Best AI tools for< Financial Risk Analyst >

Infographic

20 - AI tool Sites

ThetaRay

ThetaRay is an AI-powered transaction monitoring platform designed for fintechs and banks to detect threats and ensure trust in global payments. It uses unsupervised machine learning to efficiently detect anomalies in data sets and pinpoint suspected cases of money laundering with minimal false positives. The platform helps businesses satisfy regulators, save time and money, and drive financial growth by identifying risks accurately, boosting efficiency, and reducing false positives.

Ratugacor88

Ratugacor88 is an online gambling site affiliated with the Indonesian lottery site, providing a wide range of lottery markets including Toto Macau, SGP, HK, SDY, and many more with the biggest discounts. It is a trusted online lottery dealer and the top choice for lottery players in Indonesia, offering various conveniences and facilities to support players in placing online lottery bets comfortably and safely. With a 4D lottery prize reaching 10 million, Ratugacor88 offers a great opportunity for players to win the biggest prize in Indonesia in 2024.

Surmount AI

Surmount AI is an automated investing platform designed to make investing accessible to everyone. It utilizes advanced algorithms to provide users with personalized investment strategies based on their financial goals and risk tolerance. With Surmount AI, users can easily create and manage their investment portfolios, track performance, and receive real-time insights to make informed decisions. The platform aims to democratize investing by removing barriers to entry and empowering individuals to grow their wealth through intelligent automation.

Fraud.net

Fraud.net is an AI-powered fraud detection and prevention platform designed for enterprises. It offers a comprehensive and customizable solution to manage and prevent fraud across various industries. The platform utilizes AI and machine learning technologies to provide real-time monitoring, analytics, and reporting to help businesses combat different types of fraud such as account takeover, application fraud, and more. Fraud.net aims to create a frictionless customer experience and ensure trust at every step of the digital customer journey by offering end-to-end financial fraud and risk management solutions.

MindBridge

MindBridge is a global leader in financial risk discovery and anomaly detection. The MindBridge AI Platform drives insights and assesses risks across critical business operations. It offers various products like General Ledger Analysis, Company Card Risk Analytics, Payroll Risk Analytics, Revenue Risk Analytics, and Vendor Invoice Risk Analytics. With over 250 unique machine learning control points, statistical methods, and traditional rules, MindBridge is deployed to over 27,000 accounting, finance, and audit professionals globally.

Unit21

Unit21 is a customizable no-code platform designed for risk and compliance operations. It empowers organizations to combat financial crime by providing end-to-end lifecycle risk analysis, fraud prevention, case management, and real-time monitoring solutions. The platform offers features such as AI Copilot for alert prioritization, Ask Your Data for data analysis, Watchlist & Sanctions for ongoing screening, and more. Unit21 focuses on fraud prevention and AML compliance, simplifying operations and accelerating investigations to respond to financial threats effectively and efficiently.

FOCAL

FOCAL is an AI-driven platform designed for AML compliance and anti-fraud purposes. It offers solutions for verification, customer due diligence, fraud prevention, and financial insights. The platform leverages AI technology to streamline onboarding processes, enhance trust through advanced customer screening, and detect and prevent fraud using advanced AI algorithms. FOCAL is tailored to meet industry-specific needs, provides seamless integration with existing systems, and offers localized expertise with global standards for regulatory compliance.

BCT Digital

BCT Digital is an AI-powered risk management suite provider that offers a range of products to help enterprises optimize their core Governance, Risk, and Compliance (GRC) processes. The rt360 suite leverages next-generation technologies, sophisticated AI/ML models, data-driven algorithms, and predictive analytics to assist organizations in managing various risks effectively. BCT Digital's solutions cater to the financial sector, providing tools for credit risk monitoring, early warning systems, model risk management, environmental, social, and governance (ESG) risk assessment, and more.

Responsive.ai

Responsive.ai is a foundational software designed for financial advice, aimed at maximizing advisor productivity through workflow automation, client engagement tools, and AI-powered insights. The platform offers solutions like Prioritize for enhancing relationships and revenue growth, Enable for managing documents and integrations, and Dash for creating seamless digital experiences. Responsive empowers advisors with an API-first ecosystem to deliver advice-led financial services and elevate enterprise value.

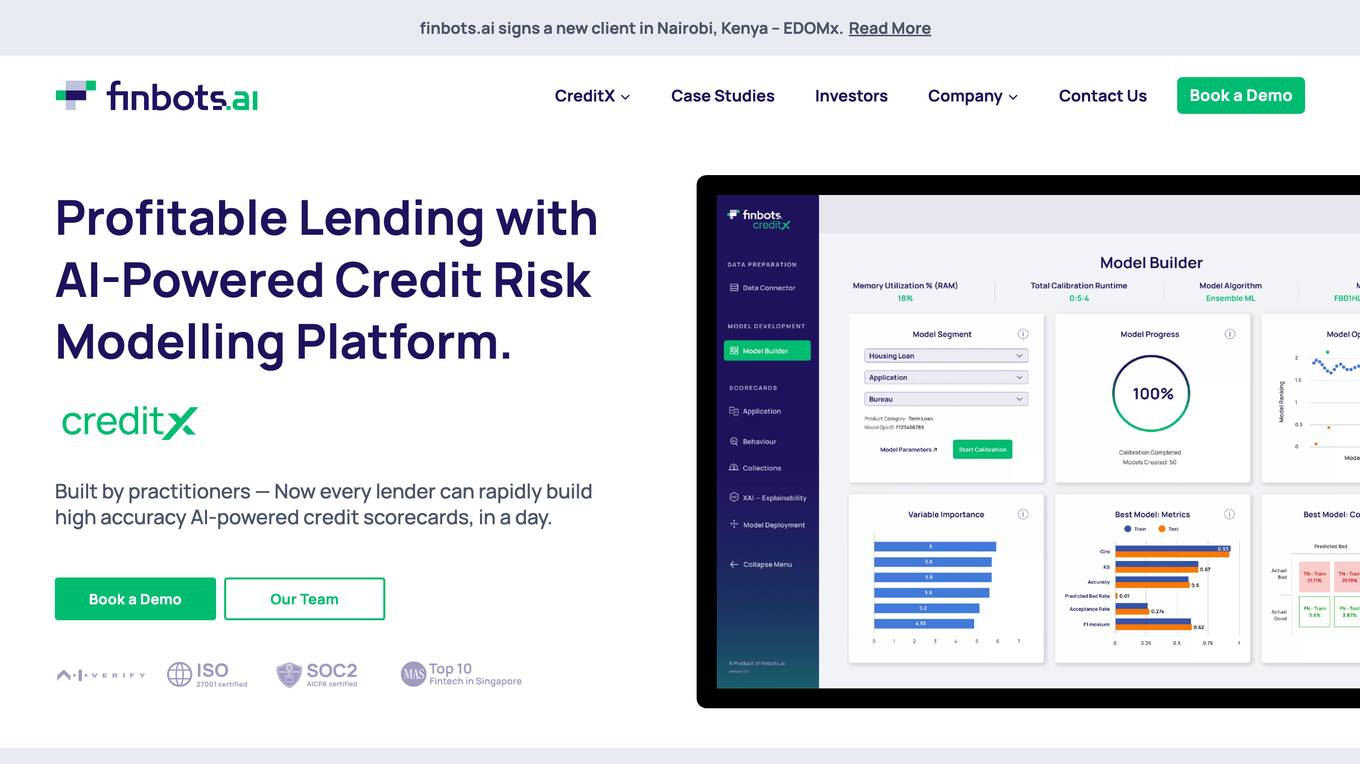

Finbots.ai

Finbots.ai is a trusted AI credit risk platform that offers AI credit scoring to boost lending profits and reduce non-performing loans. The platform provides the highest accuracy in the market, allowing users to build scorecards in a day without the need for coding. It is designed to increase revenue, decrease risk, make instant decisions, and improve operational efficiency for lending businesses. Finbots.ai is used by various financial institutions to enhance credit risk management, make accurate lending decisions, and drive down the cost of risk through AI-enabled models.

Blackbird.AI

Blackbird.AI is a narrative and risk intelligence platform that helps organizations identify and protect against narrative attacks created by misinformation and disinformation. The platform offers a range of solutions tailored to different industries and roles, enabling users to analyze threats in text, images, and memes across various sources such as social media, news, and the dark web. By providing context and clarity for strategic decision-making, Blackbird.AI empowers organizations to proactively manage and mitigate the impact of narrative attacks on their reputation and financial stability.

Ferret

Ferret is an AI-powered relationship intelligence tool designed to provide curated relationship intelligence and monitoring to help users avoid high-risk individuals and identify promising opportunities. It uses AI and proprietary data to deliver actionable intelligence in real-time, ensuring total transparency into personal and professional networks. The tool offers features such as Single Click Reputation & Safety Pre-Checks, Business and Personal Relationship Intelligence, AI Checks for Risks and Opportunities, and more. Ferret is a cutting-edge application that combines Artificial Intelligence with world-class information to provide users with comprehensive relationship intelligence.

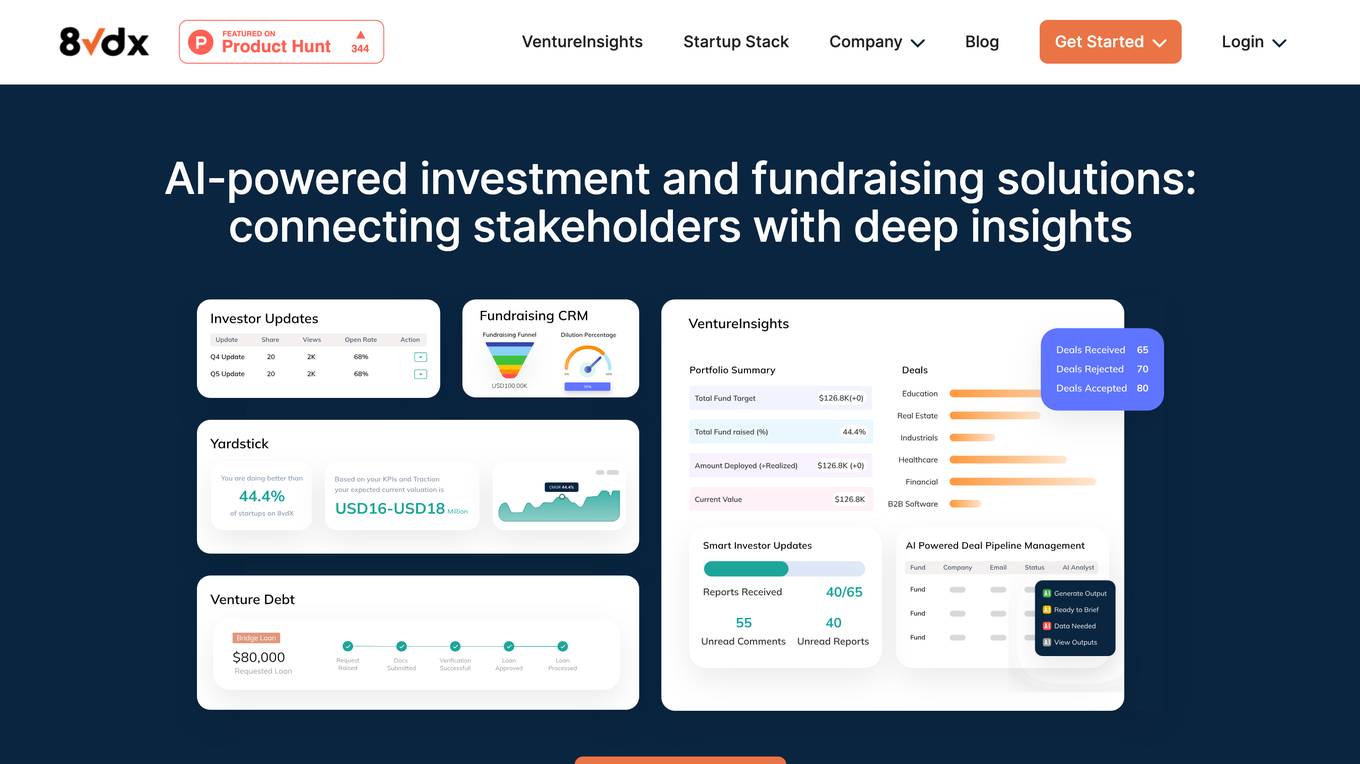

8VDX

8VDX is an AI application that offers fine-tuned AI models for credit funds, empowering users to make data-driven decisions in the realm of credit investing. The platform enhances speed, accuracy, and strategic depth across various financial instruments like bonds, private credit, and CLOs. By leveraging AI technology, 8VDX streamlines the investment analysis process, automates bond screening, and provides continuous learning from surveillance to optimize investment strategies.

Rafa.ai

Rafa.ai is an AI-powered investing application that offers a comprehensive suite of tools and features to assist users in making informed investment decisions. The platform utilizes AI agents to provide real-time insights, portfolio alerts, risk analysis, and options monitoring. Users can access data-driven trading strategies, perform equity research, and analyze news sentiment. Rafa.ai aims to help users manage their investment risks, discover investment opportunities, and make smarter investment decisions.

FairPlay

FairPlay is a Fairness-as-a-Service solution designed for financial institutions, offering AI-powered tools to assess automated decisioning models quickly. It helps in increasing fairness and profits by optimizing marketing, underwriting, and pricing strategies. The application provides features such as Fairness Optimizer, Second Look, Customer Composition, Redline Status, and Proxy Detection. FairPlay enables users to identify and overcome tradeoffs between performance and disparity, assess geographic fairness, de-bias proxies for protected classes, and tune models to reduce disparities without increasing risk. It offers advantages like increased compliance, speed, and readiness through automation, higher approval rates with no increase in risk, and rigorous Fair Lending analysis for sponsor banks and regulators. However, some disadvantages include the need for data integration, potential bias in AI algorithms, and the requirement for technical expertise to interpret results.

MarketGPT

MarketGPT is an artificial intelligence model trained to predict stock movements based on news items. It evaluates the news and decides how the company stock is going to be affected by it. Users can access the model through the MarketGPT website or mobile app to get stock predictions and picks. The model's performance can be viewed for different time frames such as 1 week, 1 month, and 1 year. However, users are advised that investing in stocks and derivatives carries a risk of financial loss, and past performance is not a guarantee of future performance. MarketGPT is designed to assist users in making informed decisions in the stock market.

SymphonyAI Financial Crime Prevention AI SaaS Solutions

SymphonyAI offers AI SaaS solutions for financial crime prevention, helping organizations detect fraud, conduct customer due diligence, and prevent payment fraud. Their solutions leverage generative and predictive AI to enhance efficiency and effectiveness in investigating financial crimes. SymphonyAI's products cater to industries like banking, insurance, financial markets, and private banking, providing rapid deployment, scalability, and seamless integration to meet regulatory compliance requirements.

SymphonyAI NetReveal Financial Services

SymphonyAI NetReveal Financial Services is an AI-powered platform that offers solutions for financial crime prevention in various industries such as banking, insurance, financial markets, and private banking. The platform utilizes predictive and generative AI applications to enhance efficiency, reduce fraud, streamline compliance, and maximize output. SymphonyAI provides a fundamentally different approach to AI by combining high-value AI capabilities with industry-leading predictive and generative AI technologies. The platform offers a range of solutions including transaction monitoring, customer due diligence, payment fraud detection, and enterprise investigation management. SymphonyAI aims to revolutionize financial crime prevention by leveraging AI to detect suspicious activity, expedite investigations, and improve compliance operations.

Quantifind

Quantifind is an AI-powered financial crimes automation platform that specializes in Anti-Money Laundering (AML) and Know Your Customer (KYC) solutions. It offers end-to-end automation impact, best-in-class accuracy, and powerful APIs and applications for risk screening, investigations, and compliance in the financial services and public sector industries. Quantifind's Graphyte platform leverages AI and external data to streamline AML-KYC processes, providing comprehensive data coverage, dynamic risk typologies, and seamless integrations with case management systems.

Ocrolus

Ocrolus is an intelligent document automation software that leverages AI-driven document processing automation with Human-in-the-Loop. It helps in classifying, capturing, detecting, and analyzing various types of documents to streamline processes and make faster and more accurate financial decisions. The software is designed to assist in cash flow analysis, income verification, address validation, employment data retrieval, and identity confirmation across different industries such as small business lending, mortgage, consumer finance, and multifamily housing.

20 - Open Source Tools

PIXIU

PIXIU is a project designed to support the development, fine-tuning, and evaluation of Large Language Models (LLMs) in the financial domain. It includes components like FinBen, a Financial Language Understanding and Prediction Evaluation Benchmark, FIT, a Financial Instruction Dataset, and FinMA, a Financial Large Language Model. The project provides open resources, multi-task and multi-modal financial data, and diverse financial tasks for training and evaluation. It aims to encourage open research and transparency in the financial NLP field.

FinRobot

FinRobot is an open-source AI agent platform designed for financial applications using large language models. It transcends the scope of FinGPT, offering a comprehensive solution that integrates a diverse array of AI technologies. The platform's versatility and adaptability cater to the multifaceted needs of the financial industry. FinRobot's ecosystem is organized into four layers, including Financial AI Agents Layer, Financial LLMs Algorithms Layer, LLMOps and DataOps Layers, and Multi-source LLM Foundation Models Layer. The platform's agent workflow involves Perception, Brain, and Action modules to capture, process, and execute financial data and insights. The Smart Scheduler optimizes model diversity and selection for tasks, managed by components like Director Agent, Agent Registration, Agent Adaptor, and Task Manager. The tool provides a structured file organization with subfolders for agents, data sources, and functional modules, along with installation instructions and hands-on tutorials.

sec-parser

The `sec-parser` project simplifies extracting meaningful information from SEC EDGAR HTML documents by organizing them into semantic elements and a tree structure. It helps in parsing SEC filings for financial and regulatory analysis, analytics and data science, AI and machine learning, causal AI, and large language models. The tool is especially beneficial for AI, ML, and LLM applications by streamlining data pre-processing and feature extraction.

openagi

OpenAGI is a framework designed to make the development of autonomous human-like agents accessible to all. It aims to pave the way towards open agents and eventually AGI for everyone. The initiative strongly believes in the transformative power of AI and offers developers a platform to create autonomous human-like agents. OpenAGI features a flexible agent architecture, streamlined integration and configuration processes, and automated/manual agent configuration generation. It can be used in education for personalized learning experiences, in finance and banking for fraud detection and personalized banking advice, and in healthcare for patient monitoring and disease diagnosis.

last_layer

last_layer is a security library designed to protect LLM applications from prompt injection attacks, jailbreaks, and exploits. It acts as a robust filtering layer to scrutinize prompts before they are processed by LLMs, ensuring that only safe and appropriate content is allowed through. The tool offers ultra-fast scanning with low latency, privacy-focused operation without tracking or network calls, compatibility with serverless platforms, advanced threat detection mechanisms, and regular updates to adapt to evolving security challenges. It significantly reduces the risk of prompt-based attacks and exploits but cannot guarantee complete protection against all possible threats.

llmware

LLMWare is a framework for quickly developing LLM-based applications including Retrieval Augmented Generation (RAG) and Multi-Step Orchestration of Agent Workflows. This project provides a comprehensive set of tools that anyone can use - from a beginner to the most sophisticated AI developer - to rapidly build industrial-grade, knowledge-based enterprise LLM applications. Our specific focus is on making it easy to integrate open source small specialized models and connecting enterprise knowledge safely and securely.

Large-Language-Model-Notebooks-Course

This practical free hands-on course focuses on Large Language models and their applications, providing a hands-on experience using models from OpenAI and the Hugging Face library. The course is divided into three major sections: Techniques and Libraries, Projects, and Enterprise Solutions. It covers topics such as Chatbots, Code Generation, Vector databases, LangChain, Fine Tuning, PEFT Fine Tuning, Soft Prompt tuning, LoRA, QLoRA, Evaluate Models, Knowledge Distillation, and more. Each section contains chapters with lessons supported by notebooks and articles. The course aims to help users build projects and explore enterprise solutions using Large Language Models.

awesome-artificial-intelligence-guidelines

The 'Awesome AI Guidelines' repository aims to simplify the ecosystem of guidelines, principles, codes of ethics, standards, and regulations around artificial intelligence. It provides a comprehensive collection of resources addressing ethical and societal challenges in AI systems, including high-level frameworks, principles, processes, checklists, interactive tools, industry standards initiatives, online courses, research, and industry newsletters, as well as regulations and policies from various countries. The repository serves as a valuable reference for individuals and teams designing, building, and operating AI systems to navigate the complex landscape of AI ethics and governance.

miyagi

Project Miyagi showcases Microsoft's Copilot Stack in an envisioning workshop aimed at designing, developing, and deploying enterprise-grade intelligent apps. By exploring both generative and traditional ML use cases, Miyagi offers an experiential approach to developing AI-infused product experiences that enhance productivity and enable hyper-personalization. Additionally, the workshop introduces traditional software engineers to emerging design patterns in prompt engineering, such as chain-of-thought and retrieval-augmentation, as well as to techniques like vectorization for long-term memory, fine-tuning of OSS models, agent-like orchestration, and plugins or tools for augmenting and grounding LLMs.

PromptChains

ChatGPT Queue Prompts is a collection of prompt chains designed to enhance interactions with large language models like ChatGPT. These prompt chains help build context for the AI before performing specific tasks, improving performance. Users can copy and paste prompt chains into the ChatGPT Queue extension to process prompts in sequence. The repository includes example prompt chains for tasks like conducting AI company research, building SEO optimized blog posts, creating courses, revising resumes, enriching leads for CRM, personal finance document creation, workout and nutrition plans, marketing plans, and more.

chatgpt-universe

ChatGPT is a large language model that can generate human-like text, translate languages, write different kinds of creative content, and answer your questions in a conversational way. It is trained on a massive amount of text data, and it is able to understand and respond to a wide range of natural language prompts. Here are 5 jobs suitable for this tool, in lowercase letters: 1. content writer 2. chatbot assistant 3. language translator 4. creative writer 5. researcher

finagg

finagg is a Python package that provides implementations of popular and free financial APIs, tools for aggregating historical data from those APIs into SQL databases, and tools for transforming aggregated data into features useful for analysis and AI/ML. It offers documentation, installation instructions, and basic usage examples for exploring various financial APIs and features. Users can install recommended datasets from 3rd party APIs into a local SQL database, access Bureau of Economic Analysis (BEA) data, Federal Reserve Economic Data (FRED), Securities and Exchange Commission (SEC) filings, and more. The package also allows users to explore raw data features, install refined data features, and perform refined aggregations of raw data. Configuration options for API keys, user agents, and data locations are provided, along with information on dependencies and related projects.

LLMs-in-Finance

This repository focuses on the application of Large Language Models (LLMs) in the field of finance. It provides insights and knowledge about how LLMs can be utilized in various scenarios within the finance industry, particularly in generating AI agents. The repository aims to explore the potential of LLMs to enhance financial processes and decision-making through the use of advanced natural language processing techniques.

qlib

Qlib is an open-source, AI-oriented quantitative investment platform that supports diverse machine learning modeling paradigms, including supervised learning, market dynamics modeling, and reinforcement learning. It covers the entire chain of quantitative investment, from alpha seeking to order execution. The platform empowers researchers to explore ideas and implement productions using AI technologies in quantitative investment. Qlib collaboratively solves key challenges in quantitative investment by releasing state-of-the-art research works in various paradigms. It provides a full ML pipeline for data processing, model training, and back-testing, enabling users to perform tasks such as forecasting market patterns, adapting to market dynamics, and modeling continuous investment decisions.

chat-with-your-data-solution-accelerator

Chat with your data using OpenAI and AI Search. This solution accelerator uses an Azure OpenAI GPT model and an Azure AI Search index generated from your data, which is integrated into a web application to provide a natural language interface, including speech-to-text functionality, for search queries. Users can drag and drop files, point to storage, and take care of technical setup to transform documents. There is a web app that users can create in their own subscription with security and authentication.

Customer-Service-Conversational-Insights-with-Azure-OpenAI-Services

This solution accelerator is built on Azure Cognitive Search Service and Azure OpenAI Service to synthesize post-contact center transcripts for intelligent contact center scenarios. It converts raw transcripts into customer call summaries to extract insights around product and service performance. Key features include conversation summarization, key phrase extraction, speech-to-text transcription, sensitive information extraction, sentiment analysis, and opinion mining. The tool enables data professionals to quickly analyze call logs for improvement in contact center operations.

20 - OpenAI Gpts

Safaricom Financial Analyst

Analyzes Safaricom's HY and FY financials, with detailed insights on different years.

Fluffy Risk Analyst

A cute sheep expert in risk analysis, providing downloadable checklists.

Credit Analyst

Analyzes financial data to assess creditworthiness, aiding in lending decisions and solutions.

CIM Analyst

In-depth CIM analysis with a structured rating scale, offering detailed business evaluations.

WealthWiz

Forward-thinking financial mentor, blending cutting-edge solutions with principles that have stood the test of time