Convr

Commercial Insurance Underwriting on Steroids

Monthly visits:14003

Description:

Convr is a modularized AI underwriting and intelligent document automation workbench that enriches and expedites the commercial insurance new business and renewal submission flow with underwriting insights, business classification and risk scoring. As a trusted technology partner and advisor with deep industry expertise, we help insurance organizations transform their underwriting operations through our AI-driven digital underwriting analysis platform.

For Tasks:

For Jobs:

Features

- AI-driven digital underwriting analysis platform

- Submission to quote with a frictionless process enriched by AI decisioning

- Empowers commercial property and casualty (P&C) carriers with modern end-to-end underwriting management

- Patented-AI decisioning engine that transforms the underwriting experience

- Improves profitability, increases efficiency, and reduces risk

Advantages

- Expands capacity, gains competitive advantage, and grows revenue

- Identifies more or less risky submissions and segments

- Prioritizes submissions to rapidly narrow risks within appetite

- Reduces data gathering touchpoints and time associated with record retrieval and validation

- Calibrates individual risks and predicts those most likely to experience a loss

Disadvantages

- May require significant investment in implementation and training

- Reliance on AI algorithms may limit flexibility and customization

- Potential for bias in AI decision-making if not properly trained

Frequently Asked Questions

-

Q:What is Convr?

A:Convr is a modularized AI underwriting and intelligent document automation workbench that enriches and expedites the commercial insurance new business and renewal submission flow with underwriting insights, business classification and risk scoring. -

Q:What are the benefits of using Convr?

A:Convr offers a range of benefits, including improved profitability, increased efficiency, reduced risk, and enhanced underwriting experience. -

Q:How does Convr work?

A:Convr utilizes a patented-AI decisioning engine that analyzes data and provides insights to help insurers make better underwriting decisions. -

Q:Is Convr easy to use?

A:Yes, Convr is designed to be user-friendly and intuitive, with a range of features to streamline the underwriting process. -

Q:How much does Convr cost?

A:Convr offers a range of pricing options to suit different needs and budgets.

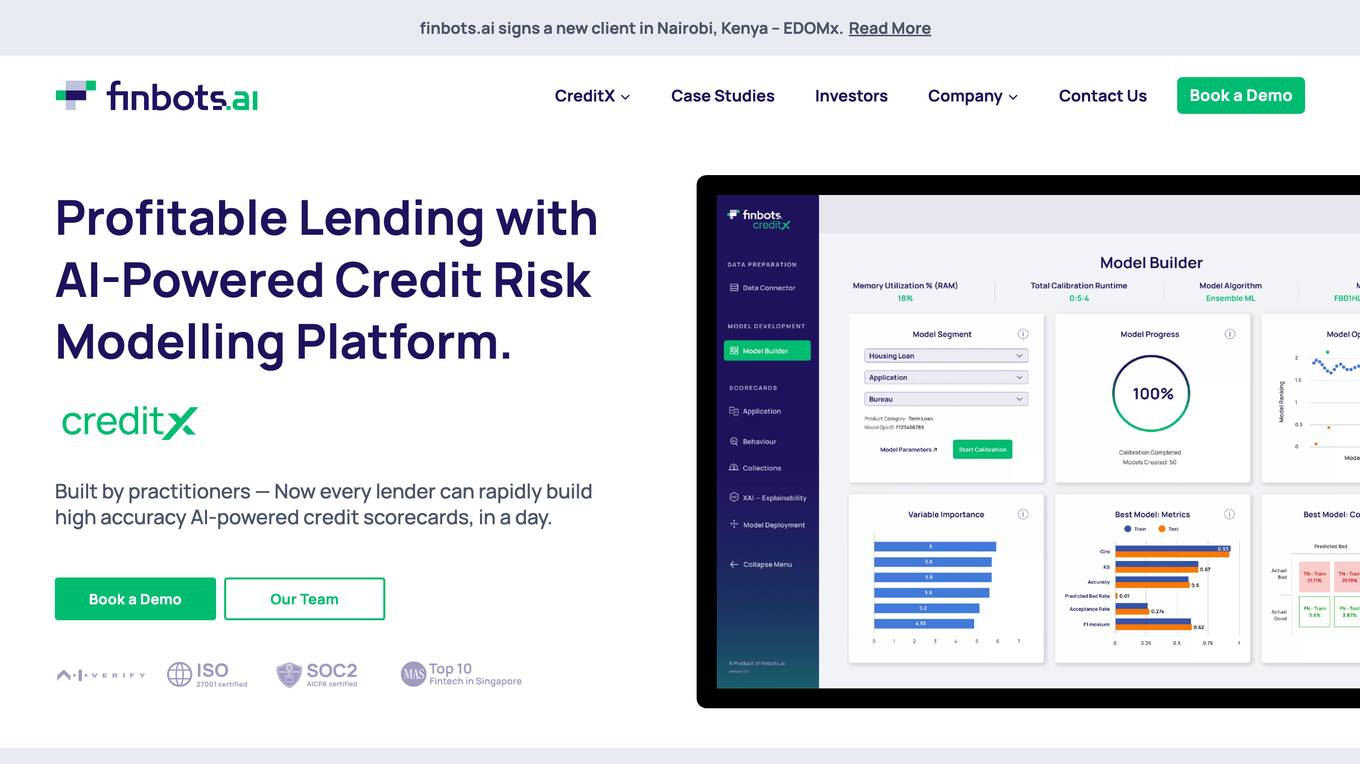

Alternative AI tools for Convr

For similar jobs

Polymath Robotics

Effortlessly add autonomous navigation to any industrial vehicle, so you can focus on what makes your customers tick.

site

: 28.1k