Best AI tools for< Detect Financial Crimes >

20 - AI tool Sites

Simudyne

Simudyne is an enterprise simulation software powered by AI technology. It allows large financial institutions to simulate various future scenarios efficiently and measure their impact in a safe virtual environment. The software offers solutions for environment, social and governance issues, market execution, financial crime analytics, and risk management. Simudyne's technology is secure, distributable, and Cloudera certified, providing a robust library of code for specialized functions. The platform also utilizes agent-based modeling to bridge the gap between theoretical and real-world scenarios in the financial services sector.

SymphonyAI Financial Crime Prevention AI SaaS Solutions

SymphonyAI offers AI SaaS solutions for financial crime prevention, helping organizations detect fraud, conduct customer due diligence, and prevent payment fraud. Their solutions leverage generative and predictive AI to enhance efficiency and effectiveness in investigating financial crimes. SymphonyAI's products cater to industries like banking, insurance, financial markets, and private banking, providing rapid deployment, scalability, and seamless integration to meet regulatory compliance requirements.

AnChainAI

AnChainAI is an AI-powered platform offering solutions for crypto investigations, AML compliance, fintech stablecoin payment screening, and Web3 smart contract security. It provides advanced AI technology to streamline financial crime investigations, compliance, and risk management for enterprises, regulators, and financial institutions. The platform leverages machine learning models, blockchain analytics, and smart contract intelligence to detect fraud, money laundering, and other illicit activities in the cryptocurrency space. AnChainAI also offers training programs through AnChain.AI University to educate users on blockchain technology, smart contracts, and cybersecurity.

iSEM.ai

iSEM.ai is an end-to-end AI-powered AML and Fraud Detection solution that empowers users to identify risks, investigate anomalies, and streamline reporting. The platform combines human intelligence with machine technology to adapt, reduce risks, and enhance efficiency in combating financial crimes. iSEM.ai offers tailored solutions to manage client data, onboard monitoring, client profile management, watchlist monitoring, transaction monitoring, transaction screening, and fraud monitoring. The application is designed to help businesses comply with regulations, detect suspicious activities, and ensure seamless protection at every step.

Quantifind

Quantifind is an AI-powered financial crimes automation platform that specializes in Anti-Money Laundering (AML) and Know Your Customer (KYC) solutions. It offers end-to-end automation impact, best-in-class accuracy, and powerful APIs and applications for risk screening, investigations, and compliance in the financial services and public sector industries. Quantifind's Graphyte platform leverages AI and external data to streamline AML-KYC processes, providing comprehensive data coverage, dynamic risk typologies, and seamless integrations with case management systems.

DataVisor

DataVisor is a modern, end-to-end fraud and risk SaaS platform powered by AI and advanced machine learning for financial institutions and large organizations. It helps businesses combat various fraud and financial crimes in real time. DataVisor's platform provides comprehensive fraud detection and prevention capabilities, including account onboarding, application fraud, ATO prevention, card fraud, check fraud, FinCrime and AML, and ACH and wire fraud detection. The platform is designed to adapt to new fraud incidents immediately with real-time data signal orchestration and end-to-end workflow automation, minimizing fraud losses and maximizing fraud detection coverage.

DataVisor

DataVisor is a modern, end-to-end fraud and risk SaaS platform powered by AI and advanced machine learning for financial institutions and large organizations. It provides a comprehensive suite of capabilities to combat a variety of fraud and financial crimes in real time. DataVisor's hyper-scalable, modern architecture allows you to leverage transaction logs, user profiles, dark web and other identity signals with real-time analytics to enrich and deliver high quality detection in less than 100-300ms. The platform is optimized to scale to support the largest enterprises with ultra-low latency. DataVisor enables early detection and adaptive response to new and evolving fraud attacks combining rules, machine learning, customizable workflows, device and behavior signals in an all-in-one platform for complete protection. Leading with an Unsupervised approach, DataVisor is the only proven, production-ready solution that can proactively stop fraud attacks before they result in financial loss.

SymphonyAI NetReveal Financial Services

SymphonyAI NetReveal Financial Services is an AI-powered platform that offers solutions for financial crime prevention in various industries such as banking, insurance, financial markets, and private banking. The platform utilizes predictive and generative AI applications to enhance efficiency, reduce fraud, streamline compliance, and maximize output. SymphonyAI provides a fundamentally different approach to AI by combining high-value AI capabilities with industry-leading predictive and generative AI technologies. The platform offers a range of solutions including transaction monitoring, customer due diligence, payment fraud detection, and enterprise investigation management. SymphonyAI aims to revolutionize financial crime prevention by leveraging AI to detect suspicious activity, expedite investigations, and improve compliance operations.

Sardine

Sardine is an AI-powered platform for fraud prevention and compliance. It offers a comprehensive suite of products to help banks, retailers, and fintechs detect fraud patterns, prevent money laundering, and stop sophisticated scams. Sardine combines deep device intelligence, behavior biometrics, and identity signals to provide a precise risk score for every customer interaction. The platform also features machine learning models, a rules engine, network graph analysis, anomaly detection, and generative AI capabilities to fight modern threats. Sardine helps reduce fraud rates, decrease false positives, and streamline risk operations with its fully integrated solutions.

Wunderschild

Schwarzthal Tech's Wunderschild is an AI-driven platform for financial crime intelligence that revolutionizes compliance and investigation techniques. It provides intelligence solutions based on network assessment, data linkage, flow aggregation, and machine learning. The platform offers expertise and insights on strategic risks related to Politically Exposed Persons, Serious Organised Crime, Terrorism Financing, and more. With features like Compliance, Investigation, Know Your Network, Media Scan, Document Drill, and Transaction Monitoring, Wunderschild empowers users to enhance compliance functions, conduct deep dives into complex transnational crime cases, and detect suspicious activities. The platform is trusted by global companies and offers advanced OCR, multilingual support, and key information extraction capabilities.

Tookitaki

Tookitaki is an AI-powered AML & Financial Crime Compliance Platform that offers end-to-end solutions for AML and fraud prevention. It provides AI-driven risk detection, real-time fraud prevention, prospect screening, risk scoring, alert prioritization, and case management. The platform is designed to help financial institutions enhance their AML risk management, reduce false positives, and meet regulatory requirements effectively.

Feedzai

Feedzai is an AI-native Fraud & Financial Crime Prevention Platform that uses purpose-built AI to stop fraud and lower compliance costs. The platform covers the entire financial crime lifecycle, from account opening to fraud prevention to AML compliance. It applies behavioral analytics to detect and prevent fraud, reduces AML compliance costs, and empowers customers to stop scams before they happen. Feedzai is trusted by global financial leaders and helps protect billions of consumers worldwide while enabling better customer experiences.

NICE Actimize

NICE Actimize is an AI-driven platform that offers solutions for combatting financial crime, including Anti-Money Laundering (AML), Enterprise Fraud Management, Financial Markets Compliance, Investigation and Case Management, and Data Intelligence. The platform utilizes AI and machine learning to optimize efficacy, accuracy, and regulatory compliance coverage in the fight against financial crime.

Napier AI

Napier AI is an AI-powered Anti-Money Laundering platform designed to combat evolving threats in the financial industry. It offers a suite of intelligent compliance products that aim to transform organizations' attitudes towards compliance by focusing on efficiency and outcomes. The platform integrates multiple compliance solutions into one master dashboard, provides flexible deployment options, and offers AI-enhanced insights to empower compliance teams to make faster and more accurate decisions. Napier AI is trusted by leading data providers and financial organizations worldwide for its innovative approach to financial crime compliance.

Unit21

Unit21 is a customizable no-code platform designed for risk and compliance operations. It empowers organizations to combat financial crime by providing end-to-end lifecycle risk analysis, fraud prevention, case management, and real-time monitoring solutions. The platform offers features such as AI Copilot for alert prioritization, Ask Your Data for data analysis, Watchlist & Sanctions for ongoing screening, and more. Unit21 focuses on fraud prevention and AML compliance, simplifying operations and accelerating investigations to respond to financial threats effectively and efficiently.

IntelleWings

IntelleWings is an advanced AML/CFT compliance solution that offers a suite of products for sanction screening, PEP screening, adverse media screening, and transaction monitoring. Powered by AI and Deep Tech, IntelleWings provides cutting-edge technology to help businesses detect fraud and simplify their CDD process. The platform is designed to meet the AML/CFT requirements of various industries, including banks, insurance companies, e-commerce platforms, and more. With a global database and automated reports, IntelleWings offers a seamless and efficient experience for users.

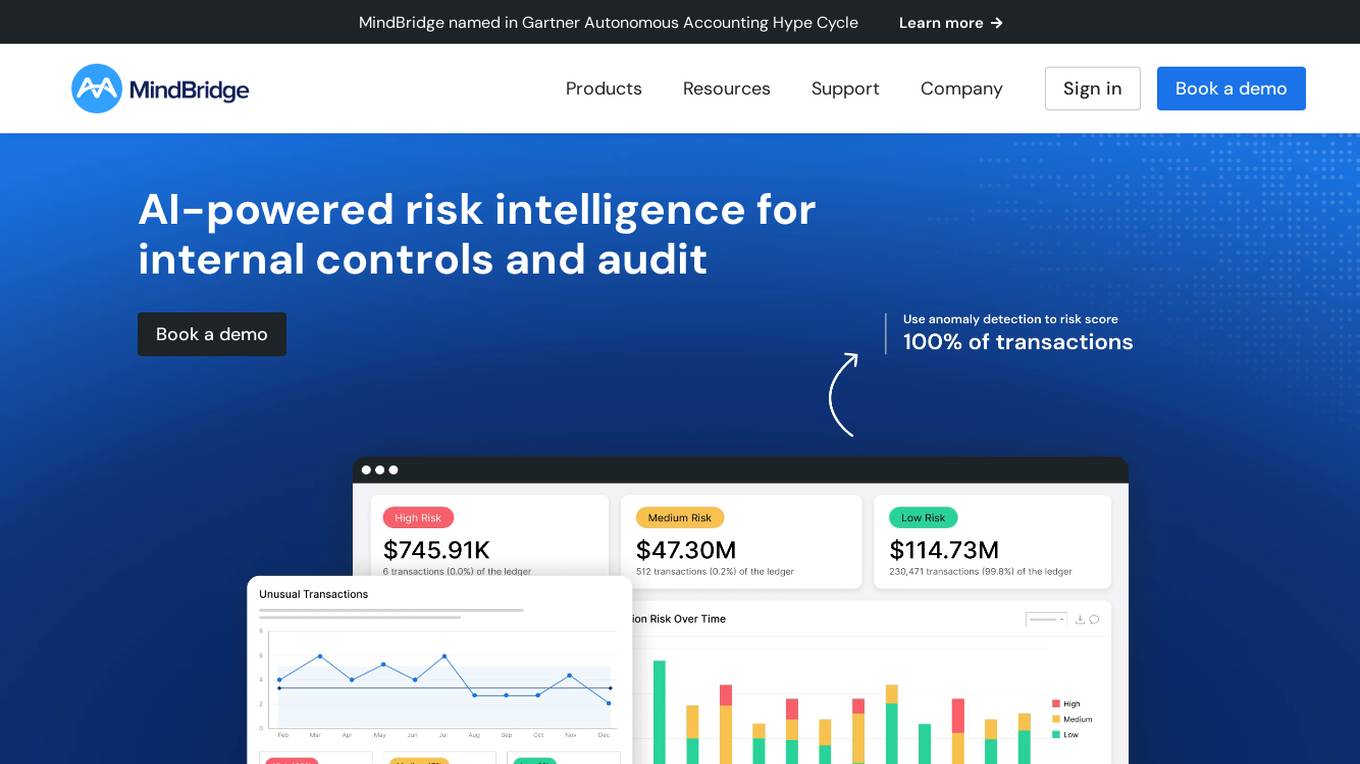

MindBridge

MindBridge is a global leader in financial risk discovery and anomaly detection. The MindBridge AI Platform drives insights and assesses risks across critical business operations. It offers various products like General Ledger Analysis, Company Card Risk Analytics, Payroll Risk Analytics, Revenue Risk Analytics, and Vendor Invoice Risk Analytics. With over 250 unique machine learning control points, statistical methods, and traditional rules, MindBridge is deployed to over 27,000 accounting, finance, and audit professionals globally.

Perfios

Perfios is an AI-powered FinTech software company that offers digital solutions for various industries such as banking, insurance, fintech, payments, e-commerce, legal, gaming, and more. Their platform provides end-to-end solutions for digital onboarding, underwriting, risk assessment, fraud detection, and customer engagement. Perfios leverages AI and machine learning technologies to streamline processes, enhance operational efficiency, and improve decision-making in financial services. With a wide range of products and features, Perfios aims to transform the way businesses experience technology and make data-driven decisions.

TradeOS AI

TradeOS AI is an advanced AI tool designed to provide professional insights for traders and investors. The platform utilizes cutting-edge artificial intelligence algorithms to analyze market trends, predict price movements, and offer personalized trading recommendations. With TradeOS AI, users can access real-time data, historical analysis, and market sentiment indicators to make informed decisions and optimize their trading strategies. Whether you are a novice trader or an experienced investor, TradeOS AI empowers you with the tools and knowledge needed to succeed in the financial markets.

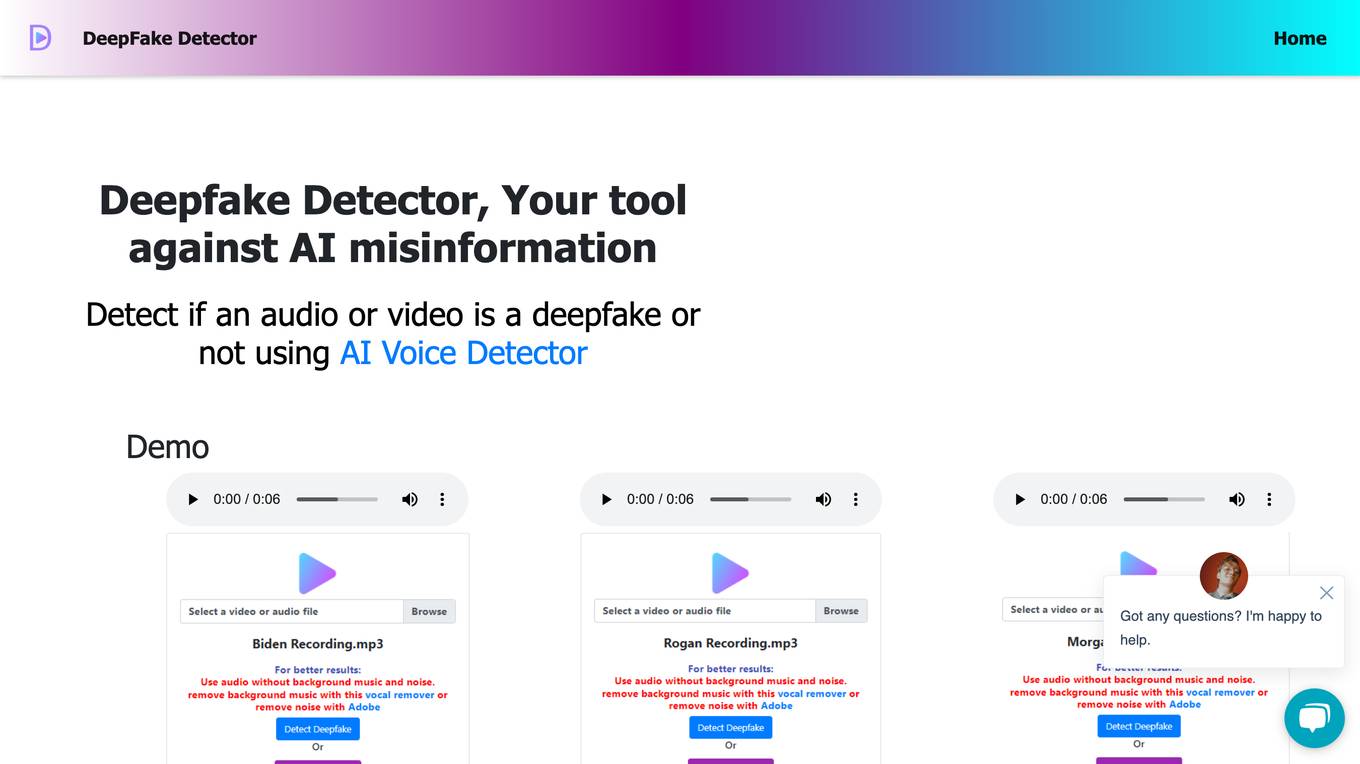

Deepfake Detector

Deepfake Detector is an AI tool designed to identify deepfakes in audio and video files. It offers features such as background noise and music removal, audio and video file analysis, and browser extension integration. The tool helps individuals and businesses protect themselves against deepfake scams by providing accurate detection and filtering of AI-generated content. With a focus on authenticity and reliability, Deepfake Detector aims to prevent financial losses and fraudulent activities caused by deepfake technology.

0 - Open Source AI Tools

20 - OpenAI Gpts

Financial Cybersecurity Analyst - Lockley Cash v1

stunspot's advisor for all things Financial Cybersec

Sherlock Holmes, The Fact Finder

Finance fact-checker with accuracy scoring, using sources like NerdWallet, Investopedia, BEA, and St. Louis Fed.

Bank Statement Analyst

Multilingual financial expert for PDF bank statement analysis ->> Latest Update: Mar 12th, 2024

FallacyGPT

Detect logical fallacies and lapses in critical thinking to help avoid misinformation in the style of Socrates

AI Detector

AI Detector GPT is powered by Winston AI and created to help identify AI generated content. It is designed to help you detect use of AI Writing Chatbots such as ChatGPT, Claude and Bard and maintain integrity in academia and publishing. Winston AI is the most trusted AI content detector.

Plagiarism Checker

Plagiarism Checker GPT is powered by Winston AI and created to help identify plagiarized content. It is designed to help you detect instances of plagiarism and maintain integrity in academia and publishing. Winston AI is the most trusted AI and Plagiarism Checker.

BS Meter Realtime

Detects and measures information credibility. Provides a "BS Score" (0-100) based on content analysis for misinformation signs, including factual inaccuracies and sensationalist language. Real-time feedback.

Wowza Bias Detective

I analyze cognitive biases in scenarios and thoughts, providing neutral, educational insights.

Defender for Endpoint Guardian

To assist individuals seeking to learn about or work with Microsoft's Defender for Endpoint. I provide detailed explanations, step-by-step guides, troubleshooting advice, cybersecurity best practices, and demonstrations, all specifically tailored to Microsoft Defender for Endpoint.

Prompt Injection Detector

GPT used to classify prompts as valid inputs or injection attempts. Json output.