Best AI tools for< Improve Credit Score >

20 - AI tool Sites

SmartDispute.ai

SmartDispute.ai is an AI-powered credit repair application that helps users improve their credit scores by leveraging artificial intelligence technology. The application offers a patented Smart Dispute System™ technology that identifies and helps remove negative accounts from credit reports, making it one of the most effective credit repair systems available. Users can easily repair their own credit with the help of SmartDispute.ai's automated processes and fact-based dispute method. The application provides users with a simple and clearly explained process, allowing them to track their progress and see significant improvements in their credit scores over time.

AI Credit Repair

AI Credit Repair is an AI-powered application designed to help users improve their credit score by providing tools such as credit card utilization builder, public records remover, dispute letter generator, and SMS alerts. The application assists users in managing their credit card payments, disputing collections, and staying on top of their credit-related activities. By leveraging artificial intelligence technology, AI Credit Repair aims to simplify the credit repair process and empower users to build a better financial future.

Dispute AI™

Dispute AI™ is an AI-powered DIY credit repair solution that leverages cutting-edge artificial intelligence to provide personalized strategies for boosting credit scores. The platform offers actionable insights, data-driven recommendations, and a fast, affordable, and flexible credit repair process. With over 20 years of expertise in credit repair, Dispute AI™ aims to revolutionize the way individuals take control of their credit by providing innovative tools that simplify and streamline the credit repair process.

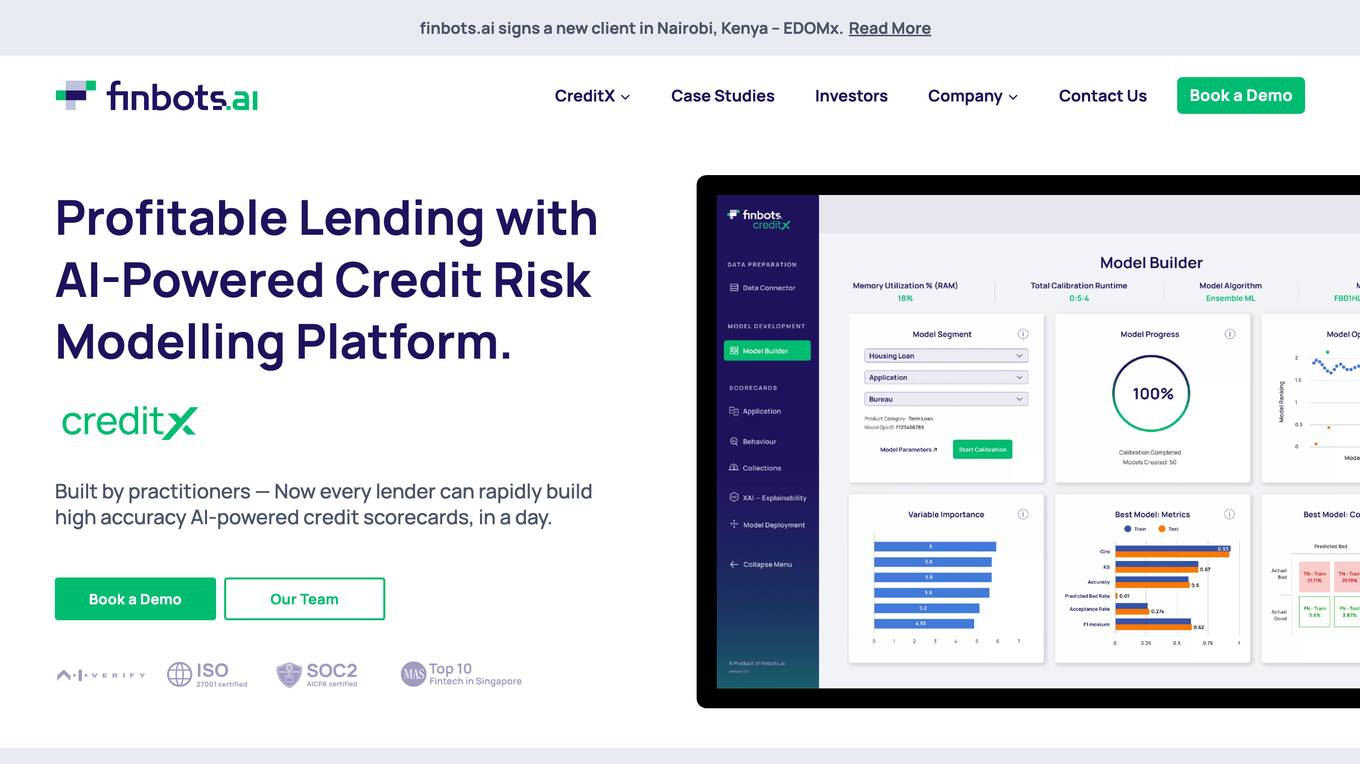

Finbots.ai

Finbots.ai is a trusted AI credit risk platform that offers AI credit scoring to boost lending profits and reduce non-performing loans. The platform provides the highest accuracy in the market, allowing users to build scorecards in a day without the need for coding. It helps in making instant decisions, increasing revenue, reducing risk, and improving operational efficiency. Finbots.ai is utilized by various financial institutions to enhance credit risk management, improve profitability, and drive down the cost of risk through AI-enabled models.

FinFloh

FinFloh is an AI-powered Accounts Receivable Software that automates the accounts receivable process effortlessly with features like credit decisioning, collections, cash application, invoice verification, and dispute resolution. It enhances collections efficiency, reduces decision-making time, and improves cash flows for B2B finance teams worldwide. The software integrates with ERP/CRM systems, offers predictive analytics, and AI-driven credit scoring to optimize accounts receivable management. FinFloh ensures secure data handling and seamless communication between finance, sales, and customer support teams, ultimately leading to increased cash flow and reduced DSO.

LingoLeap

LingoLeap is an AI-powered tool and platform designed for TOEFL and IELTS preparation. It leverages artificial intelligence to provide personalized feedback and guidance tailored to individual learning needs. With features such as instant feedback, practice tests, high-score answer generation, and vocabulary boost, LingoLeap aims to help users improve their English skills efficiently. The tool offers subscription plans with varying credits for speaking and writing evaluations, along with a free trial option. LingoLeap's innovative approach enhances language learning by analyzing users' language expression, grammar accuracy, and vocabulary application, similar to the official TOEFL test standards.

Bibit AI

Bibit AI is a real estate marketing AI designed to enhance the efficiency and effectiveness of real estate marketing and sales. It can help create listings, descriptions, and property content, and offers a host of other features. Bibit AI is the world's first AI for Real Estate. We are transforming the real estate industry by boosting efficiency and simplifying tasks like listing creation and content generation.

Sprockets

Sprockets is an AI-powered hiring software designed to help businesses overcome today's unique hiring challenges. It automates manual tasks, reduces employee turnover, and helps businesses hire the best workers every time. Sprockets offers a range of features, including a virtual recruiter, sourcing, screening, applicant tracking, reporting, time to hire, background checks, and tax credits. It also integrates with a variety of other HR systems, making it easy to use alongside your existing tools. With Sprockets, businesses can improve their hiring process, save time and money, and find the best talent for their open positions.

interface.ai

interface.ai is an AI platform that offers generative AI solutions and intelligent virtual assistant services tailored for banks and credit unions. The platform aims to optimize call center operations, automate processes, enhance customer and employee experience, and increase revenue for financial institutions. With a focus on conversational AI, voice-based biometrics, and caller-id authentication, interface.ai provides advanced solutions to improve operational efficiency and deliver personalized recommendations to prospects and customers. The platform is designed to handle call volumes, reduce wait times, and provide 24/7 member support, ultimately transforming call centers into revenue centers.

New Relic

New Relic is an AI monitoring platform that offers an all-in-one observability solution for monitoring, debugging, and improving the entire technology stack. With over 30 capabilities and 750+ integrations, New Relic provides the power of AI to help users gain insights and optimize performance across various aspects of their infrastructure, applications, and digital experiences.

Underwrite.ai

Underwrite.ai is a platform that leverages advances in artificial intelligence and machine learning to provide lenders with nonlinear, dynamic models of credit risk. By analyzing thousands of data points from credit bureau sources, the application accurately models credit risk for consumers and small businesses, outperforming traditional approaches. Underwrite.ai offers a unique underwriting methodology that focuses on outcomes such as profitability and customer lifetime value, allowing organizations to enhance their lending performance without the need for capital investment or lengthy build times. The platform's models are continuously learning and adapting to market changes in real-time, providing explainable decisions in milliseconds.

Sitelifter

Sitelifter is an AI-powered website optimization tool that provides actionable insights to improve design, messaging, and user flow. It helps users save time, reduce costs, and maximize conversions by offering AI-driven recommendations tailored to specific goals and audiences. Sitelifter is designed to be user-friendly and accessible for marketers, startups, freelancers, SaaS companies, and anyone looking to enhance their website performance without extensive testing or hiring consultants.

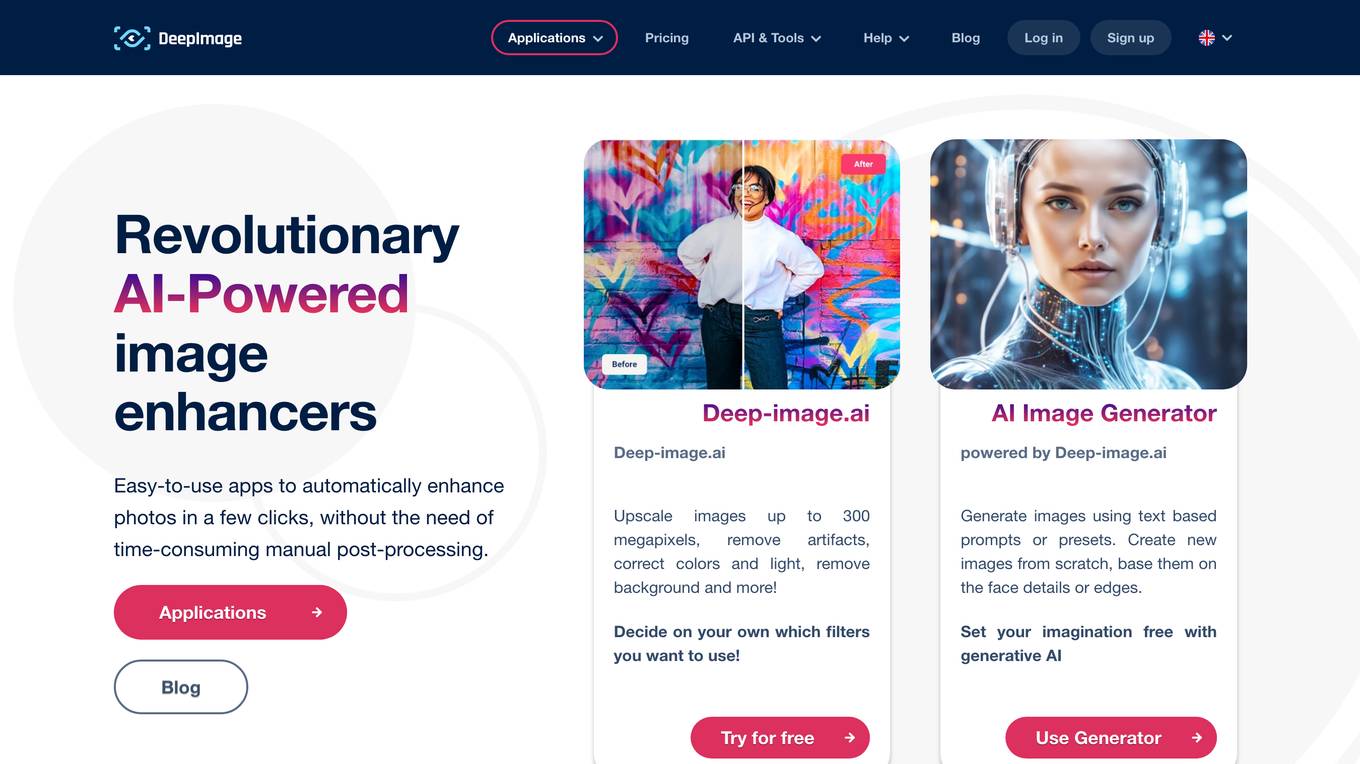

Deep Image AI

Deep Image AI is a revolutionary AI-powered image enhancer that allows users to upscale images up to 300 megapixels, remove artifacts, correct colors and light, remove backgrounds, and more. It is easy to use and does not require time-consuming manual post-processing. Deep Image AI also offers other AI-powered tools such as an avatar creator, image generator, and generative backdrops.

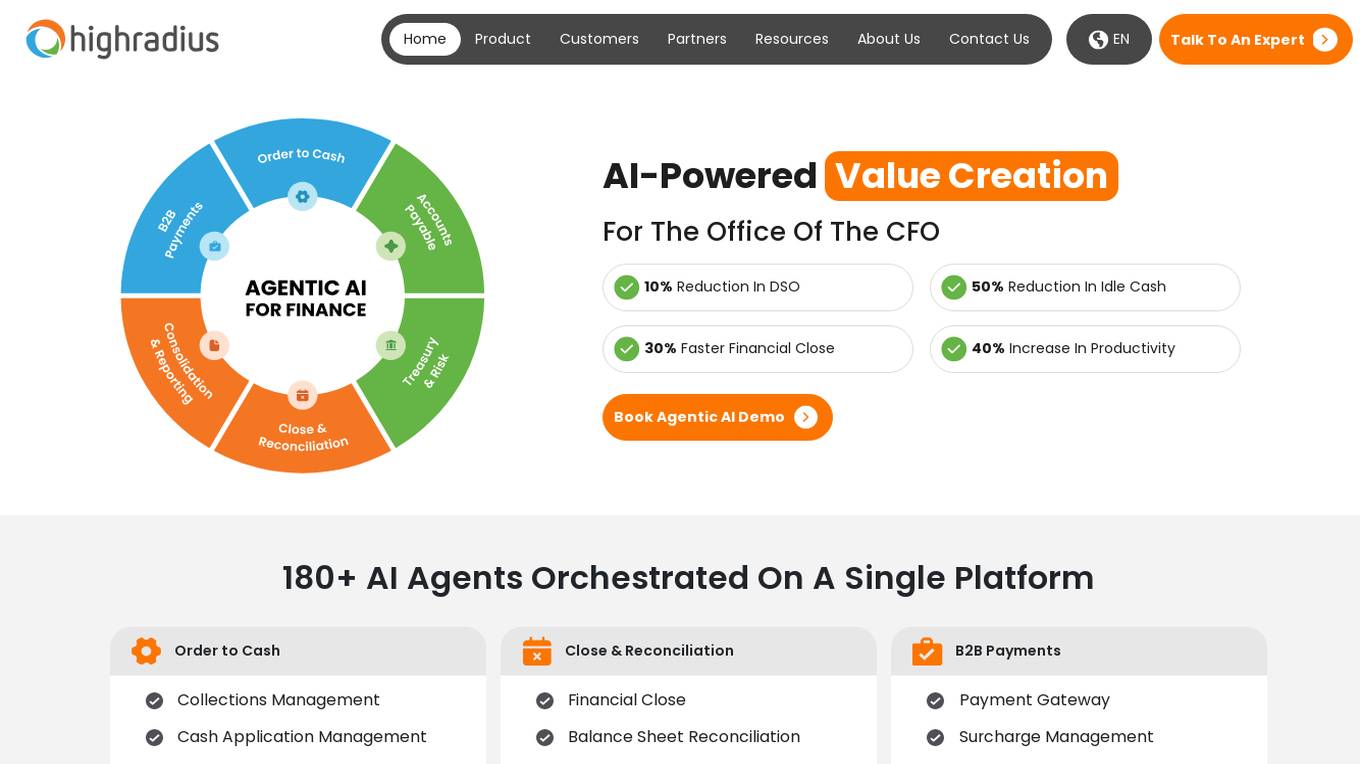

HighRadius

HighRadius is an AI-powered platform that offers Autonomous Finance solutions for Order to Cash (O2C), Treasury, and Record-to-Report (R2R) processes. It provides a single platform for various financial functions such as Accounts Payable, B2B Payments, Cash Management, and Financial Reporting. HighRadius leverages Generative AI and a No-Code AI Platform to automate data analysis and streamline financial operations for the Office of the CFO. The platform aims to enhance productivity, reduce manual work, and improve financial decision-making through advanced AI capabilities.

Zest AI

Zest AI is an AI-driven credit underwriting software that offers a complete solution for AI-driven lending. It enables users to build custom machine learning risk models, adopt model assessment and regulatory compliance, and operate performance management and model monitoring. Zest AI helps increase approvals, manage risk, control loss, drive operational efficiency, automate credit decisioning, and improve borrower experience while ensuring fair lending practices. The software is designed to provide fair and transparent credit for everyone, making lending more accessible and inclusive.

Zest AI

Zest AI is an AI-driven credit underwriting software that offers a complete solution for AI-driven lending. It enables users to build custom machine learning risk models, adopt model assessment and regulatory compliance, and operate performance management and model monitoring. Zest AI helps increase approvals, manage risk, control loss, drive operational efficiency, automate credit decisioning, and improve borrower experience while ensuring fair lending practices. The software is designed to provide powerful AI for better lending outcomes by accelerating loan growth and expanding credit access through accurate risk prediction and faster credit decisions.

Erase.bg

Erase.bg is an AI-powered tool that offers accurate background removal for images online. Users can upload images in various formats and have the background removed quickly and efficiently. The tool caters to individuals, professionals, and businesses across different industries, providing a user-friendly interface and high-quality results. Erase.bg also offers bulk image processing capabilities and API integration for seamless workflow enhancement.

Snapzion

Snapzion is an AI image generator that allows users to create high-quality images effortlessly. With Snapzion, users can unleash their creativity and generate visuals in seconds without the need for any design skills. The tool offers unlimited image generation capabilities, making it a valuable asset for individuals and businesses looking to enhance their visual content. Snapzion has received over 1.7k ratings on Product Hunt, showcasing its popularity and effectiveness in the market. Users can purchase a lifetime subscription for just $5, equivalent to the cost of a cup of coffee, providing excellent value for money.

Lama AI

Lama AI is an AI-powered platform designed to revolutionize business lending processes for banks and financial institutions. It offers advanced features, rapid configurability, and exceptional support to streamline loan origination, underwriting, and decision-making. By leveraging the power of AI, Lama AI enables banks to boost business growth potential, improve profitability, and enhance customer experience through contextual onboarding, decisioning workspace, expanded credit access, and pre-qualified applications. The platform also provides white-labeled solutions, API-first integration, high configurability, built-in AI models, and access to a network of bank lenders, all while ensuring bank-grade security and compliance standards.

Casca

Casca is a revolutionary AI-native Loan Origination System that helps banks and non-bank lenders automate 90% of manual effort in business loan origination. By leveraging AI technology, Casca enables financial institutions to process loans 10x faster, achieve 3x higher conversion rates, and save significant time for loan officers. With features like AI Loan Assistant, digital application processing, KYB checks automation, and document analysis, Casca transforms the loan origination process into a seamless and efficient experience for both lenders and borrowers.

0 - Open Source AI Tools

11 - OpenAI Gpts

Debt Management Advisor

Advises on debt management strategies to improve financial stability.

Debt Dodger

Avoid Debt Accumulation with Credit Card Interest Insights. Find out how much interest you will pay before you make that purchase with your credit card.

Pay Later

Explains 'buy now, pay later' and recommends providers in a financial, informative tone.

Credit Card Companion

Balanced guidance on credit cards for young people, with a mix of formal and casual tones

Credit Score Check

Guides on checking and monitoring credit scores, with a financial and informative tone.