Best AI tools for< Credit Analyst >

Infographic

20 - AI tool Sites

Underwrite.ai

Underwrite.ai is a platform that leverages advances in artificial intelligence and machine learning to provide lenders with nonlinear, dynamic models of credit risk. By analyzing thousands of data points from credit bureau sources, the application accurately models credit risk for consumers and small businesses, outperforming traditional approaches. Underwrite.ai offers a unique underwriting methodology that focuses on outcomes such as profitability and customer lifetime value, allowing organizations to enhance their lending performance without the need for capital investment or lengthy build times. The platform's models are continuously learning and adapting to market changes in real-time, providing explainable decisions in milliseconds.

Scienaptic Systems

Scienaptic Systems is an AI-powered Credit Decisioning Platform that revolutionizes the lending industry by automating credit underwriting processes, leveraging alternate data points, and offering self-learning models for instant credit decisions. The platform helps lenders identify creditworthy borrowers, streamline customer experience, and ensure fair lending practices through explainable AI models. Scienaptic's suite of AI-enabled technologies enables lenders to say 'Yes' to more borrowers at lower risk, providing a 360-degree risk assessment before approving applications. The platform integrates seamlessly with existing lending ecosystems, ensuring disruption-free deployment and better risk predictions through a single API call.

Zest AI

Zest AI is an AI-driven credit underwriting software that offers a complete solution for AI-driven lending. It enables users to build custom machine learning risk models, adopt model assessment and regulatory compliance, and operate performance management and model monitoring. Zest AI helps increase approvals, manage risk, control loss, drive operational efficiency, automate credit decisioning, and improve borrower experience while ensuring fair lending practices. The software is designed to provide fair and transparent credit for everyone, making lending more accessible and inclusive.

Zest AI

Zest AI is an AI-driven credit underwriting software that offers a complete solution for AI-driven lending. It enables users to build custom machine learning risk models, adopt model assessment and regulatory compliance, and operate performance management and model monitoring. Zest AI helps increase approvals, manage risk, control loss, drive operational efficiency, automate credit decisioning, and improve borrower experience while ensuring fair lending practices. The software is designed to provide powerful AI for better lending outcomes by accelerating loan growth and expanding credit access through accurate risk prediction and faster credit decisions.

FinFloh

FinFloh is an AI-powered Accounts Receivable Software that automates the accounts receivable process effortlessly with features like credit decisioning, collections, cash application, invoice verification, and dispute resolution. It enhances collections efficiency, reduces decision-making time, and improves cash flows for B2B finance teams worldwide. The software integrates with ERP/CRM systems, offers predictive analytics, and AI-driven credit scoring to optimize accounts receivable management. FinFloh ensures secure data handling and seamless communication between finance, sales, and customer support teams, ultimately leading to increased cash flow and reduced DSO.

Casca

Casca is a revolutionary AI-native Loan Origination System that helps banks and non-bank lenders automate 90% of manual effort in business loan origination. By leveraging AI technology, Casca enables financial institutions to process loans 10x faster, achieve 3x higher conversion rates, and save significant time for loan officers. With features like AI Loan Assistant, digital application processing, KYB checks automation, and document analysis, Casca transforms the loan origination process into a seamless and efficient experience for both lenders and borrowers.

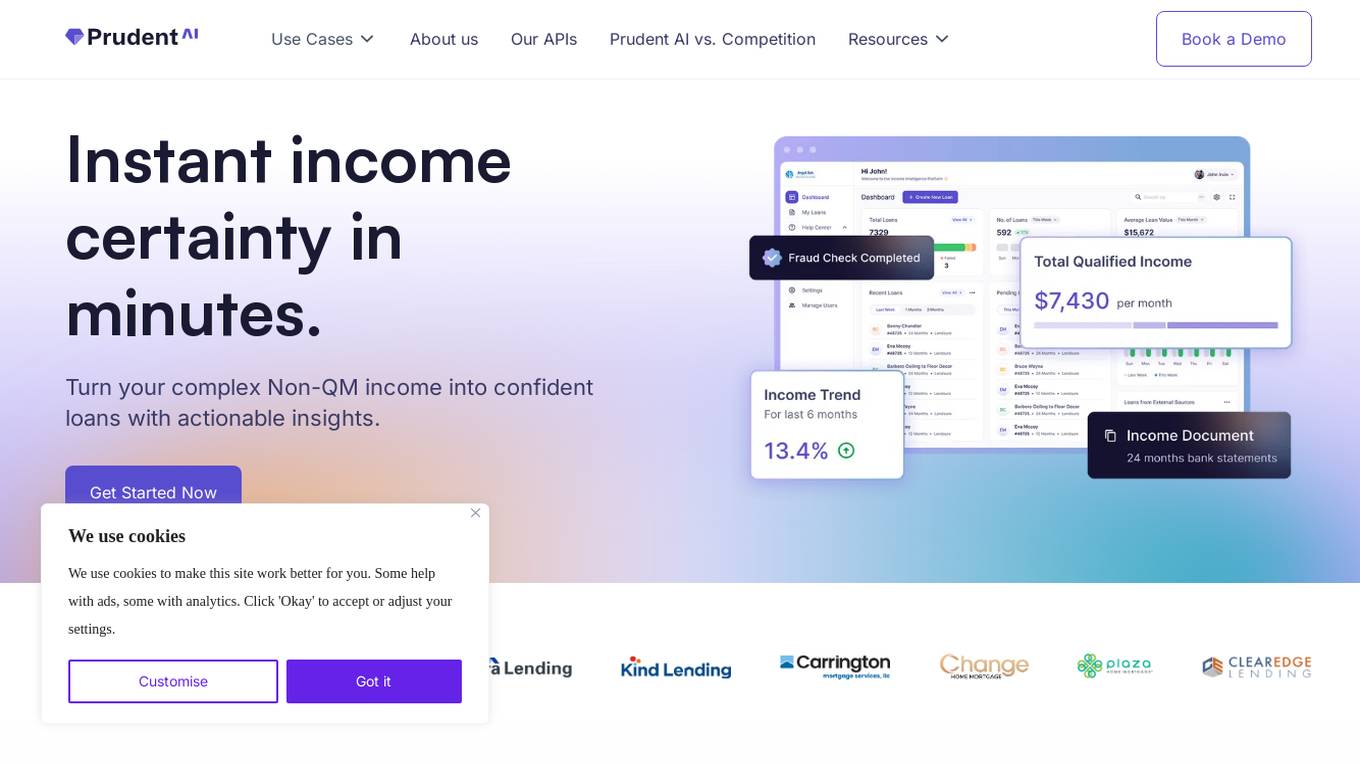

Prudent AI

Prudent AI is an AI-powered Income Intelligence Platform designed for lenders, offering fast data extraction, proactive fraud prevention, and in-depth insights on borrower income. The platform simplifies complex income calculations, streamlines the lending process, and enables lenders to make confident loan decisions quickly. Prudent AI is trusted by various lending institutions and has been proven to increase productivity, save time, and improve submission accuracy.

AI Credit Repair

AI Credit Repair is an AI-powered application designed to help users improve their credit score by providing tools such as credit card utilization builder, public records remover, dispute letter generator, and SMS alerts. The application assists users in managing their credit card payments, disputing collections, and staying on top of their credit-related activities. By leveraging artificial intelligence technology, AI Credit Repair aims to simplify the credit repair process and empower users to build a better financial future.

Dispute AI™

Dispute AI™ is an AI-powered DIY credit repair solution that leverages cutting-edge artificial intelligence to provide personalized strategies for boosting credit scores. The platform offers actionable insights, data-driven recommendations, and a fast, affordable, and flexible credit repair process. With over 20 years of expertise in credit repair, Dispute AI™ aims to revolutionize the way individuals take control of their credit by providing innovative tools that simplify and streamline the credit repair process.

SmartDispute.ai

SmartDispute.ai is an AI-powered credit repair application that helps users improve their credit scores by leveraging artificial intelligence technology. The application offers a patented Smart Dispute System™ technology that identifies and helps remove negative accounts from credit reports, making it one of the most effective credit repair systems available. Users can easily repair their own credit with the help of SmartDispute.ai's automated processes and fact-based dispute method. The application provides users with a simple and clearly explained process, allowing them to track their progress and see significant improvements in their credit scores over time.

VantedgeAI

VantedgeAI is an AI application that offers fine-tuned AI models for credit funds, revolutionizing credit investing workflows with faster, smarter, and cost-effective solutions. The application transforms manual processes into scalable, automated workflows tailored for Private Credit and Hedge Funds. VantedgeAI is trusted by market leaders in the industry, providing unique AI-driven insights to maintain a competitive advantage and ensure data security and privacy through SOC 2 compliance. The application offers advanced AI solutions for credit investing, including automated investment memo generation, data extraction for Excel models, portfolio monitoring, loan reconciliation, smart bond screening, real-time data querying with AI bots, and more.

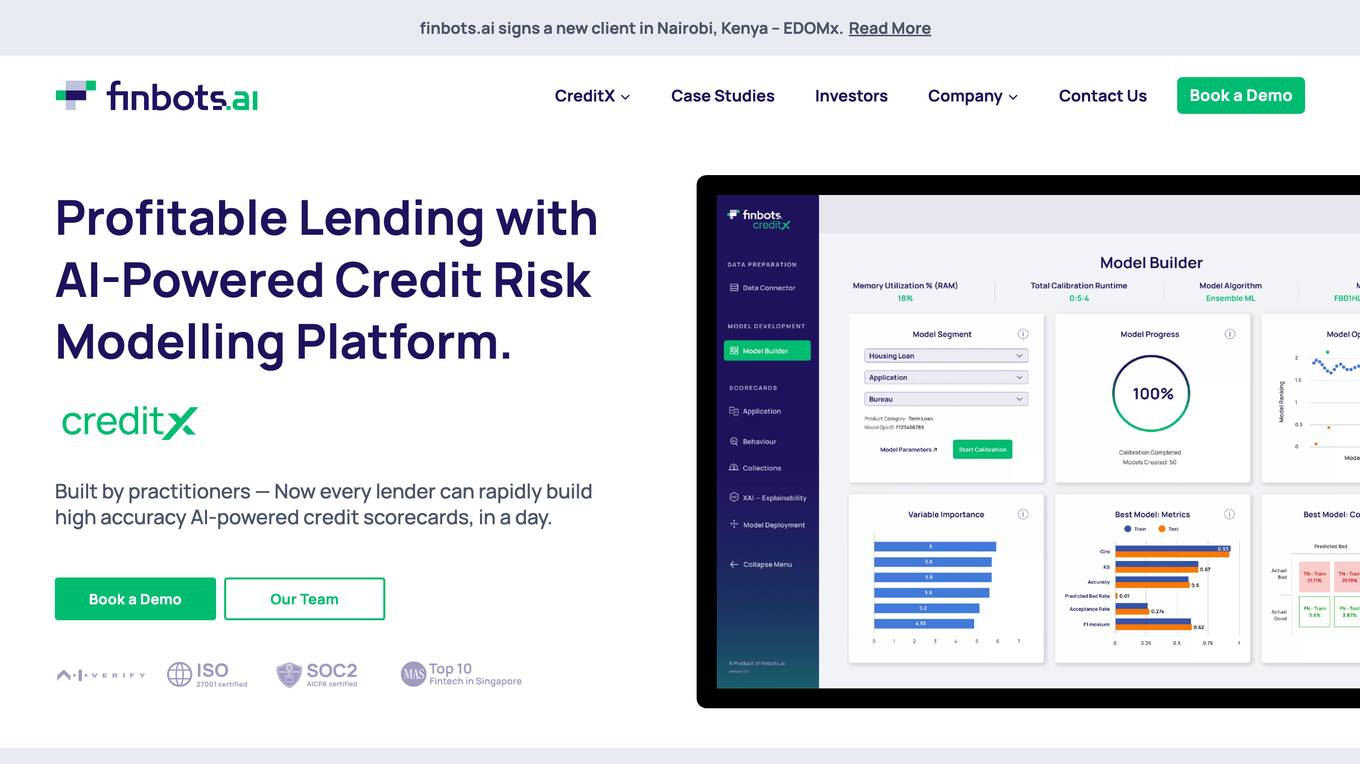

Finbots.ai

Finbots.ai is a trusted AI credit risk platform that offers AI credit scoring to boost lending profits and reduce non-performing loans. The platform provides the highest accuracy in the market, allowing users to build scorecards in a day without the need for coding. It helps in making instant decisions, increasing revenue, reducing risk, and improving operational efficiency. Finbots.ai is utilized by various financial institutions to enhance credit risk management, improve profitability, and drive down the cost of risk through AI-enabled models.

Cushion

Cushion is an AI-powered tool designed to simplify bill management and credit building. It securely connects to your accounts, organizes bills, and offers insights to help you budget better. With features like automatic bill tracking, virtual Cushion card payments, and credit history building, Cushion aims to make bill payments painless and credit building seamless.

UseCredits

UseCredits is a hassle-free credit-based billing integration that allows you to easily add credit-based billing to your Stripe or Paddle accounts. With UseCredits, you can set credits for your products, get automatic account top-ups, transparent account statements, analytics, and much more. UseCredits is flexible and un-opinionated, making it suitable for a variety of use cases, including generative AI SaaS, email or SMS API, and games and entertainment.

Slot Pulsa Indosat

Slot Pulsa Indosat is a trusted website in Indonesia for depositing credit for Tri and IM3 without deductions of 10k. Users can download the application to shop for various exclusive products with special promotions. The platform offers a comfortable and fair gaming environment with high RTP slots for easy player wins. Akang69 slot is a popular provider of credit slot games with fast 24/7 online service and quick admin responses, making it the most trusted and popular cheap credit slot site. Users can register for free and enjoy various attractive promotions for a top-notch gaming experience.

Clerkie

Clerkie is a powerful debt repayment and optimization platform that offers a full-service automation solution powered by machine learning and human expertise. It helps lenders, both big and small, to manage and optimize their loan portfolios efficiently. With features like smart payment experience, AI-driven repayment strategies, real-time reporting, and easy integration, Clerkie ensures a seamless and secure experience for lenders and borrowers alike.

wallet.AI

wallet.AI is an AI application that provides smart machines to inform users about their financial behavior. Founded in San Francisco in 2012, wallet.AI builds intelligent engines that analyze millions of pieces of data to help users make better daily financial decisions. The application aims to assist people in making informed financial choices by leveraging artificial intelligence technology.

Veriff

Veriff is an AI-powered identity verification platform that combines automation and human expertise to detect deepfakes, prevent fraud, and onboard verified customers globally. It offers a range of verification services including identity & document verification, biometric authentication, age estimation, fraud prevention, and more. Veriff helps businesses restore trust to the internet by providing fast, accurate, and secure identity verification solutions that comply with global regulations and standards.

BCT Digital

BCT Digital is an AI-powered risk management suite provider that offers a range of products to help enterprises optimize their core Governance, Risk, and Compliance (GRC) processes. The rt360 suite leverages next-generation technologies, sophisticated AI/ML models, data-driven algorithms, and predictive analytics to assist organizations in managing various risks effectively. BCT Digital's solutions cater to the financial sector, providing tools for credit risk monitoring, early warning systems, model risk management, environmental, social, and governance (ESG) risk assessment, and more.

Basis Theory

Basis Theory is a token orchestration platform that helps businesses route transactions through multiple payment service providers (PSPs) and partners, enabling seamless subscription payments while maintaining PCI compliance. The platform offers secure and transparent payment flows, allowing users to connect to any partner or platform, collect and store card data securely, and customize payment strategies for various use cases. Basis Theory empowers high-risk merchants, subscription platforms, marketplaces, fintechs, and other businesses to optimize their payment processes and enhance customer experiences.

0 - Open Source Tools

18 - OpenAI Gpts

Investment Banking Tech Prep with Recalc Academy

Coach for investment banking technical interviews

Credit & Collections Advisor

Manages credit risk and implements effective collection strategies.

Safaricom Financial Analyst

Analyzes Safaricom's HY and FY financials, with detailed insights on different years.

Credit Score Check

Guides on checking and monitoring credit scores, with a financial and informative tone.

Credit Analyst

Analyzes financial data to assess creditworthiness, aiding in lending decisions and solutions.