Best AI tools for< Ai Risk Manager >

Infographic

20 - AI tool Sites

Credo AI

Credo AI is a leading provider of AI governance, risk management, and compliance solutions. The company's platform helps organizations to track, prioritize, and control AI projects to ensure that AI remains profitable, compliant, and safe. Credo AI's platform is used by a variety of organizations, including Fortune 500 companies, government agencies, and non-profit organizations.

Credo AI

Credo AI is a leading provider of AI governance, risk management, and compliance software. Our platform helps organizations to adopt AI safely and responsibly, while ensuring compliance with regulations and standards. With Credo AI, you can track and prioritize AI projects, assess AI vendor models for risk and compliance, create artifacts for audit, and more.

Monitaur

Monitaur is an AI governance software that provides a comprehensive platform for organizations to manage the entire lifecycle of their AI systems. It brings together data, governance, risk, and compliance teams onto one platform to mitigate AI risk, leverage full potential, and turn intention into action. Monitaur's SaaS products offer user-friendly workflows that document the lifecycle of AI journey on one platform, providing a single source of truth for AI that stays honest.

Lumenova AI

Lumenova AI is an AI platform that focuses on making AI ethical, transparent, and compliant. It provides solutions for AI governance, assessment, risk management, and compliance. The platform offers comprehensive evaluation and assessment of AI models, proactive risk management solutions, and simplified compliance management. Lumenova AI aims to help enterprises navigate the future confidently by ensuring responsible AI practices and compliance with regulations.

FairNow

FairNow is an AI governance platform that simplifies and centralizes AI risk management at scale. It provides audit-ready compliance, automated bias audits, customizable AI governance tools, and seamless data integration options. FairNow ensures organization-wide oversight, meticulous organization, and unwavering accountability, helping organizations align AI projects with compliance requirements and ethical standards.

Tenable AI Exposure

Tenable AI Exposure is an AI tool that helps organizations secure and understand their use of AI platforms. It provides visibility, context, and control to manage risks from enterprise AI platforms, enabling security leaders to govern AI usage, enforce policies, and prevent exposures. The tool allows users to track AI platform usage, identify and fix AI misconfigurations, protect against AI exploitation, and deploy quickly with industry-leading security for AI platform use.

AI Safety Initiative

The AI Safety Initiative is a premier coalition of trusted experts that aims to develop and deliver essential AI guidance and tools for organizations to deploy safe, responsible, and compliant AI solutions. Through vendor-neutral research, training programs, and global industry experts, the initiative provides authoritative AI best practices and tools. It offers certifications, training, and resources to help organizations navigate the complexities of AI governance, compliance, and security. The initiative focuses on AI technology, risk, governance, compliance, controls, and organizational responsibilities.

Modulos

Modulos is a Responsible AI Platform that integrates risk management, data science, legal compliance, and governance principles to ensure responsible innovation and adherence to industry standards. It offers a comprehensive solution for organizations to effectively manage AI risks and regulations, streamline AI governance, and achieve relevant certifications faster. With a focus on compliance by design, Modulos helps organizations implement robust AI governance frameworks, execute real use cases, and integrate essential governance and compliance checks throughout the AI life cycle.

Fairo

Fairo is a platform that facilitates Responsible AI Governance, offering tools for reducing AI hallucinations, managing AI agents and assets, evaluating AI systems, and ensuring compliance with various regulations. It provides a comprehensive solution for organizations to align their AI systems ethically and strategically, automate governance processes, and mitigate risks. Fairo aims to make responsible AI transformation accessible to organizations of all sizes, enabling them to build technology that is profitable, ethical, and transformative.

datasurfr

datasurfr is an AI-driven risk monitoring and analysis platform augmented by human intelligence. It provides operational risk data and intelligence that is curated, customized, and comprehensive. The platform offers tailored alerts detected by AI, curated by surfers, and analyzed by subject matter experts for global security teams. datasurfr also offers predictive risk analytics, proactive alert risk assessment, resilience strategy, data-driven decision-making, supply chain resilience, dynamic incident response, regulatory compliance, and future-proofing strategies. The platform's algorithm works on AI detection and structuring, while human-based smart curation eliminates irrelevant data. Subject matter experts provide event summaries with insights and recommendations. datasurfr offers multi-modal communication through intuitive dashboards, mobile apps, emails, WhatsApp, and seamless APIs for versatile consumption.

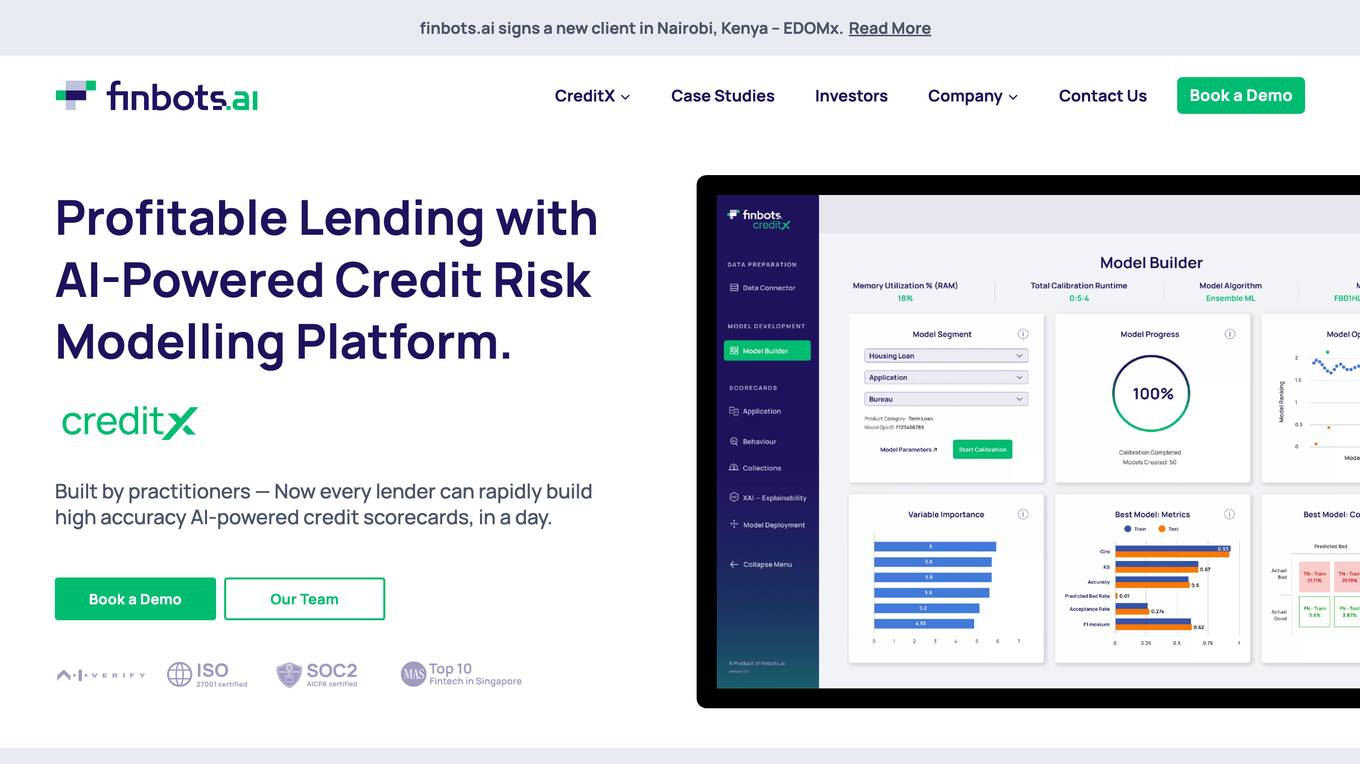

Finbots.ai

Finbots.ai is a trusted AI credit risk platform that offers AI credit scoring to boost lending profits and reduce non-performing loans. The platform provides the highest accuracy in the market, allowing users to build scorecards in a day without the need for coding. It helps in making instant decisions, increasing revenue, reducing risk, and improving operational efficiency. Finbots.ai is utilized by various financial institutions to enhance credit risk management, improve profitability, and drive down the cost of risk through AI-enabled models.

Relyance AI

Relyance AI is a platform that offers 360 Data Governance and Trust solutions. It helps businesses safeguard against fines and reputation damage while enhancing customer trust to drive business growth. The platform provides visibility into enterprise-wide data processing, ensuring compliance with regulatory and customer obligations. Relyance AI uses AI-powered risk insights to proactively identify and address risks, offering a unified trust and governance infrastructure. It offers features such as data inventory and mapping, automated assessments, security posture management, and vendor risk management. The platform is designed to streamline data governance processes, reduce costs, and improve operational efficiency.

Tookitaki

Tookitaki is an AI-powered AML & Financial Crime Compliance Platform that offers end-to-end solutions for AML and fraud prevention. It provides AI-driven risk detection, real-time fraud prevention, prospect screening, risk scoring, alert prioritization, and case management. The platform is designed to help financial institutions enhance their AML risk management, reduce false positives, and meet regulatory requirements effectively.

Feedzai

Feedzai is an AI-native Fraud & Financial Crime Prevention Platform that uses purpose-built AI to stop fraud and lower compliance costs. The platform covers the entire financial crime lifecycle, from account opening to fraud prevention to AML compliance. It applies behavioral analytics to detect and prevent fraud, reduces AML compliance costs, and empowers customers to stop scams before they happen. Feedzai is trusted by global financial leaders and helps protect billions of consumers worldwide while enabling better customer experiences.

Underwrite.ai

Underwrite.ai is a platform that leverages advances in artificial intelligence and machine learning to provide lenders with nonlinear, dynamic models of credit risk. By analyzing thousands of data points from credit bureau sources, the application accurately models credit risk for consumers and small businesses, outperforming traditional approaches. Underwrite.ai offers a unique underwriting methodology that focuses on outcomes such as profitability and customer lifetime value, allowing organizations to enhance their lending performance without the need for capital investment or lengthy build times. The platform's models are continuously learning and adapting to market changes in real-time, providing explainable decisions in milliseconds.

MindBridge

MindBridge is a global leader in financial risk discovery and anomaly detection. The MindBridge AI Platform drives insights and assesses risks across critical business operations. It offers various products like General Ledger Analysis, Company Card Risk Analytics, Payroll Risk Analytics, Revenue Risk Analytics, and Vendor Invoice Risk Analytics. With over 250 unique machine learning control points, statistical methods, and traditional rules, MindBridge is deployed to over 27,000 accounting, finance, and audit professionals globally.

Constella Intelligence

Constella Intelligence is a world-class identity protection and identity risk intelligence platform powered by AI and the world's largest breach data lake. It offers solutions for API integrations, identity theft monitoring, threat intelligence, identity fraud detection, digital risk protection services, executive and brand protection, OSINT cybercrime investigations, and threat monitoring and alerting. Constella provides precise and timely alerts, in-depth real-time identity data signals, and enhanced situational awareness to help organizations combat cyber threats effectively.

Fordi

Fordi is an AI management tool that helps businesses avoid risks in real-time. It provides a comprehensive view of all AI systems, allowing businesses to identify and mitigate risks before they cause damage. Fordi also provides continuous monitoring and alerting, so businesses can be sure that their AI systems are always operating safely.

Scienaptic Systems

Scienaptic Systems is an AI-powered Credit Decisioning Platform that revolutionizes the lending industry by automating credit underwriting processes, leveraging alternate data points, and offering self-learning models for instant credit decisions. The platform helps lenders identify creditworthy borrowers, streamline customer experience, and ensure fair lending practices through explainable AI models. Scienaptic's suite of AI-enabled technologies enables lenders to say 'Yes' to more borrowers at lower risk, providing a 360-degree risk assessment before approving applications. The platform integrates seamlessly with existing lending ecosystems, ensuring disruption-free deployment and better risk predictions through a single API call.

Dataminr

Dataminr is a leading provider of real-time event and risk detection. Its AI platform processes billions of public data units daily to deliver real-time alerts on high-impact events and emerging risks. Dataminr's products are used by businesses, public sector organizations, and newsrooms to plan for and respond to crises, manage risks, and stay informed about the latest events.

0 - Open Source Tools

20 - OpenAI Gpts

GPT Safety Liaison

A liaison GPT for AI safety emergencies, connecting users to OpenAI experts.

Technical Service Agreement Review Expert

Review your tech service agreements 24/7, find legal risk and give suggestions. (Powered by LegalNow ai.legalnow.xyz)

Compliance Officer

Oversees company compliance, managing risk and audits, with a focus on staying current with regulations and software.

Sherlock AI

A master detective GPT, adept in analysis, deduction, and intuitive problem-solving.

Crypto Guardian: Crypto Regulatory AI Advisor

Global Crypto AI Regulatory Advisor Fined Tuned by A&V: Providing Guidance On Crypto Regulations Globally

Ai Trading Indicator Creator

Specializing in AI-driven trading indicators, offering innovative, data-driven solutions for traders and investors seeking enhanced market analysis and decision-making tools.

MPM-AI

The Multiversal Prediction Matrix (MPM) leverages the speculative nature of multiverse theories to create a predictive framework. By simulating parallel universes with varied parameters, MPM explores a multitude of potential outcomes for different events and phenomena.

AI and Insurance Strategy Consultant

Formal yet witty AI & Insurance expert. Powered by Breebs (www.breebs.com)

Your AI Ethical Guide

Trained in kindness, empathy & respect based on ethics from global philosophies

Regulations.AI

Ask about AI regulations, in any language............ ZH: 询问有关人工智能的规定。DE: Fragen Sie nach KI-Regulierungen. FR: Demandez des informations sur les réglementations de l'IA. ES: Pregunte sobre las regulaciones de IA.

MarketMaster AI.

Dynamic financial expert with a multifaceted approach to market analysis.