Best AI tools for< Financial Risk Manager >

Infographic

20 - AI tool Sites

MindBridge

MindBridge is a global leader in financial risk discovery and anomaly detection. The MindBridge AI Platform drives insights and assesses risks across critical business operations. It offers various products like General Ledger Analysis, Company Card Risk Analytics, Payroll Risk Analytics, Revenue Risk Analytics, and Vendor Invoice Risk Analytics. With over 250 unique machine learning control points, statistical methods, and traditional rules, MindBridge is deployed to over 27,000 accounting, finance, and audit professionals globally.

Instnt

Instnt is an AI-powered fraud prevention solution that helps businesses increase approval rates while significantly reducing fraud risk. It eliminates financial risk by shifting fraud losses to A-rated insurers, allowing businesses to grow fearlessly and protect effortlessly. Instnt combines seamless fraud prevention and KYC checks to validate users from day one, ensuring businesses stay protected. The platform offers a comprehensive solution with advanced fraud prevention technology, performance-based pricing, and up to $100M in fraud loss insurance. Instnt is suitable for various industries such as finance, government, e-commerce, crypto, gaming, and healthcare.

Fraud.net

Fraud.net is an AI-powered fraud detection and prevention platform designed for enterprises. It offers a comprehensive and customizable solution to manage and prevent financial fraud and risks. The platform utilizes AI and machine learning technologies to provide real-time monitoring, analytics, and reporting, helping businesses in various industries to combat fraud effectively. Fraud.net's solutions are trusted by CEOs, directors, technology and security officers, fraud managers, and analysts to ensure trust and beat fraud at every step of the customer lifecycle.

FINQ

FINQ is an AI-driven platform designed to help users build dynamic investment portfolios, follow model portfolios, and optimize investments effortlessly. The platform offers AI-based stocks portfolios with three distinct strategies to outperform the S&P. FINQ assesses financial product risk daily using a data-driven approach and provides users with 100% objectivity by eliminating biases. The AI engine monitors the market 24/7, ensuring users are aware of investment opportunities and offers risk-guided investing to match products with comfort levels.

NICE Actimize

NICE Actimize is an AI-driven platform that offers solutions for combatting financial crime, including Anti-Money Laundering (AML), Enterprise Fraud Management, Financial Markets Compliance, Investigation and Case Management, and Data Intelligence. The platform utilizes AI and machine learning to optimize efficacy, accuracy, and regulatory compliance coverage in the fight against financial crime.

Flagright Solutions

Flagright Solutions is an AI-native AML Compliance & Risk Management platform that offers real-time transaction monitoring, automated case management, AI forensics for screening, customer risk assessment, and sanctions screening. Trusted by financial institutions worldwide, Flagright's platform streamlines compliance workflows, reduces manual tasks, and enhances fraud detection accuracy. The platform provides end-to-end solutions for financial crime compliance, empowering operational teams to collaborate effectively and make reliable decisions. With advanced AI algorithms and real-time processing, Flagright ensures instant detection of suspicious activities, reducing false positives and enhancing risk detection capabilities.

Perfios

Perfios is an AI-powered FinTech software company that offers digital solutions for various industries such as banking, insurance, fintech, payments, e-commerce, legal, gaming, and more. Their platform provides end-to-end solutions for digital onboarding, underwriting, risk assessment, fraud detection, and customer engagement. Perfios leverages AI and machine learning technologies to streamline processes, enhance operational efficiency, and improve decision-making in financial services. With a wide range of products and features, Perfios aims to transform the way businesses experience technology and make data-driven decisions.

Cape.ai

Cape.ai is an AI-powered platform designed to enhance business process operations in the financial sector. It offers solutions for loan servicing, risk operations, trust operations, and more. The platform enables users to leverage agentic AI for increased efficiency, insights, and automation across various daily operations in financial firms. Cape.ai is built from real-world customer use cases and provides tangible business ROI by integrating structured and unstructured data sources, automating complex manual processes, and offering context-aware insights.

Tookitaki

Tookitaki is an AI-powered AML & Financial Crime Compliance Platform that offers end-to-end solutions for AML and fraud prevention. It provides AI-driven risk detection, real-time fraud prevention, prospect screening, risk scoring, alert prioritization, and case management. The platform is designed to help financial institutions enhance their AML risk management, reduce false positives, and meet regulatory requirements effectively.

Underwrite.ai

Underwrite.ai is a platform that leverages advances in artificial intelligence and machine learning to provide lenders with nonlinear, dynamic models of credit risk. By analyzing thousands of data points from credit bureau sources, the application accurately models credit risk for consumers and small businesses, outperforming traditional approaches. Underwrite.ai offers a unique underwriting methodology that focuses on outcomes such as profitability and customer lifetime value, allowing organizations to enhance their lending performance without the need for capital investment or lengthy build times. The platform's models are continuously learning and adapting to market changes in real-time, providing explainable decisions in milliseconds.

iSEM.ai

iSEM.ai is an end-to-end AI-powered AML and Fraud Detection solution that empowers users to identify risks, investigate anomalies, and streamline reporting. The platform combines human intelligence with machine technology to adapt, reduce risks, and enhance efficiency in combating financial crimes. iSEM.ai offers tailored solutions to manage client data, onboard monitoring, client profile management, watchlist monitoring, transaction monitoring, transaction screening, and fraud monitoring. The application is designed to help businesses comply with regulations, detect suspicious activities, and ensure seamless protection at every step.

NextGenAI

NextGenAI is an AI application focused on the financial services industry. It aims to challenge the current perception of AI and its role in banking and financial institutions. The platform explores innovative ways to augment human intelligence and propel the financial sector into the next generation of AI. Through a combination of keynotes, panels, demos, and workshops, NextGenAI facilitates discussions on AI regulations, industry best practices, and collaboration opportunities.

Wunderschild

Schwarzthal Tech's Wunderschild is an AI-driven platform for financial crime intelligence that revolutionizes compliance and investigation techniques. It provides intelligence solutions based on network assessment, data linkage, flow aggregation, and machine learning. The platform offers insights on strategic risks related to Politically Exposed Persons, Serious Organised Crime, Terrorism Financing, and more. With features like Compliance, Investigation, Know Your Network, Media Scan, Document Drill, and Transaction Monitoring, Wunderschild is a comprehensive tool trusted by global companies for enhanced due diligence and risk assessment.

Quill AI

Quill is an AI-powered SEC filing platform that allows users to extract key information from filings, answer questions about public investor materials, access historical financial data, and receive real-time SEC filings and earnings call transcripts. The platform leverages financially-tuned AI to provide accurate and up-to-date information, making it a valuable tool for analysts and professionals in the finance industry.

AlphaWatch

The website offers a precision workflow tool for enterprises in the finance industry, combining AI technology with human oversight to empower financial decisions. It provides features such as accurate search citations, multilingual models, and complex human-in-loop automation. The tool integrates seamlessly with existing platforms, offers time savings, and self-improving models. It is backed by innovative generative AI solutions and neural search capabilities, with a focus on transforming data processes and decision-making in finance.

Sardine

Sardine is an AI-powered platform for fraud prevention and compliance. It offers a comprehensive suite of products to help banks, retailers, and fintechs detect fraud patterns, prevent money laundering, and stop sophisticated scams. Sardine combines deep device intelligence, behavior biometrics, and identity signals to provide a precise risk score for every customer interaction. The platform also features machine learning models, a rules engine, network graph analysis, anomaly detection, and generative AI capabilities to fight modern threats. Sardine helps reduce fraud rates, decrease false positives, and streamline risk operations with its fully integrated solutions.

Novo AI

Novo AI is an AI application that empowers financial institutions by leveraging Generative AI and Large Language Models to streamline operations, maximize insights, and automate processes like claims processing and customer support traditionally handled by humans. The application helps insurance companies understand claim documents, automate claims processing, optimize pricing strategies, and improve customer satisfaction. For banks, Novo AI automates document processing across multiple languages and simplifies adverse media screenings through efficient research on live internet data.

Scienaptic Systems

Scienaptic Systems is an AI-powered Credit Decisioning Platform that revolutionizes the lending industry by automating credit underwriting processes, leveraging alternate data points, and offering self-learning models for instant credit decisions. The platform helps lenders identify creditworthy borrowers, streamline customer experience, and ensure fair lending practices through explainable AI models. Scienaptic's suite of AI-enabled technologies enables lenders to say 'Yes' to more borrowers at lower risk, providing a 360-degree risk assessment before approving applications. The platform integrates seamlessly with existing lending ecosystems, ensuring disruption-free deployment and better risk predictions through a single API call.

Dark Pools

Dark Pools is a leading provider of AI-powered solutions for the financial industry. Our mission is to empower our clients with the tools and insights they need to make better decisions, improve their performance, and stay ahead of the competition. We offer a range of products and services that leverage AI to automate tasks, optimize workflows, and generate actionable insights. Our solutions are used by a wide range of financial institutions, including hedge funds, asset managers, and banks.

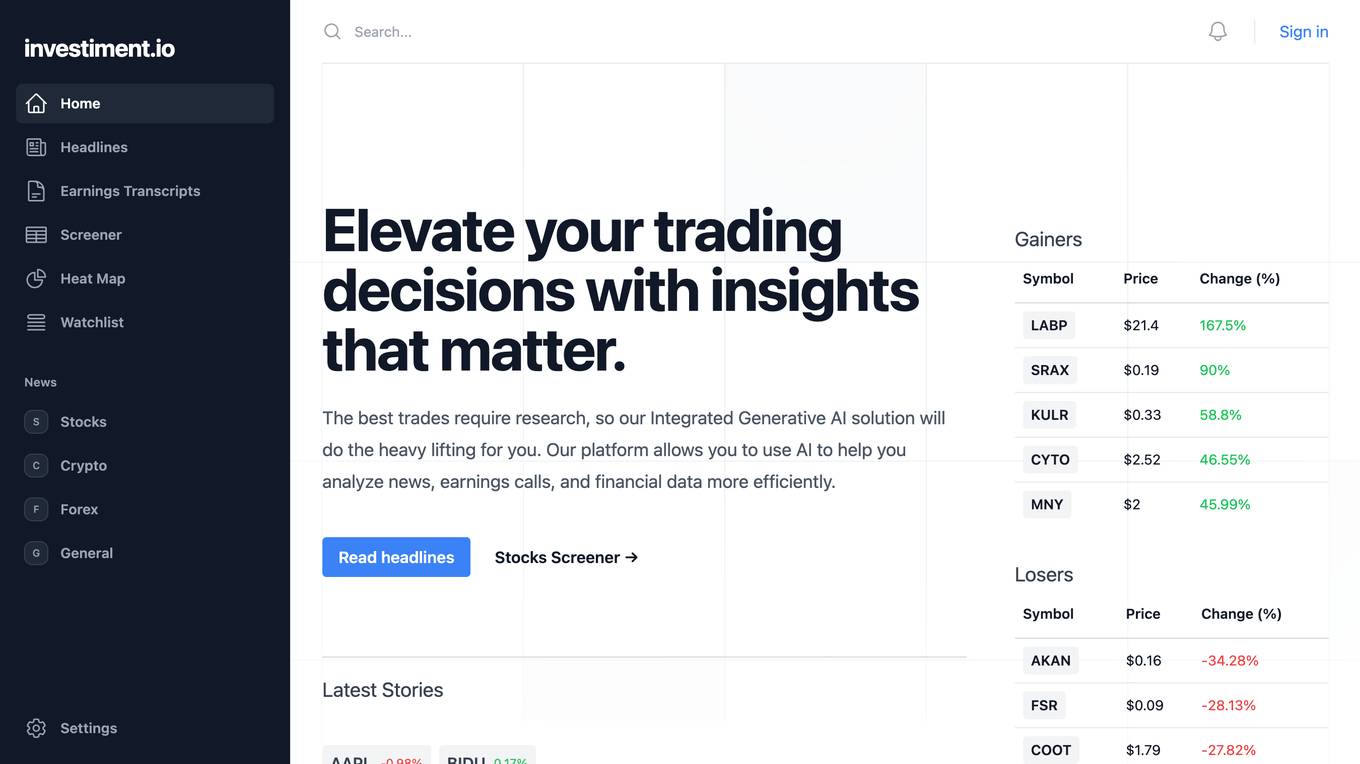

Investiment.io

Investiment.io is a financial news and data platform that uses AI to help investors make better decisions. The platform provides access to real-time news, earnings transcripts, and financial data, as well as AI-powered insights and analysis. Investiment.io is designed to help investors of all levels, from beginners to experienced professionals.

1 - Open Source Tools

PIXIU

PIXIU is a project designed to support the development, fine-tuning, and evaluation of Large Language Models (LLMs) in the financial domain. It includes components like FinBen, a Financial Language Understanding and Prediction Evaluation Benchmark, FIT, a Financial Instruction Dataset, and FinMA, a Financial Large Language Model. The project provides open resources, multi-task and multi-modal financial data, and diverse financial tasks for training and evaluation. It aims to encourage open research and transparency in the financial NLP field.

20 - OpenAI Gpts

Liquidity Management Advisor

Optimizes financial liquidity, mitigates operational risk, and enhances financial performance.

Currency Trading and Forex Strategies

🌍💱 Dive into forex trading strategies! Master currency pairs, market analysis, and risk management 📊📉. Unleash your trading potential in the world's largest financial market 💼🚀. Your forex guide! 📈💡 Not a financial advisor. 🚫💼

Financial Cybersecurity Analyst - Lockley Cash v1

stunspot's advisor for all things Financial Cybersec