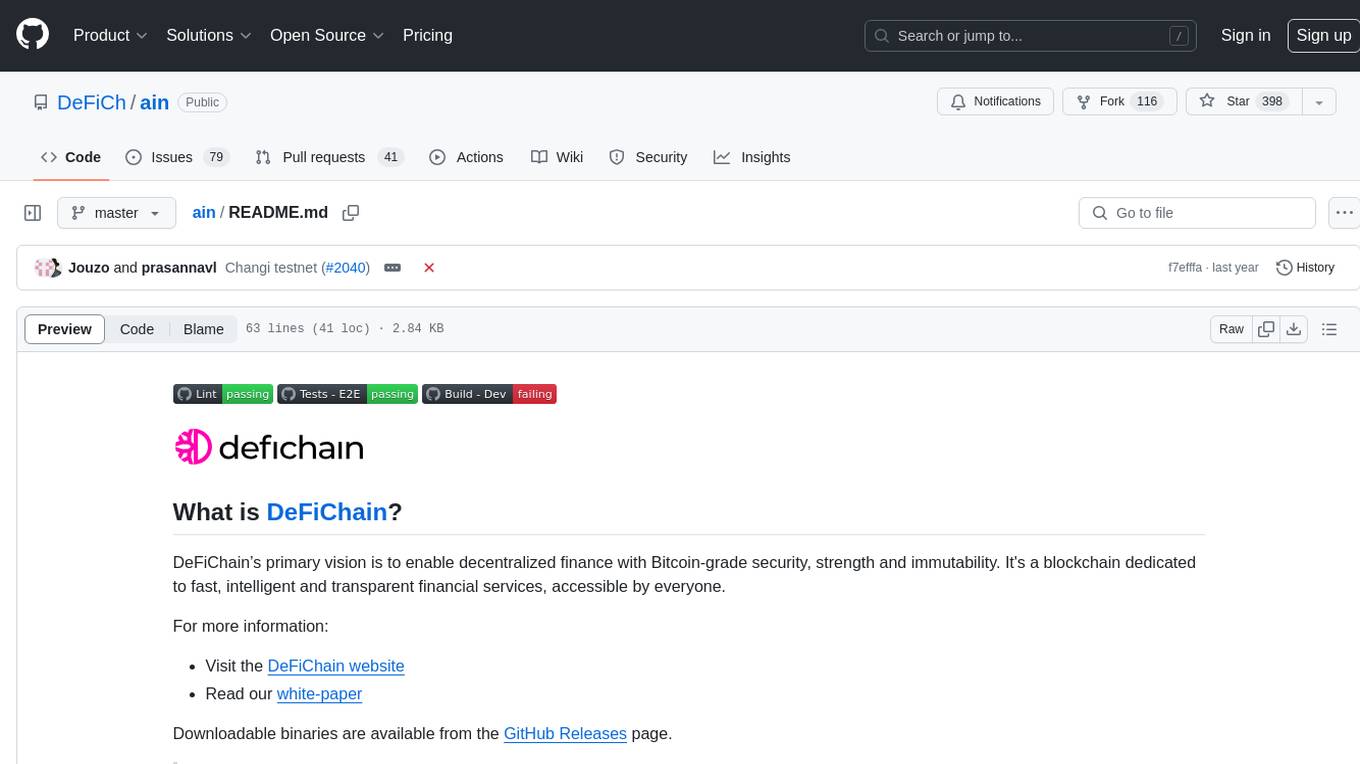

ain

DeFiChain is a blockchain platform dedicated to enabling decentralized finance with Bitcoin-grade security, strength, and immutability. It offers fast, intelligent, and transparent financial services accessible to everyone. DeFiChain has made significant modifications from Bitcoin Core, including moving to Proof-of-Stake, introducing a masternode model, supporting a community fund, anchoring to the Bitcoin blockchain, and enhancing decentralized financial transaction and opcode support. The platform is under active development with regular releases and contributions are welcomed.

parsee-core

Parsee AI is a high-level open source data extraction and structuring framework specialized for the extraction of data from a financial domain, but can be used for other use-cases as well. It aims to make the structuring of data from unstructured sources like PDFs, HTML files, and images as easy as possible. Parsee can be used locally in Python environments or through a hosted version for cloud-based jobs. It supports the extraction of tables, numbers, and other data elements, with the ability to create custom extraction templates and run jobs using different models.

RainbowGPT

RainbowGPT is a versatile tool that offers a range of functionalities, including Stock Analysis for financial decision-making, MySQL Management for database navigation, and integration of AI technologies like GPT-4 and ChatGlm3. It provides a user-friendly interface suitable for all skill levels, ensuring seamless information flow and continuous expansion of emerging technologies. The tool enhances adaptability, creativity, and insight, making it a valuable asset for various projects and tasks.

freegenius

FreeGenius AI is an ambitious project offering a comprehensive suite of AI solutions that mirror the capabilities of LetMeDoIt AI. It is designed to engage in intuitive conversations, execute codes, provide up-to-date information, and perform various tasks. The tool is free, customizable, and provides access to real-time data and device information. It aims to support offline and online backends, open-source large language models, and optional API keys. Users can use FreeGenius AI for tasks like generating tweets, analyzing audio, searching financial data, checking weather, and creating maps.

DataFrame

DataFrame is a C++ analytical library designed for data analysis similar to libraries in Python and R. It allows you to slice, join, merge, group-by, and perform various statistical, summarization, financial, and ML algorithms on your data. DataFrame also includes a large collection of analytical algorithms in form of visitors, ranging from basic stats to more involved analysis. You can easily add your own algorithms as well. DataFrame employs extensive multithreading in almost all its APIs, making it suitable for analyzing large datasets. Key principles followed in the library include supporting any type without needing new code, avoiding pointer chasing, having all column data in contiguous memory space, minimizing space usage, avoiding data copying, using multi-threading judiciously, and not protecting the user against garbage in, garbage out.

generative-ai-amazon-bedrock-langchain-agent-example

This repository provides a sample solution for building generative AI agents using Amazon Bedrock, Amazon DynamoDB, Amazon Kendra, Amazon Lex, and LangChain. The solution creates a generative AI financial services agent capable of assisting users with account information, loan applications, and answering natural language questions. It serves as a launchpad for developers to create personalized conversational agents for applications like chatbots and virtual assistants.

data-scientist-roadmap2024

The Data Scientist Roadmap2024 provides a comprehensive guide to mastering essential tools for data science success. It includes programming languages, machine learning libraries, cloud platforms, and concepts categorized by difficulty. The roadmap covers a wide range of topics from programming languages to machine learning techniques, data visualization tools, and DevOps/MLOps tools. It also includes web development frameworks and specific concepts like supervised and unsupervised learning, NLP, deep learning, reinforcement learning, and statistics. Additionally, it delves into DevOps tools like Airflow and MLFlow, data visualization tools like Tableau and Matplotlib, and other topics such as ETL processes, optimization algorithms, and financial modeling.

AixLib

AixLib is a Modelica model library for building performance simulations developed at RWTH Aachen University, E.ON Energy Research Center, Institute for Energy Efficient Buildings and Indoor Climate (EBC) in Aachen, Germany. It contains models of HVAC systems as well as high and reduced order building models. The name AixLib is derived from the city's French name Aix-la-Chapelle, following a local tradition. The library is continuously improved and offers citable papers for reference. Contributions to the development can be made via Issues section or Pull Requests, following the workflow described in the Wiki. AixLib is released under a 3-clause BSD-license with acknowledgements to public funded projects and financial support by BMWi (German Federal Ministry for Economic Affairs and Energy).

20 - OpenAI Gpts

Financial Cybersecurity Analyst - Lockley Cash v1

stunspot's advisor for all things Financial Cybersec

Financial Sentiment Analyst

A sentiment analysis tool for evaluating management-related texts.

Financial Modeling GPT

Expert in financial modeling for valuation, budgeting, and forecasting.

Financial Accounting Advisor

Provides financial guidance through accurate accounting advisory.

Financial Reporting Advisor

Enhances financial decision-making by analyzing, interpreting and reporting financial data.

Financial Reporting Advisor

Enhances financial decision-making by analyzing, interpreting and presenting financial data.

Australian Financial Legislation Explorer

Expert in comprehensive Australian government income and financial forecasting

PMJAY Financial Assistant

Expert in managing and tracking payment recoveries for Hope Hospital.

Financial Accounting Professor

Expert in financial accounting, clarifying complex concepts with academic sources.

Safaricom Financial Analyst

Analyzes Safaricom's HY and FY financials, with detailed insights on different years.

World Class Financial Expert

All things money. Feature in testing: Reports with memory system. ZERO SHOT REPORTS V0.3 (BETA)

Couples Financial Planner

Aids couples in managing joint finances, budgeting for future goals, and navigating financial challenges together.