Best AI tools for< Manage Loan Payments >

20 - AI tool Sites

Clerkie

Clerkie is a powerful debt repayment and optimization platform that offers a full-service automation solution powered by machine learning and human expertise. It helps lenders, both big and small, to manage and optimize their loan portfolios efficiently. With features like smart payment experience, AI-driven repayment strategies, real-time reporting, and easy integration, Clerkie ensures a seamless and secure experience for lenders and borrowers alike.

AI Credit Repair

AI Credit Repair is an AI-powered application designed to help users improve their credit score by providing tools such as credit card utilization builder, public records remover, dispute letter generator, and SMS alerts. The application assists users in managing their credit card payments, disputing collections, and staying on top of their credit-related activities. By leveraging artificial intelligence technology, AI Credit Repair aims to simplify the credit repair process and empower users to build a better financial future.

MyLoans.ai

MyLoans.ai is a free AI tool designed to provide personalized guidance for complex student loans. It offers instant, clear, and accurate answers to student loan queries, helping borrowers make informed decisions about their financial future. By skipping expensive advisors and confusing government websites, MyLoans.ai aims to save users thousands of dollars by leveraging official government sources for guidance.

CUBE3.AI

CUBE3.AI is a real-time crypto fraud prevention tool that utilizes AI technology to identify and prevent various types of fraudulent activities in the blockchain ecosystem. It offers features such as risk assessment, real-time transaction security, automated protection, instant alerts, and seamless compliance management. The tool helps users protect their assets, customers, and reputation by proactively detecting and blocking fraud in real-time.

Zest AI

Zest AI is an AI-driven credit underwriting software that offers a complete solution for AI-driven lending. It enables users to build custom machine learning risk models, adopt model assessment and regulatory compliance, and operate performance management and model monitoring. Zest AI helps increase approvals, manage risk, control loss, drive operational efficiency, automate credit decisioning, and improve borrower experience while ensuring fair lending practices. The software is designed to provide powerful AI for better lending outcomes by accelerating loan growth and expanding credit access through accurate risk prediction and faster credit decisions.

Zest AI

Zest AI is an AI-driven credit underwriting software that offers a complete solution for AI-driven lending. It enables users to build custom machine learning risk models, adopt model assessment and regulatory compliance, and operate performance management and model monitoring. Zest AI helps increase approvals, manage risk, control loss, drive operational efficiency, automate credit decisioning, and improve borrower experience while ensuring fair lending practices. The software is designed to provide fair and transparent credit for everyone, making lending more accessible and inclusive.

Kasisto

Kasisto is a conversational AI platform that provides financial institutions with the ability to create personalized, automated, and engaging digital experiences for their customers and employees. Kasisto's platform is infused with unmatched financial literacy and augments your workforce with remarkably competent digital bankers who facilitate accurate, human-like conversations and empower your teams with “in-the-moment” financial knowledge.

Casca

Casca is a revolutionary AI-native Loan Origination System that helps banks and non-bank lenders automate 90% of manual effort in business loan origination. By leveraging AI technology, Casca enables financial institutions to process loans 10x faster, achieve 3x higher conversion rates, and save significant time for loan officers. With features like AI Loan Assistant, digital application processing, KYB checks automation, and document analysis, Casca transforms the loan origination process into a seamless and efficient experience for both lenders and borrowers.

Scienaptic Systems

Scienaptic Systems is an AI-powered Credit Decisioning Platform that revolutionizes the lending industry by automating credit underwriting processes, leveraging alternate data points, and offering self-learning models for instant credit decisions. The platform helps lenders identify creditworthy borrowers, streamline customer experience, and ensure fair lending practices through explainable AI models. Scienaptic's suite of AI-enabled technologies enables lenders to say 'Yes' to more borrowers at lower risk, providing a 360-degree risk assessment before approving applications. The platform integrates seamlessly with existing lending ecosystems, ensuring disruption-free deployment and better risk predictions through a single API call.

Ocrolus

Ocrolus is an intelligent document automation software that leverages AI-driven document processing automation with Human-in-the-Loop. It offers capabilities such as classifying, capturing, detecting, and analyzing documents, with use cases in cash flow, income, address, employment, and identity verification. Ocrolus caters to various industries like small business lending, mortgage, consumer finance, and multifamily housing. The platform provides resources for developers, including guides on income verification, fraud detection, and business process automation. Users can explore the API to build innovative customer experiences and make faster and more accurate financial decisions.

Underwrite.ai

Underwrite.ai is a platform that leverages advances in artificial intelligence and machine learning to provide lenders with nonlinear, dynamic models of credit risk. By analyzing thousands of data points from credit bureau sources, the application accurately models credit risk for consumers and small businesses, outperforming traditional approaches. Underwrite.ai offers a unique underwriting methodology that focuses on outcomes such as profitability and customer lifetime value, allowing organizations to enhance their lending performance without the need for capital investment or lengthy build times. The platform's models are continuously learning and adapting to market changes in real-time, providing explainable decisions in milliseconds.

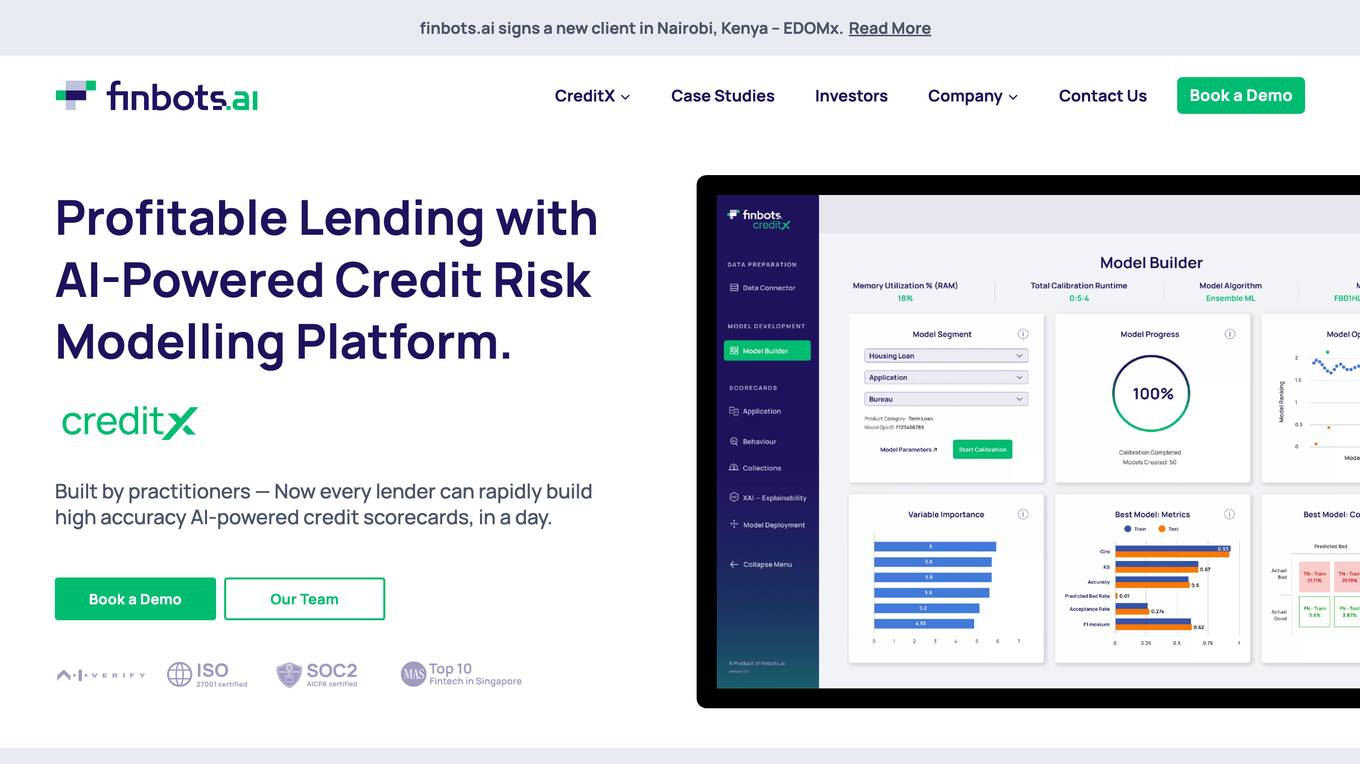

Finbots.ai

Finbots.ai is a trusted AI credit risk platform that offers AI credit scoring to boost lending profits and reduce non-performing loans. The platform provides the highest accuracy in the market, allowing users to build scorecards in a day without the need for coding. It helps in making instant decisions, increasing revenue, reducing risk, and improving operational efficiency. Finbots.ai is utilized by various financial institutions to enhance credit risk management, improve profitability, and drive down the cost of risk through AI-enabled models.

Cape.ai

Cape.ai is an agentic AI platform designed for financial operations, offering AI-powered automation to enhance reach, insight, and efficiency in daily operations for financial firms. The platform is built on real-world customer use cases, providing tangible business ROI by integrating structured and unstructured data sources, automating complex manual processes, and offering context-aware insights. Users have control over their data and processes, with customizable workflows and human-in-the-loop capabilities. Cape.ai enables flexible implementation of agentic and deterministic automation, with seamless integrations for various financial workflows and direct access to leading financial data providers. The platform empowers users to create powerful AI agents without technical barriers, unlocking real business value with speed and confidence.

VantedgeAI

VantedgeAI is an AI application that offers fine-tuned AI models for credit funds, revolutionizing credit investing workflows with faster, smarter, and cost-effective solutions. The application transforms manual processes into scalable, automated workflows tailored for Private Credit and Hedge Funds. VantedgeAI is trusted by market leaders in the industry, providing unique AI-driven insights to maintain a competitive advantage and ensure data security and privacy through SOC 2 compliance. The application offers advanced AI solutions for credit investing, including automated investment memo generation, data extraction for Excel models, portfolio monitoring, loan reconciliation, smart bond screening, real-time data querying with AI bots, and more.

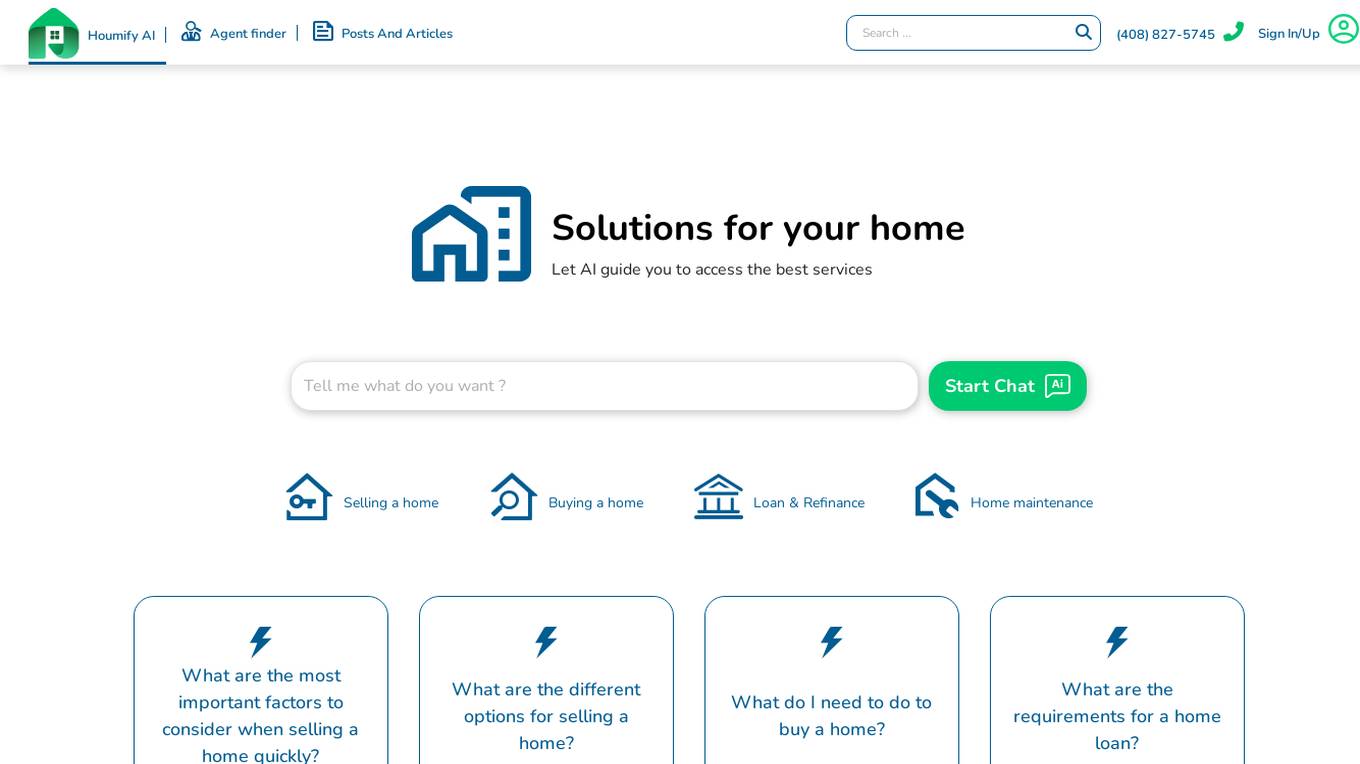

Houmify

Houmify.com is an AI-powered property companion that offers personalized real estate solutions. The platform uses artificial intelligence to guide users in accessing the best services related to selling a home, buying a home, loan & refinance, and home maintenance. Users can interact with the AI Agent to get expert advice and recommendations tailored to their specific needs and preferences. The website also provides informative posts and articles on real estate topics to help users make informed decisions. With a focus on user experience and convenience, Houmify aims to simplify the real estate process and empower individuals in their property transactions.

DeepOpinion

DeepOpinion is an Agentic Automation platform designed for enterprises to automate business operations using cutting-edge GenAI and LLMs. It offers solutions for various industries such as financial services, insurance, manufacturing, and trade financing. DeepOpinion enables users to create enterprise-grade AI agent apps, automate work processes, and achieve high levels of straight-through processing. The platform combines business process digitization, low/no-code development, and Agentic AI to build powerful business apps in minutes.

SocialBee

SocialBee is an AI-powered social media management tool that helps businesses and individuals manage their social media accounts efficiently. It offers a range of features, including content creation, scheduling, analytics, and collaboration, to help users plan, create, and publish engaging social media content. SocialBee also provides insights into social media performance, allowing users to track their progress and make data-driven decisions.

Height

Height is an autonomous project management tool designed for teams involved in designing and building projects. It automates manual tasks to provide space for collaborative work, focusing on backlog upkeep, spec updates, and bug triage. With project intelligence and collaboration features, Height offers a customizable workspace with autonomous capabilities to streamline project management. Users can discuss projects in context and benefit from an AI assistant for creating better stories. The tool aims to revolutionize project management by offloading routine tasks to an intelligent system.

Moning

Moning is a platform designed to help users manage and boost their wealth easily. It provides tools for a global view of wealth, making better investment decisions, avoiding costly mistakes, and increasing performance. With features like AI Analysis, Dividends calendar, and Dividend and Growth Safety Scores, Moning offers a mix of Human & Artificial Intelligence to enhance investment knowledge and decision-making. Users can track and manage their wealth through a comprehensive dashboard, access detailed information on stocks, ETFs, and cryptos, and benefit from quick screeners to find the best investment opportunities.

Legitt AI

Legitt AI is an AI-powered Contract Lifecycle Management platform that offers a comprehensive solution for managing contracts at scale. It combines automation and intelligence to revolutionize contract management, ensuring efficiency, accuracy, and compliance with legal standards. The platform streamlines contract creation, signing, tracking, and management processes by embedding intelligence in every step. Legitt AI enhances contract review processes, contract tracking, and contract intelligence at scale, providing users with insights, recommendations, and automated workflows. With robust security measures, scalable infrastructure, and integrations with popular business tools, Legitt AI empowers businesses to manage contracts with precision and efficiency.

0 - Open Source AI Tools

20 - OpenAI Gpts

Personal Loan

Discusses personal loans, payment methods, and financial options informatively.

Loan Management Software

Loan management software expertise. Get the most powerful loan origination and loan servicing software on the market.

Fast Loan

Discusses fast loans, application processes, and financial considerations informatively.

Pay Later

Explains 'buy now, pay later' and recommends providers in a financial, informative tone.

Finance Guide

Multilingual advisor on microfinance, focusing on clarity and educational content.

Debt Management Advisor

Advises on debt management strategies to improve financial stability.

Debt Dodger

Avoid Debt Accumulation with Credit Card Interest Insights. Find out how much interest you will pay before you make that purchase with your credit card.

Credit Card Companion

Balanced guidance on credit cards for young people, with a mix of formal and casual tones

Credit Card Advisor

Expert on credit cards, offering advice on choosing and using them wisely.