Best AI tools for< loan closer >

12 - AI tool Sites

Casca

Casca is a loan origination system that uses artificial intelligence (AI) to automate tasks and improve the loan application process. It can help banks, credit unions, and non-bank lenders originate commercial loans with 90% less manual effort. Casca's AI Loan Assistant can handle the initial qualification process, follow up with leads, collect documents, and re-engage cold applicants. It also offers a modern, mobile-friendly application form, applicant portal, and loan officer dashboard.

Silverwork Solutions

Silverwork Solutions is a fintech company that provides AI-powered mortgage automation solutions. Its Digital Workforce Solutions are role-based autonomous bots that integrate seamlessly into loan manufacturing processes, from application to post-closing. These bots utilize AI to make predictions and decisions, enhancing the loan processing experience. Silverwork's solutions empower lenders to realize the full potential of automation and transform their operations, allowing them to focus on higher-value activities while the bots handle repetitive tasks.

CreditHQ

CreditHQ is an AI-powered loan restructuring platform that helps users analyze their credit history, compare interest rates, and save money on their loans. The platform offers a range of features, including a credit score simulator, a budgeting tool, and a debt management tool. CreditHQ is trusted by over 5,500 users and companies globally.

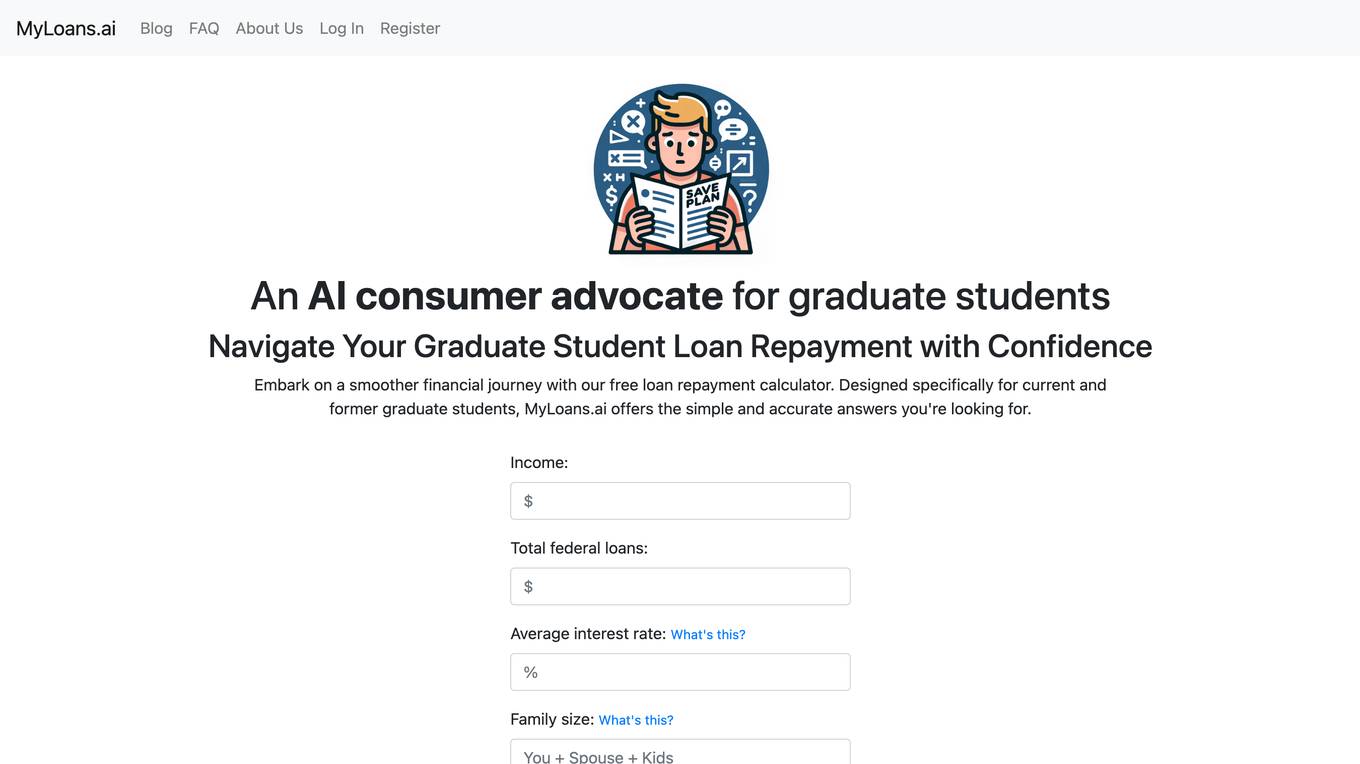

MyLoans.ai

MyLoans.ai is an AI consumer advocate tool designed to assist graduate students in navigating their student loan repayment process with confidence. The website offers a free loan repayment calculator tailored for current and former graduate students, providing simple and accurate answers to financial queries. Users can input information such as income, total federal loans, average interest rate, and family size to receive personalized guidance on managing their student loans effectively.

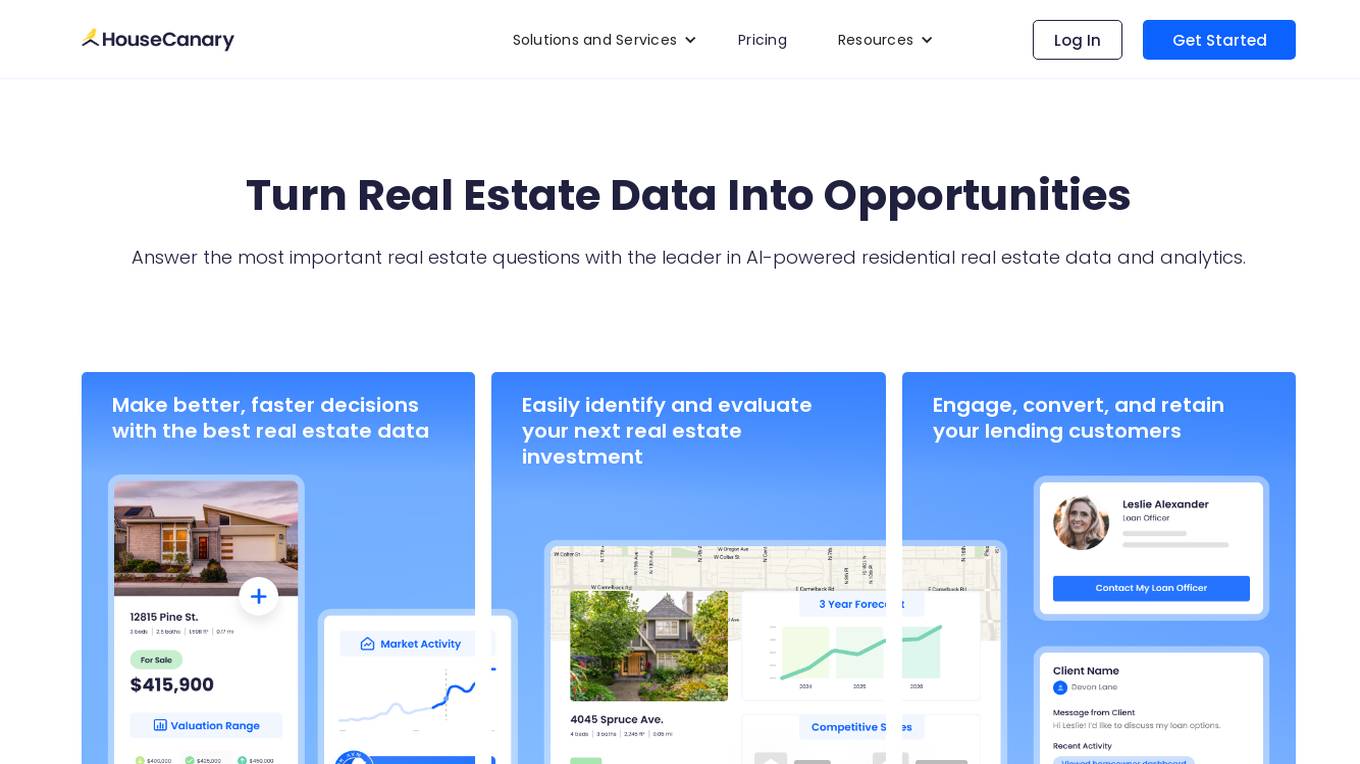

HouseCanary

HouseCanary is a leading AI-powered data and analytics platform for residential real estate. With a full suite of industry-leading products and tools, HouseCanary provides real estate investors, mortgage lenders, investment banks, whole loan buyers, and prop techs with the most comprehensive and accurate residential real estate data and analytics in the industry. HouseCanary's AI algorithms analyze a vast array of real estate data to generate meaningful insights to help teams be more efficient, ultimately saving time and money.

Ocrolus

Ocrolus is an intelligent document automation software that utilizes AI-driven document processing automation with Human-in-the-Loop. It offers capabilities such as Classify, Capture, Detect, and Analyze to streamline document processing tasks. The application caters to various industries like small business lending, mortgage, consumer, and multifamily, providing solutions for income verification, fraud detection, cash flow analysis, and business process automation. Ocrolus helps users manage risk, avoid fraud, and make faster and more accurate financial decisions by automating document analysis.

Kasisto

Kasisto is a conversational AI platform that provides financial institutions with the ability to create personalized, automated, and engaging digital experiences for their customers and employees. Kasisto's platform is infused with unmatched financial literacy and augments your workforce with remarkably competent digital bankers who facilitate accurate, human-like conversations and empower your teams with “in-the-moment” financial knowledge.

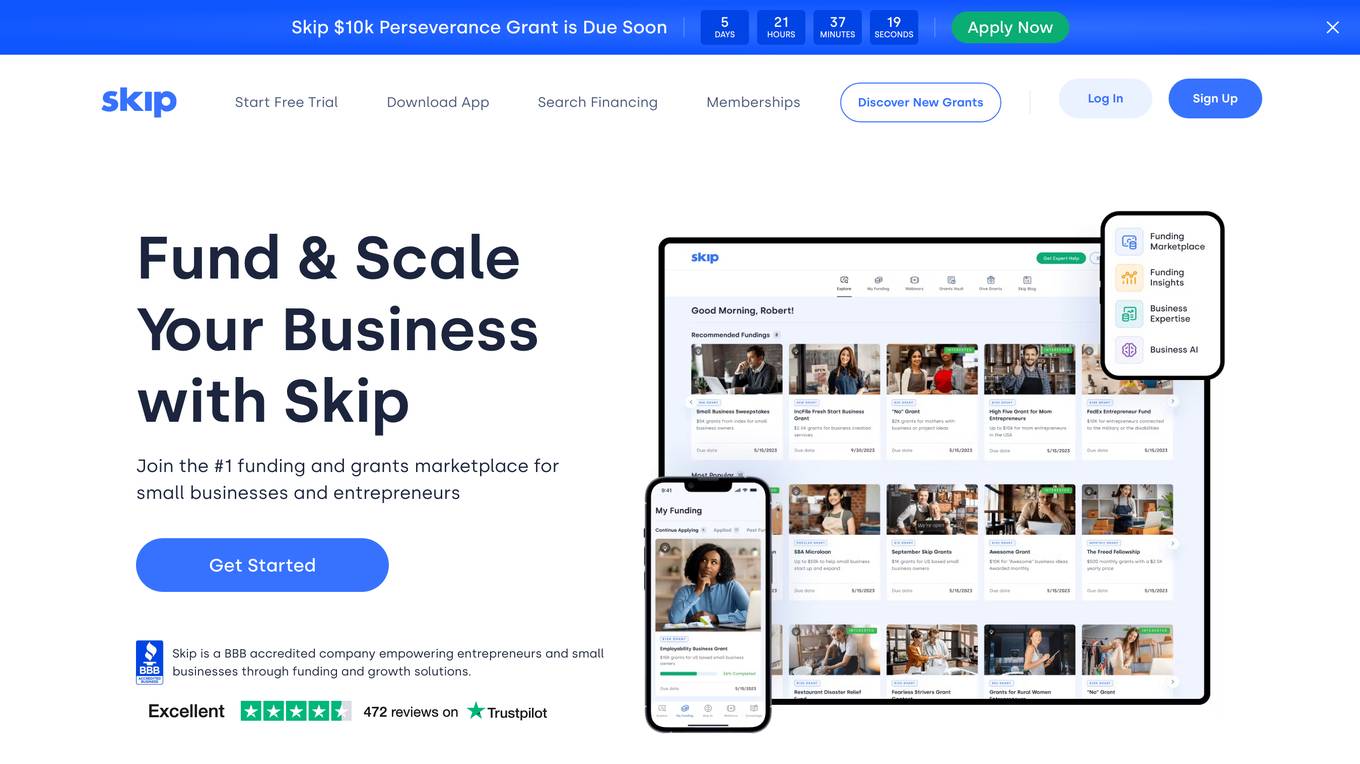

Skip

Skip is a BBB accredited company empowering entrepreneurs and small businesses through funding and growth solutions. It offers a marketplace for grants, loans, and financing options, as well as funding insights, eligibility checks, and expert assistance. Skip also has an AI tool to help users with funding-related questions.

Zest AI

Zest AI is an AI-driven credit underwriting software that offers a complete solution for AI-driven lending. It enables users to build custom machine learning risk models, adopt model assessment and regulatory compliance, and operate performance management and model monitoring. Zest AI helps increase approvals, manage risk, control loss, drive operational efficiency, automate credit decisioning, and improve borrower experience while ensuring fair lending practices. The software is designed to provide fair and transparent credit for everyone, making lending more accessible and inclusive.

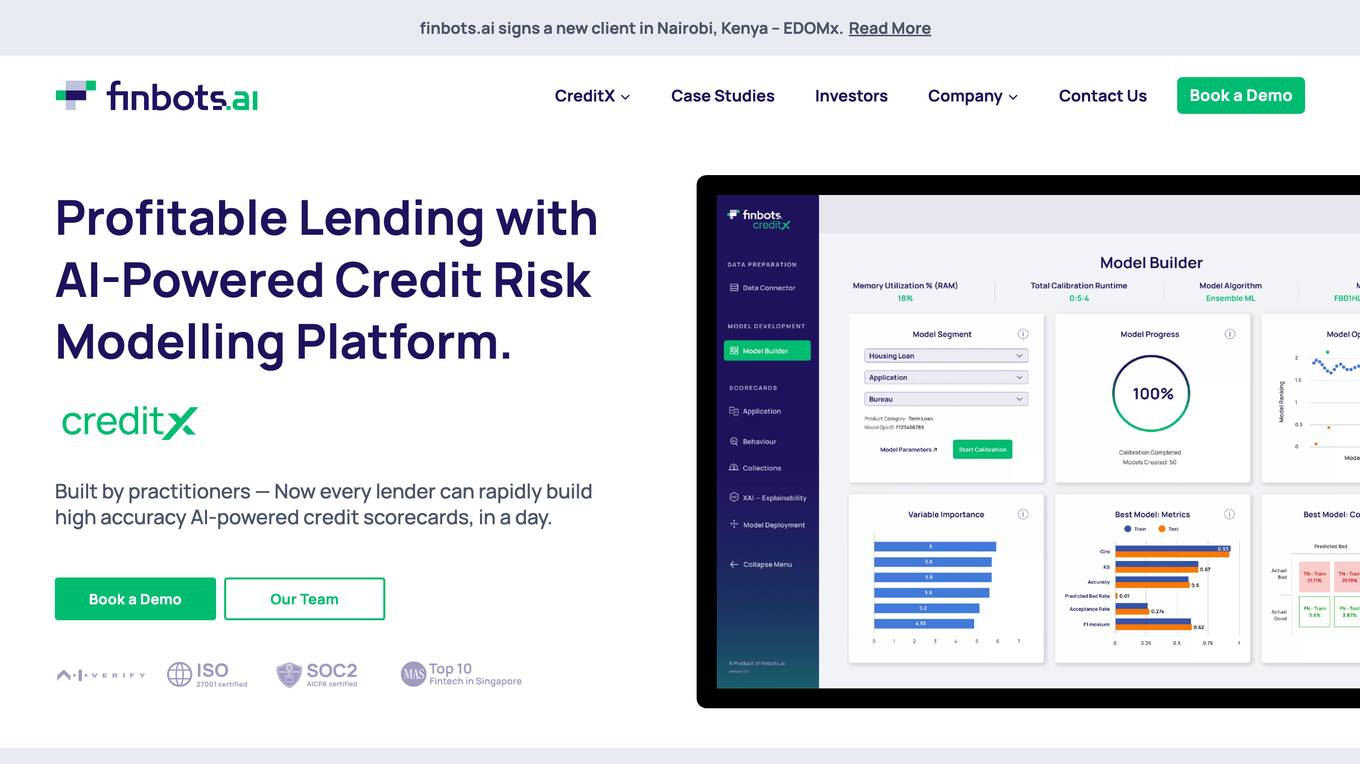

Finbots.ai

Finbots.ai is a trusted AI credit risk platform that offers a transformative solution called creditX. It enables lenders to rapidly build high accuracy AI-powered credit scorecards in a day, leading to profitable lending. The platform is built by practitioners and combines powerful AI algorithms with enterprise-level features to enhance operational efficiency and agility in credit risk management. Finbots.ai is a proud member of the AI Verify Foundation, ensuring fair, transparent, and explainable AI solutions for banks and start-up lenders globally.

Obviously AI

Obviously AI is a no-code AI tool that allows users to build and deploy machine learning models without writing any code. It is designed to be easy to use, even for those with no data science experience. Obviously AI offers a variety of features, including model building, model deployment, model monitoring, and integration with other tools. It also provides expert support from a dedicated data scientist.

DeepOpinion

DeepOpinion is a Generative Automation platform designed for enterprises to automate various business processes using cutting-edge AI technology. It offers solutions for financial services, consumer loan processing, KYC and onboarding, trade financing, insurance claims processing, customer support, underwriting slips, manufacturing, accounts payable, order to cash, and procure to pay. The platform combines business process digitization, low/no-code development, and Generative AI to create powerful automations in minutes. DeepOpinion is trusted by enterprises large and small to streamline AI model creation, handle inquiries efficiently, and achieve high levels of automation.

3 - Open Source Tools

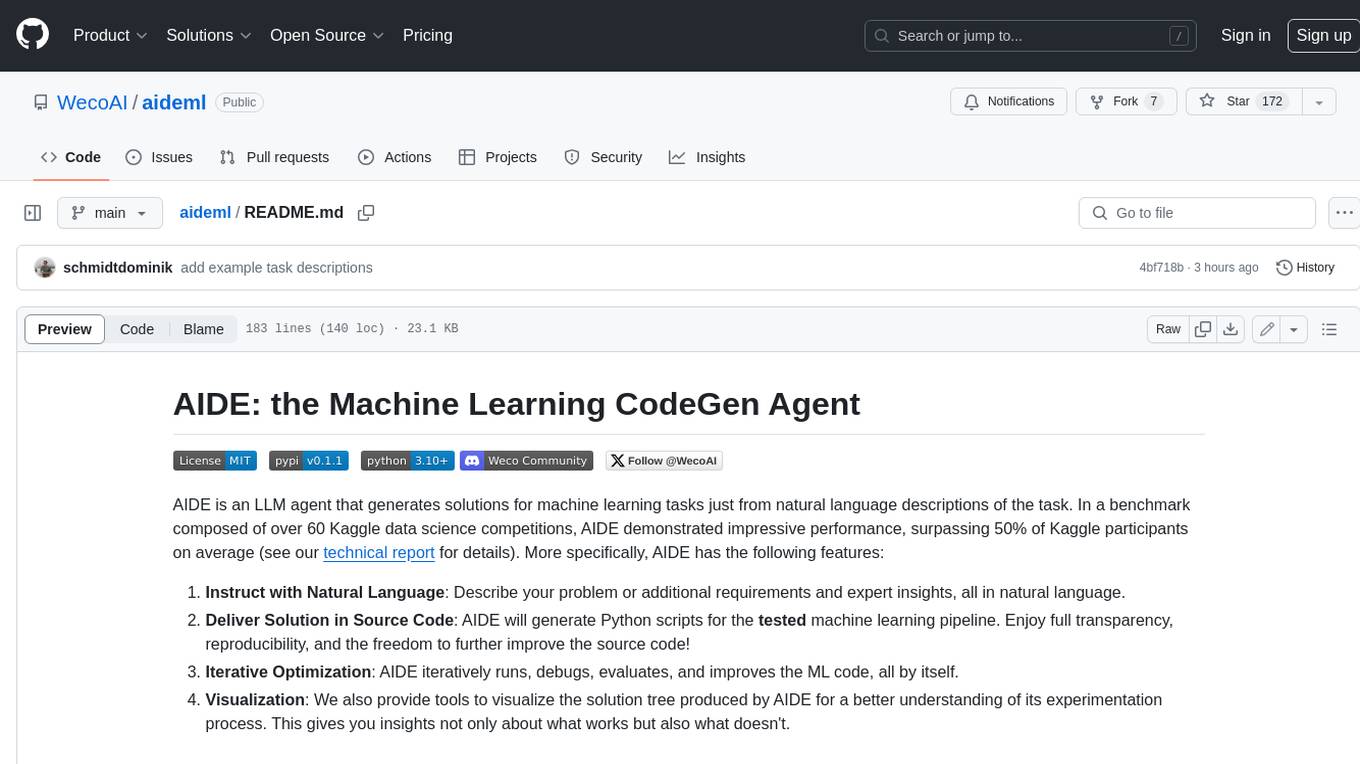

aideml

AIDE is a machine learning code generation agent that can generate solutions for machine learning tasks from natural language descriptions. It has the following features: 1. **Instruct with Natural Language**: Describe your problem or additional requirements and expert insights, all in natural language. 2. **Deliver Solution in Source Code**: AIDE will generate Python scripts for the **tested** machine learning pipeline. Enjoy full transparency, reproducibility, and the freedom to further improve the source code! 3. **Iterative Optimization**: AIDE iteratively runs, debugs, evaluates, and improves the ML code, all by itself. 4. **Visualization**: We also provide tools to visualize the solution tree produced by AIDE for a better understanding of its experimentation process. This gives you insights not only about what works but also what doesn't. AIDE has been benchmarked on over 60 Kaggle data science competitions and has demonstrated impressive performance, surpassing 50% of Kaggle participants on average. It is particularly well-suited for tasks that require complex data preprocessing, feature engineering, and model selection.

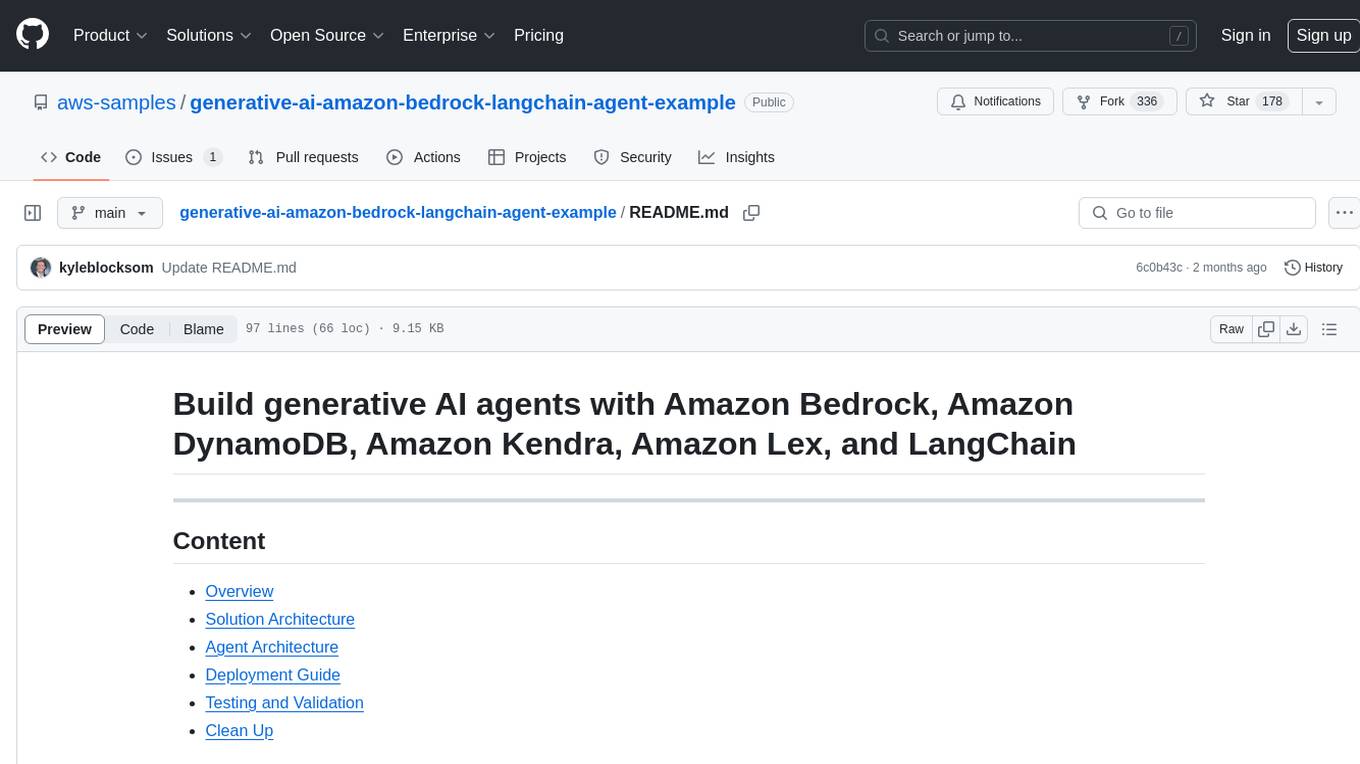

generative-ai-amazon-bedrock-langchain-agent-example

This repository provides a sample solution for building generative AI agents using Amazon Bedrock, Amazon DynamoDB, Amazon Kendra, Amazon Lex, and LangChain. The solution creates a generative AI financial services agent capable of assisting users with account information, loan applications, and answering natural language questions. It serves as a launchpad for developers to create personalized conversational agents for applications like chatbots and virtual assistants.

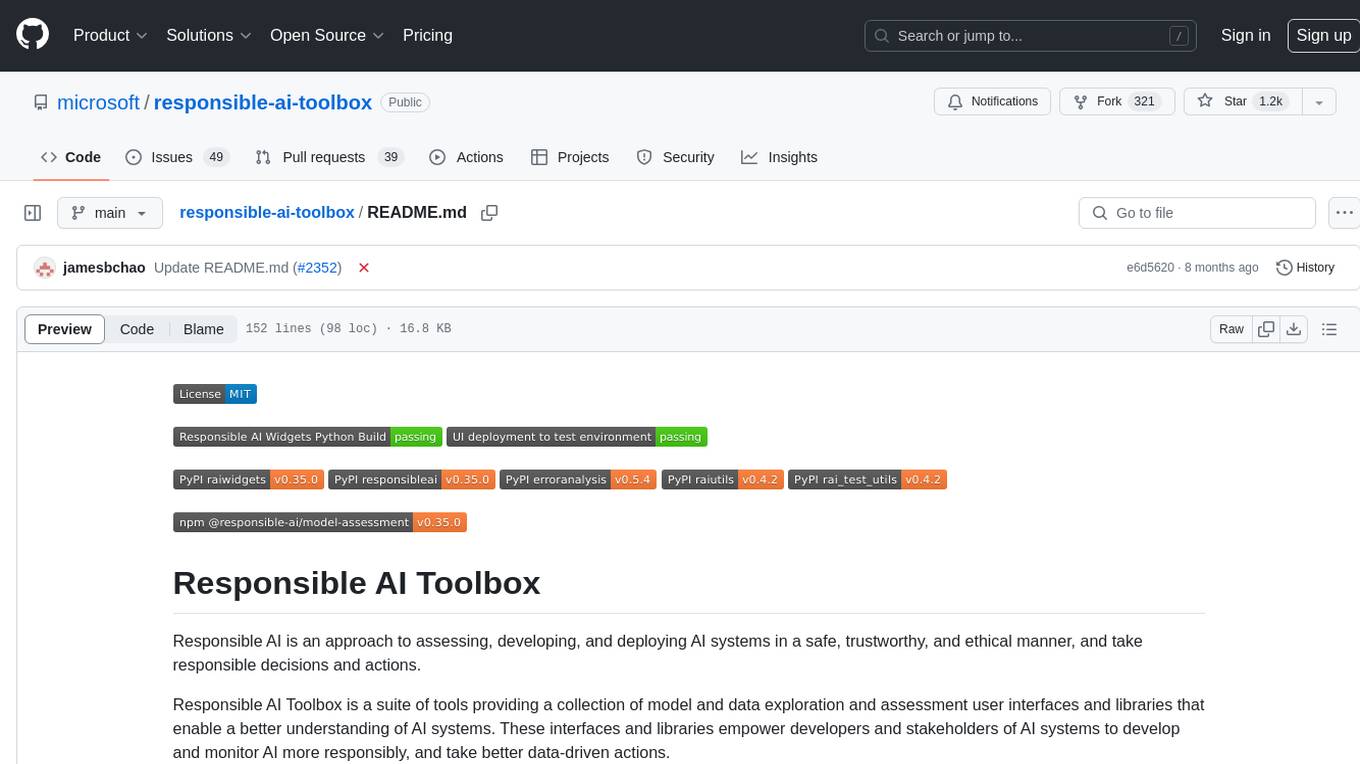

responsible-ai-toolbox

Responsible AI Toolbox is a suite of tools providing model and data exploration and assessment interfaces and libraries for understanding AI systems. It empowers developers and stakeholders to develop and monitor AI responsibly, enabling better data-driven actions. The toolbox includes visualization widgets for model assessment, error analysis, interpretability, fairness assessment, and mitigations library. It also offers a JupyterLab extension for managing machine learning experiments and a library for measuring gender bias in NLP datasets.

20 - OpenAI Gpts

Loan Management Software

Loan management software expertise. Get the most powerful loan origination and loan servicing software on the market.

SBA Loan Advisor

Using public SBA data to help you find the best fit lender for your small business

Fast Loan

Discusses fast loans, application processes, and financial considerations informatively.

Top Loan Apps Expert

An AI tool offering expert advice on financial products, focusing on Top Loan Apps, best lending apps, fast cash advance apps, online loan apps, instant loan apps, and emergency loan apps. This tool provides insights, comparisons, and guidance for users seeking quick and reliable loan solutions.

Personal Loan

Discusses personal loans, payment methods, and financial options informatively.

Borrower's Defense Assistant

Assistance in understanding and filling out the Borrower's Defense to Repayment Form provided by the United States Department of Education.

Solvo

Buying something new? Let me show you how much it will *really* cost you over time. What is it, and how much are you paying?

Pay Later

Explains 'buy now, pay later' and recommends providers in a financial, informative tone.

Mobile Home Mortgage Calculator

Get the most up to date information about mortgages for a mobile home