Best AI tools for< Provide Loan Information >

20 - AI tool Sites

Likely.AI

Likely.AI is an AI-powered platform designed for the real estate industry, offering innovative solutions to enhance database management, marketing content creation, and predictive analytics. The platform utilizes advanced AI models to predict likely sellers, update contact information, and trigger automated notifications, ensuring real estate professionals stay ahead of the competition. With features like contact enrichment, predictive modeling, 24/7 contact monitoring, and AI-driven marketing content generation, Likely.AI revolutionizes how real estate businesses operate and engage with their clients. The platform aims to streamline workflows, improve lead generation, and maximize ROI for users in the residential real estate sector.

Houmify

Houmify.com is an AI-powered property companion that offers personalized real estate solutions. The platform uses artificial intelligence to guide users in accessing the best services related to selling a home, buying a home, loan & refinance, and home maintenance. Users can interact with the AI Agent to get expert advice and recommendations tailored to their specific needs and preferences. The website also provides informative posts and articles on real estate topics to help users make informed decisions. With a focus on user experience and convenience, Houmify aims to simplify the real estate process and empower individuals in their property transactions.

MyLoans.ai

MyLoans.ai is a free AI tool designed to provide personalized guidance for complex student loans. It offers instant, clear, and accurate answers to student loan queries, helping borrowers make informed decisions about their financial future. By skipping expensive advisors and confusing government websites, MyLoans.ai aims to save users thousands of dollars by leveraging official government sources for guidance.

Kasisto

Kasisto is a conversational AI platform that provides financial institutions with the ability to create personalized, automated, and engaging digital experiences for their customers and employees. Kasisto's platform is infused with unmatched financial literacy and augments your workforce with remarkably competent digital bankers who facilitate accurate, human-like conversations and empower your teams with “in-the-moment” financial knowledge.

Dispute AI™

Dispute AI™ is an AI-powered DIY credit repair solution that leverages cutting-edge artificial intelligence to provide personalized strategies for boosting credit scores. The platform offers actionable insights, data-driven recommendations, and a fast, affordable, and flexible credit repair process. With over 20 years of expertise in credit repair, Dispute AI™ aims to revolutionize the way individuals take control of their credit by providing innovative tools that simplify and streamline the credit repair process.

Underwrite.ai

Underwrite.ai is a platform that leverages advances in artificial intelligence and machine learning to provide lenders with nonlinear, dynamic models of credit risk. By analyzing thousands of data points from credit bureau sources, the application accurately models credit risk for consumers and small businesses, outperforming traditional approaches. Underwrite.ai offers a unique underwriting methodology that focuses on outcomes such as profitability and customer lifetime value, allowing organizations to enhance their lending performance without the need for capital investment or lengthy build times. The platform's models are continuously learning and adapting to market changes in real-time, providing explainable decisions in milliseconds.

Zest AI

Zest AI is an AI-driven credit underwriting software that offers a complete solution for AI-driven lending. It enables users to build custom machine learning risk models, adopt model assessment and regulatory compliance, and operate performance management and model monitoring. Zest AI helps increase approvals, manage risk, control loss, drive operational efficiency, automate credit decisioning, and improve borrower experience while ensuring fair lending practices. The software is designed to provide powerful AI for better lending outcomes by accelerating loan growth and expanding credit access through accurate risk prediction and faster credit decisions.

Zest AI

Zest AI is an AI-driven credit underwriting software that offers a complete solution for AI-driven lending. It enables users to build custom machine learning risk models, adopt model assessment and regulatory compliance, and operate performance management and model monitoring. Zest AI helps increase approvals, manage risk, control loss, drive operational efficiency, automate credit decisioning, and improve borrower experience while ensuring fair lending practices. The software is designed to provide fair and transparent credit for everyone, making lending more accessible and inclusive.

Silverwork Solutions

Silverwork Solutions is a fintech company that provides AI-powered mortgage automation solutions. Its Digital Workforce Solutions are role-based autonomous bots that integrate seamlessly into loan manufacturing processes, from application to post-closing. These bots utilize AI to make predictions and decisions, enhancing the loan processing experience. Silverwork's solutions empower lenders to realize the full potential of automation and transform their operations, allowing them to focus on higher-value activities while the bots handle repetitive tasks.

Lama AI

Lama AI is an AI-powered platform designed to revolutionize business lending processes for banks and financial institutions. It offers advanced features, rapid configurability, and exceptional support to streamline loan origination, underwriting, and decision-making. By leveraging the power of AI, Lama AI enables banks to boost business growth potential, improve profitability, and enhance customer experience through contextual onboarding, decisioning workspace, expanded credit access, and pre-qualified applications. The platform also provides white-labeled solutions, API-first integration, high configurability, built-in AI models, and access to a network of bank lenders, all while ensuring bank-grade security and compliance standards.

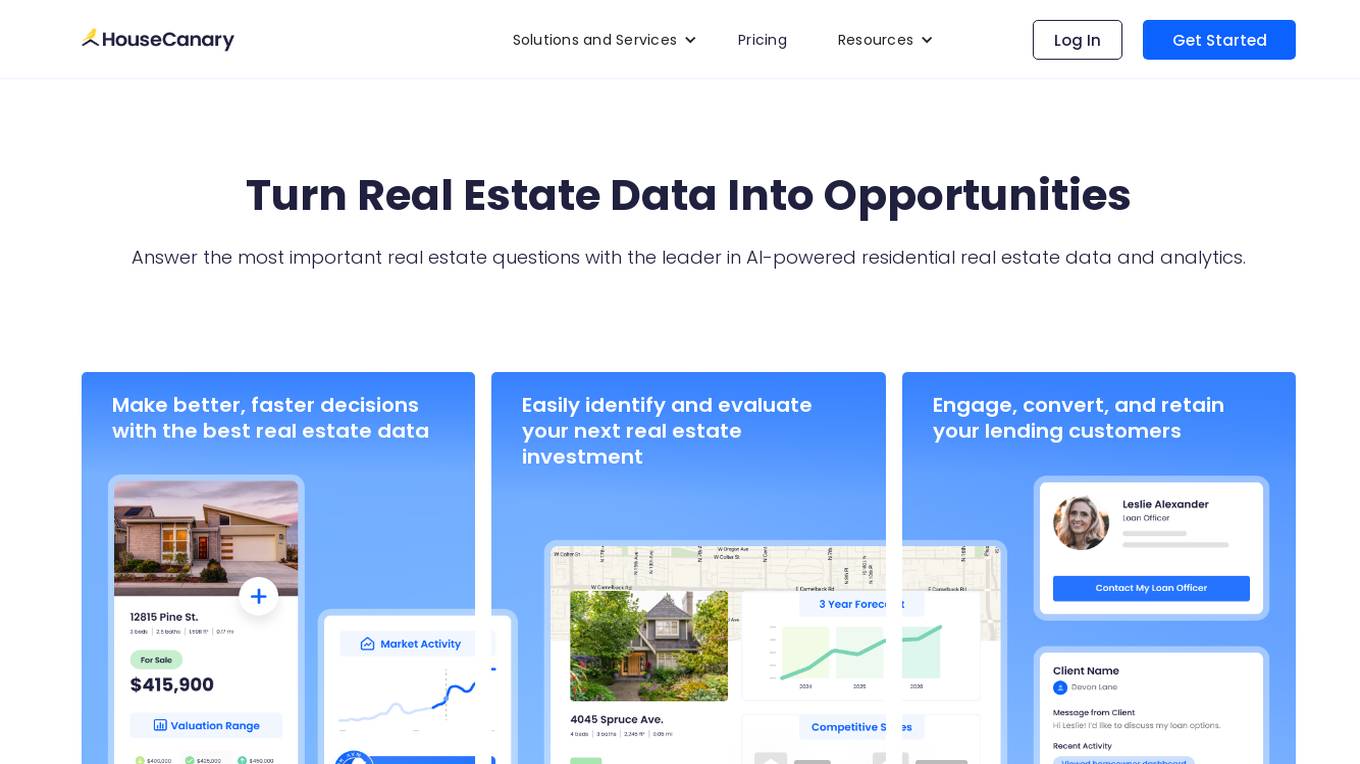

HouseCanary

HouseCanary is a leading AI-powered data and analytics platform for residential real estate. With a full suite of industry-leading products and tools, HouseCanary provides real estate investors, mortgage lenders, investment banks, whole loan buyers, and prop techs with the most comprehensive and accurate residential real estate data and analytics in the industry. HouseCanary's AI algorithms analyze a vast array of real estate data to generate meaningful insights to help teams be more efficient, ultimately saving time and money.

Ocrolus

Ocrolus is an intelligent document automation software that leverages AI-driven document processing automation with Human-in-the-Loop. It offers capabilities such as classifying, capturing, detecting, and analyzing documents, with use cases in cash flow, income, address, employment, and identity verification. Ocrolus caters to various industries like small business lending, mortgage, consumer finance, and multifamily housing. The platform provides resources for developers, including guides on income verification, fraud detection, and business process automation. Users can explore the API to build innovative customer experiences and make faster and more accurate financial decisions.

FairPlay

FairPlay is a Fairness-as-a-Service solution designed for financial institutions, offering AI-powered tools to assess automated decisioning models quickly. It helps in increasing fairness and profits by optimizing marketing, underwriting, and pricing strategies. The application provides features such as Fairness Optimizer, Second Look, Customer Composition, Redline Status, and Proxy Detection. FairPlay enables users to identify and overcome tradeoffs between performance and disparity, assess geographic fairness, de-bias proxies for protected classes, and tune models to reduce disparities without increasing risk. It offers advantages like increased compliance, speed, and readiness through automation, higher approval rates with no increase in risk, and rigorous Fair Lending analysis for sponsor banks and regulators. However, some disadvantages include the need for data integration, potential bias in AI algorithms, and the requirement for technical expertise to interpret results.

SmartDispute.ai

SmartDispute.ai is an AI-powered credit repair application that helps users improve their credit scores by leveraging artificial intelligence technology. The application offers a patented Smart Dispute System™ technology that identifies and helps remove negative accounts from credit reports, making it one of the most effective credit repair systems available. Users can easily repair their own credit with the help of SmartDispute.ai's automated processes and fact-based dispute method. The application provides users with a simple and clearly explained process, allowing them to track their progress and see significant improvements in their credit scores over time.

Finbots.ai

Finbots.ai is a trusted AI credit risk platform that offers AI credit scoring to boost lending profits and reduce non-performing loans. The platform provides the highest accuracy in the market, allowing users to build scorecards in a day without the need for coding. It helps in making instant decisions, increasing revenue, reducing risk, and improving operational efficiency. Finbots.ai is utilized by various financial institutions to enhance credit risk management, improve profitability, and drive down the cost of risk through AI-enabled models.

Obviously AI

Obviously AI is a no-code AI tool that allows users to build and deploy machine learning models without writing any code. It is designed to be easy to use, even for those with no data science experience. Obviously AI offers a variety of features, including model building, model deployment, model monitoring, and integration with other tools. It also provides expert support from a dedicated data scientist.

TheToolBus.ai

TheToolBus.ai is an AI-powered platform that offers a wide range of free digital tools to simplify various tasks. From age calculation to file conversion, image editing, text formatting, and more, TheToolBus.ai provides efficient solutions for everyday needs. Users can access tools like PDF converters, image background remover, audio to text converter, and even AI test generators. The platform aims to enhance productivity and efficiency by providing user-friendly tools for different digital tasks.

FOCAL

FOCAL is an AI-driven platform designed for AML compliance and anti-fraud purposes. It offers solutions for verification, customer due diligence, fraud prevention, and financial insights. The platform leverages AI technology to streamline onboarding processes, enhance trust through advanced customer screening, and detect and prevent fraud using advanced AI algorithms. FOCAL is tailored to meet industry-specific needs, provides seamless integration with existing systems, and offers localized expertise with global standards for regulatory compliance.

JustReply

JustReply is a customer support tool designed for teams that use Slack. It enables users to manage, respond, and resolve customer support conversations directly within their Slack workspace. JustReply offers features such as a beautiful helpcenter with customizable templates, flexible chat widget supporting various communication channels, minimalist inbox for prioritizing conversations, speedy macros for quick responses, powerful search functionality, and a smart editor for creating and editing support articles. The tool aims to streamline customer support processes and improve efficiency for smaller teams that heavily rely on Slack for communication and collaboration.

kOS

Helper Systems has developed technology that restores the trust between students who want to use AI tools for research and faculty who need to ensure academic integrity. With kOS (pronounced chaos), students can easily provide proof of work using a platform that significantly simplifies and enhances the research process in ways never before possible. Add PDF files from your desktop, shared drives or the web. Annotate them if you desire. Use AI responsibly, knowing when information is generated from your research vs. the web. Instantly create a presentation of all your resources. Share and prove your work. Try other cool features that offer a unique way to find, organize, discover, archive, and present information.

0 - Open Source AI Tools

20 - OpenAI Gpts

Sebastian

Answers questions by home owners and home buyers about Residential Mortgage products and rates and how to get started in the process of buying a new home or refinancing their current property

GPT Loans Analyzer

An economic advisor for loan feasibility, market analysis, and investment advice.

Credit Analyst

Analyzes financial data to assess creditworthiness, aiding in lending decisions and solutions.

Top Loan Apps Expert

An AI tool offering expert advice on financial products, focusing on Top Loan Apps, best lending apps, fast cash advance apps, online loan apps, instant loan apps, and emergency loan apps. This tool provides insights, comparisons, and guidance for users seeking quick and reliable loan solutions.

Borrower's Defense Assistant

Assistance in understanding and filling out the Borrower's Defense to Repayment Form provided by the United States Department of Education.

AI Consensus 🧠📊🤝

Provide a prompt followed by multiple participant responses from chatHub delimited by name, or a list of phrase pairs to combine.

Spiritual Advisor (1917 Tanakh)

Spiritual Advisor (1917 Tanakh) draws from the 1917 Tanakh to provide advise and guidance on all of life's difficulties.

Research Title Generator

Provide your topics, and receive formal, academic assistance in crafting research titles.

PerspectiveBot

Provide TOPIC & different views to compare: Gateway to Informed Comparisons. Harness AI-powered insights to analyze and score different viewpoints on any topic, delivering balanced, data-driven perspectives for smarter decision-making.

Creating structured courses by CourseGenie.ai

Provide a Topic and an Audience and we'll help you create 1. Course description 2. Outline 3. Learning Outcomes 5. Skills-Knowledge-Attitude objectives 5. Key points per lesson

IDEAfier - Song Lyrics Genre Cross-over

Provide the name, author and genre of a song and the genre you want it re-imagined to. User Prompt: Enter the name of a song, artist, current genre, and the genre you want.

Panda Man TCM

Provide some Traditional Chinese Medicine(中医) advice. For educational purposes only, not to be used for actual treatment.

On-page SEO tool

Provide a URL and this tool will provide you with 5 quick on-page optimisations to help web rankings and boost traffic.

Plotter

Provide a hand-drawing or screenshot of your desired plot along with the data and I'll make the plot.

Podcast Summarizer - Pro

Provide podcast name and episode or Spotify URL. Get key quotes. Ask questions.