Best AI tools for< Manage Credit Risk >

20 - AI tool Sites

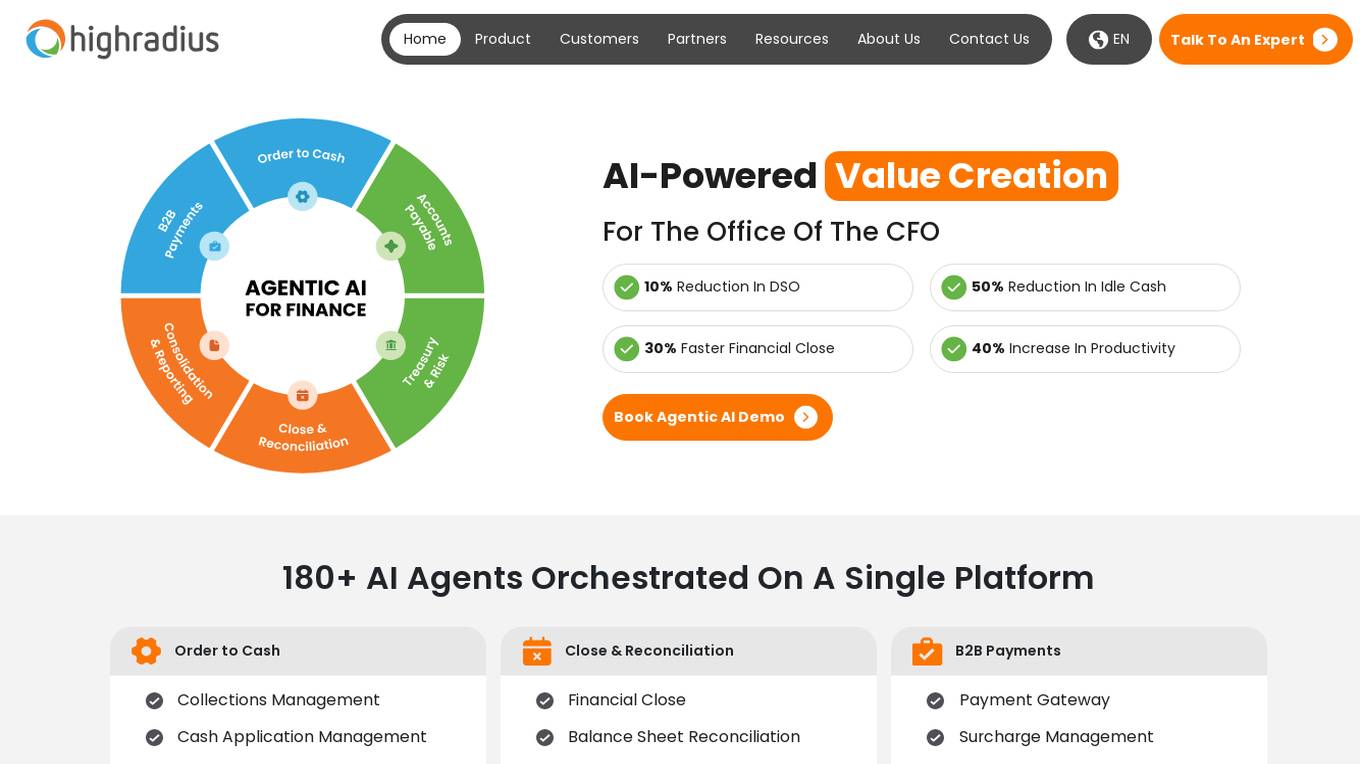

HighRadius

HighRadius is an AI-powered platform that offers Autonomous Finance solutions for Order to Cash (O2C), Treasury, and Record-to-Report (R2R) processes. It provides a single platform for various financial functions such as Accounts Payable, B2B Payments, Cash Management, and Financial Reporting. HighRadius leverages Generative AI and a No-Code AI Platform to automate data analysis and streamline financial operations for the Office of the CFO. The platform aims to enhance productivity, reduce manual work, and improve financial decision-making through advanced AI capabilities.

BCT Digital

BCT Digital is an AI-powered risk management suite provider that offers a range of products to help enterprises optimize their core Governance, Risk, and Compliance (GRC) processes. The rt360 suite leverages next-generation technologies, sophisticated AI/ML models, data-driven algorithms, and predictive analytics to assist organizations in managing various risks effectively. BCT Digital's solutions cater to the financial sector, providing tools for credit risk monitoring, early warning systems, model risk management, environmental, social, and governance (ESG) risk assessment, and more.

Zest AI

Zest AI is an AI-driven credit underwriting software that offers a complete solution for AI-driven lending. It enables users to build custom machine learning risk models, adopt model assessment and regulatory compliance, and operate performance management and model monitoring. Zest AI helps increase approvals, manage risk, control loss, drive operational efficiency, automate credit decisioning, and improve borrower experience while ensuring fair lending practices. The software is designed to provide fair and transparent credit for everyone, making lending more accessible and inclusive.

Zest AI

Zest AI is an AI-driven credit underwriting software that offers a complete solution for AI-driven lending. It enables users to build custom machine learning risk models, adopt model assessment and regulatory compliance, and operate performance management and model monitoring. Zest AI helps increase approvals, manage risk, control loss, drive operational efficiency, automate credit decisioning, and improve borrower experience while ensuring fair lending practices. The software is designed to provide powerful AI for better lending outcomes by accelerating loan growth and expanding credit access through accurate risk prediction and faster credit decisions.

Underwrite.ai

Underwrite.ai is a platform that leverages advances in artificial intelligence and machine learning to provide lenders with nonlinear, dynamic models of credit risk. By analyzing thousands of data points from credit bureau sources, the application accurately models credit risk for consumers and small businesses, outperforming traditional approaches. Underwrite.ai offers a unique underwriting methodology that focuses on outcomes such as profitability and customer lifetime value, allowing organizations to enhance their lending performance without the need for capital investment or lengthy build times. The platform's models are continuously learning and adapting to market changes in real-time, providing explainable decisions in milliseconds.

Scienaptic Systems

Scienaptic Systems is an AI-powered Credit Decisioning Platform that revolutionizes the lending industry by automating credit underwriting processes, leveraging alternate data points, and offering self-learning models for instant credit decisions. The platform helps lenders identify creditworthy borrowers, streamline customer experience, and ensure fair lending practices through explainable AI models. Scienaptic's suite of AI-enabled technologies enables lenders to say 'Yes' to more borrowers at lower risk, providing a 360-degree risk assessment before approving applications. The platform integrates seamlessly with existing lending ecosystems, ensuring disruption-free deployment and better risk predictions through a single API call.

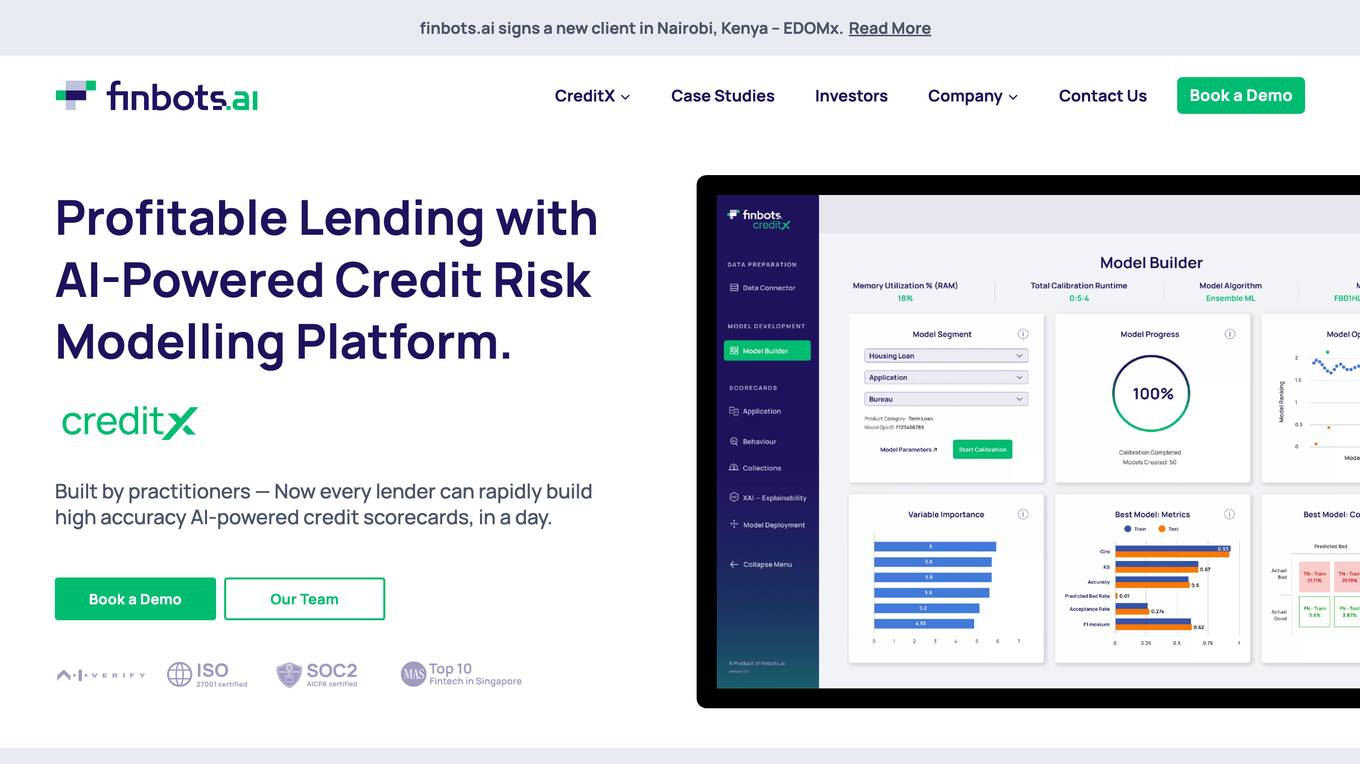

Finbots.ai

Finbots.ai is a trusted AI credit risk platform that offers AI credit scoring to boost lending profits and reduce non-performing loans. The platform provides the highest accuracy in the market, allowing users to build scorecards in a day without the need for coding. It helps in making instant decisions, increasing revenue, reducing risk, and improving operational efficiency. Finbots.ai is utilized by various financial institutions to enhance credit risk management, improve profitability, and drive down the cost of risk through AI-enabled models.

VantedgeAI

VantedgeAI is an AI application that offers fine-tuned AI models for credit funds, revolutionizing credit investing workflows with faster, smarter, and cost-effective solutions. The application transforms manual processes into scalable, automated workflows tailored for Private Credit and Hedge Funds. VantedgeAI is trusted by market leaders in the industry, providing unique AI-driven insights to maintain a competitive advantage and ensure data security and privacy through SOC 2 compliance. The application offers advanced AI solutions for credit investing, including automated investment memo generation, data extraction for Excel models, portfolio monitoring, loan reconciliation, smart bond screening, real-time data querying with AI bots, and more.

Veriff

Veriff is an AI-powered identity verification platform that combines automation and human expertise to detect deepfakes, prevent fraud, and onboard verified customers globally. It offers a range of verification services including identity & document verification, biometric authentication, age estimation, fraud prevention, and more. Veriff helps businesses restore trust to the internet by providing fast, accurate, and secure identity verification solutions that comply with global regulations and standards.

Basis Theory

Basis Theory is a token orchestration platform that helps businesses route transactions through multiple payment service providers (PSPs) and partners, enabling seamless subscription payments while maintaining PCI compliance. The platform offers secure and transparent payment flows, allowing users to connect to any partner or platform, collect and store card data securely, and customize payment strategies for various use cases. Basis Theory empowers high-risk merchants, subscription platforms, marketplaces, fintechs, and other businesses to optimize their payment processes and enhance customer experiences.

Castello.ai

Castello.ai is a financial analysis tool that uses artificial intelligence to help businesses make better decisions. It provides users with real-time insights into their financial data, helping them to identify trends, risks, and opportunities. Castello.ai is designed to be easy to use, even for those with no financial background.

Persado Motivation AI

Persado Motivation AI is an Enterprise AI platform that generates, optimizes, and personalizes marketing language at scale. It offers a full stack GenAI platform with integrations for governance, security, and privacy capabilities. Persado caters to various industries such as Financial Services, Retail & Ecommerce, Telecommunications, and Travel & Hospitality, providing personalized outputs and superior outcomes at scale without risk.

Leiga

Leiga is an AI-powered project management tool designed for product teams to enhance productivity in planning, tracking, collaboration, and decision-making. It features a natural language AI assistant that helps in generating reports, analyzing projects, interacting with AI-powered bots, generating subtasks, writing PRD documents, team management, sprint tracking, risk assessment, workflow automation, usage reports, and more. Leiga aims to streamline project management processes and improve team efficiency through AI-driven functionalities.

AI for SEO

AI for SEO is a WordPress plugin designed to help websites rank higher in search results by providing AI-driven tools to enhance SEO efforts. It offers automated generation of metadata, alt text, image titles, captions, and descriptions, making SEO optimization convenient and efficient. The plugin supports various editor integrations and provides features like progress tracking, WooCommerce compatibility, and a free plan with credit rollover. Additionally, it offers a 100% money-back guarantee within 14 days of purchase, ensuring risk-free usage.

AI Credit Repair

AI Credit Repair is an AI-powered application designed to help users improve their credit score by providing tools such as credit card utilization builder, public records remover, dispute letter generator, and SMS alerts. The application assists users in managing their credit card payments, disputing collections, and staying on top of their credit-related activities. By leveraging artificial intelligence technology, AI Credit Repair aims to simplify the credit repair process and empower users to build a better financial future.

Intuit Assist

Intuit Assist is a generative AI-powered financial assistant designed to help you achieve financial confidence. It is a comprehensive platform that offers a wide range of financial tools and services, including TurboTax, Credit Karma, QuickBooks, and Mailchimp. Intuit Assist can help you with a variety of financial tasks, such as filing your taxes, managing your credit, tracking your expenses, and invoicing your clients. It is a valuable tool for anyone who wants to take control of their finances and achieve financial success.

SocialBee

SocialBee is an AI-powered social media management tool that helps businesses and individuals manage their social media accounts efficiently. It offers a range of features, including content creation, scheduling, analytics, and collaboration, to help users plan, create, and publish engaging social media content. SocialBee also provides insights into social media performance, allowing users to track their progress and make data-driven decisions.

SocialBee

SocialBee is an AI-powered social media management tool that helps businesses and individuals manage their social media accounts efficiently. It offers a range of features, including content creation, scheduling, analytics, and collaboration, to help users plan, create, and track their social media campaigns. SocialBee also provides access to a team of social media experts who can help users with their social media strategy and execution.

Clerkie

Clerkie is a powerful debt repayment and optimization platform that offers a full-service automation solution powered by machine learning and human expertise. It helps lenders, both big and small, to manage and optimize their loan portfolios efficiently. With features like smart payment experience, AI-driven repayment strategies, real-time reporting, and easy integration, Clerkie ensures a seamless and secure experience for lenders and borrowers alike.

UseCredits

UseCredits is a hassle-free credit-based billing integration that allows you to easily add credit-based billing to your Stripe or Paddle accounts. With UseCredits, you can set credits for your products, get automatic account top-ups, transparent account statements, analytics, and much more. UseCredits is flexible and un-opinionated, making it suitable for a variety of use cases, including generative AI SaaS, email or SMS API, and games and entertainment.

0 - Open Source AI Tools

20 - OpenAI Gpts

Credit & Collections Advisor

Manages credit risk and implements effective collection strategies.

Outsourcing-assistenten (finans)

Dansk vejledning i outsourcing regler for kreditinstitutter og datacentraler

Credit Card Companion

Balanced guidance on credit cards for young people, with a mix of formal and casual tones

Credit Card Advisor

Expert on credit cards, offering advice on choosing and using them wisely.

Couples Financial Planner

Aids couples in managing joint finances, budgeting for future goals, and navigating financial challenges together.

Debt Dodger

Avoid Debt Accumulation with Credit Card Interest Insights. Find out how much interest you will pay before you make that purchase with your credit card.

Finance Guide

Multilingual advisor on microfinance, focusing on clarity and educational content.

Debt Management Advisor

Advises on debt management strategies to improve financial stability.

Pay Later

Explains 'buy now, pay later' and recommends providers in a financial, informative tone.

Wettelijke rente berekenen

✅ Bereken de wettelijke rente in Nederland voor handelstransacties: 12 % per 1 juli 2023 en de wettelijke rente voor consumententransacties: 6 % per 1 juli 2023 hier: