Best AI tools for< Financial Counselor >

Infographic

20 - AI tool Sites

FinanceRants

FinanceRants is an AI-powered financial companion that helps individuals understand their financial personality and make informed decisions to achieve financial well-being. By analyzing users' spending, saving, and investing habits, the platform provides personalized insights and actionable strategies to empower users in managing their money and mindset. With a focus on combating financial stress and promoting financial stability, FinanceRants aims to break the cycle of living paycheck to paycheck and guide users towards a more secure financial future.

CraveCoach.AI

CraveCoach.AI is an AI-powered coaching platform designed to help individuals overcome porn addiction. The platform offers a 90-day program led by an AI coach named Coach Chad, who assists users in breaking harmful habits, boosting confidence, and improving relationships. Through personalized trigger analysis, practical trigger management checklists, empathetic relapse support, daily motivational reminders, and progress streak tracking, CraveCoach.AI aims to support users in their journey towards a healthier, addiction-free lifestyle. The platform emphasizes privacy, structured support processes, and tailored guidance for each user's pace and needs.

Kyros College Prep

Kyros College Prep is an AI-assisted platform designed to help students with their college applications. The platform utilizes artificial intelligence to provide personalized guidance and support throughout the college application process. By leveraging AI technology, Kyros College Prep aims to streamline the application process, enhance the quality of applications, and increase students' chances of getting accepted into their desired colleges.

Cushion

Cushion is an AI-powered tool designed to simplify bill management and credit building. It securely connects to your accounts, organizes bills, and offers insights to help you budget better. With features like automatic bill tracking, virtual Cushion card payments, and credit history building, Cushion aims to make bill payments painless and credit building seamless.

Dispute AI™

Dispute AI™ is an AI-powered DIY credit repair solution that leverages cutting-edge artificial intelligence to provide personalized strategies for boosting credit scores. The platform offers actionable insights, data-driven recommendations, and a fast, affordable, and flexible credit repair process. With over 20 years of expertise in credit repair, Dispute AI™ aims to revolutionize the way individuals take control of their credit by providing innovative tools that simplify and streamline the credit repair process.

SmartDispute.ai

SmartDispute.ai is an AI-powered credit repair application that helps users improve their credit scores by leveraging artificial intelligence technology. The application offers a patented Smart Dispute System™ technology that identifies and helps remove negative accounts from credit reports, making it one of the most effective credit repair systems available. Users can easily repair their own credit with the help of SmartDispute.ai's automated processes and fact-based dispute method. The application provides users with a simple and clearly explained process, allowing them to track their progress and see significant improvements in their credit scores over time.

AI Credit Repair

AI Credit Repair is an AI-powered application designed to help users improve their credit score by providing tools such as credit card utilization builder, public records remover, dispute letter generator, and SMS alerts. The application assists users in managing their credit card payments, disputing collections, and staying on top of their credit-related activities. By leveraging artificial intelligence technology, AI Credit Repair aims to simplify the credit repair process and empower users to build a better financial future.

Cleo

Cleo is an AI-powered financial management tool that helps users with budgeting, saving, building credit, and managing their finances. It offers features like cash advances, budgeting tips, credit building tools, and personalized financial advice. Cleo uses AI technology to provide users with insights and recommendations to improve their financial health. The application aims to make money management easy and accessible for everyone, without the need for credit checks or complex financial jargon.

MyLoans.ai

MyLoans.ai is a free AI tool designed to provide personalized guidance for complex student loans. It offers instant, clear, and accurate answers to student loan queries, helping borrowers make informed decisions about their financial future. By skipping expensive advisors and confusing government websites, MyLoans.ai aims to save users thousands of dollars by leveraging official government sources for guidance.

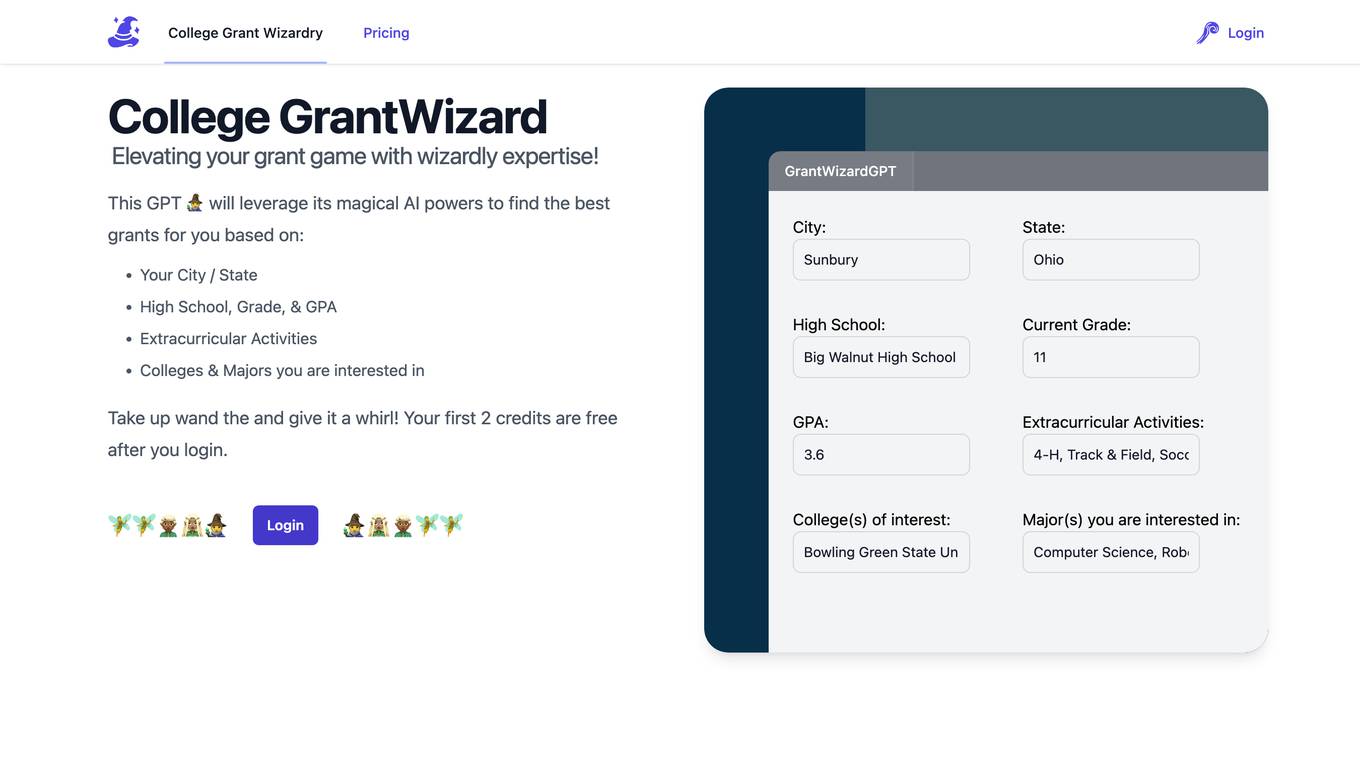

GrantWizard

GrantWizard is an AI-powered tool designed to assist students in finding the best grants for their college education. By leveraging magical AI powers, GrantWizard considers various factors such as the student's city/state, high school details, GPA, extracurricular activities, colleges of interest, and preferred majors to provide personalized grant recommendations. Users can access the platform after logging in and receive two free credits to get started. GrantWizard aims to simplify the grant search process and help students elevate their grant game with wizardly expertise.

CreditHQ

CreditHQ is an AI-powered loan restructuring platform that helps users analyze their credit history, compare interest rates, and save money on their loans. The platform offers a range of features, including a credit score simulator, a budgeting tool, and a debt management tool. CreditHQ is trusted by over 5,500 users and companies globally.

Gaite

Gaite is an AI tool designed to assist individuals in managing life's biggest moments. It offers personalized support and guidance for various life events such as finding care for loved ones, planning for retirement, managing career changes, and navigating loss. Gaite leverages AI to provide curated insights, personalized support, and actionable steps to help users seamlessly integrate technology with life for holistic well-being and success.

Palmyst

Palmyst is an AI-powered palm reading application that offers personalized, instant, and interactive palm readings to help users gain insights into various aspects of their lives, including financial health, career opportunities, personal growth, physical health, and relationships. The app uses advanced AI technology to analyze palm lines and patterns, providing accurate and detailed insights. Users can ask questions based on the readings to make informed decisions. Palmyst aims to objectively assess the ancient teachings of palmistry using modern research, data analysis, and AI, driven by evidence and scientific inquiry.

Skillsminer

Skillsminer is a Workforce Intelligence Platform that helps businesses bridge the growth gap by unlocking dynamic and scalable workforce potential. The platform utilizes AI technology to provide valuable insights and data to identify, develop, and utilize skills and talent effectively. Skillsminer supports various industries such as utilities, financial sector, education, housing associations, health sector, and government in recruiting hidden talent, maximizing internal mobility, and enhancing career opportunities. The platform aims to help businesses hire smarter, improve workforce agility, and make informed learning and development decisions to drive sustainable growth and business success while optimizing costs.

Workday

Workday is an enterprise AI platform that offers solutions for managing HR, finance, and various industry operations. It leverages artificial intelligence to empower organizations to optimize their workforce, financial processes, and legal operations. Workday provides a comprehensive suite of products and services designed to enhance productivity, drive innovation, and deliver data-driven insights. With a focus on human-AI collaboration, Workday aims to transform how work is done by integrating AI technology into its platform.

Inkwise

Inkwise is an AI-powered platform that helps users craft expert documents by extracting and integrating key information seamlessly from uploaded files. The platform offers features such as smart content extraction, predictive writing, document templates, and AI chat with files. Inkwise automates the document creation process by analyzing uploaded documents, extracting relevant data, and integrating it into customizable templates. It caters to various professions including academics, accounting, finance, corporate treasury, corporate tax, product management, procurement, legal, and marketing.

Ascent RLM

Ascent RLM is a regulatory lifecycle management platform that helps financial services companies identify, analyze, and manage regulatory obligations. It is composed of two integrated modules: AscentHorizon, a global horizon scanning tool, and AscentFocus, a regulatory mapping tool. Ascent RLM automates the regulatory mapping process, extracts individual obligations from regulatory text, and provides a centralized digital register of a firm's regulatory obligations. It also includes features such as side-by-side rule comparison, scenario planning, and audit trail.

Cimphony

Cimphony is a legal champion AI tool designed for startups and small businesses. It offers services such as legal counsel, employment/HR support, drafting and reviewing business contracts, and upcoming features like fundraise management. The platform leverages AI to address corporate needs, equity financing, contracts, and blockchain-specific issues with transparency and fair pricing. Cimphony aims to bring corporate legal services into the 21st century by providing a transparent view into legal work, faster delivery of legal advice, and flat-rate pricing for better planning.

Financial Planning

The Financial Planning website is a comprehensive platform that offers insights and resources on various aspects of financial planning, including tax investing, wealth management, estate planning, retirement planning, practice management, regulation and compliance, technology, industry news, and opinion pieces. The site covers a wide range of topics relevant to financial advisors and professionals in the wealth management industry. It also features articles on emerging trends, investment strategies, industry updates, and expert opinions to help readers stay informed and make informed decisions.

SymphonyAI NetReveal Financial Services

SymphonyAI NetReveal Financial Services is an AI-powered platform that offers solutions for financial crime prevention in various industries such as banking, insurance, financial markets, and private banking. The platform utilizes predictive and generative AI applications to enhance efficiency, reduce fraud, streamline compliance, and maximize output. SymphonyAI provides a fundamentally different approach to AI by combining high-value AI capabilities with industry-leading predictive and generative AI technologies. The platform offers a range of solutions including transaction monitoring, customer due diligence, payment fraud detection, and enterprise investigation management. SymphonyAI aims to revolutionize financial crime prevention by leveraging AI to detect suspicious activity, expedite investigations, and improve compliance operations.

0 - Open Source Tools

20 - OpenAI Gpts

Scholarship Hunter

Your partner in scholarship search. Get customized guidance and insights to help you find scholarships that resonate with your academic journey.

Borrower's Defense Assistant

Assistance in understanding and filling out the Borrower's Defense to Repayment Form provided by the United States Department of Education.

Couples Financial Planner

Aids couples in managing joint finances, budgeting for future goals, and navigating financial challenges together.

Chanakya GPT

From dating dilemmas to office strategies and financial finesse, let's solve it all with Chanakya's age-old wisdom sprinkled into today's dynamic world!

Debt Management Advisor

Advises on debt management strategies to improve financial stability.

Pay Later

Explains 'buy now, pay later' and recommends providers in a financial, informative tone.

Personal Finance Canada GPT

A GPT designed to provide everyday financial advice and tools to Canadians, primarily inspired by the subreddit Personal Finance Canada.

Top Loan Apps Expert

An AI tool offering expert advice on financial products, focusing on Top Loan Apps, best lending apps, fast cash advance apps, online loan apps, instant loan apps, and emergency loan apps. This tool provides insights, comparisons, and guidance for users seeking quick and reliable loan solutions.

Personal Loan

Discusses personal loans, payment methods, and financial options informatively.

Credit Score Check

Guides on checking and monitoring credit scores, with a financial and informative tone.

Fast Loan

Discusses fast loans, application processes, and financial considerations informatively.

CREDIT411

Providing information on consumer credit laws, regulations and resources. Because when it comes to credit, what you don't know CAN hurt you.