Best AI tools for< Analyze Financial Risk >

20 - AI tool Sites

Quill AI

Quill is an AI-powered SEC filing platform that allows users to extract key information from filings, answer questions about public investor materials, access historical financial data, and receive real-time SEC filings and earnings call transcripts. The platform leverages financially-tuned AI to provide accurate and up-to-date information, making it a valuable tool for analysts and professionals in the finance industry.

Castello.ai

Castello.ai is a financial analysis tool that uses artificial intelligence to help businesses make better decisions. It provides users with real-time insights into their financial data, helping them to identify trends, risks, and opportunities. Castello.ai is designed to be easy to use, even for those with no financial background.

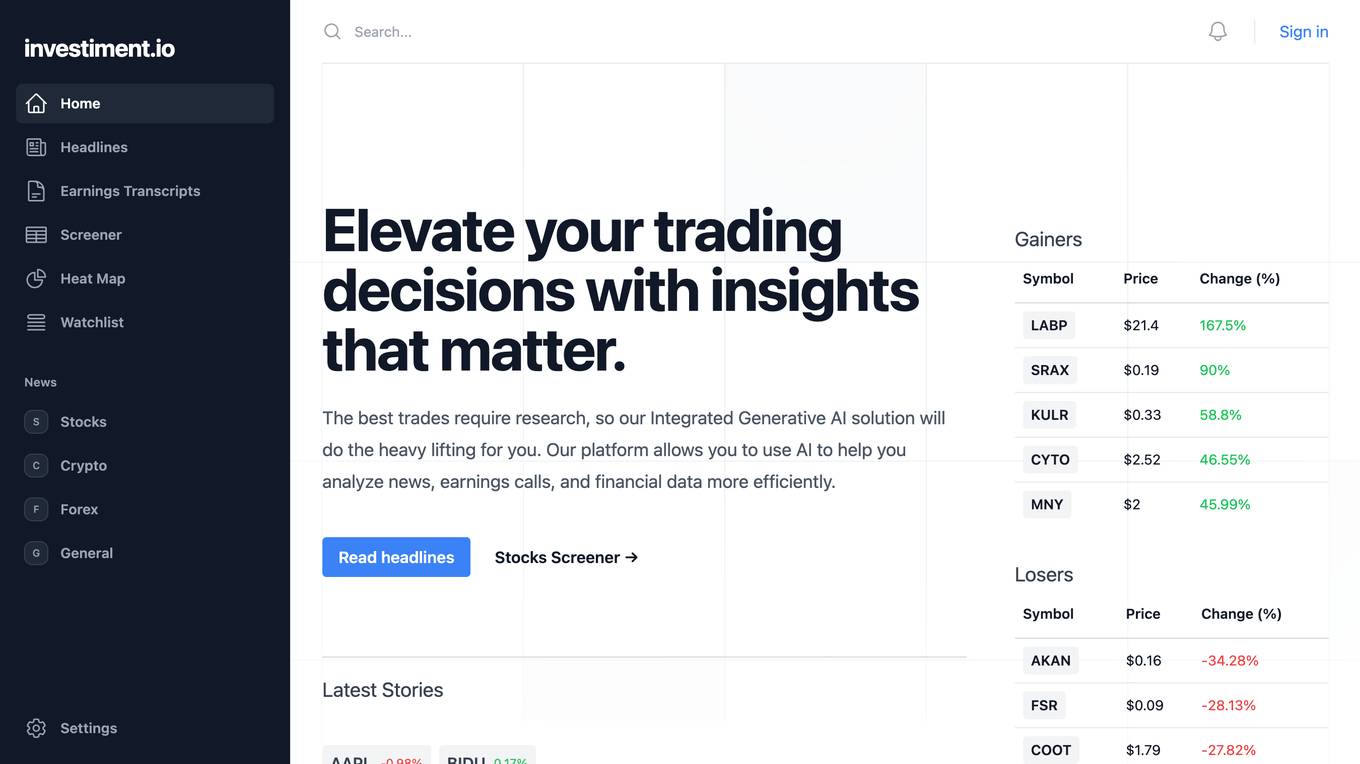

Investiment.io

Investiment.io is a financial news and data platform that uses AI to help investors make better decisions. The platform provides access to real-time news, earnings transcripts, and financial data, as well as AI-powered insights and analysis. Investiment.io is designed to help investors of all levels, from beginners to experienced professionals.

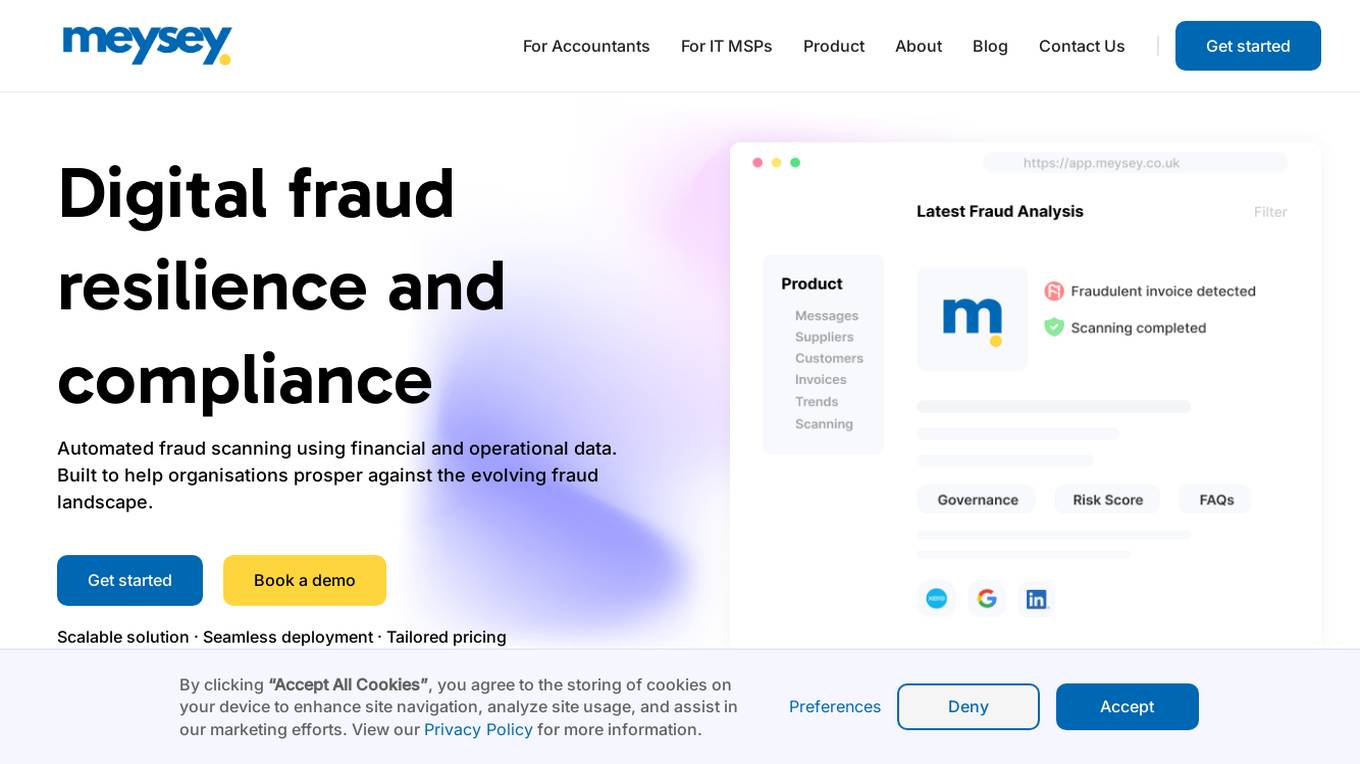

Meysey

Meysey is an AI fraud protection application designed for accountants and IT managed service providers. It offers automated fraud scanning using financial and operational data to help organizations prosper against the evolving fraud landscape. Meysey provides scalable solutions with seamless deployment and tailored pricing, enabling users to gain visibility of bribery and corruption risk, identify conflicts of interest, baseline financial patterns, and comply with fraud legislation. The application integrates with finance and business operations tools to analyze data across the commercial landscape, providing actionable insights to enhance business resilience and reduce fraud risk.

Thomson Reuters

Thomson Reuters is a leading provider of business information services. The company provides a wide range of products and services to professionals in the legal, tax, accounting, and risk management industries. Thomson Reuters' products and services include news and information, research and analysis, software and technology, and education and training. The company has a global presence with operations in over 100 countries.

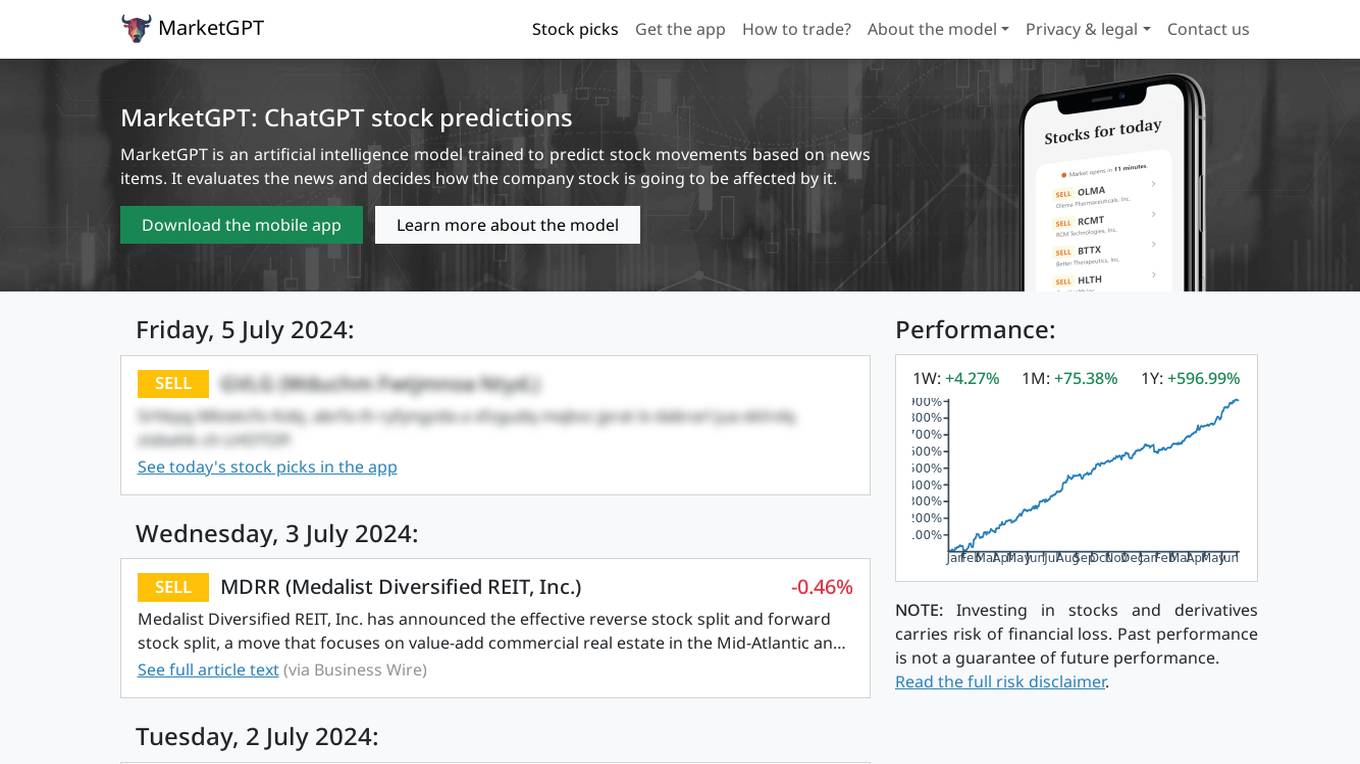

MarketGPT

MarketGPT is an artificial intelligence model trained to predict stock movements based on news items. It evaluates the news and decides how the company stock is going to be affected by it. Users can access the model through the MarketGPT website or mobile app to get stock predictions and picks. The model's performance can be viewed for different time frames such as 1 week, 1 month, and 1 year. However, users are advised that investing in stocks and derivatives carries a risk of financial loss, and past performance is not a guarantee of future performance. MarketGPT is designed to assist users in making informed decisions in the stock market.

Fraud.net

Fraud.net is an AI-powered fraud detection and prevention platform designed for enterprises. It offers a comprehensive and customizable solution to manage and prevent financial fraud and risks. The platform utilizes AI and machine learning technologies to provide real-time monitoring, analytics, and reporting, helping businesses in various industries to combat fraud effectively. Fraud.net's solutions are trusted by CEOs, directors, technology and security officers, fraud managers, and analysts to ensure trust and beat fraud at every step of the customer lifecycle.

FINQ

FINQ is an AI-driven platform designed to help users build dynamic investment portfolios, follow model portfolios, and optimize investments effortlessly. The platform offers AI-based stocks portfolios with three distinct strategies to outperform the S&P. FINQ assesses financial product risk daily using a data-driven approach and provides users with 100% objectivity by eliminating biases. The AI engine monitors the market 24/7, ensuring users are aware of investment opportunities and offers risk-guided investing to match products with comfort levels.

Perfios

Perfios is an AI-powered FinTech software company that offers digital solutions for various industries such as banking, insurance, fintech, payments, e-commerce, legal, gaming, and more. Their platform provides end-to-end solutions for digital onboarding, underwriting, risk assessment, fraud detection, and customer engagement. Perfios leverages AI and machine learning technologies to streamline processes, enhance operational efficiency, and improve decision-making in financial services. With a wide range of products and features, Perfios aims to transform the way businesses experience technology and make data-driven decisions.

RiskAssessmentAI

RiskAssessmentAI is an AI-powered platform designed to provide accurate risk assessment solutions for businesses across various industries. The application leverages advanced machine learning algorithms to analyze data and identify potential risks, helping organizations make informed decisions to mitigate threats and optimize their operations. With a user-friendly interface and customizable features, RiskAssessmentAI offers a comprehensive risk management solution that enhances decision-making processes and improves overall business performance.

NICE Actimize

NICE Actimize is an AI-driven platform that offers solutions for combatting financial crime, including Anti-Money Laundering (AML), Enterprise Fraud Management, Financial Markets Compliance, Investigation and Case Management, and Data Intelligence. The platform utilizes AI and machine learning to optimize efficacy, accuracy, and regulatory compliance coverage in the fight against financial crime.

NextGenAI

NextGenAI is an AI application focused on the financial services industry. It aims to challenge the current perception of AI and its role in banking and financial institutions. The platform explores innovative ways to augment human intelligence and propel the financial sector into the next generation of AI. Through a combination of keynotes, panels, demos, and workshops, NextGenAI facilitates discussions on AI regulations, industry best practices, and collaboration opportunities.

Cape.ai

Cape.ai is an AI-powered platform designed to enhance business process operations in the financial sector. It offers solutions for loan servicing, risk operations, trust operations, and more. The platform enables users to leverage agentic AI for increased efficiency, insights, and automation across various daily operations in financial firms. Cape.ai is built from real-world customer use cases and provides tangible business ROI by integrating structured and unstructured data sources, automating complex manual processes, and offering context-aware insights.

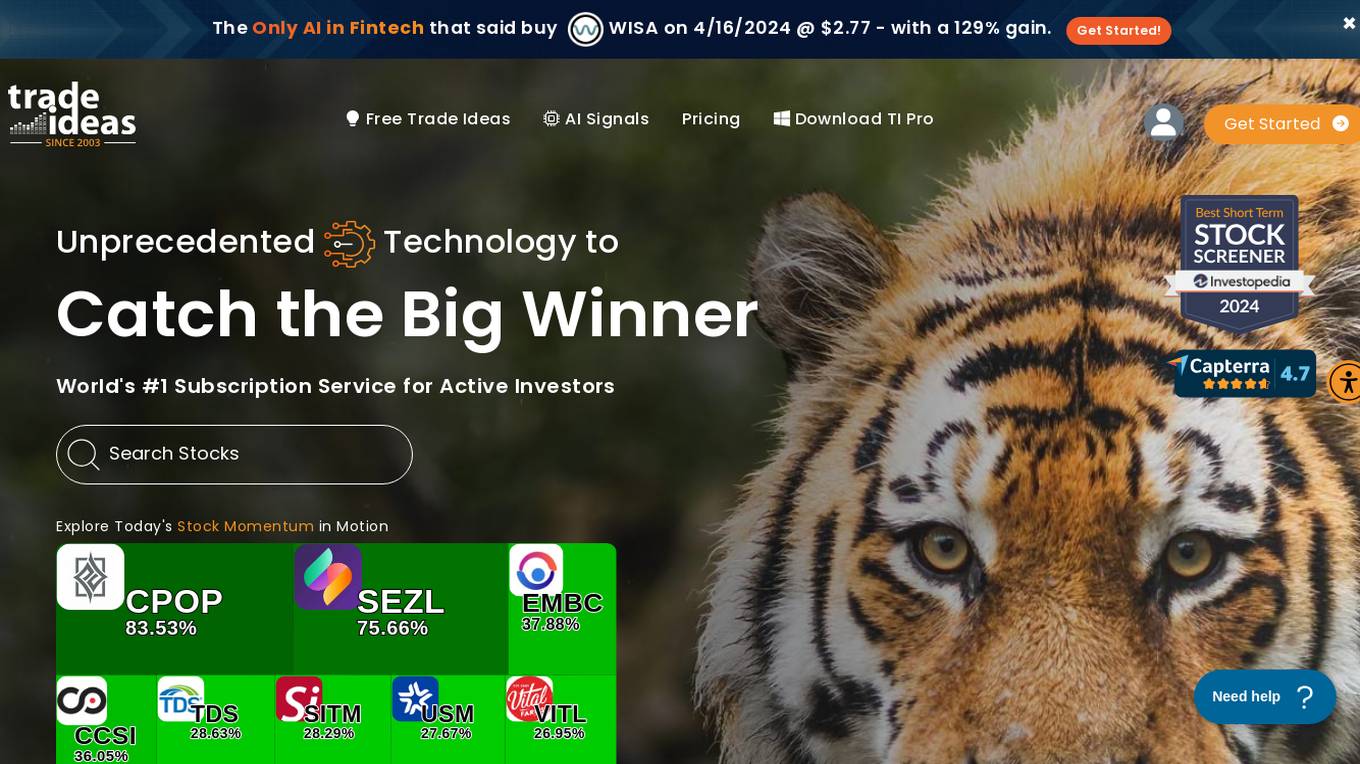

Trade Ideas

Trade Ideas is an AI-driven stock scanning and charting platform that provides unmatched precision in finding the biggest movers first. It offers AI-powered Buy/Sell signals, real-time market scanning, customizable alerts, advanced charting capabilities, and time-saving data visualization. Users can access the platform on any device, empowering them to make smarter trading decisions and stay ahead of the game. Trade Ideas also features a live trading room with expert market commentary and a simulator for practicing new trading strategies under actual market conditions. The platform is trusted by leading brokers and trading platforms, offering users a competitive edge in the market.

Trade Ideas

Trade Ideas is an AI-driven stock scanning and charting platform designed to meet the needs of active traders. It provides powerful tools such as real-time market scanning, AI-driven trade signals, customizable alerts, advanced charting capabilities, and time-saving data visualization. Trade Ideas offers users the confidence to make smarter trading decisions and the freedom to conquer markets anytime, anywhere. The platform also includes features like a trading simulator for practicing new strategies, Picture in Picture charts for visualizing multiple timeframes, and integration with leading brokers and trading platforms.

Underwrite.ai

Underwrite.ai is a platform that leverages advances in artificial intelligence and machine learning to provide lenders with nonlinear, dynamic models of credit risk. By analyzing thousands of data points from credit bureau sources, the application accurately models credit risk for consumers and small businesses, outperforming traditional approaches. Underwrite.ai offers a unique underwriting methodology that focuses on outcomes such as profitability and customer lifetime value, allowing organizations to enhance their lending performance without the need for capital investment or lengthy build times. The platform's models are continuously learning and adapting to market changes in real-time, providing explainable decisions in milliseconds.

Wunderschild

Schwarzthal Tech's Wunderschild is an AI-driven platform for financial crime intelligence that revolutionizes compliance and investigation techniques. It provides intelligence solutions based on network assessment, data linkage, flow aggregation, and machine learning. The platform offers insights on strategic risks related to Politically Exposed Persons, Serious Organised Crime, Terrorism Financing, and more. With features like Compliance, Investigation, Know Your Network, Media Scan, Document Drill, and Transaction Monitoring, Wunderschild is a comprehensive tool trusted by global companies for enhanced due diligence and risk assessment.

Nest AI

Nest AI is an autonomous DeFAI agent that utilizes artificial intelligence to provide advanced financial services. The platform offers automated investment strategies, portfolio management, and personalized financial advice to help users optimize their financial decisions. With cutting-edge AI algorithms, Nest AI aims to revolutionize the way individuals manage their finances by offering intelligent and data-driven solutions.

Unit21

Unit21 is a customizable no-code platform designed for risk and compliance operations. It empowers organizations to combat financial crime by providing end-to-end lifecycle risk analysis, fraud prevention, case management, and real-time monitoring solutions. The platform offers features such as AI Copilot for alert prioritization, Ask Your Data for data analysis, Watchlist & Sanctions for ongoing screening, and more. Unit21 focuses on fraud prevention and AML compliance, simplifying operations and accelerating investigations to respond to financial threats effectively and efficiently.

FOCAL

FOCAL is an AI-driven platform designed for AML compliance and anti-fraud purposes. It offers solutions for verification, customer due diligence, fraud prevention, and financial insights. The platform leverages AI technology to streamline onboarding processes, enhance trust through advanced customer screening, and detect and prevent fraud using advanced AI algorithms. FOCAL is tailored to meet industry-specific needs, provides seamless integration with existing systems, and offers localized expertise with global standards for regulatory compliance.

0 - Open Source AI Tools

20 - OpenAI Gpts

Performance Controlling Advisor

Drives financial performance improvement via strategic analysis and advice.

Strategic Planning Advisor

Guides financial strategy through data analysis and forecasting.

Financial Statement Analyzer

Analyze Financial Statements step by step to Predict Earnings Direction

Safaricom Financial Analyst

Analyzes Safaricom's HY and FY financials, with detailed insights on different years.

Corporate Finance Advisor

Guides financial decisions by monitoring and enforcing policies and procedures.

Credit & Collections Advisor

Manages credit risk and implements effective collection strategies.

SherLock Investor

The Sign of Money: A SherLockian Quest for Decoding the Financial Market’s Mysteries

1 Main Insight Summary for Cash Flow Statement

Comprehensive analysis of cash flow statements, covering a wide array of financial metrics.