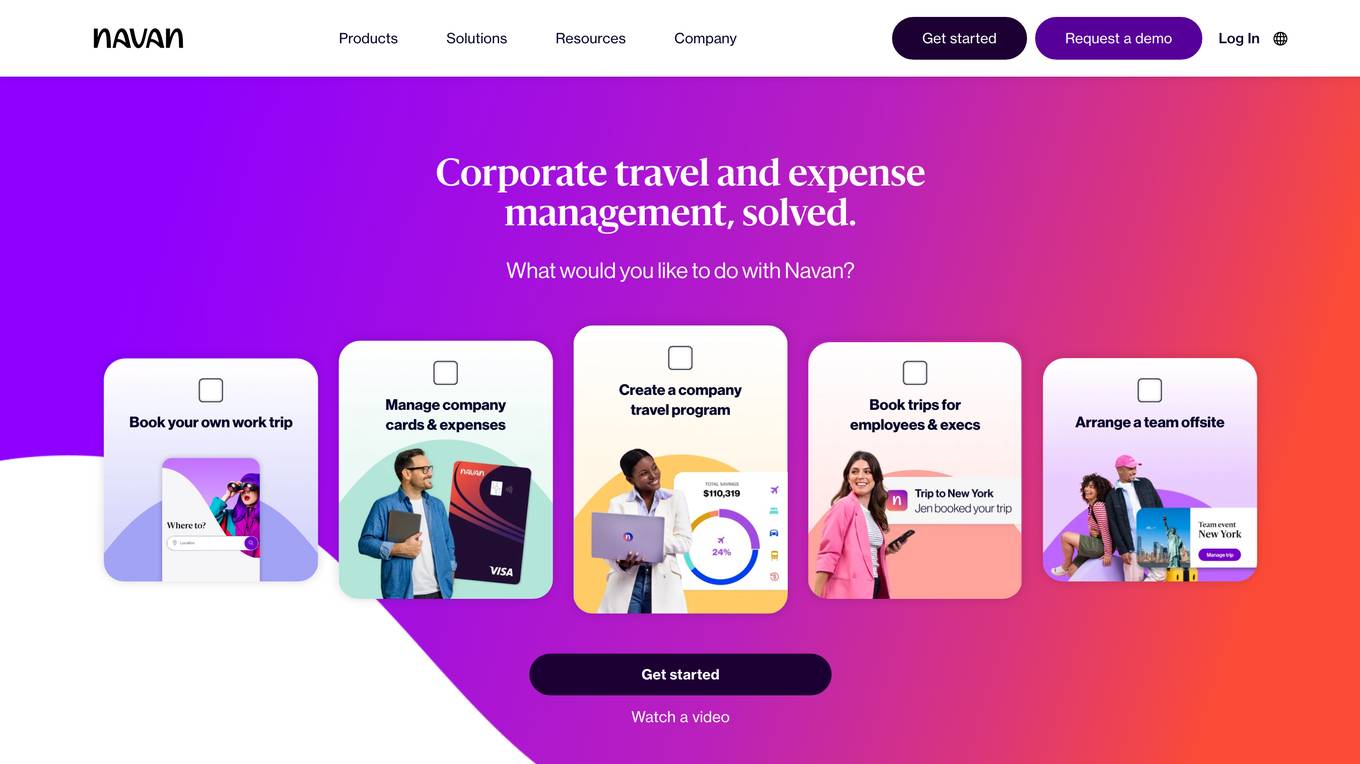

Klarna

Shop now. Pay later.

Monthly visits:50051636

Description:

Klarna is a Swedish fintech company that provides online financial services such as payments, shopping, and personal finance. It was founded in 2005 and is headquartered in Stockholm, Sweden. Klarna has over 90 million active users in 17 countries. The company's mission is to make shopping smooth, safe, and fun. Klarna offers a variety of payment options, including pay now, pay later, and monthly installments. It also offers a shopping app that allows users to browse and purchase products from a variety of retailers. Klarna's personal finance products include a savings account and a credit card.

For Tasks:

For Jobs:

Features

- Pay for your purchases over time with Klarna's flexible payment options.

- Shop from a variety of retailers with Klarna's shopping app.

- Manage your finances with Klarna's personal finance products.

- Get rewarded for shopping with Klarna's loyalty program.

- Enjoy a smooth and secure shopping experience with Klarna.

Advantages

- Klarna's flexible payment options allow you to budget your purchases and avoid paying interest.

- Klarna's shopping app makes it easy to find and purchase products from a variety of retailers.

- Klarna's personal finance products can help you save money and manage your debt.

- Klarna's loyalty program rewards you for shopping with Klarna.

- Klarna's customer service is available 24/7 to help you with any questions or concerns.

Disadvantages

- Klarna's fees can be high if you don't pay your balance on time.

- Klarna's credit reporting can impact your credit score.

- Klarna is not available in all countries.

Frequently Asked Questions

-

Q:How do I use Klarna?

A:To use Klarna, you first need to create an account. Once you have an account, you can add Klarna to your checkout on any participating retailer's website. You can then choose to pay for your purchase now, pay later, or in monthly installments. -

Q:What are the fees for using Klarna?

A:Klarna charges a variety of fees, including a late payment fee, a returned payment fee, and a currency conversion fee. The specific fees that you will be charged will depend on the payment option that you choose and the country in which you live. -

Q:How does Klarna affect my credit score?

A:Klarna reports your payment history to credit bureaus. If you make your payments on time, Klarna can help you build your credit score. However, if you miss payments, Klarna can negatively impact your credit score.

Alternative AI tools for Klarna

For similar jobs

Gestualy

Measure and improve your customers' satisfaction and mood quickly and easily through gestures.

site

: 325