Best AI tools for< Insurance Investigator >

Infographic

20 - AI tool Sites

CARCO

CARCO is an advanced Mobile AI Fraud Prevention application designed to protect insurance carriers and consumers by identifying and preventing risk events and fraudulent activities. The application streamlines the inspection process through integrated AI and fraud alert validation technology, providing a back-office solution that is easily integrated into mobile platforms, cost-effective, and fraud-detecting. CARCO also offers NMVTIS, a premier system in the U.S. that requires reporting of vehicle title data. With over 50 million transactions completed to date, CARCO has a proven track record in fraud prevention and risk mitigation for the insurance industry.

Aura

Aura is an all-in-one digital safety platform that uses artificial intelligence (AI) to protect your family online. It offers a wide range of features, including financial fraud protection, identity theft protection, VPN & online privacy, antivirus, password manager & smart vault, parental controls & safe gaming, and spam call protection. Aura is easy to use and affordable, and it comes with a 60-day money-back guarantee.

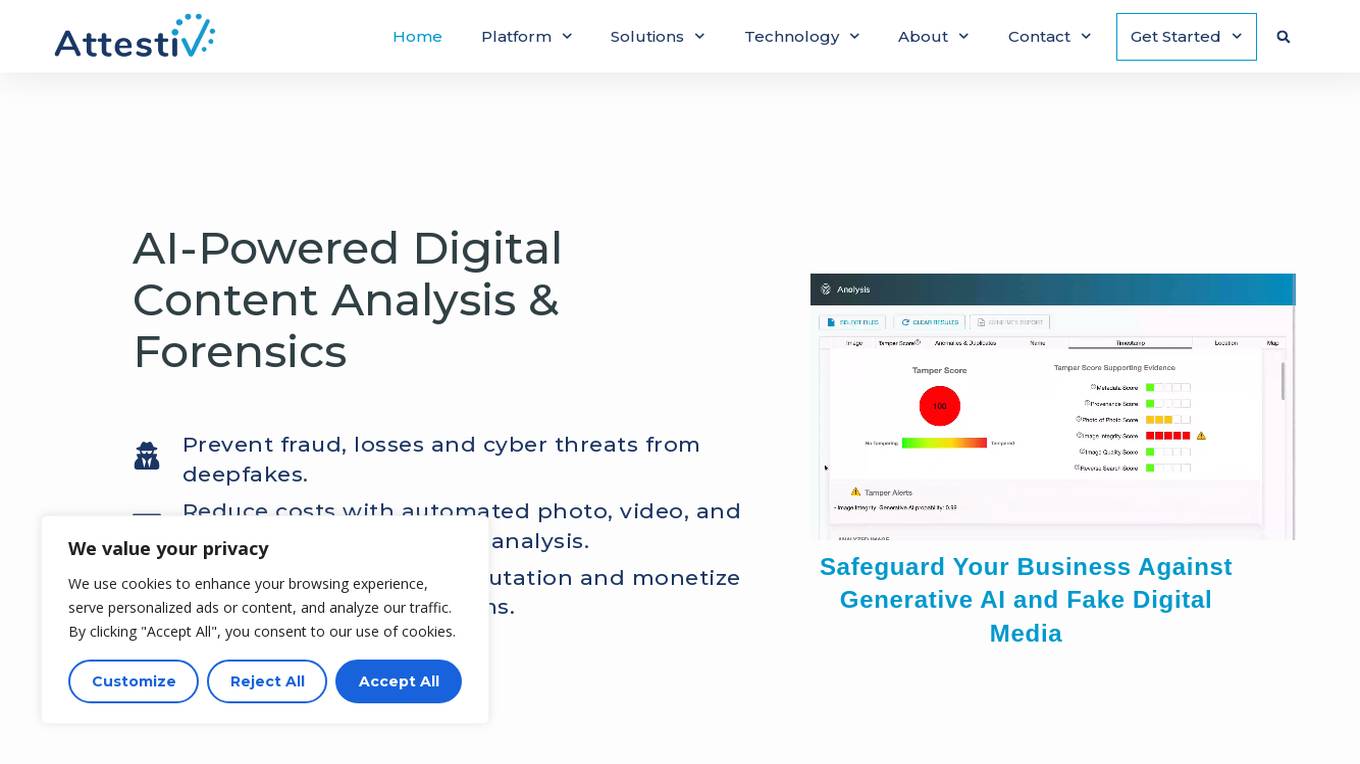

Attestiv

Attestiv is an AI-powered digital content analysis and forensics platform that offers solutions to prevent fraud, losses, and cyber threats from deepfakes. The platform helps in reducing costs through automated photo, video, and document inspection and analysis, protecting company reputation, and monetizing trust in secure systems. Attestiv's technology provides validation and authenticity for all digital assets, safeguarding against altered photos, videos, and documents that are increasingly easy to create but difficult to detect. The platform uses patented AI technology to ensure the authenticity of uploaded media and offers sector-agnostic solutions for various industries.

Verisquad

Verisquad is an AI-powered platform that specializes in claim verification. It leverages advanced artificial intelligence algorithms to streamline and automate the process of verifying claims, ensuring accuracy and efficiency. By harnessing the power of AI, Verisquad offers a reliable solution for businesses and individuals seeking to validate claims quickly and effectively.

GeoInfer

GeoInfer is a professional AI-powered geolocation platform that analyzes photographs to determine where they were taken. It uses visual-only inference technology to examine visual elements like architecture, terrain, vegetation, and environmental markers to identify geographic locations without requiring GPS metadata or EXIF data. The platform offers transparent accuracy levels for different use cases, including a Global Model with 1km-100km accuracy ideal for regional and city-level identification. Additionally, GeoInfer provides custom regional models for organizations requiring higher precision, such as meter-level accuracy for specific geographic areas. The platform is designed for professionals in various industries, including law enforcement, insurance fraud investigation, digital forensics, and security research.

SymphonyAI NetReveal Financial Services

SymphonyAI NetReveal Financial Services is an AI-powered platform that offers solutions for financial crime prevention in various industries such as banking, insurance, financial markets, and private banking. The platform utilizes predictive and generative AI applications to enhance efficiency, reduce fraud, streamline compliance, and maximize output. SymphonyAI provides a fundamentally different approach to AI by combining high-value AI capabilities with industry-leading predictive and generative AI technologies. The platform offers a range of solutions including transaction monitoring, customer due diligence, payment fraud detection, and enterprise investigation management. SymphonyAI aims to revolutionize financial crime prevention by leveraging AI to detect suspicious activity, expedite investigations, and improve compliance operations.

SymphonyAI Financial Crime Prevention AI SaaS Solutions

SymphonyAI offers AI SaaS solutions for financial crime prevention, helping organizations detect fraud, conduct customer due diligence, and prevent payment fraud. Their solutions leverage generative and predictive AI to enhance efficiency and effectiveness in investigating financial crimes. SymphonyAI's products cater to industries like banking, insurance, financial markets, and private banking, providing rapid deployment, scalability, and seamless integration to meet regulatory compliance requirements.

IntelleWings

IntelleWings is an advanced AML/CFT compliance solution that offers a suite of products for sanction screening, PEP screening, adverse media screening, and transaction monitoring. Powered by AI and Deep Tech, IntelleWings provides cutting-edge technology to help businesses detect fraud and simplify their CDD process. The platform is designed to meet the AML/CFT requirements of various industries, including banks, insurance companies, e-commerce platforms, and more. With a global database and automated reports, IntelleWings offers a seamless and efficient experience for users.

Insurance Policy AI

This application utilizes AI technology to simplify the complex process of understanding health insurance policies. Unlike other apps that focus on insurance search and comparison, this app specializes in deciphering the intricate language found in policies. It provides instant access to policy analysis with a one-time payment, empowering users to gain clarity and make informed decisions regarding their health insurance coverage.

Nestor

Nestor is an AI-powered insurance assistant that provides clear and jargon-free answers to all your insurance questions. It can audit your insurance contracts, identify potential over-insurance or under-insurance, and suggest ways to improve your coverage. Nestor is constantly learning and can provide expert advice on a wide range of insurance topics.

Quandri

Quandri is a digital workforce solution that automates repetitive tasks for insurance brokerages and agencies. By leveraging advanced automation and AI, Quandri's digital workers can help businesses save time, reduce errors, and increase efficiency. Quandri's out-of-the-box digital workers can be deployed seamlessly into any agency or brokerage, and can be trained to perform a variety of tasks, including EDI processing, closing broker activities, eDoc processing, inbound lead management, and renewal reviews. With Quandri, businesses can free up their team's time to focus on more value-producing activities, such as building relationships with clients and growing their business.

Further AI

Further AI is an AI application designed to revolutionize insurance operations by providing AI Teammates for various tasks such as quote generation, policy checking, and renewal follow-ups. The platform aims to enhance efficiency, reduce errors, and automate repetitive tasks in the insurance industry. Further AI offers innovative solutions for insurance brokers, general agents, and insurers, allowing them to scale their business without the need for additional hiring. By leveraging AI technology, users can streamline workflows, automate client calls, navigate portals, and extract data from complex documents with ease and accuracy.

BluePond GenAI PaaS

BluePond GenAI PaaS is an automation and insights powerhouse tailored for Property and Casualty Insurance. It offers end-to-end execution support from GenAI data scientists, engineers & human-in-the-loop processing. The platform provides automated intake extraction, classification enrichment, validation, complex document analysis, workflow automation, and decisioning. Users benefit from rapid deployment, complete control of data & IP, and pre-trained P&C domain library. BluePond GenAI PaaS aims to energize and expedite GenAI initiatives throughout the insurance value chain.

InsureSmart

InsureSmart is an AI-powered platform that empowers users to take control of their insurance needs. By leveraging artificial intelligence technology, InsureSmart offers personalized insurance solutions tailored to individual requirements. The platform provides a seamless and user-friendly experience for users to manage and optimize their insurance policies efficiently. With InsureSmart, users can access smart recommendations, compare insurance plans, and make informed decisions to secure their financial well-being.

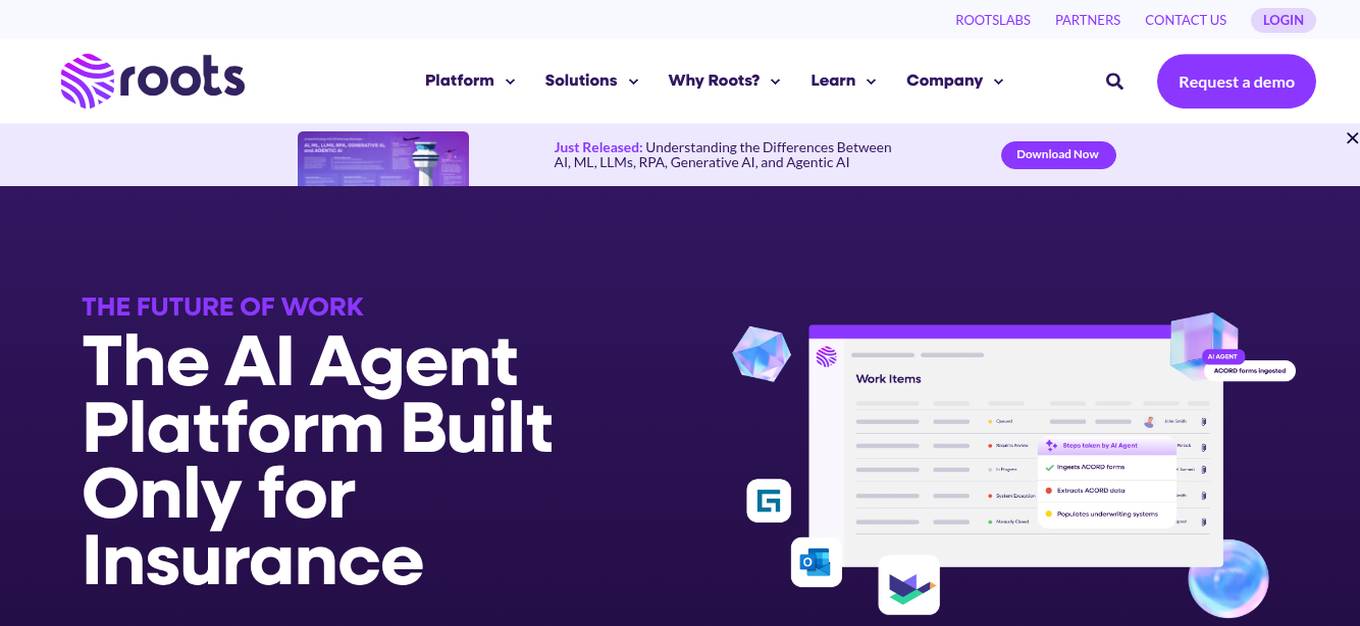

Roots

Roots is an AI Agent Platform designed specifically for the insurance industry, offering a comprehensive suite of tools and features to enhance operational efficiency, streamline processes, and improve customer experiences. The platform includes AI Agents, InsurGPT™, Cockpit, Human-in-the-Loop, Workflow Orchestration, and Responsible AI components. Roots aims to revolutionize insurance automation by providing transparent, ethical, and trustworthy AI solutions tailored for insurance companies.

Convr

Convr is an AI-driven underwriting analysis platform that helps commercial P&C insurance organizations transform their underwriting operations. It provides a modularized AI underwriting and intelligent document automation workbench that enriches and expedites the commercial insurance new business and renewal submission flow with underwriting insights, business classification, and risk scoring. Convr's mission is to solve the last big problem of commercial insurance while improving profitability and increasing efficiency.

Convr

Convr is a modularized AI underwriting and intelligent document automation workbench that enriches and expedites the commercial insurance new business and renewal submission flow with underwriting insights, business classification and risk scoring. As a trusted technology partner and advisor with deep industry expertise, we help insurance organizations transform their underwriting operations through our AI-driven digital underwriting analysis platform.

FlowX.AI

FlowX.AI is a Multi-Agent AI Platform designed for Banking and Insurance Modernization. It offers a cutting-edge AI-native agentic platform for building and deploying AI agents and mission-critical AI-enabled systems in highly regulated industries. The platform enables businesses to build the next generation of banking and insurance systems in weeks, not years, by providing faster development, time to market, and reduced maintenance and implementation costs.

Gradient AI

Gradient AI is a leading provider of artificial intelligence solutions for the insurance industry. Its solutions improve loss ratios and profitability by predicting underwriting and claims risks with greater accuracy, as well as reducing quote turnaround times and claim expenses through intelligent automation.

Sonant

Sonant is an AI receptionist designed specifically for insurance agencies, brokers, and distributors. It aims to turn routine incoming calls into revenue within a short period of time. The AI tool enables 24/7 personalized service with zero waiting times, multilingual capabilities, and the ability to transfer calls to human agents when necessary. Sonant helps agencies improve productivity, profitability, and client satisfaction by automating routine tasks, appointment scheduling, quote intaking, and post-call notes. It is GDPR compliant and integrates seamlessly with popular Agency Management Systems and CRM software.

1 - Open Source Tools

NightshadeAntidote

Nightshade Antidote is an image forensics tool used to analyze digital images for signs of manipulation or forgery. It implements several common techniques used in image forensics including metadata analysis, copy-move forgery detection, frequency domain analysis, and JPEG compression artifacts analysis. The tool takes an input image, performs analysis using the above techniques, and outputs a report summarizing the findings.

20 - OpenAI Gpts

RansomChatGPT

I'm a ransomware negotiation simulation and analysis bot trained with over 131 real-life negotiations. Type "start negotiation" to begin! New feature: Type "threat actor personality test"

TraffiQ AI V.1

Asistente especializado en accidentes de tráfico que te facilitará información y recomendaciones para iniciar una reclamación

My Dollar General Parking Lot Focus Group

Generates a unique parking lot scenario with each response.

Health Insurance Navigator

A helpful guide for choosing and understanding health insurance plans.

AI and Insurance Strategy Consultant

Formal yet witty AI & Insurance expert. Powered by Breebs (www.breebs.com)

👑 Data Privacy for Insurance Companies 👑

Insurance providers collect and process personal health, financial, and property information, making it crucial to implement comprehensive data protection strategies.

Life Insurance Leads Bot

Badass Insurance Leads helps insurance agents from across the United States find the best aged life insurance leads to sell policies to.

ZEN Influencer Insurance

I create social media influencer insurance plans with a focus on legal compliance.

Claims Brother

Chat with your new personal insurance and claims assistant - you will only need to upload your insurance policy and he will tell you if you are covered for a specific event

Travel Advisor

Travel expert offering advice on travel, travel insurance, packing, and ticket buying. Contact: [email protected]

Mindful Match

A mental health assistant to help choose a therapist based on needs, insurance, and location.

Health Insighter

Simply type "news" for easy to digest updates in the Healthcare industry, or be as specific as you want and get the top healthcare news from reliable sources. Healthtech, patient care, insurance policies, provider networks, value based care, behavioral health, condition management, therapy.