Best AI tools for< Optimize Portfolios >

20 - AI tool Sites

Macroaxis

Macroaxis is a wealth optimization platform that leverages artificial intelligence to help users make informed investment decisions. It offers a range of features to generate optimal portfolios, provide investment insights, and rebalance portfolios efficiently. The platform caters to self-directed investors, finance academia, fintech professionals, and individuals looking to invest with AI-driven strategies. Macroaxis aims to empower users with adaptive investment solutions and resilient portfolio management capabilities.

ficc.ai

ficc.ai is an AI application that revolutionizes municipal bond pricing by providing real-time, accurate AI technology for informed decisions, portfolio optimization, and compliance. The platform offers a user-friendly web app, direct API access, and integration with existing software or vendors. ficc.ai uses cutting-edge AI models developed in-house by market experts and scientists to deliver highly accurate bond prices based on trade size, ensuring valuable output for trading decisions, investment allocations, and compliance oversight.

STRATxAI

STRATxAI is an AI-powered quantitative investment platform that offers custom AI model portfolios tailored to clients' investment philosophy, risk tolerance, and objectives. The platform harnesses machine learning to deliver data-driven insights for security analysis, portfolio construction, and management. Powered by the proprietary investment engine Alana, STRATxAI processes over 8 billion financial data points daily to uncover hidden alpha beyond traditional methods. Clients benefit from smarter decision-making, better risk-adjusted returns, optimized portfolio management, and savings on resources. The platform is designed to enhance investment decisions for forward-thinking investors by leveraging AI technology.

BIASafe

BIASafe is an AI-driven platform that revolutionizes institutional portfolio management by leveraging artificial intelligence to drive unbiased, efficient, and scalable investment decisions. The platform offers a comprehensive suite of tools, including Soteria AI for data analytics, research and development capabilities, and portfolio management solutions. BIASafe empowers users with AI-powered intelligence for data-driven decision-making, predictive analytics, and uncovering hidden opportunities across portfolio strategies. The platform features a no-code R&D ecosystem for rapid design and strategy deployment, along with fully automated portfolio operations. With a focus on bias-free decisions and accelerated innovation, BIASafe sets a new standard in institutional-grade investment tools.

RockFlow

RockFlow is an AI-powered fintech platform that simplifies investing by offering AI-first trading experiences. The platform, powered by Bobby AI, allows users to build AI portfolios, execute trades, manage portfolios, and receive real-time trading opportunities. With features like Copy Trading, simplified options trading, and access to a wide range of investment products, RockFlow aims to empower users to make informed investment decisions effortlessly. The platform also prioritizes customer service and security, ensuring a safe and reliable trading environment for users.

AI Investing Tools

AI Investing Tools is a curated directory of AI tools designed to help users automate their investing process. The platform offers a handpicked collection of AI investing tools that assist in making more money, developing trading strategies, automating investing, rebalancing portfolios, and analyzing markets. It aims to leverage AI technology to enhance trading efficiency, optimize portfolios, and eliminate emotional biases in investment decisions.

DeFi Lens

DeFi Lens is an advanced market insights platform that leverages Generative AI to provide users with valuable information and analysis in the decentralized finance space. By utilizing cutting-edge AI technology, DeFi Lens offers users a unique perspective on market trends, investment opportunities, and risk assessment in the rapidly evolving DeFi landscape. The platform is designed to empower users with actionable insights and data-driven decision-making tools, enabling them to stay ahead in the competitive DeFi market.

Allex

Allex is an AI-powered project management and portfolio management software solution designed to help businesses efficiently manage projects, resources, and tasks. It offers features such as project planning, resource planning, capacity planning, team collaboration, and seamless communication. Allex is suitable for companies of all sizes and industries, including aviation, automotive, special machinery manufacturing, and pharmaceuticals. The software aims to provide users with a perfect overview of their projects and team activities, ensuring early identification of bottlenecks and effective resolution. With Allex, organizations can validate project requests, plan new projects, and enhance project coordination among different teams and stakeholders.

Clerkie

Clerkie is a powerful debt repayment and optimization platform that offers a full-service automation solution powered by machine learning and human expertise. It helps lenders, both big and small, to manage and optimize their loan portfolios efficiently. With features like smart payment experience, AI-driven repayment strategies, real-time reporting, and easy integration, Clerkie ensures a seamless and secure experience for lenders and borrowers alike.

Nest AI

Nest AI is an autonomous DeFAI agent that utilizes artificial intelligence to provide advanced financial services. The platform offers automated investment strategies, portfolio management, and personalized financial advice to help users optimize their financial decisions. With cutting-edge AI algorithms, Nest AI aims to revolutionize the way individuals manage their finances by offering intelligent and data-driven solutions.

Tickeron

Tickeron is an AI trading platform that offers a variety of tools and features to enhance trading in the stock market. It provides AI predictions for stocks, ETFs, forex, and other assets, empowering users with accurate stock predictions and trend insights. The platform includes AI robots for virtual accounts, trend predictions, pattern search engines, and real-time patterns. Additionally, Tickeron offers tools for traders and investors, such as stock portfolio wizards, active portfolios, model portfolios, and 401(k) portfolios. Users can also explore the marketplace for trading and investing tools, join trader and investor clubs, and access educational resources to improve their trading skills.

FINQ

FINQ is an AI-driven platform designed to help users build dynamic investment portfolios, follow model portfolios, and optimize investments effortlessly. The platform offers AI-based stocks portfolios with three distinct strategies to outperform the S&P. FINQ assesses financial product risk daily using a data-driven approach and provides users with 100% objectivity by eliminating biases. The AI engine monitors the market 24/7, ensuring users are aware of investment opportunities and offers risk-guided investing to match products with comfort levels.

Three Sigma

Three Sigma is a quantitative hedge fund that uses advanced artificial intelligence and machine learning techniques to identify and exploit trading opportunities in global financial markets.

Pantarai

Pantarai is an AI-powered adaptive investment platform that offers an intelligent system to interpret financial markets in real time. The platform's proprietary AI expert system, Cartesio, manages daily ETP allocation supervised by real humans. Pantarai's adaptive investment strategy adjusts to shifting market conditions, aiming to deliver consistent returns with smoother volatility across a wide range of market outcomes. The platform invests in stock, bond, commodity, and cash proxy indices via low-cost ETFs, with a focus on multi-asset investing, systematic and AI-powered processes, tactical asset rotation, and resilience in market outcomes.

Inspectr

Inspectr is an AI-powered intelligence engine designed for real estate operations. It integrates with existing tech stacks to provide real-time, actionable insights that reduce costs, improve efficiency, and drive higher returns across portfolios. Inspectr turns fragmented data into predictive intelligence, optimizing spend, budgets, and maximizing Net Operating Income (NOI) without disrupting current systems. The platform offers features like real-time strategic intelligence, seamless integrations, and work order enrichment to streamline operations and enhance asset performance.

AnalyStock.ai

AnalyStock.ai is a financial application leveraging AI to provide users with a next-generation investment toolbox. It helps users better understand businesses, risks, and make informed investment decisions. The platform offers direct access to the stock market, powerful data-driven tools to build top-ranking portfolios, and insights into company valuations and growth prospects. AnalyStock.ai aims to optimize the investment process, offering a reliable strategy with factors like A-Score, factor investing scores for value, growth, quality, volatility, momentum, and yield. Users can discover hidden gems, fine-tune filters, access company scorecards, perform activity analysis, understand industry dynamics, evaluate capital structure, profitability, and peers' valuation. The application also provides adjustable DCF valuation, portfolio management tools, net asset value computation, monthly commentary, and an AI assistant for personalized insights and assistance.

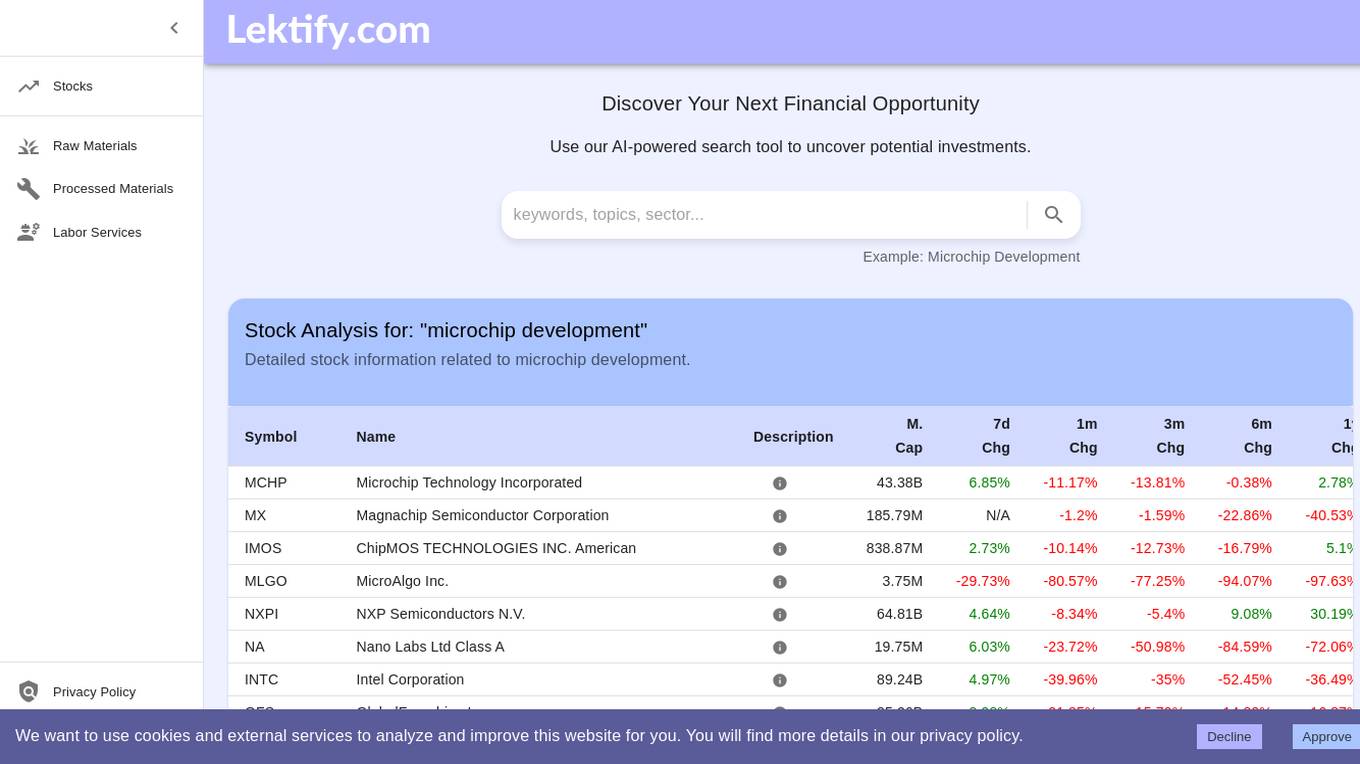

Lektify

Lektify is an AI-powered platform designed to revolutionize the way users manage their investment portfolios. By leveraging advanced artificial intelligence algorithms, Lektify helps users discover top-performing stocks and make informed investment decisions. The platform provides valuable insights and recommendations based on extensive data analysis, enabling users to optimize their investment strategies and maximize returns. With Lektify, users can stay ahead of market trends and enhance their portfolio performance with confidence.

Pluto.fi

Pluto.fi is an AI investing application that provides users with research, insights, and trading capabilities in one platform. It offers personalized AI assistance for making informed investment decisions, analyzing real-time market data, and optimizing investment portfolios. With access to over 40 data sources, Pluto ensures users stay informed and empowered to make prompt decisions. The application is trusted by individuals taking control of their finances and offers features like scheduled prompts, portfolio optimization, attachments & charts, and syncing of financial accounts.

Mool Capital

Mool Capital is an AI-powered platform that offers elevated investing and high fidelity research capabilities. The platform provides revolutionary AI tools for analyzing vast datasets in seconds, trustworthy analysis for informed investing, and performant portfolios curated for optimal performance. Users can access the latest market analysis, investment ideas, and premium articles to enhance their investment decisions. Mool Capital aims to empower investors with AI superpowers to make better investment choices and navigate the complex world of finance with confidence.

TurnCage

TurnCage is an AI-powered website and content creation platform that enables businesses, solopreneurs, and creatives to quickly and easily create professional-looking websites and digital portfolios. With TurnCage's proprietary technology, users can generate high-quality content, optimize their websites for search engines, and access a range of design templates and customization options. The platform is designed to be user-friendly and affordable, making it an accessible solution for those who lack technical expertise or resources.

2 - Open Source AI Tools

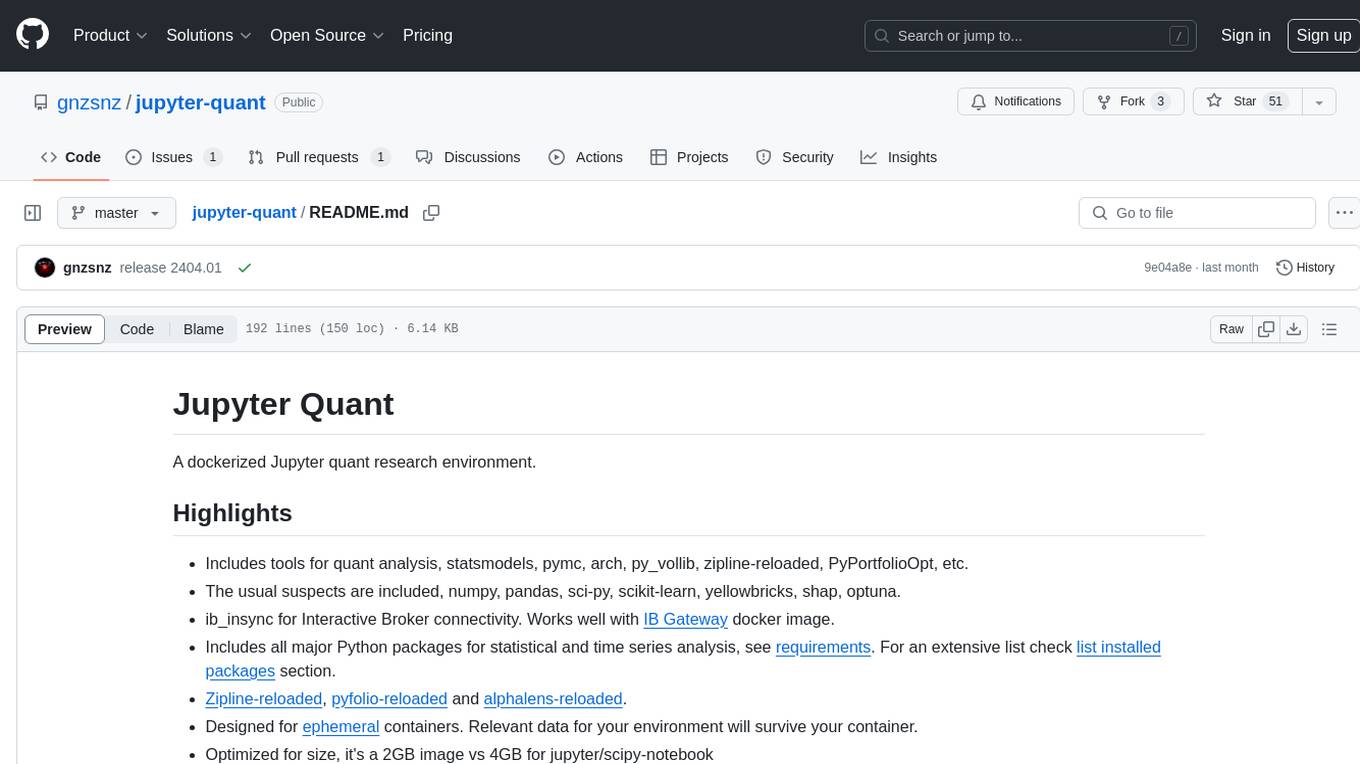

jupyter-quant

Jupyter Quant is a dockerized environment tailored for quantitative research, equipped with essential tools like statsmodels, pymc, arch, py_vollib, zipline-reloaded, PyPortfolioOpt, numpy, pandas, sci-py, scikit-learn, yellowbricks, shap, optuna, ib_insync, Cython, Numba, bottleneck, numexpr, jedi language server, jupyterlab-lsp, black, isort, and more. It does not include conda/mamba and relies on pip for package installation. The image is optimized for size, includes common command line utilities, supports apt cache, and allows for the installation of additional packages. It is designed for ephemeral containers, ensuring data persistence, and offers volumes for data, configuration, and notebooks. Common tasks include setting up the server, managing configurations, setting passwords, listing installed packages, passing parameters to jupyter-lab, running commands in the container, building wheels outside the container, installing dotfiles and SSH keys, and creating SSH tunnels.

jupyter-quant

Jupyter Quant is a dockerized environment tailored for quantitative research, equipped with essential tools like statsmodels, pymc, arch, py_vollib, zipline-reloaded, PyPortfolioOpt, numpy, pandas, sci-py, scikit-learn, yellowbricks, shap, optuna, and more. It provides Interactive Broker connectivity via ib_async and includes major Python packages for statistical and time series analysis. The image is optimized for size, includes jedi language server, jupyterlab-lsp, and common command line utilities. Users can install new packages with sudo, leverage apt cache, and bring their own dot files and SSH keys. The tool is designed for ephemeral containers, ensuring data persistence and flexibility for quantitative analysis tasks.

20 - OpenAI Gpts

FinWiz

FinWiz-GPT is designed for finance professionals. It assists in market analysis, financial modeling, and understanding complex financial instruments. It's a great tool for financial analysts, investment bankers, and accountants.

Investment Management Advisor

Provides strategic financial guidance for investment behavior to optimize organization's wealth.

Portfolio Management GPT

Assists in portfolio management, offering optimization strategies and market insights.

Liquidity Management Advisor

Optimizes financial liquidity, mitigates operational risk, and enhances financial performance.

AI Trading Ace

Expert in AI trading strategies, guiding users to leverage market opportunities.

VaultCraft Trainer

VaultCraft trains users to create automated yield strategies using the VaultCraft VCI & SDK

MarketMaster AI.

Dynamic financial expert with a multifaceted approach to market analysis.

Anything Finance Guru Advance

Advanced financial advisor for business and personal finance, with a focus on New Zealand.

Stock Photo .CSV Scribe

Upload your image, and our scribe instantly provides optimised keywords, titles, and categories in a CSV for Adobe Stock, Shutterstock and iStock. Simplify your workflow and elevate your portfolio effortlessly!