Best AI tools for< Financial Data Scientist >

Infographic

20 - AI tool Sites

Evolution AI

Evolution AI is an AI data extraction tool that specializes in extracting data from financial documents such as financial statements, bank statements, invoices, and other related documents. The tool uses generative AI technology to automate the data extraction process, eliminating the need for manual entry. Evolution AI is trusted by global industry leaders and offers exceptional customer service, advanced technology, and a one-stop shop for data extraction.

Cape.ai

Cape.ai is an agentic AI platform designed for financial operations, offering AI-powered automation to enhance reach, insight, and efficiency in daily operations for financial firms. The platform is built on real-world customer use cases, providing tangible business ROI by integrating structured and unstructured data sources, automating complex manual processes, and offering context-aware insights. Users have control over their data and processes, with customizable workflows and human-in-the-loop capabilities. Cape.ai enables flexible implementation of agentic and deterministic automation, with seamless integrations for various financial workflows and direct access to leading financial data providers. The platform empowers users to create powerful AI agents without technical barriers, unlocking real business value with speed and confidence.

Envestnet | Yodlee

Envestnet | Yodlee is an AI-powered Conversational Banking platform that provides financial institutions and FinTech innovators with powerful data solutions. It offers a range of products and APIs for data aggregation, account verification, transaction data enrichment, financial wellness, and conversational AI. The platform enables personalized financial advice, secure account verification, and deep insights into customer needs, driving meaningful interactions. Envestnet | Yodlee revolutionizes the digital customer experience by leveraging natural language processing and machine learning to create seamless, personalized banking experiences across various channels.

Reportify

Reportify is an AI platform for investment research that provides detailed analysis and insights on various companies, filings, transcripts, reports, and news. Users can explore financial data, performance metrics, and market trends to make informed investment decisions. The platform offers a comprehensive view of the investment landscape, including company histories, financial reports, and industry analysis.

Bloomberg

Bloomberg is a leading global provider of financial data, news, and analytics. The company is known for its innovative technology solutions, including the Bloomberg Terminal, which revolutionized the industry by delivering critical insights and actionable information to financial decision-makers. Bloomberg is at the forefront of artificial intelligence, machine learning, and natural language processing, offering tools and automated workflows to help clients navigate the vast amount of data available in the financial markets. With a focus on engineering value for customers and keeping humans in the loop, Bloomberg continues to drive innovation and provide cutting-edge technology solutions for over 325,000 financial professionals worldwide.

AltIndex

AltIndex is an AI-powered investment analysis platform that provides unique AI stock picks, stock alerts, and alternative insights to help users make better investment decisions. The platform goes beyond traditional financial data by integrating various alternative data points such as job postings, website traffic, customer satisfaction, app downloads, and social media trends. AltIndex offers impactful insights and alerts, cutting-edge solutions to stay informed about companies in your portfolio, and advanced algorithms for real-time investment decision-making.

Conversational Finance

Vianai's Conversational Finance is an AI application that revolutionizes financial analysis by providing real-time insights through generative AI. It empowers finance teams to make informed decisions swiftly and confidently by scanning vast amounts of data, generating accurate responses, and streamlining processes. The platform offers unparalleled speed, precision, and user experience, making it easier to navigate complex financial landscapes and accomplish more in less time.

Bigdata.com

Bigdata.com is a platform that powers AI agents for finance, offering instant insights, accelerating research, automating workflows, and enhancing returns. It provides a complete data ecosystem, including a content store with web, paywalled, and internal data, and offers features like intelligent chat, market briefs, smart watchlists, and automated workflows. The platform is designed for investors, analysts, tech & innovation leaders, developers, and engineers in the finance industry, providing access to premium data, reliable search, and enterprise-grade governance.

Potato.trade

Potato.trade was a service that has been closed down as the company evolved into an AI Finance solutions company called Telescope. The website is no longer active, and users are encouraged to explore the new direction in AI-powered financial solutions at telescope.co.

VantedgeAI

VantedgeAI is an AI application that offers fine-tuned AI models for credit funds, revolutionizing credit investing workflows with faster, smarter, and cost-effective solutions. The application transforms manual processes into scalable, automated workflows tailored for Private Credit and Hedge Funds. VantedgeAI is trusted by market leaders to provide unique AI-driven insights, accelerate analysis, enhance accuracy, and ensure data security and privacy through SOC 2 compliance. The application automates investment memo generation, data extraction for Excel models, portfolio monitoring, loan reconciliation, smart bond screening, and real-time data querying with AI bots.

STRATxAI

STRATxAI is an AI-powered quantitative investment platform that offers custom AI model portfolios tailored to clients' investment philosophy, risk tolerance, and objectives. The platform harnesses machine learning to deliver data-driven insights for security analysis, portfolio construction, and management. Powered by the proprietary investment engine Alana, STRATxAI processes over 8 billion financial data points daily to uncover hidden alpha beyond traditional methods. Clients benefit from smarter decision-making, better risk-adjusted returns, optimized portfolio management, and savings on resources. The platform is designed to enhance investment decisions for forward-thinking investors by leveraging AI technology.

Beatandraise

Beatandraise is an AI-powered SEC filings research tool that provides users with access to every SEC filing since 1995. It offers a free alternative to BamSec, allowing users to view original financial statements, ask questions with AI-powered analysis, and browse filings with 100% coverage. The platform enables users to access the complete filing history for any public company, including 10-Ks, 10-Qs, 8-Ks, and proxy statements. Users can view actual financial statements with original formatting preserved, download tables to Excel, and utilize AI-powered search to find specific disclosures or risk factors across years of filings. Additionally, Beatandraise offers an AI chat assistant for asking questions and getting answers, as well as a MCP server for developers to integrate SEC filing data directly into their AI workflows.

FlowX.AI

FlowX.AI is a Multi-Agent AI Platform designed for Banking and Insurance Modernization. It offers a cutting-edge AI-native agentic platform for building and deploying AI agents and mission-critical AI-enabled systems in highly regulated industries. The platform enables businesses to build the next generation of banking and insurance systems in weeks, not years, by providing faster development, time to market, and reduced maintenance and implementation costs.

JesseZhang.org

Jesse Zhang's personal website showcases his background in engineering, particularly in web development, AI/ML, and mathematics. He highlights his education at Harvard University and internships at renowned companies like Citadel, Google, and Intel. Zhang also mentions his entrepreneurial ventures, including founding Lowkey, which was acquired by Niantic, and his current work on a new company. The website features various projects he has worked on, such as real-time multiplayer implementations of Camel Up and Bananagrams, a financial data visualization tool, and a demo of Zero-Knowledge proofs in the game Mastermind. Additionally, Zhang shares his interest in writing math contest problems and his involvement in angel investing through Sequoia Scouts and Neo.

Perfios

Perfios is an AI-powered FinTech software company that offers digital solutions for various industries such as banking, insurance, fintech, payments, e-commerce, legal, gaming, and more. Their platform provides end-to-end solutions for digital onboarding, underwriting, risk assessment, fraud detection, and customer engagement. Perfios leverages AI and machine learning technologies to streamline processes, enhance operational efficiency, and improve decision-making in financial services. With a wide range of products and features, Perfios aims to transform the way businesses experience technology and make data-driven decisions.

Kudra

Kudra is an AI-powered data extraction tool that offers dedicated solutions for finance, human resources, logistics, legal, and more. It effortlessly extracts critical data fields, tables, relationships, and summaries from various documents, transforming unstructured data into actionable insights. Kudra provides customizable AI models, seamless integrations, and secure document processing while supporting over 20 languages. With features like custom workflows, model training, API integration, and workflow builder, Kudra aims to streamline document processing for businesses of all sizes.

Stockpulse

Stockpulse is an AI-powered platform that analyzes financial news and communities using Artificial Intelligence. It provides decision support for operations by collecting, filtering, and converting unstructured data into processable information. With extensive coverage of financial media sources globally, Stockpulse offers unique historical data, sentiment analysis, and AI-driven insights for various sectors in the financial markets.

Orbital Insight GO Platform

Orbital Insight is a leading geospatial data analytics platform that provides users with the ability to query the world with three basic parameters: WHAT type of activity? WHERE on earth? WHEN? The platform automates the most difficult steps of deriving insights, allowing you to answer many challenging geospatial questions. Orbital Insight's GO platform is designed for enterprise collaboration and transforms multiple geospatial data sources to accelerate and streamline team member's research, reporting, due diligence, and more.

TrendEdge

TrendEdge is an AI-driven platform that revolutionizes investment strategies by providing comprehensive insights through the analysis of real-time social trends and alternative data sources. It offers exclusive data access, AI-powered stock signals, and personalized recommendations to help users make informed and confident investment decisions. The platform integrates diverse data sources, including social media sentiment, technical indicators, and fundamental analysis, to provide a nuanced market view and uncover hidden trends.

Vizly

Vizly is an AI-powered data analysis tool that empowers users to make the most of their data. It allows users to chat with their data, visualize insights, and perform complex analysis. Vizly supports various file formats like CSV, Excel, and JSON, making it versatile for different data sources. The tool is free to use for up to 10 messages per month and offers a student discount of 50%. Vizly is suitable for individuals, students, academics, and organizations looking to gain actionable insights from their data.

4 - Open Source Tools

jupyter-quant

Jupyter Quant is a dockerized environment tailored for quantitative research, equipped with essential tools like statsmodels, pymc, arch, py_vollib, zipline-reloaded, PyPortfolioOpt, numpy, pandas, sci-py, scikit-learn, yellowbricks, shap, optuna, ib_insync, Cython, Numba, bottleneck, numexpr, jedi language server, jupyterlab-lsp, black, isort, and more. It does not include conda/mamba and relies on pip for package installation. The image is optimized for size, includes common command line utilities, supports apt cache, and allows for the installation of additional packages. It is designed for ephemeral containers, ensuring data persistence, and offers volumes for data, configuration, and notebooks. Common tasks include setting up the server, managing configurations, setting passwords, listing installed packages, passing parameters to jupyter-lab, running commands in the container, building wheels outside the container, installing dotfiles and SSH keys, and creating SSH tunnels.

jupyter-quant

Jupyter Quant is a dockerized environment tailored for quantitative research, equipped with essential tools like statsmodels, pymc, arch, py_vollib, zipline-reloaded, PyPortfolioOpt, numpy, pandas, sci-py, scikit-learn, yellowbricks, shap, optuna, and more. It provides Interactive Broker connectivity via ib_async and includes major Python packages for statistical and time series analysis. The image is optimized for size, includes jedi language server, jupyterlab-lsp, and common command line utilities. Users can install new packages with sudo, leverage apt cache, and bring their own dot files and SSH keys. The tool is designed for ephemeral containers, ensuring data persistence and flexibility for quantitative analysis tasks.

ai_quant_trade

The ai_quant_trade repository is a comprehensive platform for stock AI trading, offering learning, simulation, and live trading capabilities. It includes features such as factor mining, traditional strategies, machine learning, deep learning, reinforcement learning, graph networks, and high-frequency trading. The repository provides tools for monitoring stocks, stock recommendations, and deployment tools for live trading. It also features new functionalities like sentiment analysis using StructBERT, reinforcement learning for multi-stock trading with a 53% annual return, automatic factor mining with 5000 factors, customized stock monitoring software, and local deep reinforcement learning strategies.

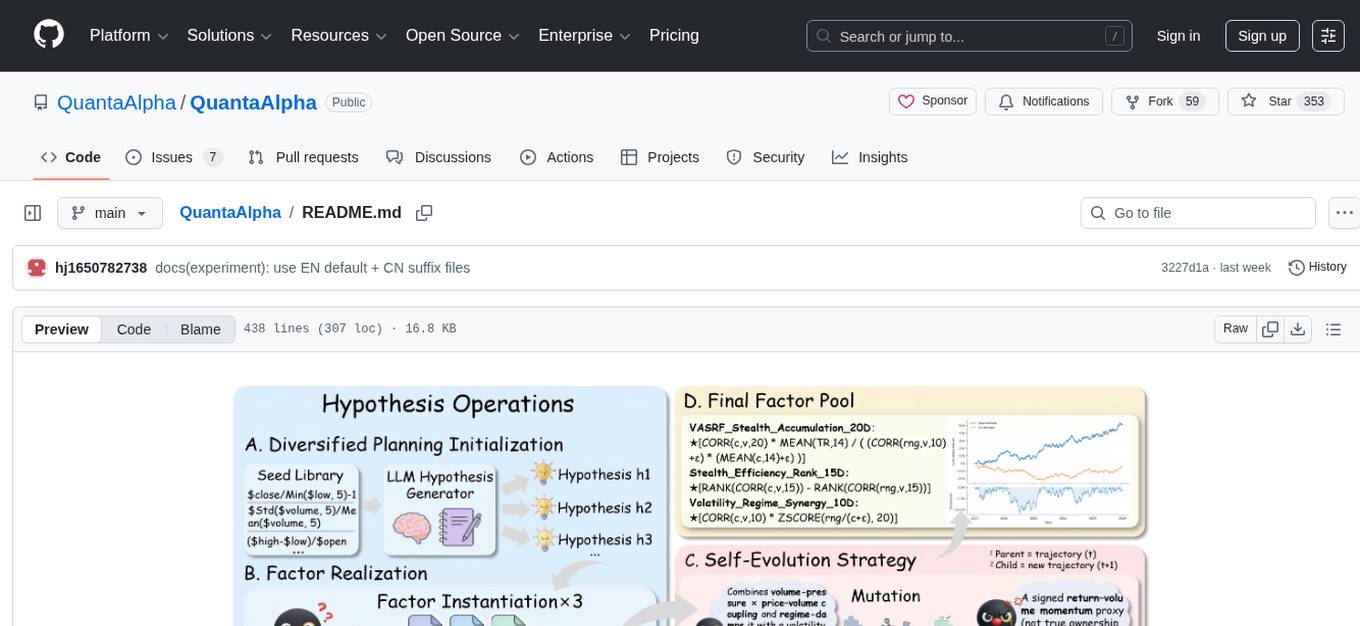

QuantaAlpha

QuantaAlpha is a framework designed for factor mining in quantitative alpha research. It combines LLM intelligence with evolutionary strategies to automatically mine, evolve, and validate alpha factors through self-evolving trajectories. The framework provides a trajectory-based approach with diversified planning initialization and structured hypothesis-code constraint. Users can describe their research direction and observe the automatic factor mining process. QuantaAlpha aims to transform how quantitative alpha factors are discovered by leveraging advanced technologies and self-evolving methodologies.

20 - OpenAI Gpts

Strategic Planning Advisor

Guides financial strategy through data analysis and forecasting.

wallstreetbets advisor

Analyzes r/wallstreetbets for top topics, trends, and potential financial advice.

Alas Data Analytics Student Mentor

Salam mən Alas Academy-nin Data Analitika üzrə Süni İntellekt mentoruyam. Mənə istənilən sualı verə bilərsiniz :)

Illuminous - The Data Exploration AI

Expert in data analysis, visualizations, and predictions.

Data Analysis & Report AI

Your expert in limitless, detailed scientific data analysis and reporting

Emmi Data Analysis and Visualizer

Expert in data analysis and visualization, offering clear explanations and guidance.

Data Insight Guru

Concise stats, data analysis, and viz expert. Clear, brief, asks for clarifications.

Data Analysis Report Creator

Creates full DOCX data analysis reports with integrated visualizations

Nimbus

Expert in CFA, quant, software engineering, data science, and economics for investment strategies.